AUD/JPY Ready to Fly? Don't Miss This Move!OANDA:AUDJPY The Aussie Dollar is showing strength against the Yen! 🇦🇺💴 We are seeing a perfect pullback into support. The trend is your friend, and the bulls are stepping back in.

The Setup:

Strong Impulse Move ⬆️

Healthy Retracement (Correction) 📉

Rejection at Support ✅

Are you taking this trade? Let me know in the comments! 👇

Audjpylong

AUD/JPY :: Market Structure & Momentum ReviewAUD/JPY (Australian Dollar vs Japanese Yen) — Bullish Technical Setup + Macro Context + Correlation Watchlist 💹

📌 TRADE IDEA — PLAN

✔️ Market bias: Bullish trend confirmed — price respect on HULL MA pullbacks + strong RSI support, momentum still favoring upside continuation. (Technical momentum structure visible on daily/4H chart)

✔️ Entry strategy: Thief layering style (multiple limit buys):

💎 Buy Limits: 106.500 — 107.000 — 107.500 — 108.000 (you can add more layers based on your risk.)

➡️ Big picture: Layers capture pullbacks into value while keeping jungle-style risk control.

📌 Stop Loss (Thief SL): 109.500

– Adjust to your risk tolerance but keep it logical above recent swing highs.

📌 Target Zone: 🎯 106.000 first target

🔥 Police-force resistance + overbought zone likely to trap late sellers — escape profits early! (manage profit levels dynamically)

📌 Note (Respect the Market):

Dear Traders (Thief OG’s), this TP/SL is a guide — your profit is your choice. Trade smart, lock gains, manage risk. 🙌

📊 REAL-TIME FUNDAMENTAL CONTEXT (London Time)

🧠 Economic Drivers Impacting AUD/JPY:

🔹 AUD Strength Factors:

• AUD rally on improved risk appetite & Aussie CPI anticipation — strong commodity flows buoy AUD.

• AUD/JPY often tracks global risk sentiment (bullish in rally phases).

🔹 JPY Dynamics:

• Japanese inflation/currency dynamics shifting — Tokyo CPI slowdown tempers BoJ tightening expectations.

• Fresh reports suggest potential yen intervention signals from Japan’s PM & policymakers.

📆 Upcoming Key Releases (Watchlist):

• AUD CPI / RBA rate commentary — big volatility trigger.

• Japan GDP / BoJ policy updates — can bend JPY strength.

• Global risk news (equity, bond routs) — impact carry crosses like AUD/JPY.

🔗 RELATED PAIRS + CORRELATION WATCHLIST

• OANDA:AUDUSD – Shows overall Australian dollar strength. If AUD/USD holds bullish momentum, it supports AUD/JPY upside.

• FX:USDJPY – Direct Yen strength indicator. Strong USD/JPY = weak JPY → bullish pressure for AUD/JPY.

• OANDA:NZDJPY – Similar risk-on carry trade behavior; often moves in the same direction as AUD/JPY.

• OANDA:EURJPY – Confirms broader JPY sentiment during risk-on / risk-off market conditions.

🔁 Correlation Insight:

AUD/JPY performs best in risk-on environments (strong equities, rising yields) and weakens when safe-haven Yen demand increases.

🛠️ TECHNICAL & STRUCTURAL NOTES

📍 Minor cross pair — subject to volatility swings but tradable with layered entry strength and defined risk.

📍 Daily/4H HULL & RSI show supportive pullbacks into key levels.

📍 Price above 100-EMA indicates medium-term bullish structure with reasonable support.

🧠 THIEF TRADER MOTIVATION & WISHES 💎🔥

💬 “Trade like a smart thief — take only what the market gives you, exit before resistance hits. Patience + precision = profit.”

💬 “Layers stack profits, discipline stacks equity.”

💬 “Be a strategist, not a spectator.”

Wishing every Thief OG 📈 smart entries, shark-level exits, and snowballing profits! 🦈💰

AUD/JPY Price Outlook – Trade Setup📊 Technical Structure

OANDA:AUDJPY AUD/JPY remains in a short-term bullish structure after staging a strong impulsive rally from the lower range. Price is currently pulling back toward the 107.85–108.05 support zone, which aligns with the prior breakout area.

