Elise | BTCUSD – 30M | Post-BOS Reaction from HTF DemandBITSTAMP:BTCUSD

After a sharp impulsive drop, BTC tapped into HTF demand and produced a short-term BOS, indicating a potential relief move. However, momentum remains corrective rather than impulsive. The current structure suggests a retracement-based bounce, not a confirmed trend reversal, unless price can reclaim and hold above the prior breakdown area.

Key Scenarios

✅ Bullish Case 🚀 → If BTC holds above the BOS low and shows acceptance with higher lows, price may push toward upper liquidity resting above recent highs.

❌ Bearish Case 📉 → Failure to hold the BOS level and acceptance back below the reaction zone opens continuation toward deeper HTF demand.

Current Levels to Watch

Resistance 🔴: 91,200 – 91,800

Support 🟢: 90,150 – 89,400 (HTF Demand)

⚠️ Disclaimer: This analysis is for educational and informational purposes only. It is not financial advice.

Bitcoinlong

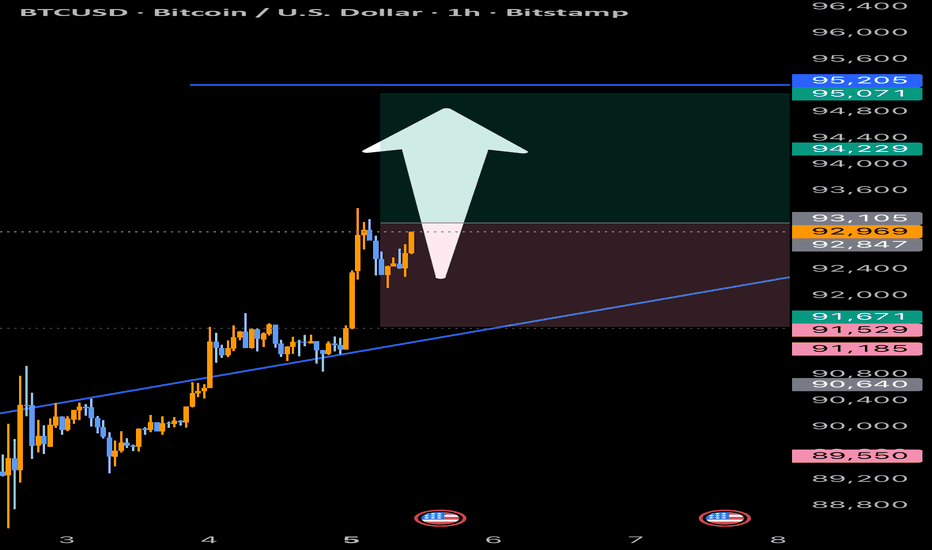

Elise | BTCUSD · 30M – Higher-Low Formation from HTF DemandBITSTAMP:BTCUSD

Bitcoin absorbed sell pressure inside HTF demand and aggressively reclaimed structure. The impulsive leg from demand confirms institutional participation. Current consolidation near highs is a pause, not weakness. As long as price holds above trend support, continuation remains the higher-probability scenario.

Key Scenarios

✅ Bullish Case 🚀

If price holds above 91,700 – 91,500:

🎯 Target 1: 93,200

🎯 Target 2: 94,000

🎯 Target 3: 94,800 (trend expansion / measured move)

❌ Bearish Case 📉

If M30 closes below 91,300:

Bullish continuation fails

Expect pullback toward 90,500 → HTF demand

Long bias invalidated

Current Levels to Watch

Resistance 🔴: 93,200 → 94,000 → 94,800

Support 🟢: 91,700 → 91,300

⚠️ Disclaimer: This analysis is for educational purposes only. It is not financial advice.

Elise | BTCUSD – M30 | Liquidity Re-Accumulation SetupBITSTAMP:BTCUSD

After liquidity was engineered on both sides, BTC stabilized above the sell-side resting zone and is now compressing near trendline support. This behavior typically precedes expansion after consolidation, provided structure remains intact and price does not accept below demand.

