Bitcoin at High-Probability Reversal Zone – Long Setup in PlayAs I expected in the previous idea , Bitcoin( BINANCE:BTCUSDT ) started declining and reached its full target.

Right now, Bitcoin has entered the heavy support zone($78,260-$70,080). Generally, strong support and resistance zones don’t break with just one attempt. On a daily timeframe, this is the second attack, but on the 4-hour timeframe, this is the first. We can expect a corrective move upward before Bitcoin attempts another attack on this key zone.

From an Elliott Wave perspective, it appears that Bitcoin is completing wave 5.

Also, we can see a positive Regular Divergence (RD+) between two consecutive valleys.

I expect Bitcoin to start rising from the Potential Reversal Zone(PRZ) and Cumulative Long Liquidation Leverage ($75,000-$74,000) and fill the CME Gap($84,560-$--,---) that will be formed once financial markets open.

Note: If tensions escalate operationally in the Middle East, we could suddenly see Bitcoin sharply decline and lose its heavy support zone($78,260-$70,080).

What do you think—can Bitcoin drop below $70,000, or is this a good buying area?

Target: $78,614

Stop Loss(SL): $71,117

Cumulative Short Liquidation Leverage: $80,000-$79,260

Cumulative Short Liquidation Leverage: $86,170-$84,760

Points may shift as the market evolves

💡 Please respect each other's opinions and express agreement or disagreement politely.

📌Bitcoin Analysis (BTCUSDT), 4-hour time frame.

🛑 Always set a Stop Loss(SL) for every position you open.

✅ This is just my idea; I’d love to see your thoughts too!

🔥 If you find it helpful, please BOOST this post and share it with your friends.

Bitcoinprediction

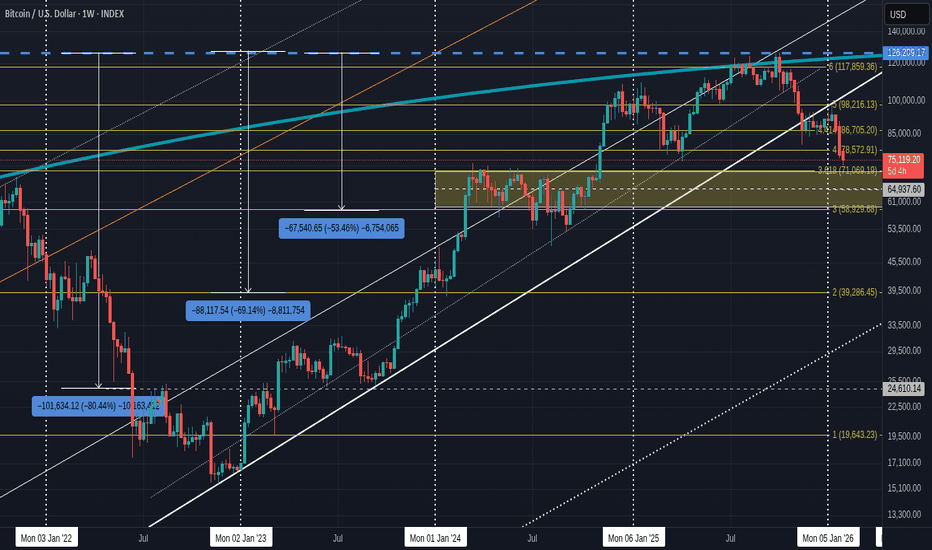

Bitcoin Is in the Wave 3 of the Bear CycleBitcoin Bear Market Comparison (2021–2022 vs 2025–2026)

Based on structural similarity with the 2021–2022 bear market, Bitcoin in 2026 is most likely positioned in Wave 3-3 of the Elliott Wave bear cycle.

After the cycle top, Bitcoin completed:

• Wave 1: Initial breakdown

• Wave 2: Bear market rally within a rising corrective channel

That channel has now failed, marking the start of Wave 3, the main bear market leg.

