Interesting Bitcoin Cycle Volume Data since 2011 - Change ahead?

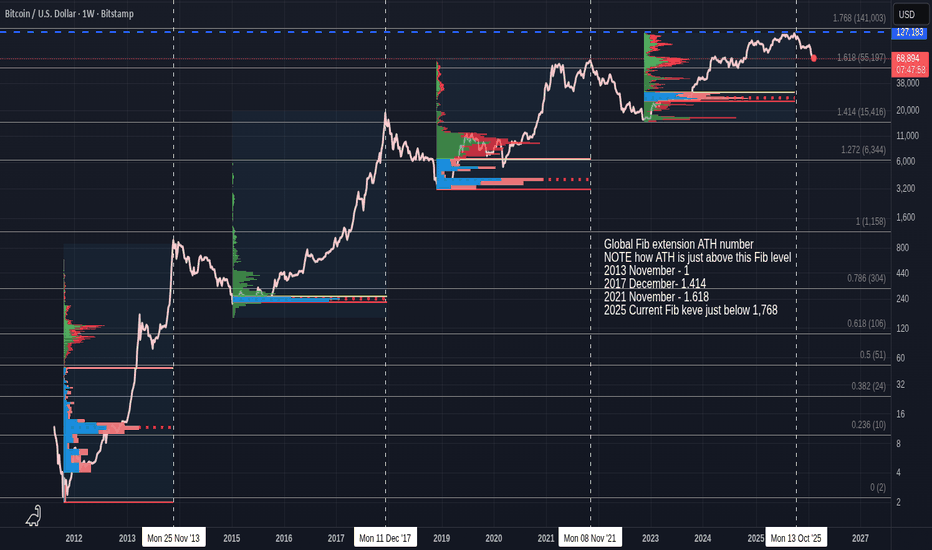

The Main Chart is using Fixed Range Volume Profiles.

These are based on the Low from the previous High, till the Next ATH, showing us the Volume profile for Each "Cycle"

OR, Where were people most interested in Buying Bitcoin in a cycle.

As we Look at each cycle Closer. you will also be seeing the Fixed VWAP.

Volume-Weighted Average Price (VWAP) is a technical analysis indicator that calculates the average price a security has traded at throughout the day, weighted by trading volume. It provides a more accurate representation of true market activity than simple averages because it gives greater importance to prices at which larger volumes were traded.

I will start these Zooomed in charts from the 2015 cycle but it is interesting to see how the Volume was from the 2011 low. The was A Bitcoin for $2 !

You will see 2 Horizontal lines , Yellow and Red, This is the VALUE AREA Range....High ( Yellow ) and LOW ( Red )

This Vakue Area shows you were 70% of the trading took place in the Given Range selected ( Low to ATH ).

Value area in 2011 -> 2013 = 2 - 47 usd

Note how Tall this Range is in the chart and how it is mostly traded Low and then traders waited till the ATH was reached.

These people were probably the creators of Bitcoin, Friends and interested parties that were offered a cheap gamble on something that May be "Big value" one day.

I bought my first Bitcoins at $33 and Lost the address,,,,,,,,,,,,,,,,NO COMMENT ( I had seen a TV program talking about it and so spent £1000 at Mt Gox, thinking I could be Rich one day)

2015 to 2017 Profile

See the 2 Horizontal yellow lines....~This is the Value Area. ( I forgot to change lower line to Red)

See how much smaller this is compared to previous.

This shows that people KNEW where the Bottom was, When to Buy and then Wait.

The Value area this time was 2015 -> 2017 = 225 - 255

a $30 range !!!!

We can see a vastly reduced Volume of trading as Price rose.....Again, Showing people understanding what to do and WAITING>

Another thing to see here is those VWAP lines,,,the Yellow and Red

The Yellow is the VWAP and the others are Multiples of that....

I'll not go into details here but Note how that VWAP (yellow ) line progresses and PA hit it at the Bottom and marked the beginning of the Next Cycle.

2019 to 2021 Profile

Again, see the 2 Horizontal yellow lines, the Value Area.

2019 -> 2021 = 3419 - 6344 usd , this time, a $3000 usd range

See how Most of the trading was done AT THE BOTTOM, where that VWAP met the PA line.

See how the VMAP line Rose, with PA above it. It is generally considered bullish when PA is above VMAP.

We did see PA drop below the VWAP line in Late 2022 and this was certainly triggered by the FTX Scam coming to light.

This scared traders and we now see more and more Professional traders entering the Bitcoin world. But as we can see on the next Profile, the FTX problems Scared traders.

2023 - 2025 profile

See how much higher the Value Area is this time ? People did trade the Bottom, the Risk was high after the previous year of Companies collapsing etc.

The Value are this time was 24812 - 31093 usd. The Low was around 15K !

People were nervous, waited and entered slowly.

BUT what makes this So Very different is looking at the amount of trading Higher up. Confidence returned when the USA decided to NOT demonise Bitcoin

This is the ETF Arrival.........The Corporate arrival and maybe the Change of cycle dynamics.

And Look were that VWAP line is NOW......PA has bounced off it already............Was that the Bottom ?

But is this the End of one Cycle and the start of another ?

I am not sure yet.

For a start, PA usualy reaches ATH by reaching above the upper band of the VWAP ( 2nd Red line)

We have not done that yet.

What is also interesting to see is how the ATH's are All Just above the Next Fib Extension , except for the current ATH, Showing that, Maybe, this cycle is NOT over yet.

