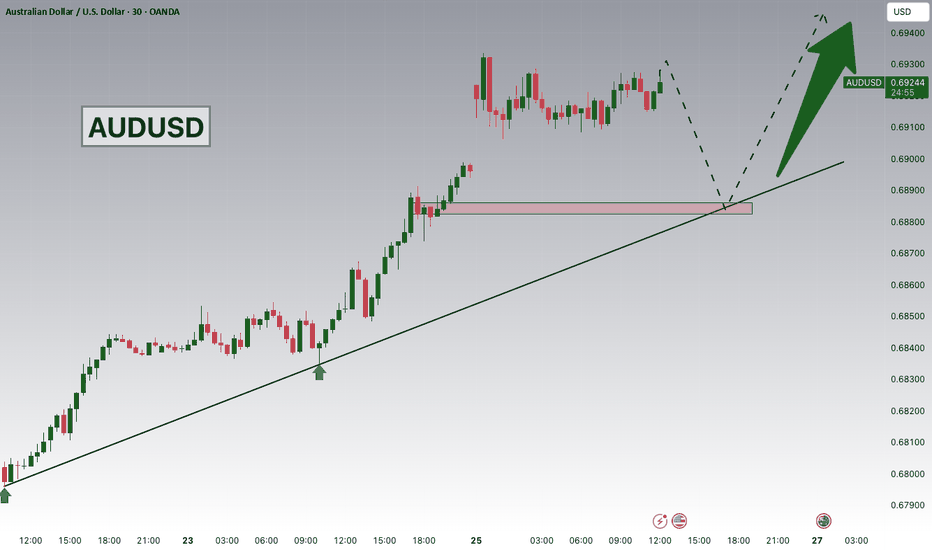

AUDUSD Strong Bullish Momentum!Hey traders, in today's trading session we are monitoring AUDUSD for a buying opportunity around 0.68800 zone, AUDUSD is trading in an uptrend and currently is in a correction phase in which it is approaching the trend at 0.68800 support and resistance area.

Trade safe, Joe.

Aud

LONG ON AUD/JPYThe Jpy Index pushed up on Friday but is now starting to retrace/pullback/correct or fall.

We have a nice choc (change of character) from down to up on AJ on the 15min timeframe.

I expect price to drop first to 106.392 then rise.

This is a buy limit order. I will be looking to catch 100-200 pips.

EURAUD H4 | Heading Towards 61.8% Fib ResistanceBased on H4 chart analysis, we could see the price rise to our sell entry level at 1.7315, which is a pullback resistance that aligns with the 61.8% Fibonaci retracement.

Our stop loss is set at 1.7481, which is an overlap resistance that is slightly above the 50% Fibonacci retracement.

Our take profit is set at 1.7102, which is a pullback support.

High Risk Investment Warning

Stratos Markets Limited fxcm.com Stratos Europe Ltd fxcm.com

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLChttps://fxcm.com/en: Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

Stratos Trading Pty. Limited fxcm.com

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at fxcm.com

AUDUSD Outlook | Uptrend Holds as Gold Supports AUD!Hey Traders,

In today’s trading session, we are closely monitoring AUDUSD for a potential buying opportunity around the 0.67600 zone. AUDUSD remains in a well-established uptrend and is currently undergoing a healthy corrective pullback, approaching a key trendline confluence and the 0.67600 support-turned-resistance area, which may act as a strong demand zone for bullish continuation.

From a fundamental perspective, the Australian Dollar often benefits from its positive correlation with Gold. With Gold maintaining a strong bullish bias, this relationship could provide additional upside support for AUDUSD, reinforcing the bullish technical outlook.

As always, wait for confirmation and manage risk responsibly.

Trade safe,

Joe.

Bullish continuation setup?AUD/CAD could fall towards the support level, which is a pullback support that is slightly above the 38.2% Fibonacci retracement and could bounce from this level to our take profit.

Entry: 0.9353

Why we like it:

There is a pullback support level that is slightly above the 38.2% Fibonacci retracement.

Stop loss: 0.92662

Why we like it:

There is a pullback support that aligns with the 50% Fibonacci retracement.