The broader structure suggests continuation higher as long as the pair holds above support. The projected path indicates a potential dip for liquidity before buyers attempt another push toward the 108.65–108.85 resistance zone.

🎯 Trade Setup (Bullish Bias)

Entry Zone: 108.05 – 107.85

Stop Loss: 107.80

Take Profit 1: 108.65

Take Profit 2: 108.85

Risk–Reward Ratio: Approx. 1 : 3.01

📌 Invalidation:

A sustained break and close below 107.80 would invalidate the bullish setup and signal weakening upside momentum.

🌐 Macro Background

AUD/JPY is supported by persistent weakness in the Japanese Yen amid fiscal uncertainty and political developments in Japan. Discussions around potential tax pauses and election-related spending have pressured the currency.

Meanwhile, the Australian Dollar remains relatively resilient, benefiting from stable risk sentiment. Although intervention concerns from Japanese authorities may slow the rally, the near-term macro environment still favours upside continuation.

🔑 Key Technical Levels

Resistance Zone: 108.65 – 108.85

Support Zone: 107.85 – 108.05

Bullish Invalidation: Below 107.80

📌 Trade Summary

AUD/JPY is undergoing a healthy pullback after a strong bullish impulse. As long as price holds above the support zone, the bias favours a buy-on-dips strategy, targeting a continuation toward the upper resistance band.

⚠️ Disclaimer

This analysis is for reference only and does not constitute trading advice. Financial markets involve significant risk; proper risk and position management are essential.

LONG ON AUD/JPYThe Jpy Index pushed up on Friday but is now starting to retrace/pullback/correct or fall.

We have a nice choc (change of character) from down to up on AJ on the 15min timeframe.

I expect price to drop first to 106.392 then rise.

This is a buy limit order. I will be looking to catch 100-200 pips.

AUD/JPY: Multi-Layer Execution Strategy | Technical & Macro View🔥 AUD/JPY Bullish Setup | Layered Buy Strategy | Smart Money Flow 📈

📌 Asset

AUD/JPY – Australian Dollar vs Japanese Yen

Forex Market Trade Opportunity Guide (Day / Swing Trade)

🧠 Market Bias

✅ Bullish Structure Confirmed

Price is holding above key demand with higher-timeframe support intact. Risk sentiment favors AUD strength while JPY remains weak under current macro conditions.

🎯 Trade Plan – Thief Layering Strategy 🧩

This setup uses a multiple limit-order layering method to optimize average entry price and reduce emotional execution.

🟢 Buy Limit Layers (Scale-In):

105.000

105.300

105.600

105.900

👉 (You may add or adjust layers based on your risk profile and capital allocation)

📌 Entry Logic:

Demand zone reaction

Mean reversion opportunity

Liquidity absorption near intraday lows

🏁 Take Profit (TP)

🎯 106.600

📍 Reasoning:

Prior resistance zone

Overbought conditions expected near highs

Possible liquidity trap above → book profits, don’t get greedy

⚠️ TP is flexible — partials are recommended based on price action.

🛑 Stop Loss (SL)

🔻 104.800

📌 SL Logic:

Invalidation of bullish structure

Below demand & liquidity pocket

⚠️ Risk management is personal — adapt SL to your strategy.

🌍 Live Fundamental & Economic Drivers (Macro Watch – London Session ⏱️)

📈 AUD Support Factors

Commodity demand resilience (China-linked exposure)

Risk-on sentiment across Asia-Pacific equities

Stable RBA stance compared to peers

📉 JPY Weakness Factors

Ongoing ultra-loose BoJ policy

Yield-spread favoring higher-yield currencies

Persistent carry-trade demand

🗓️ High-Impact Events to Monitor

🇦🇺 Australia: Employment data, CPI, RBA statements

🇯🇵 Japan: BoJ policy updates, CPI, wage data

🌐 Global: Risk sentiment, equity market flow, bond yields

📌 Always track live macro updates during London hours before execution.