Global Fib extension ATH number

NOTE how ATH is just above this Fib level

2013 November - 1

2017 December- 1.414

2021 November - 1.618

2025 Current Fib keve just below 1,768 - Are we going to see a push over that line before Real Cycle Close?

Or have we entered a Super cycle ?

So, we do seem to have a change in the making............

Early reach down to VWAP line, so far, not even a -50% drop from ATH compared to the usual -80%

Not reaching above the next Fib extension

High trading Volume late in cycle

PA Not reaching above the 2nd line high on VWAP

And so much more.

Interesting days.............................

For me, We have reached A Bottom, Not THE Bottom and I am not to sure we will ever see a real Bottom agaain...We WILL see LOWS.....

But I think Cycle dynamics have changed and this is discussed in charts I have posted about the Fibonacci Arc that has rejected every ATH

Time Will tell

Bitcointechnicalanalysis

Analytics: market outlook and forecastsWHAT HAPPENED?

Last week, bitcoin experienced a gradual decline. We were trading in conditions of reduced volumes and volatility. On Friday, just a few dollars before the buyer's zone, bitcoin formed a break in the local trend on the hourly timeframe. Then, without volume support, it grew by 8% over the weekend.

At the moment, sales have resumed, but the market picture looks quite interesting. We see a pronounced sales imbalance across both clusters and deltas. At the same time, there is no noticeable development of the movement against the background of such activity.

WHAT WILL HAPPEN: OR NOT?

In the short term, we maintain the priority for the buyer and expect an attempt to develop an upward movement towards the nearest sales area.

We’re considering two main scenarios:

• false breakdown of the $68,000 level;

• consolidation above the $69,400 mark, followed by a retest of the specified level.

Next, we’ll monitor the development of events. At the same time, even if the sales zone of $72,500-$75,200 is reached, the current sideways trend may continue.

An alternative scenario is a full-fledged breakdown of the $68,000 level. In this case, we expect a decline to the support zone of $65,000-$63,000, and we consider the range of $68,000-$69,400 as a single resistance zone.

Buy zones:

$65,000–$63,000 (maximum volumes)

$72,200–$56,000 (daily buy zone)

Sell zones:

$72,500–$75,200 (selling pressure)

$77,800–$79,200 (accumulated volumes)

$82,000–$85,500 (volume anomalies)

$87,600–$90,500 (accumulated volumes)

IMPORTANT DATES

Macroeconomic developments this week:

• Tuesday, February 17, 7:00 (UTC) — German Consumer Price Index for January is published;

• Wednesday, February 18, 7:00 (UTC) — publication of the UK Consumer Price Index for January;

• Wednesday, February 18, 19:00 (UTC) — publication of the US FOMC minutes;

• Thursday, February 19, 13:30 (UTC) — publication of the US manufacturing activity index for February from the Philadelphia Federal Reserve, as well as the number of initial applications for unemployment benefits in the United States;

• Friday, February 20, 13:30 (UTC) — publication of the basic price index of US personal consumption expenditures for December, compared with last month and January 2025, as well as the publication of US GDP for the fourth quarter;

• Friday, February 20, 14:45 (UTC) — the publication of the business activity index (PMI) in the manufacturing and services sectors of the United States for February;

• Friday, February 20, 15:00 (UTC) — publication of data on new home sales in the United States for December.

*This post is not financial recommendation. Make decisions based on your own experience.

How to Watch a BITCOIN BEAR and Bottom watching. :-) ...........

There are so many tools to use when trying to identify Bitcoin Bear signals and markers.

But it is actually not really that complicated.

All you need are 2 SMA's and the RSI

Lets Get in

On the chart above...

21 SMA - Orange

50 SMA - Red

On a monthly chart, Above, When that 21 SMA drops below PA, THAT is the Confirmation of a Bear.

On a Weekly chart. It is the 50 SMA that Gives the First signal...When that drops below PA, start looking at the monthly chart.

The Boxes on the chart are started off a Weekly chart.

On a Month Chart, Note how that 50 SMA acts as support, usually. This is the "Bottom Zone Marker"

It will be the 200 SMA on a Weeklu chart.

So, there we are,,,,simple identifiers to see the Start and the possible Low off a Bear market.

What about the End ?

That is next to impossible..................However, the RSI can show us historical data that we should not ignore.

Before we look at the RSI, Go back and look at the Main chart. Take Note of the Vertical Dashed lines, Off ATH and then the Vertical Dotted lines.

The Monthly RSI is invaluable.

The Vertical Dotted lines are the LOW point of the RSI draw down.

And as we can see, this does NOT always indicate the End of the Bear But the turning point of the RSI.

Something very interesting is how the Day count from ATH to the RSI low point was the same after 2017 and 2021.

If we use that same day number now, Does that mean we can expect tp wait till November this year ?

NO - Maybe, Impossible to say

But what Is very interesting now..is that Horizontal line that RSI has bounced off previously.

We have reached that point SO FAST.

Will that momentum continue and fall below that line , as in 2022 ?

Again, impossible to say but this needs to be watched.

So, Quick look back at main chart

Look at those Dotted lines again, the Low point of the RSI.

While Not the End of the Bear, officially, There Was a Range or a Rise in Price from these points...The BOTTOM was identified.

And we could be there NOW>.....

Personalty, I think a Range is more likely for a while but we may see a push higher for the Spring Push but statisticaly, that may not happen till Mid March / April

On a monthly Candle Close Color count.,

Feb has 10 Green to 4 Red - going to be hard to get a Green this time.

March has 6 Green to 8 Red

April has 9 Green to 5 Red

So, all we can do is wait.....

