BCH/USD :: Trend Continuation Scenario in Play🔥 Title: BCH/USD 📈 Professional Bullish Swing Setup – Layered Entry Thief Strategy 🚀

🔔 Asset: Bitcoin Cash vs U.S. Dollar (BCH/USD) – CRYPTO MARKET

A high-probability Bullish pathway trade idea with multi-layer limit entries and technical confluence.

📊 Trade Plan — Structured & Strategic

Market Bias: Bullish confirmed with Hull Moving Average pullback validation + momentum structure forming higher lows.

Strategy Style: Thief Layered Limit Entries (multiple bull layers) using precise limit orders to scale in smoothly and reduce risk.

💡 Layered Entry Levels (suggested):

🎯 630 | 📍 640 | 🟢 650

➡️ Add more layers based on your risk management & market depth.

Entry Logic:

Multiple limit orders stacked to capture demand zone strength — aim to accumulate with discipline rather than chase.

🎯 Targets & Key Zones

🚀 Primary Target: 700 — psychological + technical resistance zone.

⚠️ Major resistance confluence likely near 700+ from volume profile & overbought signals.

💡 TIP: Take partial profits at earlier minor levels (e.g., 675, 690) to lock gains.

🛑 Risk Control

⚡ Stop-Loss Base: 620 (discipline zone)

Always adjust SL based on volatility & time frame — trade your plan, not my screen.

⚠️ Risk disclosure: This is guidance, not financial advice. YOU choose SL & TP based on YOUR risk comfort.

🔗 Correlation & Pairs Watchlist

Watch closely for correlated moves:

📌 BTC/USD – leads broad sentiment & liquidity moves

📌 ETH/USD – risk-on reference for alt strength

📌 XRP/USD – often shows early breakout continuation

Correlation Insight:

When BTC rallies or breaks key levels → BCH often follows with amplified volatility due to liquidity shifts and shared trader flows.

📈 Technical Signals & Clues

✔ Pullback to Hull MA indicates healthy correction

✔ Structure higher lows building demand base

✔ Volume inflow at key levels supports continuation bias

🌍 Fundamentals + Macro Drivers (London Time)

📌 Institutional adoption catalysts: Major bank filings for crypto ETFs (Bitcoin, Solana) signals deeper traditional finance entry, boosting sentiment across alts.

📌 Macro liquidity & regulation: Crypto markets in 2026 are shaped by clearer regulation and growing institutional flows, influencing asset allocation behaviors.

📌 Global crypto policy shifts:

– UK crypto regulatory proposals aim for clarity & investor protections.

– Italian financial review on crypto risk highlights macro prudential focus.

📌 Crypto vs macro environment:

Risk assets like BCH react to central bank policies (rates & liquidity). Lower rates or easing liquidity often support bullish moves in crypto.

📌 Market sentiment flashes: Leading players debate whether 2026 will sustain a bullish trend or stay range-bound — sentiment catalysts are hitting crypto each session.

🚀 Why This Is Not a Boring Idea

✅ Multi-layer strategy gives entry flexibility

✅ Includes macro + fundamental watch factors

✅ Designed for engagement (clarity + actionable steps + fun tone + emojis)

✅ Comparative market drivers explained for broader context

📣 Final Note to Traders:

Be adaptive — markets can surprise. If you take profit early on strength, that’s winning. If you tighten your stop after entry, that’s smart. Trade with discipline & evolve your style. 🚀📊

Bitcoincashforecast

Bitcoin Cash Tests Fragile SupportFenzoFx—Bitcoin Cash is in a bear market, down 6.50% since yesterday, now trading near $490.20. BCH is still holding above the ascending trendline, but this support has been tested five times, making it fragile.

Technically, further downside is expected. A break below $469.10 could trigger a deeper decline toward $437.60. If selling pressure continues, $421.80 may be targeted. The bearish outlook remains intact while the price stays below the key resistance at $541.30.

BCH Correction Within Bearish StructureFenzoFx—Bitcoin Cash remains above the ascending trendline and $446.60 support. The price has entered the inverted fair value gap, which may act as strong resistance and cap further upside. The primary trend is bearish below $576.00, and current bullish momentum is likely corrective.

BCH could rise toward $541.30 before resuming its downtrend. If bearish pressure returns, the next target is $427.00. The ascending trendline has been tested five times, making it fragile. A close above $576.00 would invalidate the bearish outlook. Key levels to monitor for bearish setups are $541.30 and $576.70.

BCH Bearish Setup Below $545.00FenzoFx—Bitcoin Cash is trading around $485.00 in a bearish market, with pressure easing after hitting minor support at $465.00.

