AUDUSD📊 OANDA:AUDUSD Technical Analysis (4H Timeframe)

The overall trend for AUD/USD is strongly bullish, as evidenced by the consistent formation of higher highs and higher lows 📈. The price is currently trading comfortably above the EMA 200 (black line), which shows a clear upward slope, confirming long-term buyer control. The EMA 50 (red line) is also trending upwards and providing immediate dynamic support, highlighting robust bullish momentum. Looking at the candle bodies, we see significant strength in the recent impulsive moves. Currently, the price is testing a major resistance zone near 0.67550 USD. A clean break and hold above this grey box would confirm the continuation of the trend toward the next structural targets 🚀.

🔑 Key Levels to Watch:

Primary Resistance Target: 0.68190 USD (Top Grey Box) 🚩

Immediate Resistance: 0.67550 USD (Current Grey Box) 💡

Dynamic Support 1: 0.66850 USD (EMA 50 / Broken Resistance) 🎯

Dynamic Support 2: 0.66330 USD (EMA 200 / Grey Box) ⚡

Structural Support: 0.66000 USD & 0.65700 USD (Dashed Lines) 🛡️

Major Demand Zone: 0.64270 USD (Origin Grey Box) 🏗️

Audusdsell

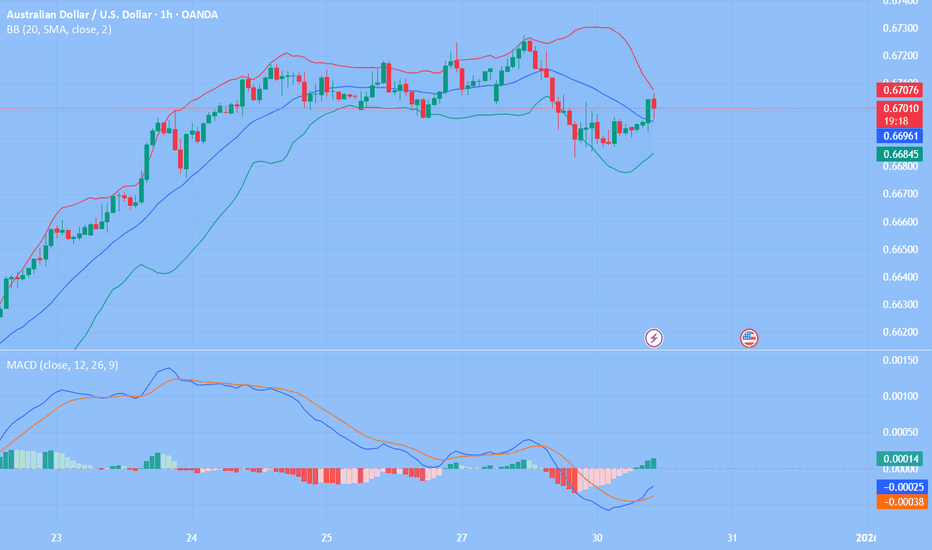

AUDUSD(20251230)Today's AnalysisMarket News:

Last week, Trump posted a lengthy statement on social media, which he called the "Trump Rule." He stated that the Federal Reserve, led by his soon-to-be-nominated new chairman, should lower interest rates to help keep the stock market and economy thriving, even at the risk of stimulating inflation. Trump posted, "I expect my new Fed chair to lower interest rates when the markets are doing well, not to destroy them without reason."

Technical Analysis:

Today's Buy/Sell Threshold:

0.6700

Support and Resistance Levels:

0.6744

0.6727

0.6717

0.6683

0.6672

0.6656

Trading Strategy:

If the price breaks above 0.6700, consider buying, with a first target price of 0.6717.

If the price breaks below 0.6683, consider selling, with a first target price of 0.6656.

AUDUSD SELL | Idea Trading AnalysisAUDUSD is moving on Resistance zone..

The chart is above the support level, which has already become a reversal point twice.

We expect a decline in the channel after testing the current level.

We expect a decline in the channel after testing the current level

Hello Traders, here is the full analysis.

I think we can soon see more fall from this range! GOOD LUCK! Great SELL opportunity AUDUSD

I still did my best and this is the most likely count for me at the moment.

