#AVAXUSDT: Targeting $60 Long Term View! Swing TradeThis crypto pair has a big potential of going back to its previous all time high, in our opinion price should reverse from $9 to $10 that area looks more appealing. We expect a swing volume to kick in the market.

Use accurate risk management while trading cryptocurrency. Like and comment for more.

Team Setupsfx_

Avaxusdtidea

AVAX/USDT - Heads Into Major Demand Zone — Bounce or Breakdown?AVAX is currently standing at one of its most critical decision points since 2023. After failing to hold its multi-year ascending trendline, the price finally broke down and closed the weekly candle below the structural level at $15.7. This isn’t a normal correction — this is a signal that the market structure has shifted, and AVAX is entering a survival phase.

But the story is far from over. Price is now sliding into a zone that has historically acted as a deep accumulation region:

$10.7 – $8.5

This yellow block is where large-volume buyers previously stepped in during the 2022 crash and later consolidated before major moves.

The long wick sweeping into this zone indicates early buyer activity — but not enough to reclaim structural levels yet.

Right now, AVAX is in the middle of a high-timeframe battlefield between two major outcomes:

Bullish Reversal Scenario → Price reclaims $15.7 and climbs back above the broken trendline.

Bearish Breakdown Scenario → Price loses $10.7, falls deeper into the accumulation block, and risks testing historical lows near $5.7.

---

Bullish Scenario — (Reversal Trigger: $15.7)

A bullish reversal starts to form if AVAX can:

1. Bounce strongly from $10.7–$8.5, and

2. Close a weekly candle back above $15.7.

This would signal that significant accumulation has taken place and that smart money is re-entering the market.

Major upside targets become:

$20.80 → First structural resistance

$32.90 → Mid-range breakout

$54.30 → High-timeframe trend reversal confirmed

This is the “comeback path” for AVAX.

---

Bearish Scenario — (Breakdown Trigger: $10.7)

If AVAX fails to hold above $10.7 on the weekly, the long-standing demand zone collapses.

Downside implications:

Immediate drop toward $8.5

If $8.5 also breaks →

Price opens the door to a deeper decline toward the historical low around $5.7

This would confirm a major redistribution phase, not just a pullback.

---

Price Action & Market Structure

AVAX is forming lower highs and lower lows, confirming a weekly downtrend.

Breaking the ascending trendline marks a clear character shift.

The $10.7–$8.5 zone now acts as the final defense for bulls before entering a multi-year lower range.

Expect liquidity sweeps & stop hunts in this region — patience and weekly confirmation are key.

---

AVAX is now sitting inside a make-or-break zone that will determine its multi-month direction.

Hold $10.7–$8.5 → Potential strong reversal back toward $20–$30

Break below $10.7 → Deeper bearish continuation toward the $5.7 region

This is the type of price zone where professional traders wait for confirmation, not quick reactions.

---

#AVAX #Avalanche #CryptoTA #AVAXUSDT #TechnicalAnalysis #Altcoins #PriceAction #MarketStructure #CryptoOutlook #SupportAndResistance

Will Avalanche (AVAX/USD) Steal the Spotlight in This Rally?💎 AVAX/USD | AVALANCHE vs US DOLLAR | Money Looting Plan 🎯

📌 Trade Bias: Bullish Swing / Day Trade

Hey Ladies & Gentlemen (Thief OG’s) — here’s the latest plan on AVAX/USD where we use the classic Thief Layer Strategy (multi-limit layering style).

Thief Strategy Plan

Entry Zone (Layering Style):

Multiple buy-limit layers around: 23.70 | 24.00 | 24.30 | 24.60

(You can increase or adjust layers based on your own setup)

Stop Loss (SL):

⛔️ This is the Thief SL @ 23.00

(Adjust SL depending on your risk appetite & strategy — this is not financial advice)

Target (TP):

🎯 Police barricade spotted — escape with the loot before getting caught!

