(1H BTC/USD chart as of ~10:34 UTC on Jan 10, 2026)Market Observation (1H BTC/USD chart as of ~10:34 UTC on Jan 10, 2026):Bitcoin has been consolidating in a tight range around the $90,000 psychological level after recent volatility. The chart shows a clear ascending channel (green shaded area) from lower lows, with price recently bouncing off channel support near $89,200–$90,000 and attempting an upside push (blue trendline arrow). Key horizontal support sits around $90,838 (marked as potential entry/study zone), with deeper risk below the channel floor toward $89,291 or lower (invalid zone if broken decisively). Current price action hovers near $90,400–$90,600 based on live data, reflecting choppy but resilient buying interest above major support. Entry Zone (for study): Around the $90,000–$90,800 area, where price has found repeated bids and aligns with channel support. Hypothetical Target Levels (for analysis): Upside toward $92,400–$94,000 if momentum builds and breaks recent highs; potential extension to prior resistance near $95,000+ on strong volume. Risk Zone / Invalid Level (example): A clean break below $89,200–$89,300 could invalidate the current channel structure and target lower supports around $87,200.Price is respecting the ascending channel structure while testing support, with momentum showing early signs of recovery after recent dips — watch for volume confirmation on any push higher or breakdown. This setup highlights classic support/resistance dynamics in a broader consolidation phase. This is an educational observation, not a trading call.

Bitcoinlong

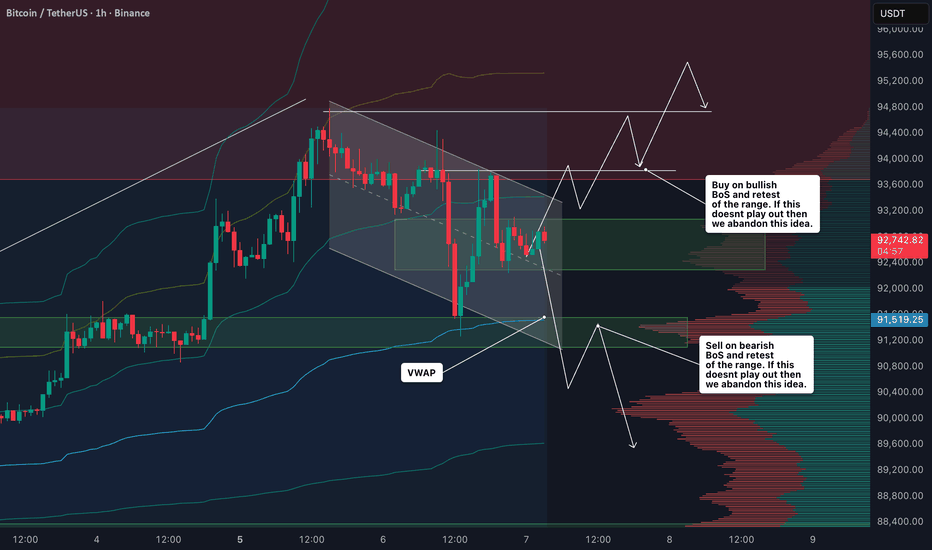

Bitcoin BTC Update: Waiting for Trend Confirmation | Key Levels I’m currently watching Bitcoin (BTC) closely — and right now, it’s sitting in no man’s land. We’ve had a bullish break, but a full trend reversal isn’t confirmed yet. For that, we need to see BTC break the most recent highs and retest the level successfully, holding above it to confirm a proper bullish shift.

At the moment, BTC is trading between a major institutional support zone and strong resistance. How it reacts at these key levels will determine the next move.

Here’s my plan:

Buy Opportunity: If BTC breaks above the recent highs and holds, I’ll be looking for a long entry.

Sell Opportunity: If BTC breaks below support, I may look for a short position.

There’s no confirmed trend yet, so patience is key. I focus on institutional levels, market structure, and price action to identify trade opportunities.

