AUDUSD Ready to Rally? Gold Correlation + 0.66700 Support!Hey Traders,

In today’s trading session, we are closely monitoring AUDUSD for a potential buying opportunity around the 0.66700 zone. AUDUSD remains in a well-established uptrend and is currently undergoing a healthy corrective pullback, approaching a key trendline confluence and the 0.66700 support-turned-resistance area, which may act as a strong demand zone for bullish continuation.

From a fundamental perspective, the Australian Dollar often benefits from its positive correlation with Gold. With Gold maintaining a constructive bullish tone, this relationship could provide additional upside support for AUDUSD, reinforcing the bullish technical outlook.

As always, wait for confirmation and manage risk responsibly.

Trade safe,

Joe.

AUDUSD

AUDUSD – A Tough Challenge for BuyersAUDUSD is moving into a zone where optimism is starting to become dangerous . After the recent rebound, the market shows no clear signs of fresh money stepping in , looking more like a brief “pause for breath” before another corrective move. As the broader macro backdrop continues to lean defensive, risk-sensitive currencies like the AUD are often the first to feel the pressure.

From a news perspective, even though the USD has shown occasional weakness, risk-off sentiment still dominates the market. Trade tensions and global uncertainty are pushing investors to limit exposure to the AUD, while the USD continues to hold its relative safe-haven role . As a result, AUDUSD lacks the momentum needed to sustain a strong short-term rally.

On the H4 chart, price is approaching the strong resistance zone at 0.6750–0.6760 and has started to slow down. Candlestick behavior suggests that buying pressure is no longer aggressive, while the Ichimoku cloud is acting as a natural price ceiling. Without a clear and decisive close above this zone, this move is more likely just a rebound for distribution.

The key scenario to watch is a rejection at resistance, followed by a pullback toward 0.6724, and potentially deeper to 0.6707. These are important support levels, and also areas where the market may attempt to rebalance if selling pressure continues to build.

AUDUSD CRACKING!After 15 years of AUD underperformance versus the USD, AUD/USD is approaching a potential long-term regime shift.

The U.S. faces bad politics, rising debt burdens, growing interest expense, fiscal instability, and diminishing returns from financial engineering, while economic growth remains increasingly policy-supported.

Australia enters this period with good politics, lower public debt, greater fiscal flexibility, a comparatively stable economy, and net commodity exports that generate real external income.

Australia runs ~45% debt-to-GDP; the U.S. runs ~120%+. One economy earns foreign income from production — the other increasingly borrows to sustain itself. Currencies eventually reflect that math.

That divergence creates the macro conditions for a structural repricing in AUD/USD.

After 15 years, Australia is in the sweet spot right now for a huge breakout. This is NOT some short-term trade. There is a lot of meat on that bone!

This is not POLITICAL! This is COUNTING!

#FAFO

If you enjoy the work:

👉 Drop a solid comment

Let’s push it to 6,000 and keep building a community grounded in raw truth, not hype.

Stop!Loss|Market View: AUDUSD🙌 Stop!Loss team welcomes you❗️

In this post, we're going to talk about the near-term outlook for the AUDUSD currency pair☝️

Potential trade setup:

🔔Entry level: 0.67910

💰TP: 0.67136

⛔️SL: 0.68449

"Market View" - a brief analysis of trading instruments, covering the most important aspects of the FOREX market.

👇 In the comments 👇 you can type the trading instrument you'd like to analyze, and we'll talk about it in our next posts.

💬 Description: As expected, pressure on the US dollar is easing by the end of the week, suggesting that the key buying priorities for the USD remain, especially in the medium term. For AUDUSD, in particular, a rebound from the upper boundary of the ascending channel is expected, with a target at the lower boundary. An additional target is seen near 0.66000.