Target Zone: 26.30

(Take profit at your own discretion, secure profits when satisfied)

📊 AVAX/USD Real-Time Data September 03

📈 24h Change: +2.67%

💰 Market Cap: ~$10.4B

🔄 24h Volume: ~$750M

🔗 Circulating Supply: 422M AVAX

😰 Fear & Greed Index

📊 Current Sentiment: Greed (60/100)

🔄 Trend: Stable (60 yesterday, 60 over past week)

💡 Interpretation: Investors are optimistic but not euphoric

🏛️ Fundamental & Macro Score

✅ Bullish Drivers

Octane Upgrade → Reduced fees by 43%, boosting adoption

Enterprise Adoption → FIFA NFTs & VanEck’s $100M RWA fund

Transaction Growth → Daily transactions up 66% weekly

Staking Demand → 48–53% supply locked, reducing circulation

❌ Bearish Risks

ETF Uncertainty → SEC decision still pending (volatility risk)

Staking Yields → Lower APY (1.2% flexible) vs competitors

Bitcoin Dominance → 57.8% limiting altcoin rallies

🌍 Overall Market Outlook

⚖️ Bull/Bear Score: 70% Bullish / 30% Bearish

🏦 Institutional Sentiment: Positive (ETF filings, RWA partnerships)

👥 Retail Sentiment: Cautiously optimistic (Greed Index at 60)

🎯 Summary

🔹 Short-Term: Bullish momentum

🔹 Medium-Term: Dependent on ETF decisions & subnet adoption

🔹 Risk Level: Moderate (watch Bitcoin dominance & macro trends)

🔎 Related Pairs to Watch

BITSTAMP:BTCUSD

BITSTAMP:ETHUSD

COINBASE:SOLUSD

COINBASE:LINKUSD

BITSTAMP:XRPUSD

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

#AVAX #Crypto #Altcoins #DayTrading #SwingTrade #LayeringStrategy #AVAXUSD #BullishSetup #CryptoTrading #ThiefTrader

AVAX/USDT — Symmetrical Triangle Approaching Breakout?Overview:

The daily chart shows AVAX forming a symmetrical triangle (converging trendlines) since the Dec–Jan peak. Price is now testing the upper resistance trendline (~26.1 USDT) — we’re at a critical point heading toward the apex (late September). Volume behavior and a confirmed daily candle close will be key to determining the breakout direction.

---

1) Pattern Description

Pattern: Symmetrical Triangle — characterized by lower highs (descending resistance line from the peak) and higher lows (ascending support line from the April bottom). Price range is narrowing → volatility dropping → usually leads to a strong move when the pattern resolves.

Context: The broader trend before the triangle was bearish (drop from ~55.8). Symmetrical triangles can be neutral but often resolve in the direction of the prior trend — technical confirmation is essential.

---

2) Key Levels (from chart)

Upper resistance trendline / critical level: ~26.10 USDT (red dashed line), current price ≈ 25.3 USDT.

Major resistance targets: 30.74, 35.62, 44.18, 53.70 – 55.80.

Ascending support trendline: around 18–22 USDT depending on timing.

Structural low: 14.665 USDT (chart low).

(Values estimated visually from chart — verify with live data before trading.)

---

3) Bullish Scenario (if breakout upward)

Bullish Trigger

Daily close above descending trendline (~26.1) with strong volume → breakout confirmation.

Preferably supported by bullish technical indicators (RSI, MACD bullish crossover, rising OBV).

Targets

Step targets: 30.7 → 35.6 → 44.2 → 53.7 (partial profit-taking recommended).

Measured move theoretical target:

− Height ≈ 55.800 − 14.665 = 41.135.

− Added to breakout point (~26.108) → theoretical target ≈ 67.24 USDT (for reference, not guaranteed).

Risk Management

Stop-loss: daily close back below breakout trendline or under nearest swing low (e.g., conservative SL < 21–22 USDT).

Strategy: scale in — partial entry before breakout, add after confirmation. Monitor risk/reward closely.

---

4) Bearish Scenario (if rejected / breakdown)

Bearish Trigger

Rejection at upper trendline + bearish daily candle (and/or rising sell volume) → drop to ascending support.

Breakdown confirmation: daily close below ascending trendline with strong volume.

Targets

Initial drop to ascending support ~18–22 USDT.

If breakdown continues → possible retest of 14.66 USDT low.

Risk Management for Shorts / Cut-loss

SL for shorts: daily close above resistance (~>28 USDT) or above fake breakout highs.

Beware of bull traps — volume confirmation reduces risk.

---

5) Practical Trade Plans (example)

Conservative Long: Wait for daily close > 26.1 + strong volume → enter 50% position; add after retest. Targets: 30.7 / 35.6. SL under retest zone (~21–22).

Conservative Short: If clear rejection at upper trendline → short toward lower trendline. SL above recent high (~28).

Range Trading: Buy near lower trendline, sell near upper trendline until breakout confirmed.

---

6) Risk & Confluence Checks

Broader market/Bitcoin sentiment: AVAX is often correlated, which can amplify moves.

