Bitcoin-trade

Gold Compresses in a Range - The Breakout Will Not Be Random🔹 MARKET BRIEFING – XAU/USD (1H)

Market State:

– Price is moving sideways after a strong impulsive rally, forming a clear range structure between a well-defined support zone and a resistance zone.

– The current price action shows controlled consolidation, not distribution, indicating the market is waiting for a catalyst rather than reversing.

Key Technical Structure:

– Support Zone: ~4255–4265

– Resistance Zone: ~4345–4360

– Price is respecting both boundaries, creating higher lows into resistance — a classic compression before expansion setup.

Market Bias:

– Neutral to bullish while price holds above the support zone.

– The sideways movement reflects absorption, not selling pressure.

🌍 Macro Context – Why Gold Is Ranging

– Federal Reserve: Markets are pricing in a wait-and-see stance from the Fed. Rate expectations are stable, limiting directional momentum in USD.

– US Yields: Bond yields have stalled after the recent move, removing immediate pressure on gold.

– Risk Sentiment: Equity markets remain mixed, keeping gold supported but not aggressive.

→ This macro balance explains the range-bound behavior seen on the chart.

Next Move:

– As long as price continues to hold above the support zone, the structure favors an upside breakout.

– A clean break and acceptance above the resistance zone would likely trigger a continuation leg toward higher liquidity targets.

– Failure to hold the support zone would invalidate the bullish structure and shift focus back to deeper demand levels.

Bottom Line:

– Gold is not weak it is waiting.

– The current sideways phase is a preparation zone, and the breakout direction will align with the next macro impulse rather than random price noise.

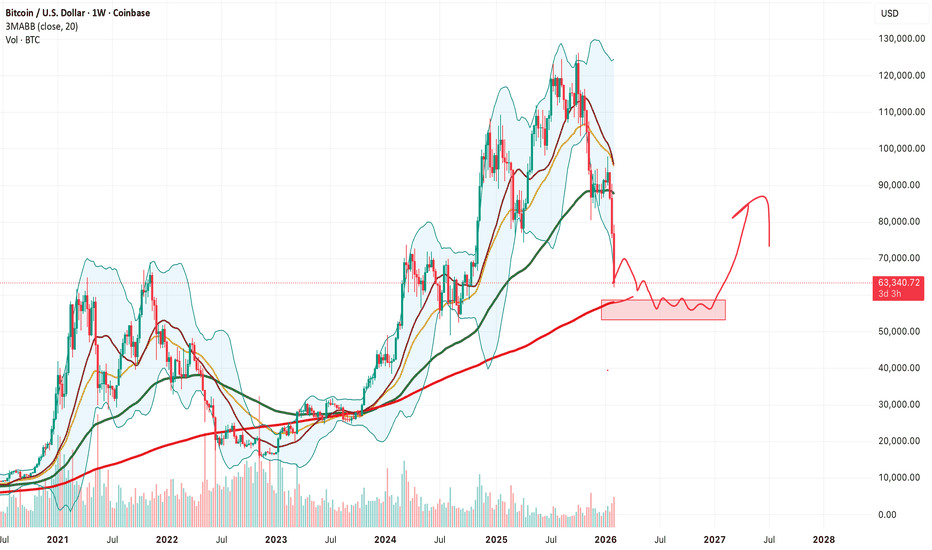

Bitcoin – Technical Outlook

🔹 Key Zone: 101,500 – 104,500

At the moment, price is trading within this key zone where strong buying and selling activity is taking place — a critical area that will likely determine the next major move.

🟢 Bullish Scenario (Uptrend)

If price breaks above and holds above 104,500, this would confirm a continuation of bullish momentum.

In that case, price is expected to move higher toward 120,040, with further potential extension toward 125,567.

📈 This zone is an important confirmation area that could signal the beginning of a new bullish leg.

🔴 Bearish Scenario (Downtrend)

However, if price drops below and stabilizes under 101,500, this would indicate a potential bearish reversal.

In that case, the price may move downward toward the support zone at 97,700 – 93,400.

Breaking below this area would confirm further bearish extension toward 88,080.

📊 Summary:

Currently, Bitcoin is trading inside the key zone (101,500–104,500).

A breakout above or below this range will likely define the next strong market direction — whether a bullish continuation or a deeper bearish correction.

Recession's here? Don't fear, Gold signifies the new frontier.Gold monthly setting up for an explosive upward move in relation to forex bulletins and potential global bifurcation.

GLong

Bitcoin (BTC/USD) – Bullish Breakout in Progress📈 Chart Pattern:

Bitcoin has been trading inside a descending channel for several weeks. Recently, BTC has broken out of the channel’s upper boundary, indicating a potential shift in momentum.

🔹 Key Levels:

Support: $80,043.75 (Critical stop-loss level)

Resistance: $87,500 (Short-term)

Target: $92,944.17 (Upside projection)

📊 Trading Plan:

BTC might retest the breakout zone before continuing the upward move.

A confirmed higher low formation could signal strong bullish momentum.

If BTC remains above $85,500, further upside toward $92,944.17 is possible.

