BTC/USDT Analysis. Market Panic

Hello everyone! This is the CryptoRobotics trader-analyst with your daily market update.

Yesterday, Bitcoin broke a key support level. While the breakdown itself was expected, as mentioned previously, the magnitude of the move was significantly stronger than anticipated. At its peak, the decline exceeded 7%.

The $86,000–$84,800 zone (anomalous activity) was broken, and only upon reaching the major buy zone at $84,000–$82,000 (strong volume anomalies) did the sell-off temporarily pause.

At this stage, the scenario remains unfavorable for buyers. Defensive activity is present, but it is mainly driven by limit orders — market buying pressure is largely absent. Additionally, a mirrored resistance zone with strong selling pressure has formed above at $84,500–$86,000.

A retest of this area may provide a solid opportunity to re-enter short positions. The current context suggests an elevated probability of further downside continuation toward the technical level around $74,500.

A reversal from the current support is possible, but only if price tests the $84,500–$86,000 zone and sellers fail to continue the downward move. Until such confirmation appears, the priority remains on short setups.

Buy Zones

$84,000–$82,000 (strong volume anomalies)

Sell Zones

$87,000–$88,000 (selling pressure)

$84,500–$86,000 (mirrored zone, selling pressure)

$92,600–$93,500 (volume anomalies)

$96,000–$97,500 (selling pressure)

$101,000–$104,000 (accumulated volumes)

This publication is not financial advice.

Bitcoinresistance

BTC/USDT Analysis. Deeper Pullback Likely Before Further Growth

Hello everyone! CryptoRobotics trader-analyst here, and this is the daily market analysis.

Yesterday, as expected, Bitcoin performed a deeper test of the $87,800–$86,400 zone. At one point, the level was breached, volumes increased significantly, and positioning was mainly skewed toward selling pressure.

Today, price has returned back into this zone and we are seeing a reaction from a strong volume bar, highlighted in orange on the chart by the indicator. This indicates local absorption and consolidation, but without a clear dominance from buyers yet.

The primary expectation remains a continuation of the decline toward the key support zone at

$84,000–$82,000 (volume anomalies). This area may become a critical turning point capable of reversing the current bearish move.

An alternative scenario involves buyers re-entering the market from current levels within the now mirror zone at $87,800–$86,400. In this case, the upside potential would target the nearest local resistance.

Buy Zones

• $84,000–$82,000 (volume anomalies)

Sell Zones

• ~$90,300 (local sell zone)

• ~$92,400 (local sell zone)

• $92,000–$93,000 (local volume zone)

• $94,000–$97,500 (volume zone)

• $101,000–$104,000 (accumulated volume)

This publication is not financial advice.

BTC/USDT Analysis. Signs of Defense

Hello everyone! This is CryptoRobotics trader-analyst with the daily market review.

Yesterday Bitcoin dropped into the buyer’s zone at $110,000–$105,000 (accumulated volumes). At that level, delta fell sharply, and the first buyback appeared. Reaching this area also coincided with the return of BTC ETF inflows on the 25th, which may indicate renewed interest from large capital.

At the moment, the situation does not yet look like a full reversal, and most likely the bottom has not been formed. However, the first signs of demand are already visible. At $110,000 we see absorption of selling pressure, which gives today a chance to close in the green.

Above, we have key supply zones from which a renewed downward wave and a retest of the current low or the $110,000 level are expected.

Buy Zones:

$110,000–$105,000 (accumulated volumes)

Sell Zones:

~$112,000 (absorption of market buys)

$114,400–$115,500 (volume zone)

~$116,500 (volume anomaly)

$117,200–$119,000 (accumulated volumes)

$121,200–$122,200 (absorption of buys)

*This post is not financial recommendation. Make decisions based on your own experience.

Analytics: market outlook and forecasts📈 WHAT HAPPENED?

After a positive start to the week and the ATH update on Thursday, bitcoin went into a rapid correction. This happened against the background of negative macroeconomic data from the United States, which increased pressure on the market.

In the daily analysis we noted weak protection from buyers and recommended to refrain from opening long positions.

After testing local resistance around $118,480, the decline continued, and the price reached the next support zone — $115,300–$114,000 (accumulated volumes).

💼 WHAT WILL HAPPEN: OR NOT?

Currently, there's a limit absorption of market sales inside the resistance zone. When a market buyer becomes active, an initial rebound is possible.

However, there are no reversal formations for buys in the medium-term structure: even with a strong buy-back, we should expect a second wave of sales from the $117,200-$119,000 zone (accumulated volumes). It's worth going long only with obvious signs of sellers' weakness — as long as the structure remains favorable for shorts.