Thanks for your support 🚀

Profits for all ✅

AUDUSD — FRGNT DAILY CHART FORECAST Q1 | D22 | W3 | Y26📅 Q1 | D22 | W3 | Y26

📊AUDUSD — FRGNT DAILY CHART FORECAST

🔍 Analysis Approach

I’m applying a developed version of Smart Money Concepts, with a structured focus on:

• Identifying Key Points of Interest (POIs) on Higher Time Frames (HTFs) 🕰️

• Using those POIs to define a clear and controlled trading range 📐

• Refining those zones on Lower Time Frames (LTFs) 🔎

• Waiting for a Break of Structure (BoS) as confirmation ✅

This process keeps me precise, disciplined, and aligned with market narrative, rather than reacting emotionally or chasing price.

💡 My Motto

“Capital management, discipline, and consistency in your trading edge.”

A positive risk-to-reward ratio, combined with a high-probability execution model, is the backbone of any sustainable trading plan 📈🔐

⚠️ On Losses

Losses are part of the mathematical reality of trading 🎲

They don’t define you — they are necessary, expected, and managed.

We acknowledge them, learn, and move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Further context and supporting material can be found in the Links section.

Stay sharp 🧠

Stay consistent 🎯

Protect your capital 🔐

— FRGNT 🚀📈

FX:AUDUSD

AUD/USD Made Clear Reversal Pattern,Long Setup To Get 150 Pips !Here is my 4H Chart On AUD/USD , The price creating a very clear reversal pattern ( Inverted Head & Shoulders ) and the price made a very good bullish price action now And the price confirmed the pattern by closing above the neckline. so we can enter a buy trade when the price go back to retest the broken neckline to can use a small stop loss ,or we can enter directly now cuz we have a very good bullish candle confirmed the pattern , and we can targeting from 50 to 100 pips with a decent stop loss .

Reasons To Enter :

1- Perfect Touch For The Area .

2- Clear Bullish Price Action .

3- Bigger T.F Giving Good Bullish P.A .

4- Clear Reversal Pattern .

5- Pattern Confirmed .

AUDUSD Trend continuation pattern supported at 0.6637The AUDUSD remains in a bullish trend, with recent price action showing signs of a breakout within the broader uptrend.

Support Zone: 0.6637 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 0.6637 would confirm ongoing upside momentum, with potential targets at:

0.6756 – initial resistance

0.6780 – psychological and structural level

0.6800 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 0.6637 would weaken the bullish outlook and suggest deeper downside risk toward:

0.6620 – minor support

0.6600 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the AUDUSD holds above 0.6637 A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

AUD/USD SHORT FROM RESISTANCE

AUD/USD SIGNAL

Trade Direction: short

Entry Level: 0.680

Target Level: 0.677

Stop Loss: 0.682

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

USDJPY and AUDUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

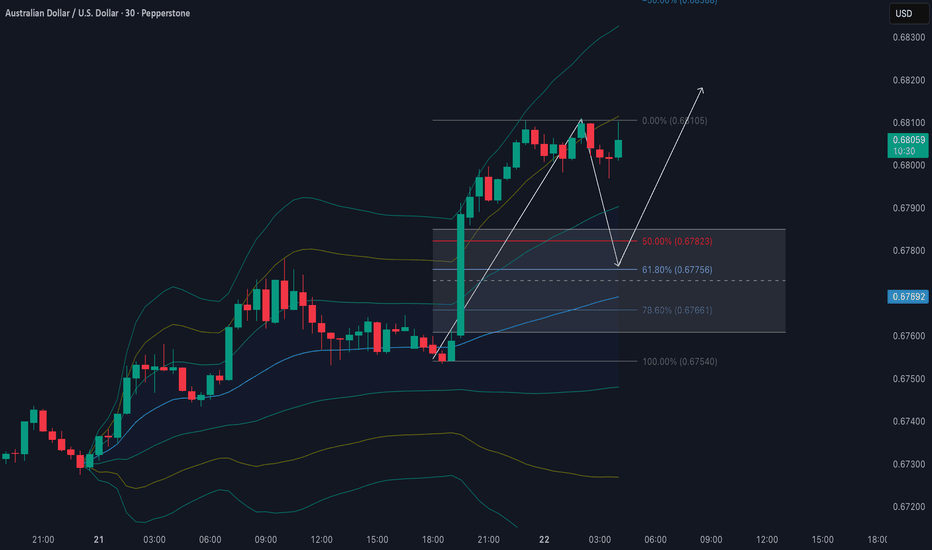

AUDUSD Outlook | Uptrend Holds as Gold Supports AUD!Hey Traders,

In today’s trading session, we are closely monitoring AUDUSD for a potential buying opportunity around the 0.67600 zone. AUDUSD remains in a well-established uptrend and is currently undergoing a healthy corrective pullback, approaching a key trendline confluence and the 0.67600 support-turned-resistance area, which may act as a strong demand zone for bullish continuation.

