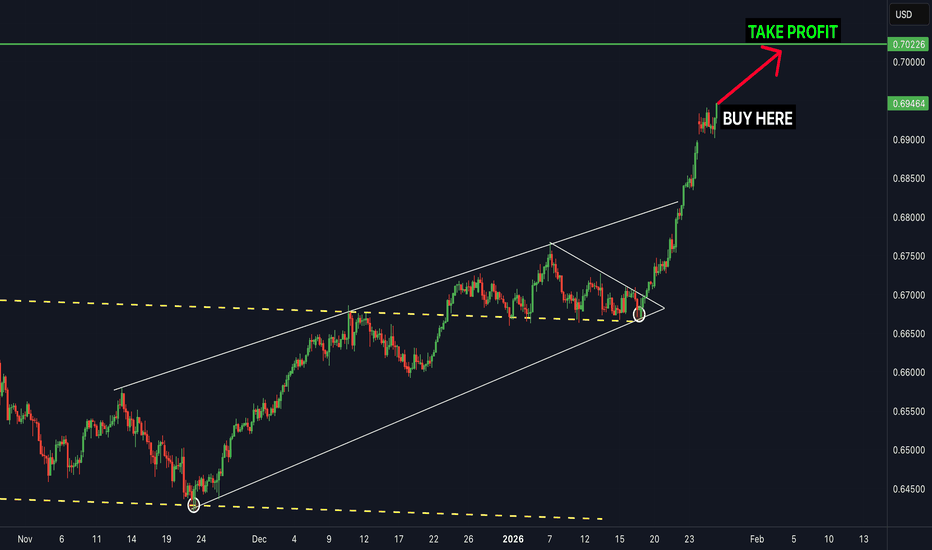

Buy AUDUSD nowAUDUSD was in a recent downtrend for the last few weeks and struggled to stay bullish, but recently it has just broken a strong resistance trend line which it tested several times and failed to break through. AUDUSD is very likely to hit the next major resistance zone which is market as the "TAKE PROFIT" LEVEL. There are many clear signs of new bullish movements. BUY AUDUSD now

Audusdforecast

AUDUSD — FRGNT DAILY CHART FORECAST. Q1 | W4 | D26| Y26📅 Q1 | W4 | D26| Y26

📊 AUDUSD — FRGNT DAILY CHART FORECAST

🔍 Analysis Approach

I’m applying a developed version of Smart Money Concepts, with a structured focus on:

• Identifying Key Points of Interest (POIs) on Higher Time Frames (HTFs) 🕰️

• Using those POIs to define a clear and controlled trading range 📐

• Refining those zones on Lower Time Frames (LTFs) 🔎

• Waiting for a Break of Structure (BoS) as confirmation ✅

This process keeps me precise, disciplined, and aligned with market narrative, rather than reacting emotionally or chasing price.

💡 My Motto

“Capital management, discipline, and consistency in your trading edge.”

A positive risk-to-reward ratio, combined with a high-probability execution model, is the backbone of any sustainable trading plan 📈🔐

⚠️ On Losses

Losses are part of the mathematical reality of trading 🎲

They don’t define you — they are necessary, expected, and managed.

We acknowledge them, learn, and move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Further context and supporting material can be found in the Links section.

Stay sharp 🧠

Stay consistent 🎯

Protect your capital 🔐

— FRGNT 🚀📈

FX:AUDUSD

AUDUSD — FRGNT FUN COUPON FRIDAY Q1 | D23 | W3 | Y26📅 Q1 | D23 | W3 | Y26

📊 AUDUSD — FRGNT FUN COUPON FRIDAY DAILY CHART FORECAST

🔍 Analysis Approach

I’m applying a developed version of Smart Money Concepts, with a structured focus on:

• Identifying Key Points of Interest (POIs) on Higher Time Frames (HTFs) 🕰️

• Using those POIs to define a clear and controlled trading range 📐

• Refining those zones on Lower Time Frames (LTFs) 🔎

• Waiting for a Break of Structure (BoS) as confirmation ✅

This process keeps me precise, disciplined, and aligned with market narrative, rather than reacting emotionally or chasing price.