For now, I am assuming we are on or near the Bottom unless something Stupid happens in the eworld...

So, I buy Sats, amd Wait......................Cautiously

Bitcoin in Bottom Range with Ability to move but just waiting

This really is just a waiting game right now.

We may wait for months before a REAL push higher

Initially, we wait for the USA Inflation data tomorrow and it is worth noting there is no FOMC meeting in Feb, so the next Rates decision will be on March 17 - 18.

So, while Bitcoin is rarely directly effected by Rates (See Circle in chart below ), The effect of Rates is more on the Companies in the Bitcoin world, like the ones that collapsed in 2022.

However, Inflation data DOES make an impact

So, where is Bitcoin right now ?

PA has Dropped since ATH and currently in the C wave of an ABC correction, that has the potental to go to around 50K. This followed the 12345 Elliot waves up to ATH.

Perfect PA

On the main chart

we see PA bounced off the Value Area Low of the VRVP ( Red Dash)

The White Dotted line is the Area of the 2021 ATH.. PA Should not Drop Much below this area normaly..

The Point of Control ( POC Red Dotted line ) is an aera of High trading volume. Resistance as we rise.

The Orange Dash line at the top is the Value Area High of Trading Volume and is also the current ATH line.

And the Red Line that has been falling with PA is the 50 Daily SMA - THIS needs to be crossed and Held again to be Truly Bullish, at a currentl price line around 87K

So, We ARE in the final stage of correction but we simply do not know how Deep .

However, we can look at other data and get an idea.

Bitcoin IS Oversold. The Daily MACD is just one that shows us how deeply Over Sold.

MACD looks like this on many Timeframes.....But we should remember that MACD being this Low does NOT guarantee a Rise but it can certainly point towards Ranging. Notice the Histogram bars getting smaller and White, showing increased potential for moves higher.

The RSI is also Down Low

Simply showing Room to move higher under the right circumstances.

This environment is created by Fear..People Selling and Capitulating......

We can see this below....

The SOPR ( Spent Output Profit Loss ) Shows us the Volume of Coins sold at a profit or Loss.....and we see a Lot of people selling at a Loss, for fear of Price continuing to Drop.

Bitcoin is being Sold a Lot...It is Over Sold.

This drops price, creates Fear and uncertainty. PERFECT Buying opportunity

These coins are being Bought back by others ..Cheap Bitcoin....

I'll End on this Chart

The weekly Version

Green SMA - 9

Red SMA - 50

Blue DMS - 100

Yellow SMA - 200

PA fell through the 9, 50 amd 100 in a simialr way to in 2021 but in a quicker time period.

That was most likely due to how PA had "ranged" for a year before a little push to ATH..Cooler Calmer PA.

And I see the same now....

PA is currently above the 200, having bounced off it. PA fell directly throuh it in 2021.

And I can see PA ranging inbetwen that 1.768 Fib Extension and the Green Bar for the remainder of this Bear Run...A similar range to what we saw in 2024....as mentioned previously.

The Daily

And what are we waiting For ?

For PA to break over and Hold that 9 SMA and on Friday, we may see PA do that if the inflation figures are acceptable.

If not, We may hit the 200 Weekly SMA again

As we have seen, we have FEAR in the Market and Clever Money is Buying the Sold Coins.

PA is over Sold and has abi;ity to push higher, even if it is just to remain in Range.

PA is near the Bottom on so many Chart lines and this includes the Ascending channel.

PA has NEVER fallen out of that channel and Currently, the base is around 60K

Enjoy, we Have past most of the painful stages.

We just waiting,,,,,,,,,,,,,,,,,,,,,

Bitcoin Long Term future. Cycle and Projections Just changed.

One of the things I do is to project into the future as much as possible, to spot continuing Trends and patterns.

By Projecting, we are able to ascertain if a trend is continuing or not, as happened with the 2013 to 2017 Fractal that I placed on Current BTC PA in October 2022

Anyone that followed this with me was able to expect certain moves until Feb 2025, when PA fell off that Fractel. Patterns work until they do not.

We knew then that things had changed.

The main chart today, is another Chart I have been using and posting for a while.

It is one that may seem a bit "out there" but, so far, it is being proved accurate in many ways.

Lets look at the bigger picture.

This is the entire Bitcoin PA

The things to see here are simply the Ascending line of Support that BTC PA has been above since March 2013

And the Blue Arc, that is a part of the Larger Fibonacci Spiral ( dashed Arc ). As you can see, This Arc has rejected EVERY BITCOIN ATH, until now.

The Blue Arc and the spiral appear to seperate and this is due to allowing a Tolerance for Error in my calculations.

On the chart above, we see a little more detail. We also see that it was Very Important for Bitcoin to break ABOVE this spiral or be pushed back under. Should PA remain below this Arc / Spiral, PA has gone past its ATH and will never reach higher.

I think few people realised just how much of a battle took place in 2025.

Bulls managed to push PA Over that spiral, allowing for the potential for a further rise higher.

On the dashed Version, PA even came back down and tested it as support.....and bounced.

But PA got exhausted doing so and so, as we see, PA got rejected.

But what is Most important to see here is how we have also dropped Below that LongTerm line of support.

That is now HUGE resistance.

Should PA remain below this line, This could create a new cycle type and pattern.

This is actualy BULLISH. We are now Below an ever rising line of Strong resistance....But it will always RISE> It is NOT an Arc like we have been under since 2013, that rose higher but was always going to start dropping at some point.