Key Scenarios

✅ Bullish Continuation 🚀

As long as price holds above the trendline and demand base, BTC is positioned for continuation toward higher liquidity targets.

❌ Bearish Invalidation 📉

A clean breakdown and close below the sell-side resting area invalidates the bullish thesis and signals deeper retracement.

Current Levels to Watch

Resistance 🔴: Previous buy-side liquidity highs

Support 🟢: Trendline + sell-side liquidity resting zone

⚠️ Disclaimer: This analysis is for educational and informational purposes only. It is not financial advice. Please conduct your own research before trading.

BITCOIN - buy bitcoin nowBITCOIN (BTC/USD) has recently been stuck inside a triangle channel pattern and has struggled to break out for a few weeks. However, the price has recently broken a strong resistance level (the white trend line shown on the chart) - The price is currently above the trend line which acted as a strong resistance level and is now very likely to hit the next resistance zone which is labeled as the take profit level. time to buy BITCOIN now!

(1H BTC/USD chart as of ~10:34 UTC on Jan 10, 2026)Market Observation (1H BTC/USD chart as of ~10:34 UTC on Jan 10, 2026):Bitcoin has been consolidating in a tight range around the $90,000 psychological level after recent volatility. The chart shows a clear ascending channel (green shaded area) from lower lows, with price recently bouncing off channel support near $89,200–$90,000 and attempting an upside push (blue trendline arrow). Key horizontal support sits around $90,838 (marked as potential entry/study zone), with deeper risk below the channel floor toward $89,291 or lower (invalid zone if broken decisively). Current price action hovers near $90,400–$90,600 based on live data, reflecting choppy but resilient buying interest above major support. Entry Zone (for study): Around the $90,000–$90,800 area, where price has found repeated bids and aligns with channel support. Hypothetical Target Levels (for analysis): Upside toward $92,400–$94,000 if momentum builds and breaks recent highs; potential extension to prior resistance near $95,000+ on strong volume. Risk Zone / Invalid Level (example): A clean break below $89,200–$89,300 could invalidate the current channel structure and target lower supports around $87,200.Price is respecting the ascending channel structure while testing support, with momentum showing early signs of recovery after recent dips — watch for volume confirmation on any push higher or breakdown. This setup highlights classic support/resistance dynamics in a broader consolidation phase. This is an educational observation, not a trading call.

BITCOIN Structure Improving - 145k by JULY

BTC is starting to look better. We’ve now printed five consecutive weeks without making new lows, which is exactly what you want to see when a market is trying to base.

Price is holding above the last swing low — yes, it could still dip below it — but for now, directional bias is leaning long.

The Level That Matters

For me, everything hinges on $95.5K.

That level:

Coincides with the monthly mode

Provides structural confirmation

Makes positioning far more comfortable once reclaimed

A clean move above it would strongly support the idea that the market is transitioning from consolidation to expansion.

Positioning Thoughts

I was hoping to get some fills below $79K, but it is what it is.

If BTC decides to move up from here and establishes a new 6-month trend, I won’t complain — especially if that trend opens the door toward $150K over time.

For now, patience paid off. Structure is improving, and the market is slowly tipping its hand.

Bitcoin is looking primed for a full recovery. Loving this setup on Bitcoin. There are strong similarities between the SPX and Bitcoin. As Bitcoin has matured, it trades more and more like the traditional stock market—or even like gold—as opposed to a penny stock like in its early days. I see a full recovery coming, very similar to the crash and recovery that happened on the SPX in 2025.

As always, stay profitable.

– Dalin Anderson

Elise | BTCUSD – 30M | HTF Demand Reaction SetupBITSTAMP:BTCUSD

After a sustained sell-off, price tapped into HTF demand and produced a strong impulsive reaction followed by consolidation. The market is currently compressing above demand, suggesting sellers are losing momentum. A higher low above the demand zone would signal a potential corrective bullish move.