From a fundamental perspective, the Australian Dollar often benefits from its positive correlation with Gold. With Gold maintaining a strong bullish bias, this relationship could provide additional upside support for AUDUSD, reinforcing the bullish technical outlook.

As always, wait for confirmation and manage risk responsibly.

Trade safe,

Joe.

AUDUSD Technical Analysis and Trade IdeaHi all. My bias remains bullish on the AUDUSD 🐂, but patience is the name of the game today. Fundamentally, the Aussie is ripping on the back of that monster jobs print (unemployment down to 4.1%!), which has traders aggressively pricing in an RBA hike for February. Combine that with the "Tariff Truce" relief rally crushing the USD, and we have a perfect storm for upside 🌪️. Technically, the 4H structure is flagging beautifully at the highs, but we need to be smart about our entry.

I am not chasing price at the highs 🚫 — I want to see the market flush the weak hands down to our discount zone. We are looking for an optimal entry around 0.6765 – 0.6785 to catch the next leg up. This trade is invalidated if we lose the 0.6715 structural pivot 🛑.

If the trade sets up, aim for a 5R return to start 🎯. Look to close partial profits (50%) at 1R 💰, then let the rest run using our indicator alerts for dynamic exits if the trend resumes. Patience pays on this one, let the setup come to us. ⏳

AUD/USD Demand Zone Holding as Bulls Regain Control📈 AUD/USD “THE AUSSIE” Signal — Swing & Day Trade Guide 🇦🇺💵

Bullish Bias — Multi-Layered Entry Thief Strategy 🎯📊

🔔 Current live rate: ~0.6680–0.6700 (major FX session volatility)

📌 Trade Plan — Bullish Thief Layers

We’re positioning for Aussie strength vs USD as risk sentiment improves and macro data evolves.

💡 Layered Buy Entries (Thief Method):

➡️ 0.66800

➡️ 0.66900

➡️ 0.67000

➡️ 0.67200

(Add more buy limit layers based on your risk tolerance & market structure)

📊 Thief Strategy = Multiple limit buys to build position slowly, reducing average entry.

🎯 Targets & Structure

📍 Primary Target: 🎯 0.68300 — Strong resistance zone + possible overbought trap exit.

📍 Let price validate upside momentum & lock profits if premium levels reject.

⚠️ Stop Loss (Thief SL): 🛑 0.66600

(Close below key support = invalidation zone)

📌 Take Profit & Stop Loss decisions remain your responsibility. Manage risk per your risk profile.

🌐 Fundamentals & Macro Drivers 📊

Bullish drivers for AUD/USD:

✔️ AUD/USD has rallied ~5% since late 2025 due to improving China data & commodity support.

✔️ RBA vs Fed rate dynamics — RBA possibly more hawkish/sticky while Fed easing slows.

✔️ Aussie behaves like a risk-linked & commodity currency — iron ore, coal & gold flows matter.

✔️ IMF warns prolonged above-target inflation for Australia (affects interest expectations).

🗓️ Key Real-Time Economic Events to Watch (London time basis):

• RBA Rate Decision & statement

• Australian CPI / employment figures

• US Nonfarm Payrolls & Unemployment claims

• US CPI & Retail Sales

Use global Economic Calendar for live impacts.

🔁 Correlated Pairs to Watch 🧠

These help confirm bias and manage risk:

📌 GBP/USD & EUR/USD — Often move with USD strength/weakness

📌 USD/JPY — Inverse USD risk signal

📌 Gold (XAU/USD) — Positive correlation with AUD/USD on risk sentiment / commodity flows

📌 AUD/JPY & NZD/USD — Commodity/carry-linked peers

💡 When USD weakens broad-based, AUD/USD tends to benefit.