If the market buyer doesn't show itself in the current zone, the next reduction target will be the $112,000 level.

Buy Zones:

• $115,300–$114,000 (accumulated volumes)

• $110,000–$105,000 (accumulated volumes)

Sell Zones:

• $117,200–$119,000 (accumulated volumes)

• $121,200–$122,200 (buy absorption)

IMPORTANT DATES

We're following these macroeconomic developments this week:

• Wednesday, August 20, 2:00 (UTC) — announcement of the New Zealand interest rate decision for August;

• Wednesday, August 20, 6:00 (UTC) — publication of the UK Consumer Price Index (CPI) for July;

• Wednesday, August 20, 9:00 (UTC) — publication of the Eurozone Consumer Price Index (CPI) for July;

• Wednesday, August 20, 18:00 (UTC) — publication of FOMC minutes;

• Thursday, August 21, 12:30 (UTC) — publication of the number of initial applications for unemployment benefits in the United States for August and the index of US manufacturing activity for August from the Federal Reserve Bank of Philadelphia;

• Thursday, August 21, 13:45 (UTC) — publication of business activity indices (PMI) in the manufacturing and services sectors of the United States for August;

• Thursday, August 21, 14:00 (UTC) — publication of data on sales in the US secondary housing market for July;

• Friday, August 22, 6:00 (UTC) — publication of German GDP for the second quarter of 2025;

Friday, August 22, 14:00 (UTC) — speech by Federal Reserve Chairman Jerome Powell.

*This post is not financial recommendation. Make decisions based on your own experience.

#analytics

Market overview

📈 WHAT HAPPENED?

Last week, a less priority but expected scenario was realized for Bitcoin. We broke through the sideways in a downward direction and fell to the area of pushing volumes ~$115,000. At this level, strong volume anomalies were recorded, and a rebound occurred.

On Friday, the daily analysis on TradingView indicated a point to join the long movement, which confirmed its accuracy. The price reached the accumulated volume zone of the sideways at $117,600-$119,200 and was able to consolidate above without any significant reaction, which strengthens the buyers' position.

💼 WHAT WILL HAPPEN: OR NOT?

At the moment, the first protection from sellers has appeared. Let's consider possible scenarios:

1. A decline to the mirror zone of $118,300-$117,300, from which, if the buyers' reaction is confirmed, buys are expected to resume.

Next, a narrow sideways formation within the mentioned zone and a local sell zone of $119,500-$119,000 is possible, followed by a long position.

Another option is to develop a further long divergence from the current levels. In this case, the local sell zone of $119,000-$119,500 will provide additional support.

2. A less priority scenario is a decline to the volume anomaly zone of $116,200-$115,000, with a test of the local minimum. In this case, the recovery will take longer.

Buy Zones:

$118,300–$117,300 (mirror volume zone)

$116,200–$115,000 (volume anomalies)

$110,000–$107,000 (accumulated volumes)

Sell Zone:

$119,500–$119,000 (potential resistance if a correction develops)

📰 IMPORTANT DATES

Macroeconomic events this week:

• July 29, Tuesday, 14:00 (UTC) - publication of the US Consumer Confidence Index from CB for July;

• July 29, Tuesday, 14:00 (UTC) - publication of the US Job Openings and Labor Turnover (JOLTS) for June;

• July 30, Wednesday, 08:00 (UTC) - publication of Germany's GDP for the second quarter of 2025;

• July 30, Wednesday, 12:15 (UTC) — ADP's July change in the number of non-agricultural employees in the United States;

• July 30, Wednesday, 12:30 (UTC) — U.S. GDP for the second quarter of 2025;

• July 30, Wednesday, 13:45 (UTC) — Canada's interest rate decision;

• July 30, Wednesday, 18:00 (UTC) — US FOMC statement and announcement of the US Federal Reserve interest rate decision;

•July 30, Wednesday, 18:30 (UTC) — US FOMC press Conference;

• July 31, Thursday, 01:30 (UTC) — publication of the Chinese Manufacturing PMI for July;

•July 31, Thursday, 03:00 (UTC) — announcement of Japan's interest rate decision;

• July 31, Thursday, 12:00 (UTC) — publication of Germany's July Consumer Price Index (CPI);

• July 31, Thursday, 12:30 (UTC) — publication of the United States' June Personal Consumption Expenditure Price Index and Initial Jobless Claims;

• August 1, Friday, 09:00 (UTC) — publication of the Eurozone Consumer Price Index (CPI) for July;

• August 1, Friday, 12:30 (UTC) — publication of the average hourly wage, changes in the number of employees in the non-agricultural sector, and the unemployment rate in the United States for July;

• August 1, Friday, 13:45 (UTC) — publication of the U.S. Manufacturing Purchasing Managers' Index (PMI) for July.