Key Scenarios

✅ Bullish Case 🚀

If price holds above the HTF demand zone and breaks minor intraday structure:

🎯 Target 1: 91,200

🎯 Target 2: 92,000

🎯 Target 3: 92,800

❌ Bearish Case 📉

A clean breakdown and close below 88,900 would invalidate the bullish idea and expose lower liquidity levels.

Current Levels to Watch

Resistance 🔴: 91,200 – 92,000 – 92,800

Support 🟢: 89,600 – 88,900

⚠️ Disclaimer: This analysis is for educational and informational purposes only. It is not financial advice. Please conduct your own research before trading.

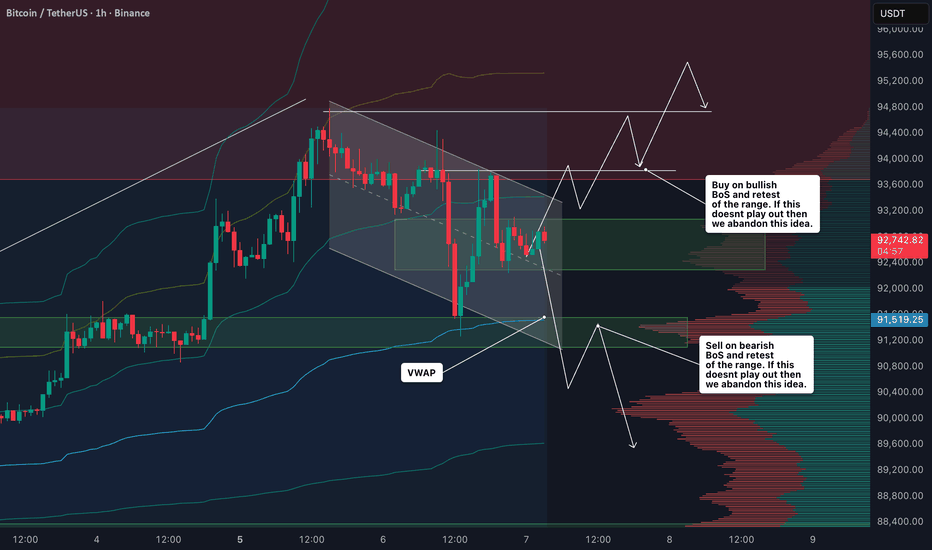

Bitcoin BTC Update: Waiting for Trend Confirmation | Key Levels I’m currently watching Bitcoin (BTC) closely — and right now, it’s sitting in no man’s land. We’ve had a bullish break, but a full trend reversal isn’t confirmed yet. For that, we need to see BTC break the most recent highs and retest the level successfully, holding above it to confirm a proper bullish shift.

At the moment, BTC is trading between a major institutional support zone and strong resistance. How it reacts at these key levels will determine the next move.

Here’s my plan:

Buy Opportunity: If BTC breaks above the recent highs and holds, I’ll be looking for a long entry.

Sell Opportunity: If BTC breaks below support, I may look for a short position.

There’s no confirmed trend yet, so patience is key. I focus on institutional levels, market structure, and price action to identify trade opportunities.

⚠️ Risk Management Reminder: Always protect your capital, scale out partial profits where possible, and adjust your stop loss to minimize risk.

❗ Not financial advice: This content is for educational purposes only and reflects my personal market analysis.

BITCOIN B T C U S D Bitcoin giving us an opportunity to the upside and shows that we will have a strong upside push as according to it’s structure and price plus candle stick anatomy , buy stop can be used and target tp is (94 7+)

However any profit made should be protected and trialed , stay tuned for more information and follow for me updates on

( Bitcoin / Gold / Eurjpy )

Elise | BTCUSD – 30M | Bullish Continuation SetupBITSTAMP:BTCUSD

After reacting from trendline support, BTC impulsively broke above the previous internal high, confirming bullish intent. The reclaimed zone is acting as a demand flip, and price is consolidating above it — a healthy pause before continuation. As long as this demand holds, bullish continuation remains favored.