🔗 Correlated & Related Pairs to Watch

💲 AUD/USD – Confirms AUD strength

💲 NZD/JPY – Risk sentiment alignment

💲 USD/JPY – Yen weakness validation

💲 AUD/NZD – Regional currency balance

👉 If AUD strength aligns across pairs and JPY remains soft → bullish AUD/JPY bias stays valid.

🧩 Key Technical Notes

✔️ Structure holding above demand

✔️ Layered entries reduce timing risk

✔️ Liquidity-based TP zone

✔️ Macro + technical confluence

⚠️ Risk Disclaimer

This idea is for educational purposes only.

You control your entries, exits, and risk. Trade responsibly.

💬 If this setup adds value, boost it with a 👍, 💬 your view, and ⭐ follow for more structured trade ideas.

Let the chart do the talking 📊🔥

AUD/JPY Price Outlook – Trade Setup📊 Technical Structure

OANDA:AUDJPY AUD/JPY pulled back after the recent rally and is now consolidating around the 105.70–105.93 support zone. This area overlaps with prior demand and a key technical base, where downside momentum has started to slow.

From a structural perspective, the current move appears to be a corrective pullback within an ongoing bullish trend, rather than a trend reversal. As long as price holds above the support zone, the broader price action favours a continuation higher toward the upper resistance area.

🎯 Trade Setup (Bullish Bias)

Entry Zone: 105.70 – 105.93

Stop Loss: 105.61

Take Profit 1: 106.62

Take Profit 2: 106.84

Risk–Reward Ratio: Approx. 1 : 2.36

📌 Invalidation

A sustained break and close below 105.61 would invalidate the bullish setup and suggest a deeper corrective move.

🌐 Macro Background

On the macro front, the Japanese Yen continues to face pressure despite repeated verbal warnings from Japanese officials regarding potential intervention. So far, these comments have failed to translate into concrete action, keeping the JPY structurally vulnerable.

Meanwhile, the Australian Dollar remains supported by expectations that the Reserve Bank of Australia maintains a relatively hawkish stance, especially compared with Japan’s still-accommodative policy environment. This ongoing policy divergence continues to underpin AUD/JPY, favouring buy-on-dips strategies rather than aggressive selling.

🔑 Key Technical Levels

Resistance Zone: 106.68 – 106.84

Support Zone: 105.70 – 105.93

Bullish Invalidation: Below 105.61

📌 Trade Summary

AUD/JPY is undergoing a healthy pullback within a broader bullish structure. As long as price holds above the 105.70 support zone, the technical bias favours a rebound toward the upper resistance band. The overall setup supports a buy-on-dips approach, rather than a bearish trend reversal.

⚠️ Disclaimer

This analysis is for reference only and does not constitute trading advice. Financial markets involve significant risk; proper risk and position management are essential.

TheGrove | AUDJPY BUY | Idea Trading AnalysisAUDJPY is moving in an UP trend channel.

The chart broke through the dynamic Resistance line, which now acts as support.

We expect a decline in the channel after testing the current level which suggests that the price will continue to rise

Hello Traders, here is the full analysis.

I think we can soon see more fall from this range! GOOD LUCK! Great BUY opportunity AUDJPY

I still did my best and this is the most likely count for me at the moment.

-------------------

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 🤝

AUD/JPY Price Outlook – Trade Setup📊 Technical Structure

FOREXCOM:AUDJPY AUD/JPY is currently consolidating near recent highs after a strong impulsive rally. Price has pulled back into the 105.18–105.37 support zone, where buying interest has emerged and downside momentum has clearly slowed.

The broader market structure remains bullish. As long as price holds above the support zone, AUD/JPY is likely to form a higher low and resume its upward move. The projected path suggests a brief consolidation or shallow retracement, followed by a continuation toward the 105.75–105.93 resistance zone, rather than a deeper corrective breakdown.

🎯 Trade Setup (Bullish Bias)

Entry Zone: 105.15 – 105.37

Stop Loss: 105.15

Take Profit 1: 105.75

Take Profit 2: 105.93

Risk–Reward Ratio: Approx. 1 : 2.6

📌 Invalidation:

A sustained break and close below 105.15 would invalidate the bullish setup and signal a deeper correction risk.

