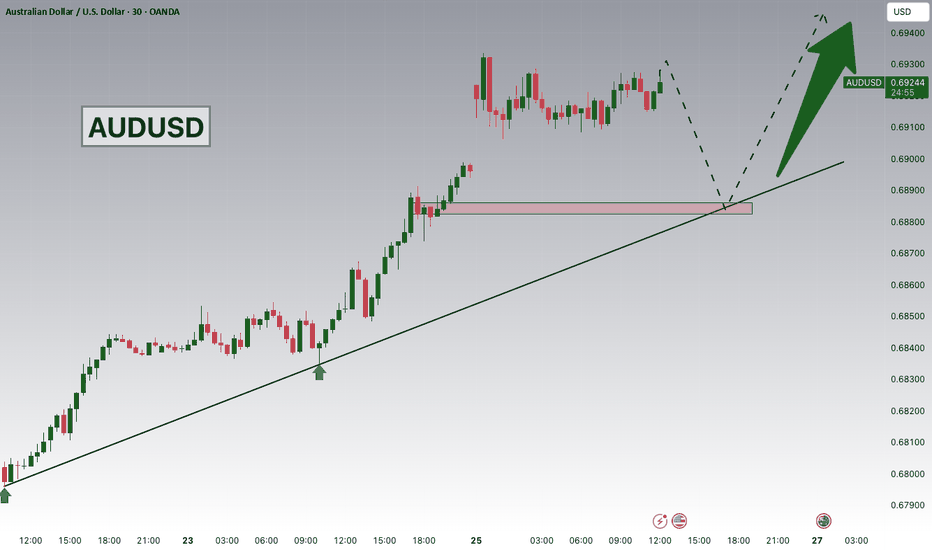

AUDUSD Buy Setup | 0.69800 Support + Bullish Gold Prices!Hey Traders,

In today’s trading session, we are closely monitoring AUDUSD for a potential buying opportunity around the 0.69800 zone. AUDUSD remains in a well-established bullish trend and is currently undergoing a healthy corrective pullback, approaching a key trendline confluence and the 0.69800 support-turned-resistance area, which may act as a strong demand zone for trend continuation.

From a fundamental perspective, the Australian Dollar often benefits from its positive correlation with Gold. With Gold prices maintaining a constructive bullish tone, this relationship could provide additional upside support for AUDUSD, reinforcing the bullish technical setup and favoring a continuation toward higher levels.

As always, wait for confirmation and manage risk responsibly.

Trade safe,

Joe.

Aud-usd

AUDUSD - When Structure Meets RealityAUDUSD is now retesting a strong technical intersection:

the weekly resistance marked in green is lining up perfectly with the upper bound of the weekly rising channel in blue.⚔️

On top of that, price is sitting in an over-bought zone after an extended push higher.

As long as this intersection holds, the odds favor a bearish correction, with price rotating lower toward the lower bound of the channel. This wouldn’t be a trend reversal, but a healthy reset within the bigger structure.

If this zone gets cleanly broken and accepted above, then the narrative changes.

Until then, I’m respecting resistance and letting structure lead the bias.

⚠️ Disclaimer: This is not financial advice. Always do your own research and manage risk properly.

📚 Stick to your trading plan regarding entries, risk, and management.

Good luck! 🍀

All Strategies Are Good; If Managed Properly!

~Richard Nasr

AUD/USD – H1 - Head & Shoulders BreakdownAUD/USD has printed a clean Head & Shoulders pattern on the H1 timeframe , signaling a potential trend reversal after a strong bullish run. Price has now broken below the neckline, confirming bearish momentum and opening the door for a deeper correction. OANDA:AUDUSD

🔍 Technical Analysis

🧠 Classic Head & Shoulders formation

Left Shoulder → Head → Right Shoulder clearly respected

❌ Neckline break confirms bearish bias

📉 Momentum shifting from bullish to bearish

🎯 Downside targets:

1.First Key Support Zone

2.Psychological level & lower demand zone

As long as price stays below the neckline, bearish continuation remains favored.

✅Psychological Discipline:

1️⃣Stick to plan – No Revenge Trades.

2️⃣Accept losing trades as part of the strategy.

3️⃣Risk only 1–2% of your account balance per trade.

✅ Support this analysis with a

LIKE 👍 | COMMENT 💬 | FOLLOW 🔔

It helps a lot & keeps the ideas coming!

⚠️ Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Forex trading involves high risk. Trade only with capital you can afford to lose and always do your own research.