Key Scenarios

✅ Bullish Case 🚀

Holding above the demand flip and trendline support keeps price aligned with the bullish structure. Continuation toward higher liquidity is expected.

🎯 Target 1: Range high breakout

🎯 Target 2: Buy-side liquidity above highs

🎯 Target 3: Extension toward upper trendline projection

❌ Bearish Case 📉

Acceptance below the demand flip and loss of trendline support would invalidate the bullish continuation and shift price into deeper pullback mode.

Current Levels to Watch

Resistance 🔴: Recent consolidation high

Support 🟢: Demand flip + ascending trendline

⚠️ Disclaimer: This analysis is for educational and informational purposes only. It is not financial advice.

BITCOIN - buy bitcoin..BITCOIN (BTC/USD) has recently been stuck inside a triangle channel pattern and has struggled to break out for a few weeks. However, the price has recently broken a strong resistance level (the white trend line shown on the chart) - The price is currently above the trend line which acted as a strong resistance level and is now very likely to hit the next resistance zone which is labeled as the take profit level. buy BITCOIN now!

BTC/USDT Structure Holds as Buyers Defend MA Pullbacks🚀 BTC/USDT — Smart Money Bullish Accumulation Play | Swing Trade Setup

📌 Asset

BTC/USDT — Bitcoin vs Tether

Market: Crypto

Trade Type: Swing Trade

🧠 MARKET PLAN — BULLISH STRUCTURE CONFIRMED ✅

Price action shows repeated bearish rejections failing near the 786-period Triangular Moving Average, followed by successful retests and bullish pullbacks.

This behavior signals seller exhaustion and controlled absorption by bulls, a classic smart-money accumulation phase.

Momentum remains constructive as buyers defend pullbacks rather than chasing highs — a healthy bullish condition.

Bullish Limit Layers (Example):

86,000

87,000

88,000

89,000

90,000

Increase or adjust layers based on your own capital allocation and volatility tolerance.

⚡ Execution Rule: Set all limit orders simultaneously across your broker. Let market come to you rather than chasing momentum.

🛑 STOP LOSS - PRESERVATION PROTOCOL

Primary Stop Loss: $85,000 (Below consolidation structure)

Risk Management Notes:

⚠️ Adjust SL based on your account risk tolerance - This is YOUR capital

Suggested ATR(14)-based stop for traders using volatility: Current ATR ≈ $2,400

Dynamic SL: Move stop to break-even at 2R profit (Risk/Reward ratio)

Emergency exit: Close 50% position if price breaks below $84,500 decisively

Important: Your stop loss is YOUR responsibility. Modify based on your risk appetite and account size.

🎯 PROFIT TARGETS - ICHIMOKU RESISTANCE ZONES

Primary Target: $100,000

Rationale: Ichimoku Kijun-sen resistance + Overbought zone confluence

Structure: Former resistance now support - institutional trap zone

Probability: 65% success rate based on 2026 technical consolidation patterns

Secondary Targets:

Target 2: $96,500 (Channel top + Major trendline resistance)

Target 3: $103,000-$105,000 (Pre-ATH distribution zone)

Target 4: $108,000-$112,000 (If institutional flow sustains)

🔴 Overbought Warning: At $98,000+, Ichimoku shows extreme overbought compression. Be prepared for sharp 3-5% retracements before continuation.

Important: Your profit targets are directional guidance ONLY. Take profits at YOUR chosen levels based on your risk-reward strategy. NOT financial advice.