The current momentum uptick may be short-lived, as price tends to fill liquidity voids between $489.00 and $507.00. Bearish setups could emerge within this zone. If confirmed, BCH may target $446.00, followed by $427.00 and $408.00.

The bearish outlook remains valid while price stays below the $545.00 bearish order block.

Bitcoin Cash Faces Resistance at $568FenzoFx—Bitcoin Cash closed bearish after testing the $568.7 resistance. BCH is now trading near $555.0, inside the bearish fair value gap. The market outlook remains bearish as price closed below the bullish channel, with $568.0 acting as key resistance.

If this level holds, BCH/USD may dip toward $515.0. A close and stabilization above $568.0 would invalidate the bearish setup and suggest a bullish move toward $615.0.

BCH: Weak Volume Signals Pullback Risk FenzoFx—Bitcoin Cash is trending upward after tapping $606.80 buy-side liquidity in early October. Despite higher highs, the cumulative volume profile shows lower lows, signaling weak buying interest.

The first manipulation occurred after exiting the accumulation zone (purple box), but price held above its mean threshold. A dip below $580.10 is expected to sweep liquidity. If BCH rebounds with a bullish engulfing pattern, the next target is $650.90.

However, if price closes and stabilizes below $580.10, the bullish outlook is invalidated, and BCH may drop toward equal lows at $533.40.

BCH: Cumulative Volume Delta Signals Potential UpsideFenzoFx—Bitcoin Cash (BCH) is consolidating within the bullish fair value gap, supported at $551.80 and trading at $560.00, up 0.48% today. Despite a new lower low, volume remains bullish, suggesting the current bearish momentum may be consolidation rather than a downtrend.

Immediate resistance is at $570.20. If price closes and stabilizes above this swing high, BCH/USD could form a bullish wave toward $594.00.

Bitcoin Cash Holds Bullish StructureFenzoFx—Bitcoin Cash slipped nearly 3.00% after approaching $607.60, now trading around $586.00.

The bullish outlook holds while BCH stays above the inverted fair value gap, with key support at $568.00.

Consolidation near or within the FVG is expected before a potential rebound. If the mean threshold holds, BCH could aim for $626.00.

A drop below $568.00 would invalidate the bullish scenario.

BCH Consolidates Below $620 HighsFenzoFx—Bitcoin Cash is consolidating after forming equal highs at $620.0. While the trend remains bullish, the current phase may push toward lower support.

Equal highs signal low liquidity, often followed by a move to lower levels before a rally. The bullish order block at $514.0 is a key discount level, offering a potential entry for buyers targeting $640.0 resistance.

If BCH closes below $514.4, consolidation could deepen toward $482.1.

Bitcoin Cash: - Bearish Setup Awaits Liquidity SweepFenzoFx—Bitcoin Cash continues its bullish momentum, currently trading around $609.5. The uptrend is expected to persist, with BCH targeting the December 2024 high of $640.0.

Once liquidity above this level is cleared, bearish setups may will likely come into play.

Bitcoin Cash Breaks Structure With Bullish MomentumFenzoFx—Bitcoin Cash remains bullish, trading back above the VWAP from July 24 near $582.9. Today’s breakout above $572.6 featured a strong bullish engulfing pattern, leaving a fair value gap now under test.

The outlook favors revisiting the $607.0 high, and with the trend still positive, it’s advisable to leave a runner open. A further rally toward $630.0 remains likely if momentum persists.

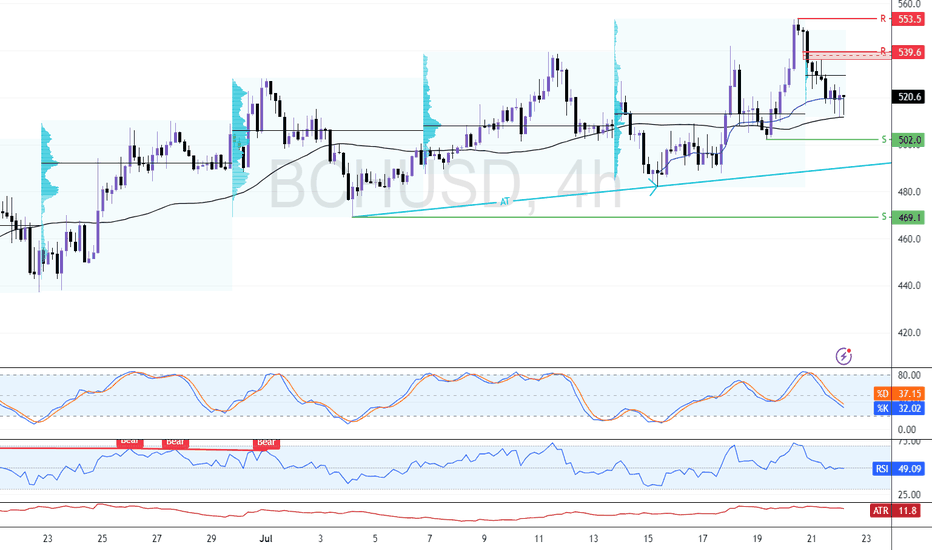

BCH/USD: Bullish Momentum Builds Near Key Volume ZoneFenzoFx—Bitcoin Cash is testing last week's volume point of interest, with bullish long-wick candlesticks signaling buyer strength on the 4-hour chart.