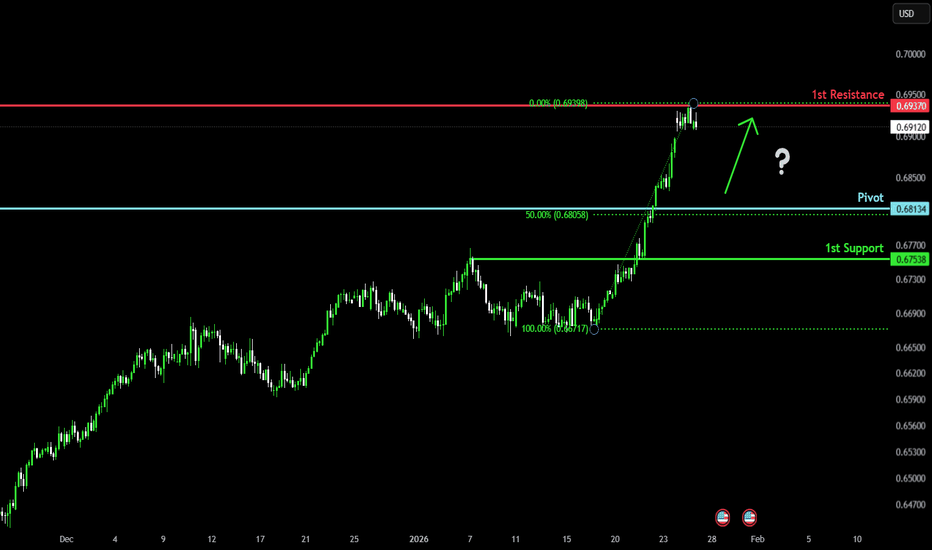

Bullish momentum to extend?Aussie (AUD/USD) could fall towards the pivot, which aligns with the 50% Fibonacci retracement, and could bounce to the 1st resistance.

Pivot: 0.6813

1st Support: 0.6753

1st Resistance: 0.6937

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

AUDUSD Strong Bullish Momentum!Hey traders, in today's trading session we are monitoring AUDUSD for a buying opportunity around 0.68800 zone, AUDUSD is trading in an uptrend and currently is in a correction phase in which it is approaching the trend at 0.68800 support and resistance area.

Trade safe, Joe.

AUDUSD Outlook | Uptrend Holds as Gold Supports AUD!Hey Traders,

In today’s trading session, we are closely monitoring AUDUSD for a potential buying opportunity around the 0.67600 zone. AUDUSD remains in a well-established uptrend and is currently undergoing a healthy corrective pullback, approaching a key trendline confluence and the 0.67600 support-turned-resistance area, which may act as a strong demand zone for bullish continuation.

From a fundamental perspective, the Australian Dollar often benefits from its positive correlation with Gold. With Gold maintaining a strong bullish bias, this relationship could provide additional upside support for AUDUSD, reinforcing the bullish technical outlook.

As always, wait for confirmation and manage risk responsibly.

Trade safe,

Joe.

AUDUSD Ready to Rally? Gold Correlation + 0.66700 Support!Hey Traders,

In today’s trading session, we are closely monitoring AUDUSD for a potential buying opportunity around the 0.66700 zone. AUDUSD remains in a well-established uptrend and is currently undergoing a healthy corrective pullback, approaching a key trendline confluence and the 0.66700 support-turned-resistance area, which may act as a strong demand zone for bullish continuation.

From a fundamental perspective, the Australian Dollar often benefits from its positive correlation with Gold. With Gold maintaining a constructive bullish tone, this relationship could provide additional upside support for AUDUSD, reinforcing the bullish technical outlook.

As always, wait for confirmation and manage risk responsibly.

Trade safe,

Joe.

AUDUSD Ready to Push Higher? | 0.66700 Support+Gold Correlation!Hey Traders,

In the coming week, we are closely monitoring AUDUSD for a potential buying opportunity around the 0.66700 zone. AUDUSD remains in a well-established uptrend and is currently undergoing a healthy corrective pullback, approaching a key trendline confluence and the 0.66700 support-turned-resistance area, which may act as a strong demand zone for bullish continuation.

From a fundamental perspective, the Australian Dollar often benefits from its positive correlation with Gold. With Gold maintaining a strong bullish tone, this correlation could provide additional upside support for AUDUSD, reinforcing the bullish technical outlook.

As always, wait for confirmation and manage risk responsibly.

Trade safe,

Joe.

Aussie H4 | Potential bullish bounceBased on the H4 chart analysis, we can see that the price has bounced off our buy entry level at 0.6681, which is a pullback support.

Our stop loss is set at 0.6653, which is a pullback support that aligns with the 61.89% Fibonacci retracement.

Our take profit is set at 0.6752, which is a swing high resistance.

High Risk Investment Warning

Stratos Markets Limited (

Bullish bounce off?The Aussie (AUD/USD) has bounced off the pivot, which has been identified as an overlap support, and could rise to the 1st resistance, a swing high.

