BTC/USDT Liquidity Map & Order Block Analysis🚀 BTC/USDT Bullish Setup | Bitcoin vs Tether Technical Roadmap

📊 Asset: BTC/USDT — Bitcoin vs Tether

Market: Cryptocurrency

Style: Day Trade / Swing Trade

Bias: Bullish Continuation Structure

🔎 Market Structure Overview

BTC/USDT is holding above key higher-timeframe support, maintaining a bullish market structure with:

✅ Higher Highs & Higher Lows (4H / Daily)

✅ Price respecting dynamic Moving Average support

✅ Liquidity sweep completed below recent swing low

✅ RSI recovering from mid-zone (bullish momentum rebuild)

✅ Volume expansion on upside impulse

The broader crypto market sentiment remains constructive as long as BTC defends key structural demand zones.

🎯 Trade Plan

Entry:

Flexible execution — look for pullbacks into intraday demand zones, previous breakout levels, or dynamic MA support for refined risk positioning.

Target: 75,000 USDT

Major psychological resistance

Previous liquidity pool

Potential distribution zone

Overbought condition likely near that level

If price approaches this region with weakening momentum or bearish divergence, profit protection is recommended.

Stop Loss: 67,000 USDT

Below key structural swing low

Below liquidity cluster

Invalidates bullish continuation structure

⚠️ Always adjust risk based on your account size and strategy. Risk management defines survival.

📈 Technical Confluence

🔵 50 & 200 Moving Averages acting as dynamic support

🔵 Bullish order block respected on 4H

🔵 MACD momentum building

🔵 Market structure intact above previous breakout zone

🔵 Liquidity imbalance partially filled

As long as BTC trades above the 67K structural support, upside continuation toward 75K remains technically valid.

🔗 Related Pairs to Watch (Correlation Insight)

Monitoring correlated assets strengthens conviction:

ETH/USDT → Ethereum strength confirms broader crypto risk appetite. If ETH outperforms BTC, bullish continuation probability increases.

BTC/USD → Spot USD pricing gives additional macro perspective vs stablecoin pricing.

TOTAL (Crypto Total Market Cap) → Expansion confirms risk-on environment.

DXY (U.S. Dollar Index) → Inverse correlation. Strong USD = pressure on BTC. Weak USD = supportive for crypto.

NASDAQ (US100) → Positive correlation with risk assets. Equity rally often supports BTC upside.

If DXY weakens while NASDAQ and ETH push higher → bullish confluence strengthens.

🌍 Fundamental & Macro Drivers

Key economic and crypto-specific catalysts influencing BTC:

🏦 U.S. Macro Factors

Federal Reserve interest rate expectations

CPI (Inflation Data)

Core PCE

NFP (Non-Farm Payrolls)

Treasury yields movement

🔎 Lower inflation + dovish Fed tone = supportive for BTC

🔎 Strong USD + rising yields = short-term pressure

💰 Crypto-Specific Catalysts

Spot Bitcoin ETF inflows/outflows

Institutional accumulation data

On-chain exchange reserve changes

Mining hash rate trends

Stablecoin liquidity expansion (USDT supply growth)

Growing ETF inflows + declining exchange reserves = bullish supply dynamics.

🧠 Trading Psychology Reminder

Markets reward discipline, not emotion.

Secure profits when momentum weakens.

Protect capital before chasing targets.

This plan outlines structure — execution and risk control remain personal responsibility.

If this setup aligns with your analysis:

👍 Drop a like

💬 Share your target in comments

🔔 Follow for structured crypto breakdowns

Precision. Patience. Profit.

Bitcoinpriceprediction

BTC 1H🧠 Market Context

Bitcoin has just completed a liquidity sweep after an extended move, tapping into a high-timeframe supply/demand reaction zone. Price action is currently compressing, signaling that we’re approaching a decision point where momentum traders and HTF participants collide.

The recent impulse leg shows aggressive positioning, but follow-through volume is starting to fade — typically a precursor to either consolidation or a sharp expansion move.

