6N1!

NZDUSD: Bearish! Look For Valid Sell Setups!Welcome back to the Weekly Forex Forecast for the week of Oct. 6 - 10th

In this video, we will analyze the following FX market: NZDUSD

NZDUSD made a very impulsive bearish move, and spent last week retracing to the -FVG.

Now, the expectation is price will potentially begin the next bearish impulse.

Wait for a bearish BOS, and sell the pullback on the LTFs.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

NZDUSD: Bearish! Sell The Pullback!NZDUSD has been the most bearish of the majors. I am expecting more of the same this week.

Wait for the retracement, as this market is overextended. The -FVGs are perfect poi's to look for sell setups.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

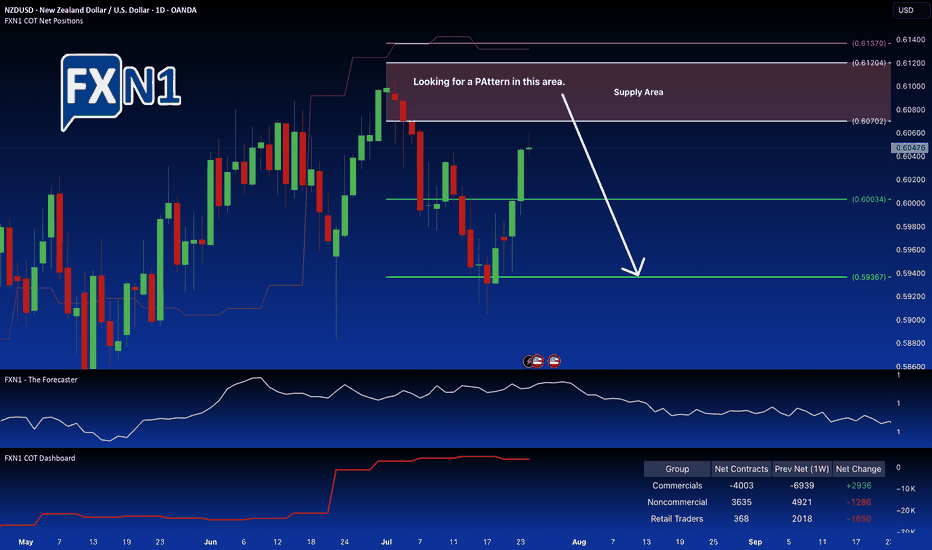

NZD/USD Approaches Key Supply ZoneThe NZD/USD is currently approaching a notable supply zone on the daily chart, indicating a potential area where selling pressure may intensify. According to the Commitment of Traders (COT) report, there has been a slight increase in short positions among Non-Commercial traders, suggesting that large speculators are beginning to bet on a decline. Conversely, retail traders are predominantly going long, which often acts as a contrarian indicator, hinting at possible exhaustion or a forthcoming reversal.

This confluence of signals points toward the possibility of an additional bearish impulse in the near term. Our forecast aligns with this view, as the DXY (US Dollar Index) shows signs of potential strength and could surge higher, further pressuring the NZD/USD pair. Moreover, seasonal analysis indicates a historically bearish trend during this period, adding another layer of confirmation to the outlook.

What are your thoughts on these developments? Do you see the potential for a downside move reinforcing, or are there other factors to consider?

✅ Please share your thoughts about NZDUSD index in the comments section below and HIT LIKE if you appreciate my analysis. Don't forget to FOLLOW ME; you will help us a lot with this small contribution.

NZDUSD: Bearish. Clean Setup For Potential Sells!Welcome back to the Weekly Forex Forecast for the week of Sept 1 - 5th.

In this video, we will analyze the following FX market: NZDUSD

NZDUSD is currently showing the cleanest setup for the FX pairs.

- it's in a downtrend on the HTFs

- D1 shows the LH. LL, low and the -BOS clearly

- the retracement is contacting a decent -OB

- the Descending Channel is only an added bonus as a confluence for resistance.

I like the probabilities for a potential rejection downward from the -OB.

