Market analysis from EdgeClear

Futures contracts are everywhere, from crude oil and stock indices to interest rates and even Bitcoin. They’re essential tools for traders and institutions to manage risk or capitalize on price speculation. What Are Futures? A futures contract is a legally binding agreement to buy or sell an asset at a set price on a future date. These contracts can involve...

NYMEX:CL1! NYMEX:MCL1! Markets Overview Markets have largely shrugged off the U.S. government shutdown, with major indices pressing to fresh all-time highs. While the headline optimism continues, it’s important to note that over one million federal employees remain furloughed, leading to delays in key economic data releases and potential short-term...

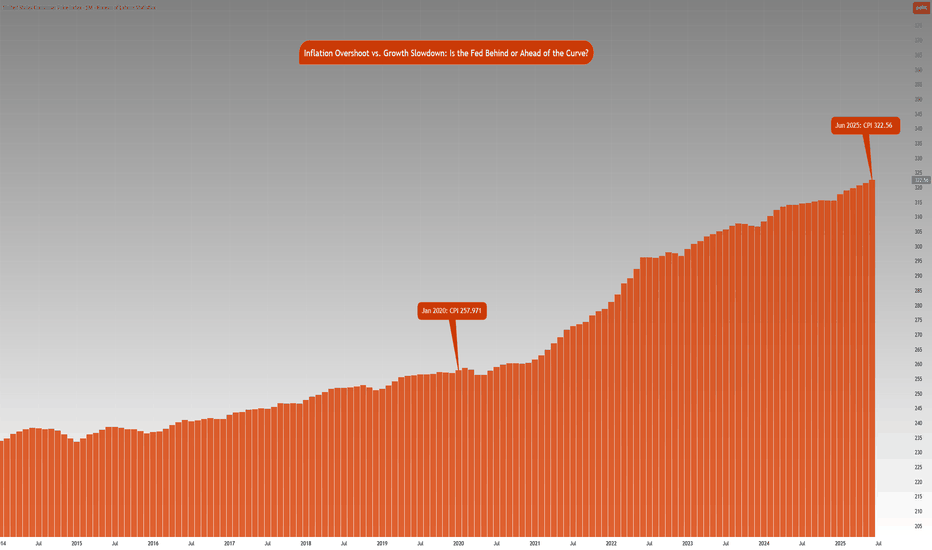

ECONOMICS:USCBBS CBOT:ZB1! CBOT:ZN1! CME_MINI:NQ1! There is growing market speculation that the Fed may tolerate inflation above 2% for longer, consistent with its Average Inflation Targeting (AIT) framework introduced in 2020. This also implies that real rates i.e., nominal rates minus inflation are likely to fall significantly. Given this, we...

Let’s start with the biggest event this week. Unless, of course, some unexpected headline swoops in and steals the spotlight — because markets love a good plot twist. Emotions are running high, and volatility is flying around like confetti at a surprise party nobody asked for. But don’t worry, Chair Powell might just play the role of the calm voice in the...

CME_MINI:NQ1! CME_MINI:ES1! CME_MINI:MNQ1! CME_MINI:MES1! CBOT_MINI:YM1! CBOT:ZN1! CBOT:ZB1! ECONOMICS:USNFP The stock market is currently holding near all-time highs. Today, the BLS (Bureau of Labor Statistics) report, which includes the NFP (non-farm payrolls), will be released at 7:30 am CT. Market participants are closely watching the non-farm...

Few forces shape global markets more than U.S. monetary policy. The Federal Reserve’s dual mandate, maximum employment and 2% inflation is the anchor for its decisions. For traders, understanding how these objectives translate into interest rate changes is critical for positioning in gold futures and across the yield curve. The Fed’s Dual Mandate 1. Maximum...

