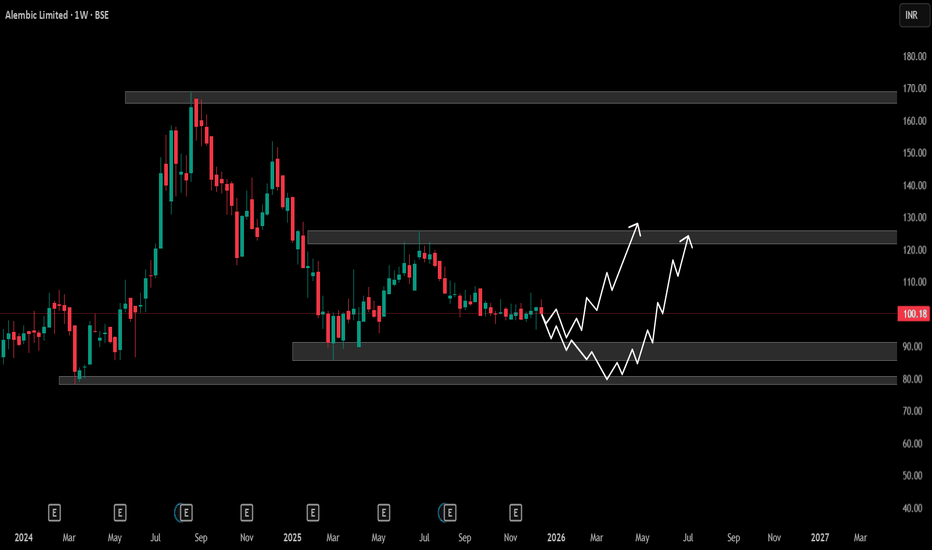

Alembic Limited – Weekly Chart Technical AnalysisMarket Structure

On the weekly timeframe, the stock has been in a broad consolidation phase after a sharp decline from the ₹160–165 supply zone.

Price is currently trading near ₹100, which lies in the middle of a long-term range, indicating indecision and low momentum.

Multiple rejections from higher levels suggest that sellers remain active near resistance zones.

Key Demand & Supply Zones

Major Support Zone: ₹80–85

This is a long-term demand area where strong buying previously emerged.

Intermediate Support: ₹90–92

Short-term support; loss of this level may accelerate downside.

Immediate Resistance: ₹120–125

Strong supply zone; price needs acceptance above this level for trend reversal.

Major Resistance: ₹165–170

Previous distribution zone and long-term supply area.

Price Action Outlook

As long as price holds above ₹80–85, the structure remains range-bound with accumulation potential.

A pullback towards ₹90–85, followed by strong bullish price action, can act as a base for medium-term recovery.

A decisive weekly close above ₹125 would signal a trend change and open upside towards higher resistance zones.

Until then, rallies are likely to face selling pressure near ₹120–125.

Bias

Neutral to mildly bearish below ₹120

Range-bound between ₹85 and ₹125

Bullish confirmation only on sustained breakout above ₹125

Disclaimer

This analysis is based purely on technical analysis and historical price behavior. It is provided for educational purposes only and should not be considered as investment or trading advice.

ALEMBICLTD

ALEMBIC LTD Weekly Double BottomAlembic Ltd has formed a double Bottom on weekly chart, Enter with little qty @ CMP and add on dips for the retest. Safe Buyers can wait for retest of the neckline and enter after confirmation.

Please give a boost if you like the analysis and follow for more. Any suggestions or advice is humbly welcomed.

Disclaimer:I am not a SEBI Registered Analyst, and the views expressed here are solely my own and for educational purposes only. Make sure you consult your Financial advisor before investing, as I won't be responsible for any losses incurred.

Alembic looks for an arrival in the Bull marketAlembic Ltd. is engaged in the business of pharmaceuticals and real estate. Its core operation is manufacturing and marketing of APIs (active pharmaceutical ingredients) and construction and leasing of corporate & commercial properties. The company is also engaged in research and development in his pharma business. Alembic CMP is 69.20.

Negative aspects of the company are declining annual net profit & FIIs are decreasing stake. Positive aspect of the company is improving cash from operations annual, no debt, zero promoter pledge.

Entry in the stock can be taken after closing above 70. The short-term targets are 76 and 80. The long-term target is 87. Keep a stop loss at 63.