The caution here is that it would require the USD to show strength, pulling the NZD down. That part is still iffy. The DXY has not shown its hand just yet.... but it will very soon.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

NZD/USD Chart Breakdown and Divergence Amid Market UncertaintyThe U.S. dollar continued its downward trend yesterday, influenced by dovish remarks from Federal Reserve's Kashkari, who aligned with other policymakers in suggesting a potential rate cut as early as September. This shift in tone was largely prompted by the softer-than-expected Non-Farm Payroll (NFP) report released last Friday.

While the employment data wasn’t as dire as initial market reactions suggested, it did cause some reevaluation. Prior to the report, market positioning was geared toward a robust labor market, and the Fed’s hawkish stance had already been priced in. The unexpectedly weak data, therefore, prompted a swift adjustment in expectations, leading to a rapid reprice of the dollar.

On the technical front, the NZD/USD chart highlights the breach of our previous daily supply zone following the release of the CPI data. However, I’ve decided to place a limit order at the next supply level. From a fundamental perspective, the recent activity of non-commercial traders adding short positions last week indicates a potential divergence between the chart pattern and underlying fundamentals. This divergence suggests opportunities for strategic entries as market sentiment and macroeconomic signals appear to be at odds.

✅ Please share your thoughts about NZDUSD in the comments section below and HIT LIKE if you appreciate my analysis. Don't forget to FOLLOW ME; you will help us a lot with this small contribution.

NZD/USD Faces Resistance at Daily Supply Zone Amid Rising Short On the daily chart, the NZD/USD pair has approached and responded to a significant supply zone. Notably, there has been a marked increase in short positions among non-commercial traders. These initial short entries were established in July, and current market dynamics suggest a potential continuation of the bearish trend. If, throughout this week, the Dollar Index gains momentum and sees an increase in long positions, it could further drive the NZD downward.

✅ Please share your thoughts about NZDUSD in the comments section below and HIT LIKE if you appreciate my analysis. Don't forget to FOLLOW ME; you will help us a lot with this small contribution.

NZDUSD: Amid 15% Tariffs & Rate Cuts Looming, Time To Sell?Welcome back to the Weekly Forex Forecast for the week of Aug 11 - 15.

In this video, we will analyze the following FX market: NZDUSD

NZDUSD is dealing with new 15% tariffs from the US and signs of a rate cut coming in the next RBNZ meeting. Not to mention price mad a bearish impulsive move, and correcting into a bearish FVG. This would be the perfect premium array for the retracement to end, and the establishment of a lower high, followed by the start of the new bearish leg.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

NZD/USD Weekly Bearish Trend Faces Critical Supply LevelThe NZD/USD pair is nearing a significant supply zone near 0.6070, where notable market activity is unfolding. Non-commercial traders are beginning to trim their holdings, signaling a potential shift in market sentiment. Conversely, commercial traders are at their lowest net positions since August 2024 and are starting to accumulate again, creating a divergence between these two groups.

This divergence, combined with the presence of a defined supply area and seasonal factors, suggests a possible reversal point in the current downtrend. On the weekly chart, the overall trend remains bearish, but the confluence of these technical and seasonal signals points toward a potential reversal pattern forming within the supply zone.

Traders may consider monitoring this area for signs of a reversal, potentially setting up for a short position if a clear pattern confirms the shift in momentum. Overall, the setup indicates a cautious opportunity for a bearish trade, provided the price action confirms the anticipated reversal.

✅ Please share your thoughts about NZD/USD in the comments section below and HIT LIKE if you appreciate my analysis. Don't forget to FOLLOW ME; you will help us a lot with this small contribution.

July 7 - 1th: Sell The RIPs, Buy The DIPs! (PART 1)This is Part 1 of the FOREX futures outlook for the week of July 7 - 11th.

In this video, we will analyze the following FX markets:

USD Index, EUR, GBP, AUD, NZD, & CAD.

Last Friday was a bank holiday, so the price action is discounted. This Monday has no red folders on the calendar, so the environment is set for a day of misdirection. Be careful to take only trades that confirm your directional bias!

USD is still weak, and analyst have determined the FED will put off cutting rates until September. Tariffs wars may start up again July 9th. And Trumps Bill can add 3+ trillion to the debt.

None of this supports the USD!

Look to buy the dips xxx USD, and look to sell the rips vs USD xxx.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

Risk On! The US Dollar Is Weak! Buy The Major Pairs!This is the FOREX futures outlook for the week of Jun 29 - July 4th.