🌐 Macro Background

The macro backdrop continues to favor AUD/JPY on a relative basis. Persistent uncertainty surrounding the Bank of Japan’s policy normalization keeps the Japanese Yen structurally weak, while expectations of a relatively hawkish Reserve Bank of Australia continue to support the Australian Dollar.

In the near term, markets remain sensitive to global risk sentiment and upcoming U.S. macro data. However, as long as risk appetite does not deteriorate sharply, yield differentials and policy divergence should continue to underpin AUD/JPY, favoring buy-on-dips opportunities near key technical support.

🔑 Key Technical Levels

Resistance Zone: 105.75 – 105.93

Support Zone: 105.15 – 105.37

Bullish Invalidation: Below 105.15

📌 Trade Summary

AUD/JPY is holding above a critical support zone following a corrective pullback from recent highs. As long as price remains supported above 105.15, the bias favours a buy-on-dips approach, targeting a continuation toward the upper resistance band near 105.90.

⚠️ Disclaimer

This analysis is for reference only and does not constitute trading advice. Financial markets involve significant risk; proper risk and position management are essential.

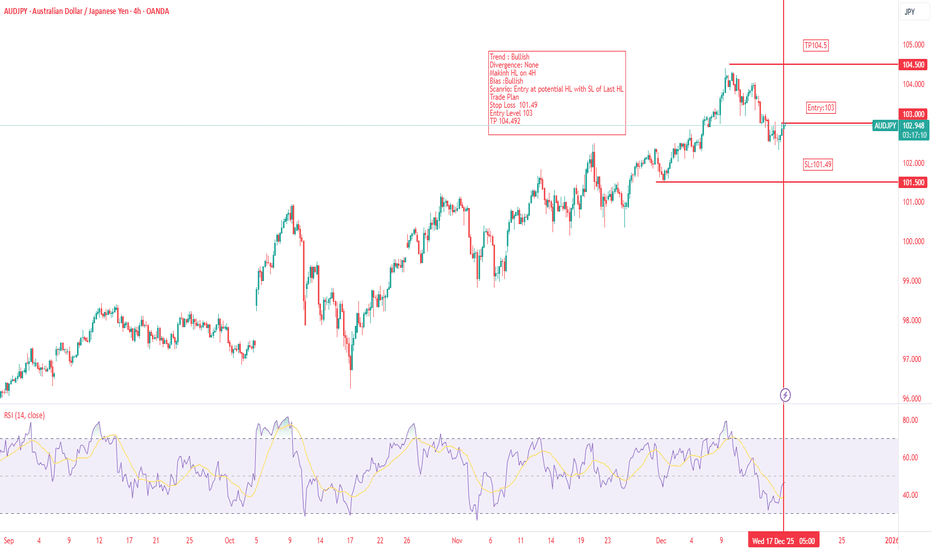

AUDJPY: +400 Pips Possible Buying Opportunity! Dear Traders,

AUDJPY is likely to continue the bullish price momentum up until 104, currently price has reversed from a critical point. You may consider buying at this moment with a proper risk management. Please use strict management while trading and use this analysis for educational purposes only.

Please like and comment for more!

Team Setupsfx_❤️🏆

AUD/JPY | Bullish Momentum After Australian CPI Data ReleaseThe AUD/JPY pair gained a strong bullish boost after higher-than-expected Australian consumer inflation data, which dampened speculation of an interest rate cut by the Reserve Bank of Australia (RBA). Currently, the price is at a new weekly high and awaits confirmation of a breakout.

1. Market Fundamental Factors (Drivers of the Upside)

Higher Australian Inflation: The hotter (higher) Australian consumer inflation figures dampened market bets for further interest rate cuts by the RBA.

Impact: This significantly boosted the Australian Dollar (AUD), lifting the AUD/JPY pair to the 101.70 area (a new weekly high).

2. Technical Analysis and Indicators

Long-Term Bias: The 100-day Simple Moving Average (SMA) is rising steadily, and the price is holding above it, reinforcing the bullish bias.

Trend Conditions: Trend conditions will remain favorable as long as the price is above the rising SMA, which is currently below 98.00.