Wave 3-3 is typically the most aggressive phase:

• Fast downside acceleration

• Rising volatility and volume

• Rapid failure of support levels

This suggests the market is not at the bottom. Historically, the true bear market low forms only after Wave 5, not during Wave 3.

Any near-term rebound should be viewed as a counter-trend bounce, not a trend reversal.

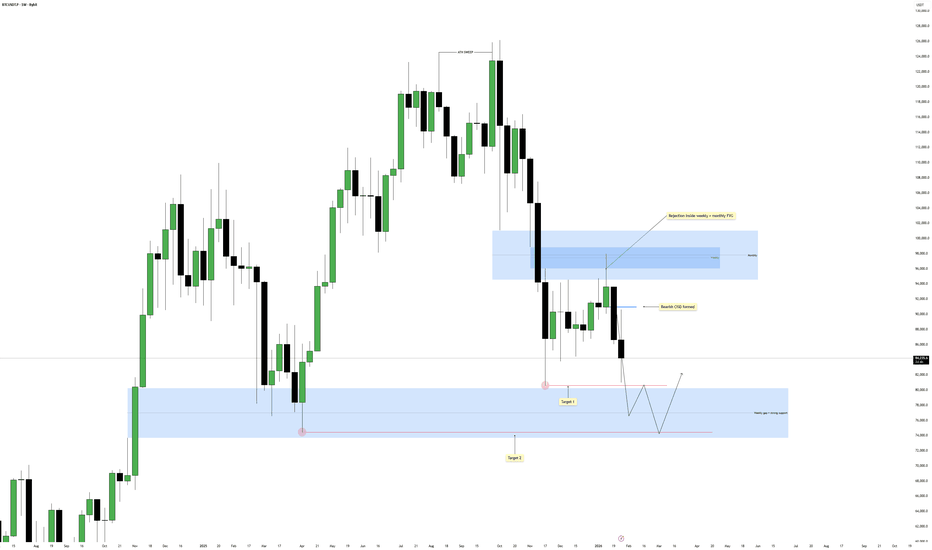

Bitcoin - Outlook for the Upcoming WeeksMarket Overview

Bitcoin is currently trading under clear higher timeframe pressure after a strong reaction from a premium zone. Price tapped into a confluence area of weekly and monthly Fair Value Gaps and showed immediate rejection, confirming that sellers are active at these levels. This reaction shifts the broader outlook from neutral to bearish for the coming weeks, as price failed to accept above higher timeframe imbalance.

Higher Timeframe Context and FVG Rejection

The most important development is the clean rejection inside the overlapping weekly and monthly FVG. This zone acted as a high probability area for distribution, and the response validates it as a strong supply region. The rejection was decisive, with displacement to the downside, signaling that higher timeframe participants are likely defending this area and looking for lower prices.

Bearish CISD Formation

Following the rejection, price formed a bearish CISD, confirming that the move was not just a reaction but a structural shift. The CISD came after the liquidity interaction, aligning well with proper ICT sequencing. This adds confluence to the bearish case and suggests that the market is now in a sell side delivery phase rather than a corrective pullback.

Downside Targets and Liquidity Objectives

With structure now bearish, the primary expectation is continuation toward Target 1, which aligns with a key liquidity area below current price. If price accepts below this level, continuation toward Target 2 becomes likely, targeting deeper weekly liquidity and a strong demand zone that previously supported price. These areas are logical objectives for the current bearish leg.

Invalidation and Alternative Scenario

The bearish structure remains valid as long as price stays below the rejected weekly and monthly FVG zone. Any sustained acceptance back into and above that area would weaken the bearish narrative and signal potential range behavior instead. Until that happens, downside continuation remains the higher probability scenario.

Conclusion

Bitcoin rejected a major weekly and monthly FVG, formed a bearish CISD, and is now structurally aligned for further downside. The focus remains on Target 1 first, with Target 2 as a continuation objective if sell side momentum persists. Overall structure supports a bearish outlook for the upcoming weeks.

___________________________________

Thanks for your support!