💡 My Motto

“Capital management, discipline, and consistency in your trading edge.”

A positive risk-to-reward ratio, combined with a high-probability execution model, is the backbone of any sustainable trading plan 📈🔐

⚠️ On Losses

Losses are part of the mathematical reality of trading 🎲

They don’t define you — they are necessary, expected, and managed.

We acknowledge them, learn, and move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Further context and supporting material can be found in the Links section.

Stay sharp 🧠

Stay consistent 🎯

Protect your capital 🔐

— FRGNT 🚀📈

FX:AUDUSD

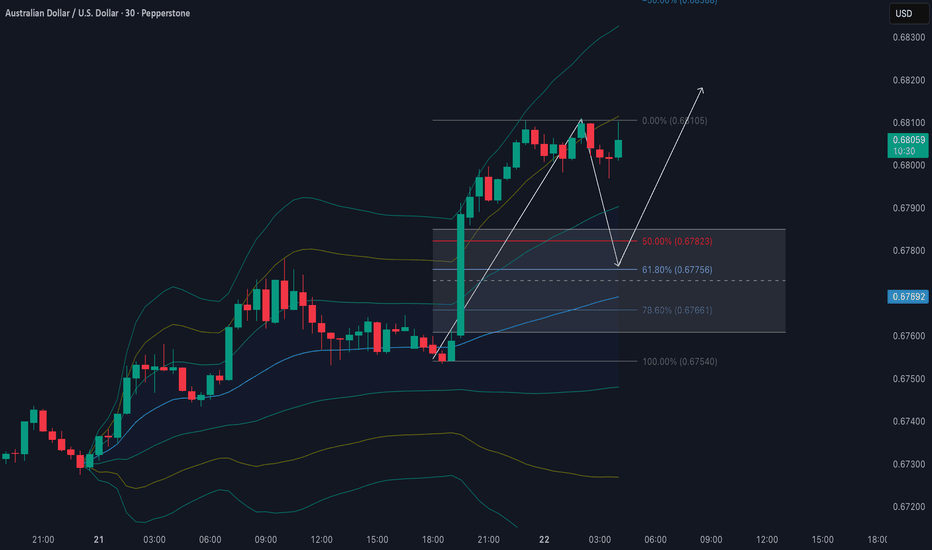

AUDUSD Technical Analysis and Trade IdeaHi all. My bias remains bullish on the AUDUSD 🐂, but patience is the name of the game today. Fundamentally, the Aussie is ripping on the back of that monster jobs print (unemployment down to 4.1%!), which has traders aggressively pricing in an RBA hike for February. Combine that with the "Tariff Truce" relief rally crushing the USD, and we have a perfect storm for upside 🌪️. Technically, the 4H structure is flagging beautifully at the highs, but we need to be smart about our entry.

I am not chasing price at the highs 🚫 — I want to see the market flush the weak hands down to our discount zone. We are looking for an optimal entry around 0.6765 – 0.6785 to catch the next leg up. This trade is invalidated if we lose the 0.6715 structural pivot 🛑.

If the trade sets up, aim for a 5R return to start 🎯. Look to close partial profits (50%) at 1R 💰, then let the rest run using our indicator alerts for dynamic exits if the trend resumes. Patience pays on this one, let the setup come to us. ⏳

AUDUSD — FRGNT DAILY CHART FORECAST Q1 | D22 | W3 | Y26📅 Q1 | D22 | W3 | Y26

📊AUDUSD — FRGNT DAILY CHART FORECAST

🔍 Analysis Approach

I’m applying a developed version of Smart Money Concepts, with a structured focus on:

• Identifying Key Points of Interest (POIs) on Higher Time Frames (HTFs) 🕰️

• Using those POIs to define a clear and controlled trading range 📐

• Refining those zones on Lower Time Frames (LTFs) 🔎

• Waiting for a Break of Structure (BoS) as confirmation ✅

This process keeps me precise, disciplined, and aligned with market narrative, rather than reacting emotionally or chasing price.

