Natural Gas Holding On For Dear Life!Natural Gas is trying to defend the weekly high volume surge candle from the cold snap forecast.

This commodity looks very vulnerable if it gets another lower weekly candle close.

Right now the asset class is showing sell side pressure as we progress into building season.

I don't like the long setup....nor do i like the short setup.

The price action in Nat gas seems broken and needs to settle.

Ar

Will Natural Gas Keep Rallying? Nat Gas continues to flex it muscles through this cold front.

Demand has certainly increased and is likely going to stay firm into the Feb 8 week, as we get updated forecasts that are expected to warm up.

Resource stocks remain strong which should support Nat gas pushing a bit higher.

If Nat Gas pushes up another 10% we will be trading into an extreme 3 standard deviation move. This open up the probabilities of a sharp pullback.

UNG volume has been excessively high on recent weeks.

We have trimmed some of our resource stock longs... selling into strength but letting runners run.

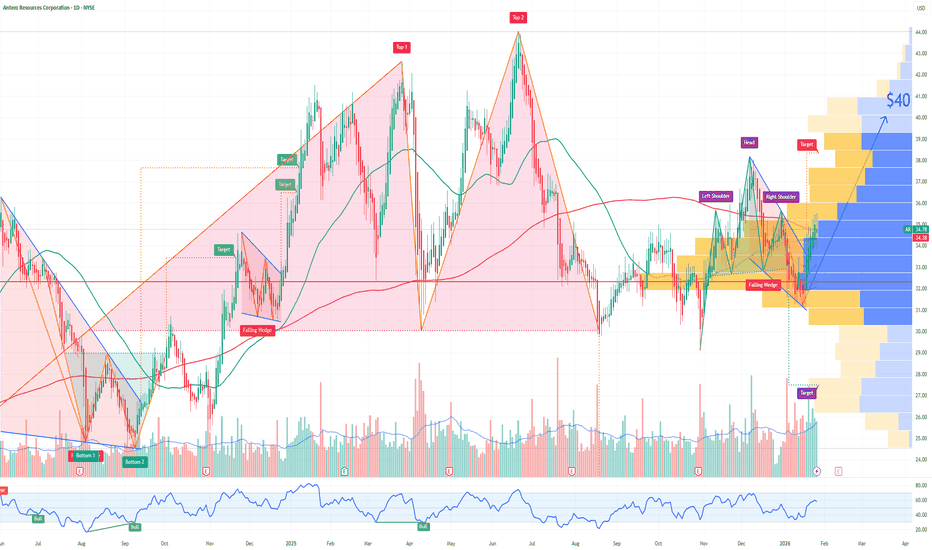

AR Antero Resources Bullish Bets in the Options Market! PT: $40Macro Catalyst: Winter Storm Fern:

The severe storm has disrupted U.S. gas supply, cutting production by 9–15% and boosting demand. For AR, focused on Appalachian gas, this spells direct upside as exports and heating needs spike.

Technicals:

AR held support above $34, with recent highs at $35.51. Volume topped 3.69M shares. A bullish pennant pattern suggests a breakout past $35.50–36 could target $37–38, accelerating to $40 post-earnings. EPS growth hit +472% Q/Q, limiting downside (support at $32–30).

Options Flow: Heavy Bullish Bets:

Sentiment screams bullish: $105M call premiums vs. minimal puts, volumes 6.8x daily average. Key unusual activity on long-dated calls:

Massive blocks on Feb 2026 $37 strikes (35k+ contracts, $2.6M–$8.6M premium)

Mar 2026 $38/$39 strikes with sweeps (40k/3k contracts)

Recent Mar $39 calls at $0.85

IV at 41–48%, high heat score signals aggressive upside plays. Dark pool blocks (e.g., 1.17M shares ~$40M) show smart money accumulating quietly.

Analyst Consensus: Strong Buy with Upside!

15 analysts rate Buy overall (9 Buy, 7 Hold, 2 Strong Buy), average target $44.33 (~29% upside). Wells Fargo at $46, Siebert at $48; optimists see $60. Stable BBB- ratings from Fitch/S&P. Expect ~$500M FCF boost from recent acquisitions like HG Energy.

Outlook: $40 Feasible!

Volatility in gas prices and post-storm corrections are risks, plus options decay without quick moves.

But with insider buying, earnings positioning, and flow momentum, $40 looks realistic post-report – a ~16% gain aligning with key strikes!

Natural Gas - Supply Fears? Natural Gas had one of the largest moves i have ever seen in one day.

Fear has spread into the nat gas market on supply fears since tensions have been rising around NATO / USA / EU....

With tarrifs being threatened one area that the EU remains vulnerable is their energy consumption.

We closed our AMEX:UNG calls today for over 900% locking in extraordinary gains...

We sold our AMEX:BOIL for 31% gain...

Nat Gas equities remain interesting and still a buy if this price holds / consolidates.

NATURAL GAS Epic Short Squeeze? Natural gas on Friday closed near the lows of the session but hitting extreme support.

Over the weekend news hit the tape about colder weather reports and increased snow.