-------------------

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad ⚜️

Time to BUY AUDUSD nowAUDUSD was in a recent downtrend for the last few weeks and struggled to stay bullish, but recently it has just broken a strong resistance trend line which it tested several times and failed to break through. AUDUSD is very likely to hit the next major resistance zone which is market as the "TAKE PROFIT" LEVEL. There are many clear signs of new bullish movements. BUY AUDUSD now - buy AUDUSD now

AUDUSD Price Action Near Descending Trendline – 4H OutlookAUDUSD 4H – Price Testing Key Descending Channel Resistance

Symbol: AUDUSD

Timeframe: 4H

Trend: Sideways to Bearish

Indicators: SMA 9 & SMA 20, Descending Channel

📉 Market Structure Analysis

AUDUSD has been trading inside a descending channel since September. Price recently bounced from the lower channel support and is now approaching the upper channel resistance zone around 0.6620–0.6650.

Despite the recent bullish push, price is failing to break and sustain above the descending resistance, indicating weak buying momentum at higher levels.

The 9 & 20 SMA are closely aligned, suggesting indecision and a possible rejection from resistance.

📌 Key Levels

Resistance: 0.6620 – 0.6650 (Descending channel top)

Support 1: 0.6500

Support 2: 0.6400

Channel Breakdown Target: 0.6300

📊 Trade Scenarios

🔴 Bearish Scenario (Preferred):

If price shows rejection near the channel resistance, a short setup is possible with targets back toward 0.6500 and 0.6400.

🟢 Bullish Scenario:

A strong 4H close above 0.6650 with volume could invalidate the channel and open upside toward 0.6750 – 0.6800.

⚠️ Conclusion

AUDUSD remains technically weak below descending resistance. Traders should wait for clear rejection or confirmed breakout before entering positions.

Always manage risk and wait for confirmation.

🔔 Like, comment & follow for more Forex analysis!

AUDUSD FRGNT DAILY FORECAST - Q4 | W50 | D10 | Y25 |📅 Q4 | W50 | D10 | Y25 |

📊 AUDUSD FRGNT DAILY FORECAST

🔍 Analysis Approach:

I’m applying Smart Money Concepts, focusing on:

Identifying Points of Interest on the Higher Time Frames (HTFs) 🕰️

Using those POIs to define a clear trading range 📐

Refining those zones on Lower Time Frames (LTFs) 🔎

Waiting for a Break of Structure (BoS) for confirmation ✅

This method allows me to stay precise, disciplined, and aligned with the market narrative, rather than chasing price.

💡 My Motto:

"Capital management, discipline, and consistency in your trading edge."

A positive risk-to-reward ratio, paired with a high win rate, is the backbone of any solid trading plan 📈🔐

⚠️ Losses?

They’re part of the mathematical game of trading 🎲

They don’t define you — they’re necessary, they happen, and we move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Stay sharp, stay consistent, and protect your capital

— FRNGT 🚀

FX:AUDUSD

BUY AUDUSD - great opportunity ..AUDUSD was in a recent downtrend for the last few weeks and struggled to stay bullish, but recently it has just broken a strong resistance trend line which it tested several times and failed to break through. AUDUSD is very likely to hit the next major resistance zone which is market as the "TAKE PROFIT" LEVEL. There are many clear signs of new bullish movements. BUY AUDUSD now - great buy opportunity,

AUDUSD FRGNT WEEKLY FORECAST - Q4 | W50 | Y25 |📅 Q4 | W50 | Y25 |

📊 AUDUSD FRGNT WEEKLY FORECAST

🔍 Analysis Approach:

I’m applying Smart Money Concepts, focusing on:

Identifying Points of Interest on the Higher Time Frames (HTFs) 🕰️

Using those POIs to define a clear trading range 📐

Refining those zones on Lower Time Frames (LTFs) 🔎

Waiting for a Break of Structure (BoS) for confirmation ✅

This method allows me to stay precise, disciplined, and aligned with the market narrative, rather than chasing price.

💡 My Motto:

"Capital management, discipline, and consistency in your trading edge."

A positive risk-to-reward ratio, paired with a high win rate, is the backbone of any solid trading plan 📈🔐

⚠️ Losses?