This will also prevent parabolic rises that led for 80% drops after ATH.

That is all OK

The Problem we have right now is that PA is also below Both Projections of that ARC, Spiral.

BITCOIN has a huge battle ahead.

It is Over Sold on longer time frames, giving it some strength

Currently, to rise over the dashed Arc, This could happen soon

Then it will face that Rising line of Resistance..and then, the Blue Arc.

This sequence will stay the same untill Q4 2026, when the Blue Arc drops below that Line of resistance.

PA often targets intersections of resistance to try and break through....So..This could be one to Watch.

Some projection point towards a Push to a lower High in early 2026, then retrace and a harder push / end of Bear in Q4, so this may have confluence.

And the price range that will show a level of safety ?

Once we pass and hold around 138k -142K usd

And THAT is the beauty of PROJECTONS.....TIME ALWAYS TELLS>...............

BTW, I welcome your comments on this......

Bitcoin Following a previous path but Accelerated and BULLISH

The Beauty of Data on a chart is that it is FACT.

So lets have a look

SMA colors

50 SMA - RED

100 SMA - Blue

128 SMA - Green

200 SMA - Yellow

Bitcoin followed a 2013 to 2017 Fractel for most of the recovery from the Deep Bear, from Jan 2023.

But in February 2025, PA fell off this Path, and so avoided a Parabolic rise and a Blow off Top.

We may have entered another Fractel but I am waiting for confirmation before talking about it.

But what IS happening is a very srrong similarity to the post Novemebr 2021 ATH>

Lets have a look

The 2021 Bear was a Harsh education of world finances for many and the Deep Bear Market Bitcoin experienced was painful. But even this did not Stop the Bulls keeping their hands in as best as possible...as a result, we saw some recoveries attemoted while other Companies and organisations collapsed.

So, we saw PA falling below 50 SMA , 56 days after ATH

PA fell below the 100 SMA 119 days later

PA Hit the 200, Normally a Strong line of support, just 42 days after we lost the 100.

PA fell straight through the 200.

And we stayed below the 200 for nealry 10 Months., The longest period Ever

And so, How is this similar to wat is happening now ?

We are having a sharp fall down...and on this occasion, it is happening QUICKER than in 2021.

Lets Look

So, we saw PA falling below 50 SMA , 35 days after ATH

PA fell below the 100 SMA 77 days later

PA Hit the 200, just 7 days after we lost the 100.

On both occasions, we had a short Period of time.

Then a longer period which was approximatly Twice the length of the first time length.

Follwed by a shorter period

The Difference this time is the 200 Held as support.

In my mind, what we are seeing now, is what should have happened , post 2021 ATH, with out the TradFi pressures trying to Crash Bitcoin.

And as I have stated in another post last week, I am confident that we are around the baseline of the Drop.

Reasons being, we are on the 200 weekly SMA

We are in very close price range to the 2021 ATH line.

PA is over Sold on Most Time Frames.

This is not to say we can go Lower, we certainly can...

But we are certainly in an area for Ranging and I thinnk it is htis that we will do Till we get the inflation Data from the USa this week

Bitcoin reached Lower trend line of long term Ascending Channel

Going to just say this Clean and simple

Lets remind ourselves of the Bigger picture

Bitcoin has used 4 Cups and a Trendline channel since it started. It entered the channel in 2017 and has been in it ever since.

PA just got down to the lower trendline.

That is where PA is right now. There are multioke lines of supprt here, Not all shown.

Previous occasions were PA can to this line.

2022

2020

The Covid Crash did manage to get PA below that line butnot for Long.

2019

It is Highly unlikely that PA will Drop out of this channel....But It could.... We need to remember this

From the 2013 ATH, PA did Drop out. This was BEFORE PA had fully entered channel BUT there is a chance that we could do this again as we see Bitcoin enter a new Series if cycle patterns. ( this is covered in other posts )

For now though, I will carry on watching Bitcoin and hope we remain in channel and so , see that we may have Hit a Bottom Zone.

This will only be confirmed when we have pushed higher and repassed 100K

Why? Because if we get a Big bounce from here, PA has NEBER gpne to a New ATH directly.....We Rose, Dipped, Rose pr Just Ranged.

A quick look at where we are now.

There we are. But under the 2021 ATH line ( dotted )

That line could be strong resistance. I think PA Will cross it and use it as support..If that happens, I get more Bullish...

I think we are as low as we will go..Could Flash down and recover quick..But..........

We maybe here for a while but not months...We could shoot up and get rejected..

Be cautious.............

Bitcoin Deep dives into Support zone - Can it Hold position ?

That Deep Dive was a little surprisingand Quick but Given the speed of events right now, I was Stupid to think PA would hang around on the upper lines of support.

The Bears seem to want to show Strength.

It is now time for the Bulls to Show us they are Here.

PA went right down to the 3 Fib Extension at approx 60K usd.

Do we have support here ?

The 4 hour chart

We can seea Very Clear line of support off the Bottom line as PA touched it and bounced right back up to the Middle line.

It is this line that now needs to be Crossed and held as support.

The 1 hour chart is not one I use very often However, when it comes to Situation like this, It is perfect for showing us the initial stages of recovery....or not...

As we look on the 4 hour chart, we see PA appears to have Halted at the Dashed Middle line.

1 hour chart

The ! hour actualy shows us that PA did get over that middle line but then came back down to test it as support.

At the time of writing, this line is holding....................

Let me show you another 1 hour chaart

This shows us a Close up of PA and 3 SMA's

Orange is 9 SMA

Green is 14 and RED is 50

Se how PA is sitting on the 9.......so long as it remains there....we are able to piush higher.