📈 CORRELATED PAIRS TO MONITOR 📈

Primary Correlation Pairs (Move with BTC ~80-95%):

1. ETH/USDT (Ethereum) - $3,010 | 24h Change: +1.01%

Correlation: 0.87 (Very High)

Key Level: Watch $3,100-$3,200 for strength confirmation

Status: Following BTC structure; if ETH breaks $2,800, BTC weakness likely

2. XRP/USDT (Ripple) - $2.08 | 24h Change: +2.67%

Correlation: 0.72 (Strong)

Critical Support: $2.00 (Make-or-break level)

Insight: XRP showing relative strength - suggests institutional rotation into altcoins beginning

Risk Level: If XRP closes below $1.61, full crypto correction possible

3. SOL/USDT (Solana) - $135.92 | 24h Change: +3.17%

Correlation: 0.79 (High)

Range-bound play: $120-$145 consolidation

Breakout signal: SOL break above $145 suggests BTC momentum building

Altseason indicator: First to move before broader altcoin rally

4. BNB/USDT (Binance Coin) - $899.26 | 24h Change: +1.31%

Correlation: 0.75 (Strong)

Support: $850 | Resistance: $950

Institutional ladder: BNB accumulation often precedes macro rallies

5. SPL (Solana Network Token) - Watch for RWA ecosystem expansion

2026 Prediction: RWA market reaching $1B+ (currently $873M)

Status: Emerging institutional infrastructure play

Divergence Signals to Watch:

If BTC rallies but ETH/XRP fall: Institutional profit-taking coming

If SOL outperforms BTC: Altseason phase likely beginning (not yet confirmed)

If XRP breaks $2.30 decisively: Macro shift toward risk-on environment

📰 FUNDAMENTAL & ECONOMIC DRIVERS - JANUARY 2026

BULLISH FACTORS FOR BTC:

✅ Institutional Demand Acceleration

Spot ETFs purchased 710,777 BTC (network produced 363,047) → Net supply deficit

Major firms: Morgan Stanley, Merrill Lynch, Vanguard approved crypto access for retail

Prediction: ETF AUM could exceed $400B by end-2026 (currently $200B+)

✅ Favorable Macro Environment (Q1-Q2 2026)

Fed leadership change potential: Kevin Hassett (favors lower rates) frontrunner for Fed Chair

Quantitative easing likely: QT ending, Fed pivot expected mid-year

Yield curve normalization: Long rates may fall while short rates stabilize (bullish for BTC)

✅ Regulatory Tailwinds

CLARITY Act discussions gaining momentum (Ethereum/Solana ATH scenario)

SEC generic listing standards enabling "ETF-palooza" (100+ crypto ETFs expected in 2026)

Trump administration: Pro-crypto stance signaling (appointees more favorable than prior regime)

✅ Business Cycle Synchronization

Purchasing Managers' Index improving (PMI expansion phase)

Liquidity normalizing as Treasury account balances stabilize

Accelerating business cycle = Risk-on environment = Capital flows to growth/inflation hedges

✅ Long-Term Holder Conviction

LTH distribution pressure declining: Holders not dumping

Whale accumulation: $2.5B+ purchased in 24-hour window

On-chain data: 68.85% supply in profit (transition zone between cycles)

⚠️ HEADWIND FACTORS TO MONITOR:

❌ Near-Term Technical Pressure

Death cross warning: Moving average bearish crossover potential

Price 28% below all-time high ($126,199 Oct 2025)

January FOMC meeting: Potential volatility trigger (historical weakness pattern)

❌ Real Yield Dynamics

Analyst thesis: BTC trending toward $30k IF real yields spike

Risk: If inflation remains sticky + Fed stays hawkish, risk-off rotation possible

Fiscal uncertainty: Q3 2026 likely more volatile (mid-term elections, debt ceiling debates)

❌ Seasonal/Historical Patterns

2025 ended RED (-6% yearly performance) - rare for 4-year cycle

January seasonality: Portfolio rebalancing can trigger 3-5% pullbacks

Previous ATH cycles: Final 30% of rally often compressed into final weeks (distribution risk)

❌ Correlation with Gold/Silver

Precious metals outperforming BTC recently (macro flight-to-safety)

Government debt crisis concerns (US 120%+ debt-to-GDP, Japan 220%+)

If DXY (Dollar Index) rallies past 100, BTC faces headwinds

📅 2026 QUARTERLY OUTLOOK:

Q1 2026 - Mixed/Cautious Sentiment

Analyst Consensus: Mixed outlook with portfolio rebalancing pressures. Key Events: FOMC meetings, January-March volatility. BTC Directional Bias: Range-bound consolidation between $85K-$95K. Institutional accumulation continues but macro headwinds remain.