3. Bullish Scenario ⬆️

Strong Upside Trigger: Bulls await a breakout through the nearly three-week-old trading range (currently around 101.70). A decisive MACD push into positive territory would strengthen this case.

Next Target: A move will head towards the 102.45-102.50 region, or the highest level since July 2024, touched last week.

4. Bearish Scenario ⬇️

Initial Key Support: Weakness below the 101.40 area is likely to find decent support near the 101.00 round number.

Trading Range Support: A break below 101.00 could retest the trading range support around the 100.40-100.35 region.

Bias Reversal: A convincing break below 100.35 could trigger technical selling and drag the price below the psychological 100.00 mark, towards the next relevant support near the 99.65 - 99.60 region.

AUD/JPY Price Outlook – Trade Setup📊 Technical Structure

OANDA:AUDJPY AUD/JPY has rebounded toward 101.20 after defending the 100.40–100.70 support zone, keeping the medium-term uptrend structure intact. Price continues to trade above a rising trendline and the 100-day EMA, while momentum (RSI) remains in bullish territory.

The chart shows a clear range within an ascending structure:

Support zone: 100.40 – 100.70

Resistance zone / target area: 102.07 – 102.39

As long as the cross holds above 100.40, dips into support are likely to attract buyers, with upside potential back toward the 102.00+ resistance band. A decisive 4H close below 100.40 would invalidate the bullish scenario and expose the 99.80 area.

🎯 Trade Setup

Idea: Buy dips into support, targeting a move back into the 102.00 resistance zone.

Entry: 100.70 – 100.40

Stop Loss: 100.10 (below support and recent swing low)

Take Profit 1: 102.07

Take Profit 2: 102.39

Risk–Reward Ratio: ≈ 1 : 2.81

Bias stays constructively bullish while price holds above 100.40–100.70 on a closing basis. A 4H close below this zone would warn that the bullish structure is breaking down.

🌐 Macro Background

According to FXStreet, AUD/JPY has attracted buyers near 101.20 in early European trading as the Japanese Yen weakens on fiscal concerns and uncertainty over the Bank of Japan’s (BoJ) tightening path. Mixed signals from Tokyo keep JPY under pressure, supporting the cross.

BoJ & Japan:

Markets remain unsure how quickly the BoJ will move away from ultra-loose policy.

Japan’s Finance Minister Satsuki Katayama reiterated that FX intervention is possible if JPY moves become “excessively volatile and speculative,” which could cap AUD/JPY on sharp spikes higher.

Australia:

Traders are watching October CPI data due Wednesday for clues on the RBA’s rate path.

A firmer CPI print could reinforce expectations that the RBA will keep policy relatively tight, lending support to AUD.

Overall, BoJ uncertainty and relatively firmer Australian yields favour AUD/JPY on dips, but the risk of verbal or actual FX intervention argues for scaling out profits near resistance rather than chasing the move.

🔑 Key Technical Levels

Resistance zone: 102.07 – 102.39

Interim resistance: 101.70–101.90

Support zone: 100.40 – 100.70

Invalidation level (bulls): 100.40 (4H close below)

📌 Trade Summary

AUD/JPY remains in a gradually bullish structure above the 100-handle, with buyers defending the 100.40–100.70 support band. As long as this floor holds, the setup favours buying dips toward support and targeting 102.07–102.39 where prior supply and intervention risk may re-emerge. Traders should stay alert to Japanese officials’ comments and the upcoming Australian CPI release, which could amplify short-term volatility.

⚠️ Disclaimer

This analysis is for reference only and does not constitute trading advice. Trading involves significant risk, and proper risk management is essential.

AUDJPY Forming Bullish StructureAUDJPY continues to show strong bullish structure, with price breaking out of a descending channel and pushing toward new highs, confirming continued buying interest. The market has been forming higher highs and higher lows, and this recent breakout signals a potential continuation of bullish momentum. From a technical perspective, the breakout above the consolidation zone reflects aggressive demand from institutional participants, and as long as price holds above the recent support region, buyers may continue controlling the trend.