Supporting indicators: check volume, RSI, MACD, EMA(50/200) for confirmation.

Watch for false breakouts — confirm with volume + retests.

---

7) Summary

> AVAX is forming a Symmetrical Triangle. Critical resistance at ~26.1 USDT — daily close + volume will decide the next move. Valid breakout → step targets at 30.7 / 35.6 / 44.2 (measured move theoretical ~67.2). Rejection / breakdown → support at 18–22 and possible drop to 14.66. Manage risk with confirmation, stop-loss, and partial profit-taking.

#AVAX #AVAXUSDT #Crypto #TechnicalAnalysis #Triangle #Breakout #SupportResistance #Altcoin #SwingTrading

AVAX at the Edge: Golden Pocket Support or Breakdown Incoming?🧠 Overview:

AVAX is currently trading at a decisive support zone, aligned perfectly with the Fibonacci golden pocket (0.5–0.618) at $21.03–$19.54. This level has historically acted as a strong pivot zone, serving both as resistance during bear markets and support in bullish recoveries.

The market has compressed into this key demand zone after a prolonged sideways structure. Now, all eyes are on how price will react — this zone will likely determine AVAX's mid-to-long-term trend.

---

🔍 Key Technical Highlights:

🔸 Fibonacci Confluence Zone (Golden Pocket):

0.5 Fib Level: $21.03

0.618 Fib Level: $19.54

This area coincides with a weekly demand block — a high-probability reversal zone where buyers have historically stepped in.

🔸 Major Resistance Levels to Watch:

$28.76 – First significant supply zone.

$32.68 – Previous lower high, potential breakout confirmation zone.

$43.07 – Weekly structure resistance.

$58.30 – Mid-term bullish target.

🔸 Support Levels Below:

$15.00 – Local base during early 2023.

$8.61 – Multi-year low (critical support if demand collapses).

🔸 Structure Insight:

Price is currently forming a macro higher low, suggesting a potential accumulation phase. However, failure to hold this zone could trigger a bearish continuation.

---

🚀 Bullish Scenario:

If price sustains above $19.54–21.03 and breaks above $25.50, the following upside targets could be reached:

1. $28.76 – Local resistance

2. $32.68 – Break of bearish structure

3. $43.07 – Momentum extension

4. $58.30 – Bullish macro target

Catalyst to watch: Weekly bullish engulfing candle + volume spike + break of structure → these would confirm buyers are in control.

---

🔻 Bearish Scenario:

If the price breaks below $19.54 with strong bearish volume, then:

1. $15.00 – First zone of interest for buyers

2. $8.61 – Critical long-term support zone

This would confirm a distribution pattern and signal that the market may revisit lower accumulation zones before any major uptrend resumes.

---

🧩 Market Psychology Insight:

This current range is where smart money positions themselves — either for continuation or reversal. Retail traders often get shaken out in this kind of compression. Stay patient and wait for confirmation rather than anticipation.

---

🎯 Conclusion:

AVAX is now at a make-or-break point. With the price sitting in a high-confluence demand zone, traders should prepare for volatility and monitor weekly closes. A strong move in either direction will likely determine the next multi-week trend.

> “The bigger the base, the higher in space.” – If this is true accumulation, the upside could surprise many.

#AVAX #AVAXUSDT #CryptoTechnicalAnalysis #AltcoinWatch #FibonacciLevels #SupportResistance #BullishOrBearish #SmartMoneyZone #WeeklyChart #CryptoTrading #BreakoutOrBreakdown