But do remember, the 1 hour charts are "Noisey" , easy to be mislead....Only use to see initial stages.....No more.

The 4 hour shows us another story]

Here you can see how the 9 SMA actually REJECTED PA.

SO, Do we have support Here ?

Potentially, YES but there is yet to be better confirmation of its ability to Keep PA here for a While.

This

area is a Superb Buying Area BUT remeber, this is only a 50% draw down from ATH.

If We are to have a Traditional Bear, we have anoterh 30% to go......

But we simply do not know if that will happen.....................

Caution..........

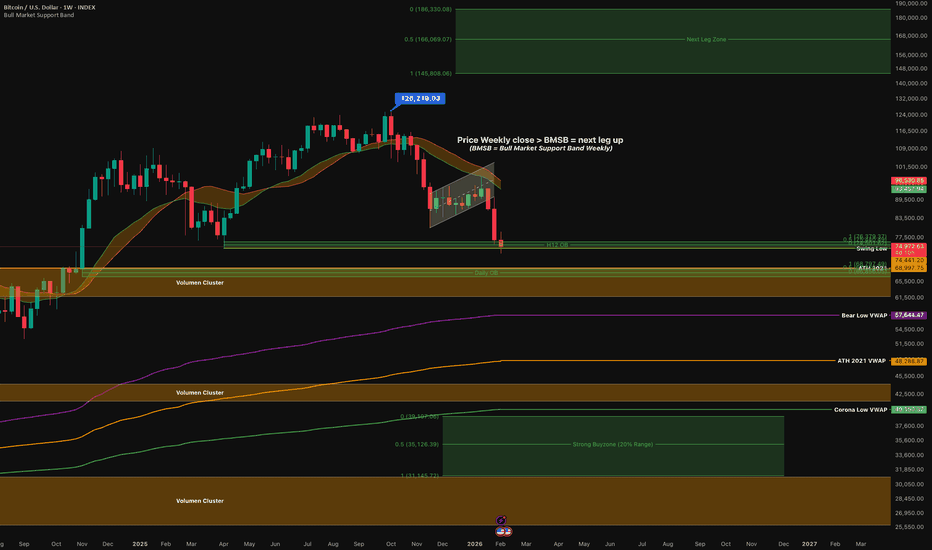

BTC Long-Term Chart – Support Zones & Personal PlaybookThis chart shows my long-term Bitcoin plan and the key support zones I’m watching over the coming weeks and months. It represents my personal playbook, not financial advice.

Not every zone needs to be revisited, but if price does return to these areas, I plan to accumulate spot positions step by step rather than all at once.

The zones are based on higher-timeframe structure, volume clusters, and major moving averages.

My focus is on patience and scaling in, not chasing momentum.

Invalidation for this idea would be a clear structural breakdown on the weekly timeframe.

As always, risk management comes first. This is just how I currently view the market and how I intend to react if price moves into these regions.

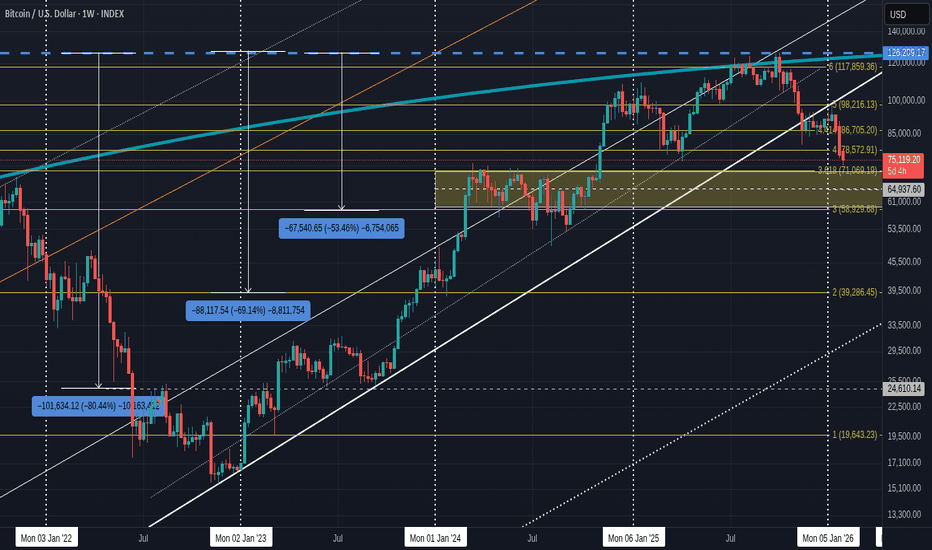

Bitcoin Entering the 2024 Range and this offers Support But.....

Another Set of "Trend lines" that suggest a Cross roads has been reached.

This green Bar is the Range Box that Bitcoin was in in 2024 and the Lower trend line is at an approx price of 59000 usd and is a 53.46% drop from ATH.

We may go lower but I do not think for long.

For me, a more likely area to watch for a turn around is at the dashed Middle line of Box, at a price range around 65000K

This may be the Range zone...and we have to wait and see.....

This is a Zoomed in chart of that 2024 PA range

See the Support / resistance in the upper and Middle lines.

The Lower line is not as strong and we need to hope we do not arrive there.......

Daily Chart

Look at the Fib extension lines.

We ranged along the 4.414 for near on 2 months. We lost that , fell right through the 4 and now have arrived at the 3.618 Fib Extension.

