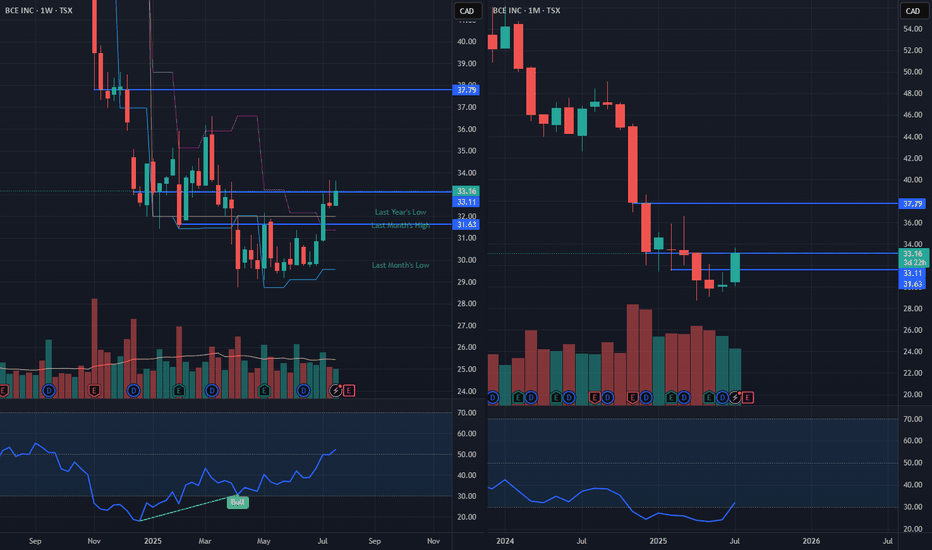

BCE monthly oversoldBCE monthly is oversold, a rare occasion to potentially load up and sell when the monthly RSI hits 70.

Monthly volume is not as big as the 2000-2010 period, however it does match the volume from 2021-2022 highs suggesting this may be the bottom.

Weak red monthly candles followed by June's revers

BCE Inc. Cum Conv Red 1st Pfd Series AC

No trades

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

6.64 CAD

344.00 M CAD

24.41 B CAD

931.59 M

About BCE Inc.

Sector

Industry

CEO

Mirko Bibic

Website

Headquarters

Verdun

Founded

1970

Identifiers

3

ISIN CA05534B7869

BCE, Inc. is a telecommunications and media company, which provides communication services to residential, business, and wholesale customers. It operates through the Bell Communication and Technology Services (Bell CTS) and bell media segments. The Bell CTS segment provides a wide range of communication products and services to consumers, businesses and government customers across Canada. The Bell Media segment includes conventional, specialty and pay television, digital media, radio broadcasting services, and out-of-home advertising services. The company was founded on February 25, 1970 and is headquartered in Verdun, Canada.

Related stocks

BCE weekly macd buy signalFollowing a huge sell off and post-earnings flush signs of life emerge as the daily Macd followed by the weekly Macd turn positive. A lift into the high 40's looks possible. Anyone who wanted to sell BCE has been washed out already. Dividend cut is already discounted in the action imho.In fact any s

BCE, Long, 1h✅ BCE has formed a clear inverse head and shoulders pattern, with the neckline decisively broken. The price is now moving upward toward the key resistance at 38. This level is likely to act as a strong resistance, potentially leading to a bullish continuation.

LONG 🔥

✅ Like and subscribe to never mi

Use of implied and Historical for ranges when your left guessingTrap trading gets you out of making guesses that are not confirmed by price action .

Set your stops and wait for the market to rebound to consolidation or break out of it.

These snippits are from Barchart. Makes scanning for stocks that have high IV rank and are worth your time watching. I create

Trying oa quick scalp of BCEMy target is 3.5% above so nothing to go crazy about.

I think BCE has been consolidating, broke above the creek level of the trading range and that it is now retesting. Today we have what I think is an ok retest of the low of the demand that came in on August 6 and its also testing the high of Augu