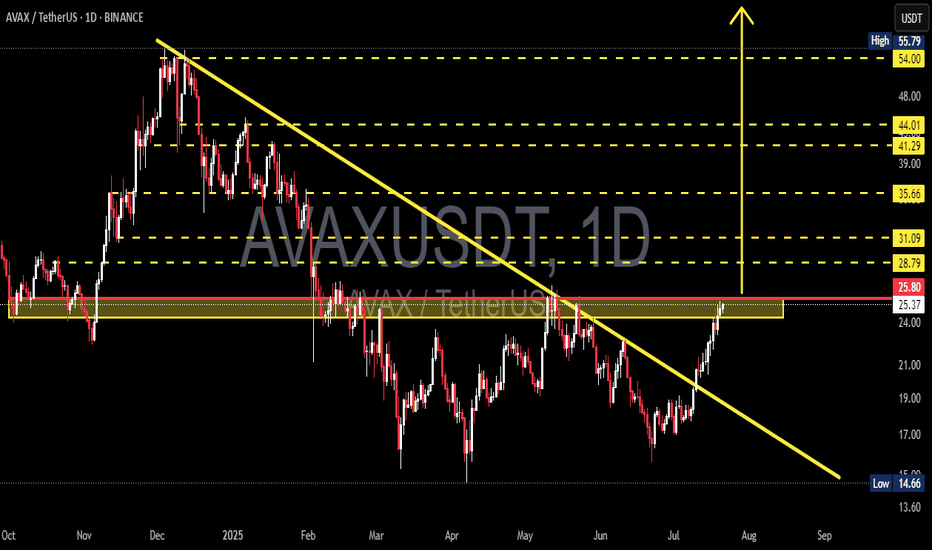

AVAX/USDT Massive Trend Reversal: Breakout from 8-Month DowntrenAVAX has just delivered one of its most technically significant moves in recent months. After spending over 8 months trapped under a descending resistance line, price action has finally broken free — suggesting a potential trend reversal and the beginning of a much larger bullish phase.

🧠 Pattern & Structure Breakdown:

📌 Descending Trendline Breakout

AVAX had been forming a descending triangle pattern, characterized by consistent lower highs and a horizontal support zone between $14.66 – $22. The recent bullish breakout from this structure, accompanied by strong volume, is a highly encouraging sign for bulls.

📌 Accumulation Zone Identified

The yellow zone on the chart ($14.66 – $22) has proven to be a strong demand zone where buyers consistently stepped in. The recent rally originates from this base, indicating possible institutional accumulation.

📌 Critical Horizontal Resistance at $25.80

Price is now testing the $25.80 resistance zone, which historically acted as a supply area. A successful daily close and confirmation above this level would officially flip the structure bullish.

📈 Bullish Scenario – Multi-Level Upside Targets:

If AVAX confirms the breakout above $25.80, these are the key bullish targets ahead:

🎯 Target 1: $28.79 – minor resistance & potential short-term TP zone

🎯 Target 2: $31.09 – previous price equilibrium

🎯 Target 3: $35.66 – key pivot from past market structure

🎯 Target 4: $41.29 and $44.01 – heavy historical supply zones

🎯 Target 5 (measured move): $54.00 to $55.79 – the projected breakout target from the descending triangle pattern

This move would represent a full technical recovery if AVAX aligns with broader market sentiment and Bitcoin remains stable or bullish.

📉 Bearish Scenario – Pullback Risks:

On the flip side, if price fails to sustain above $25.80 and gets rejected:

⚠️ A retest of $24.00 – $22.00 is likely

⚠️ If that zone breaks down, next support lies at $19.00 – $17.00

⚠️ A loss of the $17 level may trigger a return to the critical low near $14.66

This would invalidate the bullish breakout and return AVAX into a sideways or downward consolidation phase.

🔍 Additional Technical Insights:

✅ Volume is steadily increasing — showing renewed buying pressure

✅ Indicators like RSI and MACD (if applied) are likely showing bullish divergence

✅ Overall altcoin sentiment is improving, providing a tailwind for AVAX's potential breakout continuation

🧩 Final Thoughts:

AVAX is at a pivotal moment in its medium-term price structure. The breakout above the long-term downtrend line is a strong technical shift. A confirmed breakout and hold above $25.80 could trigger a multi-week or multi-month rally targeting $40 – $55+.

However, traders should be cautious of possible pullbacks and manage risk accordingly — especially as resistance zones from previous structures are being tested.

#AVAX #AVAXUSDT #CryptoBreakout #TechnicalAnalysis #Altcoins #BullishCrypto #DescendingTriangle #ReversalPattern #AVAXAnalysis

AVAX/USDT Weekly Reversal Zone — Major Support Holding

🟨 CRITICAL ZONE (Key Support Area)

AVAX is currently trading within a major demand zone between $13.5–17.5, a historically strong support area that previously acted as the base for significant upward movements. Multiple weekly candles show rejection from this level, indicating buyer interest.

📊 Pattern Overview:

Double Bottom / Potential Triple Bottom:

The chart illustrates a clear double bottom structure, potentially forming a triple bottom, suggesting accumulation and reversal from the lows.

Bullish Projection Path:

The yellow arrow outlines a projected bullish impulse wave, targeting higher resistance levels if support holds.

📈 Bullish Scenario:

If AVAX maintains support at around $17.1:

1. Price may first test $20.25 (initial resistance).

2. A breakout above $20.25 could open the way to:

$24.98 (strong weekly resistance)

$32.75 (previous distribution zone)

$55.42 (major target/resistance zone)

3. In an extended bullish cycle, price could revisit:

$98.87, $110, and even $128.62 long term (2026+)

A confirmed breakout above $25 with strong volume would further validate the bullish case.

