AUDCAD: Bearish Drop to 0.907?FX:AUDCAD is eyeing a bearish pullback on the 4-hour chart , with price testing resistance after rebounding from major support, converging with a potential entry zone that could trigger downside momentum if sellers defend amid recent volatility. This setup suggests a correction opportunity in the uptrend, targeting lower levels with risk-reward exceeding 1:3.🔥

Entry between 0.91890–0.92050 for a short position (entry at these levels with proper risk and capital management is recommended). Target at 0.90745 . Set a stop loss at a close above 0.9226 , yielding a risk-reward ratio of more than 1:3 . Monitor for confirmation via a bearish candle close below entry with rising volume, leveraging the pair's dynamics near resistance.🌟

Fundamentally , AUDCAD is trading around 0.914 in mid-December 2025, with key Canadian events this week potentially impacting CAD strength. On December 16 at 12:30 PM UTC, BoC Governor Macklem speaks in Montreal, which could provide policy insights. December 18 features the Bank of Canada Rate Decision at 09:45 AM UTC, where a potential hold or cut amid economic data could weaken CAD if dovish. Followed by Macklem's Speech at 12:45 PM UTC for further guidance. December 19 brings CPI (Nov) at 08:30 AM UTC, with hotter inflation possibly supporting CAD, while softer readings could pressure it. December 22 includes GDP (Oct) at 08:30 AM UTC, where strong growth might bolster CAD. No major high-impact releases for AUD this week, leaving the pair sensitive to CAD catalysts and broader USD sentiment. 💡

📝 Trade Setup

🎯 Entry (Short):

0.91890 – 0.92050

(Entries in this zone are valid with proper risk & capital management.)

🎯 Target:

• 0.90745

❌ Stop Loss:

• 4H / Daily close above 0.9226

⚖️ Risk-to-Reward:

• > 1:3

💡 Your view?

Will AUDCAD reject this resistance for a clean pullback toward 0.90745 — or will CAD weakness invalidate the setup and push price higher? 👇

Audcadsell

AUD/CAD Daily Market OutlookThe AUD/CAD structure on the daily timeframe is showing clear signs of bearish pressure after repeated rejections within the 0.91500–0.92270 supply zone. Price has been consolidating beneath this resistance area, forming lower highs and indicating a weakening bullish momentum.

My expectation is a continuation to the downside, targeting the next significant liquidity level around 0.84439, but the short-term confirmation zone sits at 0.90789.

At the moment, price is hovering just above 0.90789. For a cleaner and higher-probability sell scenario, I require a decisive daily close below 0.90789, followed by a bearish engulfing candle to signal strong seller dominance. Such a break would confirm that the market has transitioned from distribution into a stronger downside phase.

Trade Idea (Sell Bias):

• Entry Zone: Confirmation comes after a clear close below 0.90789 followed by an engulfing candle.

• Stop Loss: Positioned above the red zone around 0.92270, protecting against any liquidity grab or false breakout.

• Targets: The broader downside structure points to a continuation towards the lower range around 0.84439, where previous major demand sits.

This setup aligns with the prevailing market structure, the visible supply rejection, and the need for confirmation to avoid premature entries. OANDA:AUDCAD

AUDCAD: Bearish as Aussie Struggles Against Resilient LoonieAUDCAD has come under renewed selling pressure, sliding back toward key support zones after failing to sustain gains above 0.9200. The Canadian dollar remains supported by solid employment data and oil market stability, while the Australian dollar faces headwinds from weaker Chinese demand and a cautious RBA. With momentum shifting lower, AUDCAD looks poised for further downside if support levels give way.

Current Bias

Bearish – Price is testing the lower end of its recent consolidation and risks breaking down toward 0.8950.

Key Fundamental Drivers

AUD Weakness: RBA’s cautious tone and China’s slower growth outlook weigh heavily on the Australian dollar.

CAD Strength: Stronger-than-expected labor market data and oil resilience underpin CAD.

Commodity Flows: Oil boosts CAD, while iron ore softness limits AUD upside.

Macro Context

Interest Rate Expectations: RBA remains cautious, signaling no rush to hike, while BoC is data-dependent but reluctant to cut aggressively amid still-high inflation.

Economic Growth Trends: Australia faces slowing domestic consumption, while Canada’s growth outlook is steadier, albeit with labor market slack.

Commodity Flows: CAD benefits from oil’s relative stability, while AUD remains exposed to weakening iron ore demand from China.

Geopolitical Themes: US-China tariff tensions pressure AUD more directly, while CAD benefits from closer US trade alignment.