⚠️ Risk Management Reminder: Always protect your capital, scale out partial profits where possible, and adjust your stop loss to minimize risk.

❗ Not financial advice: This content is for educational purposes only and reflects my personal market analysis.

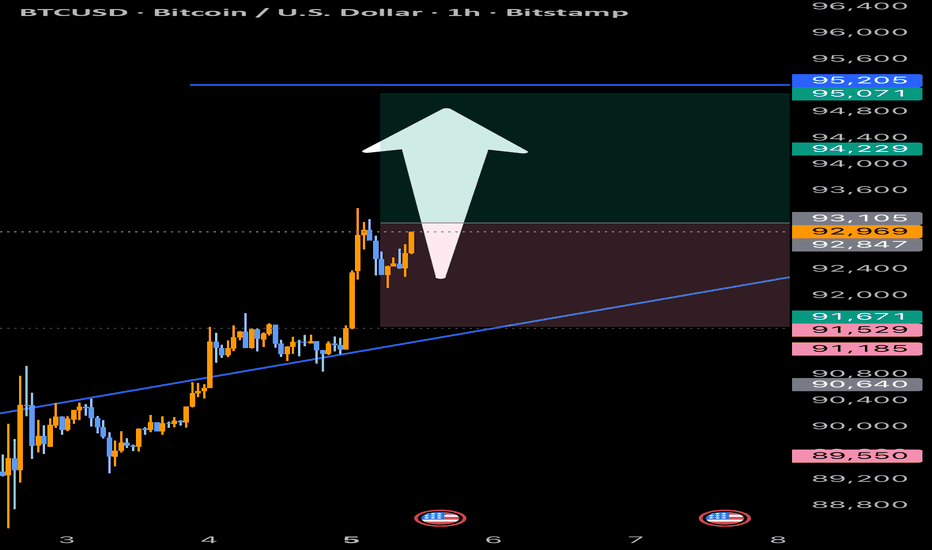

BITCOIN B T C U S D Bitcoin giving us an opportunity to the upside and shows that we will have a strong upside push as according to it’s structure and price plus candle stick anatomy , buy stop can be used and target tp is (94 7+)

However any profit made should be protected and trialed , stay tuned for more information and follow for me updates on

( Bitcoin / Gold / Eurjpy )

BITCOIN - buy bitcoin..BITCOIN (BTC/USD) has recently been stuck inside a triangle channel pattern and has struggled to break out for a few weeks. However, the price has recently broken a strong resistance level (the white trend line shown on the chart) - The price is currently above the trend line which acted as a strong resistance level and is now very likely to hit the next resistance zone which is labeled as the take profit level. buy BITCOIN now!

BTC/USDT Structure Holds as Buyers Defend MA Pullbacks🚀 BTC/USDT — Smart Money Bullish Accumulation Play | Swing Trade Setup

📌 Asset

BTC/USDT — Bitcoin vs Tether

Market: Crypto

Trade Type: Swing Trade

🧠 MARKET PLAN — BULLISH STRUCTURE CONFIRMED ✅

Price action shows repeated bearish rejections failing near the 786-period Triangular Moving Average, followed by successful retests and bullish pullbacks.

This behavior signals seller exhaustion and controlled absorption by bulls, a classic smart-money accumulation phase.

Momentum remains constructive as buyers defend pullbacks rather than chasing highs — a healthy bullish condition.

Bullish Limit Layers (Example):

86,000

87,000

88,000

89,000

90,000

Increase or adjust layers based on your own capital allocation and volatility tolerance.

⚡ Execution Rule: Set all limit orders simultaneously across your broker. Let market come to you rather than chasing momentum.