If you found this idea helpful or learned something new, drop a like 👍 and leave a comment, I’d love to hear your thoughts! 🚀

IS BITCOIN ABOUT TO CREATE A MASSIVE PUMP!?? (or dump first?) Yello Paradisers! Enjoy the video!

And Paradisers! Keep in mind to trade only with a proper professional trading strategy. Wait for confirmations. Play with tactics. This is the only way you can be long-term profitable.

Remember, don’t trade without confirmations. Wait for them before creating a trade. Be disciplined, patient, and emotionally controlled. Only trade the highest probability setups with the greatest risk to reward ratio. This will ensure that you become a long-term profitable professional trader.

Don't be a gambler. Don't try to get rich quick. Make sure that your trading is professionally based on proper strategies and trade tactics.

Bitcoin - Starting the final -30% drop!🛟Bitcoin ( CRYPTO:BTCUSD ) is dropping another -30%:

🔎Analysis summary:

The underlying trend on Bitcoin remains clearly bullish. But following the unusual curve channel, Bitcoin perfectly rejected the upper resistance curve. Quite likely therefore that Bitcoin will now create another bullish break and retest and first drop -30%.

📝Levels to watch:

$55,000

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

Bitcoin Market Update – Structure, Capitulation & ScenariosNomads,

In my previous IG:BITCOIN analysis I mapped out multiple zones and scenarios in advance.

Price respected this roadmap pixel-perfect.

BTC topped exactly at the first “Watch This Zone” around 98k

It then sold off directly into my first Level of Interest between 73k–75k

We are now trading inside that key area

This move was not random — it was structural.

Recent Price Action & Context

Bitcoin experienced a sharp liquidation-driven selloff last week.

Price moved from ~90,500 → ~74,000

A decline of roughly −18% from Friday until now

The speed and magnitude clearly indicate forced deleveraging

This matters because after large liquidation events, the market typically enters a post-liquidation environment, where behavior changes fundamentally.

External Structure: The Mathematical Framework

On November 11, Bitcoin initiated a clear external rotation:

A: 107,500

B: 77,900

C: Retrace into ~98,000

The retrace into 98k is critical:

It sits exactly inside the Golden Pocket

This confirms the move lower was corrective, not impulsive

After that:

Price broke below B

The next question becomes: where should the next lower low form if price follows mathematical rotations?

Because price retraced from the Golden Pocket, the next logical extension is the 1.272 of the A → B move.

That level sits at 73,283

This makes 73.3k the first statistically valid terminal area

HTF Confluence at 73k–75k

This zone is important because multiple HTF elements align here:

1. Anchored VWAP (Aug 4, 2024) – Lower Band

Anchored from the wick that initiated the entire rally to ATH (~126k)

The lower band represents maximum statistical deviation from value

Price returning here means we’re revisiting an area where long-term participants previously accumulated

2. 1.272 Fibonacci Extension

The most common extension where corrective moves terminate

Aligns precisely with 73.3k

3. Below a Weak Low (April 9, 2025)

Weak lows often contain resting sell-side liquidity

Price typically sweeps these levels before reversing

This supports a final push lower before a reaction

Order Flow & Capitulation Evidence

(Check the Order Flow data here: ibb.co

Now the most important part: what the data is telling us.

Open Interest has been bleeding since ~84.8k

→ Positions are being closed, leverage is being removed

Funding has flipped negative without OI expansion

→ Bearish positioning formed by removal of longs, not new shorts

CVD (coin-margined, stable-margined, and spot) is declining

→ Selling pressure is driven by exits and panic, not aggressive continuation

This is not trend strength.

This is post-liquidation capitulation behavior:

Participation is shrinking

Conviction is fading

Price is moving due to cleanup, not initiative

LTF Structure: Bullish Three Drives

On the lower timeframes, Bitcoin is forming a Bullish Three Drives pattern.

The third drive completes around 73.5k

This aligns with:

HTF VWAP lower band

1.272 extension

Liquidity sweep

Capitulative order flow (OI bleed + negative funding)

This is typical terminal behavior, not trend continuation.