They’re part of the mathematical game of trading 🎲

They don’t define you — they’re necessary, they happen, and we move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Stay sharp, stay consistent, and protect your capital

— FRNGT 🚀

AUDUSD FRGNT WEEKLY FORECAST -Q4 | W49 | Y25 |📅 Q4 | W49 | Y25 |

📊 AUDUSD FRGNT WEEKLY FORECAST

🔍 Analysis Approach:

I’m applying Smart Money Concepts, focusing on:

Identifying Points of Interest on the Higher Time Frames (HTFs) 🕰️

Using those POIs to define a clear trading range 📐

Refining those zones on Lower Time Frames (LTFs) 🔎

Waiting for a Break of Structure (BoS) for confirmation ✅

This method allows me to stay precise, disciplined, and aligned with the market narrative, rather than chasing price.

💡 My Motto:

"Capital management, discipline, and consistency in your trading edge."

A positive risk-to-reward ratio, paired with a high win rate, is the backbone of any solid trading plan 📈🔐

⚠️ Losses?

They’re part of the mathematical game of trading 🎲

They don’t define you — they’re necessary, they happen, and we move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Stay sharp, stay consistent, and protect your capital

— FRNGT 🚀

FX:AUDUSD

AUDUSD FRGNT Daily Forecast - Q4 | W48| D26 | Y25 |📅 Q4 | W48| D26 | Y25 |

📊 AUDUSD FRGNT Daily Forecast

🔍 Analysis Approach:

I’m applying Smart Money Concepts, focusing on:

Identifying Points of Interest on the Higher Time Frames (HTFs) 🕰️

Using those POIs to define a clear trading range 📐

Refining those zones on Lower Time Frames (LTFs) 🔎

Waiting for a Break of Structure (BoS) for confirmation ✅

This method allows me to stay precise, disciplined, and aligned with the market narrative, rather than chasing price.

💡 My Motto:

"Capital management, discipline, and consistency in your trading edge."

A positive risk-to-reward ratio, paired with a high win rate, is the backbone of any solid trading plan 📈🔐

⚠️ Losses?

They’re part of the mathematical game of trading 🎲

They don’t define you — they’re necessary, they happen, and we move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Stay sharp, stay consistent, and protect your capital

— FRNGT 🚀

FX:AUDUSD

AUDUSD FRGNT Daily Forecast - Q4 | W47| D19 | Y25 |📅 Q4 | W47| D19 | Y25 |

📊 AUDUSD FRGNT Daily Forecast

🔍 Analysis Approach:

I’m applying Smart Money Concepts, focusing on:

Identifying Points of Interest on the Higher Time Frames (HTFs) 🕰️

Using those POIs to define a clear trading range 📐

Refining those zones on Lower Time Frames (LTFs) 🔎

Waiting for a Break of Structure (BoS) for confirmation ✅

This method allows me to stay precise, disciplined, and aligned with the market narrative, rather than chasing price.

💡 My Motto:

"Capital management, discipline, and consistency in your trading edge."

A positive risk-to-reward ratio, paired with a high win rate, is the backbone of any solid trading plan 📈🔐

⚠️ Losses?

They’re part of the mathematical game of trading 🎲

They don’t define you — they’re necessary, they happen, and we move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Stay sharp, stay consistent, and protect your capital

— FRNGT 🚀

OANDA:AUDUSD

AUD/USD – Bearish Breakout Signal Triggered AUD/USD – Bearish Breakout Signal Triggered (79% Backtest Probability)

A fresh SELL signal has been generated on AUD/USD, driven by a confirmed Breakout pattern on the current timeframe.

This setup aligns strongly with our automated trend-following model and carries a 79% historical backtest probability, indicating a high-quality bearish continuation opportunity.

🔍 Technical Breakdown

The price structure on AUD/USD is currently reflecting:

1. Bearish Breakout Structure

The pair recently pushed through a minor intraday structure, forming a lower high — a classic precursor to bearish continuation.

The breakout reflects rejection of upper liquidity, signaling sellers stepping in with control.

2. Trend Alignment

Our trend-following model confirms that:

The pair is trading below key dynamic levels.

Momentum indicators show downside pressure building.

The breakout pattern is clean and free from noise, improving its reliability.

This confluence increases the confidence that the downside move may continue.

