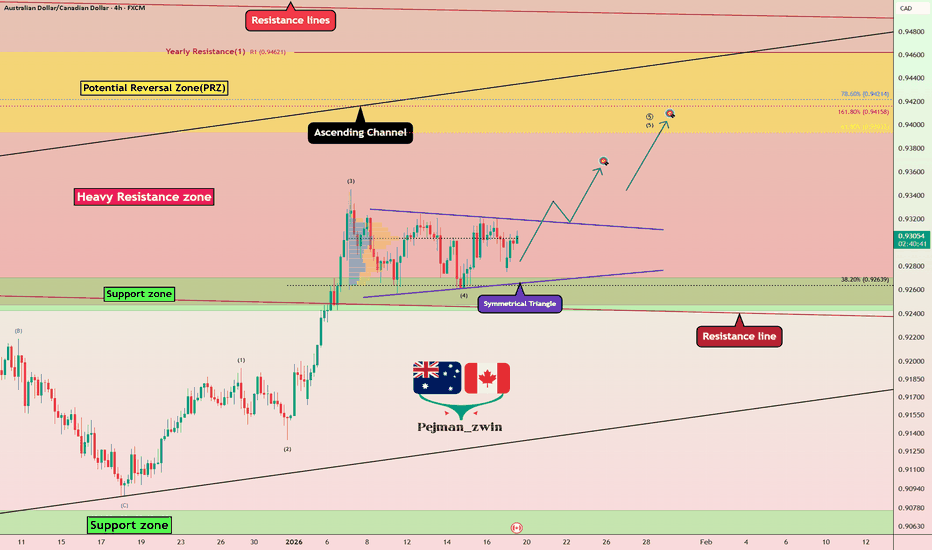

AUDCAD is Breaking Triangle — Bullish Breakout Ahead of CPI?Today, I want to share a long trading opportunity on the AUDCAD pair ( FX:AUDCAD ), so stay tuned!

Currently, AUDCAD has successfully broken through its resistance line and is now situated within a heavy resistance zone(0.9585 CAD-0.9247 CAD).

From a classic technical analysis perspective, if we look at the AUDCAD chart on the 4-hour timeframe, we can see a symmetrical triangle pattern, which suggests a continuation of the recent bullish trend of AUDCAD.

From an Elliott Wave perspective, it appears that AUDCAD has completed microwave 4 of the main wave 5, and we can expect the start of microwave 5 of the main wave 5. The breakout above the upper line of the symmetrical triangle could confirm the end of the microwave 4.

Additionally, today’s Canadian CPI data could act as a key catalyst for AUDCAD.

Based on recent macro trends, I expect inflation pressures in Canada to remain soft.

If CPI comes at or below expectations, it should weaken CAD and support a bullish continuation on AUDCAD.

As long as the structure holds, I remain biased to the long side.

As a result, I expect that after breaking the upper line of the symmetrical triangle, AUDCAD could rise at least to 0.9357 CAD.

First Target: 0.9357 CAD

Second Target: 0.9397 CAD

Stop Loss(SL): 0.9241 CAD

💡 Please respect each other's opinions and express agreement or disagreement politely.

📌Australian Dollar/Canadian Dollar Analysis (AUDCAD), 4-hour time frame.

🛑 Always set a Stop Loss(SL) for every position you open.

✅ This is just my idea; I’d love to see your thoughts too!

🔥 If you find it helpful, please BOOST this post and share it with your friends.

Audcadanalysis

AUDCAD Under Heavy Supply | Downside Targets Align🔻🔥 AUDCAD Under Heavy Supply | Downside Targets Align 🎯

Overview:

AUDCAD is showing strong bearish conviction, with price firmly positioned below key resistance, opening the door for a sustained move lower.

Sell Zone (Focus Area):

🔴 0.9320

This level is acting as a confirmed supply area, where selling pressure is firmly in control.

Downside Targets:

🎯 Target 1: 0.9300 – Immediate downside reaction

🎯 Target 2: 0.9280 – Momentum continuation

🎯 Target 3: 0.9260 – Structure extension

🎯 Target 4: 0.9240 – Deeper downside target

🎯 Target 5: 0.9200 – Major downside objective

🚀 Extended Target: 0.9180 – Possible stretch if selling accelerates

Why This Setup Works:

✔ Strong rejection from a confirmed resistance level

✔ Clear bearish structure with momentum alignment

✔ Clean downside path with multiple target zones

Trade Management Insight:

Gradual profit booking across targets allows capital protection while keeping exposure for extended moves.