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

BCE5358698

Bell Telephone Company of Canada 3.65% 15-AUG-2052Yield to maturity

5.91%

Maturity date

Aug 15, 2052

US778FPAA7

Bell Telephone Company of Canada 4.464% 01-APR-2048Yield to maturity

5.85%

Maturity date

Apr 1, 2048

BCE4832163

Bell Telephone Company of Canada 4.3% 29-JUL-2049Yield to maturity

5.83%

Maturity date

Jul 29, 2049

BCE5752875

Bell Telephone Company of Canada 5.55% 15-FEB-2054Yield to maturity

5.83%

Maturity date

Feb 15, 2054

BCE5149386

Bell Telephone Company of Canada 3.65% 17-MAR-2051Yield to maturity

5.79%

Maturity date

Mar 17, 2051

US778FPAH2

Bell Telephone Company of Canada 3.2% 15-FEB-2052Yield to maturity

5.78%

Maturity date

Feb 15, 2052

CA7813ZCM4

Bell Telephone Company of Canada 5.15% 09-FEB-2053Yield to maturity

5.19%

Maturity date

Feb 9, 2053

BCE5752564

Bell Telephone Company of Canada 5.2% 15-FEB-2034Yield to maturity

4.92%

Maturity date

Feb 15, 2034

BCE5584816

Bell Telephone Company of Canada 5.1% 11-MAY-2033Yield to maturity

4.83%

Maturity date

May 11, 2033

BCE5237308

Bell Telephone Company of Canada 2.15% 15-FEB-2032Yield to maturity

4.73%

Maturity date

Feb 15, 2032

CA7813ZCG7

Bell Telephone Company of Canada 3.0% 17-MAR-2031Yield to maturity

3.70%

Maturity date

Mar 17, 2031

See all BCE.PR.C bonds

Frequently Asked Questions

The current price of BCE.PR.C is 20.63 CAD — it has decreased by −0.67% in the past 24 hours. Watch BCE Inc. Cum Conv Red 1st Pfd Series AC stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on TSX exchange BCE Inc. Cum Conv Red 1st Pfd Series AC stocks are traded under the ticker BCE.PR.C.

BCE.PR.C stock has fallen by −0.10% compared to the previous week, the month change is a 2.69% rise, over the last year BCE Inc. Cum Conv Red 1st Pfd Series AC has showed a 15.83% increase.

BCE.PR.C reached its all-time high on Mar 5, 2004 with the price of 27.99 CAD, and its all-time low was 9.65 CAD and was reached on Mar 18, 2020. View more price dynamics on BCE.PR.C chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

BCE.PR.C stock is 0.34% volatile and has beta coefficient of −0.09. Track BCE Inc. Cum Conv Red 1st Pfd Series AC stock price on the chart and check out the list of the most volatile stocks — is BCE Inc. Cum Conv Red 1st Pfd Series AC there?

Today BCE Inc. Cum Conv Red 1st Pfd Series AC has the market capitalization of 30.50 B, it has increased by 2.89% over the last week.

Yes, you can track BCE Inc. Cum Conv Red 1st Pfd Series AC financials in yearly and quarterly reports right on TradingView.

BCE Inc. Cum Conv Red 1st Pfd Series AC is going to release the next earnings report on Feb 5, 2026. Keep track of upcoming events with our Earnings Calendar.

BCE.PR.C earnings for the last quarter are 0.79 CAD per share, whereas the estimation was 0.72 CAD resulting in a 10.44% surprise. The estimated earnings for the next quarter are 0.62 CAD per share. See more details about BCE Inc. Cum Conv Red 1st Pfd Series AC earnings.

BCE Inc. Cum Conv Red 1st Pfd Series AC revenue for the last quarter amounts to 6.05 B CAD, despite the estimated figure of 6.08 B CAD. In the next quarter, revenue is expected to reach 6.52 B CAD.

BCE.PR.C net income for the last quarter is 4.54 B CAD, while the quarter before that showed 619.00 M CAD of net income which accounts for 633.44% change. Track more BCE Inc. Cum Conv Red 1st Pfd Series AC financial stats to get the full picture.

Yes, BCE.PR.C dividends are paid quarterly. The last dividend per share was 0.32 CAD. As of today, Dividend Yield (TTM)% is 6.82%. Tracking BCE Inc. Cum Conv Red 1st Pfd Series AC dividends might help you take more informed decisions.

BCE Inc. Cum Conv Red 1st Pfd Series AC dividend yield was 11.97% in 2024, and payout ratio reached 2.23 K%. The year before the numbers were 7.42% and 170.05% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jan 22, 2026, the company has 40.39 K employees. See our rating of the largest employees — is BCE Inc. Cum Conv Red 1st Pfd Series AC on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. BCE Inc. Cum Conv Red 1st Pfd Series AC EBITDA is 10.60 B CAD, and current EBITDA margin is 43.38%. See more stats in BCE Inc. Cum Conv Red 1st Pfd Series AC financial statements.

Like other stocks, BCE.PR.C shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade BCE Inc. Cum Conv Red 1st Pfd Series AC stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So BCE Inc. Cum Conv Red 1st Pfd Series AC technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating BCE Inc. Cum Conv Red 1st Pfd Series AC stock shows the strong buy signal. See more of BCE Inc. Cum Conv Red 1st Pfd Series AC technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.