🔑 Key Levels To Watch

Major Resistance / Supply: Previous breakdown region + liquidity cluster

Mid-Range Pivot: Intraday structure flip area

Primary Support: Demand zone aligned with prior consolidation base

Invalidation Level: Clean break + acceptance beyond HTF structure

These zones are not just horizontal levels — they represent orderflow interest areas where reactions are statistically more likely.

📈 Bullish Scenario

If price holds above the mid-range structure and builds higher lows:

Expect continuation toward equal highs / resting liquidity

Break-and-retest of resistance could trigger expansion

Momentum confirmation: strong candle closes + increasing volume

Bias shifts bullish on structure confirmation, not anticipation.

📉 Bearish Scenario

Failure to reclaim reclaimed structure could signal:

Distribution inside resistance

Sweep-and-reverse pattern

Rotation back into lower demand zones

A clean breakdown below support with acceptance likely opens a fast-move liquidity vacuum.

⚠️ Trading Strategy

Avoid chasing mid-range noise

Let price come into levels

Focus on confirmations:

Structure breaks

Volume expansion

Reaction speed at zones

Remember: Location > Prediction.

🧭 Final Thoughts

Bitcoin is sitting at a high-probability reaction area. The next expansion move will likely come after liquidity is fully engineered around current consolidation.

Stay patient, trade the reaction — not the emotion.

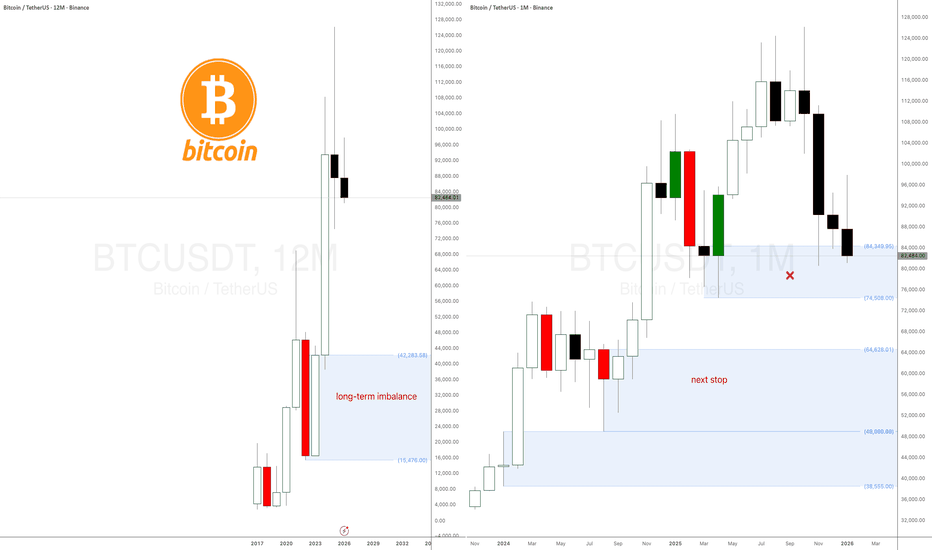

Bitcoin Sky‑View Analysis - Real Drop Comes NextIn this video, I break down Bitcoin from a true top‑down perspective, starting with the quarterly (3‑month) chart and drilling all the way down to the 4‑hour timeframe. The higher‑timeframe structure forms the foundation of the broader thesis—it is not designed for trade entries or exits, but for understanding where Bitcoin is positioned in its macro cycle.

On the 3‑month chart, Bitcoin has found support at the 21 EMA, which aligns with the 50 EMA on the monthly timeframe. This behavior mirrors the structural pause we saw in 2021. Based on this pattern, I expect price to hold this region into next month before a potential major sell‑off into the deeper liquidity zone between $49,000 and $56,000.

However, I do not expect a final bottom in that zone. The Stochastics cycle—one of the most reliable tools for timing Bitcoin’s macro highs and lows—has not yet reached the 20‑level floor. Until that cycle completes and turns upward, it is premature to call a long‑term bottom. When the Stochastics cycle finally resets, that will be the ideal accumulation window for the next major rally.