💡 My Motto

“Capital management, discipline, and consistency in your trading edge.”

A positive risk-to-reward ratio, combined with a high-probability execution model, is the backbone of any sustainable trading plan 📈🔐

⚠️ On Losses

Losses are part of the mathematical reality of trading 🎲

They don’t define you — they are necessary, expected, and managed.

We acknowledge them, learn, and move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Further context and supporting material can be found in the Links section.

Stay sharp 🧠

Stay consistent 🎯

Protect your capital 🔐

— FRGNT 🚀📈

FX:AUDUSD

AUDUSD(20260121)Today's AnalysisMarket News:

The Polish central bank has approved a plan to purchase 150 tons of gold, increasing its gold reserves to 700 tons.

Technical Analysis:

Today's Buy/Sell Threshold:

0.6728

Support and Resistance Levels:

0.6769

0.6754

0.6744

0.6712

0.6703

0.6687

Trading Strategy:

Consider buying if the price breaks above 0.6744, with a first target price of 0.6754.

Consider selling if the price breaks below 0.6728, with a first target price of 0.6712.

AUDUSD REVERSAL INCOMINGGeopolitical risks, Elections and Tariffs determined price action on the AUDUSD. While we are bearish on the long term, the AUDUSD has been in corrective state for since April 2025. Presently, AUDUSD is seeking to clear market imbalance that could signal a reversal is in the medium term. Once price clears the Fair Value Gap at 0.68, we will look for sell opportunities.

Time To Buy AUDUSD nowAUDUSD was in a recent downtrend for the last few weeks and struggled to stay bullish, but recently it has just broken a strong resistance trend line which it tested several times and failed to break through. AUDUSD is very likely to hit the next major resistance zone which is market as the "TAKE PROFIT" LEVEL. There are many clear signs of new bullish movements. TIME TO BUY AUDUSD now

AUDUSD — FRGNT DAILY CHART FORECAST Q1 | D20 | W3 | Y26📅 Q1 | D20 | W3 | Y26

📊AUDUSD — FRGNT DAILY CHART FORECAST

🔍 Analysis Approach

I’m applying a developed version of Smart Money Concepts, with a structured focus on:

• Identifying Key Points of Interest (POIs) on Higher Time Frames (HTFs) 🕰️

• Using those POIs to define a clear and controlled trading range 📐

• Refining those zones on Lower Time Frames (LTFs) 🔎

• Waiting for a Break of Structure (BoS) as confirmation ✅

This process keeps me precise, disciplined, and aligned with market narrative, rather than reacting emotionally or chasing price.

💡 My Motto

“Capital management, discipline, and consistency in your trading edge.”

A positive risk-to-reward ratio, combined with a high-probability execution model, is the backbone of any sustainable trading plan 📈🔐

⚠️ On Losses

Losses are part of the mathematical reality of trading 🎲

They don’t define you — they are necessary, expected, and managed.

We acknowledge them, learn, and move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Further context and supporting material can be found in the Links section.

Stay sharp 🧠

Stay consistent 🎯

Protect your capital 🔐

— FRGNT 🚀📈

FX:AUDUSD

AUDUSD(20260119)Today's AnalysisMarket News:

President Trump vowed last Saturday to impose a series of escalating tariffs on EU member states Denmark, Sweden, France, Germany, the Netherlands, and Finland, as well as the UK and Norway, until the US is authorized to purchase Greenland. On March 17th, Trump announced on social media that a 10% tariff would be imposed on goods imported from Denmark, Norway, Sweden, France, Germany, the UK, the Netherlands, and Finland starting February 1st, and declared that the tariff rate would increase to 25% from June 1st, until the parties reach an agreement on the US's "full and complete purchase of Greenland."

