ARB - JUMP SHIP or BAGHOLD ??Hello Traders

ARB is at an all time low.

Since October last year, it's basically been a freefall or call it price discovery if you will, but to the down side. The true question here is if buyers will still show up for support, or if bag holders are just waiting for every opportunity to get out?

It's sad to see yet another promising alt seemingly rugpull over time, losing over 94% since peaking:

In the short term, however, it is encouraging to see that you can still expect anywhere from 10 - 20% during a bounce. This is of course high risk, since bargaining on an increase, especially when the price is so obviously bearish, is high risk.

It's much harder to predict how low the price can go, a per above, since we are in "price discovery" mode.

What are your thoughts on Arb?

ARBUSD

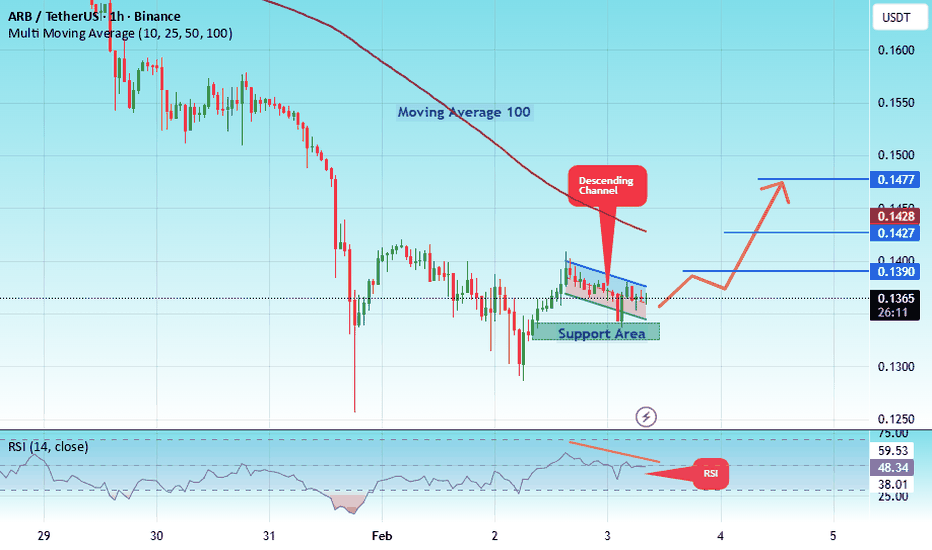

#ARB/USDT | Testing Wedge Breakout Amid Key Support#ARB

The price is moving within a descending channel on the hourly timeframe. It has reached the lower boundary and is heading towards a breakout, with a retest of the upper boundary expected.

The Relative Strength Index (RSI) is showing a downward trend, approaching the lower boundary, and an upward bounce is anticipated.

There is a key support zone in green at 1333, and the price has bounced from this level several times. Another bounce is expected.

The RSI is showing a trend towards consolidation above the 100-period moving average, which we are approaching, supporting the upward move.

Entry Price: 0.1364

Target 1: 0.1390

Target 2: 0.1427

Target 3: 0.1477

Stop Loss: Below the green support zone.

Remember this simple thing: Money management.

For any questions, please leave a comment.

Thank you.

