BAJAJ FINSERV – SELL CALL | Equity + F&O Strategy📉 BAJAJ FINSERV – SELL CALL | Equity + F&O Strategy🔥

SELL @ CMP: 2162

🎯 Targets:

• TP1 → 2140

• TP2 → 2120

⛔ Stop-Loss → 2188

Trade Type: Short-Term Positional / Intraday

⸻

📌 Technical Outlook

BAJAJ FINSV is showing bearish momentum after a failed breakout attempt near 2185–2195 zone.

Bearish confirmations:

✅ Price rejection from supply zone

✅ Lower-high structure forming — trend weakening

✅ Volume supported sell pressure on recent candles

✅ Banking & Financial sector sentiment soft → adds weight to downside

Break below 2140 likely to accelerate toward 2120 zone.

⸻

🔥 F&O View – Derivative Play

Index: F&O

Strategy: Short Futures OR Buy Put Options

Suggested contracts:

• 2150 PE / 2120 PE (weekly for faster move)

• Partial booking near 2140 is ideal ✅

Open Interest indicates short build-up, signaling smart money expectation of further decline.

⸻

⚠️ Risk Management

• Keep the SL strictly above 2188

• Book profits in parts if volatility expands

• Avoid chasing after a big drop — plan your entry

⸻

✅ Call to Action

If you like clear levels with price action logic —

Follow me for Daily Premium Setups 💼📊

Comment “DONE ✅” after entering the trade!

Bajajfinance

BAJFINANCE – SELL CALL | Equity + Futures Traders📉 BAJFINANCE – SELL CALL | Equity + Futures Traders Alert 🚨

Sell Zone: 1080 – 1087

🎯 Targets:

• TP1 → 1060

• TP2 → 1050

⛔ Stop-Loss: 1098

⸻

📌 Trade Logic

BAJFINANCE is rejecting resistance around 1085–1095 and forming lower highs, indicating weakening upside momentum.

Bearish reasons:

✅ Short-term trend turning negative

✅ Fresh selling visible near supply zone

✅ Sector sentiment weak – Financials under pressure

✅ Strong downside probability if price breaks 1060

⸻

🔥 How to Trade

Equity Traders:

→ Short delivery OR intraday sell setup

→ Book partial profits at 1060 ✅

Futures Traders:

→ Short Futures in the sell zone

→ Maintain strict SL @ 1098

→ Trail SL after TP1 is hit

⸻

⚠️ Risk Control

• Futures can move sharply, size positions carefully

• Don’t chase if price falls too fast — wait for pullback entry

• Booking profits in stages is always smart ✅

⸻

✅ Follow for More

If you love simple but powerful setups —

Follow me for daily Equity + F&O trades 🚀📊

Comment “SHORT ✅” if you entered!

BAJAJFINANCENSE:BAJFINANCE

One Can enter now!

Or Wait for a retest of the trendline(BO)!

Or Wait for a better Risk:Reward Ratio!

Note :

1. One should go long with a StopLoss, below the Trendline or the Previous Swing Low.

2. Risk :Reward ratio should be minimum 1:2.

3. Plan your trade as per the Money Mangement and Risk Appetite.

Disclamier : You are responsible for your profits and loss.

The idea shared here is purely for Educational purpose.

Follow back, for more ideas and thier notifications on your email.

Support and Like incase the idea works for you.

