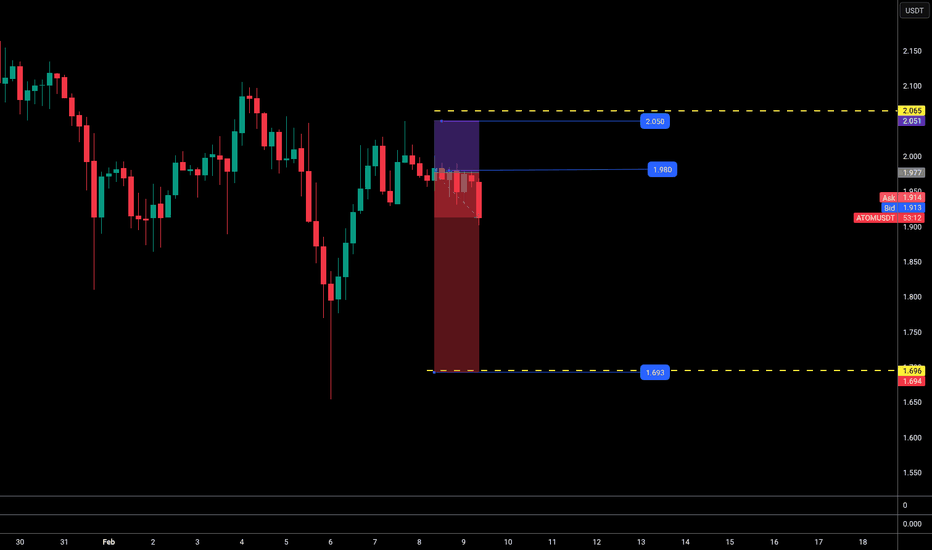

ATOMUSDT - A QUICK SELL SET UP - 09-02-2026ATOMUSDT - G-Money's short version analysis based purely on technical analysis only, no nonsense or "BS". I do totally ignore any fundamental analysis, technical analysis only

ATOMUSDT - still kinda on the "move" and continue DOWN...

Who did enter this trade earlier congratulations! Who missed it... See you next time! ;)

(TRY TO "EXPLORE" LTF ENTRY SET UPS, DON'T RUSH TO "JUMP IN", TAKE YOUR TIME...)

!!!!! BE AWARE: TESTING OF UNTESTED TECHNICAL ANALYSIS IN PROGRESS, BE AWARE OF "GLITCHES" !!!!!!

Chart is itself explaining. Kept a "KISS" approach all the way ( "Keep It Simple, Stupid") & beginners friendly... ;)

I do hope that nobody ignoring SL ( Stop Loss) ! Without it, It is a fastest way to loose hard earned money...

;)

Trade safe & don't do "gambling". In the end it never pays, not worth it to risk loose all your $...

PS: above technical analysis is done for the community & educational purpose only! It is not a financial advice. Just share my very own insight to it.

ATOMUSDT

ATOM / USDT - A QUICK SELL SET UP - 29-01-2026ATOM-USDT G-Money's short version analysis based purely on technical analysis only, no nonsense or "BS". I do totally ignore any fundamental analysis, technical analysis only

ATOM / USDT still kinda on the "move" and continue DOWN...

Who did enter this trade earlier congratulations! Who missed it... See you next time! ;)

Chart is itself explaining. Kept a "KISS" approach all the way ( "Keep It Simple, Stupid") & beginners friendly... ;)

I do hope that nobody ignoring SL ( Stop Loss) ! Without it, It is a fastest way to loose hard earned money...

;)

Trade safe & don't do "gambling". In the end it never pays, not worth it to risk loose all your $...

PS: above technical analysis is done for the community & educational purpose only! It is not a financial advice. Just share my very own insight to it.

ATOM is still bullish (8H)ATOM price has recently shown a sharp and powerful impulsive move from the bottom, which clearly indicates the presence of strong institutional and smart money buyers. This aggressive reaction from demand zones suggests that buyers are in control of the market structure at the moment.

The bullish momentum is very strong, and price is respecting higher highs and higher lows. As long as this momentum remains intact, minor pullbacks and shallow corrections can be considered healthy and optimal opportunities to enter Buy/Long positions, rather than signs of weakness.

From a market structure perspective, we can clearly identify a Bullish Change of Character (CHoCH) on the chart. This CH confirms that the previous bearish structure has been broken and the market has officially shifted into a bullish phase. Additionally, price is currently trading around key levels, which further increases the importance of this zone and validates the bullish scenario.