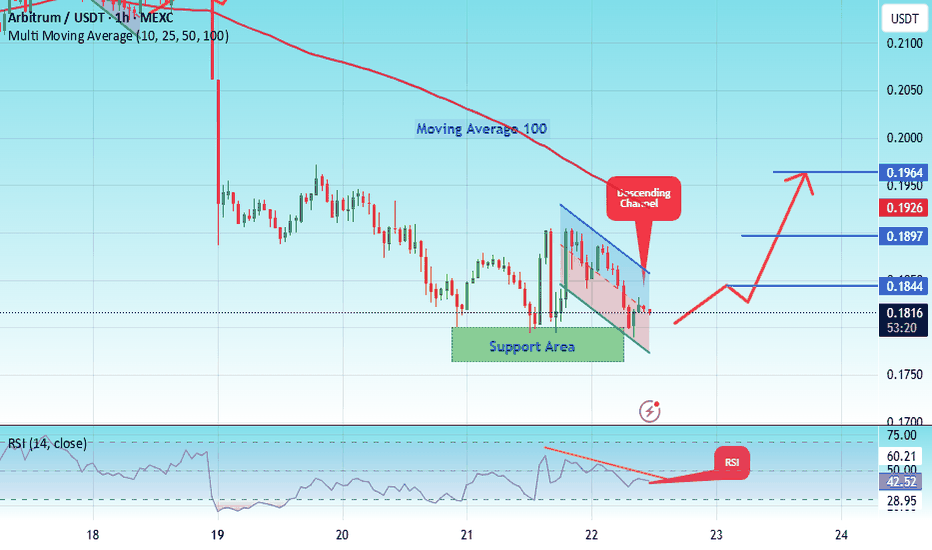

#ARB/USDT | Testing Wedge Breakout Amid Key Support#ARB

The price is moving within a descending channel on the hourly timeframe. It has reached the lower boundary and is heading towards a breakout, with a retest of the upper boundary expected.

The Relative Strength Index (RSI) is showing a downward trend, approaching the lower boundary, and an upward bounce is anticipated.

There is a key support zone in green at 0.1777. The price has bounced from this level several times and is expected to bounce again.

The RSI is showing a trend towards consolidation above the 100-period moving average, which we are approaching, supporting the upward move.

Entry Price: 0.1817

Target 1: 0.1844

Target 2: 0.1897

Target 3: 0.1964

Stop Loss: Below the green support zone.

Remember this simple thing: Money management.

For any questions, please leave a comment.

Thank you.

#ARB/USDT | Testing Wedge Breakout Amid Key Support#ARB

The price is moving within a descending channel on the hourly timeframe. It has reached the lower boundary and is heading towards a breakout, with a retest of the upper boundary expected.

The Relative Strength Index (RSI) is showing a downward trend, approaching the lower boundary, and an upward bounce is anticipated.

There is a key support zone in green at 0.2100. The price has bounced from this level several times and is expected to bounce again.

The RSI is showing a trend towards consolidation above the 100-period moving average, which we are approaching, supporting the upward move.

Entry Price: 0.2130

First Target: 0.2157

Second Target: 0.2190

Third Target: 0.2234

Stop Loss: Below the green support zone.

Remember this simple thing: Money management.

For any questions, please leave a comment.

Thank you.

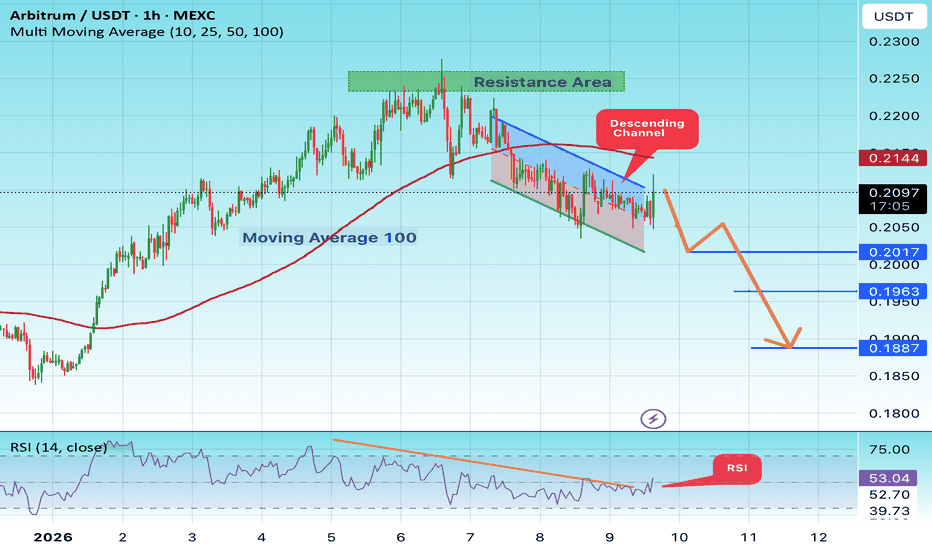

#ARB/USDT#ARB

The price is moving within a descending channel on the hourly timeframe. It has reached the upper boundary and is trending downwards, with a retest of this boundary expected.

The Relative Strength Index (RSI) is showing an upward trend, approaching the upper boundary, and a downward reversal is anticipated.