🌍 Market Context & Macro Influence

Dollar strength continues to weigh heavily on AUD/USD, as:

Risk sentiment remains fragile

Interest rate differentials favor USD

Recent macro data prints support a stronger dollar outlook

AUD continues to show weakness due to commodity softness and cautious global sentiment

In short, the macro backdrop supports the bearish technical structure currently forming on the chart.

📌 Key Technical Levels to Watch

Immediate Resistance: 0.65297

Sellers are expected to defend this zone aggressively.

Immediate Support: 0.64907

A clean break below this region may accelerate bearish momentum.

Major Resistance: 0.65753

A strong structural ceiling — bullish invalidation sits above this level.

Major Support: 0.64451

The next major liquidity target for sellers if the present breakout expands.

🎯 Trade Parameters (Based on 0.10 Lot Size)

Parameter Level

Entry 0.65102

Stop Loss (SL) 0.65302

Take Profit (TP) 0.64702

Risk $50

Potential Profit $100

R:R Ratio 1 : 2

This structure offers a clean, mechanical setup with well-defined risk boundaries.

🛡 Risk Management Notes

Professional-grade risk practices include:

Never risk more than 1–2% of total capital per trade

Consider scaling into the position if price retests the breakout zone

Use a trailing stop after price moves in your favor

Avoid holding during high-impact USD or AUD economic events

Ensure proper position sizing based on your account balance

If volatility expands, consider partial profit-taking

Breakout trades can accelerate quickly — staying disciplined is essential.

📌 Final Thoughts

AUD/USD currently presents a high-probability bearish continuation setup, supported by both technical structure and macro context.

With backtested performance at 79%, clear levels, and defined risk, this opportunity fits well within professional trend-following models.

Traders should monitor price behavior near support at 0.64907 — a breakdown from this region may trigger the next wave of selling pressure toward 0.64702 and beyond.

AUDUSD FRGNT Daily Forecast -Q4 | W46 | D14 | Y25 |📅 Q4 | W46 | D14 | Y25 |

📊 AUDUSD FRGNT Daily Forecast

FRGNT FUN COUPON FRIDAY

🔍 Analysis Approach:

I’m applying Smart Money Concepts, focusing on:

Identifying Points of Interest on the Higher Time Frames (HTFs) 🕰️

Using those POIs to define a clear trading range 📐

Refining those zones on Lower Time Frames (LTFs) 🔎

Waiting for a Break of Structure (BoS) for confirmation ✅

This method allows me to stay precise, disciplined, and aligned with the market narrative, rather than chasing price.

💡 My Motto:

"Capital management, discipline, and consistency in your trading edge."

A positive risk-to-reward ratio, paired with a high win rate, is the backbone of any solid trading plan 📈🔐

⚠️ Losses?

They’re part of the mathematical game of trading 🎲

They don’t define you — they’re necessary, they happen, and we move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Stay sharp, stay consistent, and protect your capital

— FRNGT 🚀

OANDA:AUDUSD

AUDUSD: Neutral View First Buy and Then Sell! Hey everyone!

Our first buy swing entry is going swimmingly! We’ve got over 500 pips running positively, and we reckon price can keep going up and then when it hits our selling zone, you can swing sell too. This is a fantastic opportunity where we can wait for price to do its thing and then when it reaches the sell zone, we can execute our order. But if you’re feeling adventurous and want to take a bit of a risk, you can take a buy entry at the given point and keep it up until it reaches our sell area.

With just one shot, we can make two entries!

Good luck and trade safely!

Thanks a bunch for your unwavering support! 😊

If you’d like to lend a hand, here are a few ways you can contribute:

- Like our ideas

- Comment on our ideas

- Share our ideas

Cheers,

Team Setupsfx_

❤️🚀

AUD/USD) Bearish trend analysis Read The captionSMC Trading point update

Technical analysis of AUD/USD 4-hour chart represents a bearish continuation setup based on Smart Money Concepts (SMC) and confluence with key moving averages and Fibonacci retracement zones. Here's a breakdown of the idea behind this analysis:

---

Overall Bias: Bearish Continuation

The chart suggests the market is in a downtrend, with price expected to pull back into a premium zone (a sell area) before continuing downward toward a new low or liquidity target.

---

Technical Breakdown

1. Trend Context

Price has been making lower highs and lower lows, confirming a bearish structure.

Both the 50 EMA (blue) and 200 EMA (black) are positioned above the current price, which reinforces bearish momentum.