On the weekly and daily timeframes, indicators are already oversold, suggesting Bitcoin may continue to move sideways while momentum resets. During this consolidation, I expect liquidity to be taken on both sides of the range—toward $75,000 on the upside and $62,000 on the downside. This is classic market‑maker behavior, so trade with caution.

This analysis reflects my personal outlook and is not financial advice. If you find value in these breakdowns, show your support with a boost and share this with a trader you care about—you might help them avoid a costly mistake. Let’s continue growing as a community that studies, understands, and masters the markets together.

Cheers!

BTC Friday Retrace Hits VWAP: Bullish Reversal or Bull Trap?Will Bitcoin hold this level, or are we looking at a deeper correction?

The Friday retrace played out exactly as anticipated, with price pulling back into the VWAP and establishing a reversal into the weekly close. We are now sitting at a major resistance level where the market must decide its next macro move. In this video, I break down the exact price action signals I'm watching to determine if we break bullish or if the bears take control for a deeper run into the lows. 📉🚀

As a trader, the most dangerous move is front-running a breakout before the market settles. I’ll walk you through my Step-by-Step Trade Plan for the beginning of the week, including the specific entry triggers and risk zones I’m using to navigate this volatility.

What we cover today:

The significance of the Friday VWAP retrace and weekly close 📊

Key support and resistance levels for the Monday open 🔑

Market structure shift vs. trend continuation scenarios

My personal bias

Stay Disciplined: We don't predict; we react. Let the market settle into the new week and provide the confirmation needed to execute.

⚠️ RISK DISCLAIMER: Trading involves significant risk. This video is for educational and entertainment purposes only and does not constitute financial advice. Always perform your own due diligence before risking capital.

Bitcoin’s V-Bounce Raises Red Flags! Short Squeeze or Real BottoBTC Today: Short Squeeze or Real Bottom? Why This Move Might Be a Trap

Today’s Bitcoin move has sparked optimism across the market. After dipping into the ~60k region, BTC aggressively squeezed higher, reclaiming key levels around 68k–71k in a short amount of time. Many are already calling this “the bottom.”

But if you zoom out and study Bitcoin’s historical behavior, this move looks far more like a short squeeze than a confirmed cycle low.

Why Today’s Move Looks Like a Short Squeeze

The rally came after:

A sharp sell-off into a well-known high-liquidity demand zone (~58k–60k)

Extremely bearish sentiment

Heavy short positioning after multiple breakdowns

This is the perfect environment for a squeeze:

Shorts pile in late

Price hits a major level

Market snaps higher as shorts cover and late longs FOMO

Short squeezes are fast, emotional, and convincing — exactly like what we saw today.

The Historical Problem: BTC Rarely Bottoms With a V-Shaped Recovery

Here’s the key issue:

Bitcoin almost never forms a macro bottom with a clean V-shaped recovery.

Across prior cycles:

Bottoms are formed through chop, retests, and boredom

Price usually revisits the lows at least once

Structure builds slowly, not explosively

The only major exception was the COVID crash, which was driven by:

Emergency global stimulus

Forced liquidations across all markets

Extreme external intervention

Outside of that event, V-shaped BTC bottoms are not the norm.

Why This Move May Be Creating False Hope

Markets often rally just enough to:

Convince traders the worst is over

Pull sidelined money back in

Force shorts to exit

This creates hope, which is a powerful tool.

But hope-driven rallies inside broader corrective structures often lead to:

Lower highs

Failed breakouts

A return to sweep remaining liquidity

And right now, there is still significant liquidity resting below 60k.

Why the “Real Move” Often Happens on the Weekend

Another pattern worth noting:

Bitcoin frequently makes decisive moves during low-liquidity periods

Weekends are notorious for:

Stop hunts

Fake breakouts

Sharp reversals when participation is low

If the market truly wants to reset positioning, a weekend move that:

Reverses lower

Sweeps liquidity below 60k

Forces maximum pain

…would be completely in line with historical behavior.

