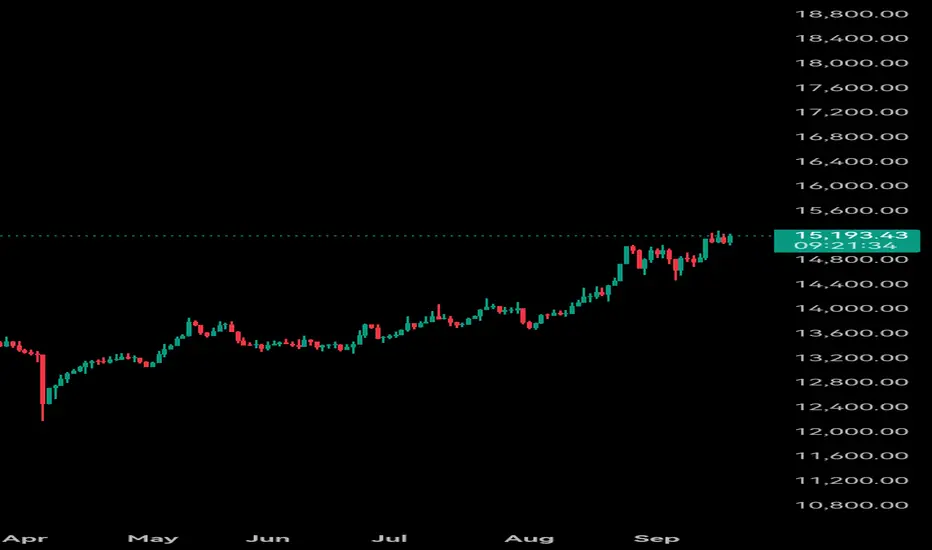

**Analysis of the A50 Index**

The recent trend of the FTSE China A50 Index is closely tied to China's macroeconomic policies. As a benchmark representing the 50 largest companies in the A-share market, its performance directly reflects market expectations for China’s core assets and economic outlook.

Currently, policy measures have become the core driver of the A50's movement. A series of stimulus policies introduced by the central government to stabilize the economy, particularly favorable measures in the real estate and capital markets, have effectively boosted investor confidence and provided solid bottom support for the index. However, sustained upward movement still faces challenges. Although domestic economic data has shown some improvement, issues such as insufficient demand persist, and the recovery of corporate profitability needs time to verify, limiting the index’s rebound potential.

From an external perspective, persistently high U.S. dollar interest rates continue to create capital outflow pressures, weighing on the financial and technology sectors, which have significant weight in the index.

Technically, the A50 Index faces a key resistance level near 12,000 points, with major support at around 11,500 points. In the short term, it is expected to consolidate within this range, awaiting further validation from substantive economic data and additional policy catalysts. The future direction of a breakout will depend on the visible effects of policies and marginal changes in global liquidity. Investors should closely monitor the effectiveness of economic recovery following policy implementation.

The recent trend of the FTSE China A50 Index is closely tied to China's macroeconomic policies. As a benchmark representing the 50 largest companies in the A-share market, its performance directly reflects market expectations for China’s core assets and economic outlook.

Currently, policy measures have become the core driver of the A50's movement. A series of stimulus policies introduced by the central government to stabilize the economy, particularly favorable measures in the real estate and capital markets, have effectively boosted investor confidence and provided solid bottom support for the index. However, sustained upward movement still faces challenges. Although domestic economic data has shown some improvement, issues such as insufficient demand persist, and the recovery of corporate profitability needs time to verify, limiting the index’s rebound potential.

From an external perspective, persistently high U.S. dollar interest rates continue to create capital outflow pressures, weighing on the financial and technology sectors, which have significant weight in the index.

Technically, the A50 Index faces a key resistance level near 12,000 points, with major support at around 11,500 points. In the short term, it is expected to consolidate within this range, awaiting further validation from substantive economic data and additional policy catalysts. The future direction of a breakout will depend on the visible effects of policies and marginal changes in global liquidity. Investors should closely monitor the effectiveness of economic recovery following policy implementation.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.