🛑 STOP LOSS - PRESERVATION PROTOCOL

Primary Stop Loss: $85,000 (Below consolidation structure)

Risk Management Notes:

⚠️ Adjust SL based on your account risk tolerance - This is YOUR capital

Suggested ATR(14)-based stop for traders using volatility: Current ATR ≈ $2,400

Dynamic SL: Move stop to break-even at 2R profit (Risk/Reward ratio)

Emergency exit: Close 50% position if price breaks below $84,500 decisively

Important: Your stop loss is YOUR responsibility. Modify based on your risk appetite and account size.

🎯 PROFIT TARGETS - ICHIMOKU RESISTANCE ZONES

Primary Target: $100,000

Rationale: Ichimoku Kijun-sen resistance + Overbought zone confluence

Structure: Former resistance now support - institutional trap zone

Probability: 65% success rate based on 2026 technical consolidation patterns

Secondary Targets:

Target 2: $96,500 (Channel top + Major trendline resistance)

Target 3: $103,000-$105,000 (Pre-ATH distribution zone)

Target 4: $108,000-$112,000 (If institutional flow sustains)

🔴 Overbought Warning: At $98,000+, Ichimoku shows extreme overbought compression. Be prepared for sharp 3-5% retracements before continuation.

Important: Your profit targets are directional guidance ONLY. Take profits at YOUR chosen levels based on your risk-reward strategy. NOT financial advice.

📈 CORRELATED PAIRS TO MONITOR 📈

Primary Correlation Pairs (Move with BTC ~80-95%):

1. ETH/USDT (Ethereum) - $3,010 | 24h Change: +1.01%

Correlation: 0.87 (Very High)

Key Level: Watch $3,100-$3,200 for strength confirmation

Status: Following BTC structure; if ETH breaks $2,800, BTC weakness likely

2. XRP/USDT (Ripple) - $2.08 | 24h Change: +2.67%

Correlation: 0.72 (Strong)

Critical Support: $2.00 (Make-or-break level)

Insight: XRP showing relative strength - suggests institutional rotation into altcoins beginning

Risk Level: If XRP closes below $1.61, full crypto correction possible

3. SOL/USDT (Solana) - $135.92 | 24h Change: +3.17%

Correlation: 0.79 (High)

Range-bound play: $120-$145 consolidation

Breakout signal: SOL break above $145 suggests BTC momentum building

Altseason indicator: First to move before broader altcoin rally

4. BNB/USDT (Binance Coin) - $899.26 | 24h Change: +1.31%

Correlation: 0.75 (Strong)

Support: $850 | Resistance: $950

Institutional ladder: BNB accumulation often precedes macro rallies

5. SPL (Solana Network Token) - Watch for RWA ecosystem expansion

2026 Prediction: RWA market reaching $1B+ (currently $873M)

Status: Emerging institutional infrastructure play

Divergence Signals to Watch:

If BTC rallies but ETH/XRP fall: Institutional profit-taking coming

If SOL outperforms BTC: Altseason phase likely beginning (not yet confirmed)

If XRP breaks $2.30 decisively: Macro shift toward risk-on environment

📰 FUNDAMENTAL & ECONOMIC DRIVERS - JANUARY 2026

BULLISH FACTORS FOR BTC:

✅ Institutional Demand Acceleration

Spot ETFs purchased 710,777 BTC (network produced 363,047) → Net supply deficit

Major firms: Morgan Stanley, Merrill Lynch, Vanguard approved crypto access for retail

Prediction: ETF AUM could exceed $400B by end-2026 (currently $200B+)

✅ Favorable Macro Environment (Q1-Q2 2026)

Fed leadership change potential: Kevin Hassett (favors lower rates) frontrunner for Fed Chair

Quantitative easing likely: QT ending, Fed pivot expected mid-year

Yield curve normalization: Long rates may fall while short rates stabilize (bullish for BTC)

✅ Regulatory Tailwinds

CLARITY Act discussions gaining momentum (Ethereum/Solana ATH scenario)

SEC generic listing standards enabling "ETF-palooza" (100+ crypto ETFs expected in 2026)