Execution Guidance:

Wait for price acceptance or rejection near the sell level before execution. Precision and patience matter.

Final Note:

As long as price respects the resistance level, downside continuation toward lower targets remains the dominant scenario.

⸻

✨ Special Note for Serious Traders

If you look for high-conviction setups with defined targets and disciplined execution, feel free to connect. I work closely with traders who value structure, control, and long-term consistency.

🔒 High conviction. Clear targets. Professional execution.

Q1 | W2 | Y26 AUDCAD — FRGNT WEEK AHEAD FORECAST 📅 Q1 | W2 | Y26

📊 AUDCAD — FRGNT WEEK AHEAD FORECAST

🔍 Analysis Approach

I’m applying a developed version of Smart Money Concepts, with a structured focus on:

• Identifying Key Points of Interest (POIs) on Higher Time Frames (HTFs) 🕰️

• Using those POIs to define a clear and controlled trading range 📐

• Refining those zones on Lower Time Frames (LTFs) 🔎

• Waiting for a Break of Structure (BoS) as confirmation ✅

This process keeps me precise, disciplined, and aligned with market narrative, rather than reacting emotionally or chasing price.

💡 My Motto

“Capital management, discipline, and consistency in your trading edge.”

A positive risk-to-reward ratio, combined with a high-probability execution model, is the backbone of any sustainable trading plan 📈🔐

⚠️ On Losses

Losses are part of the mathematical reality of trading 🎲

They don’t define you — they are necessary, expected, and managed.

We acknowledge them, learn, and move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Further context and supporting material can be found in the Links section.

Stay sharp 🧠

Stay consistent 🎯

Protect your capital 🔐

— FRGNT MASTERY 🚀📈

FX:AUDCAD

AUDCAD: Bearish Drop to 0.907?FX:AUDCAD is eyeing a bearish pullback on the 4-hour chart , with price testing resistance after rebounding from major support, converging with a potential entry zone that could trigger downside momentum if sellers defend amid recent volatility. This setup suggests a correction opportunity in the uptrend, targeting lower levels with risk-reward exceeding 1:3.🔥

Entry between 0.91890–0.92050 for a short position (entry at these levels with proper risk and capital management is recommended). Target at 0.90745 . Set a stop loss at a close above 0.9226 , yielding a risk-reward ratio of more than 1:3 . Monitor for confirmation via a bearish candle close below entry with rising volume, leveraging the pair's dynamics near resistance.🌟

Fundamentally , AUDCAD is trading around 0.914 in mid-December 2025, with key Canadian events this week potentially impacting CAD strength. On December 16 at 12:30 PM UTC, BoC Governor Macklem speaks in Montreal, which could provide policy insights. December 18 features the Bank of Canada Rate Decision at 09:45 AM UTC, where a potential hold or cut amid economic data could weaken CAD if dovish. Followed by Macklem's Speech at 12:45 PM UTC for further guidance. December 19 brings CPI (Nov) at 08:30 AM UTC, with hotter inflation possibly supporting CAD, while softer readings could pressure it. December 22 includes GDP (Oct) at 08:30 AM UTC, where strong growth might bolster CAD. No major high-impact releases for AUD this week, leaving the pair sensitive to CAD catalysts and broader USD sentiment. 💡

📝 Trade Setup

🎯 Entry (Short):

0.91890 – 0.92050

(Entries in this zone are valid with proper risk & capital management.)

🎯 Target:

• 0.90745

❌ Stop Loss:

• 4H / Daily close above 0.9226

⚖️ Risk-to-Reward:

• > 1:3

💡 Your view?