Q2 2026 - Bullish Breakout Phase

Analyst Consensus: Strong bullish conviction building. Key Events: Fed pivot confirmation expected, ETF inflows resume, regulatory clarity materializes. BTC Directional Bias: Break above $96.5K target zone likely. Momentum shifts toward risk-on environment.

Q3 2026 - Mixed/Corrective Period

Analyst Consensus: Cautious, seasonal weakness patterns emerge. Key Events: Mid-term elections uncertainty, summer doldrums, profit-taking cycles. BTC Directional Bias: Correction period likely, pullback toward $80-85K support zones. Consolidation phase before final Q4 rally.

Q4 2026 - Bullish Year-End Rally

Analyst Consensus: Strong bullish momentum returns. Key Events: Year-end reallocation, institutional bonus period spending, holiday season liquidity surge. BTC Directional Bias: Drive toward $125K+ resistance, potential breakout above ATH into 2027. Final leg of macro bull cycle.

🎲 POSITION MANAGEMENT RULES

Entry Execution: Use limit orders ONLY - don't chase market entries

Scaling: Enter 5% position per layer, never all-in

Take Profits: Sell 20-30% at each target level (pyramid profit-taking)

Trail Stop: Move stop-loss to entry after hitting +2R profit

Time Management: Hold swing trade 5-14 days minimum for layer rebalance

⚡ CRITICAL DISCLAIMERS

🔴 THIS IS NOT FINANCIAL ADVICE

Your stop-loss, position size, and profit targets are YOUR responsibility

Only risk capital you can afford to lose completely

Past performance ≠ future results

Cryptocurrency volatility can exceed 20% in 24-hour periods

Institutional accumulation data doesn't guarantee price appreciation

Do Your Own Research (DYOR): Verify all technical levels on your own charts. Cross-reference fundamentals with latest news sources.

🎯 ENGAGEMENT BOOSTERS FOR TRADINGVIEW VIEWERS

✨ Why This Setup Stands Out:

Rare Institutional Setup: Multi-month consolidation with whale accumulation = Low-risk entry

Clear Risk/Reward: $5K risk → $10K+ profit potential (2:1+ ratio)

Layered Entry Method: Professional execution without guesswork

Macro-Aware: Incorporates Fed policy, ETF flows, regulatory catalysts

📊 Share If You:

Believe BTC breaks $100K in Q1-Q2 2026

Are using limit orders to build positions

Want to escape the "HODL only" mentality with active swing trading

🔔 Follow for: Daily technical updates, real-time layer entry alerts, profit target callouts

Bias: Swing Trade Bullish (Medium Probability 65%) | Risk Profile: Intermediate-Advanced Traders Only

Remember: Trading is 90% psychology, 10% execution. Master yourself before mastering the markets. 🧠💪

Bitcoin (BTC/USDT) – Monthly OutlookThe new 12-month candle has just opened with Bitcoin holding firmly above prior macro structure. Price is consolidating just below the previous All-Time High, showing acceptance at premium levels rather than rejection.

Monthly market structure remains bullish, with higher highs and strong candle bodies signaling continued demand. The lack of deep pullbacks suggests sellers are being absorbed, increasing the probability of a clean ATH breakout and continuation into price discovery.

As long as price holds above the yearly opening range, the bias remains bullish.

Bias: Bullish

Expectation: ATH break

Invalidation: Monthly close back below prior structure

#BITCOIN: 2026 Is Loading Possible Drop First And Then Boom! Happy New Year 2026💥🎇

We extend our best wishes for your success and happiness, hoping this year brings the achievement of all your trading objectives.