This is a traditional Fib line of support.

It failed................and PA landed on top of the line of support off the top of the 2024 Range box.

To me, this shows us that this Range Box is a serious area of support and, as a consequence, we May remain in this area, slightly above and below for a while....OR NOT>..Impossible to be sure but the way PA stopped at the top....Hmmm...But we are below that 3.618..Maybe Tough.

The 4 hour shows this in more detail.

We are in an area of support

Bitcoin is OverSold on many Time Frames

We just need some confidence to return...THAT may take a little while....

I expect PA to Jump around a bit now..Volatility returns.........

We Watch, We Wait.We Hope..............

Bitcoin Ascending channel And Cups UPDATE, Crossroads in sight

This post is in reference to a post I posted on December 27 and suggested that Bitcoin PA had entered a New Cup after reaching its New ATH.

A Quick reminder of the Bigger Montly Version of the chart above. it was this chart that was posted on Dec 27 2025

This post is a continuation of that. For Details on the original post, I have linked it to this post.

What we are looking at today, is the lower trendline...the line of support that has held PA everytime since 2019, keeping it in channel.

We can see on every Cup since 2017, PA slides down the Cup edge, after ATH, till it reaches the lower trend line, where it bounces higher to some extent.

Because the ATH this last cycle did not even reach the Upper Trendline "The Bear Slide" is shorter and we are getting within reach of that lower trend line already.

Lets look at the weekly chart

Here we can see that the Cup reaches the Lower trendline around 16 Feb.

This is the Earliest it can happen, unless PA falls through the Cup. So, for me, I am now VERY ALERT to the Fact that PA could Bounce soon AND Is Oversold on most TimeFrames.

Before we even reach the lower trendline, we have a dotted line. This is a line of support that Runs through the 2024 Range But is also around the 2021 ATH line.

This should be Strong.

Look back over to the 2021 Cup.

PA Fell through the Cup hit a Simialr line of support, also off the previous ATH, and Ranged. The Fall below was caused by the FTX Scam so not really a PA structure.

On the Daily, we can see more

The Dotted line of support is around the 66300 Area.

At time of writing, we have Just dropped below 71K and so I am getting ready for the possibility of a push higher. This may not be a sustained Push but could easily be a Range across till we hit the Lower trend line in Mid / Late Spring.

This is the BULLISH Idea.

There is a Very Strong potential for a BEARISH continuation also.

And that could take us out of the Channel.

Lets go back to the Monthly chart

Look over to the Left, the 2013 ATH was also in channel, as was this 2025 ATH.

Back in 2014, PA Hit the lower trend line bounced, got rejected and fell out of channel but remained in Cup.

THIS needs to be remembered as the same May happen again.ans Could take PA tp bottom of Cup around Mid 20K !

But I doubt this Very Much.

There are plenty of Ideas and Mettrics that suggest Bitcoin Cycle Dynamics have changed and so the Cycle patterns may change.

Why is that 2013 - 2017 Cup so important ?

Because it was THAT Cup cycle that Put Bitcoin PA in channel for the next 2 Cycles. The Only Time PA left channel was to go to ATH.

So, we are arriving at a Cross roads....

Which way are we going to go ?

I am more Bullish than Bearish Long term. But right now, CAUTION is the name of the Game..........

What ever happens, I am on for the Ride..............................

BTC lost vital support. Where to now? 3 Levels to watch

As Mentioned in posts earlier, the 236 Fib Retrace line was a Vital line of support, that if lost, could show a deeper Bear market is waiting..

And we lost it this afternoon.

We can see how PA fell below that line and is currently bouncing off the Value Area LOW of the VRVP, technically a line of support that may hold, if the Bulls decide to.

A Closer look at the chart above

eThis show us, in Green highlight, the 2024 Range Zone, that I am hoping PA will go no lower than.

We have 3 levels.

Just below where we are now, we have the 3.618 Fib extension line, this is a Cycle Fib set, based on the Start in December 2022.

This Fib line is around the 71K usd line

The Middle line of this Range is around 65K and is a VERY possible bottom line in my books, but we can never be sure.....

And the lower line of support, we find around 3 Cycle Fib extension line at 59K..less likely but possible on a Quick dive down and recovery

I have Buy orders on all 3 lines.

If we zoom out again, here is the original chart ...

See over on the left, the 3 blue boxes, these show you the % level drop from the current ATH to various Levels.

If we do a traditional 80% drop, we will see PA way down , on the top of the original pause in Rise in 2022 at a price around 24600. I find this unlikely But, should large Corporations begin to sell their ETF holdings.......

Next is the 69% Drop we would have if PA fell to the 2 Cycle Fib Extension. This has a price around 39200. What a Buying opportunity that would be..........

My expected absolute low around 59K, we find sitting on the Cycle 3 Fib extension. Which as a Note, was just below the 2021 ~ATH line.

We are currently just above the 2024 Range Box and , as mentioned Earlier, I am NOT wasting this opportunity to buy, even if that price carries on dropping.

This is where we "Scale In"

Do NOT use all your money in one go. use 10% of it, see where price goes, Use another 10% at the next opportunity.....and so on..............

The same pribciple is used to "Scale put" when you want to sell.

Keep Calm and BUY BITCOIN

Bitcoin Monthly Candle Color Closes since 2014 I have had to rewrite this post this morning after the Bears closed in yesterday and destroyed any hope of a Green January close.

January closed RED and Bear Market confirmed.

I think we should consider the only other occasions where we had 4 or more Red months in a Row.