Fundamentally, AUDJPY is currently influenced by contrasting monetary conditions between the Reserve Bank of Australia and the Bank of Japan. The RBA has maintained a firm stance as inflation in Australia remains above the target range, increasing the probability of additional rate policy firmness to keep inflation under control. This supports the Australian dollar, as higher interest rates strengthen currency demand in global carry trade flows. On the opposite side, the Bank of Japan continues to maintain an ultra-dovish stance, with very low interest rates and ongoing financial easing, which keeps the yen fundamentally weak.

At the same time, global equity sentiment remains risk-on, which typically benefits AUD over JPY due to Australia’s commodity-linked profile. With Japanese yields still suppressed and foreign capital outflows steady, traders continue favoring AUDJPY as a popular carry trade pair. If risk sentiment remains stable and RBA maintains its policy outlook, the pair may continue advancing toward higher price levels in the medium term.

Overall, as long as price remains above the breakout level and the fundamental divergence between the two central banks persists, AUDJPY has the potential to sustain further upside. Professional traders will continue watching price reactions on retests and market volume to secure profitable continuation entries as the bullish trend develops.

AUDJPY – Bullish Structure Continuation Setup (1H)

Price is holding a clear Higher Low (HL) around 100.60, keeping the bullish trend structure intact.

Recent swing behavior shows HL → HH → HL, indicating buyers still control the market.

Price is attempting to reclaim short-term EMAs, suggesting momentum may shift upward again.

RSI is stabilizing above mid-level, supporting a possible bullish continuation.

Trade Plan

Buy Zone: 100.80 – 100.90

Take-Profit (TP): 102.00

Stop-Loss (SL): 100.07

Why This Setup Works

Bullish market structure remains valid while HL holds.

102.00 aligns with previous liquidity and psychological resistance.

Momentum indicators and structure both point toward upside continuation.

Invalidation

Break and close below 100.07 cancels the bullish setup and suggests a trend shift.

AUD/JPY - Bullish Flag (03.11.2025)🧠 Setup Overview:

AUD/JPY is forming a Bullish Flag Pattern on the 30-minute chart — a continuation setup suggesting potential upside momentum after consolidation. The price has respected the flag support zone and is attempting a breakout above the descending channel, signaling renewed bullish pressure.

💡 Technical Plan: Pattern: Bullish Flag Pattern

Bias: Buy after confirmation breakout and retest

Support Zone: 100.650 – 100.700

Entry Zone: Near 100.850 – 100.900 (after breakout confirmation)

Targets:

🎯 1st Resistance: 101.460

🎯 2nd Resistance: 101.753

Invalidation: Close below 100.600 negates the bullish bias

🌏 Fundamental Insight (Today – 3 Nov 2025)

The AUD finds strength as China’s manufacturing PMI beats expectations, improving sentiment for commodity-linked currencies.

Meanwhile, the JPY remains under pressure due to continued Bank of Japan dovishness and yield differentials favoring risk assets.

Market tone is risk-on, further supporting bullish momentum in AUD/JPY.

⚠️ Disclaimer:

This setup is shared for educational purposes only. It is not financial advice. Always do your own analysis and apply proper risk management before trading any setup.

#AUDJPY #Forex #TechnicalAnalysis #PriceAction #BullishFlag #BreakoutTrading #Ichimoku #KABHI_TA_TRADING #ChartsDontLieTradersDontQuit #ForexSetup #MarketAnalysis #TradingView #FXMarket #BuySetup #ForexCommunity #AUD #JPY #ForexTrader

💬 Support My Work ❤️

If you find this analysis useful — LIKE 👍, COMMENT 💭, and FOLLOW 🔔 for more daily Forex chart updates and trade setups!

Can The Yen Fight Inflation While Rates Stay Low?The AUD/JPY currency pair's surge above 101.00 is a direct result of two opposite forces. The Australian Dollar (AUD) is strong because inflation is unexpectedly high, forcing the RBA to keep its interest rate at 3.60%. This high rate attracts global investment, as traders move money to Australia for better returns. Meanwhile, the Japanese Yen (JPY) is weak because the BoJ maintains an extremely low interest rate, near zero, to boost its economy. This wide gap in rates makes the AUD/JPY a favorite for the "Carry Trade," where investors earn the difference, pushing the pair higher.