Let us now analyse Bitcoin's concluding performance for the year 2025👨💻📈

🔺Bitcoin is currently exhibiting strong consolidation, trading within a range of $80,000 to $95,000. It is possible that the price is awaiting robust Non-Farm Payroll (NFP) data to bolster the DXY, which could indirectly lead to a price correction towards the $67,000-$64,000 range. This area is characterized by significant bullish volume and liquidity. A potential swing target could be established above the recent yearly high of $125,000.

Entry, Stop Loss, and Take Profit💭

🔺A strong order block entry is identifiable at $67,000, a critical level for global investors. Upon a price rejection from this vicinity, we anticipate a reversal and subsequent progression towards our designated take-profit target of $135,000.

🔺 A stop loss can be positioned below $59,000 providing a sufficient buffer in the event of a liquidity hunt. This trade may require up to a full year to materialise unless fundamental shifts induce unexpected price movements.

Support and Encouragement 🏆

🔺 We encourage you to comment on and share this analysis if you find it insightful. Your engagement, particularly through likes, provides valuable affirmation of our efforts.

We wish you good year ahead and appreciate your continued support.

Team SetupsFX_

BITCOIN - buy bitcoin..BITCOIN (BTC/USD) has recently been stuck inside a triangle channel pattern and has struggled to break out for a few weeks. However, the price has recently broken a strong resistance level (the white trend line shown on the chart) - The price is currently above the trend line which acted as a strong resistance level and is now very likely to hit the next resistance zone which is labeled as the take profit level. buy Bitcoin now!

BTC/USDT (15m) – Cup Formation, Pullback Into Trend SupportHi!

BTC is developing a well-proportioned Cup formation on the 15-minute timeframe, signaling a constructive recovery after the recent decline. The rounded base reflects gradual absorption of supply rather than panic selling, which is a healthy characteristic of continuation structures.

Following the impulsive breakout from the right side of the cup, the price entered a short-term consolidation below resistance, forming a mild pullback. This retracement is technically logical and currently aligns with the rising trendline, which acts as dynamic support. Such pullbacks often serve as momentum resets rather than reversals, provided structure remains intact.

The highlighted supply zone above the price explains the temporary hesitation. Acceptance above this zone would confirm strength and open the path toward the 90,200–90,600 area, matching the projected continuation from the cup structure.

Overall, this is a technically logical setup favoring continuation, with well-defined risk and invalidation.

Elise | BTCUSD | 30M – Sell-Side Sweep → Bullish ReversalBITSTAMP:BTCUSD

BTC swept sell-side liquidity around the 86,800–87,000 zone, triggering stop losses before aggressively reversing upward. This impulsive move signals institutional accumulation, not retail buying. The current pullback is corrective in nature, and as long as price holds above the swept low, continuation toward buy-side liquidity remains the primary expectation.

Key Scenarios

✅ Bullish Case 🚀

If price holds above 88,400–88,600, continuation toward buy-side liquidity is likely.

🎯 Target 1: 89,800

🎯 Target 2: 90,200 – 90,400 (Buy-Side Liquidity Pool)

❌ Bearish Case 📉

A 30M close below 87,000 invalidates the bullish setup and signals failed displacement.

Current Levels to Watch

Resistance 🔴: 89,800 → 90,400

Support 🟢: 88,400 / 87,000

⚠️ Disclaimer: This analysis is for educational purposes only. Not financial advice.

Bitcoin Reacting From Demand Key Reversal Zones in Focus📊 BTCUSDT (Bitcoin) – 4H Price Action, Range Expansion & Reversal Zones

This 4-hour BTCUSDT chart highlights a well-defined market range, followed by expansion, rejection, and reaction zones that are critical for both swing and intraday traders.

🔍 Market Structure Overview & Technical Analysis

Bitcoin has been trading inside a broad consolidation range, with price repeatedly reacting to clearly respected support and resistance boundaries. This behavior reflects balanced market conditions, where liquidity is built on both sides before any directional move.