This has sent Nat gas roaring up over double digits.

In our group we swung UNG 10.50 calls which should be up over 1000%

There is a strong thesis that this week the shorts will be caught off guard and forced to cover which could add more fuel to the fire.

The inventory report on Thursday will be interesting to see and price may stay firm into the report.

Is Natural Gas Bottoming? Natural gas continues to remain at the lower end of support.

Intra day nat gas is potentially forming a bullish inverse heads and shoulder pattern.

As long as Nat gas keeps giving is some higher lows - we should see a near term pop to the upside.

Failure to break out in the coming sessions could send us to 2.75.

I remain net long nat gas at these levels.

Is Natural Gas Bull Market Back? Natural gas saw an epic bounce today as 3 major weekly moving averages were defended.

Price action rallied sharply higher off the weekly 20, 50 & 200 MA.

This could be a massive bullish back test before we bounce back to new highs.

Resource stocks showed impressive strength during a day when markets were under pressure.

We have been nibbling on resource stock like we have said in our videos.

Inventories are tomorrow which could set the tone for the next bull rally.

Natural Gas - Epic Trade SetupNatural Gas made a new 52 week high today.

Inventory report came out and printed a smaller drawdown of 12BCF vs 18BCF expectation.

The initial reaction saw a bearish selloff all to be met with a bullish reversal to new highs.

Many traders closed out their shorts today as seen by the influx of volume across the sector.

Nat gas resource stocks saw some selling from the highs which could indicate some profit taking is occurring.

I'm looking for a short scalp setup in Nat gas tomorrow / next week.

Is Natural Gas In a Bull Market? Nat GAs technicals were defended at a key area especially when you observe the UNG chart.

Today Nat Gas resource stocks were some of the strongest stocks despite the market being weak.

Many resource chart patterns are looking very juicy and bullish.

They could be indicating a robust continuation move on Nat Gas into year end.

My only caution is the weak inventory reports we have been getting for the last 2 weeks.

I would like price to dip on Thursdays report to lessen the risk on the long side.

Bullish bounce off pullback supportUSD/ZAR is declining toward the pivot point, which serves as a pullback support level. From there, the pair could potentially bounce toward the 1st resistance level, which acts as a pullback resistance and sits slightly above the 60% Fibonacci retracement.

Pivot: 17.16611

1st Support: 17.10068

1st Resistance: 17.27964

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party.

Will ARUSDT's Hidden Liquidity Grab Spark a Major Bullish Move?Yello, Paradisers — are you watching ARUSDT closely? Because this setup could develop into one of the cleanest short-term opportunities we’ve seen lately, but only for those who remain patient and calculated. The current structure is showing early signs of a potential bullish shift, and here’s what we’re seeing.

💎ARUSDT has displayed a proper bullish Change of Character (CHoCH) along with a Break of Structure (BOS), both occurring right after a clean sweep of seller-side liquidity. This kind of price action generally signals a potential reversal and significantly increases the probability of a short-term bullish continuation.

💎However, while the bias is clearly tilting bullish, jumping in at current price levels doesn't offer an optimal risk-to-reward setup. Entering now would only give about a 1:1 RR, which isn’t ideal for high-probability trading. The more strategic move would be to wait for a retracement back into the Fair Value Gap (FVG). If price pulls back into that zone and forms a clear bullish candlestick pattern, the probability of a strong move upward increases substantially, and the RR improves in our favor.

💎That said, the setup isn't without its invalidation. If ARUSDT breaks down and we get a candle close below the invalidation level, the entire bullish scenario becomes invalid. In that case, there’s no reason to force a trade. It’s smarter to stay patient and wait for a clearer structure to reappear.

🎖Strive for consistency, not quick profits. Treat the market as a businessman, not as a gambler. There will always be another opportunity, but only if you protect your capital and remain disciplined. Stay focused and let the setup come to you — not the other way around.

MyCryptoParadise

iFeel the success🌴

Natural Gas - The Short SqueezeNatural gas had another stellar rally today.

Bouncing hard off the 7 day moving average and making new weekly highs.

We have completed the measured bull flag move in the near term so an extra rally from here is pure shorts getting cooked in my opinion.

With price action rallying so far so quickly we pared back and secured some profits on our natural gas equity positions.

We sold our RRC December calls for 115% gain.

We trimmed our AR January calls for 65% gain.

We still have equity exposure and positions in profit so now it becomes a game of managing protecting profits.

In the near term I would not be surprised to see a minor pullback or 1-2 weeks of consolidation.

Arweave – The Forgotten Web3 Infrastructure Gem Arweave – The Forgotten Web3 Infrastructure Gem 🌐🧠

ARUSDT just bounced from a brutal multi-year base near $5 — but this isn’t just another altcoin.

Arweave powers the permanent web. A decentralized data layer where information lives forever — not 30 days, not 30 years. Forever. It’s Bitcoin for storage, backed by the MIT License (2025) and built for one mission: data immortality .