Trump administration: Pro-crypto stance signaling (appointees more favorable than prior regime)

✅ Business Cycle Synchronization

Purchasing Managers' Index improving (PMI expansion phase)

Liquidity normalizing as Treasury account balances stabilize

Accelerating business cycle = Risk-on environment = Capital flows to growth/inflation hedges

✅ Long-Term Holder Conviction

LTH distribution pressure declining: Holders not dumping

Whale accumulation: $2.5B+ purchased in 24-hour window

On-chain data: 68.85% supply in profit (transition zone between cycles)

⚠️ HEADWIND FACTORS TO MONITOR:

❌ Near-Term Technical Pressure

Death cross warning: Moving average bearish crossover potential

Price 28% below all-time high ($126,199 Oct 2025)

January FOMC meeting: Potential volatility trigger (historical weakness pattern)

❌ Real Yield Dynamics

Analyst thesis: BTC trending toward $30k IF real yields spike

Risk: If inflation remains sticky + Fed stays hawkish, risk-off rotation possible

Fiscal uncertainty: Q3 2026 likely more volatile (mid-term elections, debt ceiling debates)

❌ Seasonal/Historical Patterns

2025 ended RED (-6% yearly performance) - rare for 4-year cycle

January seasonality: Portfolio rebalancing can trigger 3-5% pullbacks

Previous ATH cycles: Final 30% of rally often compressed into final weeks (distribution risk)

❌ Correlation with Gold/Silver

Precious metals outperforming BTC recently (macro flight-to-safety)

Government debt crisis concerns (US 120%+ debt-to-GDP, Japan 220%+)

If DXY (Dollar Index) rallies past 100, BTC faces headwinds

📅 2026 QUARTERLY OUTLOOK:

Q1 2026 - Mixed/Cautious Sentiment

Analyst Consensus: Mixed outlook with portfolio rebalancing pressures. Key Events: FOMC meetings, January-March volatility. BTC Directional Bias: Range-bound consolidation between $85K-$95K. Institutional accumulation continues but macro headwinds remain.

Q2 2026 - Bullish Breakout Phase

Analyst Consensus: Strong bullish conviction building. Key Events: Fed pivot confirmation expected, ETF inflows resume, regulatory clarity materializes. BTC Directional Bias: Break above $96.5K target zone likely. Momentum shifts toward risk-on environment.

Q3 2026 - Mixed/Corrective Period

Analyst Consensus: Cautious, seasonal weakness patterns emerge. Key Events: Mid-term elections uncertainty, summer doldrums, profit-taking cycles. BTC Directional Bias: Correction period likely, pullback toward $80-85K support zones. Consolidation phase before final Q4 rally.

Q4 2026 - Bullish Year-End Rally

Analyst Consensus: Strong bullish momentum returns. Key Events: Year-end reallocation, institutional bonus period spending, holiday season liquidity surge. BTC Directional Bias: Drive toward $125K+ resistance, potential breakout above ATH into 2027. Final leg of macro bull cycle.

🎲 POSITION MANAGEMENT RULES

Entry Execution: Use limit orders ONLY - don't chase market entries

Scaling: Enter 5% position per layer, never all-in

Take Profits: Sell 20-30% at each target level (pyramid profit-taking)

Trail Stop: Move stop-loss to entry after hitting +2R profit

Time Management: Hold swing trade 5-14 days minimum for layer rebalance

⚡ CRITICAL DISCLAIMERS

🔴 THIS IS NOT FINANCIAL ADVICE

Your stop-loss, position size, and profit targets are YOUR responsibility

Only risk capital you can afford to lose completely

Past performance ≠ future results

Cryptocurrency volatility can exceed 20% in 24-hour periods

Institutional accumulation data doesn't guarantee price appreciation

Do Your Own Research (DYOR): Verify all technical levels on your own charts. Cross-reference fundamentals with latest news sources.