🛠 Technical Structure & Indicators

Indicators adding conviction:

📌 Price above key moving averages

📌 RSI approaching bullish momentum

📌 Higher lows structure forming

A break above intermediate resistance ~0.6760 would accelerate bullish odds.

💬 Trade Notes & Community Buzz

👍 This setup blends technical precision + fundamental context, crafted for engagement & clarity.

👥 Traders tracking commodities, risk appetite and central bank tilts will find this useful.

Stop!Loss|Market View: NZDUSD🙌 Stop!Loss team welcomes you❗️

In this post, we're going to talk about the near-term outlook for the NZDUSD currency pair☝️

Potential trade setup:

🔔Entry level: 0.58563

💰TP: 0.59196

⛔️SL: 0.58157

"Market View" - a brief analysis of trading instruments, covering the most important aspects of the FOREX market.

👇 In the comments 👇 you can type the trading instrument you'd like to analyze, and we'll talk about it in our next posts.

💬 Description: The price has aggressively approached the resistance area near 0.58500, suggesting a rebound, as it did last time. However, if buyers continue to hold the price near this resistance, we can expect further growth towards 0.59000 - 0.59500. If this doesn't happen, we'll likely see a downward movement towards the support area at 0.57440 in the near future.

Thanks for your support 🚀

Profits for all ✅

AUDUSD(20260121)Today's AnalysisMarket News:

The Polish central bank has approved a plan to purchase 150 tons of gold, increasing its gold reserves to 700 tons.

Technical Analysis:

Today's Buy/Sell Threshold:

0.6728

Support and Resistance Levels:

0.6769

0.6754

0.6744

0.6712

0.6703

0.6687

Trading Strategy:

Consider buying if the price breaks above 0.6744, with a first target price of 0.6754.

Consider selling if the price breaks below 0.6728, with a first target price of 0.6712.

AUDUSD: Will Keep Falling! Here is Why:

Balance of buyers and sellers on the AUDUSD pair, that is best felt when all the timeframes are analyzed properly is shifting in favor of the sellers, therefore is it only natural that we go short on the pair.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

AUD/USD Testing Key Fibonacci Resistance Amid Bullish MomentumThe daily chart of AUD/USD shows price action approaching a critical resistance zone near 0.6744, which aligns closely with the 78.6% Fibonacci retracement level at 0.6730. This level has acted as a ceiling in recent sessions, and the latest candle suggests renewed buying pressure as price attempts to break above it.

Key Technical Observations:

Moving Averages:

The 50-day SMA (blue) at 0.6618 and the 200-day SMA (red) at 0.6533 are both trending upward, signaling a medium- to long-term bullish bias. The price remains well above both averages, reinforcing the strength of the current uptrend.

Momentum Indicators:

MACD: The MACD line is slightly above the signal line, indicating positive momentum, though the histogram shows modest strength. A sustained expansion could confirm bullish continuation.

RSI: Currently at 63, the RSI is in bullish territory but not yet overbought, leaving room for further upside before hitting extreme levels.

Price Structure:

The pair has been forming higher highs and higher lows since mid-November, suggesting a well-established uptrend. A decisive close above 0.6744 could open the door for further gains, while failure to break this level may lead to consolidation or a pullback toward the 50-day SMA.

Summary:

AUD/USD is testing a significant resistance zone with bullish technical signals supported by rising moving averages and positive momentum. Traders should watch for confirmation of a breakout or signs of rejection at this level.

-MW

Time To Buy AUDUSD nowAUDUSD was in a recent downtrend for the last few weeks and struggled to stay bullish, but recently it has just broken a strong resistance trend line which it tested several times and failed to break through. AUDUSD is very likely to hit the next major resistance zone which is market as the "TAKE PROFIT" LEVEL. There are many clear signs of new bullish movements. TIME TO BUY AUDUSD now

NZDUSD: rejection at 0.5860🛠 Technical Analysis: Price has rallied into a key resistance/supply zone around 0.5850–0.5860, where sellers are attempting to defend the level. The latest push looks stretched after the impulse leg, and the “local/global bearish” signals on the chart suggest a corrective pullback may develop. A breakdown below the rising support line (and the nearby MA-cluster) would add confirmation for continuation lower toward the next demand area. Nearest downside objectives sit around 0.5739 first, then deeper support levels if momentum accelerates.

