#AVAX/USDT : The Calm Before the Squeeze Storm#AVAX

The price is moving within a descending channel on the hourly timeframe. It has reached the lower boundary and is heading towards a breakout, with a retest of the upper boundary expected.

The Relative Strength Index (RSI) is showing a downward trend, approaching the lower boundary, and an upward bounce is anticipated.

There is a key support zone in green at 9.61, and the price has bounced from this level several times. Another bounce is expected.

The indicator is showing a trend towards consolidation above the 100-period moving average, which we are approaching, supporting the upward move.

Entry Price: 9.88

First Target: 10.04

Second Target: 10.27

Third Target: 10.62

Stop Loss: Below the green support zone.

Remember this simple thing: Money management.

For any questions, please leave a comment.

Thank you.

Avaxusdtlong

AVAXUSDT 1,625% profits potential with 5X leverage —LONG tradeAvalanche has been moving within a descending channel for almost two years, since March 2024. Lower highs with lower lows and the market flush last year reveals the climax of this bearish pattern.

The action recently, December 2025 and this month, is moving within a higher low compared to the October 2025 flush. This is the main signal supporting the start of a bullish wave.

The fact that the bearish period has been a very long one; the market always alternates between bear and bull, and the multiple years long low. The flush low produced the lowest price for AVAX since 2023.

These are the price dynamics, we expect a trend reversal to happen next. Not only a strong bullish breakout but an actual change of trend.

How will this happen with Bitcoin entering a bearish period after the relief rally ends? I don't know, but the market continues to grow and evolve. Some will go down while others go up.

Full trade-numbers below:

_____

LONG AVAXUSDT

Leverage: 5X

Potential: 1625%

Allocation: 5%

Entry zone: $10.5 - $12.5

Targets:

1) $15

2) $17

3) $21

4) $24

5) $27

6) $31

7) $36

8) $44

9) $51

Stop: Close weekly below $10

_____

Thanks a lot for your continued support.

Patience is key. After buying, there is no need to take any action, simply hold.

When the market runs, let it run. Secure profits on the way up.

It is unwise to buy, rebuy and buy more if the market doesn't move right away. It is better to wait and once the position is secured, look for new trades. Profits potentials are huge on each chart setup, it is better to play it safe.

Win-win-win. Secure as many wins as you can. Develop a habit, the habit of winning. In this way, you can't go wrong long-term.

Namaste.

#AVAX/USDT : The Calm Before the Squeeze Storm#AVAX

The price is moving within a descending channel on the hourly timeframe. It has reached the lower boundary and is heading towards a breakout, with a retest of the upper boundary expected.

The Relative Strength Index (RSI) is showing a downward trend, approaching the lower boundary, and an upward bounce is anticipated.

There is a key support zone in green at 14.00, and the price has bounced from this level several times and is expected to bounce again.

The indicator shows a trend towards consolidation above the 100-period moving average, which we are approaching, supporting the upward move.

Entry Price: 14.35

First Target: 14.67

Second Target: 15.09

Third Target: 15.67

Stop Loss: Below the green support zone.

Don't forget one simple thing: Money Management.

For any questions, please leave a comment.

Thank you.

$AVAX at last and crucial support!CRYPTOCAP:AVAX has dropped back into a major multi-year support zone after a sharp weekly selloff. This level has held the range multiple times since 2021, and the price is now reacting around the same support + long-term trendline.

If AVAX manages to hold this area, a bounce toward the mid-range levels ($21.40 → $33.22) becomes possible. Failure to hold support would expose lower targets.

This zone is critical — CRYPTOCAP:AVAX either stabilizes here or breaks structure for a deeper move.

Fundamental Analysis:

BINANCE:AVAXUSDT stands out as a leading Layer-1 blockchain, known for speed, scalability, and growing real-world asset (RWA) adoption. Subnet activity is rising, DeFi liquidity is improving, and the network’s decentralized finance ecosystem is gaining fresh momentum. Exchange reserves continue to decline, showing healthy on-chain fundamentals and liquid supply trends.

Latest Updates:

- Avalanche recently completed a major network upgrade, temporarily suspending AVAX C-Chain deposits and withdrawals for enhanced security.

