- Strong Rejection at Premium Pricing

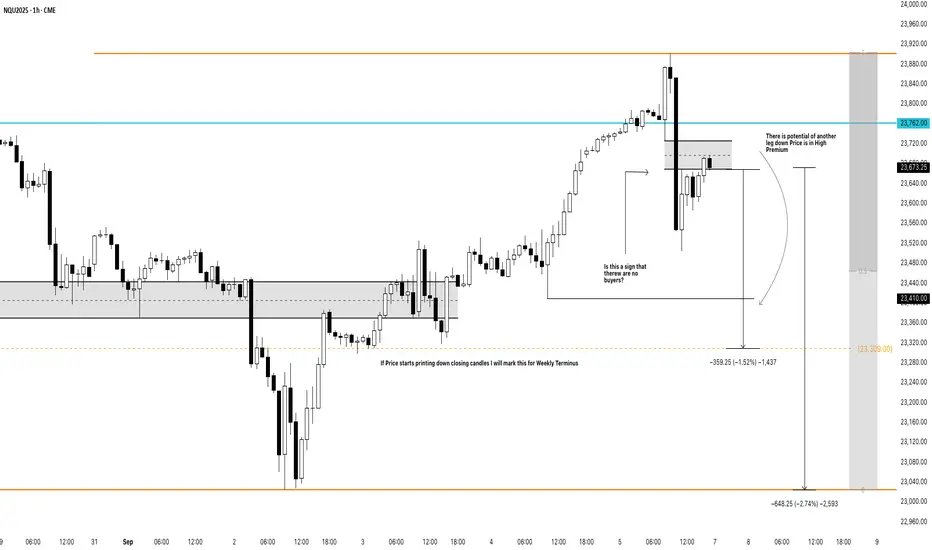

*Price rallied into a high-premium area above 23,800 and sharply rejected, leaving a large bearish displacement candle.

*This suggests aggressive selling pressure and potentially an exhaustion of buyers at higher levels.

- High Premium Context

*Price is consolidating in a “high premium” zone (above equilibrium of the most recent swing).

*The gray box marks the imbalance, which is currently acting as resistance where sellers may re-enter.

- Liquidity & Posible Weekly Terminus

*watching for confirmation of sustained bearish order flow.

- Key Support Zones

*23,410 → First downside target, aligning with partial fill of prior inefficiency and structural support.

*23,309 → Major liquidity pool and marked as a potential weekly terminus if price breaks lower.

*23,040 → Extended downside projection, aligning with prior weekly low sweep.

- Market Sentiment

*buyers failed to sustain price above 23,762.

*If true, this supports a bearish continuation narrative into next week.

Bias & Trade Scenarios

Bearish Bias (Primary)

*Trigger: Failure to reclaim 23,762 or rejection inside the gray FVG zone.

*Entry: Look for bearish price action confirmation in the 23,700–23,750 zone.

*Targets:

*TP1 → 23,410

*TP2 → 23,309

*TP3 (extended) → 23,040

*Stop: Above 23,880 (previous high / invalidation).

Bullish Counter Scenario (Secondary)

*Trigger: A clean break and close above 23,762 followed by acceptance above 23,800.

*Target: Re-test of 23,900 highs with potential continuation toward 24,000 round number.

*Stop: Below 23,600.

Summary

Nasdaq futures rejecting a high-premium zone near 23,900, with price now consolidating inside a bearish FVG. Unless buyers reclaim 23,762 decisively, the path of least resistance favors another leg lower toward 23,410 → 23,309 → 23,040.

This setup highlights a bearish displacement with downside liquidity objectives, but traders should monitor reactions at 23,410 and 23,309 as potential bounce zones.

Note

This looks great but the truth of the matters is that the HTF sentiment remains Bullish and until structure is broken and we see clear confirmation of a reversal we should treat it as a Bullish trend.Please remember it is what it is until it is not.

Note

Not getting the triggers needed for confirmation for a short position.Trade closed manually

Do not like PA running up at the open it might still go in desired direction but I will rather wait for confirmation to the downside first. Remember HTF sentiment is Bullish so this position at the moment is against the trendNote

Huge and another reason why I decided to close this Thesis is due to DXYDXY continues to print downclosing candles this only fuels the Bullish sentiment. Making all other assets cheaper.

Another thing to consider. It does not mean we will not see the short play, but it does say that it might not be the right time. Stay patient and allow price action to dictate direction and time.

DO YOUR OWN RESEARCH!!!

linktr.ee/thetradingworkshop

linktr.ee/thetradingworkshop

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

DO YOUR OWN RESEARCH!!!

linktr.ee/thetradingworkshop

linktr.ee/thetradingworkshop

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.