As long as BCH/USD holds above the ascending trendline, the price may rise toward the bearish FVG at $539.6, then target the previous high at $553.5. If the trendline fails, downside momentum could extend to $469.1.

BCH Eyes $600.0 on Bullish Continuation SetupFenzoFx—Bitcoin Cash remains bullish, consolidating above the ascending trendline after reaching $539.5. The price is pulling back toward the $469.1 support, which could trigger a new bullish wave if it holds. In that case, BCH may target the bearish fair value gap near $600.0.

However, if BCH/USD closes below $469.1, the current momentum dip could extend toward $437.0.

Bitcoin Cash Tests $528.3 as Double Top FormsBitcoin Cash faces resistance at $528.3, forming a double top and trading slightly below this level. Stochastic readings above 80.0 signal an overbought market, increasing the risk of a correction.

If BCH fails to break above $528.3, a pullback to $514.1 and $500.0 is likely, offering potential bullish re-entry zones. Alternatively, a confirmed breakout above $528.3 could pave the way toward the next supply area at $560.0.

Bitcoin Cash Slips After Rejecting $516.0 FVGFenzoFx—Bitcoin Cash start consolidating after testing the bearish FVG at $516.0. The primary trend remains bullish above $500.4.

A test of the Bullish FVG and point of interest at $500.4 is expected. If this support holds, BCH may rebound and retest resistance at $506.0.

Bitcoin Cash Tests $500.4 Resistance After Strong ReboundFenzoFx—Bitcoin Cash rebounded from $469.1, a demand zone backed by the anchored VWAP and ascending trendline. BCH is now testing resistance at $500.4, supported by volume profile and anchored VWAP.

Bullish Scenario : While the bullish trend remains intact above $469.1, consolidation toward $480.0 is likely before aiming for $528.3.

Bearish Scenario : A close below $469.1 would invalidate the bullish scenario, exposing $437.0 as the next support.

Bitcoin Cash Rebounds from VWAP-Backed SupportBitcoin Cash eased from $528.3 to $469.8, finding support backed by the anchored VWAP and ascending trendline. BCH trades at $485.0, with Stochastic at 17.0 signaling oversold conditions.

A bullish wave may emerge if $469.8 holds, targeting $500.0 and $515.2.

Bitcoin Cash Slides as Bearish Signals StrengthenBitcoin Cash fell below last week’s low and now trades around $506.8. Technical indicators show bearish signals, with RSI diverging and the Stochastic trending lower.

BCH/USD may retest support at $487.3; if broken, it could slide to $469.8. The bearish outlook is invalidated if price closes above $528.2.

BCH Faces Pullback RiskFenzoFx—Bitcoin Cash broke above last week’s high at $510.0 and is stabilizing near $525.0. However, the daily Stochastic is overbought, suggesting a pullback toward the 50-SMA at $487.4.

A rebound from there could resume the uptrend, while a close below $487.4 may send BCH toward $437.0.

BCH Faces Resistance at $500.0 Amid Bearish SignalsBitcoin Cash rose to $500.0, a resistance zone backed by the June 19 high. Stochastic reads 85.0, indicating short-term overpricing.

The 4-hour chart shows a possible double top pattern, suggesting consolidation. If BCH stays below $500.8, it could target $494.8 and, if selling continues, drop to $480.9.

Bitcoin Cash Faces Pressure Below Key Resistance ZoneFenzoFx—Bitcoin Cash rose from $437.0 support, now trading near $461.3 and testing resistance backed by volume profile and the 50-period SMA.

If BCH stays below $470.8, bearish momentum may resume, targeting $437.0 and potentially $421.2. A bullish breakout could follow a close above $470.8, aiming for $478.0.

Bitcoin Cash Rebounds from $456 as RSI Shows Bullish DivergenceFenzoFx—Bitcoin Cash swept liquidity below $456.0 during NY midnight and is now rising around $464.0. RSI 14 signals bullish divergence, suggesting growing momentum. If BCH holds above $456.2, it could target $472.0 and potentially $481.2.

The bullish outlook is invalidated if BCH stabilizes below $456.0.