CME Context & Upside Scenarios

On CME Bitcoin, the current local high around 97,800 is a weak high:

Formed without strong displacement

Likely to be revisited once price reverses

Base Case

I believe Bitcoin can reverse around 73.3k–73.5k, then move higher to start cleaning short-side liquidity.

First potential reaction target: 91,500

This is the first area where price can realistically pause or react

Extended Upside Scenario

If 91,500 breaks with acceptance:

Price can continue higher

Take out the weak CME high at ~97,800

And potentially reverse around 100,500

That level is important because it aligns with:

A daily FVG / imbalance

A Low Volume Node (LVN)

→ Areas where price often reacts sharply due to poor auctioning

Alternative Downside Scenario

If the 1.272 (blue box) does not hold:

Next mathematical extensions become:

1.414 → ~70k

1.618 → ~64k

These remain valid but are secondary scenarios.

Final Takeaway

This is not a market aggressively trending lower.

This is:

A post-liquidation environment

With shrinking participation

Capitulative order flow

And a terminal structural setup at a major HTF confluence

Price is falling because traders are exiting — not because bears are pressing.

Math aligned.

Data confirmed.

Reaction over prediction.

— ThetaNomad

-----

If this kind of structured, data-driven analysis resonates with you, feel free to like or comment.

Not selling anything — just helping people see through the noise.

-----

Bitcoin – Market Context & Liquidity PerspectiveEven though Bitcoin remains bullish in the long term, price has been in a corrective bearish phase since October, which is a normal reaction after a strong impulsive move.

Since October 2022, price has been retracing and is currently revisiting a key area that many traders are watching closely.

In the past, this level acted as resistance before being broken. Once broken, it became support, and price has recently reacted from this area.

At this level, many participants are positioning long, while others are already positioned short. It is important to remember that for price to move higher, sell-side liquidity is required.

In order to generate that sell-side liquidity, price often needs to trade below support levels where liquidity is resting. For this reason, I expect Bitcoin to sweep liquidity below the 72,000 level at minimum.

As long as the 98,000 high remains intact, there is no clear structural reason for price to move higher from current levels. Before a break above 98,000, a break below the 72,000 support is, in my view, more likely.

Weekly BTC SummaryBTC is trading into a major high-timeframe Critical Zone that previously acted as a key distribution and decision area. Price is currently below prior weekly structure, with value and POC overlapping this zone and the weekly 200 EMA approaching from below. This creates a high-confluence area where direction will be decided. Acceptance below the zone increases the probability of continuation toward the weekly 200 EMA and lower value, while a strong weekly reclaim and hold above the zone would signal demand absorption and open the door for continuation toward prior highs. Weekly closes are decisive here — expect volatility inside this area before a clear direction is confirmed.

Breaking: Bitcoin Dips to $70K Zone The price of the notable asset - Bitcoin ( CRYPTOCAP:BTC ) Dips to $70K Zone amidst market turmoil. The asset has broken the base of a bearish symmetrical triangle further hinting on more selling pressure in the short to long term.

Notable assets like CRYPTOCAP:ETH , CRYPTOCAP:SOL and CRYPTOCAP:XRP all experience their own fair share of the market volatility.

A major reason the sell-off became so aggressive was leverage. Many traders were using borrowed funds in Bitcoin and altcoin derivatives. When prices dropped quickly, those positions were forced to close.

These liquidations created a chain reaction. Each forced sell pushed prices lower, triggering more liquidations. This is common during sharp crypto pullbacks, especially when markets are thin and traders are over-positioned.

Traders will be watching whether Bitcoin can stay above recent support levels. If it holds, the market may slowly recover. If it breaks lower again, another wave of selling could follow.

For now, the market looks shaken but not broken. The weekend sell-off was sharp, but Bitcoin’s ability to stabilize suggests this may be a reset, not the start of a deeper collapse.