Key Levels to Watch

Resistance: 71k–72k (squeeze extension zone)

Support: 68k, then 66.8k

Liquidity magnet: sub-60k

As long as BTC remains below major weekly resistance, today’s move should be treated with caution.

Final Thoughts

This rally does not need to fail immediately to still be a trap.

Short squeezes can extend, consolidate, and then reverse.

Until Bitcoin:

Holds higher lows on higher timeframes

Reclaims and sustains key weekly levels

Stops reacting violently to liquidity

…it’s premature to declare the bottom is in.

Hope rallies feel good. Real bottoms feel boring.

Stay patient. The market may still have unfinished business below.

BITCOIN: One Last Drop And Then On The Way $200,000Dear Traders,

In our previous analysis, we predicted a price drop from 100k to 60k through multiple analyses. This prediction has come true as the price is currently plummeting sharply. We believe the price will likely fall between 63k and 58k, which would be ideal for swing buyers and a potential high volume zone.

We anticipate a final drop before the price reverses and potentially reaches a record high. Our initial targets are $100k, $150k and ultimately $200k. This is likely to be a significant reversal.

Please like and comment for more updates. Also, follow us for the latest news.

Team Setupsfx_

My BTC Gameplan: How to Trade the Retest of This Big Supply ZoneThe macro narrative for BTC Bitcoin is currently under intense pressure as we navigate a significant "Risk-Off" shift across global markets 🏦. This week's carnage was largely fueled by a cooling AI sector and disappointing labor data, which sent a shockwave through speculative assets. Interestingly, general online sentiment has reached a point of extreme "capitulation" chatter, with retail consensus flipping heavily bearish as price breached the psychological $65k floor. This level of synchronized fear often signals a "liquidity hunt" is underway, where the market seeks to flush out late-stage shorts before finding a stable floor.

We are seeing a clear Bearish Market Structure on the 30m chart 📉. The price has been respecting a steep descending Parallel Channel, characterized by aggressive sell-offs followed by shallow "bear flag" consolidations. While widespread community chatter is calling for a "death spiral" toward $50k, the technicals show we are approaching the $60,079.58 level, which represents the 0.00% Fibonacci extension of the recent leg. This suggests the immediate downside momentum might be overextended, setting the stage for a relief rally toward the supply zones above.

Key Zone: The primary area of interest is the confluence between the upper boundary of the Parallel Channel and the Fibonacci 51.8% to 61.8% Retracement zone (approximately $71,457 to $71,878).

We are currently trading at the bottom of the current impulse range, just under the $61k mark. I am watching for a "run on liquidity" to sweep the late sellers who are piling into shorts at the bottom of the channel 🧹. My view is that the market will likely bounce to retest the VWAP and the 50% Fibonacci level near $69,471 before the next major decision point.

IMPORTANT BITCOIN ALERT! TRAP BEFORE THE CRASH? Jan 30 2026!!BTC IMPORTANT ALERT! Jan 29 2026.

I know you've been waiting for this update, but there's been a new development in the chart.

Data from 2014 to 2026, presented across multiple charts, suggests that we are approaching a major market crash. That said, there may still be short-term rallies in altcoins, while Bitcoin is likely to remain relatively muted. This final move could turn out to be the ultimate bull trap.

This is purely based on fractal analysis; it’s not a personal bias.

I expect Bitcoin to form a bottom somewhere between $44k and $54k over the coming months. I’ll be sharing a more detailed chart soon, including the projected timelines for potential bottoms in both BTC and altcoins.

I plan to position on the bearish side once the final bull trap is in. Until then, we will continue scalping on lower timeframes, primarily from the short side.

We will make money even if the market crashes.

This cycle hasn’t been the bull run we hoped for; it’s been brutal. But what defines us is that we never give up. We adapt, we fight back, and we keep going.

Hope this gets the point across.

In short, BTC could still push as high as $100k in the coming weeks as part of a final bull trap, even though the overall structure looks extremely ugly.

Please hit the like button if you like it.

Let me know what you think in the comments.