Entry Strategy (DCA Approach)

We have two potential entry zones, marked on the chart. These entries can be executed using a DCA (Dollar Cost Averaging) strategy to reduce risk and improve the average entry price. This approach allows better position management in case of short-term volatility.

Targets & Trade Management

All targets are clearly marked on the chart.

At Target 1, it is recommended to secure partial profits to reduce exposure.

After reaching the first target, move the stop loss to Break Even to protect capital and allow the trade to run risk-free.

Remaining positions can be held towards higher targets as long as bullish structure and momentum remain valid.

Final Thoughts

As long as price holds above key support levels and maintains its bullish structure, the overall bias remains bullish. Always manage risk properly and avoid over-leveraging, especially in volatile market conditions.

⚠️ This analysis is not financial advice. Always do your own research and manage risk accordingly.

If you would like us to analyze a coin or altcoin for you, first like this post, then comment the name of your altcoin below.

TradeCityPro | ATOM Testing Support as Bears Dominate👋 Welcome to TradeCityPro’s first analysis of 2026!

In this analysis, I want to review the ATOM coin for you. One of the DeFi projects in the Osmosis ecosystem, which with a market cap of $937 million is ranked 63rd on CoinMarketCap.

⏳ 4-hour timeframe

On the 4-hour timeframe, this coin has a bearish trend and has now entered a correction and ranging phase, preparing to start its next move.

✨ The main support level we have on ATOM is 1.834. However, the price has also formed another support at 1.916, which it has previously touched several times and has now reached again.

✔️ After the previous bearish wave ended, the price corrected upward, and after reaching 2.103, bearish momentum entered the market again.

🧮 Currently, the price is sitting on the 1.916 support. Given the bearish momentum and the increasing selling volume, the probability of breaking 1.916 has increased.

⚡️ With the break of 1.916, we can open a short position.The main trigger for confirming ATOM turning bearish is the break of the 1.834 level.

⛏ However, if the price gets supported from this area and moves upward, breaking 2.103 will give us the first confirmation of ATOM turning bullish.

📈 Personally, I prefer to only open short positions on ATOM for now, since it has a strong bearish trend, and for long positions, we can use other coins that have bullish structures.

📝 Final Thoughts

Stay calm, trade wisely, and let's capture the market's best opportunities!

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

ATOM/USDT short-term🔍 Market Structure

Clear downtrend – price is moving within a descending channel (lower highs and lows).

Each bounce is sold at the upper band of the channel.

No signal of a change in structure yet (no HH + HL).

📉 Current Price Status

Price is at the lower end of the channel.

Consolidation after a downward impulse → typical bearish continuation or short technical rebound.

Current Zone:

~2.02–2.05 USDT – local support + demand reactions.

🟢 Key Levels

Support

2.049 – local support (current reaction)

1.999 – strong psychological support

1.951

1.878 – lower demand zone (important!)

Resistance

2.099

2.125

2.201 – key resistance / S→R flip.

Upper channel line (~2.20–2.23)

📊 Stochastic RSI

Oscillator often in oversold territory.

Currently recovering from the low → possible short rebound.

BUT: in a downtrend. The Stoch RSI is not a long-term signal.

➡️ More likely a pullback, not a trend change.

🧠 Scenarios

🔴 Baseline scenario (most likely)

Bounce to:

2.09 → 2.12

Rejection + further decline:

1.99

then 1.95 / 1.88

➡️ Short at resistance levels in line with the trend.

🟢 Alternative scenario (less likely)

Breakout of 2.20 + close of the 1H candle above the channel

Retest from above

Then targets:

2.28

2.35–2.40

➡️ Only then can we talk about a change in structure.

#ATOM/USDT | ATOMUSDT Preparing for a Potential Drop#ATOM

The price is moving in a descending channel on the 1-hour timeframe. It has reached the lower boundary and is heading towards breaking above it, with a retest of the upper boundary expected.

We have a downtrend on the RSI indicator, which has reached near the lower boundary, and an upward rebound is expected.

There is a key support zone in green at 2.40. The price has bounced from this zone multiple times and is expected to bounce again.

We have a trend towards stability above the 100-period moving average, as we are moving close to it, which supports the upward movement.

Entry price: 2.51

First target: 2.58

Second target: 2.66

Third target: 2.75

Don't forget a simple principle: money management.