Take profit: 0.94381

Why we like it:

There is a pullback resistance level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

AUDCHF - Pullback Into Structure, Watching the ReactionAUDCHF remains overall bullish, trading cleanly inside the rising blue channel. After the recent push higher, price is now pulling back into a very interesting area.

We’re approaching the intersection of the demand zone and the lower blue trendline. This is exactly the kind of confluence I like to see in a trending market.

As long as this intersection holds and price respects the lower boundary of the channel, I’ll be looking for trend-following long setups, with confirmation coming from lower timeframes.

⚠️ Disclaimer: This is not financial advice. Always do your own research and manage risk properly.

📚 Stick to your trading plan regarding entries, risk, and management.

Good luck! 🍀

All Strategies Are Good; If Managed Properly!

~Richard Nasr

GBPAUD to continue in the downward move?GBPAUD - 24h expiry

There is no indication that the selloff is coming to an end.

Daily signals for sentiment are at oversold extremes.

Offers ample risk/reward to sell at the market.

The lack of interest is a concern for bulls.

Our outlook is bearish.

We look to Sell at 1.9875 (stop at 1.9935)

Our profit targets will be 1.9695 and 1.9655

Resistance: 1.9886 / 1.9950 / 2.0050

Support: 1.9823 / 1.9750 / 1.9700

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

AUDUSD Ready to Rally? Gold Correlation + 0.66700 Support!Hey Traders,

In today’s trading session, we are closely monitoring AUDUSD for a potential buying opportunity around the 0.66700 zone. AUDUSD remains in a well-established uptrend and is currently undergoing a healthy corrective pullback, approaching a key trendline confluence and the 0.66700 support-turned-resistance area, which may act as a strong demand zone for bullish continuation.

From a fundamental perspective, the Australian Dollar often benefits from its positive correlation with Gold. With Gold maintaining a constructive bullish tone, this relationship could provide additional upside support for AUDUSD, reinforcing the bullish technical outlook.

As always, wait for confirmation and manage risk responsibly.

Trade safe,

Joe.

Bullish bounce setup?AUD/NZD is falling towards the pivot, which is slightly below the 61.8% Fibonacci retracement, and could bounce to the 1st resistance.

Pivot: 1.15059

1st Support: 1.14634

1st Resistance: 1.16091

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

GBPAUD - END OF THE RANGE THE SELL OF BEGINS?As per previous posts - GBPAUD is struggling to hold within the range above - we can see yesterdays daily candle reject the of the support now turned resistance, todays price action we made a second attempt to break higher but failed and are continuing to trade out of the range.

I am expecting a huge drop in the pair towards TP - 1.97831

Bullish bounce off?AUD/JPY has bounced off the support level, which acts as an overlap support that aligns with the 38.25 Fibonacci retracement and could potentially rise from this level to our take profit.

Entry: 106.20

Why we like it:

There is an overlap support level that aligns with the 38.2% Fibonacci retracement.

Stop loss: 105.74

Why we like it:

There is a pullback support that is slightly below the 61.8% Fibonacci retracement.

Take profit: 107.24

Why we like it:

There is a resistance level at the 78.6% Fibonacci projection.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Bearish breakout?AUD/CHF is rising towards the resistance level, which is a pullback resistance that aligns with the 50% Fibonacci retracement and could reverse from this level to our take profit.

Entry: 0.53367

Why we like it:

There is a pullback resistance that aligns with the 50% FIbonacci retracement.

Stop loss: 0.53586

Why we like it:

There is a pullback resistance level.

Take profit: 0.52857

Why we like it:

There is a pullback support level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

GBPAUD LONGS - RANGE TRADE

GBPAUD has found support at the 2.0000 zone, this is in confluence with the price stabilising above the weekly 100MA.

Given this areas level of strong support I am anticipating buyers to enter the market with TP 1 @ 2.012 & TP2 @ 2.01800 if the range is completed with the expected buy pressue

AUDUSD Ready to Push Higher? | 0.66700 Support+Gold Correlation!Hey Traders,

In the coming week, we are closely monitoring AUDUSD for a potential buying opportunity around the 0.66700 zone. AUDUSD remains in a well-established uptrend and is currently undergoing a healthy corrective pullback, approaching a key trendline confluence and the 0.66700 support-turned-resistance area, which may act as a strong demand zone for bullish continuation.