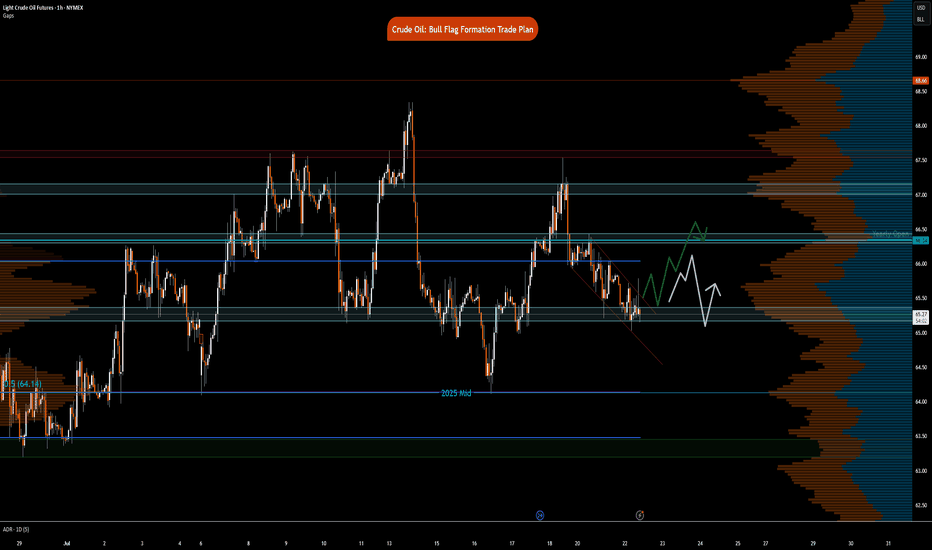

NYMEX:CL1! NYMEX:MCL1! Market Recap In our prior crude oil commentary, we identified a bullish flag formation with key support anchored at the Q3 micro composite Value Area Low. Following a measured pullback, prices decisively reclaimed the Q3 micro composite Value Area High, subsequently advancing toward the $70 level. However, this upward momentum proved...

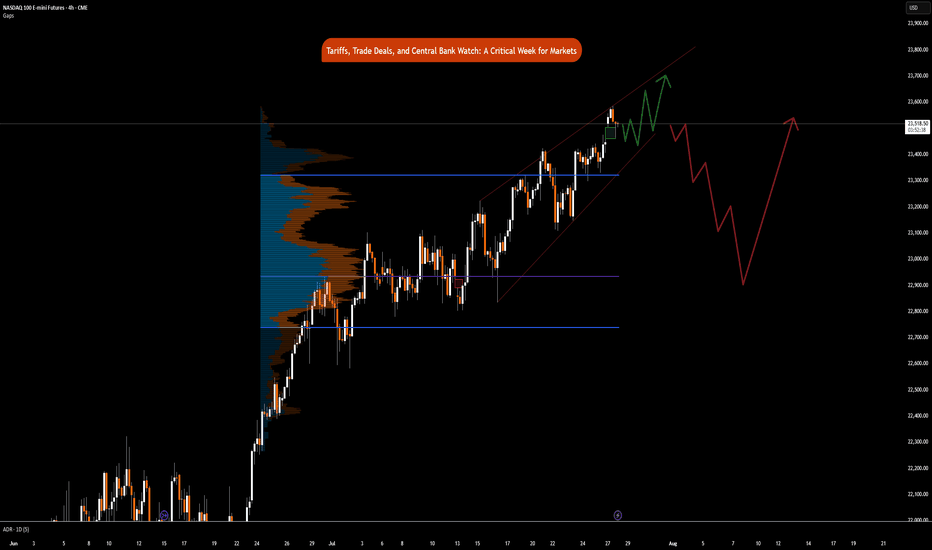

CME_MINI:NQ1! CME_MINI:ES1! CME_MINI:MNQ1! COMEX:GC1! FRED:FEDFUNDS Happy 4th of August, Traders! As we head into the new week, here’s a look at what’s on the calendar: Key Economic Data Releases Monday: • Factory Orders (MoM) – June • Supply: 3-Month Bill Auction, 6-Month Bill Auction Tuesday: • Trade Balance (June), Exports (June), Imports...

CME_MINI:NQ1! CME_MINI:ES1! CME_MINI:MNQ1! Happy Friday, folks! Today is the first Friday of August, and that means the highly anticipated Non-Farm Payroll (NFP) numbers came in at 7.30 am CT. US Non-Farm Payrolls (Jul) 73.0k vs. Exp. 110.0k (Prev. 147.0k, Rev. 14k); two-month net revisions: -258k (prev. +16k). Other key labor market indicators were as...

CME_MINI:NQ1! CME_MINI:ES1! CME_MINI:MNQ1! COMEX:GC1! CME_MINI:MES1! NYMEX:CL1! This is a significant week in terms of macroeconomic headlines, key data releases, central bank decisions, and major trade policy developments. We get numbers for growth, inflation and decision and insights into monetary policy. Combining this with ongoing trade policy...