Place your stop-loss below the support zone in green.

For any questions, please leave a comment.

Thank you.

Breaking: Cosmos ($ATOM) Spike 11% Today Albeit Market Dip The price of ( NASDAQ:ATOM ) soared 11% today despite the market bloodbirth that saw Ethereum tanked to $2900 zone and CRYPTOCAP:BTC to the $80k zone.

NASDAQ:ATOM is constricted in a tight symmetrical triangle pattern with the RSI at 53. Should the altcoin break the ceiling of the triangle to the $5 resistance, the asset will be eyeing the $40 resistant.

In another news, South Korea’s leading exchange Bithumb has announced a crucial temporary suspension affecting ATOM transactions. Starting November 10 at 9:00 AM UTC, the platform will temporarily halt all ATOM deposits and withdrawals to facilitate an essential network upgrade. This proactive measure ensures the Cosmos ecosystem continues to evolve securely and efficiently.

What Is Cosmos (ATOM)?

In a nutshell, Cosmos bills itself as a project that solves some of the “hardest problems” facing the blockchain industry. It aims to offer an antidote to “slow, expensive, unscalable and environmentally harmful” proof-of-work protocols, like those used by Bitcoin, by offering an ecosystem of connected blockchains.

Cosmos Price Data

Cosmos price today is $3.04 USD with a 24-hour trading volume of $189,904,725 USD. Cosmos is up 10.03% in the last 24 hours. The current CoinMarketCap ranking is #52, with a market cap of $1,457,333,330 USD. It has a circulating supply of 478,764,540 ATOM coins.

ATOM/USDT — Diving into the Zone 2.4–1.9: Breakout or breakdown?Cosmos (ATOM) is now standing at its most critical point in recent years, precisely within the historical support zone of 2.45–1.95, which has served as a major accumulation area since the early phase of the 2020 bull run. This zone isn’t just a number—it represents the psychological foundation of ATOM’s market.

In recent weeks, the weekly chart has shown a sharp decline followed by a long lower wick, signaling a massive liquidity sweep. In other words, many long positions were flushed out before price was pulled back up — an indication that smart money might be accumulating here, though no confirmed reversal has occurred yet.

Technically, ATOM remains in a medium- to long-term downtrend, forming a series of lower highs and lower lows since 2022. However, the current level opens two major possibilities — the beginning of a new accumulation phase, or the continuation of the final capitulation wave.

---

Pattern Structure & Technical Context

1. Main Trend: The multi-year downtrend remains intact.

2. Golden Zone (Historical Support): 2.45–1.95 — the same accumulation area that fueled the 2021 bull run.

3. Fakeout & Liquidity Sweep: The long wick below the zone shows liquidity collection, a potential reversal signal if confirmed by a bullish weekly candle.

4. Reversal Confirmation: Requires a weekly close above 3.75, followed by a successful retest.

5. Volume & Divergence: Watch for bullish divergence on RSI or MACD to reinforce reversal strength.

---

BULLISH SCENARIO – “The Rebirth Zone”

If price holds and rebounds strongly from the 2.45–1.95 zone, this could mark the beginning of a major re-accumulation phase. The bullish case strengthens if:

A weekly close above 3.75 occurs (reclaiming old structural support).

The move is supported by strong volume and a solid bullish candle.

A higher low forms above 2.45.

Step-by-step target levels:

➡️ 3.75 → 5.25 → 6.60 → 10.10 → 13.15 → 15.85

If momentum continues, a potential Adam & Eve Reversal or Inverse Head & Shoulders could form in this zone, signaling the transition from bear market to a new bull trend.

Core Bullish Idea: The 2.45–1.95 zone is a “life-or-death point” — holding above it offers a high-reward setup compared to the downside risk.

---

BEARISH SCENARIO – “Break the Floor”

However, if a weekly close occurs below 1.95, this historical support would be officially invalidated.

This could trigger:

A final capitulation wave toward 1.20 or even 0.85, levels that previously acted as a base before the 2020 rally.

A failed retest of the 2.45–1.95 zone (flipping it into resistance).

Weakening market sentiment, pushing ATOM into a prolonged bearish continuation phase.

In this case, traders should wait for a confirmed bottom before accumulating, as further downside risk remains open.

---

CONCLUSION

ATOM is now at the ultimate battlefield between buyers and sellers.