From a fundamental perspective, the Australian Dollar often benefits from its positive correlation with Gold. With Gold maintaining a strong bullish tone, this correlation could provide additional upside support for AUDUSD, reinforcing the bullish technical outlook.

As always, wait for confirmation and manage risk responsibly.

Trade safe,

Joe.

Aussie H4 | Potential bullish bounceBased on the H4 chart analysis, we can see that the price has bounced off our buy entry level at 0.6681, which is a pullback support.

Our stop loss is set at 0.6653, which is a pullback support that aligns with the 61.89% Fibonacci retracement.

Our take profit is set at 0.6752, which is a swing high resistance.

High Risk Investment Warning

Stratos Markets Limited (

Bullish bounce off?The Aussie (AUD/USD) has bounced off the pivot, which has been identified as an overlap support, and could rise to the 1st resistance, a swing high.

Pivot: 0.6673

1st Support: 0.6646

1st Resistance: 0.6752

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Bearish reversal off 61.8% Fib resistance?AUD/JPY is reacting off the resistance level, which is a pullback resistance that aligns with the 61.8% Fibonacci retracement and could reverse from this level to our take profit.

Entry: 106.26

Why we like it:

There is a pullback resistance level that aligns with the 61.8% Fibonacci retracement.

Stop loss: 106.69

Why we like it:

There is a multi-swing high resistance level.

Take profit: 105.59

Why we like it:

There is a pullback support level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Bullish bounce off?AUD/CHF is falling towards the support level, which is a pullback support that is slightly above the 38.25 Fibonacci retracement and could bounce from this level to our take profit.

Entry: 0.53690

Why we like it:

There is a pullback support that is slightly above the 38.2% Fibonacci retracement.

Stop loss: 0.53471

Why we like it:

There is a pullback support that aligns with the 61.8% Fibonacci retracement.

Take profit: 0.54061

Why we like it:

There is a resistance level at the 161.8% FIbonacci extension.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Heading towards pullback resistance?EUR/AUD is rising towards the pivot, which acts as a pullback resistance that aligns with the 38.2% Fibonacci retracement and could reverse to the 1st support.

Pivot: 1.74971

1st Support: 1.73126

1st Resistance: 1.75919

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Bearish drop?AUD/JPY is rising towards the pivot, which aligns with the 50% Fibonacci retracement, and could reverse to the 1st support that aligns with the 61.8% Fibonacci retracement.

Pivot: 106.19

1st Support: 105.49

1st Resistance: 106.68

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

GBPAUD to find sellers at market price?GBPAUD - 24h expiry

Intraday rallies continue to attract sellers and there is no clear indication that this sequence for trading is coming to an end.

Our outlook is bearish.

20 1day EMA is at 2.0118.

Offers ample risk/reward to sell at the market.

There is no clear indication that the downward move is coming to an end.

We look to Sell at 2.0115 (stop at 2.0171)

Our profit targets will be 1.9955 and 1.9925

Resistance: 2.0145 / 2.0189 / 2.0204

Support: 2.0100 / 2.0060 / 2.0028

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

AUDUSD Major bullish break-out after 5 years!The AUDUSD pair broke not just above its 1W MA200 (orange trend-line) but also above its 5-year Lower Highs trend-line that has been holding since February 22 2021, keeping the long-term trend bearish.

Now the long-term trend may be shifting to bullish and ahead of a potential 1W Golden Cross, we expect a pull-back to retest this 5-year Lower Highs trend-line, potentially even the 1W MA50 (blue trend-line) as a Support and then rebound towards the September 2024 Resistance. Our Target is just below it at 0.69000.

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

AUDUSD H4 | Bullish Bounce OffBased on the H4 chart analysis, we can see that the price has bounced off our buy entry level at 0.6681, which is a pullback support.

Our stop loss is set at 0.6646, which is a pullback support that aligns with the 127.2% Fibonacci retracement.

Our take profit is set at 0.6726, which is a pullback resistance level.

High Risk Investment Warning

Stratos Markets Limited (