Will AUDCAD reject this resistance for a clean pullback toward 0.90745 — or will CAD weakness invalidate the setup and push price higher? 👇

AUD/CAD Technical Outlook: Bullish Continuation Scenario🔥 AUD/CAD BULLISH BREAKOUT | Swing/Day Trade Setup 📈

🎯 AUSSIE DOLLAR VS CANADIAN DOLLAR - Forex Market Opportunity

📊 CURRENT MARKET STATUS

Live Price: 0.91588 CAD (December 24, 2025)

Trend: BULLISH ✅

Setup Type: Triangular MA Pullback + SMA Dynamic Resistance BREAKOUT

🎲 THIEF STRATEGY - LAYERED ENTRY METHOD

⚡ ENTRY ZONES (Multi-Layer Limit Orders):

🔹 Layer 1: 0.91400

🔹 Layer 2: 0.91500

🔹 Layer 3: 0.91600

💡 Tip: Scale in based on YOUR risk tolerance - Add more layers if desired

Current Price Action: Market trading near Layer 2-3 zone - ACTIVE ENTRY WINDOW

🛡️ RISK MANAGEMENT

🔴 STOP LOSS (Thief's SL): 0.91300

⚠️ IMPORTANT: Dear Ladies & Gentlemen (Thief OG's) - This is MY stop loss level. ADJUST YOUR SL BASED ON YOUR OWN STRATEGY & RISK APPETITE. You are responsible for your own risk management.

🎯 PROFIT TARGET

🟢 TARGET: 0.92200

Exit Reasoning:

✅ Police Barricade = Strong Resistance Zone

✅ Overbought Conditions Expected

✅ Potential Trap + Correction Zone

✅ Take Profits & ESCAPE with Gains!

⚠️ IMPORTANT: Dear Ladies & Gentlemen (Thief OG's) - This is MY take profit level. YOU CAN TAKE MONEY AT YOUR OWN RISK. Not financial advice - make your own decisions!

📈 CORRELATED PAIRS TO WATCH

💵 USD-Based Correlations:

AUD/USD - Primary correlation driver (0.6613 current price)

Positive correlation: AUD strength benefits both pairs

USD/CAD - Inverse correlation monitor

CAD weakness = AUD/CAD bullish support

NZD/CAD (0.7939) - Regional correlation

Oceanic currency strength indicator

AUD/JPY (104.31) - Risk sentiment gauge

Risk-on = AUD strength, supports our bullish view

⛽ Commodity Correlation:

Crude Oil Prices - CRITICAL for CAD strength

⬇️ Oil DOWN = CAD Weakness = AUD/CAD UP ✅

⬆️ Oil UP = CAD Strength = AUD/CAD Pressure ⚠️

📰 KEY ECONOMIC FACTORS TO CONSIDER

🇦🇺 AUSTRALIA (AUD Drivers):

Reserve Bank of Australia (RBA) Policy

Interest rate decisions

Monetary policy stance

Commodity Exports

Iron ore prices (China demand)

Coal & LNG exports

China Economic Data

Australia's largest trading partner

Manufacturing PMI, GDP growth

Employment Change & Wage Growth

Labor market strength = AUD support

Australian Q3 GDP (upcoming key release)

🇨🇦 CANADA (CAD Drivers):

Bank of Canada (BoC) Policy

Rate cuts expectations

Inflation targeting (CPI data)

Crude Oil Prices ⛽ (MOST IMPORTANT)

Canada's top export

WTI & Brent correlation

US Economic Data

85% of Canadian exports go to USA

USD/CAD heavily influences AUD/CAD

Employment Data & GDP

Canadian economic health indicators

Trade Balance

Export/import levels impact CAD value

🧠 TECHNICAL SETUP SUMMARY

✅ Triangular Moving Average pullback completed

✅ Simple Moving Average dynamic resistance BROKEN

✅ Support zone holding at lower entry layers

✅ Bullish momentum building for 0.92200 target

✅ Risk-reward ratio favorable with layered entries

💬 Engagement Question for Community:

👉 What's YOUR take on AUD/CAD? Are you watching crude oil prices or RBA policy more closely? Drop your analysis below! 👇

🔔 Follow for more setups | 👍 LIKE if this helps | 💬 COMMENT your thoughts

#AUDCAD #ForexTrading #SwingTrade #DayTrading #ThiefStrategy #TechnicalAnalysis #ForexSignals #TradingView #CommodityCurrencies #RiskManagement

AUDCAD; Heikin Ashi Trade Idea📈 Hey Traders!

Here’s a fresh outlook from my trading desk. If you’ve been following me for a while, you already know my approach:

🧩 I trade Supply & Demand zones using Heikin Ashi chart on the 4H timeframe.

🧠 I keep it mechanical and clean — no messy charts, no guessing games.

❌ No trendlines, no fixed sessions, no patterns, no indicator overload.

❌ No overanalyzing the market; use only two time frames.

❌ No scalping, and no need to be glued to the screen.