BITCOIN - time to buy BTCUSDBITCOIN (BTC/USD) has recently dropped in price but struggled to break through a major support level which is currently holding the price. A few weeks ago the price also broke a strong resistance level (the white trend line shown on the chart) - The price is currently bouncing off the major support zone and likely to go back to the upside and hit the take profit level (drawn on the chart). Buy BTCUSD now!

BTC Bullish Setup: RSI < 30 Has Marked Strong ReversalsBTC Daily Chart – RSI < 30 Has Historically Marked Strong Bounce Zones

On the BTC daily chart, we can see a recurring pattern: whenever the RSI dips below the 30 level (oversold conditions), price has historically reacted with a notable bounce.

The highlighted blue circles show multiple instances across different market phases where:

- RSI dropped into oversold territory

-Price was trading near key support or demand zones

\-BTC followed with a relief rally or trend continuation move

This does not guarantee a bottom every time, but it does suggest that risk-to-reward improves significantly when BTC becomes oversold on higher timeframes like the daily chart.

Key takeaways:

- RSI < 30 on the daily has often aligned with local or macro bottoms

- These zones are worth watching for reversal signals, bullish divergence, or confirmation from price action

- Best used in combination with support levels, volume, and market structure

Cheers

Hexa

Bitcoin Bear Flag Breakdown in Play - Target $74k - $75kAnd this chart of Bitcoin we see the Bear Flag pattern playing out as forecast by the Red zigzag line a few weeks ago.

Price pushed up directly into the Red Cell Zone which are just visualizations of limit sell orders on the order books. Similarly, there are strong limit buy orders in the buy support green zone below around 84 to 85k.

But based on my prior study of the macro Head and Shoulders that likely will play out, even if we get it bounce here I do believe we will roll over and take out the buy support Zone below us and complete the Bear Flag measured move target down to 74k to 75k.

This will likely be the bottom, as Bitcoin is never gone below the price it was when a new incoming president won an election. 74k was a prior resistance level flipped as support and I expected to hold.

If it doesn't, then likely Bitcoin can head to 62k which would be the measured move on the macro Head and Shoulders in the prior study here.

In the meantime, lots of uncertainty in the markets, that could drive prices either way in the short term.

Today we have FOMC and although there is a 97% chance they do not cut rates, Powell's comments will be important and may move the markets depending on how hawkish or doveish he sounds.

With war tensions in the Middle East and Iran's escalatory language, Market participants are staying out as they don't like uncertainty.

On the other hand, hearing rumors that the US is buying Japanese yen to help prop up their currency and potentially start the money printer which would be bullish.

The DXY is also heading down, and if it breaks the 95 level then typically we enter another bullish phase as we saw in 2021.

Let me know your thoughts!

Bitcoin Downside Target📉 INDEX:BTCUSD continues to unfold a bearish sequence from the October peak, with short‑term bounces expected to fail below 98K.

#Bitcoin temporary bounce toward the 85K area remains possible before the next leg lower unfolds, targeting the 57K zone as the next downside objective.

BTC lost vital support. Where to now? 3 Levels to watch

As Mentioned in posts earlier, the 236 Fib Retrace line was a Vital line of support, that if lost, could show a deeper Bear market is waiting..

And we lost it this afternoon.

We can see how PA fell below that line and is currently bouncing off the Value Area LOW of the VRVP, technically a line of support that may hold, if the Bulls decide to.

A Closer look at the chart above

eThis show us, in Green highlight, the 2024 Range Zone, that I am hoping PA will go no lower than.

We have 3 levels.

Just below where we are now, we have the 3.618 Fib extension line, this is a Cycle Fib set, based on the Start in December 2022.

This Fib line is around the 71K usd line

The Middle line of this Range is around 65K and is a VERY possible bottom line in my books, but we can never be sure.....

And the lower line of support, we find around 3 Cycle Fib extension line at 59K..less likely but possible on a Quick dive down and recovery

I have Buy orders on all 3 lines.

If we zoom out again, here is the original chart ...

See over on the left, the 3 blue boxes, these show you the % level drop from the current ATH to various Levels.