Thank you

#PEACE

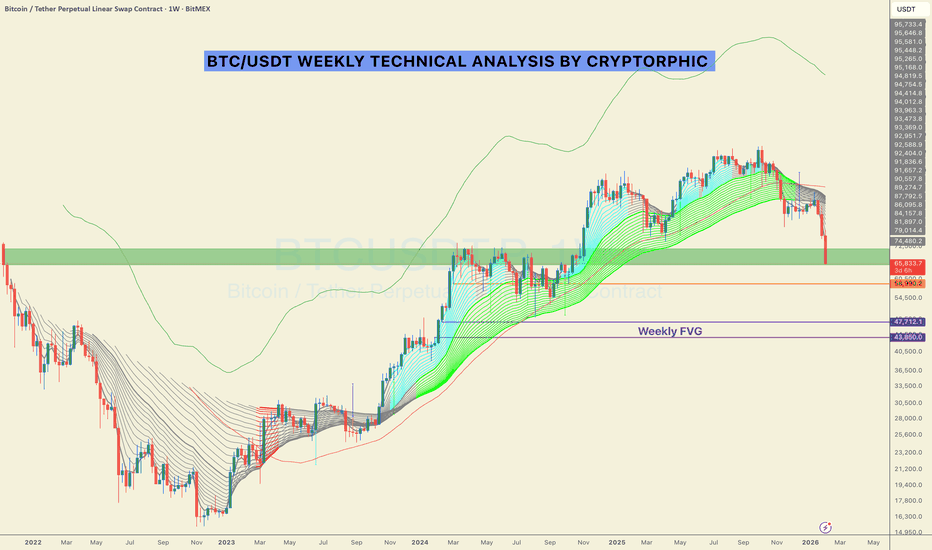

#URGENT BITCOIN UPDATE! Don't Miss the Bottom!!CRYPTOCAP:BTC has entered a very important level. It has been a severe correction.

To keep it simple, the only meaningful support left in this entire move is around $58K.

If price breaks below that level, the downside could be aggressive, with BTC likely moving into the $43,850 – $47,712 range, which aligns with the weekly Fair Value Gap.

The current candle closes in 3 days.

From a technical perspective, price is approaching a potential short-term reversal in LTF. This is not optimism; it is what the chart is showing.

DYOR | NFA

Please hit the like button and share your views in the comments.

Thank you

#PEACE

BITCOIN: As Expected Price Is Dropping, Waiting To Come at 60K?Dear Traders,

As anticipated, the price is reversing from $98,000 and may experience a significant drop towards $60,000. The $60,000 area remains strong and attracts swing buyers. Our recommendation is to wait for the price to break through this trading range pattern. A strong breakthrough would indicate a clear price pattern.

If you like our idea, please like and comment for more.

Team SetupsFX_

#BITCOIN: 2026 Is Loading Possible Drop First And Then Boom! Happy New Year 2026💥🎇

We extend our best wishes for your success and happiness, hoping this year brings the achievement of all your trading objectives.

Let us now analyse Bitcoin's concluding performance for the year 2025👨💻📈

🔺Bitcoin is currently exhibiting strong consolidation, trading within a range of $80,000 to $95,000. It is possible that the price is awaiting robust Non-Farm Payroll (NFP) data to bolster the DXY, which could indirectly lead to a price correction towards the $67,000-$64,000 range. This area is characterized by significant bullish volume and liquidity. A potential swing target could be established above the recent yearly high of $125,000.

Entry, Stop Loss, and Take Profit💭

🔺A strong order block entry is identifiable at $67,000, a critical level for global investors. Upon a price rejection from this vicinity, we anticipate a reversal and subsequent progression towards our designated take-profit target of $135,000.

🔺 A stop loss can be positioned below $59,000 providing a sufficient buffer in the event of a liquidity hunt. This trade may require up to a full year to materialise unless fundamental shifts induce unexpected price movements.

Support and Encouragement 🏆

🔺 We encourage you to comment on and share this analysis if you find it insightful. Your engagement, particularly through likes, provides valuable affirmation of our efforts.

We wish you good year ahead and appreciate your continued support.