✅ I trade exclusively with limit orders, so it’s more of a set-and-forget style.

✅ This means more freedom, less screen time, and a focus on quality setups.

✅ Just a simplified, structured plan and a calm mindset.

💬 Let’s Talk:

💡Do you trade supply & demand too ?

💡What’s your go-to timeframe ?

💡Ever tried Heikin Ashi ?

📩 Got questions about my strategy or setup? Drop them below — ask me anything, I’m here to share.

Let’s grow together and keep it simple. 👊

Trading The AUD/CAD Breakout - A Systematic Approach.🎯 Aussie vs Cad Dollar – Market Capital Flow Blueprint (AUD/CAD Bull Setup) 🦘🍁

Hello Market Money Makers & Thief OG’s!

We’re watching the AUD/CAD pair with a bullish bias — the Aussie is showing strength vs the Loonie, and the capital-flow looks supportive. Here’s the plan:

📈 Setup:

A breakout of the triangular moving average structure has just been confirmed — signalling a potential swing/day trade environment.

Risk-reward is favourable, and layered entries give us flexibility in execution.

🛒 Entry Strategy (Layering Style):

Using multiple buy limit orders (classic Thief layering method) at the following levels:

0.91300

0.91400

0.91500

0.91600

(You can add more layers if you like — scale as you see fit.)

🚫 Stop Loss (Thief’s SL):

0.91100 — if price drops below here the trade is invalidated.

Note: Dear Ladies & Gentlemen (Thief OG’s), I am not recommending you blindly follow my SL — it's your choice, you can make money then take money at your own risk.

🎯 Target (TP):

0.92300 — this level acts as a police barricade (strong resistance) + overbought trap zone.

Note: Dear Ladies & Gentlemen (Thief OG’s), I am not recommending you blindly follow my TP — it's your choice, you can make money then take money at your own risk.

🔍 Watch-Pairs / Correlations:

OANDA:USDCAD – watch relative strength of USD vs CAD.

OANDA:AUDJPY – for Aussie strength confirmation.

OANDA:GBPCAD – another CAD-weakness proxy.

Monitoring these helps us see if CAD remains weak or if AUD continues to shine.

📌 Key Points / Why This Setup Works:

Capital flow: Aussie assets drawing interest, contributing to AUD strength.

Breakout confirmation: Moving average triangle resolved bullishly.

Layered entries: lets us average into the trade if price comes down to support.

Target zone backed by resistance and structural trap — good exit zone.

Stop-loss placement protects capital if market flips direction.

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

Disclaimer: This is Thief style trading strategy just for fun.

#AUDCAD #Forex #FX #DayTrade #SwingTrade #CapitalFlow #LayeringStrategy #ThiefTrader

Swing Trading AUD/CAD: A Detailed Bullish Scenario📌 𝐀𝐬𝐬𝐞𝐭: AUD/CAD — “Aussie vs Canadian Dollar”

𝐅𝐨𝐫𝐞𝐱 𝐌𝐚𝐫𝐤𝐞𝐭 𝐓𝐫𝐚𝐝𝐞 𝐎𝐩𝐩𝐨𝐫𝐭𝐮𝐧𝐢𝐭𝐲 𝐆𝐮𝐢𝐝𝐞 (𝐒𝐰𝐢𝐧𝐠 𝐓𝐫𝐚𝐝𝐞)

🧭 𝐓𝐫𝐚𝐝𝐞 𝐏𝐥𝐚𝐧: 𝐁𝐮𝐥𝐥𝐢𝐬𝐡 — 𝐌𝐀 𝐏𝐮𝐥𝐥𝐛𝐚𝐜𝐤 + 𝐏𝐫𝐞𝐜𝐢𝐬𝐞 𝐑𝐞𝐭𝐞𝐬𝐭 𝐂𝐨𝐧𝐟𝐢𝐫𝐦𝐞𝐝

The trend structure remains bullish with clean higher-lows. Price has reacted strongly from the dynamic support zone around the Moving Averages, validating a trend-continuation setup. Momentum stays on the buyers’ side with exhaustion signs on the sellers.