🎯 ENGAGEMENT BOOSTERS FOR TRADINGVIEW VIEWERS

✨ Why This Setup Stands Out:

Rare Institutional Setup: Multi-month consolidation with whale accumulation = Low-risk entry

Clear Risk/Reward: $5K risk → $10K+ profit potential (2:1+ ratio)

Layered Entry Method: Professional execution without guesswork

Macro-Aware: Incorporates Fed policy, ETF flows, regulatory catalysts

📊 Share If You:

Believe BTC breaks $100K in Q1-Q2 2026

Are using limit orders to build positions

Want to escape the "HODL only" mentality with active swing trading

🔔 Follow for: Daily technical updates, real-time layer entry alerts, profit target callouts

Bias: Swing Trade Bullish (Medium Probability 65%) | Risk Profile: Intermediate-Advanced Traders Only

Remember: Trading is 90% psychology, 10% execution. Master yourself before mastering the markets. 🧠💪

Bitcoin (BTC/USDT) – Monthly OutlookThe new 12-month candle has just opened with Bitcoin holding firmly above prior macro structure. Price is consolidating just below the previous All-Time High, showing acceptance at premium levels rather than rejection.

Monthly market structure remains bullish, with higher highs and strong candle bodies signaling continued demand. The lack of deep pullbacks suggests sellers are being absorbed, increasing the probability of a clean ATH breakout and continuation into price discovery.

As long as price holds above the yearly opening range, the bias remains bullish.

Bias: Bullish

Expectation: ATH break

Invalidation: Monthly close back below prior structure

BITCOIN - buy bitcoin..BITCOIN (BTC/USD) has recently been stuck inside a triangle channel pattern and has struggled to break out for a few weeks. However, the price has recently broken a strong resistance level (the white trend line shown on the chart) - The price is currently above the trend line which acted as a strong resistance level and is now very likely to hit the next resistance zone which is labeled as the take profit level. buy Bitcoin now!

BTC/USDT (15m) – Cup Formation, Pullback Into Trend SupportHi!

BTC is developing a well-proportioned Cup formation on the 15-minute timeframe, signaling a constructive recovery after the recent decline. The rounded base reflects gradual absorption of supply rather than panic selling, which is a healthy characteristic of continuation structures.

Following the impulsive breakout from the right side of the cup, the price entered a short-term consolidation below resistance, forming a mild pullback. This retracement is technically logical and currently aligns with the rising trendline, which acts as dynamic support. Such pullbacks often serve as momentum resets rather than reversals, provided structure remains intact.

The highlighted supply zone above the price explains the temporary hesitation. Acceptance above this zone would confirm strength and open the path toward the 90,200–90,600 area, matching the projected continuation from the cup structure.

Overall, this is a technically logical setup favoring continuation, with well-defined risk and invalidation.

Bitcoin Reacting From Demand Key Reversal Zones in Focus📊 BTCUSDT (Bitcoin) – 4H Price Action, Range Expansion & Reversal Zones

This 4-hour BTCUSDT chart highlights a well-defined market range, followed by expansion, rejection, and reaction zones that are critical for both swing and intraday traders.

🔍 Market Structure Overview & Technical Analysis

Bitcoin has been trading inside a broad consolidation range, with price repeatedly reacting to clearly respected support and resistance boundaries. This behavior reflects balanced market conditions, where liquidity is built on both sides before any directional move.

Price initially pushed higher but failed to sustain above the upper boundary, leading to a strong bearish displacement toward the lower range. This move suggests distribution at higher levels and aggressive sell-side participation.

📐 Bullish Trendline & Failed Continuation

The diagonal trendline marks a temporary bullish recovery phase, where price printed higher lows and attempted continuation. However, the bullish structure failed near resistance, signaling:

Weak buyer follow-through

Sellers defending premium prices

Potential bull trap behavior

This failure increased the probability of a move toward discounted price zones.