Team SetupsFX_

Bitcoin BTC Hits Major Support: Why I Am Not Selling YetIs the Bitcoin sell-off going to grind to a halt? Or are we just catching our breath before the next leg down? In this session, we break down the aggressive price action that has pushed BTC into a high-confluence support zone and why patience is your most profitable tool right now. 📉

As we approach the weekly close, the market structure remains bearish, but entering a short at these lows carries significant expansion risk. I am walking you through my technical bias, explaining why I’m avoiding "chasing the move" and instead waiting for a high-probability pullback into the 61.8% Fibonacci retracement level.

What we cover in today’s analysis:

Market Structure: Identifying the recent impulse leg and key support levels.

Fibonacci Confluence: Why the 61.8 zone is the "Golden Mean" for this short setup.

Risk Management: Why the end-of-week liquidity makes new entries dangerous.

Execution Strategy: The specific price action confirmations I need to see before clicking sell. 📊

Whether you are a swing trader or a scalper, understanding this higher-timeframe context is vital for protecting your capital. Stay disciplined and wait for the setup to come to you. 🔥

RISK DISCLAIMER: Trading foreign exchange, cryptocurrencies, and indices on margin carries a high level of risk and may not be suitable for all investors. The content in this video is for educational purposes only and does not constitute financial advice. Past performance is not indicative of future results.

BTC/USDT Analysis. A Logical Continuation of the Decline

Hello everyone! This is the CryptoRobotics trader-analyst with your daily market update.

Yesterday, the expected downside scenario played out, although we did not see liquidity taken above the $79,500 level. After a short consolidation within the $77,400–$79,400 range, price continued downward and swept liquidity below the local low.

During the breakdown, strong selling pressure was absorbed, followed by a confident rebound that pushed price back above the broken level. This creates an interesting setup for a speculative long position, as continued selling pressure is failing to produce further downside results.

We consider long positions on a retest of the selling absorption zone at $75,000–$74,000 if buyer reaction appears. The nearest upside target in this case is the $80,000 area.

Buy Zones

$75,000–$74,000 (selling absorption)

$72,200–$56,000 (daily buy zone)

Sell Zones

$82,000–$85,500 (volume anomalies)

$87,000–$88,000 (selling pressure)

$92,600–$93,500 (volume anomalies)

$96,000–$97,500 (selling pressure)

$101,000–$104,000 (accumulated volumes)

This publication is not financial advice.

Breaking: Bitcoin Dips to $70K Zone The price of the notable asset - Bitcoin ( CRYPTOCAP:BTC ) Dips to $70K Zone amidst market turmoil. The asset has broken the base of a bearish symmetrical triangle further hinting on more selling pressure in the short to long term.

Notable assets like CRYPTOCAP:ETH , CRYPTOCAP:SOL and CRYPTOCAP:XRP all experience their own fair share of the market volatility.

A major reason the sell-off became so aggressive was leverage. Many traders were using borrowed funds in Bitcoin and altcoin derivatives. When prices dropped quickly, those positions were forced to close.

These liquidations created a chain reaction. Each forced sell pushed prices lower, triggering more liquidations. This is common during sharp crypto pullbacks, especially when markets are thin and traders are over-positioned.

Traders will be watching whether Bitcoin can stay above recent support levels. If it holds, the market may slowly recover. If it breaks lower again, another wave of selling could follow.

For now, the market looks shaken but not broken. The weekend sell-off was sharp, but Bitcoin’s ability to stabilize suggests this may be a reset, not the start of a deeper collapse.

USDT.D Signalling Crypto Crash Zone & Bear Market Revisiting this study again that I originally shared months ago as a possible 'path' to either the new ATH targets and/or the Crypto Crash & Bear Market zones...

We can see the the Blue bars from the last cycle are an important fractal to follow.

USDT.D (Tether Dominance) clearly shows the inverse relationship it has with Bitcion and TOTAL market cap, which I have hidden here.

But the Yellow line is the midpoint and can be considered the 'Mean' in the 'reversion to the mean' equation.