🎯 𝐄𝐧𝐭𝐫𝐲: 𝐌𝐮𝐥𝐭𝐢-𝐋𝐚𝐲𝐞𝐫 𝐁𝐮𝐲 𝐎𝐫𝐝𝐞𝐫 𝐒𝐭𝐫𝐚𝐭𝐞𝐠𝐲 (𝐓𝐡𝐢𝐞𝐟 𝐌𝐞𝐭𝐡𝐨𝐝)

This plan uses a layered limit entry system to reduce risk and improve average execution:

Buy Limit Layers:

0.91400

0.91500

0.91600

0.91700

(You may increase or decrease layers based on your personal strategy.)

Concept: This layering method allows catching pullback liquidity sweeps and retest reactions across micro-levels — ideal for swing positioning.

🛡️ Stop Loss (SL): 0.91200

This is the proposed Thief SL.

However, you must adjust SL based on your risk tolerance, trade size, and personal strategy.

Your money—your responsibility.

🎯 Target (TP): 0.92400

Price is approaching a Police Barricade Zone — a strong resistance area where:

Market is entering overbought territory,

A possible bull trap might form,

Liquidity zones cluster tightly.

Take profits safely.

Again, adjust TP as per your risk and comfort.

📚 Related Pairs to Watch (Correlation Insights)

💱 1. USD/CAD ( OANDA:USDCAD )

Correlation: Moderate Positive

When CAD strengthens (often due to oil), USDCAD tends to drop, and AUDCAD may also feel downside pressure.

Watch oil and CAD macro data.

💱 2. AUD/USD ( OANDA:AUDUSD )

Correlation: Strong Positive with AUD strength

If AUD shows broad market strength versus USD, chances increase for AUD to outperform CAD as well.

Risk sentiment (RISK-ON/RISK-OFF) heavily impacts it.

💱 3. CAD/JPY ( OANDA:CADJPY )

Correlation: Risk sentiment indicator

When CADJPY weakens, global risk sentiment may be shifting, which can slow AUDCAD bullish momentum.

💱 4. AUD/JPY ( OANDA:AUDJPY )

Correlation: High risk sentiment sensitivity → guidance for AUD strength

If AUDJPY rallies, it shows strong AUD flows—supportive for AUDCAD longs.

💱 5. WTI Crude Oil ( TVC:USOIL )

Correlation: Inverse Effect on AUDCAD

CAD is an oil-linked currency.

Rising oil → CAD strengthens → AUDCAD may drop.

Falling oil → CAD weakens → AUDCAD tends to rise.

🧠 Final Notes

This is a structured swing setup designed for layered execution, strong risk control, and clarity.

Always adapt entries, stops, and targets to your own strategy.

Trade responsibly, trade smart.

AUDCAD – H4 | 02-12-2025 Wave 3 is back in playAUDCAD – H4 | 02-12-2025

Wave 3 is back in play

A clean Elliott Wave reaction once again.

Following the previous update, price extended lower to 0.90565, completing the blue wave 5, thereby finishing white wave C of yellow wave Y, and simultaneously confirming the completion of the red wave 2 corrective structure.

From the 0.90565 low, the market has rallied strongly into yellow wave 1 of red wave 3. Within this advance, the internal structure of yellow wave 1 is unfolding as a clear five-wave impulsive sequence in white, and price is currently progressing through white wave 5.

Price may push slightly higher to finalize this five-wave structure of yellow wave 1 before entering a corrective pullback as yellow wave 2.

Primary Plan

Wait for yellow wave 2 to complete, then look for long opportunities aligned with the powerful yellow wave 3 of red wave 3.

Invalidation

A break below 0.90565 would invalidate the count and require reassessment.

AUD/CAD Daily Market OutlookThe AUD/CAD structure on the daily timeframe is showing clear signs of bearish pressure after repeated rejections within the 0.91500–0.92270 supply zone. Price has been consolidating beneath this resistance area, forming lower highs and indicating a weakening bullish momentum.

My expectation is a continuation to the downside, targeting the next significant liquidity level around 0.84439, but the short-term confirmation zone sits at 0.90789.

At the moment, price is hovering just above 0.90789. For a cleaner and higher-probability sell scenario, I require a decisive daily close below 0.90789, followed by a bearish engulfing candle to signal strong seller dominance. Such a break would confirm that the market has transitioned from distribution into a stronger downside phase.

Trade Idea (Sell Bias):

• Entry Zone: Confirmation comes after a clear close below 0.90789 followed by an engulfing candle.

• Stop Loss: Positioned above the red zone around 0.92270, protecting against any liquidity grab or false breakout.