If the 2.45–1.95 zone holds, we could witness the early stages of ATOM’s major recovery, potentially heading back toward the 5–10 USD range. But if it breaks down, the long-term bull structure officially collapses, and the market may seek equilibrium much lower.

The coming weeks will determine whether this zone becomes the foundation of a rebirth, or the gateway to deeper decline.

---

#ATOMUSDT #Cosmos #CryptoAnalysis #WeeklyChart #SupportZone #MarketStructure #SwingTrade #BullishReversal #BearishBreakdown #TradingViewAnalysis #TechnicalAnalysis

Atom , update .Didn’t went well as 4 years cycle fooled most of us and almost at the. Mars 2020 level , now that we left the 4 year cycle behind I can see clearly that we hit the bottom, RSI bullish divergence with price channel tightening tells us a possible reversal is on the edge, for me an ATH is ideal and possible, remember the history is being written by tough times.

TradeCityPro | ATOMUSDT Ready for a Sharp Drop!👋 Welcome to TradeCityPro Channel!

Let’s analyze ATOM (Cosmos) — one of the older and more established coins in the market. Personally, I’ve been holding and staking this one for quite a while.

🌐 Overview of Bitcoin

Before we begin, let me remind you that we’ve moved the Bitcoin analysis section to a separate daily report at your request, so we can go into more detail about Bitcoin’s condition, price action, and dominance:

📊 Higher Time Frames

On the higher time frames, ATOM has been ranging for a long period of time and interestingly, it has even formed a smaller range inside its main range.

Currently, it’s oscillating near the bottom support of that larger range, showing weakness.

🕓 4H Time Frame

In the 4-hour chart, the price remains stuck inside a range between $4.002 and $4.310.

However, this time it has been rejected from the midline, which increases the likelihood of losing the lower support.

📉 Short Position Setup

If the price breaks below $4.002 with increasing volume and momentum, opening a short position would be completely logical and I’ll personally be taking that short setup as well.

📈 Long Position Setup

For a long position, patience is key.

Other coins like MNT, HYPE, and AVAX currently show stronger bullish potential, but if ATOM breaks above $4.310 and starts forming higher highs and higher lows, we can then begin to shift our bias to bullish.

📝 Final Thoughts

Stay calm, trade wisely, and let's capture the market's best opportunities!

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

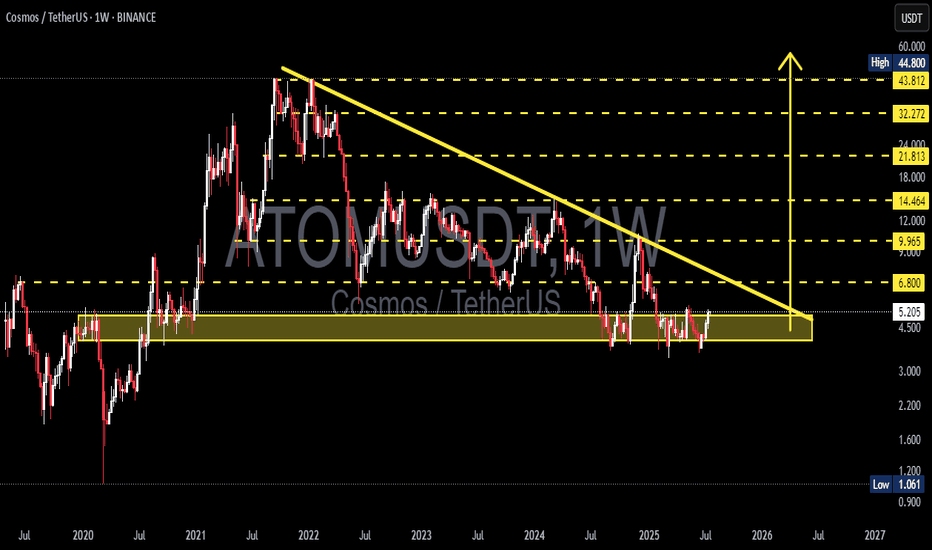

ATOMUSDT — Holding at Historical Support, Rebound or Break Down?📊 Overview

The Cosmos (ATOM/USDT) Weekly chart is at a decisive point. Price is currently sitting inside the historical support zone around 3.5 – 4.5 USDT, which has acted as a strong defense since 2020. Every time ATOM touched this area, a rebound followed — but this time the repeated tests suggest the support is getting weaker.