There is a key resistance zone (in green) at 0.2250, and the price has bounced from this zone several times. Another bounce is expected.

The price is showing a consolidation pattern above the 100-period moving average, which we are approaching, supporting the possibility of a downward move towards it.

Entry Price: 0.2120

Target 1: 0.2017

Target 2: 0.1963

Target 3: 0.1887

Stop Loss: Above the green resistance zone.

Don't forget one simple thing: Money Management.

For inquiries, please leave a comment.

Thank you.

ARB Buy/Long Signal (4H)Market makers are currently building a bullish structure accompanied by a corrective phase. During this process, they often use both time-based and price-based corrections to force retail traders out of otherwise correct positions. These corrective phases are designed to create confusion, emotional pressure, and impatience among traders.

The bullish momentum of the impulse move has been strong, but the recent correction has been mostly time-based rather than price-based. From a price perspective, the pullback has been relatively weak, which actually supports the bullish scenario. However, this type of slow and choppy consolidation tends to shake out traders, causing many to enter positions too early or lose patience. As a result, some traders end up closing their positions at a loss, while otherswho initially entered in the correct direction—exit prematurely. Once this shakeout is complete, price often continues strongly to the upside.

Currently, ARB is trading around major key levels, and on the chart we can clearly identify a Bullish Change of Character (CHoCH). This structural shift confirms that the market bias has changed and that the higher-timeframe structure is now supportive of Buy/Long positions.

Given that the overall structure favors bullish continuation, it is more optimal to use the recent correction as an opportunity to enter Buy/Long positions near key support zones, rather than chasing price at higher levels.

Entry Plan & Risk Management

We have two predefined entry zones, marked on the chart, and positions should be executed using a DCA (Dollar Cost Averaging) approach to improve average entry price and reduce exposure to short-term volatility.

If you decide to enter a position, remember that risk management always comes first. Define your risk clearly, size your position appropriately, and remain patient once you are in the trade.

Targets & Trade Management

All targets are clearly marked on the chart.

At Target 1, it is recommended to secure partial profits.

After taking partial profit, move the stop loss to Break Even to protect capital and allow the trade to continue risk-free.

As long as the bullish structure remains valid and key support levels hold, the probability continues to favor further upside.

⚠️ This analysis is for educational purposes only and not financial advice.

ARB/USDT - Falling Wedge: Trend Reversal or Consolidation?ARB/USDT on the 2-Day timeframe is trading within a medium-term corrective structure after a prolonged bearish move from mid-2025. Price action is now compressing inside a Falling Wedge pattern, indicating a gradual reduction in selling pressure.

Currently, price is hovering near the lower boundary of the wedge, a critical zone that often acts as a decision area between a bullish reversal breakout or a bearish continuation if the structure fails.

---

Chart Pattern Explanation

Falling Wedge (Bullish Reversal Pattern)

Formed by lower highs and lower lows with contracting price range

The upper trendline slopes downward with decreasing momentum

The lower trendline also slopes downward but with weaker selling pressure

This pattern often appears at the end of a downtrend

A confirmed breakout above the upper wedge trendline usually signals a trend reversal or strong bullish retracement.

---

Key Levels

Resistance Levels:

0.2450 → Key breakout resistance (wedge invalidation level)

0.3050 → Major resistance / mid-range supply zone

0.3600 – 0.4560 → Strong distribution area

0.5850 → Upper structure / extreme bullish target

Support Levels:

0.2180 – 0.2000 → Current short-term support inside the wedge

0.1600 – 0.1350 → Structural support zone

0.1049 → Historical low / last strong demand area

---

Bullish Scenario

Price holds above the 0.20 support zone

Clear breakout above the Falling Wedge upper trendline

Strong candle close above 0.2450

Bullish Targets:

1. 0.3050

2. 0.3600

3. 0.4560

4. Maximum extension: 0.5850

➡️ This scenario confirms a bullish reversal from the Falling Wedge, especially if supported by increasing volume.

---

Bearish Scenario

Price fails to hold the 0.20 support

Breakdown below the lower wedge support

Strong candle close below 0.1600

Bearish Targets:

1. 0.1350

2. 0.1150

3. 0.1049 (previous low)

➡️ This indicates pattern failure, opening the door for bearish continuation toward historical demand zones.