Technical Analysis:

Today's Buy/Sell Threshold:

0.6687

Support and Resistance Levels:

0.6725

0.6711

0.6702

0.6672

0.6663

0.6649

Trading Strategy:

If the price breaks above 0.6687, consider buying with a first target price of 0.6711.

If the price breaks below 0.6663, consider selling with a first target price of 0.6649.

AUDUSD — FRGNT WEEKLY CHART FORECAST Q1 | W3 | Y26📅 Q1 | W3 | Y26

📊 AUDUSD — FRGNT WEEKLY CHART FORECAST

🔍 Analysis Approach

I’m applying a developed version of Smart Money Concepts, with a structured focus on:

• Identifying Key Points of Interest (POIs) on Higher Time Frames (HTFs) 🕰️

• Using those POIs to define a clear and controlled trading range 📐

• Refining those zones on Lower Time Frames (LTFs) 🔎

• Waiting for a Break of Structure (BoS) as confirmation ✅

This process keeps me precise, disciplined, and aligned with market narrative, rather than reacting emotionally or chasing price.

💡 My Motto

“Capital management, discipline, and consistency in your trading edge.”

A positive risk-to-reward ratio, combined with a high-probability execution model, is the backbone of any sustainable trading plan 📈🔐

⚠️ On Losses

Losses are part of the mathematical reality of trading 🎲

They don’t define you — they are necessary, expected, and managed.

We acknowledge them, learn, and move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Further context and supporting material can be found in the Links section.

Stay sharp 🧠

Stay consistent 🎯

Protect your capital 🔐

— FRGNT 🚀📈

FX:AUDUSD

AUDUSD(20260115)Today's AnalysisMarket News:

Daniel Casali, investment strategy partner at UK wealth management firm Evelyn Partners, said on Tuesday that his team is optimistic about both gold and silver. He pointed out that the uncertainty caused by events such as the outbreak of the Russia-Ukraine conflict in 2022 and US President Trump's announcement of so-called "Liberation Day" tariffs last April continues to support gold prices. As major world powers continue to diversify their trade war tactics, Casali stated that an atmosphere of "resource nationalism" is forming, continuously driving the precious metals market higher. In the first week of 2026, the US forcibly took control of Venezuelan strongman Maduro, while the White House hinted at possible military action to control Greenland. These actions exacerbated political risks and further strengthened the uncertainty supporting rising precious metal prices. Casali stated, "The current geopolitical game is complex, but the core conclusion is that resource nationalism will drive up gold and silver prices."

Technical Analysis:

Today's Buy/Sell Threshold:

0.6684

Support and Resistance Levels:

0.6713

0.6702

0.6695

0.6673

0.6666

0.6655

Trading Strategy:

If the price breaks above 0.6684, consider buying, with a first target price of 0.6702.

If the price breaks below 0.6673, consider selling, with a first target price of 0.6655.

AUDUSD: Big Rejection From W -FVG! Time To Sell?Welcome back to the Weekly Forex Forecast for the week of Jan 12 - 16th.

In this video, we will analyze the following FX market: AUDUSD

AUDUSD had a big rejection from the W -FVG, leaving a huge wick behind. If the market continues to trade below the 50% of that wick, which is inside a Quarterly -OB, we can start to look for sell setups on the LTFs.