In this video, we will analyze the following FX markets:

USD Index, EUR, GBP, AUD, NZD, CAD, CHF, and JPY.

Investors are taken money out of safe havens and putting it into risk assets. The US Dollar saw those outflows last week, and we are likely to see that continue going into this week.

Buy the EUR, GBP and CHF vs USD. JPY should also see some upside.

The AUD and NZD continue to grind upwards as well.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

US Missiles Flyin'! Buy USD vs EUR GBP AUD NZD CAD CHF JPY!This is the FOREX futures outlook for the week of Jun 22-28th.

In this video, we will analyze the following FX markets:

USD Index, EUR, GBP, AUD, NZD, CAD, CHF, and JPY.

The USD is the world's reserve currency. When there are geo-political hot spots in the world, the USD sees inflows from investors. In light of US strikes against Iranians nuke sites last night, buying the USD versus other currencies is prudent and wise.

The USD should see more gains as long as the current tensions are high. If Iran comes back to the negotiations table, then the environment switches back to a risk on scenario, where the outflows from the USD go back into riskier assets like the stock market.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

Short Term USD Strength This Week! Sell The Majors?This is the FOREX futures outlook for the week of Jun 8 - 12th.

In this video, we will analyze the following FX markets:

USD Index, EUR, GBP, AUD, NZD, CAD, CHF, and JPY.

USD gained some strength on Friday's job data. Talks with China this week may add to it. But I believe the bullishness will be short term.

Look for valid sells in EUR and GBP. Be cautious with AUD and NZD. CAD and CHF will also offer opportunities to sells.

CPI Data due Wed, making that day and the days that follow potentially the best trading days this week.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

Weekly FOREX Forecast: When Missiles Fly, So Does The US Dollar This is the FOREX futures outlook for the week of Jun 16-20th.

In this video, we will analyze the following FX markets:

USD Index, EUR, GBP, AUD, NZD, CAD, CHF, and JPY.

Middle East tensions are high, missiles flying.... and so will the USD. Look for the USD to

out perform its counterparts during precarious period.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

Weekly FOREX Forecast Jun 2 - 6th: Wait to BUY Majors vs USD!This is the FOREX futures outlook for the week of Jun 2 - 6th.

In this video, we will analyze the following FX markets:

USD Index EUR GBP AUD NZD CAD CHF JPY (CHF and JPY forecast to follow).

It's been a consolidative week, but the USD is still weak. Look for valid breakdowns of consolidations before buying against the USD.

NFP week ahead! Mon-Wed will be the best days to trade.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

Weekly FOREX Forecast: USD, EUR, GBP, AUD, NZD, CAD, CHF, JPYThis is the FOREX Currency futures outlook for the week of May 18 - 24th.

In this video, we will analyze the following FX Majors markets:

USD Index

EUR

GBP

AUD

NZD

CAD

CHF

JPY

USD Index has been bullish for 4 weeks. Will it continue? Expect a pullback before bullish continuation.

Selling the commodity currencies (AUD, CAD, NZD) may be the best course of action this week. Buying the EUR, GBP and CHF may also be worthwhile.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

BUY The Major FX Pairs vs USD?? This is the FOREX Currency futures outlook for the week of May 12 - 16th.

In this video, we will analyze the following FX Majors markets:

USD Index

EUR

GBP

AUD

NZD

CAD

CHF

JPY

USD Index finally finished the move to the Daily -FVG, as forecasted last week. Now, will the resistance hold, sending prices lower? I thinking so.

Look to buy xxxUSD pairs. Sell USDxxx pairs.

Wait for valid setups. CPI Data on Tuesday, so be careful.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

NZD/USD Climbs on US-China Optimism and RBNZ Rate Cut ExpectatioNZD/USD Climbs on US-China Optimism and RBNZ Rate Cut Expectations

The NZD/USD currency pair edged higher during European trading hours on Thursday, recovering from two consecutive sessions of losses. Trading near 0.5982, the pair benefited from renewed optimism surrounding potential US-China trade negotiations, a key factor given New Zealand's strong economic ties with China.