Primary Risk to the Trend

A rebound in Chinese stimulus measures or stronger-than-expected Australian data could provide support for AUD.

Most Critical Upcoming News/Event

Australia jobs data and CPI prints – critical for RBA policy outlook.

Canada CPI – pivotal for BoC’s rate stance.

Leader/Lagger Dynamics

AUDCAD is typically a lagger, reflecting broader AUD performance against China-sensitive pairs and CAD’s alignment with oil. It follows AUDUSD trends and CAD crosses but reacts slower than majors like AUDUSD or USDCAD.

Key Levels

Support Levels:

0.9050

0.8950

Resistance Levels:

0.9160

0.9230

Stop Loss (SL): 0.9230

Take Profit (TP): 0.8950

Summary: Bias and Watchpoints

AUDCAD is bearish, with downside momentum reinforced by weak AUD fundamentals and firmer CAD drivers. A break below 0.9050 opens the path to 0.8950, while resistance at 0.9160–0.9230 caps upside. Stop loss sits above resistance at 0.9230, and profit-taking is aimed near 0.8950. Watch for Australia’s jobs/CPI data and Canada’s CPI as the key catalysts that could either reinforce or undermine this bearish setup.

AUD/CAD: Bearish Drop to 0.9097?As the previous analysis worked exactly as predicted, FX:AUDCAD is signaling a bearish continuation on the 1-hour chart , with price testing a downward trendline and forming lower highs, indicating sustained selling pressure. The entry zone sits near the resistance zone , aligning with the trendline for a high-probability short setup if sellers maintain control.

Entry between 0.9182-0.9200 for a sell position. Targets at 0.9116 (first) and 0.9097 (second) near the support zone for a solid risk-reward ratio. Set a stop loss on a close above 0.922 to protect against an unexpected reversal. Look for confirmation with a break below 0.9182 accompanied by increasing volume, driven by the prevailing bearish momentum.

Fundamentally , tomorrow—Thursday, October 16, 2025—we have the Australian Unemployment Rate report, which could trigger volatility in AUD. Additionally, the Bank of Canada Governor’s participation in a friendly session in Washington tomorrow may influence CAD movements, adding another layer of uncertainty to the pair. 💡

📝 Trade Plan:

✅ Entry Zone: 0.9182 – 0.9200 (short setup near resistance & trendline)

❌ Stop Loss: Close above 0.9220

🎯 Targets:

TP1: 0.9116 (initial support)

TP2: 0.9097 (extended downside target)

What’s your take on this setup? Share below! 👇

AUD/CAD: Bearish Drop to 0.91630?FX:AUDCAD is signaling a bearish move on the 1-hour chart , with an entry zone between 0.92215-0.92280 near a resistance level.

First target at 0.91875 🎯 marks initial support, while the second at 0.91630 🎯 offers a deeper downside play. 📈 Set a stop loss on a daily close above 0.9232 to manage risk effectively. 🌟

A break below 0.92 with strong volume could confirm this drop, driven by CAD strength and AUD weakness. Watch commodity trends! 💡

📝 Trade Plan:

✅ Entry Zone: 0.92215 – 0.92280 (resistance area)

❌ Stop Loss: Daily close above 0.9232 to manage risk

🎯 Target 1: 0.91875 (initial support)

🎯 Target 2: 0.91630 (deeper downside target)

Ready for this move? Drop your take below! 👇

AUDCAD - Possible Buy Setup AheadThe market is approaching a significant zone.

We’re standing by — no rush, no guessing.

If a clean bullish signal appears, we go long.

If it breaks through, we wait for a pullback and adapt.

Our job isn’t prediction — it’s reaction.

Follow the plan. Let the profits take care of themselves

AUDCAD - Short Term Sell IdeaH1 - Strong bearish move.

No opposite signs.

Currently it looks like a pullback is happening.