A Daily close below 0.6684 would be confirmation to me to begin looking for sell setups in this market.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

AUDUSD — FRGNT DAILY CHART FORECAST Q1 | D13 | W2 | Y26📅 Q1 | D13 | W2 | Y26

📊 AUDUSD — FRGNT DAILY CHART FORECAST

🔍 Analysis Approach

I’m applying a developed version of Smart Money Concepts, with a structured focus on:

• Identifying Key Points of Interest (POIs) on Higher Time Frames (HTFs) 🕰️

• Using those POIs to define a clear and controlled trading range 📐

• Refining those zones on Lower Time Frames (LTFs) 🔎

• Waiting for a Break of Structure (BoS) as confirmation ✅

This process keeps me precise, disciplined, and aligned with market narrative, rather than reacting emotionally or chasing price.

💡 My Motto

“Capital management, discipline, and consistency in your trading edge.”

A positive risk-to-reward ratio, combined with a high-probability execution model, is the backbone of any sustainable trading plan 📈🔐

⚠️ On Losses

Losses are part of the mathematical reality of trading 🎲

They don’t define you — they are necessary, expected, and managed.

We acknowledge them, learn, and move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Further context and supporting material can be found in the Links section.

Stay sharp 🧠

Stay consistent 🎯

Protect your capital 🔐

— FRGNT 🚀📈

FX:AUDUSD

#AUDUSD: Accumulated Completed Now Time For DistributionThe AUD/USD currency pair has been quite active lately. It has moved from a period of buying to an early selling phase. This analysis looks at the market, how prices are moving, technical tools and what might happen when trading, keeping an eye on how to manage risk.

1. Market Overview

The Australian Dollar (AUD) has become stronger against the US Dollar (USD). After a long period of little change, the price action seems to be changing. The bulls are still in charge, with a target swing at 0.7050, which could be a 400-pip move from where they were accumulating.

In terms of the economy, AUD’s strength is supported by stable commodity prices and a positive outlook for Australia. The USD is feeling a bit uncertain because people are speculating about what the Federal Reserve will do next and how much risk people are willing to take around the world.

Price Action Structure:

Accumulation Phase:

The pair stayed around the 0.6650 – 0.6750 range, which showed that big investors were buying. This usually happens before a big move, which we saw on both daily and H4 charts.

Breakout and Shift to Distribution:

Recently, the price broke above the main resistance near 0.6800, which means it is going up. This confirms that the accumulation phase was right and that the market is set up for buyers. The next step is to move into the distribution phase, where prices are aiming for higher targets and testing the upper resistance zones before any possible reversal.

Swing Targets:

The main focus is on 0.7050, a spot where the price has reacted quite strongly before. For smaller gains, we have intermediate targets at 0.6920 and 0.6990. This move could be worth about 400 pips, which is a good chance for traders who are careful.

Fibonacci Retracement Levels:

A Fibonacci projection hints at possible targets around 0.6990 (which is a 1.618 extension) and 0.7050 (which is a 2.0 extension), which helps us stick to our price targets.

- First target: 0.6920 (this is where resistance is)

- Second target: 0.6990 (this is where Fibonacci levels meet)

- Final swing target: 0.7050 (this is a big supply zone)

The way people feel about the market can help us decide when to buy or sell. Smart money got in during the time when prices were building up, but they weren’t sure what to do. When the price broke out, it showed that more people were feeling bullish, and retail traders were joining in. The last part of the move towards 0.7050 will probably get more momentum traders before the price goes into a new pattern and might reverse.

Things like how well commodities are doing and what people expect the US interest rate to be will affect the pair. If people suddenly change their minds about risk, the price could get really volatile, so it’s important to keep an eye on news.

The AUD/USD pair has moved from a time when prices were building up to a bullish breakout, which means we might see a 400-pip move with a main target at 0.7050. The intermediate targets at 0.6920 and 0.6990 are good places to think about taking some profits. Looking at things like moving averages, RSI and Fibonacci levels, we can see that this is a good time to be bullish.

Traders should be careful with their risk, avoid using too much leverage and stay alert to important economic events that could change the price. By sticking to a plan and being disciplined, they can make the most of this good situation in the forex market.