📦 Lower Reversal Zone + Volume Burst

The lower highlighted zone is a high-interest area where:

Previous demand exists

Strong volume burst was observed

Sellers showed exhaustion

Price reacted positively from this area, confirming it as a valid demand / accumulation zone. This reaction indicates that smart money may be defending discounted levels, at least temporarily.

🔄 Measured Expansion & Upside Target

The marked vertical measurement (~130 units) reflects a range-based expansion projection, commonly used to estimate potential upside after a successful reaction from demand.

Price is currently rebounding and may attempt a move toward the upper reversal zone, which aligns with:

Prior resistance

Range high

Premium pricing area

🚧 Upper Reversal Zone (Supply Area)

The upper green zone is a critical decision area:

Ideal for profit-taking on longs

Potential zone for short setups

Area where sellers previously dominated

⚠️ Important:

No trades should be taken blindly here. A valid setup requires clear confirmation, such as:

Bearish engulfing on 4H / 1H

Long upper wick rejections

Market structure shift (MSS) on lower timeframes

🧠 Trading Psychology (Minds)

Retail traders often chase breakouts

Smart money waits for reaction and confirmation

The best trades occur at extremes of the range, not the middle

Patience is essential. Let price enter the zone first, then react — not predict.

📌 Trading Plan Summary

Bias: Range-based, reaction-focused

Buy idea: Confirmed bullish reaction from lower reversal zone

Sell idea: Only after bearish confirmation at upper reversal zone

Avoid: Entries in the middle of the range

⚠️ Final Reminder

This analysis is probability-based, not predictive.

Always wait for confirmation and manage risk accordingly.

📈📉 Trade the levels. Respect the structure. Protect your capital.

Bitcoin's Downtrend: What the Chart is Telling UsCurrent Situation: Bitcoin is trading at $87,242, down about 0.28% today. But zoom out, and you'll see it's been a rough ride from the October highs near $127,000.

What I'm Seeing in This Chart

The price has been stuck in a falling channel since October. Each time Bitcoin tries to bounce, it hits resistance and gets pushed back down. Right now, we're sitting at a pretty critical level around $87,000.

The Bearish Case:

We've broken below the descending trendline pretty convincingly

Every rally has been met with selling pressure - classic lower highs pattern

The momentum is clearly pointing down

That $85k-$87k zone is being tested as we speak

Price Levels That Matter

Support (where buyers might step in):

We're right at $85k-$87k now - this is the first line of defense

If that breaks, the chart is pointing toward $72k-$75k (that red zone)

Below that? $70k is the big psychological number everyone's watching

Resistance (where sellers are waiting)

Any bounce will likely face resistance around $92k-$95k first

Then there's a bigger wall at $100k-$105k

The $116k-$120k area (that teal box) looks like serious resistance if we get there

My Take

Look, the trend is clearly down right now. The chart suggests we could see a move toward that $72k-$75k zone, especially if this current support gives way. That said, Bitcoin has gotten pretty beaten up, so we might see a relief bounce first - maybe back to $92k or so before the next leg down.

But honestly? Bitcoin does what it wants. Charts give us probabilities, not certainties.

Important Reality Check

I need to be straight with you - this is just chart analysis. I'm not a financial advisor, and this definitely isn't investment advice. Crypto is insanely volatile. People lose real money trading this stuff. If you're thinking about making moves based on any analysis (mine or anyone else's), talk to a proper financial advisor first. Only risk what you can genuinely afford to lose completely

BTC Xmas Eve Santa's PresentAs far as Its a Perfect Pattern nowalready, either if it is par of a correcction or the beginning of the next Bull run, the C wave down is over.

Buly Level 85.500 / 85.000

Secure and partial profits 94.000 , Maybe a Hedge in short to 83.000

Ultimate Targets 107.000 / 107.500

Merry Xmas!