• Targets: The broader downside structure points to a continuation towards the lower range around 0.84439, where previous major demand sits.

This setup aligns with the prevailing market structure, the visible supply rejection, and the need for confirmation to avoid premature entries. OANDA:AUDCAD

AUDCAD: Bearish as Aussie Struggles Against Resilient LoonieAUDCAD has come under renewed selling pressure, sliding back toward key support zones after failing to sustain gains above 0.9200. The Canadian dollar remains supported by solid employment data and oil market stability, while the Australian dollar faces headwinds from weaker Chinese demand and a cautious RBA. With momentum shifting lower, AUDCAD looks poised for further downside if support levels give way.

Current Bias

Bearish – Price is testing the lower end of its recent consolidation and risks breaking down toward 0.8950.

Key Fundamental Drivers

AUD Weakness: RBA’s cautious tone and China’s slower growth outlook weigh heavily on the Australian dollar.

CAD Strength: Stronger-than-expected labor market data and oil resilience underpin CAD.

Commodity Flows: Oil boosts CAD, while iron ore softness limits AUD upside.

Macro Context

Interest Rate Expectations: RBA remains cautious, signaling no rush to hike, while BoC is data-dependent but reluctant to cut aggressively amid still-high inflation.

Economic Growth Trends: Australia faces slowing domestic consumption, while Canada’s growth outlook is steadier, albeit with labor market slack.

Commodity Flows: CAD benefits from oil’s relative stability, while AUD remains exposed to weakening iron ore demand from China.

Geopolitical Themes: US-China tariff tensions pressure AUD more directly, while CAD benefits from closer US trade alignment.

Primary Risk to the Trend

A rebound in Chinese stimulus measures or stronger-than-expected Australian data could provide support for AUD.

Most Critical Upcoming News/Event

Australia jobs data and CPI prints – critical for RBA policy outlook.

Canada CPI – pivotal for BoC’s rate stance.

Leader/Lagger Dynamics

AUDCAD is typically a lagger, reflecting broader AUD performance against China-sensitive pairs and CAD’s alignment with oil. It follows AUDUSD trends and CAD crosses but reacts slower than majors like AUDUSD or USDCAD.

Key Levels

Support Levels:

0.9050

0.8950

Resistance Levels:

0.9160

0.9230

Stop Loss (SL): 0.9230

Take Profit (TP): 0.8950

Summary: Bias and Watchpoints

AUDCAD is bearish, with downside momentum reinforced by weak AUD fundamentals and firmer CAD drivers. A break below 0.9050 opens the path to 0.8950, while resistance at 0.9160–0.9230 caps upside. Stop loss sits above resistance at 0.9230, and profit-taking is aimed near 0.8950. Watch for Australia’s jobs/CPI data and Canada’s CPI as the key catalysts that could either reinforce or undermine this bearish setup.

AUDCAD Forming Bullish ContinuationAUDCAD is showing strong signs of a potential bullish continuation as price consolidates just below a key resistance zone around the 0.9200 region. The market has maintained higher lows, reflecting steady buyer interest and a gradual shift in sentiment toward the upside. If the pair manages to break above this resistance with strong momentum, it could confirm a breakout structure, opening the door for a rally toward the 0.9350–0.9400 levels in the coming sessions. The technical picture supports the idea of accumulation, with the market forming a bullish flag-type pattern before continuation.

From a fundamental perspective, the Australian dollar remains relatively supported as the Reserve Bank of Australia maintains a firm tone on inflation and continues to assess the impact of its prior tightening measures. Meanwhile, the Canadian dollar has been weighed down by weaker oil prices and softening domestic demand, which have limited the Bank of Canada’s ability to maintain a hawkish stance. The diverging central bank outlooks and commodity performance are creating a favorable backdrop for further AUD strength against the CAD.

As long as AUDCAD holds above the 0.9100 support region, buyers are likely to maintain control, with the next key level of interest being the 0.9250 zone. A confirmed breakout above resistance would strengthen bullish conviction and align with the broader upward trend that has been building since mid-year. This setup remains technically and fundamentally aligned for potential continuation, making it a pair to keep on the radar for bullish opportunities in the near term.