Pivot: 0.6673

1st Support: 0.6646

1st Resistance: 0.6752

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

AUDUSD Major bullish break-out after 5 years!The AUDUSD pair broke not just above its 1W MA200 (orange trend-line) but also above its 5-year Lower Highs trend-line that has been holding since February 22 2021, keeping the long-term trend bearish.

Now the long-term trend may be shifting to bullish and ahead of a potential 1W Golden Cross, we expect a pull-back to retest this 5-year Lower Highs trend-line, potentially even the 1W MA50 (blue trend-line) as a Support and then rebound towards the September 2024 Resistance. Our Target is just below it at 0.69000.

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

AUDUSD H4 | Bullish Bounce OffBased on the H4 chart analysis, we can see that the price has bounced off our buy entry level at 0.6681, which is a pullback support.

Our stop loss is set at 0.6646, which is a pullback support that aligns with the 127.2% Fibonacci retracement.

Our take profit is set at 0.6726, which is a pullback resistance level.

High Risk Investment Warning

Stratos Markets Limited (

Bearish reversal off 50% Fib resistance?Aussie (AUD/USD) is reacting off the pivot and could reverse to the 1st support.

Pivot: 0.6718

1st Support: 0.6661

1st Resistance: 0.6752

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

AUDUSD is Nearing an Important Support!Hey Traders, in today's trading session we are monitoring AUDUSD for a buying opportunity around 0.66600 zone, AUDUSD is trading in an uptrend and currently is in a correction phase in which it is approaching the trend at 0.66600 support and resistance area.

Trade safe, Joe.

AUSSIE H1 | Bullish ReversalBased on the H1 chart analysis, we could see the price fall to our buy entry level at 0.6690, which is an overlap support.

Our stop loss is set at 0.6667, which is a multi-swing low support.

Our take profit is set at 0.6717, which is an overlap resistance that aligns with the 50% Fibonacci retracement.

High Risk Investment Warning

Stratos Markets Limited (

AUDUSD (Short)This is a good short opportunity, on Friday price failed to take out structure lows it looks like it's deciding to liquidate people who were targeting those lows first... I don't take this trade thinking it will just break that big liquidity today but I see it temporarily pulling back and targeting that TP1 and will decide later if to leave a part of the position run to the full TP.

AUD/USD H1 | Bullish Reversal SetupBased on the H1 chart analysis, we can see that the price has bounced off our buy entry level at 0.6683, which aligns with the 78.6% Fibonacci retracement.

Our stop loss is set at 0.6660, which is a pullback support.

Our take profit is set at 0.6717, which is an overlap resistance that is slightly above the 38.2% Fibonacci retracement.

High Risk Investment Warning

Stratos Markets Limited (

Bullish bounce off?AUD/USD has bounced off the support level, which is a pullback support that aligns with the 78.6% Fibonacci retracement, and could bounce from this level to our take profit.

Entry: 0.6685

Why we like it:

There is a pullback support that aligns with the 78.6% Fibonacci retracement.

Stop loss: 0.6665

Why we like it:

There is a multi-swing low support.

Take profit: 0.6712

Why we like it:

There is a pullback resistance that aligns with the 38.2% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Bearish drop off?Aussie (AUD/USD) is reacting off the pivot and could drop to the overlap support that aligns with the 61.8% Fibonacci retracement.

Pivot: 0.6718

1st Support: 0.6666

1st Resistance: 0.6752

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

AUDUSD (Short Bias)The sell is still forming and yesterday price decided to do 1 more spike up above the consolidation box. The new data printed makes me think there wont be a retest of the consolidation, based on the type of schematic it printed this might be the type that just leaves a supply for future incentivized shorts.

AUDUSD Potential Bullish Bias | 0.66500 Support + USD Weakness!Hey Traders,

In today’s trading session, we are closely monitoring AUDUSD for a potential buying opportunity around the 0.66500 zone. AUDUSD remains in a well-established uptrend and is currently experiencing a healthy corrective pullback, approaching a key trendline confluence and the 0.66500 support & resistance zone, which may act as a strong demand area for bullish continuation.

From a fundamental perspective, increasing expectations of a potential interest rate cut at the upcoming FOMC meeting continue to weigh on the US Dollar. Ongoing USD weakness typically supports risk-sensitive currencies such as the Australian Dollar, further strengthening the bullish bias on AUDUSD.

As always, wait for confirmation before entry and manage risk responsibly.

Trade safe,

Joe.

AUDUSD (Short)The pair is still on a Uptrend its currently looking like its in the process of making a Higher Low, There is a good risk to reward trade presenting itself but it is Friday the last day of the trading week I don't like holding trades over the weekend but in this pair it is common for a weekly low or high to be set on Friday... Spreads suck especially on a sell order during market close or open the spread alone can hit your stop loss, so unless this trade is in profit by a big margin I don't recommend holding on Friday just my opinion from experience.