JENUARY 27 Bitcoin Bybit chart analysisHello

It's a Bitcoin Guide.

If you "follow"

You can receive real-time movement paths and comment notifications on major sections.

If my analysis was helpful,

Please click the booster button at the bottom.

This is a Bitcoin 30-minute chart.

Shortly, there's a Nasdaq indicator release at 12:00 PM.

On the left, with the purple finger,

I've linked the strategy to yesterday's long position entry point, 87.5K.

*Red finger movement path:

One-way long position strategy

1. $87,276 long position entry point / Stop loss if the green support line is broken

2. $88,691.1 long position first target -> Target prices in order from Gap 8 onwards

88.1K in the middle is a useful long position re-entry point.

For those holding long positions yesterday,

I recommend setting a stop loss if the green support line is broken.

Bottom: Light blue support line -> If the first section is broken,

the bottom: $85,238.3 is the final support line.

Up to this point, I ask that you use my analysis for reference only.

I hope you operate safely, with a focus on principled trading and stop-loss orders.

Thank you.

Bitget

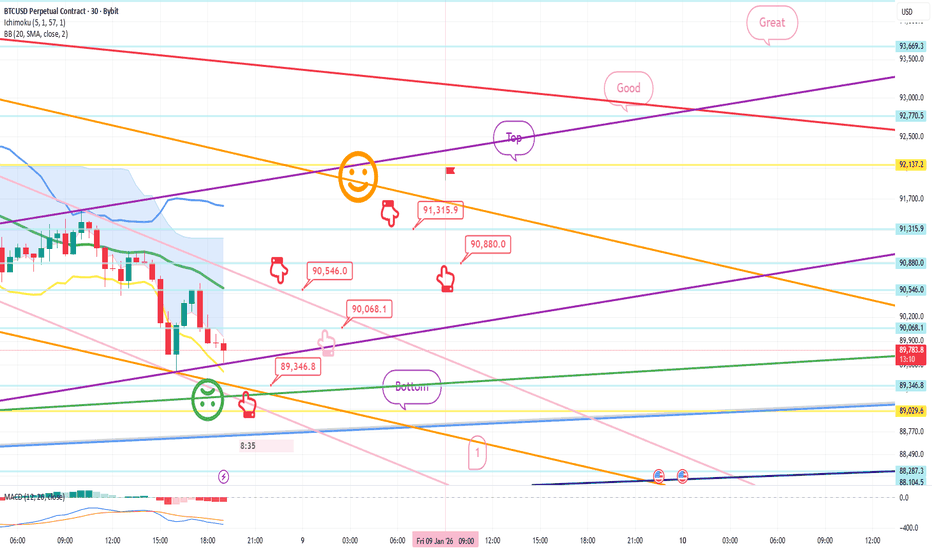

JENUARY 26 Bitcoin Bybit chart analysisHello

It's a Bitcoin Guide.

If you "follow"

You can receive real-time movement paths and comment notifications on major sections.

If my analysis was helpful,

Please click the booster button at the bottom.

This is a Bitcoin 30-minute chart.

There are no Nasdaq indicators released.

*If the red finger moves,

this is a long position strategy.

1. Confirm the first touch of the purple finger at the top

-> Red finger: $87,538.8, long position entry point

/ Stop-loss price if the green support line is broken

2. $89,210.1, long position first target -> Top: second target

If the strategy is successful, 88.6K is the long position re-entry point.

If the top falls immediately without touching the first point,

Long hold at the second point / Stop-loss price if the green support line is broken

From the green support line breakout, the bottom point / sideways market. Below that, the most important support line remains at $85,238.3.

Please note that if this point is broken, a prolonged correction is possible.

Up to this point, I ask that you use my analysis for reference only.

I hope you operate safely, with a focus on principled trading and stop-loss orders.

Thank you.

JENUARY 22 Bitcoin Bybit chart analysisHello

It's a Bitcoin Guide.

If you "follow"

You can receive real-time movement paths and comment notifications on major sections.

If my analysis was helpful,

Please click the booster button at the bottom.

This is a 30-minute Bitcoin chart.

Nasdaq indicators will be released shortly at 10:30 AM and 12:00 PM.

*The blue finger path indicates a short-to-long switching or a long-position waiting strategy. (Two-Way Neutral Strategy)

1. Short position entry point at $90,870.1 above / Stop loss if the orange resistance line is broken.

2. Long position switch at $90,170.2 / Stop loss if the green support line is broken.

3. Long position switch at $92,456 / Stop loss if the red resistance line is broken.

4. Long position switch at $91,612.7 / Stop loss if the green support line is broken.

If the price falls directly without touching the blue finger at the top (90.8K),

Pink finger at the bottom (1st section), $89,335.7.

Long position waiting strategy / Stop loss is the same if the green support line is broken.