Expecting bearish continuation until the two Fibonacci resistance zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

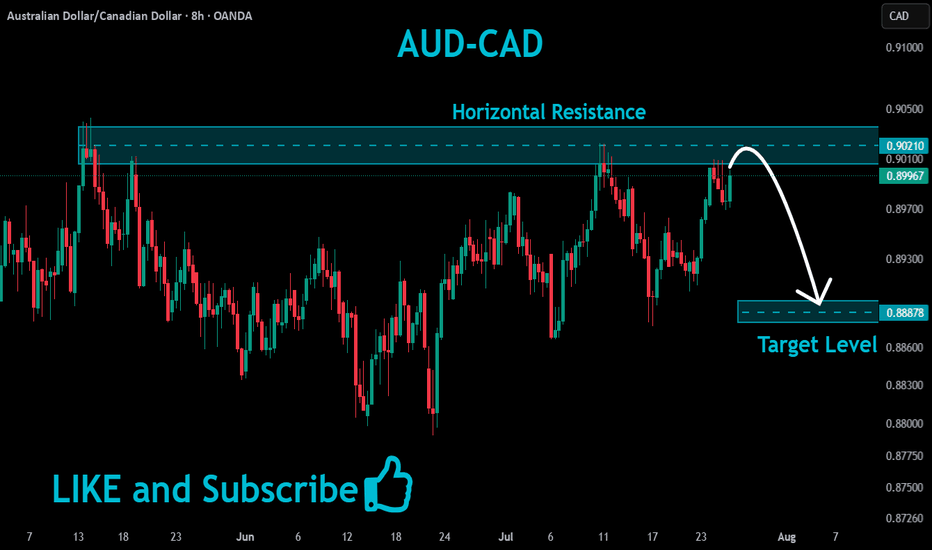

AUDCAD – Bearish Setup Following Retracement to Key ResistanceWelcome to Velatrix Capital.

Below is a live market opportunity identified by our internal trading desk.

This is not financial advice. It’s a data-backed, logic-driven trading edge. Use it with discipline — or don’t use it at all.

🧠 Technical Outlook

AUDCAD is currently showing bullish momentum on the lower timeframes, approaching a key resistance zone between 0.89057 – 0.89272.

Our trading desk expects price to reach this supply zone and then present a short-selling opportunity with favorable risk/reward potential.

We advise waiting patiently for the price to enter this key range before initiating any short trades.

Trade Parameters:

• Timeframe: 1H

• Direction: Sell

• Entry Zone: 0.89272 – 0.89057

• Stop Loss (SL): 0.89386

• Take Profit 1 (TP1): 0.88458

• Take Profit 2 (TP2): 0.87954

• Risk/Reward (R/R): 1:2 / 1:4.80

Note: Setup is invalidated if price breaks and closes above 0.89386.

🔔 Follow Us

This is just the surface.

For more setups, clean breakdowns, and performance-driven content:

📌 Follow, engage, and stay sharp. Our edge is real — and it’s public.

We don’t chase hype. We build edge.

AUDCAD SHORT FORECAST Q2 W25 D18 Y25AUDCAD SHORT FORECAST Q2 W25 D18 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside intraday confirmation breaks of structure.

💡Here are some trade confluences📝

✅Weekly 50 EMA

✅Weekly order block rejection

✅Daily order block rejection

✅15’ order block identification

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

Why AUDCAD is On My Watchlist for a Short Trade🔎 AUDCAD Trade Idea Overview 🔎

Currently watching AUDCAD closely 👀 — and here’s what I’m seeing across the key timeframes:

📉 On the weekly timeframe, the pair remains in a clear bearish trend, with lower highs and lower lows forming consistently.

🕰️ Dropping down to the daily, we’re seeing continued bearish momentum in alignment with the higher timeframe bias.

⏳ On the 4-hour chart, there’s been a clean break of market structure, confirming short-term weakness.

🎯 I’m eyeing a pullback into equilibrium within the current price range for a potential short entry.

🔹 Entry: On retracement into a key value zone

🔹 Stop loss: Positioned above recent swing highs

🔹 Take profit: Targeting previous lows and liquidity pockets 💧

Patience is key here — waiting for the right setup to align across multiple timeframes. 📊

⚠️ Disclaimer: This is not financial advice. This analysis is for educational and informational purposes only. Always do your own research and manage risk responsibly. 💼

AUDCAD SHORT FORECAST Q2 W23 D2 Y25AUDCAD SHORT FORECAST Q2 W23 D2 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside intraday confirmation breaks of structure.

💡Here are some trade confluences📝

✅Daily 50 EMA

✅Weekly order block rejection

✅Daily order block rejection

✅15’ order block identification

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

HOT PICK ALERT AUDCAD SHORT FORECAST Q2 W22 Y25HOT PICK ALERT AUDCAD SHORT FORECAST Q2 W22 Y25

SELL SELL SELL

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

💡In depth trade confluences provided during the week 📝

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

ALL WE NEED IS A PULL BACK.AUDCAD SHORT FORECAST Q2 W21 D22 Y25ALL WE NEED IS A PULL BACK

AUDCAD SHORT FORECAST Q2 W21 D22 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅ Weekly order block

✅ Intraday 15 order block

✅Tokyo ranges to be filled

✅ Weekly 50 EMA

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

AUDCAD Q2 W21 D19 Y25,SHORT RISK OFF ASAP ! We'll explain why...AUDCAD Q2 W21 D19 Y25 RISK OFF ASAP !