If we do a traditional 80% drop, we will see PA way down , on the top of the original pause in Rise in 2022 at a price around 24600. I find this unlikely But, should large Corporations begin to sell their ETF holdings.......

Next is the 69% Drop we would have if PA fell to the 2 Cycle Fib Extension. This has a price around 39200. What a Buying opportunity that would be..........

My expected absolute low around 59K, we find sitting on the Cycle 3 Fib extension. Which as a Note, was just below the 2021 ~ATH line.

We are currently just above the 2024 Range Box and , as mentioned Earlier, I am NOT wasting this opportunity to buy, even if that price carries on dropping.

This is where we "Scale In"

Do NOT use all your money in one go. use 10% of it, see where price goes, Use another 10% at the next opportunity.....and so on..............

The same pribciple is used to "Scale put" when you want to sell.

Keep Calm and BUY BITCOIN

BULLISH Long Term Bitcoin Setup*NOT INVESTMENT ADVICE*

From a long term perspective, Bitcoin looks strong and we are entering an area of *POTENTIAL* support.

The $65K to $75K area has provided major resistance and support previously. As we trade into this area, we need to be aware that Bitcoin has the possibility of bouncing from here.

We see the 20 & 50 month SMA' sloping upwards, indicating the long term bullish trend is in play still.

The Monthly ADX shows us that this bullish trend has integrity (ADX above 25 with buyers in control based on +DMI above -DMI). We have seen on the pullback from ATH that the ADX has been declining, indicating that the Sellers lack integrity on the Monthly timeframe, and that this is a dip to be bought ONLY ONCE THERE IS CONFIRMATION THAT THE BULLISH MOMENTUM HAS RESUMED. Personally, I'll be looking for the weekly chart to show resumption of momentum via 5 period RSI closing above 50.

If a person is looking to accumulate Bitcoin for an investment style trade, this is a great area to look to enter ONLY IF the bull step up.

Let me know your thoughts and questions.

BTC/USDT Analysis. What to Expect Next?

Hello everyone! This is the CryptoRobotics trader-analyst with your daily market update.

Yesterday’s session favored buyers, as price reached the previously marked volume zone at $77,400–$79,400, where trading continues within this range.

At the moment, the primary scenario still points to a potential continuation of the downside move. Weak market buying pressure, volume distribution, and the presence of long-term liquidity below current levels all support this view. A false breakout of the technical level around $79,500 could trigger another wave of selling. The nearest liquidity magnet remains around $74,400, where significant liquidity is positioned.

A less likely scenario involves consolidation above the $77,400–$79,400 zone. In this case, short positions would be considered from higher resistance zones. Only after another failed selling attempt could longer-term long scenarios become relevant.

Buy Zones

$72,200–$56,000 (daily buy zone)

Sell Zones

$82,000–$85,500 (volume anomalies)

$87,000–$88,000 (selling pressure)

$92,600–$93,500 (volume anomalies)

$96,000–$97,500 (selling pressure)

$101,000–$104,000 (accumulated volumes)

This publication is not financial advice.

The Elephant Jungle Page 8Today looks like another resting day in the Wild.

So the question remains...Who will prevail, the Bulls or the Bears?

I’ll be ready for whatever situation presents itself, and I hope you will be too.

Like always, stay safe out there. Use good risk management. Wait patiently for your levels and your confirmations.

The Elephant Jungle Page 7So now we’ve dropped down to the 15m timeframe, and wouldn’t you know it, we’ve got a 15M range forming. Two taps at the low. One tap at the high. That alone puts a Wyckoff Accumulation on the table. The real question is which model the market wants to play. Model 1 Accumulation: Price sweeps the range low a third time, then pops back up toward the range high. If this plays out, the Macro Range Low could get swept as well, opening the door for a move into the 1M Demand Range. And if that move holds... I’d say there’s a real chance we could eventually see ATHs again off that bounce. The second play is a Model 2 Accumulation, which would show up as an inverted head and shoulders. All the criteria are there. We’ve got a 45m Internal Demand Range to bounce from, and there’s even a clean 15m order block sitting above it. This could be the area where the Bulls plan to pop off just enough to push price back up into the 1W Supply Range. Now let’s put on another pair of glasses.