BITCOIN - time to buy bitcoin..BITCOIN (BTC/USD) has recently been stuck inside a triangle channel pattern and has struggled to break out for a few weeks. However, the price has recently broken a strong resistance level (the white trend line shown on the chart) - The price is currently above the trend line which acted as a strong resistance level and is now very likely to hit the next resistance zone which is labeled as the take profit level. buy BTCUSD now!

Analytics: market outlook and forecasts

WHAT HAPPENED?

Last week, the seller sought to "push" the price of bitcoin to a significant zone of $84,000-$82,000. However, each time the local minimum was updated, it was protected by the buyer. As a result, the whole week passed within the range, without a specific direction of movement.

WHAT WILL HAPPEN: OR NOT?

The first signs of buyer activity are now visible in the delta. Volumes support the price, which indicates a potential shift to the upper boundary of a more global sideways trend around $94,500.

We’re considering buys from the local support of $88,000, where an absorption of sales was noticed, or — in the absence of a reaction — from lower levels. Only two local selling zones are located above the current levels, from which no significant resistance is expected.

Buy Zones

$88,000 (absorption of selling)

$86,000–$84,800 (abnormal activity)

$84,000–$82,000 (volume anomalies)

Sell Zones

$90,000 (untested volume, local zone)

~$92,400 (local sell zone)

$94,000–$97,500 (high-volume zone)

$101,000–$104,000 (accumulated volumes)

IMPORTANT DATES

This week, Christmas holidays are starting in many countries, so there aren’t many macroeconomic events ahead:

• Monday, December 22, 15:00 (UTC) — publication of the basic price index of US personal consumption expenditures for October;

• Tuesday, December 23, 13:30 (UTC) — publication of US GDP for the third quarter of 2025;

• December 23, Tuesday, 15:00 (UTC) — publication of the CB Consumer confidence index for December;

• December 23, Tuesday, 20:00 (UTC) — publication of data on new home sales in the United States for September, October and November;

• Wednesday, December 24, 13:30 (UTC) — publication of the number of initial applications for unemployment benefits in the United States.

*This post is not a financial recommendation. Make decisions based on your own experience.

#analytics

Elite | BTCUSD | 2H – Descending Structure Into Major DemandBITSTAMP:BTCUSD

After failing to hold above 92K–94K, BTC continued respecting the descending trendline, showing controlled sell pressure rather than panic. The current reaction at demand suggests sell-side liquidity has been tapped, but structure has not yet flipped bullish. Any upside move without a structural reclaim remains corrective until proven otherwise.

Key Scenarios

✅ Bullish Reversal / Expansion 🚀

Conditions (MANDATORY):

Strong 2H hold above 85,000

Break and acceptance above 88,500

Trendline breakout with follow-through

🎯 Target 1: 90,500

🎯 Target 2: 93,500

🎯 Target 3: 96,400 (major liquidity)

❌ Bearish Continuation 📉

Conditions:

2H close below 84,500

🎯 Downside Target 1: 82,800

🎯 Downside Target 2: 81,000

Current Levels to Watch

Resistance 🔴: 88,500 – 90,500 – 96,400

Support 🟢: 85,200 – 84,500 – 82,800

⚠️ Disclaimer: This analysis is for educational purposes only. It is not financial advice

Bitcoin Market Outlook (BUY BITCOIN 21 DECEMBER 2025)Bitcoin continues to show strong bullish intent as price holds above key higher-timeframe support and maintains a clear structure of higher highs and higher lows. Recent consolidation appears to be healthy, suggesting accumulation rather than distribution, with sellers failing to push price below critical demand zones.

As long as BTC remains above support, the bias stays firmly bullish. A sustained hold and expansion from this range increases the probability of continuation toward the next liquidity pool and previous highs. Momentum favors the upside, and any shallow pullbacks into support are viewed as potential opportunities for continuation rather than signs of weakness.