---

Conclusion

ARB/USDT is currently trading at a critical structural zone.

A confirmed breakout from the Falling Wedge favors a bullish reversal or strong recovery move

Failure to hold key supports would invalidate the pattern and resume the dominant downtrend

Waiting for a confirmed breakout or breakdown is crucial for risk management.

---

#ARBUSDT #ARBITRUM #CryptoAnalysis #TechnicalAnalysis #FallingWedge

#AltcoinTrading #MarketStructure #SupportResistance

#ARB/USDT | Testing Wedge Breakout Amid Key Support#ARB

The price is moving in a descending channel on the 1-hour timeframe. It has reached the lower boundary and is heading towards a breakout, with a retest of the upper boundary expected.

We are seeing a bearish trend in the Relative Strength Index (RSI), which has reached near the lower boundary, and an upward bounce is expected.

There is a key support zone in green at 0.1840, and the price has bounced from this level several times. Another bounce is expected.

We are seeing a trend towards stabilizing above the 100-period moving average, which we are approaching, supporting the upward trend.

Entry Price: 0.1900

First Target: 0.1924

Second Target: 0.1958

Third Target: 0.1995

Remember a simple principle: Money Management.

Place your stop-loss order below the green support zone.

For any questions, please leave a comment.

Thank you.

#ARB/USDT | Testing Wedge Breakout Amid Key Support#ARB

The price is moving in a descending channel on the 1-hour timeframe. It has reached the lower boundary and is heading towards breaking above it, with a retest of the upper boundary expected.

We have a downtrend on the RSI indicator, which has reached near the lower boundary, and an upward rebound is expected.

There is a key support zone in green at 0.1850. The price has bounced from this zone multiple times and is expected to bounce again.

We have a trend towards consolidation above the 100-period moving average, as we are moving close to it, which supports the upward movement.

Entry price: 0.1900

First target: 0.1931

Second target: 0.1984

Third target: 0.2044

Don't forget a simple principle: money management.

Place your stop-loss order below the support zone in green.

For any questions, please leave a comment.

Thank you.

FireHoseReel | ARB 4H Range Structure with Pre-Breakout Zones🔥 Welcome To FireHoseReel !

Let’s dive into Arbitrum (ARB) analysis.

⛳️ ARB Fundamental Overview

Arbitrum (ARB) is an Ethereum Layer-2 scaling solution ranked #56 on CoinMarketCap. It makes transactions faster and cheaper while supporting many dApps.

👀 ARB 4H Overview

ARB is trading inside a 4-hour range, with the upper boundary at $0.2242 and the lower boundary at $0.1875. At the moment, two pre-breakout zones have formed, both offering potential trading opportunities.

📊 Volume Analysis

Compared to other coins, ARB’s volume remains relatively strong. However, while price is ranging inside this box, volume has slightly decreased compared to previous levels. A volume expansion could trigger the next move and drive price out of the range.

✍️ ARB Trading Scenarios

🟢 Long Scenario 1:

A break above the pre-breakout zone at $0.2025, supported by rising buying volume and an RSI momentum break above the 46 level, could provide a valid long setup. The next resistance is located at the range high around $0.2242.

🔴 Short Scenario:

A break below the pre-breakout zone at $0.1921, confirmed by increasing selling volume and an RSI momentum break below the 32 level, could offer a short opportunity. The next support lies near the range low at $0.1875. Since these two levels are close, the position would be entered slightly earlier.

🧠 Protect your capital first. No setup is worth blowing your account. If risk isn’t controlled, profit means nothing. Trade with rules, not emotions.

#ARB/USDT | Testing Wedge Breakout Amid Key Support#ARB

The price is moving in a descending channel on the 1-hour timeframe. It has reached the lower boundary and is heading towards breaking above it, with a retest of the upper boundary expected.

We have a downtrend on the RSI indicator, which has reached near the lower boundary, and an upward rebound is expected.

There is a key support zone in green at 0.2000. The price has bounced from this level multiple times and is expected to bounce again.

We have a trend towards consolidation above the 100-period moving average, as we are moving close to it, which supports the upward movement.