AUDCAD Forming Descending WedgeAUDCAD on the 4H timeframe has been consolidating within a descending wedge structure, and price is now breaking out of the upper trendline, signaling a potential bullish shift. The series of higher lows forming near the wedge base hints at accumulation, while repeated rejections from the lower boundary suggest sellers are losing momentum. As long as price holds above the breakout zone, I expect continuation toward 0.9220 and eventually the 0.9300 region.

On the fundamental side, the Australian dollar is gaining traction as improving risk sentiment and stabilizing commodity demand support AUD strength. Meanwhile, the Canadian dollar is softening due to recent pullbacks in crude oil prices and increasing speculation that the Bank of Canada may not maintain its hawkish stance for long if economic slowdown persists. This divergence creates a favorable backdrop for AUDCAD bulls.

I’ll be watching for a minor retest of the broken wedge resistance to confirm support. If momentum holds, buyers could drive an impulsive leg toward previous supply areas. For now, I remain bullish as long as price stays above recent breakout levels, turning this structure into a profitable continuation play.

AUD/CAD: Bearish Drop to 0.9097?As the previous analysis worked exactly as predicted, FX:AUDCAD is signaling a bearish continuation on the 1-hour chart , with price testing a downward trendline and forming lower highs, indicating sustained selling pressure. The entry zone sits near the resistance zone , aligning with the trendline for a high-probability short setup if sellers maintain control.

Entry between 0.9182-0.9200 for a sell position. Targets at 0.9116 (first) and 0.9097 (second) near the support zone for a solid risk-reward ratio. Set a stop loss on a close above 0.922 to protect against an unexpected reversal. Look for confirmation with a break below 0.9182 accompanied by increasing volume, driven by the prevailing bearish momentum.

Fundamentally , tomorrow—Thursday, October 16, 2025—we have the Australian Unemployment Rate report, which could trigger volatility in AUD. Additionally, the Bank of Canada Governor’s participation in a friendly session in Washington tomorrow may influence CAD movements, adding another layer of uncertainty to the pair. 💡

📝 Trade Plan:

✅ Entry Zone: 0.9182 – 0.9200 (short setup near resistance & trendline)

❌ Stop Loss: Close above 0.9220

🎯 Targets:

TP1: 0.9116 (initial support)

TP2: 0.9097 (extended downside target)

What’s your take on this setup? Share below! 👇

AUD/CAD: Bearish Drop to 0.91630?FX:AUDCAD is signaling a bearish move on the 1-hour chart , with an entry zone between 0.92215-0.92280 near a resistance level.

First target at 0.91875 🎯 marks initial support, while the second at 0.91630 🎯 offers a deeper downside play. 📈 Set a stop loss on a daily close above 0.9232 to manage risk effectively. 🌟

A break below 0.92 with strong volume could confirm this drop, driven by CAD strength and AUD weakness. Watch commodity trends! 💡

📝 Trade Plan:

✅ Entry Zone: 0.92215 – 0.92280 (resistance area)

❌ Stop Loss: Daily close above 0.9232 to manage risk

🎯 Target 1: 0.91875 (initial support)

🎯 Target 2: 0.91630 (deeper downside target)

Ready for this move? Drop your take below! 👇

AUDCAD: Watching for Pullback .. Here's My Trade Plan📊 AUDCAD has rallied strongly following the release of positive RBA data, giving the Aussie a notable boost 💹.

🔎 On the chart, we can clearly see a phase of bullish expansion 🚀. At this stage, my focus is on waiting for a retracement, allowing price to pull back and then confirm with a bullish break of structure on a lower timeframe for a long entry 🎯.

⚠️ Disclaimer: This analysis is for educational purposes only and not financial advice. Always apply proper risk management.

AUDCAD - Expecting Bullish Continuation In The Short TermH1 - Strong bullish momentum.

No opposite signs.

Until the two Fibonacci support zones hold I expect the price to move higher further.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