⚠️ Risk Management:

If BTC drops below $80,043.75, the bullish setup could become invalid.

Traders should wait for confirmation before entering long positions.

💡 Conclusion:

This breakout could lead to a strong uptrend, but traders should watch for a successful retest before making a move. 🚀🔍

BTC/USDT SELL/SHORTbitcoin can move down

In this analysis, we are observing the potential repetition of market history by comparing the current Bitcoin price action to the previous bearish cycle. By utilizing Fibonacci retracement levels, historical patterns, , we can formulate a hypothesis that the market might follow a similar trajectory if bearish sentiment prevails.

Technical Analysis for Numerico (NWC/USDT) + TRADE PLANTechnical Analysis for Numerico (NWC/USDT)

The price is showing a breakout potential at the top of the channel, which may signal a trend reversal.

Descending Channel Pattern:

Resistance: The upper trendline shows where the price has faced rejection multiple times. The resistance level is gradually declining.

Support: The lower trendline indicates strong support, where buyers have consistently entered the market, preventing further decline.

Breakout Potential:

The price appears to have tested the upper trendline of the channel. The arrow pointing upward suggests the possibility of a breakout above the descending resistance, which would indicate a bullish reversal.

Indicators:

Volume: A spike in volume supports the possibility of the breakout. A breakout with increased volume is generally a stronger confirmation of the trend change.

VMC Cipher B: This momentum oscillator shows a shift from negative to positive momentum, implying that the buying pressure is gaining strength.

RSI (14): The Relative Strength Index is around 58.66, indicating that momentum is neutral to slightly bullish. RSI above 50 usually signals increasing buying pressure.

Stochastic RSI: The stochastic RSI is currently in the overbought zone (91.21), which might signal some short-term correction, but the overall momentum remains strong.

HMA+ Hist: HMA (Hull Moving Average) shows that the histogram is close to zero but shifting upward, which could imply a possible change in trend direction soon.

Support and Resistance Levels:

Immediate Support: $0.0719 (marked by the horizontal blue line).

Resistance Zone: Around $0.0753 (upper edge of the channel).

Great Entry Point: The label indicates that a long entry is ideal around the breakout zone, with an upward arrow suggesting that this level ($0.0721) could offer a solid risk-reward ratio for buyers entering before a potential upward movement.

Trading Plan

Entry Point:

Enter the trade at the breakout above $0.0721 (highlighted as the "Great Entry Point"). If the price closes above this level on the 4-hour timeframe with significant volume, it will confirm a bullish breakout.

Stop-Loss:

Place a stop-loss slightly below the recent support of $0.0719, at approximately $0.0690, to minimize risk in case the breakout turns into a false breakout.

Profit Targets:

First Target: $0.0800 – This level aligns with a previous resistance zone and would be a conservative target for short-term traders.

Second Target: $0.0850 – If momentum remains strong, the price may continue toward this higher level of resistance, providing a larger reward.

Risk Management:

Ensure a risk-to-reward ratio of at least 2:1. For example, if the stop-loss is set at $0.0690 (risk of approximately 3%), aim for the first target at $0.0800 (a reward of approximately 10%).

Use position sizing techniques to risk only 1-2% of the portfolio per trade, to ensure long-term sustainability and avoid major losses in case of unexpected market moves.

Monitoring & Adjustments:

Watch for volume confirmation during the breakout. If the volume diminishes, consider closing the position early, as it may signal a weakening breakout.

Adjust the stop-loss to breakeven once the price hits the first profit target, ensuring a risk-free trade for the remaining portion of the position.

Conclusion:

The technical analysis for NWC/USDT suggests a bullish breakout from the descending channel pattern, with indicators supporting a potential upward move. Entering at the breakout level of $0.0721 with proper risk management offers a promising opportunity, especially with a positive shift in momentum.

BTCBTC mitigating Daily timeframe order block to moving upside. Next Bitcoin mitigate order block (3) to moving upside is high possible.

Order block (2) was sell side order block. So some downside correction possible. If the order block (2) was fail, bitcoin moving upside.

Bitcoin mitigating Daily timeframe order block. So the Trend reversal was high possible. But $62800 is best support zone. Maybe Bitcoin moving downside to touch the support to moving upside is high possible.

BTCBTC mitigating orderblock (1) to moving downside. Order block (2) was already work. So this time it was fail high possible.

Order block (4) was next sell side order block. If this order block was fail, bitcoin moving upside and sweep the swing high (💀) to moving downside.

Next $63100 is possible support area.

Potential BTCUSD Reversal and Downtrend from ResistanceAnalysis Overview:

In this analysis, we observe a potential reversal pattern for BTCUSD based on the 4-hour chart. The price is approaching a significant resistance zone, indicating a possible turning point.

Key Points:

Swing High & Lower High: BTCUSD has formed a recent swing high followed by a lower high, suggesting weakening bullish momentum.

Resistance Zone: The price is nearing a critical resistance area marked by the PREVIOUS monthly ATH and the 4-hour FVG.

Bearish Order Block: The red zone indicates a bearish order block, which could act as a strong resistance.

Possible Scenarios:

Rejection and Downtrend: If BTCUSD gets rejected at the resistance zone, we could see a decline towards the swing low and potentially further down.