*This post is not a financial recommendation. Make decisions based on your own experience.

#analytics

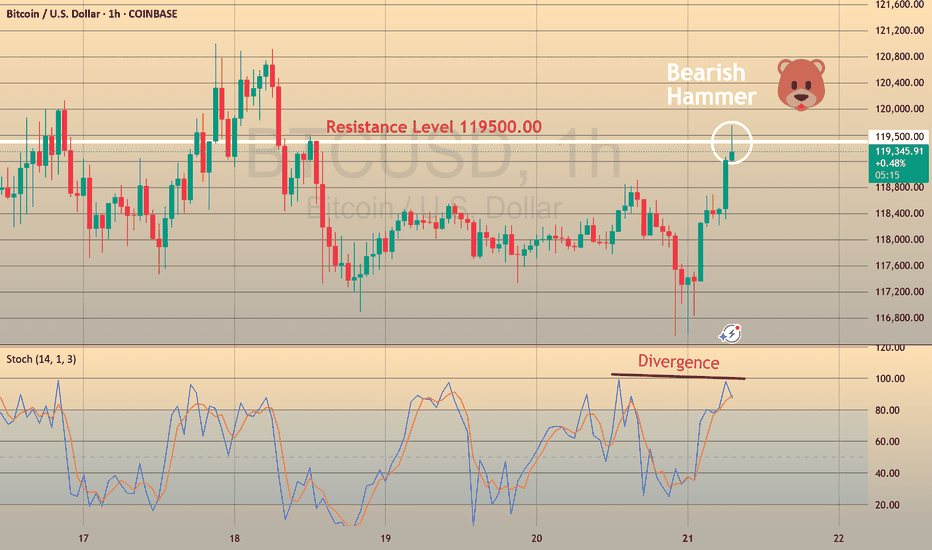

BTCUSD - BEARISH DIVERGENCE DETECTEDCAPITALCOM:BTCUSD

BTCUSD has been in a bullish trend over the past few hours and is now approaching the resistance at 119,500.00.

On the hourly chart, a bearish hammer has formed alongside a stochastic divergence, signaling potential downside.

⚡ This signal is reinforced by a strong resistance level above, adding weight to a possible pullback scenario.

📉 If BTCUSD rebounds from this level, consider Sell setups with take profit at the nearest support.

📈 If it breaks out, look for Buy opportunities on confirmation.

⚡ We use Stoch (14) to spot potential reversals when it exits overbought or oversold zones — helping you catch clear, confident entries.

Good Breakout in BitCoin but two important resistances ahead. Bitcoin has given a breakout this week above trend line resistance but there are 2 important resistances to cross. These 2 resistances are 48061 which rejected further advance of Bitcoin vehemently and 51115. However things took slightly better for Crypto investors compared to last year as liquidity ease may commence with rate cuts happening (By US FED) later this year. (At least we expect that.). 43535 is now a good support for Bitcoin.

I do not Invest in Crypto as of now and do not recommend the same but this message is for analysis purposes only. The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock. We do not guarantee any success in highly volatile market or otherwise. Stock market investment is subject to market risks which include global and regional risks. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message.

Bitcoin trying to fightback but stiff resistance weakness ahead.Bitcoin trying to fightback but stiff resistance ahead 33031 which was a major support is not a major resistance.

Supports for Bitcoin: 29757, 28616, 26101. If 26101 broken next major support will be only at 19808. (reaching 19808 very likely in the medium term).

Resistances for Bitcoin: 33031, 34787, 37173 and major resistances will be 39303 and 43086.(reaching 43086 very unlikely)

Bitcoin Big Picture LevelsUPDATE #BTC levels.. A break of 35.9k opens move to 34.5k looks like it could send it much lower toward a target near 26k-30k.

#Bitcoin support levels: 36,300 / 34,500 / 33,000 / 29,000 / 26,300

Bitcoin resistance levels: 38,800 / 39,250 / 40,000-40,200 / 45,800 / 50,000

The facts are: Bitcoin isn’t a good hedge against inflation when Fed is tightening. It’s not really leading into a favorable seasonality trend for end of Feb into March. Google search trends peaked in 2021.

USD strength = BTC sells off (most likely) / The mechanics of a credit unwind are essentially a short squeeze on the deflating (appreciating) fiat currency. What is the main denomination of Bitcoin? = USD