The macro structure still shows a pattern of lower highs since the 2021 peak, indicating a dominant bearish bias. However, the prolonged pressure has also pushed ATOM into an attractive long-term accumulation zone — if the support holds.

---

🔑 Key Technical Levels

Main Support Zone (Current): 3.5 – 4.5 USDT

Next Support: 2.7 USDT (structural low from 2020)

Resistance 1: 5.375 USDT

Resistance 2: 6.800 USDT

Resistance 3: 9.965 USDT

Major Resistances: 14.464 – 21.813 – 32.272 – 45.612 USDT

These levels provide the roadmap for ATOM’s mid-to-long-term direction.

---

🟢 Bullish Scenario

1. Confirmation: a weekly close above 5.375 – 5.5 USDT with strong volume.

2. Implication: signals that selling pressure is fading and the support zone has held.

3. Targets:

Initial: 6.8 USDT

Mid-term: 9.965 USDT

Extended: 14.4 – 21.8 USDT if market momentum strengthens.

4. Pattern potential: a double bottom or accumulation base may form if the zone continues to hold and buyers step in aggressively.

---

🔴 Bearish Scenario

1. Confirmation: a weekly close below 3.5 USDT.

2. Implication: breakdown of historical support → opens the path for deeper downside.

3. Targets:

First: 2.7 USDT (2020 structural support).

Extended: 2.1 – 1.6 USDT if selling accelerates.

4. Warning: repeated testing of the same support weakens it, making a breakdown scenario highly possible if buyers fail to defend.

---

📌 Structure & Pattern Insights

Horizontal consolidation within support zone, small weekly candles → market indecision.

Lower highs keep pressuring the structure downward.

Potential double bottom if ATOM holds above 3.5 and reverses strongly.

Beware of false breaks — always confirm with volume and retest.

---

🎯 Trader & Investor Takeaways

Short-term traders: watch closely for reaction inside 3.5–4.5. Aggressive entries possible here with tight stops below 3.3. Safer entries only after a weekly close above 5.5.

Long-term investors: this zone is historically a strong accumulation area, but patience and risk management are crucial due to breakdown risks.

Strategy: scale into positions gradually, risk max 1–2% per trade, and rely on weekly confirmation.

---

📝 Conclusion

ATOM is at a crossroads. Holding the 3.5–4.5 support zone could spark a rebound toward 6.8 – 10 USDT, while a confirmed breakdown below 3.5 would expose ATOM to 2.7 or even lower.

The next weekly close will likely decide the medium-term trend. ATOM now stands like a last fortress under siege — either it defends and rallies, or it crumbles into deeper lows.

---

#ATOM #Cosmos #ATOMUSDT #Crypto #TechnicalAnalysis #PriceAction #SupportResistance #CryptoMarket #SwingTrading #InvestInCrypto

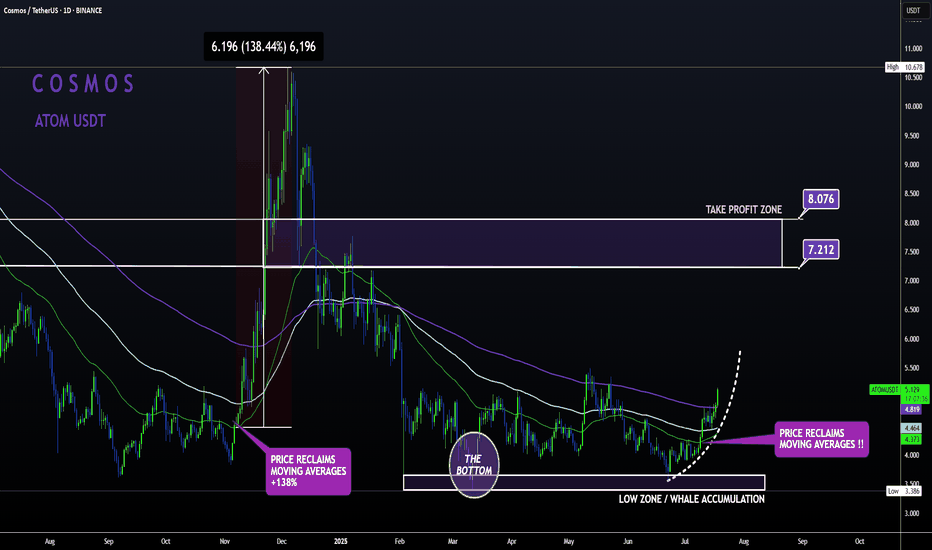

ATOM Sleeping GIANT ALT | Moving Averages BULLISH like NOV24'ATOM is slowly but surely making a turn up towards the first Take Profit point.