Only 3 times and each was in a deep Bear, after an ATH, early in Bitcoin history.

These are marked with Arrows and all are different from each other and this one is also a unique set. however, if we look at some other Charts, we can see that we maybe repeating the post 2021 Nov ATH. That was 3 Red and then a Green and we did nealry get this.

As a result, I am still watching the 236 cycle Fib Retrace line. which PA bounced off last night.

CHART

We hit that line in a similar time period in eaely 2022. On that Occasion we fell right through it and on this occasion, the bounce has signalled a potential Green Feb, if the Bulls are ready to step in.

But as we fully understand, this bounce may not hold...we will have to wait and see.

We have a high probability of a Green Feb. Previously, 10 Green to 4 Red Monthly closes.

Of the previous 3 occasions of 4 Red Monthly closes in a Row, 2 had a Green Candle as the 5th.

And in the post Nov 2021 ATH draw down, Feb 2022 also closed Green

The Febuary Candle will let us know nore.

Should Febuary close Green

We would then , if we Follow previous cycles and patterns, have a High probability of a RED March, But also remember that March 2022 was also Green.

And looking back at previous Multi Red candles and then a Green, the Green is a Pause in the Down trend.

Should Febuary Close RED

EVERY RED Feb close has been followed by a RED March.

Simple as that.

The ONLY occasion we had a long run of Red candles was in Q3 and Q4 of 2018 and Jan 2019. the 3rd Arrow.

I think the only way we can repaet that is to see Stratagy or similar Large Corporations begin to Capitulate their holdings or to see a similar Collapse in Finance as we saw in 2008....and this IS possible.

So, we wait to see what Frbuary brings....I am Buying the Dip with the understanding we may go lower but I doubt is will be a lot lowerl

Foe me, we are past the Half way line of the Drop now....Bearer the Floor than the last ATH.

But we are in uncertain times and CAUTION is upmost priority

Bitcoin Weekly MACD repeating the pre 2023 Push ?

I will just leave this here and let you look and form your own ideas.

For me, this is totaly possible,,,,,,,,,,,,,,,,,,we just waiting for the Daily MACD to Hit LOW and turn

All to play for here......

If GOLD continues to reset, the money HAS to go somewhere....and the option is surely BITCOIN....Over Sold. everywhere- Except on the Daily..........

Just waiting.....

Very Quick $ hour BITCOIN Update

So, Looks like Bitcoin is heading towards that intersection of 3 lines of resistance, a point of Least resistance.

And PA is perfectly poised just below , ready to make apush higher if the FED s [eech later today if considered Favourable/

No Change is expected in the Rates.....

We wait till Mr Powell tells us what the Group of private Bankers has decided.

Quick BITCOIM 4 hour Update- suggested Bounce occuring but .....

We Got that Bounce that was suggested yesterday and for me, I think that 4.618 Fib extension is the target.

It will either Act as resistance or be Crossed and retested as support.

Both of these are possible and I have No idea which way this will go but I am slightly Bearish over all.

What I can see is that Bitcoin certainly has the ability in the shorter term

The 4 hour MACD

MACD down Low and turning with plenty of room to move higher.

Do remember, on the longer daily time Frame, MACD is still Falling Bearish and , so, I see this as a bounce that is unlikley to reach a higher high

4 Hour RSI

RSI bumping into its own MA and we wait to see if it crosses or not. But certainly has Room to move higher but is the same situation as the Daily MACD, Longer Term Bearish

So, Lets see how BTC PA Reacts to the 4.618. Resistance or will PA climb over and FLip it back to support.

We Wait

Bitcoin 4 hour - -levels of support exist just below,

Longs Git ruined again - Will they Ever Learn ?

So, Now we see PA using the 4.618 Fib Extension as support. AND we fell back under the Fib Circle. PA Back in Squeeze with the Apex towards the end of Month

If the 4.618 Fails to hold, then we could see 87500 area again..That Price area h is a Safe zone to many extents

That 4k618 is strong...we have to wait and see if it holds.

4 Hour RSI is Oversold now

But the Daly has further to fall long term.

The 4 hour MACD is approaching OverSold....We could see a bounce

But the Daily MACD very clearly rejected off rejecting trend line.

THIS MACD chart is my Key to whats happening.

IT IS BEARISH Divergence.

Untill MACD crosses that descending trendline, we remain Bearish over all

Short term gains maybe had if you day trade......

Bitcoin back in the fight and under pressure. MAJOR resistance

While we all remain ever so Bullish and LONGS increase, we REALLY need to remember just where Bitcoin PA is Right now.

In an area that could very easily turn into a Bear Trap, as it did in 2021

Why could this happen?

WE ARE UNDER MAJOR RESISTANCE.

Why ?

Looking at the chart justt above, we can see that rising Trend line..This is NOT a Weak line.

Here is the same chart zoomed out.

To Cross this line and remain above it Will be just the First Step towards a new ATH.

The MAJOR Wall is as we get near that 100K -> 106K line.

Remember this Chart ?

The Blue Arc of Resistance. The One thing that has rejected EVERY Bitcoin ATH since Bitcoin started.

This line MUST be crossed but is Obviously HUGELY STRONG

A Closer View of where we are now on this chart.

So, that current green candle we know is just under that Cycle line of resistance mentioned earlier.

The next step is that 50 SMA ( Red, Just around where we see that Blue Arc.

AND we see PA in a Squeeze.

We have come back up to this and approach a new APEX around end of March 2026.