At the lows of the USDT.D multi-year trendline going back to 2018, when touch the trendline, crypto is rallying and hitting all time highs.

In contract, when USDT.D is pushing higher (Money flowing into Stablecoins) we see markets correcting and crashing.

I've labeled the corresponding areas, which we can see that USDT.D is now forming support above the 6.5% prior resistance, indicating a deeper crash is likely coming.

Tomorrow is a Triple Witching expiration, so expect volatility.

However, in the past these usually mark reversal points in the markets.

So we'll have to watch and see...

However, most other technical signals are flagging bearish like the Monthly MACD and mult-month Bearish Divergences on the RSI, MFI, and Stoch/RSI

Good time to be out of the markets IMO until this clarifies.

Even if we get a 'Santa Rally' I'll be selling into it, b/c the USDT.D has plenty of room to run to the upside... And we're unlikely to see liquidity return to the markets without more interest rate cuts, QE, and money printing.

All eyes are on Japan's Fed Rate meeting tomorrow, where there's rumored to be a .25 rate HIKE which also has the markets on edge.

BitCoin long-term forecast 2026 dropping to $45k?Bitcoin monthly demand level is under attack. New low printed.

The yearly timeframe is trending up and the dump has started, hopefully. CRYPTOCAP:BTC can continue the dump as explained a few weeks ago.

Next stop is the monthly demand imbalance at $64k. No longs are adviced in the middle or a long-term dump.

BTC Bitcoin MONSTER Trade in Play | Planning Our Next MoveIn this video, we continue managing our BTC Bitcoin MONSTER trade 🥇💪. We break down our strategy and how this can be a lifge changing opportunity.. now planning our next move. Price is printing clear higher highs and higher lows on the 30-minute chart ⏱️📊, and we’re looking to capitalize on the next swing high and retracement.

BTC vs HYPE - or we will grow from here like hypeWhy the setups are actually similar (BTC ↔ HYPE)

Common characteristics:

Upward impulse → pullback

The pullback does NOT break the impulse low

Price is holding:

either the 0.382–0.5 Fibonacci zone

or an ascending local trendline

Structure = bullish pullback, but without confirmation

So this is not “weakness” — it’s a test.

2️⃣ Key moment — where we are now

Right now we are:

below the local high

at the edge of a Fibonacci zone, where:

either real buyers step in

or the market says: “Okay, let’s go deeper.”

And this is where it becomes critical:

how the Sunday candle opens

3️⃣ Two scenarios (and they are clean)

🟢 SCENARIO 1 — MOVE UP FROM HERE

Valid if:

Sunday opens without a gap down

The candle holds 0.382 / the trendline

We see:

a long lower wick

or an impulsive reaction to the upside

👉 Then this is:

liquidity collection

trend continuation

targets: a return to the local high + extension

This is a healthy, clean bullish continuation.

🔴 SCENARIO 2 — DROP ON THE OPEN

Triggered if:

Sunday opens below 0.382

The candle closes below the trendline

There is no fast buyback

👉 Then:

the pullback is invalidated

this becomes distribution → continuation down

logical targets:

0.618

or a full retest of the impulse

And this part is critical:

don’t try to catch the knife

because this would no longer be a “correction,” but a phase shift.

bitcoin daily bullish outlook Like i said earlier, i have a bullish bias on bitcoin. All you have to do is zoom out.

My next buy zone is around 86k. I am going to long bitcoin from 85-86k all the way back to 103-104k, where the next daily liquidity and supply zone is located

Wait for price to form sort of a reverse head and shoulder pattern and buy from the break out.