From the bottom, Cosmos has already increased a whopping 52% , with even more room to grow:

In my previous update, the 4 was still bearish when looking at trend lines and moving averages.

However, this has flipped to bullish from the 4h upward, with the price trading high above the moving averages in the 4h and in the daily timeframe:

4H:

Daily:

Note how previously, the big increases started as soon as the price regained the moving averages as support.

ATOM Short

Short entry positioned at $5.16, aligning with a strong supply zone and major resistance based on the 2.618 Fibonacci extension.

Stop loss set at $5.48, above recent highs and upper resistance to mitigate risk from volatility spikes and potential wicks.

Take profit targeted between $4.23 and $4.03, within a solid historical demand zone on high volume.

Setup offers favourable risk/reward ratio (approx. 1:3).

4H ADX currently at 23, indicating a modest trend but favouring range-bound trading strategies.

Main risk includes the possibility of false breakouts above resistance, leading to stop-outs before a reversal.

Price may find strong support around the take profit zone, causing potential bounce or stalling.

Broader market structure neutral to slightly bullish; range may eventually break after repeated tests.

Setup validity is reinforced if BTC and overall crypto market continue consolidating in established ranges.

ATOMUSDT 4H Chart Analysis | Momentum Breakout in PlayATOMUSDT 4H Chart Analysis | Momentum Breakout in Play

🔍 Let’s dive into the ATOM/USDT perpetual contract and analyze the latest price action, outlining key bullish setups and momentum signals.

⏳ 4-Hour Overview

The 4-hour chart reveals a strong bullish push, with price surging above the trendline resistance and reclaiming the local $4.917 zone. Volume has notably increased, confirming the move’s strength. Meanwhile, the RSI indicator is closing above 70, marking the overbought territory and highlighting a surge in buyer momentum.

🔺 Long Setup:

On the upside, sustained momentum could ignite a rally toward $5.262 first, with a further target at $5.640 should follow-through buying persist. These levels line up with previous resistance zones and potential trend-based extensions.

📊 Key Highlights:

- 4H breakout confirms bullish bias and momentum shift.

- Volume spike adds conviction to the move.

- RSI closing above 70 signals strong momentum; a continuation could bring further upside.

- Short-term resistance targets are $5.262 and $5.640.

- “Closing above 70 in 4h brings momentum” — if sustained, might hint at a new trend leg.

🚨 Conclusion:

ATOM/USDT is showcasing renewed bullish momentum. Watch for confirmations above resistance and be mindful of short-term exhaustion signals in the overbought zone. If momentum holds, upside targets at $5.262 and $5.640 are in play.

ATOM/USDT Weekly – Strong Accumulation, Is a Major Reversal?📊 Overview

The ATOM/USDT weekly chart shows that the price is currently in a long-term accumulation phase after a massive downtrend since 2022.

The 3.5–4.6 USDT demand zone has acted as a strong historical support level since 2020 and has once again proven its strength during 2024–2025.

In simple terms, this area is the “last defense” zone for buyers and could determine whether ATOM will start a new bullish cycle or face a deeper breakdown.

---

🔹 Structure & Pattern Analysis

Macro Pattern: ATOM has formed a wide sideways/base structure near the multi-year demand, signaling potential accumulation by smart money.

Key resistance (short-term): 5.375 – 6.00 USDT, the first gate to confirm a bullish reversal.

Further resistances: 6.80 → 9.96 → 14.46 (strong mid-cycle supply).

If broken: The path opens toward 21.81 – 32.27 USDT, aligning with higher timeframe resistances.

---

✅ Bullish Scenario

1. Price continues to hold above the 3.5–4.6 demand zone, showing strong buyer presence.

2. A confirmed breakout above 5.375 with volume could shift market structure into a new Higher High (HH) formation.

3. Bullish targets:

6.00 → 6.80 (first resistance levels)

9.96 → 14.46 (major supply zone)

Extended targets: 21.81 – 32.27 USDT

📌 Bullish confirmation: A solid weekly close above 6.00 USDT.

---

❌ Bearish Scenario

1. Rejection from 5.3–6.0 resistance may drag price back toward the middle of the current range.

2. A decisive weekly close below 3.50 would invalidate the accumulation structure and open downside continuation:

2.70 → 2.10

Possible extension: 1.65 – 1.30 USDT (historical supports).