As per our most recent weekly trade forecast, we are indeed short biased & currently short AUDCAD. For those of you speculating with us, here I'll be quick in reason regarding why you should manage your risk effectively NOW. Whether that means rolling stops to half risk and or going breakeven, whatever risk management you use, the time is now.

Now here is why. Whilst, yes we do forecast but we also are hedging on reactions from price points of interests. The market does not know our lot sizes, nor our stop size nor our profit target.

Have we had the reaction from the POI? yes. Should that be good enough, YES!

In our opinion, in order to be successful trade, a robotic approach is required. To enter with minimal objectiveness. If the shoe fits and I like shoe is the one I've been waiting for then, it's simple. I try on the shoe. A lot like trading via a robotic approach, if the set up is the one that matches the catalog of setups that I acknowledge as a position, it is executed. With that said, the robotic approach works inline with when to know that its time to illuminate the potential for loss even though risk is always accepted, accepted, does not mean acceptable.

It is so very easy to be locked into a mindset that aligns with your current bias. exaggerated more so when you're in a position that stokes your thoughts ... BE MINDFUL of that. Stay robotic and try to illuminated self assurance. Look at price action with open eyes and hold no bias aside from the split second that you build your bias. then drop it and re evaluation continually. That I the "major key".

Remain open minded.

Remain Objective, not subjective.

Remember the aim. To print money.

Let’s see what price action is telling us NOW!

💡Here are some trade confluences📝

✅ Weekly order block

✅Intraday 15 order block

✅Tokyo ranges to be filled

✅ Weekly 50 EMA

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

AUDCAD SHORT FORECAST Q2 W21 Y25AUDCAD SHORT FORECAST Q2 W21 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅ Weekly order block

✅Intraday 15 order block

✅Tokyo ranges to be filled

✅ Weekly 50 EMA

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

AUDCAD SHORT FORECAST Q2 W19 D5 Y25AUDCAD SHORT FORECAST Q2 W19 D5 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅ Weekly order block

✅Intraday 15 order block

✅Tokyo ranges to be filled

✅Intraday bearish breaks of structure to be confirmed

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

AUDCAD SHORT FORECAST WEEKLY DAILY 50EMA Q2 W17 D25 Y25AUDCAD SHORT FORECAST WEEKLY DAILY 50EMA Q2 W17 D25 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Trade confluences📝

✅Daily 50 EMA

✅Intraday 15' bearish breaks of structure to be created

✅Daily order block mitigated

✅Previous daily imbalance fill upon short positon

✅Tokyo ranges to be filled

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

#AUDCAD: 550+ Swing Sell Intraday Setup Idea! The AUDCAD has hit a major snag and is currently rejected from that area. The way the price has been moving lately has completely changed our minds, so we’re now completely bearish.

Thanks for your support! 😊

If you want to help us out, here are a few things you can do:

- Like our ideas

- Comment on our ideas

- Share our ideas

Team Setupsfx_

AUDCAD Discretionary Analysis: Next stop? Rock bottomIt’s more of a sixth sense (like when you just know your girlfriend's about to cancel plans). AUDCAD’s giving off that "Next stop? Rock bottom" kind of energy. I see it dropping hard, like it missed the elevator and took the shaft instead. If I’m right, I’ll be looking at some solid trades to take. If I’m wrong, well, I’ll just grab a coffee and wait for the next pair to make its move.

Just my opinion, not financial advice.

#AUDCAD: Using 1-Day Time Frame For Intraday Entry! We have been closely monitoring the AUDCAD currency pair for an extended period and believe that selling AUDCAD at the current market conditions presents a more favourable opportunity with a sufficient number of sellers. However, we must acknowledge that we need to wait for the price to approach our entry zone, which will allow us to execute a sell entry with strict risk management. This analysis has identified a single target.

We extend our best wishes for your success and encourage you to provide support by liking and commenting on the idea.

Team Setupsfx_

AUDCAD Discretionary Analysis: Taking the Elevator DownIt’s more of a sixth sense(like when you just know the milk is bad before you smell it). I think it’s headed down, like an elevator with a broken cable . If I’m right, I’ll make some money. If I’m wrong, well… guess I’ll take the stairs next time.

Just my opinion, not financial advice.