📉 Bearish Scenario:

If the $15–17 support zone breaks down:

1. Price could drop further to:

$11.00 (minor support)

$8.61 (historical low and weekly support)

2. This would indicate strong bearish pressure, potentially leading AVAX into a longer-term accumulation phase.

🔍 Conclusion:

This is a critical decision zone for AVAX. The technical structure shows signs of accumulation and possible trend reversal. However, if support fails, a deeper retracement could occur. Traders should watch this area closely for breakout or breakdown confirmations.

#AVAX #AVAXUSDT #Avalanche #CryptoReversal #TechnicalAnalysis #Altcoins #WeeklyChart #CryptoSupportZone #CryptoBreakout

#AVAXUSDT: Three Swing Buy Take Profit EntriesThe cryptocurrency market has experienced volatility in recent months, particularly with the #AVAXUSDT token. We have identified two potential price reversal points:

1. **Current Price Range:** The market is currently experiencing a surge in volume, indicating a potential reversal.

2. **Liquidity Removal and Reversal:** If the price were to remove liquidity and subsequently reverse at its previous low, it could trigger a significant price drop.

Additionally, we recommend setting three targets based on your analysis to guide your trading decisions.

We extend our sincere gratitude for your unwavering support since the beginning. We anticipate that this support will continue to grow and evolve.

Team Setupsfx_

🚀❤️

AVAXUSDT Elliott Waves (Investment Idea)Hello friends.

Please support my work by clicking the LIKE button👍(If you liked). Also i will appreciate for ur activity. Thank you!

Everything on the chart.

Main(investment) target zone: 250-300

Targets: 75 - 150 - 250

Cancellation of setup - consolidation under ~11

RR: 1 to ~35

risk is justified

Good luck everyone!

Follow me on TRADINGView, if you don't want to miss my next analysis or signals.

It's not financial advice.

Dont Forget, always make your own research before to trade my ideas!

Open to any questions and suggestions

AVAXUSDT: 4HR VIEW BINANCE:AVAXUSDT currently in consolidation phase, few candles show some bullish character and we expect a nice clean move from this area. Though, if price decides to remain bearish then it can fall further down where there is imbalance which price will likely to fill before it touches the 55.00 region.

What do you think about this pair, do you think it will create a new record?

AVAXUSDT Elliott Waves AnalysisHello friends.

Please support my work by clicking the LIKE button👍(If you liked). Also i will appreciate for ur activity. Thank you!

Everything on the chart.

Entry zone: 8 - 6.5$

Targets: 12 - 16 - 22

after first target reached move ur stop to breakeven

Stop: (depending of ur risk). ALWAYS follow ur RM .

risk is justified

Good luck everyone!

Follow me on TRADINGView, if you don't want to miss my next analysis or signals.

It's not financial advice.

Dont Forget, always make your own research before to trade my ideas!

Open to any questions and suggestions

AVAXUSDT Elliott Waves AnalysisHello friends.

Please support my work by clicking the LIKE button👍(If you liked). Also i will appreciate for ur activity. Thank you!

Everything on the chart. (update)

Entry: market and lower

Target: 20 - 25 and maybe 28-33 zone

after first target reached move ur stop to breakeven

Stop: (depending of ur risk). ALWAYS follow ur RM.

Risk/Reward: 1 to 5

risk is justified

Good luck everyone!

Follow me on TRADINGView, if you don't want to miss my next analysis or signals.

It's not financial advice.

Dont Forget, always make your own research before to trade my ideas!

Open to any questions and suggestions.

AVAXUSDT Elliott Waves AnalysisHello friends.

Please support my work by clicking the LIKE button👍(If you liked). Also i will appreciate for ur activity. Thank you!

Everything on the chart. (update)

We got decreasing that i expected earlier, now i want to see continuation of growth.

Entry: market and lower

Target: 25 - 28 - ~31

Main target zone: 29-35

after first target reached move ur stop to breakeven

Stop: agressive 13.8, conservative ~11 (depending of ur risk). ALWAYS follow ur RM.

Risk/Reward: 1 to 3

risk is justified

Good luck everyone!

Follow me on TRADINGView, if you don't want to miss my next analysis or signals.

It's not financial advice.

Dont Forget, always make your own research before to trade my ideas!

Open to any questions and suggestions.