📌 Bearish confirmation: Consistent weekly closes below 3.50 USDT.

---

🎯 Conclusion

The 3.5–4.6 zone remains the ultimate pivot: hold = bullish potential, breakdown = deeper downside.

5.375–6.00 acts as the breakout trigger zone: clearing this level may spark a major reversal trend.

Currently, ATOM is in a long-term accumulation range, waiting for a decisive breakout.

#ATOM #Cosmos #ATOMUSDT #CryptoAnalysis #PriceAction #SupportResistance #SwingTrade #WeeklyChart

buy midterm atom "🌟 Welcome to Golden Candle! 🌟

We're a team of 📈 passionate traders 📉 who love sharing our 🔍 technical analysis insights 🔎 with the TradingView community. 🌎

Our goal is to provide 💡 valuable perspectives 💡 on market trends and patterns, but 🚫 please note that our analyses are not intended as buy or sell recommendations. 🚫

Instead, they reflect our own 💭 personal attitudes and thoughts. 💭

Follow along and 📚 learn 📚 from our analyses! 📊💡"

Cosmos 365 · Proof of Bullish · Bull Market Wave NextCosmos (ATOMUSDT) has been sideways for an entire year now. The current trading range is a long-term support, buy and accumulation zone. This zone is already proven to be a bullish launchpad based on late 2024. The same levels were active in August-October-November 2024 leading to a mild bullish wave. This is only the start.

The same support range is activated again in Febraury-March-April-May-June-July-August 2025 and this will lead to a major bullish wave. Notice that the first period of consolidation lasted only three months and thus we had a mild wave only. With now six full months of consolidation the next bullish wave will be at least twice as big. But the market and how participants act and react doesn't work linearly. A six months consolidation period can lead to a bullish wave that is 3-5 times stronger than the previous one.

What you are seeing right now is actually pretty good. ATOMUSDT is red, yes. Notice weeks of bearish action yet no new lows, no significant challenge of support. More sideways which is as bullish as it gets. We already saw many examples of a downtrend and how the market goes lower and lower always producing new lows. This scenario is far from being what is present on the chart.

ATOM has been dropping for weeks but its price isn't affected that much negatively because this is only a minor retrace. An intermediary pause. The positive side of this type of market behavior is how it tends to unravel. It goes from quiet and shy to fast, surprising and unexpected. The market can change any day.

You can start seeing bullish action tomorrow just as it can start next week or the week above. The retrace has been going long enough and it lacks volume and momentum, sellers are running dry; when momentum dies down, the market turns.

Look at Bitcoin, it isn't dropping anymore. It stopped at the previous high and so far this is a strong support. Even if it moves lower, we continue bullish above $100K long-term. It is normal for a small pause before additional growth. $15 is an easy target, ATOM can grow much more in the coming months. Late 2025-early 2026 are the best dates for higher prices. Buy now and hold.

Namaste.

ATOM/USDT Weekly Analysis – Major Reversal Incoming?🔍 Technical Structure & Price Action:

ATOM has been in a prolonged downtrend since peaking at $44.80 in 2022, forming consistent lower highs and lower lows. However, the price has recently returned to a major long-term demand zone between $4.00 – $5.37, which has historically acted as a strong support since 2020.

The price is showing a bullish reaction from this level, indicating a potential trend reversal or relief rally.

---

🧱 Key Levels & Technical Zones:

Level Role

$4.00 - $5.37 Major Historical Demand Zone (Strong Support) 🟨

$6.80 Minor Resistance & Double Bottom Neckline

$9.96 Mid-Term Key Resistance

$14.46 Next Bullish Target If Breakout Holds

$21.81 Major Resistance Ahead

$32.27 - $43.81 Long-Term Distribution Zone / ATH Range

$44.80 All-Time High (ATH)

---

📐 Patterns and Price Behavior:

🟡 1. Potential Double Bottom (Reversal Pattern)

The price appears to be forming a double bottom structure with a neckline around $6.80. A successful breakout above this level could signal a confirmed trend reversal.

🟡 2. Sideways Accumulation

ATOM has been ranging sideways within a tight zone, suggesting institutional accumulation before a possible impulse breakout.

🟡 3. Volume Compression

Declining volume near support often precedes a strong breakout move, either up or down.