Price initially pushed higher but failed to sustain above the upper boundary, leading to a strong bearish displacement toward the lower range. This move suggests distribution at higher levels and aggressive sell-side participation.

📐 Bullish Trendline & Failed Continuation

The diagonal trendline marks a temporary bullish recovery phase, where price printed higher lows and attempted continuation. However, the bullish structure failed near resistance, signaling:

Weak buyer follow-through

Sellers defending premium prices

Potential bull trap behavior

This failure increased the probability of a move toward discounted price zones.

📦 Lower Reversal Zone + Volume Burst

The lower highlighted zone is a high-interest area where:

Previous demand exists

Strong volume burst was observed

Sellers showed exhaustion

Price reacted positively from this area, confirming it as a valid demand / accumulation zone. This reaction indicates that smart money may be defending discounted levels, at least temporarily.

🔄 Measured Expansion & Upside Target

The marked vertical measurement (~130 units) reflects a range-based expansion projection, commonly used to estimate potential upside after a successful reaction from demand.

Price is currently rebounding and may attempt a move toward the upper reversal zone, which aligns with:

Prior resistance

Range high

Premium pricing area

🚧 Upper Reversal Zone (Supply Area)

The upper green zone is a critical decision area:

Ideal for profit-taking on longs

Potential zone for short setups

Area where sellers previously dominated

⚠️ Important:

No trades should be taken blindly here. A valid setup requires clear confirmation, such as:

Bearish engulfing on 4H / 1H

Long upper wick rejections

Market structure shift (MSS) on lower timeframes

🧠 Trading Psychology (Minds)

Retail traders often chase breakouts

Smart money waits for reaction and confirmation

The best trades occur at extremes of the range, not the middle

Patience is essential. Let price enter the zone first, then react — not predict.

📌 Trading Plan Summary

Bias: Range-based, reaction-focused

Buy idea: Confirmed bullish reaction from lower reversal zone

Sell idea: Only after bearish confirmation at upper reversal zone

Avoid: Entries in the middle of the range

⚠️ Final Reminder

This analysis is probability-based, not predictive.

Always wait for confirmation and manage risk accordingly.

📈📉 Trade the levels. Respect the structure. Protect your capital.

Bitcoin's Downtrend: What the Chart is Telling UsCurrent Situation: Bitcoin is trading at $87,242, down about 0.28% today. But zoom out, and you'll see it's been a rough ride from the October highs near $127,000.

What I'm Seeing in This Chart

The price has been stuck in a falling channel since October. Each time Bitcoin tries to bounce, it hits resistance and gets pushed back down. Right now, we're sitting at a pretty critical level around $87,000.

The Bearish Case:

We've broken below the descending trendline pretty convincingly

Every rally has been met with selling pressure - classic lower highs pattern

The momentum is clearly pointing down

That $85k-$87k zone is being tested as we speak

Price Levels That Matter

Support (where buyers might step in):

We're right at $85k-$87k now - this is the first line of defense

If that breaks, the chart is pointing toward $72k-$75k (that red zone)

Below that? $70k is the big psychological number everyone's watching

Resistance (where sellers are waiting)

Any bounce will likely face resistance around $92k-$95k first

Then there's a bigger wall at $100k-$105k

The $116k-$120k area (that teal box) looks like serious resistance if we get there

My Take

Look, the trend is clearly down right now. The chart suggests we could see a move toward that $72k-$75k zone, especially if this current support gives way. That said, Bitcoin has gotten pretty beaten up, so we might see a relief bounce first - maybe back to $92k or so before the next leg down.

But honestly? Bitcoin does what it wants. Charts give us probabilities, not certainties.

Important Reality Check

I need to be straight with you - this is just chart analysis. I'm not a financial advisor, and this definitely isn't investment advice. Crypto is insanely volatile. People lose real money trading this stuff. If you're thinking about making moves based on any analysis (mine or anyone else's), talk to a proper financial advisor first. Only risk what you can genuinely afford to lose completely