- Its DeFi roadmap features the V1 launch on Sepolia testnet (Q4 2025), including new liquidity pools and support for ETH and USDT.

- Recent audits and a $50k bug bounty solidify Avalanche’s reputation for security and reliability.

#AVAX/USDT : The Calm Before the Squeeze Storm#AVAX

The price is moving in a descending channel on the 1-hour timeframe. It has reached the lower boundary and is heading towards breaking above it, with a retest of the upper boundary expected.

We have a downtrend on the RSI indicator, which has reached near the lower boundary, and an upward rebound is expected.

There is a key support zone in green at 12.80. The price has bounced from this zone multiple times and is expected to bounce again.

We have a trend towards stability above the 100-period moving average, as we are moving close to it, which supports the upward movement.

Entry price: 13.22

First target: 13.38

Second target: 13.74

Third target: 14.11

Don't forget a simple principle: money management.

Place your stop-loss below the support zone in green.

For any questions, please leave a comment.

Thank you.

#AVAX/USDT : The Calm Before the Squeeze Storm#AVAX

The price is moving in a descending channel on the 1-hour timeframe. It has reached the lower boundary and is heading towards breaking above it, with a retest of the upper boundary expected.

We have a downtrend on the RSI indicator, which has reached near the lower boundary, and an upward rebound is expected.

There is a key support zone in green at 11.80. The price has bounced from this zone multiple times and is expected to bounce again.

We have a trend towards stability above the 100-period moving average, as we are moving close to it, which supports the upward movement.

Entry price: 12.21

First target: 12.33

Second target: 12.59

Third target: 12.84

Don't forget a simple principle: money management.

Place your stop-loss below the support zone in green.

For any questions, please leave a comment.

Thank you.

AVAXUSDT Forming Falling WedgeAVAXUSDT is forming a clear falling wedge pattern, a classic bullish reversal signal that often indicates an upcoming breakout. The price has been consolidating within a narrowing range, suggesting that selling pressure is weakening while buyers are beginning to regain control. With consistent volume confirming accumulation at lower levels, the setup hints at a potential bullish breakout soon. The projected move could lead to an impressive gain of around 70% to 80% once the price breaks above the wedge resistance.

This falling wedge pattern is typically seen at the end of downtrends or corrective phases, and it represents a potential shift in market sentiment from bearish to bullish. Traders closely watching AVAXUSDT are noting the strengthening momentum as it nears a breakout zone. The good trading volume adds confidence to this pattern, showing that market participants are positioning early in anticipation of a reversal.

Investors’ growing interest in AVAXUSDT reflects rising confidence in the project’s long-term fundamentals and current technical strength. If the breakout confirms with sustained volume, this could mark the start of a fresh bullish leg. Traders might find this a valuable setup for medium-term gains, especially as the wedge pattern completes and buying momentum accelerates.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is your opinion about this Coin?)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

AVAX/USDT : LIVE TRADEHello friends

Considering the decline I had, you can see that the price has been supported in our support area and the price has grown well.

Now, given the good growth we had, we have a high and low, which is a sign of the entry of sellers, and this means that the price will correct to the specified areas, and from there we can again expect the price to grow to the specified targets.

This analysis is technically reviewed and is not a buy or sell recommendation, so please follow risk and capital management.

*Trade safely with us*

AVAX – 15m Technical Analysis (Breakout Setup)🔥 AVAX – 15m Technical Analysis (Breakout Setup)

( BINANCE:AVAXUSDT )

✅ 1) Pattern Analysis – Falling Wedge

A falling wedge usually signals that sellers are weakening, and buyers are absorbing liquidity.

What confirms the breakout?

Price broke above the wedge’s upper trendline.

A large bullish candle with increased volume.

Retest area around 13.20–13.25, which is happening now.

📌 This is a classic bullish breakout behaviour.

✅ 2) Entry Logic

The entry around 13.25 is technically correct because:

It's exactly at the breakout retest zone.

Buying pressure is visible.

Volume supports continuation.

This setup is high probability when supported by volume (which is clearly rising).

✅ 3) Stop Loss (SL)

Your SL below 13.05 – 13.10 is perfect because:

It sits below the wedge structure.

If price returns below this level, the breakout becomes invalid.

This is the correct technical placement.