Break and Continuation: Conversely, a break above the resistance could invalidate the bearish outlook and suggest further bullish movement.

Trade Idea:

Short Entry: Around 70,000 USDT.

Target: Initial target at 55,000 USDT.

Stop Loss: Above the resistance at 72,000 USDT.

Conclusion:

This analysis highlights a potential short trade opportunity based on the identified resistance zone and bearish order block. The targets and stop loss levels are clearly stated to manage risk effectively. Please ensure to conduct your own research and consider the market conditions before taking any trade.

✅TRADE REVIEW: $JASMYUSD- Opening a position.

- Very risky so I have positioned sized accordingly

- Very tight stop as well

I want to see this GO right away and have no patience

It is a lower quality name in an uncertain market.

I see above average volume moving up.

Consturctive pattern.

If you are aware of the High Tight Flag (or PowerPlay) concept in stocks, I use this analogy when I trade crypto. The HTF requires a +100% move up (powerful) and less than 20% correction - indicating stong buyers piling into the stocks. I extrapolate this logic into the more volatile crypto names as I would like to see less than 20% retracement of the gain. To explain further, JASMYUSD has soared +450% since Feb2024. I would take 20% of 450% and allow this stock to correct up to 90% to be a valid base. Currently it has corrected only 40% and is staring to move up with great volume patterns. Hence why I have been willing to risk capital into this TRADE.

✅ +27% PROFIT TRADE REVIEW: $TONUSDT part 2- TON is acting great

- It is a good place to improve the worst case scenario and move stop loss

- I would protect +15% guaranteed win on the position IF i have not sold before (READ PREVIOUS ALERTS I OFFERED A FEW SCENARIOS HOW TO PROTECT GAINS)

- If you sold half already at +25% Profit, then you can keep previous stop at +10% and give it more room to play out (I generally prefer to move stop loss and 'choke' the position out)

✅ +24% PROFIT TRADE REVIEW: $TONUSDT- Coin continues to move up, today it soared +24% profit

- When a position makes such move, I start to aggressively protect and guarantee myself a profit.

- I would advise 1 of 2 things:

a) raising Stop loss to +10%

OR

b) sell half and keep original stop

a) or b) depend on your goals, risk torrelence and profit targets

DENT - Huge potential after the breakout BINANCE:DENTUSDT (1D CHART) Technical Analysis Update

DENT is currently trading at $0.00150 and showing overall bullish sentiment and looking to breakout from the resistance.

Once the resistance is broken we can expect the price to reach the next target around 0.002200 and the another resistance is around 0.004014

Entry level: $ 0.001500 (after candle close above this price)

Stop loss level: $ 0.001178

Target 1: $ 0.001682

Target 2: $ 0.001997

Target 3: $ 0.002400

Target 4: $ 0.003211

Target 4: $ 0.004014

Max Leverage: 3x

Don't forget to keep stop loss.

Follow Our TradingView Account for More Technical Analysis Updates, | Like, Share and Comment Your thoughts.

Cheers

GreenCrypto

BTC Bitcoin Strong Bullish Will Rise to 37000,46000 and 71000USDBTC Bulls to Retarget $31,500

BTC could be in for a choppy session as investors consider the chances of SEC approvals for the ETFs and US inflation in focus.

the crypto news wires provided much-needed support. News of Fidelity filing for a spot Bitcoin Exchange-Traded Fund (ETF) was the key to the bullish session.

This morning, BTC was down 0.03% to $30,524. A bearish start to the day saw BTC fall from an early high of $30,534 to a low of $30,507.

Looking at the EMAs and the 4-hourly candlestick chart (below), the EMAs sent bullish signals. BTC sat above the 50-day EMA ($30,032). The 50-day EMA pulled further away from the 100-day EMA, with the 100-day EMA widening from the 200-day EMA, sending bullish signals.

A hold above S1 ($30,158) and the 50-day EMA ($30,032) would support a move through R1 ($30,882) to give the bulls a run at R2 ($31,232). However, a fall through S1 ($30,158) and the 50-day EMA ($30,032) would bring S2 ($29,784) into view. A fall through the 50-day EMA would send a bearish signal.

Resistance & Support Levels

R1 – $ 30,882 S1 – $ 30,158

R2 – $ 31,232 S2 – $ 29,784

R3 – $ 31,956 S3 – $ 29,060

Strategy Bullish

3Lots

2 Lots will be excecuted at Profit Target Zones

1Lot will follow the Trend

It will be only!!! excecuted ,if Bullish Trend changes

The stops will be delivered as soon as possible to break even,better some pips above the Buyinh price

I have marked my profit targets

Psychology:

1:The price is always right

2The Market is alwas right

3 The Chart is always right

4 IGNORE THE NEWS; Plan your trades and trade your plan.

5Drawdowns are partof the game

6 Risk management and money mangement is King!

7 wHATEVER HAPPENS;sTICK TO YOUR PLAN!

8 In a bear market no price is weak enough

9 In a bull market no price is strong enough

10 Patience !Wait for confirmation: Control emotions and tensions.