Entry price: 0.2142

First target: 0.2170

Second target: 0.2219

Third target: 0.2280

Don't forget a simple principle: money management.

Place your stop-loss order below the support zone in green.

For any questions, please leave a comment.

Thank you.

#ARB/USDT | Testing Wedge Breakout Amid Key Support#ARB

The price is moving within an ascending channel on the 1-hour timeframe and is adhering to it well. It is poised to break out strongly and retest the channel.

We have a downtrend line on the RSI indicator that is about to break and retest, which supports the upward move.

There is a key support zone in green at 0.2276, representing a strong support point.

We have a trend of consolidation above the 100-period moving average.

Entry price: 0.2318

First target: 0.2384

Second target: 0.2447

Third target: 0.2520

Don't forget a simple money management rule:

Place your stop-loss order below the green support zone.

Once you reach the first target, save some money and then change your stop-loss order to an entry order.

For any questions, please leave a comment.

Thank you.

#ARB/USDT — Last Line of Defense: Reversal Incoming or Breakdo#ARB

The price is moving within an ascending channel on the 1-hour timeframe and is adhering to it well. It is poised to break out strongly and retest the channel.

We have a downtrend line on the RSI indicator that is about to break and retest, which supports the upward move.

There is a key support zone in green at 0.2517, representing a strong support point.

We have a trend of consolidation above the 100-period moving average.

Entry price: 0.2619

First target: 0.2693

Second target: 0.2776

Third target: 0.2883

Don't forget a simple money management rule:

Place your stop-loss order below the green support zone.

Once you reach the first target, save some money and then change your stop-loss order to an entry order.

For any questions, please leave a comment.

Thank you.

#ARB/USDT#ARB

The price is moving within an ascending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We have a bearish trend on the RSI indicator that is about to be broken and retested, which supports the upward breakout.

There is a major support area in green at 0.3200, which represents a strong support point.

We are heading for stability above the 100 moving average.

Entry price: 0.3307

First target: 0.3363

Second target: 0.3470

Third target: 0.3618

Don't forget a simple matter: capital management.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

#ARB/USDT Analysis: Breakout Potential with Overbought RSI !#ARB

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We have a bearish trend on the RSI indicator that is about to be broken and retested, which supports the upward breakout.

There is a major support area in green at 0.4180, which represents a strong support point.

We are heading for consolidation above the 100 moving average.

Entry price: 0.4229

First target: 0.4303

Second target: 0.4370

Third target: 0.4454

Don't forget a simple matter: capital management.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

#ARB/USDT (ARB): Looking For Buy Entry | 2 Zones To Keep an Ey#ARB

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and heading for a strong breakout and retest.

We have a bearish trend on the RSI indicator that is about to be broken and retested, which supports the upward breakout.

There is a major support area in green at 0.4140, which represents a strong support point.

We are heading for consolidation above the 100 moving average.

Entry price: 0.4160

First target: 0.4215

Second target: 0.4264

Third target: 0.4325

Don't forget a simple matter: capital management.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

BUY AND HOLDHello friends

Given the price reaching the bottom and the floor that this currency has made, we can expect its price to grow because the buyers at the bottom pushed the price up and now we are in a correction, which is a good opportunity to buy with capital and risk management and in steps and move with it to the specified goals.

Note that the holding period is at least 3 months, so be patient and observe capital management.

*Trade safely with us*

#ARB/USDT (ARB): Strong Liquidity Grab | Expecting Quick Recov#ARB

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We have a bearish trend on the RSI indicator that is about to be broken and retested, which supports the upward breakout.

There is a major support area in green at 0.4200, which represents a strong support point.

We are heading for stability above the 100 moving average.

Entry price: 0.4400

First target: 0.4490

Second target: 0.4590

Third target: 0.4720

Don't forget a simple matter: capital management.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

#ARB/USDT | TON Testing Wedge Breakout Amid Key Support#ARB

The price is moving in a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a major support area in green that pushed the price higher at 0.4858.

Entry price: 0.4940.

First target: 0.5076.

Second target: 0.5213.

Third target: 0.5390.

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change the stop order to an entry order.

For inquiries, please comment.

Thank you.

