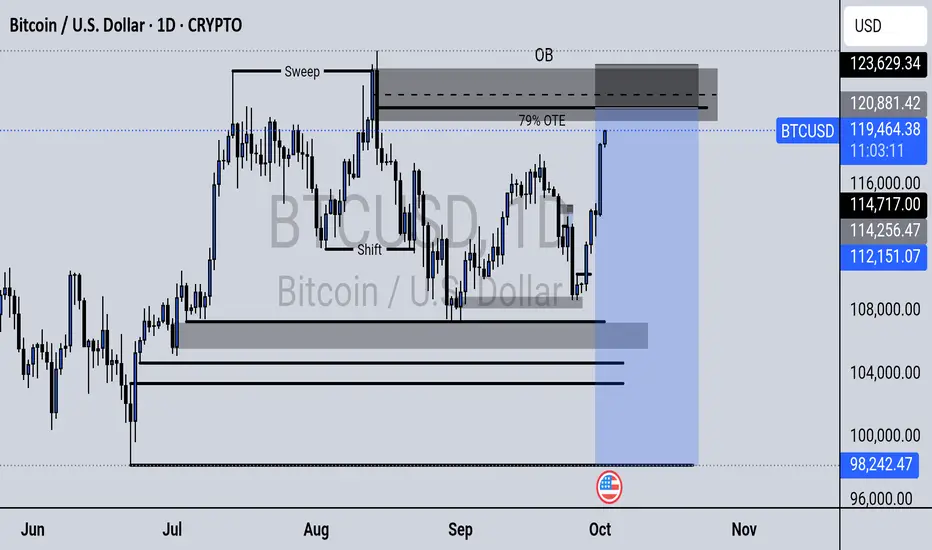

Bitcoin has just completed a clean setup that often signals a high-probability short.

🔑 Technical Breakdown (Chart Notes):

Sweep: Price ran above the August highs, collecting liquidity from breakout buyers and stops.

Shift: After the sweep, market structure flipped bearish, showing sellers stepping in.

79% OTE + Daily OB: BTC is now trading right inside the Optimal Trade Entry zone, which aligns with a daily Order Block (supply). This confluence makes it a prime reversal area.

📝 In My Words:

The market likes to trap late buyers by running liquidity above obvious highs. Once that’s done, price usually shifts lower to hunt the next pool of liquidity. Here, BTC swept the highs, flipped structure, and retraced deep into a supply zone where institutions often sell. Unless bulls can break above 120.8K – 121K, the path of least resistance is lower.

🎯 Downside Targets:

First inefficiency fill: 114.2K – 112.1K

Main liquidity draw: 98.2K

⚡ Trader’s Note:

This short is possible because price delivered the textbook sequence: liquidity grab → structure shift → return to supply. But remember, it’s not about “being right,” it’s about managing risk. If BTC closes strong above the OB, invalidate the short and step aside.

🔑 Technical Breakdown (Chart Notes):

Sweep: Price ran above the August highs, collecting liquidity from breakout buyers and stops.

Shift: After the sweep, market structure flipped bearish, showing sellers stepping in.

79% OTE + Daily OB: BTC is now trading right inside the Optimal Trade Entry zone, which aligns with a daily Order Block (supply). This confluence makes it a prime reversal area.

📝 In My Words:

The market likes to trap late buyers by running liquidity above obvious highs. Once that’s done, price usually shifts lower to hunt the next pool of liquidity. Here, BTC swept the highs, flipped structure, and retraced deep into a supply zone where institutions often sell. Unless bulls can break above 120.8K – 121K, the path of least resistance is lower.

🎯 Downside Targets:

First inefficiency fill: 114.2K – 112.1K

Main liquidity draw: 98.2K

⚡ Trader’s Note:

This short is possible because price delivered the textbook sequence: liquidity grab → structure shift → return to supply. But remember, it’s not about “being right,” it’s about managing risk. If BTC closes strong above the OB, invalidate the short and step aside.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.