If price sweeps the high of the range again before touching the demand zones, that would give us a second tap on the high. And at that point a Wyckoff Distribution enters the chat.

From there, it’s a clean 50/50.

Accumulation or Distribution.

Continuation or collapse.

Looks like London might leave the decision up to New York.

The Elephant Jungle Page 6Now things are starting to get interesting.

On the last leg of the 4H market structure, we also have 1H structure in play. And depending on who you ask, some will say the Bulls broke structure back to the upside on the 1H.

If you’re asking me... Then no, they didn’t. Here’s why. If you actually look at the candlesticks, you’ll notice that the so called “break” is made up almost entirely of wicks. The Bulls never managed to get a clean body close above the 1H high. And this is where a little trick comes in.

If you take the trendline tool and draw it from the first wick that “broke” to the next candle, you’ll see that the following candle SFP’d the previous one. Do it again with the next candle forward, and you’ll notice the same thing, it SFP’d the candle before it. This process is called staircase-ing.

Staircase-ing helps you identify whether you have a true structural break or just price stepping over itself with wicks.

With that being said, the 1H low is technically weak, and in theory, price should be heading back down. But, this is the Jungle.

The Bulls don’t always play by the rules. They could find some internal demand somewhere below, bounce price back up, sweep the equal highs, and finally push into that FVG.

Until then, wick breaks don’t impress me.

Body closes do.

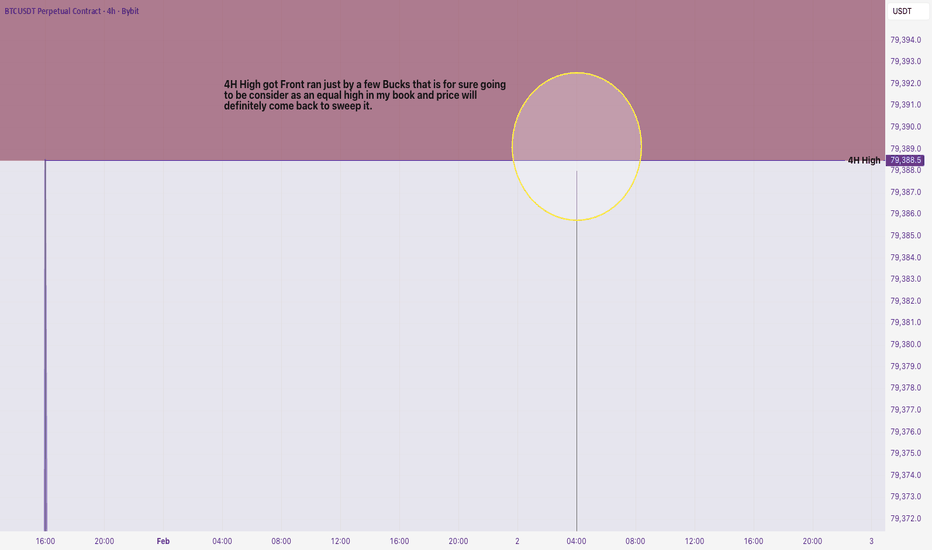

The Elephant Jungle Page 5So we SFP’d the 4H low, which instantly made the 4H high weak.

The Bulls tried to push up and take that high, but it looks like they came up short. The level didn’t get taken, it got front ran by a few dollars.

That’s the part people need to pay attention to.

So now we’ve got a real question in the Jungle, Is this the Bears taking an early stance, stepping in ahead of the level and getting ready to make a serious run at the Macro Range Low? Or… Is this the Bulls intentionally letting a retrace happen allowing more liquidity to be grabbed so they can come back with a stronger push, to finally take the 4H high, and drive price up into the FVG?

This is where patience matters. Front runs don’t happen by accident. Failed highs don’t either. One side is positioning early. The other is reloading. And the next clean move will tell us exactly who’s lying.