PA always reacts before the APEX>

We now have PA snadwiched between the 50 SMA and the 100 SMA ( Blue )

That 100 is also around that LONGGGGG term line of support

We really do NOT want to loose that support.

But this may happen if we do not break through that Blue Arc.

But we have talk of New beginnings for Bitcoin......

New Cycle patterns appear to be forming

Super Cycles are possible as we see signals that the 4 year cyce pattern maybe ending,,Yet to be proved.

And this could happen with out Major change to long term PA patterns.

This would NOT involve dropping out of the Area PA has been in since 2017

PA can drop as low as 60K before long term Channrl is Lost.

So, here we are, New patterns maybe forming and we will not know for a Long time yet. Proof of change is onlly seen afterwards

Should PA break over that Blue Arc, It MUST be used as support after.

Fasinating Times......Watch that 50 Month SMA closely.

We Break that, Off we go

So, we wait

Quick Bitcoin DAILY Bullish moves continue, now testing support

Strong moves by Bitcoin so far this week and potential for more.

PA is taking a breather ,as it needs to and will come back down and test that Dotted line as support. This same Trend line was used in September 2024 to push Bitcoin up to New Highs.

This 4 hour chart shows us more detail

Would be SO VERY Bullish for PA to come back here and test that line as support and hold it.....

Can it do that?

My opinion is YES but we do have some very strong resistance over head, in many forms.

It maybe Good if PA sits on top of this line for a while....And it may do so, as it cools off.

The Daily RSI

RSI not over bought yet but in an area that shows RSI could do with Cooling and it has turned down slightly...It may continue to do so.

The Daily MACD

This is one I am watching CLOSE>

See that descending line that has rejected MACD twice already.

It may do that again....and as we get nearer the end of the month, I am wondering which way this will go

The Month candle is currently Green and is statistically, likely to remain that way, However, this could change very easily should we loose this line and PA looses the Bulish sentiment.

So, remain Alert and have a plan.

Quick Bitcoin Update- 4 hour chart shows PA is STUCK

Bulls once again rejected off that Long Term line

Maybe the Bulls allowed this till we get the USa inflation figures later today

The 4 hour MACD shows plenty of room to move higher

Same story on the 4 hour RSI

And despite a this short term Bullish possibilities, I do remind you, we may only be repeating what happened in 2021 after the Nov ATH, where we Went down, had a push higher, just before dropping lower.

That may not happen again, we simply do not know BUT it is a Very good idea to be ready for all occasions

This weekly Bitcoin chart is a simple version of that

There are so many more similarities... but here, see how the 50 SMA ( RED) began turning down after the ATH as PA crossed it.....The same has happened again.

But, this time, PA is nearer the 100 SMA ( BLUE ) and using t as support.

So, we still wait for PA to move higher, just be ready incase it does not remain higher......

Quick Bitcoin Daily & 4 Hour- remains Bullish with Wall overhead

The Daily chart shows us how PA has used the Fib Circles and how we are heading towards another one in the near Future that may, as mentioned yesterday, push PA into a Squeeze with the an apex around end of month...The 4.618 Fib Extension is the horizontal line, that has been acting as support.

PA Always reacts before the Apex and this move may have begun.

The 4 hour shows more

On this chart we see that the Fib circle will be met around the 91K - 93K mark

This 4 hour chart shows us how PA is also fighting this Trend line.

That Blue line has been long term support and we are up against it right now, trying to turn it back into support. THIS is the Wall we need to Get over.

As you can see, that blue line has been Support a LONG time and the fact we lost it is a little worrying.

We need to get this Back....

Important times ahead.

Is Bitcoin Repeating the 2021 Post ATH sequence ? - Possibly

I first posted this chart last year, highlighting how PA has some similarities with the 2021 ATH Runs.

A Quick Recap, Both 2021 and now have an early ATH, a retreat, a push higher to a New ATH and then a deeper Dive.

Both had Divergences in play

Both the 2021 and 2025 ATH's are within the 0 to 0.236 Fib retracement Fib lines.

From the First ATH to the Low of the retreat, Both went to the 236 Fib line before pushing to a new ATH

We do have to wait and see if this does play out again but what is interesting is that the ATH to next high in 2021 / 2022 was 147 days

Should this happen again, that puts us around beginning of March.....which is a Moment of interest on a number of charts, with a price range around 95K - 105K usd

The Crucial point in this PA is IF the 236 Fib lines gets broken or not.

Should this happen, where would we go ?

Impossible to say for sure but we should all remember the pressure and rising interest rates that were applied in the FIAT banking system , that rekt many large influential Companies and the stupidity of FTX.

These things applied negative pressure to Bitcoina nd Crypto, driving the Bear deeper.

Providing this does not happen again, we may stop at the 382 Fib line, around 54K - 57K but that is My assumption and I will have to react if we get there...

For now, I am watching that 236 Fib line around 77K USD as a trigger line.

And the 95K - 105K usd as a Rejection area.

Time will Tell

Quick BITCOIN Daily update - Looking Very Good BULLISH

As was mentioned yeaterday, PA had got through that Blue line of resistance.

It is now testing it repeatably as support.

The 4 hour chart shows this Better

We may remain here till the 4 hour MACD finds Support.

As we can see on the MACD, thismaybe very soon or in a Day or so

If that line does noy hold for the MACD, we can expect MACD to reach for Neutral

The Daily MACD is still around Neutral and rising Bullish

What is VERY interesting is how SOPR has flashed BULLISH also, 2 days after it flashed a warning for the BEARS>

The Orange Diamond......BULLISH

Lets GOOOOOOOOOOO