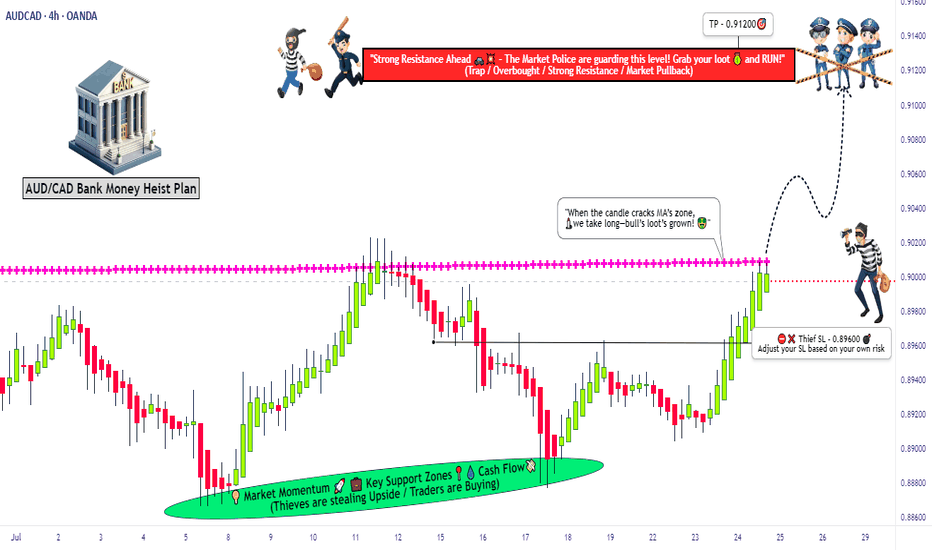

AUDCAD Forex Heist Plan: Entry, SL & TP by Thief Trader Style🏴☠️🔥 AUD/CAD Bank Heist Plan – Thief Trader's Long Con in Motion! 🔥🏴☠️

Breakout Bulls vs Bearish Guards – Who Wins the Forex Vault This Time?

🌍 Hello Money Makers, Market Bandits, and Strategic Robbers! 💰🚀💣

It’s Thief Trader back again, dropping heat with another high-stakes Forex bank job – this time we're targeting the AUD/CAD vault. This is not your grandma’s trading plan. We’re executing a well-calculated heist based on a fusion of technical breakouts + fundamental drivers with a dose of pure trading psychology warfare. 🎯

💼 The Heist Blueprint: Long Entry Game Plan

🧠 Our job is to move in silence until the breakout alarms go off.

We target 0.90200 as the clean breakout trigger over the Moving Average. This zone marks the guard shift — bulls take over if we break through.

📌 Entry Types (Choose your weapon):

🔹 Buy Stop: Above 0.90200 (Post-MA breakout confirmation).

🔹 Buy Limit (DCA Style): Set limit buys at recent lows (M15/M30 swing low) for pullback entries. Layer your entries like a true strategist.

🔔 Set Alerts: Don't sleep on this. Place alerts at breakout zones – let the chart notify you when the bank door opens. 📡

🛑 Risk Management – The Escape Plan

We don't jump in blind. Place your Stop Loss ONLY AFTER the breakout confirms.

📍Suggested SL: 0.89600, near recent 4H wick low.

🔥 Reminder: Your stop depends on your lot size, risk tolerance, and how many entries you're stacking. Don't set it too tight – we don't want early alarms killing the mission.

🎯 Profit Target – Rob & Exit

📍 Primary TP: 0.91200

🎭 Or simply: Escape before the alarm rings (i.e., close early if you see price weakness near resistance or news surprises).

🧲 Scalpers, stick to long bias only. If you're running capital deep, go in hard. If not, ride with the swing team. Use trailing SLs to protect and ride the move like a ghost.

🧠 Behind the Heist – What Fuels Our Mission?

The AUD/CAD pair is showing bullish signs backed by:

✴️ Macroeconomic indicators

✴️ Central Bank divergences

✴️ COT data (Commitment of Traders)

✴️ Intermarket correlations

✴️ Sentiment shifts & positioning strategies

Before executing any trade, read your fundamentals. Study the landscape. Then strike. 🕵️♂️

⚠️ Trading Safety Alert – Timing Is Everything

🚫 Avoid placing trades during high-impact news.

✅ Use trailing SL to lock in profits and prevent whipsaw hits.

📊 Protect your capital like it’s stolen loot – because it is!

💥Support the Crew 💥

🚀 Smash that 💗 Boost Button if you’re vibing with the plan.

Every like strengthens the Thief Trading Crew – and gets us closer to daily market domination. 🎉💪

📲 Stay locked in. Another heist is coming soon.

Till then – rob smart, trade sharp, and vanish like a legend. 🐱👤💸

🔑 #AUDCAD #ThiefTrader #ForexBreakout #LongSetup #ScalpToSwing #TradeWithPlan #DCAEntry #ForexHeist #MarketStrategy #RiskReward