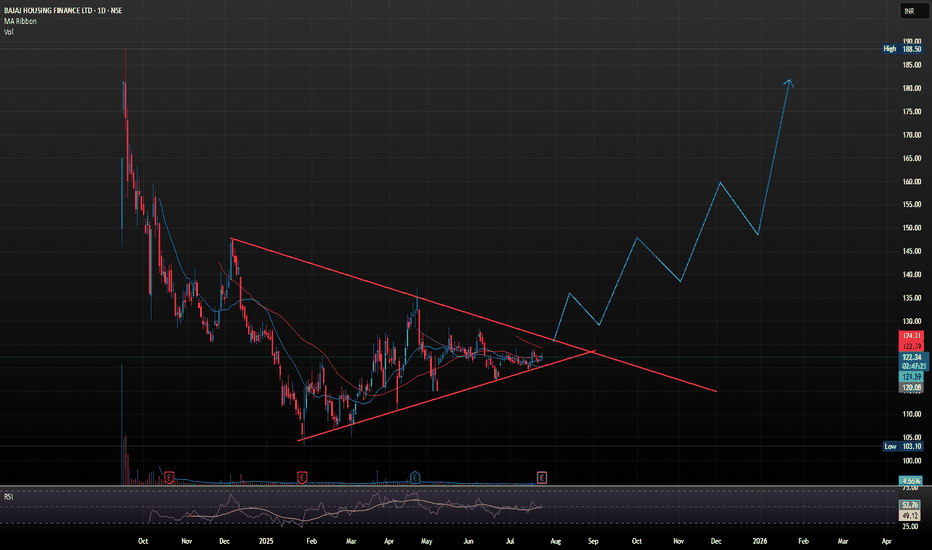

BAJAJ HOUSING FINANCE LTD GOOD TIME TO PICK IT Bajaj Housing Finance Ltd. (BHFL) is a prominent non-banking financial company (NBFC) in India, specializing in housing-related finance. It's a subsidiary of Bajaj Finance Ltd., and has been classified as an Upper-Layer NBFC by the RBI under its Scale-Based Regulations.

📊 Latest Financial Highlights (Q1 FY26 Preview)

- Assets Under Management (AUM): 1.2 lakh crore, up 24% YoY and 5% QoQ

- Loan Assets: 1.05 lakh crore, up 24.2% YoY

- Disbursements: 14,640 crore, up 22% YoY

- Net Profit (PAT): Expected to rise 19–21% YoY to 574–584 crore

- Net Interest Income (NII): Estimated to grow 24–28% YoY to 827–851 crore

- Net Interest Margin (NIM): Projected at ~3.2%, slightly compressed due to rate cuts

The company is well-positioned to benefit from the rising demand for housing loans, as more people seek to buy homes. With a focus on technology and customer service, BHFL is likely to enhance its operational efficiency, attracting more clients and growing its market share. As a result, the stock price of BHFL could rise, with steady growth by its expanding loan portfolio and strong brand recognition. In 2026, its share price target would be 253, as per our analysis.

SHORT TERM VIEW

entry - 119.50-123

stop loss - 117.60

target - 135-140

BAJFINANCENSE:BAJFINANCE

One Can Enter Now ! Or Wait for Retest of the Trendline (BO).

Note :

1.One Can Go long with a Strict SL below the Trendline or Swing Low of Daily Candle.

2. Close, should be good and Clean.

3. R:R ratio should be 1 :2 minimum

4. Plan as per your RISK appetite

Disclaimer : You are responsible for your Profits and loss, Shared for Educational purpose

Bajaj Finance - Complex Cup & HandleAmazing opportunity in an amazing business.

Bajaj Finance had broken out of a complex cup & handle pattern and have fallen since with the falling market.

The fundamentals in my views are ever strong and the financial performances are unparalleled.

The valuations are around the all-time low.

This isn't a buy call and should be considered as a source of learning to make technical and fundamental analysis in stock markets.

Bajaj Finance Breaks All-Time High After 2+ Years: What’s Next.?Bajaj Finance has surpassed its previous all-time high of 8,080 rupees, fueled by robust buying activity amidst optimistic projections of rising consumer demand and a potential reduction in RBI interest rates. Traders may want to consider initiating a long position if the stock retests the 8,140 level. However, it is important to note that setting specific price targets may not be feasible at this time, as the stock is currently in a price discovery phase.

Bajaj Housing Finance AnalysisNSE:BAJAJHFL

Technical Analysis : You can get an Idea about the potential move from the given chart if the price follows the price action and market sentiment remain bullish.

Fundamental Analysis :

Key Financial Data:

1. **Share Price**: ₹129.56.

2. **Market Capitalization**: ₹1,07,899 crore.

3. **Earnings Per Share (EPS)**: ₹2.65.

4. **Revenue (FY2023-24)**: ₹7,617 crore (34% growth YoY).

5. **Profit After Tax (FY2023-24)**: ₹1,731 crore (38% growth YoY).

6. **Total Assets**: ₹81,827 crore.

7. **ROE (Return on Equity)**: 3.78%.

### Analytical Valuation Models:

Using a combination of financial models to estimate the fair value:

1. **Discounted Cash Flow (DCF) Analysis**:

Assuming moderate growth in free cash flows and using an estimated discount rate (WACC), the DCF valuation suggests a fair value of **₹140 per share**.

2. **Comparable Company Analysis (CCA)**:

Analyzing peers like LIC Housing Finance and Housing Development Corporation, Bajaj Housing Finance appears fairly priced in the **₹125–₹135 range** based on its P/E and P/B ratios.

3. **Precedent Transactions Analysis**:

Benchmarking against recent acquisitions in the housing finance sector, a fair value of **₹135 per share** is plausible.

4. **Dividend Discount Model (DDM)**:

Given the company’s limited dividends, this model is less applicable as it skews conservative with a valuation below **₹100**.