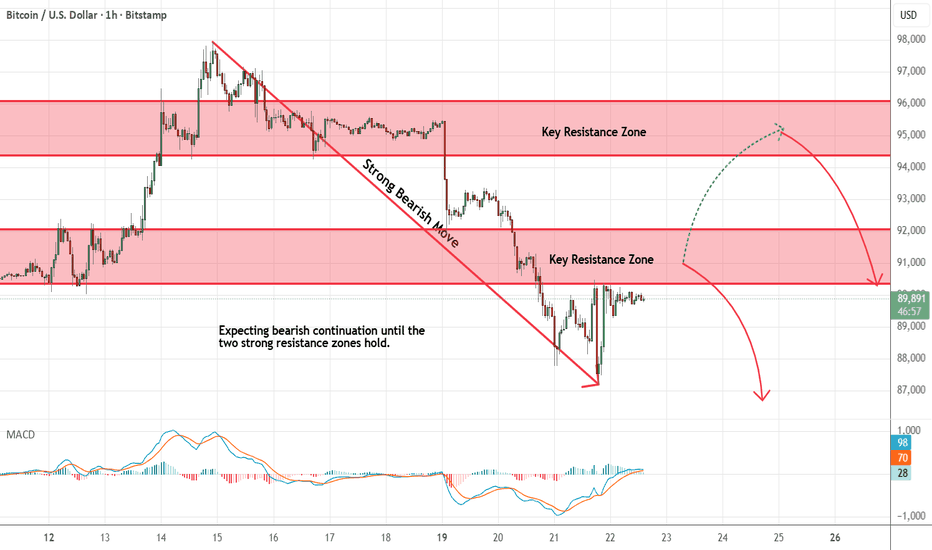

Bitcoin - Looking To Sell Pullbacks In The Short TermH1 - Strong bearish move.

No opposite signs.

Currently it looks like a pullback is happening.

Expecting bearish continuation until the two strong resistance zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------

BITCOIN - buy BTCUSD nowBITCOIN (BTC/USD) has recently been stuck inside a triangle channel pattern and has struggled to break out for a few weeks. However, the price has recently broken a strong resistance level (the white trend line shown on the chart) - The price is currently above the trend line which acted as a strong resistance level and is now very likely to hit the next resistance zone which is labeled as the take profit level. time to buy BTCUSD now!

Analytics: market outlook and forecasts

WHAT HAPPENED?

At the beginning of last week, we broke through an important resistance in the $92,000-$93,000 zone. This was followed by a rapid and steady rise to the upper boundary of the sideways trend and the level of $94,800, which was also broken.

The consolidation of the above-mentioned level and the formation of a support zone of $94,400-$93,200 (volume anomalies) initially gave grounds for the continuation of the uptrend. However, the reaction of buyers in this area turned out to be weak, followed by an impulsive breakdown downwards on the part of sellers. This effectively cancelled the scenario of reaching the $100,000 mark in the near term.

WHAT WILL HAPPEN: OR NOT?

We have now tested the accumulated volume zone of $92,000-$90,400.

The reaction in the form of abnormal volumes has been received, but buyers aren’t yet active to resume growth. The main focus is now on the $93,200-$94,400 mirror zone. The advantage still remains with the seller. The resumption of buys is possible only with a confident breakdown and retest of this zone.

So far, local short positions look like a priority. We consider reaching the technical level of $90,160 as the base scenario.

Buy Zones

$92,000–$90,400 (accumulated volumes)

$88,400–$87,000 (accumulated volumes)

$86,000–$84,800 (anomalous activity)

$84,000–$82,000 (strong volume anomalies)

Sell Zones

$93,200–$94,400 (mirror zone)

$96,000–$97,500 (selling pressure)

$101,000–$104,000 (accumulated volumes)

IMPORTANT DATES

Macroeconomic developments this week:

• Wednesday, January 21, 7:00 (UTC) — publication of the UK Consumer Price Index for December;

Wednesday, January 21, 13:30 (UTC) — speech by US President Donald Trump;

• Thursday, January 22, 13:30 (UTC) — publication of US GDP for the third quarter of 2025, as well as the number of initial applications for unemployment benefits in the United States;

• Thursday, January 22, 15:00 (UTC) — publication of the basic price index of US personal consumption expenditures for November;

• Friday, January 23, 3:00 (UTC) — announcement of Japan's interest rate decision;

• Friday, January 23, 14:45 (UTC) — the publication of the index of business activity in the US services and manufacturing sector for January.

*This post is not a financial recommendation. Make decisions based on your own experience.

#analytics