Invalidation is clear: a decisive break and close below major support would weaken the bullish case and shift focus toward deeper retracements. Until then, the trend remains intact, and Bitcoin looks positioned for another leg higher.

BTC/USDT Analysis. Another Manipulative Move

Hello everyone! This is the CryptoRobotics trader-analyst with a daily market update.

Yesterday, Bitcoin tested the sell zone at $88,800–$90,000 (area of abnormal selling activity), where price once again met resistance and went on to print a new local low.

The $87,000 level — previously marked by the largest seller volume — failed to produce a reaction on the retest and did not act as a buyer absorption zone, highlighting short-term demand weakness.

Price did not reach the key support at $84,000–$82,000 (volume anomalies). However, before testing that area, significant buyer activity emerged: attempts to push below the local low were defended, and selling pressure failed to extend the move.

At the moment, Bitcoin is moving back toward $90,000, where untested abnormal volume remains.

In the near term, we are considering a scenario involving the formation of a full reversal structure with a potential move toward the technical level at $94,500.

On a retest of the abnormal activity zone $86,000–$84,800, and upon a clear buyer reaction, we will look for long opportunities.

Buy Zones

$86,000–$84,800 (abnormal activity)

$84,000–$82,000 (volume anomalies)

Sell Zones

~$90,000 (abnormal volume)

~$92,400 (local sell zone)

$94,000–$97,500 (major volume zone)

$101,000–$104,000 (accumulated volumes)

This publication is not financial advice.

Bitcoin Investors Rotate, But Don’t Rebuild, Price Momentum StalBitcoin is trading near $87,108 at the time of writing, holding above the $86,361 support level. While this zone provides near-term stability, recovery remains fragile. BTC must reclaim higher levels before signaling a meaningful trend reversal.

Short-term holders continue to pose a risk to upside progress. If they begin taking profits, Bitcoin could remain range-bound below $88,210. A failure to maintain this structure could result in another test of $84,698, a level already visited during recent volatility.

A stronger recovery requires Bitcoin to breach $88,210 convincingly. A push toward $90,401 would signal improving momentum. Achieving this move depends on renewed investor support, which may emerge as value-oriented buyers respond to current price discounts.

Selena | BTCUSD | 1H – Liquidity Sweep Into DemandBITSTAMP:BTCUSD

After rejection from the top rejected zone (~102k–103k), BTC sold off aggressively. The decline stabilized near the 81k–83k strong buy zone, where multiple reactions confirm demand. The recent downside spike appears engineered to grab sell-side liquidity before continuation higher. However, price is still below key descending resistance, meaning confirmation is required.

Key Scenarios

✅ Bullish Case 🚀 (Only if structure holds)

Condition: Price holds above 85,000–87,000 demand zone

🎯 Target 1: 91,000

🎯 Target 2: 95,000

🎯 Target 3: 99,000

❌ Bearish Case 📉 (Invalidation)

If price breaks and closes below 81,000

🎯 Downside Target 1: 78,000

🎯 Downside Target 2: 74,500

Current Levels to Watch

Resistance 🔴: 91,500 – 94,000 – 99,000

Support 🟢: 87,000 – 83,000 – 81,000

⚠️ Disclaimer: This analysis is for educational and informational purposes only. It is not financial advice. Please conduct your own research before trading.

BITCOIN SIGNAL: HERE ARE THE NEXT BTC TARGETS!!!! (trap) Yello Paradisers! Enjoy the video!

And Paradisers! Keep in mind to trade only with a proper professional trading strategy. Wait for confirmations. Play with tactics. This is the only way you can be long-term profitable.

Remember, don’t trade without confirmations. Wait for them before creating a trade. Be disciplined, patient, and emotionally controlled. Only trade the highest probability setups with the greatest risk to reward ratio. This will ensure that you become a long-term profitable professional trader.

Don't be a gambler. Don't try to get rich quick. Make sure that your trading is professionally based on proper strategies and trade tactics.