✅ 4) Take Profit (TP) Projection

Your TP zone around 13.70 – 13.80 is realistic and matches:

Previous major support turned resistance.

Measured move of wedge height placed at breakout.

High-volume node from earlier.

✔ Expected targets:

TP1 → 13.48 (first resistance)

TP2 → 13.68 (upper range)

TP3 → 13.78–13.80 (full wedge target)

✅ 5) Market Behaviour to Expect

After a falling wedge breakout, price typically:

Breaks the trendline ✔

Pulls back slightly to retest the breakout level

Then accelerates upward toward targets

#AVAXUSDT: Targeting $60 Long Term View! Swing TradeThis crypto pair has a big potential of going back to its previous all time high, in our opinion price should reverse from $9 to $10 that area looks more appealing. We expect a swing volume to kick in the market.

Use accurate risk management while trading cryptocurrency. Like and comment for more.

Team Setupsfx_

AVAX/USDT - Heads Into Major Demand Zone — Bounce or Breakdown?AVAX is currently standing at one of its most critical decision points since 2023. After failing to hold its multi-year ascending trendline, the price finally broke down and closed the weekly candle below the structural level at $15.7. This isn’t a normal correction — this is a signal that the market structure has shifted, and AVAX is entering a survival phase.

But the story is far from over. Price is now sliding into a zone that has historically acted as a deep accumulation region:

$10.7 – $8.5

This yellow block is where large-volume buyers previously stepped in during the 2022 crash and later consolidated before major moves.

The long wick sweeping into this zone indicates early buyer activity — but not enough to reclaim structural levels yet.

Right now, AVAX is in the middle of a high-timeframe battlefield between two major outcomes:

Bullish Reversal Scenario → Price reclaims $15.7 and climbs back above the broken trendline.

Bearish Breakdown Scenario → Price loses $10.7, falls deeper into the accumulation block, and risks testing historical lows near $5.7.

---

Bullish Scenario — (Reversal Trigger: $15.7)

A bullish reversal starts to form if AVAX can:

1. Bounce strongly from $10.7–$8.5, and

2. Close a weekly candle back above $15.7.

This would signal that significant accumulation has taken place and that smart money is re-entering the market.

Major upside targets become:

$20.80 → First structural resistance

$32.90 → Mid-range breakout

$54.30 → High-timeframe trend reversal confirmed

This is the “comeback path” for AVAX.

---

Bearish Scenario — (Breakdown Trigger: $10.7)

If AVAX fails to hold above $10.7 on the weekly, the long-standing demand zone collapses.

Downside implications:

Immediate drop toward $8.5

If $8.5 also breaks →

Price opens the door to a deeper decline toward the historical low around $5.7

This would confirm a major redistribution phase, not just a pullback.

---

Price Action & Market Structure

AVAX is forming lower highs and lower lows, confirming a weekly downtrend.

Breaking the ascending trendline marks a clear character shift.

The $10.7–$8.5 zone now acts as the final defense for bulls before entering a multi-year lower range.

Expect liquidity sweeps & stop hunts in this region — patience and weekly confirmation are key.

---

AVAX is now sitting inside a make-or-break zone that will determine its multi-month direction.

Hold $10.7–$8.5 → Potential strong reversal back toward $20–$30

Break below $10.7 → Deeper bearish continuation toward the $5.7 region

This is the type of price zone where professional traders wait for confirmation, not quick reactions.

---

#AVAX #Avalanche #CryptoTA #AVAXUSDT #TechnicalAnalysis #Altcoins #PriceAction #MarketStructure #CryptoOutlook #SupportAndResistance

AVAX on Track — Ready for a ComebackFor me, AVAXUSDT is starting to show clear signs of growth 🚀

The chart structure looks encouraging — I like the way bulls are slowly stepping in and building momentum for a potential move to the upside.

🎯 Target: 18,400

❌ Invalidation zone (stop): 16,789

Let’s see how the market plays it out — the setup looks promising!

⚠️ Disclaimer:

This is not a financial signal. Trade according to your own risk management and never trade without stop-losses.

💬 Drop your reactions and comments below — and hit follow if you’d like me to post regular updates and forecasts on AVAX!