This resurgence in the Kiwi dollar (NZD) contrasts with the broader trend of recent days. The previous decline was likely fueled by concerns over global economic growth and the impending interest rate decisions from central banks across the globe. The pair's upward movement now suggests a shift in sentiment, with investors recognizing the potential positive impact of a potential trade thaw.

Crucially, expectations surrounding the Reserve Bank of New Zealand's (RBNZ) upcoming May meeting are also playing a significant role. Markets are overwhelmingly pricing in a 25 basis-point cut to the Official Cash Rate (OCR) from its current 3.5%. Furthermore, there's a growing expectation of further easing to 2.75% by the year-end. This anticipated easing of monetary policy in New Zealand is providing substantial support to the NZD, adding another bullish element to the current trading environment.

From a technical perspective, the price action around the crucial 0.5980 level highlights the interplay of fundamental and technical factors. While the price has reached a weekly supply zone, the confluence of optimistic trade sentiment and the expected OCR cut is currently outpacing any bearish technical indicators.

However, a sustained move above the significant resistance of the 0.6000 level is critical to confirming the renewed bullish momentum. A break above this psychological barrier would signal further strength in the Kiwi dollar, whereas a reversal below 0.5980 would bring the previously discussed bearish factors back into the forefront.

Looking ahead, the key to future direction for the NZD/USD will likely depend on the outcome of the US-China trade negotiations and any potential further developments regarding the RBNZ's interest rate decisions. Markets will be watching closely for any tangible progress in either area, as this will likely dictate the pair's trajectory.

✅ Please share your thoughts about NZD/USD in the comments section below and HIT LIKE if you appreciate my analysis. Don't forget to FOLLOW ME; you will help us a lot with this small contribution.

USD is Bearish, SO BUY EUR, GBP, AUD, NZD CHF & JPY!In this video, we will update Saturday's forecasts mid-week, and look for valid setup for the rest of the week ahead. The following FX markets will be analyzed:

USD Index

EURUSD

GBPUSD

AUDUSD

NZDUSD

USDCAD

USDCHF

USDJPY

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or other wise. In this video, we will update the forecasts for the following FX markets:

USD Is Bullish Short Term. Short The Majors! This is the FOREX outlook for the week of April 28 - May 2nd.

In this video, we will analyze the following FX markets:

USD Index

EUR

GBP

AUD

NZD

CAD, USDCAD

CHF, USDCHF

JPY, USDJPY

The USD Index is heading up towards a bearish FVG. The EURUSD, GBPUSD, and the other Major pairs will be pulled down by this price action .... until the USD hits it's POI. Then things will get interesting!

Take advantage of the USD push higher!

Remember, NFP is Friday! Be careful of wonky price action on Thursday and Friday.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

Weekly FOREX Forecast: Wait for Buys vs USD!This is the FOREX outlook for the week of April 14-18th.

In this video, we will analyze the following FX markets:

USD Index

EUR

GBP

AUD

NZD

CAD

CHF

JPY

The USD is still overall bearish... but is due for a correction. Short term bullishness in the USD is what I am monitoring this week, then aa resumption of it's bearish trend. This will provide

buying opportunities in xxxUSD pairs, and selling opportunities in USDxxx pairs.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

Weekly FOREX Forecast: Buy EUR, GBP, AUD, NZD vs USDThis is an outlook for the week of April 7 - 11th.

In this video, we will analyze the following FX markets:

USD Index

EUR

GBP

AUD

NZD

CAD

CHF

JPY

Wait for the market to tip its hand! Monday is a no red folder news day. Great time to let the markets settle on a direction.

Trading a market after a huge push in one direction can be tricky. There is likely to be a pullback before continuing the overall trend. Bear this in mind with the USD.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

Weekly FOREX Forecast Mar 17-21: Buy EUR, GBP, AUD, NZD vs USD!This is an outlook for the week of March 17-21st.

In this video, we will analyze the following FX markets:

USD Index

EUR

GBP

AUD

NZD

The USD Index is entering a Daily +FVG, which is nested in a Weekly +FVG. This is a bearish indication for the USD, which is a potential bullish situation for EURUSD, GBPUSD, AUDUSD and NZDUSD. This will be potentially bearish for the USDCAD, USDCHF, and USDJPY. Wait for the market structure shift going in the direction of your TP, and enter on the pullback.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.