The EMAs are acting as dynamic resistance zones.

2. Retracement Zone (Supply Area)

The blue zone marks a premium retracement area (0.62–0.79 Fibonacci levels) where institutional sellers might re-enter.

The red arrow highlights the anticipated rejection point near 0.6530–0.6540 — confluence of:

50%–79% Fibonacci retracement

EMA resistance

Previous structure zone

3. Projected Price Path

The chart expects a short-term bullish retracement into the highlighted zone.

Once liquidity is collected and the zone is tapped, a bearish rejection is expected.

After that, price may form a lower high, confirming bearish structure before dropping further.

4. Target Point

The final target zone is around 0.64530, aligned with:

Prior swing low (liquidity area)

0% Fibonacci extension

This acts as the next liquidity sweep or take-profit zone for short positions.

Mr SMC Trading point

---

Market Structure Summary

Element Direction Key Levels

Market Bias Bearish

Retracement Zone 0.6520 – 0.6540 Supply area

Resistance Confluence 50 EMA, 200 EMA, Fib 0.62–0.79

Entry Zone After rejection from blue zone

Target 0.6453 Liquidity target

---

Trade Idea (Conceptually)

Wait for price to enter the blue zone and show bearish confirmation (e.g., rejection candle or structure break).

Then consider a short position targeting 0.6453.

Stop-loss would logically be above 0.6550–0.6560, above the supply zone.

---

Narrative Summary

> This setup anticipates a pullback to a premium supply zone aligning with EMA resistance, then a continuation to the downside following smart money structure principles. The bearish trend remains intact unless price breaks cleanly above 0.6560.

---

please support boost 🚀 this analysis

AUDUSD FRGNT Weekly Forecast -Q4 | W46 | Y25 |📅 Q4 | W46 | Y25 |

📊 AUDUSD FRGNT Weekly Forecast

🔍 Analysis Approach:

I’m applying Smart Money Concepts, focusing on:

Identifying Points of Interest on the Higher Time Frames (HTFs) 🕰️

Using those POIs to define a clear trading range 📐

Refining those zones on Lower Time Frames (LTFs) 🔎

Waiting for a Break of Structure (BoS) for confirmation ✅

This method allows me to stay precise, disciplined, and aligned with the market narrative, rather than chasing price.

💡 My Motto:

"Capital management, discipline, and consistency in your trading edge."

A positive risk-to-reward ratio, paired with a high win rate, is the backbone of any solid trading plan 📈🔐

⚠️ Losses?

They’re part of the mathematical game of trading 🎲

They don’t define you — they’re necessary, they happen, and we move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Stay sharp, stay consistent, and protect your capital

— FRNGT 🚀

OANDA:AUDUSD

AUD/USD) Bearish trend analysis Read The captionSMC Trading point update

Technical analysis of AUD/USD (Australian Dollar / U.S. Dollar) – Bearish Continuation Setup

Timeframe: 1H (IC Markets)

Concepts: Smart Money Concepts (SMC), Market Structure, Fair Value Gap (FVG), EMA Confluence

---

Market Structure Overview

The overall structure remains bearish, forming lower highs and lower lows.

Price is trading within a descending channel, respecting both upper and lower trendlines.

The recent impulsive bearish leg suggests continuation after a corrective retracement.

---

Key Technical Zones

Retracement Zone (Sell Area):

0.5 – 0.79 Fibonacci levels mark the premium short zone.

Overlaps with a Fair Value Gap (FVG) and supply area, making it a strong potential sell zone.

Zone: 0.6520 – 0.6540

EMA Confluence:

EMA-50 ≈ 0.6528

EMA-200 ≈ 0.6540

Both EMAs are positioned near the FVG zone, confirming dynamic resistance.

---

Scenario Plan

1. Expect a short-term retracement toward the 0.652–0.654 region.

2. Look for bearish rejection or lower-timeframe BOS confirmation within the zone.

3. Anticipate continuation to the lower channel boundary, aligning with target point 0.6458.

---

Targets

Next Reaction Zone: 0.6500 (intermediate liquidity area)

Final Bearish Target: 0.6458 – marked on chart as the target point

Mr SMC Trading point

---

Bias:

> Bearish – Structure, EMAs, and FVG confluence all favor a downside continuation after a corrective pullback.