AVAXUSDT – Critical Support Zone: Will Decide the Next Trend?Yellow Block (Support Zone): 21 – 17.5 (Weekly)

This zone is the bulls’ last stronghold, an area that has historically marked AVAX’s major turning points. Price has now returned to this critical region — and what happens next could define the next macro trend.

---

Market Structure & Big Picture

After a long downtrend since 2022, AVAX has entered a macro consolidation phase, ranging between $17.5 and $43.

The current movement sits right at the bottom of this range, making the upcoming weekly close extremely important.

Major Range: 17.5 – 43

Key Support: 21 – 17.5

Main Resistance: 28.7 – 32.7 → 43.1 → 58.3

Historical High: 127 – 147

Historical Low: 8.5

This yellow zone isn’t just a technical area — it’s a battleground between long-term accumulation and potential distribution.

Every time AVAX touched this region in the past, price rebounded significantly, suggesting a possible mid-term reversal opportunity if bulls defend it again.

---

Pattern & Technical Characteristics

The chart currently shows a sideways accumulation pattern over more than a year.

Each retest of the 21–17.5 zone has produced deep wicks and strong rejections — signals of institutional absorption or smart money re-entry.

However, if this support fails, it could trigger a structural breakdown and re-open the path toward the lower double-digit region.

Potential pattern formations:

Double Bottom (Reversal) if price bounces and breaks above 28–33

Descending Channel Breakdown if price loses 17.5 with a confirmed close

---

Bullish Scenario – “Bounce From The Abyss”

If the weekly candle closes above 21, the support remains intact — and this could mark the start of a strong reversal swing.

Bullish confirmation signals:

Strong rejection with long lower wick

Rising volume during recovery

Weekly close > 24

Upside targets:

1. 28.7 → First resistance zone

2. 32.7 → Structural breakout confirmation

3. 43.1 → Major swing target

4. 58.3 → Mid-term continuation goal

Potential gain: 35% up to 170% from current levels if the bullish setup plays out.

---

Bearish Scenario – “Breaking the Last Line of Defense”

If the weekly close falls below 17.5, it confirms a macro breakdown.

AVAX could enter a new redistribution phase, targeting 12.0 – 9.0, and possibly 8.5 if a market-wide capitulation occurs.

Bearish confirmation signals:

Weekly close < 17.5

High-volume selling pressure

Failed retest (17.5 flips into resistance)

This would shift the macro bias fully bearish, and patient traders might wait for a new accumulation phase at much lower levels.

---

Conclusion & Macro Sentiment

AVAX currently sits in a golden decision zone — the line between collapse and recovery.

As long as the price holds above 21–17.5, the potential for a macro rebound remains strong.

But a confirmed breakdown below that area would signal that the accumulation phase isn’t over yet, and the market might need one final washout before a full recovery.

---

#AVAX #AVAXUSDT #CryptoAnalysis #TechnicalAnalysis #WeeklyChart #CryptoMarket #AltcoinAnalysis #TradingView #SwingTrading #SupportAndResistance #Avalanche #CryptoReversal #MarketStructure #CryptoUpdate

AVAX : Under the priceHello friends

well, technically, this currency has hit its resistance and formed a double top pattern, and here we have found good and strong support, which can be purchased in stages with capital and risk management, and moved with it to the specified target.

From this perspective, you should note that this currency is currently trading below its intrinsic value, and given that it is a good project, there is a good opportunity to buy it with this decline.