———————————————

❗️ Trade Parameters (SELL)

———————————————

➡️ Entry Point: 0.58385

🎯 Take Profit: 0.57392

🔴 Stop Loss: 0.59042

⚠️ Disclaimer: This is a potential trade idea based on current analysis; market conditions and price direction are subject to change based on news factors and volatility.

AUDUSD REVERSAL INCOMINGGeopolitical risks, Elections and Tariffs determined price action on the AUDUSD. While we are bearish on the long term, the AUDUSD has been in corrective state for since April 2025. Presently, AUDUSD is seeking to clear market imbalance that could signal a reversal is in the medium term. Once price clears the Fair Value Gap at 0.68, we will look for sell opportunities.

AUDUSD H4 | Bullish Continuation Off Pullback supportMomentum: Bullish

Price is currently above the ichimoku cloud.

Buy entry: 0.67168

- Pullback support

- 38.2% Fib retracement

- 78.6% Fib projection

- Fair value gap

Stop Loss: 0.66962

- Pullback support

Take Profit: 0.67526

- Swing high resistance

High Risk Investment Warning

Stratos Markets Limited (fxcm.com/uk), Stratos Europe Ltd (fxcm.com/eu):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (fxcm.com/en): Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

Stratos Trading Pty. Limited (fxcm.com/au):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at fxcm.com/au

Stop!Loss|Market View: GOLD🙌 Stop!Loss team welcomes you❗️

In this post, we're going to talk about the near-term outlook for GOLD ☝️

Potential trade setup:

🔔Entry level: 4623.726

💰TP: 4527.035

⛔️SL: 4712.744

"Market View" - a brief analysis of trading instruments, covering the most important aspects of the FOREX market.

👇 In the comments 👇 you can type the trading instrument you'd like to analyze, and we'll talk about it in our next posts.

💬 Description: Short-term additional strengthening of metals is expected until mid-week, with a likely correction expected closer to the end of today, but only if the price approaches the last open gap. Only in this situation should selling be considered, with a target of 4500. However, 4400 and 4200 are also considered as additional targets.

Thanks for your support 🚀

Profits for all ✅

AUDUSD bullish M Chart, appears to have completed its 'test'.I have been long on this trade for maybe 2 weeks, there existed a H & S's pattern on the high time frames a couple of years ago, well now its playing out.

To trade this I would look at main charts Monthly where the 50 EMA is turning up now, look for support and resistance levels on W,D,4HR,2HR charts and take the trade Long from the Hourly might be best.

Look for an indicator like the True Strength Index to confirm your setup, in price action or whatever it is you look for.

TSI is a lot like MACd I find but more precision, it will show the long term bias/direction but its very slow on the VHT. For eg. it will display on a Monthly chart for example, that the bullish move is set to continue, but dont get caught, because price will still dip lower in the interim following Stochastics and RSI which move more natual with price on the lopwer time frames.

MACd and TSI are the high time frame compos and the wonderful thing with True Strength Index, if you drop to a intraday T-frame it will perform very accurately with the same settings that its configured.

Long trades: it should strike through the zero line with its upward angled curve and ideally a curl up on the signal line just above the zero line. RSI can confirm with a upwards strike recently or concurrently at the 50 line. Which is its zero line.

AUDUSD FREE SIGNAL|SHORT|

✅AUDUSD Price taps into a clear premium supply zone after a corrective push, showing rejection and loss of bullish momentum. With liquidity taken above highs, ICT bias favors bearish continuation toward discounted liquidity below.

———————————

Entry: 0.6716

Stop Loss: 0.6728

Take Profit: 0.6700

Time Frame: 3H

———————————

SHORT🔥

✅Like and subscribe to never miss a new idea!✅