---

✅ Bullish Scenario:

Price continues to hold above the $4.00 – $5.37 demand zone.

If weekly candle closes above $6.80, bullish confirmation is triggered.

Potential targets:

Short-Term: $9.96

Mid-Term: $14.46 – $21.81

Long-Term: $32.27 – $43.81 (if momentum sustains)

📈 Confirmation Signs:

Break and weekly close above $6.80

Increasing breakout volume

RSI divergence from oversold territory

---

⚠️ Bearish Scenario:

If price breaks down below $4.00, bears could regain control.

Possible downside targets:

Next Support: $2.80

Breakdown invalidates the double bottom structure

Continuation of macro downtrend likely

📉 Confirmation Signs:

Strong weekly close below $4.00

Spike in selling volume

Failure to break $6.80 resistance

---

🎯 Conclusion & Strategy:

ATOM is sitting at a make-or-break level, where a strong historical support zone meets growing bullish momentum. If bulls manage to break above $6.80, it could trigger a multi-week rally toward mid-term targets. This setup presents a high reward-to-risk opportunity if managed correctly.

---

⚙️ Trading Strategy Suggestion:

Aggressive Entry: Within $5.00 - $5.37 zone, stop loss below $4.00

Conservative Entry: After confirmed breakout above $6.80

Take-Profit Zones: $9.96 → $14.46 → $21.81

Risk Management is a MUST 🚨

#ATOMUSDT #Cosmos #CryptoAnalysis #DoubleBottom #AltcoinOutlook #TechnicalAnalysis #SupportResistance #PriceAction #CryptoTrading #BreakoutWatch #TrendReversal

ATOM/USDT – Long-Term Accumulation Phase Nearing Breakout?📊 Full Technical Breakdown:

🟡 Long-Term Accumulation Zone

ATOM is currently trading within a horizontal accumulation zone between $4.50 and $5.20, which has held strong since early 2021. This key area has acted as a solid floor across multiple market cycles, suggesting strong buying interest from long-term holders or institutional participants.

🔻 Descending Trendline Resistance

Since reaching its all-time high (~$44.8) in late 2021, ATOM has been in a sustained downtrend, forming a descending trendline acting as dynamic resistance. The price is now retesting this line for the first time in months, hinting at a potential trend reversal setup if broken.

🧱 Potential Descending Triangle Breakout

The current structure closely resembles a Descending Triangle, with a flat base of support and a descending resistance line. While typically a bearish continuation pattern, in this context — combined with prolonged oversold conditions — it may serve as a bear trap and precede a major breakout.

✅ Bullish Scenario (Confirmed Breakout & Trend Reversal):

If ATOM breaks and closes weekly above $6.80, the breakout could trigger a powerful move, marking the start of a new macro bullish phase.

📈 Upside targets based on historical resistance levels:

📍 $9.96 → former short-term resistance

📍 $14.46 → previous support-turned-resistance

📍 $21.81 → major structural breakdown point

📍 $32.27 → upper resistance zone

🎯 $43.81 – $44.80 → All-Time High (ATH) zone

🟢 Potential upside: Over 700% from current levels if breakout is validated with strong momentum and volume.

❌ Bearish Scenario (Rejection & Breakdown):

If price gets rejected at the trendline and breaks below the $4.50 accumulation floor:

📉 Downside targets to watch:

🔻 $3.00 → previous minor support

🔻 $2.20 → pandemic-era support zone

🔻 $1.06 → historical bottom (2020)

This would confirm a continuation of the macro downtrend and indicate that further accumulation is needed before any major reversal.

📌 Key Technical Confirmation Signals:

Weekly Volume: A true breakout must be supported by a volume spike well above the weekly average.

RSI (Relative Strength Index): A move above 50 on the weekly RSI would support a bullish thesis.

Bullish Divergence (on lower timeframes): Would strengthen the breakout probability.

🔮 Strategic Takeaway:

ATOM is at a make-or-break level. With a long period of sideways consolidation and tightening price action, a high-volatility move is imminent.

> For long-term investors, this zone offers a high reward-to-risk opportunity. For traders, it's time to prepare for a confirmed breakout or rejection trade setup.

#ATOMUSDT #CosmosAnalysis #CryptoBreakout #TechnicalAnalysis #DescendingTriangle #BullishSetup #AltcoinSeason #CryptoMomentum #AccumulationZone #TrendReversal #CryptoSignals