What’s wild? Major chains and dApps already use it to store:

NFT metadata

On-chain governance archives

Front-ends for fully decentralized apps

📊 Chartwise:

$5.42 current

$16.98 first key resistance

$45.44 → $71.07 → $113.53 are the next Fibonacci zones if this cycle fully rotates

The rabbit hole is deep. But if the internet ever truly decentralizes, Arweave will be the hard drive it lives on.

Perspective Shift 🔄

Most people chase tokens that “do something.” Arweave stores the entire narrative. And in a digital world, storage is everything.

Disclaimer: I’m just sharing wisdom, not instructions. No licenses, no guarantees — just years of trading scars and precision chartwork. Be smart, protect your capital, and don’t copy blindly.

One Love,

The FXPROFESSOR 💙

Natural Gas - Golden CrossWhen this signal occurs you better no how to trade it.

The golden cross has now occured on the daily chart.

This is the 50MA intersecting with the daily 200 MA.

This is a medium to long term bullish signal that suggests nat gas over $5.

In the very short term traders often take profits and gains but buying dips over the next several weeks is a high technical probable setup.

Natural Gas - Bullish Long Term SignalNatural Gas rallied on inventories today.

Inventory report came in better than expected. 33B build vs 34B estimate.

Natural Gas is on the precipous of squeezing to $5.40

A golden cross is set to occur in the next few sessions....When the 50MA and the 200 MA crossover occurs it likely means the medium to long term price goes higher.

In the very near term that signal often results in some profit taking.

Natural Gas Short Squeeze!Natural Gas has entered the weekly short squeeze level.

Another impeccable rally, it makes you wonder where the bullish fundamentals are coming from.

It hasn't been from the inventory level demand.

Perhaps their is a escalation or conflict brewing that we will be discovering soon enough.

We have been discussing the Nat GAs inventories and how they were into good accumulation levels.

If Nat gas can hold above that weekly high pivot it swing the probabilities in favor of a $5 target.

Natural Gas Rallies on Weak InventoriesNatural Gas surged up 6% today.

Inventories came out 74B vs 71B estimate.

Despite the weaker report the commodity still surged.

This is showing a great relative strength trade.

A bull flag could be primed for a breakout on the daily chart.

Nat gas equities are beginning to look cheap again.

Natural Gas - Did You Profit?Today natural gas saw some downside pressure.

We closed our KOLD long - which was our short trade on Nat Gas, netting over 8% gain.

Being nimble in the Nat gas market is key, as its a very choppy asset and gains can be lost very quickly.

Breaking below the 7 day MA needs to be watched closely as it does leave room for more downside.

Inventories lately have been lack luster and need to show some positivity before price start to gravity to the weekly trend.

Natural Gas - Horrific Inventory ReportToday Nat gas showed a greater than expected build in inventories.

The consensus was 78B vs 87B actual.

Nat Gas has now triggered a bearish hourly pattern that takes us lower. If we lose the 3.60 area you can be sure we are likely going to target the gap fill.

I'm watching for Natural gas to potentially end the week with a weekly topping tail.

This colder weather report could be a fakeout pump to shakeout shorts.

Natural Gas Demolishes Shorts! Will The Move Hold?U.S. natural gas was up sharply today as some colder weather shows up in the temperature forecasts.

The fundamentals based off of previous inventories show slightly lower demand expectations.

This move could be a one off pop, it certainly needs to be reinforced by Thursdays inventory number to be able to sustain itself.

Natural Gas in one fells swoop has almost completed the upside 4 target.

Today we nibbled on an overnight shirt on Nat Gas by going long $KOLD.

This is just a day trade and I'm expecting to close it out withing 1-3 days.

Natural Gas Full Bear After Inventories!Natural GAs plummeted today on inventory report.

The consensus was for 76BCF build but came in higher at 80BCF build.

This demonstrates less demand and higher production.

The technical picture is slowly starting to breakdown for Nat Gas...the bulls need to do something quick to firm up price or we run the risk of the weekly downtrend taking hold.

next key area to watch will be a retest of the 3.30 zone.

Simultaneously you need to be monitoring inter market analysis (ie. watch Nat gas resource stock to see how their price action responds).

We booked profits on a small Boil long scalp today.

Natural Gas - Holding Daily SupportNat GAs is holding daily chart support.

The bulls today pierced the 200 MA but failed to close above it.

Inventories on Thursday will likely dictate whether we get the weekly chart downtrend to resume.

Nat gas has volatile price action as its stuck in 2 trend formations.

The daily remains in an uptrend but the weekly remains in a downtrend.

I'm waiting on the sideline until i get the right entry.

AR (Arweave) - Major Support Zone In PlayAR has seen a sharp pullback over the last few weeks and is now testing a key support level. This zone has previously acted as a strong base, making it a potential area for bullish reversal or bounce.

💡 Trade Idea:

🔹 Entry Zone: $5.20 – $5.40

🔹 Targets (TP):

• First target: $6.10 – $6.60

• Second target: $7.80 – $8.75

🔹 Stop Loss: Just below $5.00

🔍 Watch for bullish confirmation (volume spike, candle reversal) at support before entering. Manage your risk and scale out at key resistance levels.