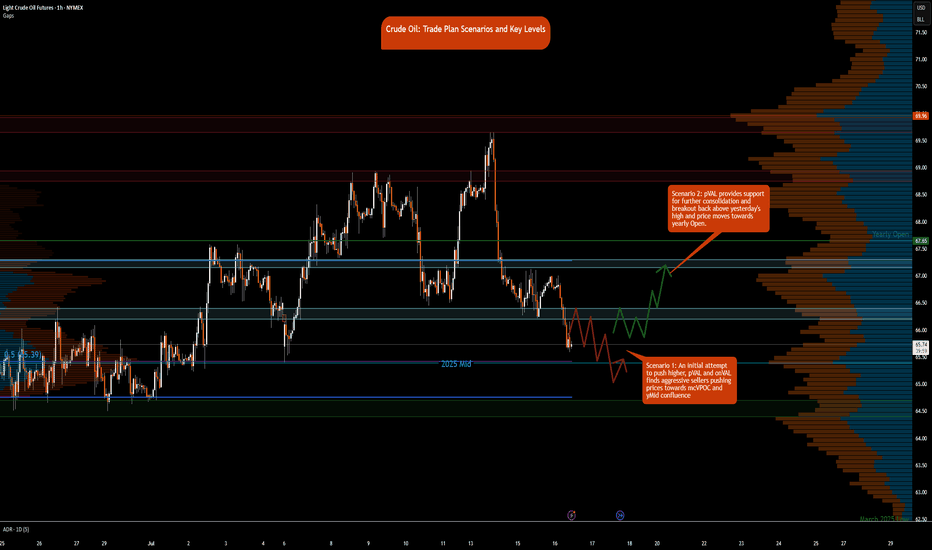

NYMEX:CL1! NYMEX:MCL1! Big Picture: Let the price action and market auction be your guide What has the market done? The market has consolidated and pushed higher. There is an excess high at 67.87 from July 14th RTH. Market pushed lower, leaving behind excess with single prints above this showcasing strong area of resistance. What is it trying to do?...

CME_MINI:NQ1! CME_MINI:ES1! CME_MINI:MNQ1! CME_MINI:MES1! CBOT:ZN1! Fed Policy recap: There is an interesting and unusual theme to keep an eye on this week. The Fed is in a ‘blackout period’ until the FOMC meeting- this is a customary quiet period ahead of an FOMC policy meeting. Fed Chair Powell is scheduled to give a public talk on Tuesday....

NYMEX:CL1! It’s Wednesday today, and the DOE release is scheduled for 9:30 a.m. CT. This may provide fuel—pun intended—to push prices out of the two-day consolidation. Also, note that the August contract expires on July 22, 2025. Rollover to the September contract is expected on Thursday/Friday. You can see the pace of the roll here at CME’s pace of roll...

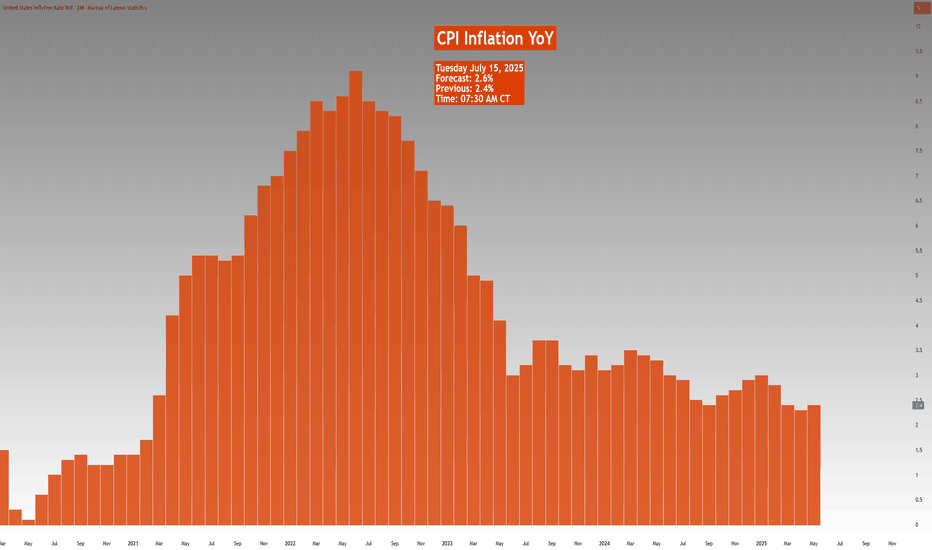

CME_MINI:ES1! CME_MINI:NQ1! COMEX:GC1! CME:BTC1! CME_MINI:RTY1! COMEX:SI1! CME_MINI:MNQ1! NYMEX:CL1! CME_MINI:M6E1! CBOT:ZN1! CME_MINI:MES1! Highlights this week include Chinese economic data points, UK CPI, US CPI, PPI, and Retail Sales. Inflation data is key, as it comes ahead of the Fed's meeting on July 30th, 2025. Market participants,...

NYMEX:CL1! NYMEX:MCL1! Bigger Picture: Traders should note that news headlines do not always drive the price action. More often, news outlets look for narrative to align with the price action. Previously, it was about the supply glut and worsening demand due to an uncertain outlook. Now the latest news flow is about Aramco OSP rising, OPEC+ adding another...

CME_MINI:NQ1! It’s a quiet week for US economic news. However, the RBA and RBNZ are scheduled to announce interest rate decisions. As has been the theme this year, markets remain highly sensitive to headline news and associated risks. US President Trump signed the One Big Beautiful Bill Act into law at the White House. Treasury Secretary Bessent is currently...

NYMEX:CL1! NYMEX:MCL1! With Nasdaq futures hitting all-time highs, our attention now turns to Crude Oil, which has seen a sharp pullback over the past week. All-time highs in equity indices present a unique challenge: There are no historical reference points—no prior price or volume data to lean against. Traders typically turn to tools like Fibonacci...

NYMEX:CL1! NYMEX:MCL1! NYMEX:BZ1! Macro: Geopolitical tensions remain high and markets are now likely to price in our scenario discussing ongoing air and missile war, given one-off intervention from the US thus far. According to Reuters, the U.S. now assesses that Iranian retaliation could occur within the next two days.What happens next is...