---

please support boost 🚀 this analysis

AUDUSD FRGNT Daily Forecast -Q4 | W45 | D5| Y25 |📅 Q4 | W45 | D5| Y25 |

📊 AUDUSD FRGNT Daily Forecast

🔍 Analysis Approach:

I’m applying Smart Money Concepts, focusing on:

Identifying Points of Interest on the Higher Time Frames (HTFs) 🕰️

Using those POIs to define a clear trading range 📐

Refining those zones on Lower Time Frames (LTFs) 🔎

Waiting for a Break of Structure (BoS) for confirmation ✅

This method allows me to stay precise, disciplined, and aligned with the market narrative, rather than chasing price.

💡 My Motto:

"Capital management, discipline, and consistency in your trading edge."

A positive risk-to-reward ratio, paired with a high win rate, is the backbone of any solid trading plan 📈🔐

⚠️ Losses?

They’re part of the mathematical game of trading 🎲

They don’t define you — they’re necessary, they happen, and we move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Stay sharp, stay consistent, and protect your capital

— FRNGT 🚀

OANDA:AUDUSD

AUDUSD FRGNT Weekly Forecast -Q4 | W45 | Y25 |📅 Q4 | W45 | Y25 |

📊 AUDUSD FRGNT Weekly Forecast

🔍 Analysis Approach:

I’m applying Smart Money Concepts, focusing on:

Identifying Points of Interest on the Higher Time Frames (HTFs) 🕰️

Using those POIs to define a clear trading range 📐

Refining those zones on Lower Time Frames (LTFs) 🔎

Waiting for a Break of Structure (BoS) for confirmation ✅

This method allows me to stay precise, disciplined, and aligned with the market narrative, rather than chasing price.

💡 My Motto:

"Capital management, discipline, and consistency in your trading edge."

A positive risk-to-reward ratio, paired with a high win rate, is the backbone of any solid trading plan 📈🔐

⚠️ Losses?

They’re part of the mathematical game of trading 🎲

They don’t define you — they’re necessary, they happen, and we move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Stay sharp, stay consistent, and protect your capital

— FRNGT 🚀

OANDA:AUDUSD

AUDUSD FRGNT Daily Forecast -Q4 | W44 | D30| Y25 |📅 Q4 | W44 | D30| Y25 |

📊 AUDUSD FRGNT Daily Forecast

🔍 Analysis Approach:

I’m applying Smart Money Concepts, focusing on:

Identifying Points of Interest on the Higher Time Frames (HTFs) 🕰️

Using those POIs to define a clear trading range 📐

Refining those zones on Lower Time Frames (LTFs) 🔎

Waiting for a Break of Structure (BoS) for confirmation ✅

This method allows me to stay precise, disciplined, and aligned with the market narrative, rather than chasing price.

💡 My Motto:

"Capital management, discipline, and consistency in your trading edge."

A positive risk-to-reward ratio, paired with a high win rate, is the backbone of any solid trading plan 📈🔐

⚠️ Losses?

They’re part of the mathematical game of trading 🎲

They don’t define you — they’re necessary, they happen, and we move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Stay sharp, stay consistent, and protect your capital

— FRNGT 🚀

OANDA:AUDUSD

AUDUSD FRGNT Daily Forecast -Q4 | W43 | D24| Y25 |📅 Q4 | W43 | D24| Y25 |

📊 AUDUSD FRGNT Daily Forecast

🔍 Analysis Approach:

I’m applying Smart Money Concepts, focusing on:

Identifying Points of Interest on the Higher Time Frames (HTFs) 🕰️

Using those POIs to define a clear trading range 📐

Refining those zones on Lower Time Frames (LTFs) 🔎

Waiting for a Break of Structure (BoS) for confirmation ✅

This method allows me to stay precise, disciplined, and aligned with the market narrative, rather than chasing price.

💡 My Motto:

"Capital management, discipline, and consistency in your trading edge."

A positive risk-to-reward ratio, paired with a high win rate, is the backbone of any solid trading plan 📈🔐

⚠️ Losses?

They’re part of the mathematical game of trading 🎲

They don’t define you — they’re necessary, they happen, and we move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Stay sharp, stay consistent, and protect your capital

— FRNGT 🚀

OANDA:AUDUSD