5. **Gordon Growth Model (GGM)**:

Factoring the modest dividend growth, the GGM valuation estimates **₹120 per share**.

6. **Financial Ratios**:

- **P/E Ratio**: Trading at 7.11x earnings.

- **Fair Value**: ₹130 per share based on earnings growth.

7. **Price/Earnings to Growth (PEG) Ratio**:

Considering robust profit growth (38% YoY), the PEG method supports a valuation of **₹140 per share**.

8. **Residual Income Model**:

Using the ROE and cost of equity, the fair value aligns near **₹135 per share**.

9. **Economic Value Added (EVA)**:

Assessing the company’s ability to generate returns over its cost of capital, EVA-based valuation gives **₹138 per share**.

Summary Table:

| **Model** | **Fair Value (₹)** |

|----------------------------------------------|---------------------|

| Discounted Cash Flow (DCF) | 140 |

| Comparable Company Analysis (CCA) | 125–135 |

| Precedent Transactions | 135 |

| Dividend Discount Model (DDM) | 100 |

| Gordon Growth Model (GGM) | 120 |

| Financial Ratios | 130 |

| PEG Ratio | 140 |

| Residual Income Model | 135 |

| Economic Value Added (EVA) | 138 |

**Average Fair Value**: ₹133 per share

**Current Price**: ₹129.56

**Upside Potential**: ~2.66%

Conclusion:

Bajaj Housing Finance Ltd. is currently trading close to its estimated fair value. While not significantly undervalued, it offers stability and modest growth potential, suitable for long-term holding in portfolios focused on housing finance or related sectors.

Disclaimer: This analysis is for informational purposes only. Please consult a financial advisor before making investment decisions.

INVESTMENT IDEA - BAJAJ FINANCE Bajaj Finance , a major financial services provider in India, showcases a promising investment setup supported by both technical and fundamental strengths.

Technical Reasons :

Trend Line Support: The stock is holding above a long-term trend line, indicating resilience and potential for an upward move.

Intact Trend: Continuous higher highs and higher lows signal that the bullish trend remains intact.

Doji and Inside Candle Pattern on Weekly: This pattern suggests a possible reversal or continuation, highlighting a period of consolidation with potential for breakout.

Fundamental Reasons :

Record Revenue and Net Profit: Both metrics are at all-time highs, underscoring the company's financial strength.

Attractive Valuation: With a current 10-year PE ratio of 27.9, Bajaj Finance trades below its 10-year median PE of 45.4, suggesting it is undervalued relative to historical standards.

Solid Growth and Returns: The company boasts a 24% compounded sales growth rate, an ROCE of 11.9%, and an ROE of 22.1%, reflecting effective utilization of capital and profitability.

These combined factors make Bajaj Finance an attractive long-term investment option, with technical support for entry and solid fundamentals for sustained growth potential.

Bajfinance Intraday Levels: 23-Sep-24 Stock taken support from 4570-4500 and move upside & formed triangle wait for breakout of triangle or rejection from support for upside momentum. Else breakout Downside below 4560 drag price for Down

Bullish> 4600

Bearish< 4560

Use SL trailing method to secure profits

BAJAJ HOUSING FINANCE INTRADAY RANGECurrently, BAJAJ HOUSING FINANCE is trading within a specific price range as indicated above. It is advisable to wait for a significant price movement either above the upper limit (breakout) or below the lower limit (breakdown) of this range before considering further trades. It's worth noting that since BAJAJ HOUSING FINANCE was listed just 2 days ago, there is limited historical data available for conducting a comprehensive technical analysis.

Bajaj Finance - Hidden Gem?Bajaj Finance is a company of the prestigious Bajaj group. It is the largest NBFC company of India. It has the lowest NPA among NBFC companies as the largest customer of the company is Bajaj Auto which is another group company of Bajaj Group. The company is continuously increasing its market share and onboarding new customers.

The P/E ratio of the company is at 27.33 which is very less than the 20 year median P/E of 45.6.

The company is constantly increasing its quarterly and yearly revenue and net profit.

The company has significantly decreased its Net NPA from 1.46% in June 2021 to 0.38% in June 2024 which shows the good performance of the company.

The ROE is 22.12% which is considered excellent for NBFC segment stocks.

Regardless of such extraordinary performance and financials the company is trading at the same levels at which it was trading 3 years ago. It is a golden opportunity to invest in this stock at this point of time for long term as it may go 3-4 times up from this level.

I am not a SEBI registered analyst.

Please do your own analysis before investing.

Do like and follow and share among your friends and family.

Thank you.