#ARB/USDT Pro | ARB Set for Pump After Pullback to Support#ARB

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We have a bearish trend on the RSI indicator that is about to be broken and retested, which supports the upward breakout.

There is a major support area in green at 0.4890, which represents a strong support point.

For inquiries, please leave a comment.

We are in a consolidation trend above the 100 moving average.

Entry price: 0.4942

First target: 0.5085

Second target: 0.5216

Third target: 0.5400

Don't forget a simple matter: capital management.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

#ARB/USDT | ARB Set for Pump After Pullback to Support#ARB

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We have a bearish trend on the RSI indicator that is about to be broken and retested, which supports the upward breakout.

There is a major support area in green at 0.4950, which represents a strong support point.

For inquiries, please leave a comment.

We are in a consolidation trend above the 100 moving average.

Entry price: 0.5083

First target: 0.5158

Second target: 0.5262

Third target: 0.5388

Don't forget a simple matter: capital management.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

#ARB/USDT possible resistance/support flip happening#ARB

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 Moving Average once again.

We have a bearish trend on the RSI indicator, supporting the upward break.

We have a support area at the lower boundary of the channel at 0.4900, acting as strong support from which the price can rebound.

We have a major support area in green that pushed the price upward at 0.4860.

Entry price: 0.4940.

First target: 0.5008.

Second target: 0.5085.

Third target: 0.5180.

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change your stop order to an entry order.

For inquiries, please comment.

Thank you.

ARB/USDT — Retesting the Golden Pocket Before the Next Big Move?

📝 Key Summary:

Arbitrum (ARB) is currently consolidating within the Fibonacci golden pocket (0.445–0.471), which also acts as a major demand zone. This area will decide whether ARB can continue its bullish phase toward the psychological $1+ levels, or fail to hold and revisit deeper supports.

---

🔍 Price Structure & Key Patterns

1. Accumulation / Demand Zone (0.445–0.471):

This zone is a confluence of Fibonacci 0.5–0.618 and a strong historical support-resistance flip. Holding this level keeps the mid-term bullish case alive.

2. Higher Low Formation Since June:

From the 0.242 bottom, ARB has started forming higher lows, suggesting a potential transition toward a healthier uptrend.

3. Rejection at Supply Zone (0.62–0.63):

The latest rally was rejected here, confirming strong selling pressure. A clean breakout above this zone will be a key signal for a larger rally.

4. Wide Trading Range:

ARB is still ranging between 0.24 (low) and 1.23 (high). The current price sits in the lower-mid range, making this a high-interest zone for medium-term investors.

---

📈 Bullish Scenario

✅ Conditions: Price holds above 0.445–0.471 (2D bullish close + volume confirmation).

➡️ Upside targets:

First resistance: 0.6266

Next: 0.7148 → 0.9197 → 1.0317 → 1.1695 → 1.2392 (previous high)

📌 Note: A breakout above 0.63 with strong volume could trigger a multi-week swing rally.

---

📉 Bearish Scenario

❌ Conditions: 2D close below 0.4458 + strong selling volume.

➡️ Downside targets:

0.35 (intermediate support)

0.2420 (multi-month low / extreme demand zone)

📌 Note: Losing the golden pocket usually signals that the market isn’t ready for a bullish trend, raising the risk of retesting previous lows.

---

🧭 Trading Approach

Conservative: Wait for a 2D bullish rejection above 0.47 → long entry, stop below 0.445, first target 0.6266+.

Aggressive: Partial long entries at current levels, adding more upon bullish confirmation.

Short setup: Valid on breakdown below 0.445 → target 0.35, extension to 0.24 if selling persists.

Always apply risk management (RR ≥ 1:2), scale out at resistance levels.

---

📌 Conclusion

ARB is currently sitting at the key decision zone (Fibonacci golden pocket 0.445–0.471).

If this zone holds → bullish bias toward 0.63 up to 0.92+.

If this zone breaks → bearish bias toward 0.35 and potentially 0.24.

Traders should wait for candle + volume confirmation before committing, as this level could mark a major turning point in ARB’s mid-term trend.

---

#ARB #ARBUSDT #Arbitrum #CryptoAnalysis #PriceAction #SupportResistance #Fibonacci #CryptoTrading #Altcoins #SwingTrade