*Trade safely with us*

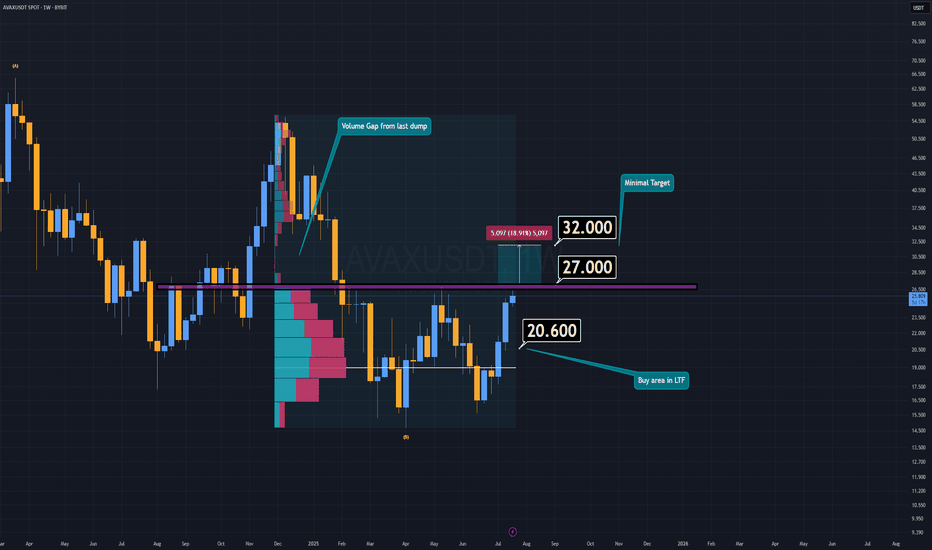

AVAX Analysis (1W)AVAX is currently attempting to form a double bottom pattern, which could signal a strong bullish reversal if confirmed. Earlier this week, AVAX made an effort to break down the key support/resistance zone, but it lacked the necessary volume to succeed.

If AVAX manages to reclaim the resistance area around $27 or higher, and confirms the breakout with a daily candle retest, the minimum target sits at $32.

However, if AVAX fails to break through resistance, there’s potentially an even better buying opportunity in the lower timeframes—a demand zone between $20 and $20.6.

I believe altcoins will offer another chance to catch up while prices are still far below their future valuations.

-S Wishes you the best in luck.

AVAXUSDT ; Did the buyers arrive?Hello friends

You see that the price has created a channel and broken it and has had a good growth and has created a channel again that buyers support. Still, and considering the sharp movement that we are seeing, it seems that the price can break this channel.

If it fails to break the channel in the first encounter, it can move to the specified support areas and then grow.

If the channel is broken, the price can move to the specified targets.

*Trade safely with us*

$AVAX Performing Bullish Ascending Triangle CRYPTOCAP:AVAX Performing Bullish Ascending Triangle

a continuation chart pattern in technical analysis that signals a likely breakout to the upside. It suggests that buying pressure is increasing, and buyers are becoming more aggressive, while sellers are losing momentum.

#AVAX/USDT : The Calm Before the Squeeze Storm#AVAX

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We have a bearish trend on the RSI indicator that is about to be broken and retested, which supports the upward move.

There is a major support area in green at 28.30, representing a strong support point.

For inquiries, please leave a comment.

We are in a consolidation trend above the 100 Moving Average.

Entry price: 29.10

First target: 29.41

Second target: 29.90

Third target: 30.50

Don't forget a simple matter: capital management.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

AVAXUSDT Forming Bullish MomentumAVAXUSDT is showing strong signs of bullish momentum as it continues to gather strength around key technical levels. The bullish momentum pattern suggests that buyers are gradually building control, setting the stage for a potential breakout. With solid trading volume backing the current market action, AVAX is well-positioned to push toward higher levels, and momentum traders are watching this closely for confirmation of trend continuation.

The projected expectation of a 90% to 100%+ gain reflects the strong upside potential that this setup presents. Once AVAXUSDT clears its near-term resistance levels, it could unlock rapid price acceleration, driven by increased demand and renewed investor confidence. Patterns of this nature often lead to explosive rallies as bullish sentiment fuels buying pressure.

Investor interest in this project continues to grow, signaling healthy market participation. The combination of strong volume, favorable technical indicators, and increasing community support makes AVAX one of the promising candidates for a major bullish run. If the current momentum sustains, AVAXUSDT could become a standout performer in the upcoming sessions.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

AVAX Price Hits 7-Month High, Seeks $1 Billion for Crypto FirmsAt the time of writing, AVAX is trading at $29.00 after rising 11.3% in a single day. The surge pushed the token to a 7-month high, though it is currently facing resistance at $30.00.

If investor enthusiasm holds, Avalanche could flip the $30.00 resistance into support, enabling a move toward $31.15 or higher. Sustained inflows and stronger correlation with Bitcoin would reinforce this bullish trajectory.

However, risks remain. If investors begin booking profits at current levels, AVAX could lose momentum. A dip to the $27.00 support or even further to $25.86 would erase much of the recent rally and invalidate the bullish thesis in the short term.