Beyond just interest rates, geopolitics is playing a crucial role. The recent US-China trade deal, which saw a truce on certain tariffs and export controls on rare earth minerals, strongly benefits the commodity-linked AUD. Australia is a major exporter of these minerals. This trade calm reduces global risk and boosts demand for Australian goods. Conversely, the JPY suffers from political choices, as Japan's new government plans aggressive spending. This combination of low rates and high spending ensures the JPY remains weak, reinforcing the strong case for continued AUD/JPY strength.

AUD/JPY - M30 - Bullish Channel FormationAUD/JPY – Buy Entry (M30- Channel Pattern)

The AUD/JPY Pair, Price has been trading within a Channel Pattern on the M30 chart, forming consistent higher highs and higher lows. Price action is now testing the upper boundary of the Pattern, signalling a possible breakout.

✅Market Context:

1️⃣Strong Upward Structure Inside the Pattern.

2️⃣Buyers are showing strength near Resistance.

3️⃣Breakout above the Trendline indicates Momentum continuation toward higher zones.

✅Trade Plan:

Entry: Buy after Confirmed Breakout above the Resistance (H1 candle close above trendline or retest of the breakout).

💰Take Profit (TP): At the Key Zone – a Major Resistance area identified ahead.

🛑Stop Loss (SL): Below the Pattern Structure.

✅Psychological Discipline :

1️⃣Stick to plan – No Revenge Trades.

2️⃣Accept losing trades as Part of the Strategy.

3️⃣Risk only 1–2% of your account balance per trade.

💬 Support the community: If you found this useful, drop a 👍 like and share your thoughts in the comments!

⚠️ Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Forex trading involves high risk. Trade only with capital you can afford to lose and always do your own research.

AUDJPY Eyes a Rally Above 100.00 as Japan Likely Holds RatesHey Realistic Traders!

Falling Wedge Breakout & Looser Fiscal Policies, Could OANDA:AUDJPY exceed 100.000 level?

Current Market Sentiment

The yen slipped to a one-week low on Tuesday after hardline conservative Sanae Takaichi was elected as Japan’s new prime minister. Her expected push for looser fiscal policies and the potential for greater uncertainty over interest rates have added pressure on the currency. Therefore, we anticipate further yen weakness ahead.

Now, Let’s dive into the technical analysis to see what the chart is really telling us.

Technical Analysis

AUDJPY has moved above the EMA200 again and the bullish candlestick remains above the EMA200 level, indicating bullish trend. While the MACD golden cross added confirmation to the bullish bias. Together, these factors strengthen the case for continuation of the prevailing trend.

In this scenario, the first upside target lies at 100.774 , a level that coincides with historical resistance and where a short-term correction could take place. Should bullish momentum persist, AUDJPY has the potential to extend higher toward 102.098.

This bullish outlook will remain valid as long as price stays above 96.254. A move below that level would invalidate the setup and return the outlook to neutral.

Support the channel by engaging with the content, using the rocket button, and sharing your opinions in the comments below.

Disclaimer: "Please note that this analysis is solely for educational purposes and should not be considered a recommendation to take a long or short position on AUDJPY.

AUDJPY Overextended: Watching for a Corrective Pullback 📈 Taking a closer look at AUD/JPY, we can see that price is in a strong bullish trend, but currently overextended and trading into a major external range high — an area rich in liquidity 🏦. The market appears to be absorbing buy-side liquidity, signaling that a corrective phase may be approaching.

From a structural standpoint, I’m monitoring two overlapping concepts — a potential Three-Drive pattern 🌀 and a Five-Wave structure that may lead into an ABC correction. Both suggest that price could be preparing for a deeper retracement before the next bullish leg resumes.

At this stage, I’m not interested in buying at a premium 💸. Instead, I’ll wait for price to pull back, ideally into a discount zone, and then look for bullish structure confirmation to rejoin the trend. Patience here is key — let the market come to you. 🧘♂️

💬 Disclaimer: This analysis is for educational purposes only and not financial advice. Always trade responsibly and manage risk effectively.