Team Setupsfx_

Buy AUDUSD nowAUDUSD was in a recent downtrend for the last few weeks and struggled to stay bullish, but recently it has just broken a strong resistance trend line which it tested several times and failed to break through. AUDUSD is very likely to hit the next major resistance zone which is market as the "TAKE PROFIT" LEVEL. There are many clear signs of new bullish movements. BUY AUDUSD now

Week of 1/11/26: AUDUSD AnalysisPrice has pushed to the extreme swing structure of the 4h and daily chart. 1h structure is bearish, so we are not exactly bullish yet until 1h switches bullish. We're going to wait until price makes its move to the upside or downside for a market structure shift.

Major News:

Tues - CPI

Wed - PPI

AUDUSD(20260108)Today's AnalysisMarket News:

U.S. Energy Secretary Chris Wright stated that the Trump administration plans to take over Venezuela's future oil sales and use the proceeds to rebuild the country's economy.

"If we control where the oil flows and the cash flow generated from those sales, we will have tremendous leverage," Wright said Wednesday at the Goldman Sachs Energy, Clean Technology, and Utilities conference in Miami. "We need that leverage and control over oil sales to drive the necessary changes in Venezuela." Wright anticipates that Venezuela's daily crude oil production could increase by hundreds of thousands of barrels in the short to medium term. The U.S. government plans to deposit the proceeds into government accounts to benefit the Venezuelan people.

Technical Analysis:

Today's Buy/Sell Threshold:

0.6733

Support and Resistance Levels:

0.6783

0.6764

0.6752

0.6714

0.6703

0.6684

Trading Strategy:

If the price breaks above 0.6733, consider buying with a first target price of 0.6752.

If the price breaks below 0.6714, consider selling with a first target price of 0.6703.

AUDUSD📊 OANDA:AUDUSD Technical Analysis (4H Timeframe)

The overall trend for AUD/USD is strongly bullish, as evidenced by the consistent formation of higher highs and higher lows 📈. The price is currently trading comfortably above the EMA 200 (black line), which shows a clear upward slope, confirming long-term buyer control. The EMA 50 (red line) is also trending upwards and providing immediate dynamic support, highlighting robust bullish momentum. Looking at the candle bodies, we see significant strength in the recent impulsive moves. Currently, the price is testing a major resistance zone near 0.67550 USD. A clean break and hold above this grey box would confirm the continuation of the trend toward the next structural targets 🚀.

🔑 Key Levels to Watch:

Primary Resistance Target: 0.68190 USD (Top Grey Box) 🚩

Immediate Resistance: 0.67550 USD (Current Grey Box) 💡

Dynamic Support 1: 0.66850 USD (EMA 50 / Broken Resistance) 🎯

Dynamic Support 2: 0.66330 USD (EMA 200 / Grey Box) ⚡

Structural Support: 0.66000 USD & 0.65700 USD (Dashed Lines) 🛡️

Major Demand Zone: 0.64270 USD (Origin Grey Box) 🏗️

Time to BUY AUDUSD... AUDUSD was in a recent downtrend for the last few weeks and struggled to stay bullish, but recently it has just broken a strong resistance trend line which it tested several times and failed to break through. AUDUSD is very likely to hit the next major resistance zone which is market as the "TAKE PROFIT" LEVEL. There are many clear signs of new bullish movements. BUY AUDUSD now - buy AUDUSD now.

Week of 1/14/26: AUDUSDThis week price is continuing to correct in the 4h where we have finally reached a daily POI level where the 4h could finish correcting. We will follow the 1h trend where internal structure is bullish at the moment. If 1h internal structure breaks 1h external structure bullish, it will further make our case of bullish price action to an eventual new 4h high. If it breaks bearish, then we can expect the 4h to continue in the correction phase.

Major News:

Mon - PMI

Tues - CPI

Wed - ADP NFP, PMI, JOLTS

Thu - Unemployment

Fri - Hourly Earnings, NFP, Unemployment Rate, UoM