If the price falls below that point, it could fall up to two times, so be cautious of Nasdaq fluctuations.

Up to this point, I ask that you use my analysis for reference only.

I hope you operate safely, with a focus on principled trading and stop-loss orders.

Thank you.

JENUARY 21 Bitcoin Bybit chart analysisHello

It's a Bitcoin Guide.

If you "follow"

You can receive real-time movement paths and comment notifications on major sections.

If my analysis was helpful,

Please click the booster button at the bottom.

This is a Bitcoin 30-minute chart.

The Nasdaq has been acting up lately.

As the Nasdaq is undergoing forced coupling,

please pay close attention to its movements.

*Long Position Strategy:

1. Confirm the touch of the purple finger at the top,

and then switch to a long position at $88,784 at the red finger at the bottom.

/ If the purple support line is broken, set a stop loss.

2. $91,612.7 long position initial target -> Top, then Good in that order.

If the strategy is successful, $90,566.3 is the long position re-entry point.

If the upper level falls immediately without touching the first point,

wait for a final long position at point 2. / If the green support line is broken, set a stop loss.

Today's bottom -> $86,977.3

is a major rebound point on the daily Bollinger Band chart.

Also, the orange resistance line at the top is the center line of the 4-hour Bollinger Band chart.

A strong breakout of this area is necessary for a true rebound.

Please use my analysis to this point for reference only.

I hope you operate safely, with a clear focus on principled trading and stop-loss orders.

Thank you.

JENUARY 20 Bitcoin Bybit chart analysisHello

It's a Bitcoin Guide.

If you "follow"

You can receive real-time movement paths and comment notifications on major sections.

If my analysis was helpful,

Please click the booster button at the bottom.

This is a Bitcoin 30-minute chart.

There are no Nasdaq indicators released today.

*Conditional red finger long position strategy.

1. After touching the purple finger once at the top,

$91,069.8 is the entry point for a long position at the bottom.

2. $92,611.2 is the initial target for a long position -> Target prices are Top, Good, and so on.

If the strategy is successful, $91,954 can be used as a re-entry point for a long position.

If the price falls immediately without touching the first purple finger at the top, $90,142.8 is the final long position waiting point at the second section,

and the stop loss is set if the green support line is broken.

If the price falls to section 2,

the possibility of a sideways movement increases, and there is an uptrend line below it. If the Nasdaq falls sharply,

the price remains open at $89,029.6,

and from the bottom, $89,029.6 is where Bitcoin's mid-term pattern is likely to recover.

Please use my analysis to this point for reference only.

I hope you operate safely, with a focus on principled trading and stop-loss orders.

Thank you.

JENUARY 19 Bitcoin Bybit chart analysisHello

It's a Bitcoin Guide.

If you "follow"

You can receive real-time movement paths and comment notifications on major sections.

If my analysis was helpful,

Please click the booster button at the bottom.

Here's a Bitcoin 30-minute chart.

The Nasdaq is closed today.

I developed a strategy centered around the upper Gap 7.

*When the red finger moves,

One-way long position strategy.

1. $92,756.9 is the entry point for a long position. / Stop loss if the green support line is broken.

2. $95,506.9 is the first target price at the top -> Target prices are Good, Great, and so on.

If the strategy is successful, 94.5K is the point where I can re-enter the long position.

If the purple support line holds, a vertical rise is possible.

The first section below is a sideways market.

Below that is the bottom. The gray line is a mid-term uptrend line.

So, if the price holds at section 1 today, it's good for a long position.

Since the Nasdaq is closed,

Bitcoin also seems likely to move sideways.

As per the rule, I followed the trend-following strategy.

Up to this point, I ask that you use my analysis for reference only.

I hope you operate safely, with a focus on principled trading and stop-loss orders.

Thank you.

JENUARY 16 Bitcoin Bybit chart analysisHello

It's a Bitcoin Guide.

If you "follow"

You can receive real-time movement paths and comment notifications on major sections.

If my analysis was helpful,

Please click the booster button at the bottom.

This is Bitcoin's 30-minute chart.

There are no separate indicators released today.

Currently, the 6-hour MACD is forming a dead cross.

I've kept it as simple as possible.

*Long position strategy before and after the purple finger touches the top line

1. After the purple finger touches the first line (autonomous short)

-> Red finger: $95,235.6, long position entry point

/ Stop-loss price if the purple support line is broken

2. $97,512.1, long position first target

-> Target price from the top to 104.7K, sequentially over the weekend

If the top fails to touch the first line and immediately falls,

final hold on the long position at the second line (No.2) / Stop-loss price if the purple support line is broken

From the purple support line break,

Bottom -> Open to $93,555.6. If it falls to this level, the medium-term pattern will be broken again, so it may take a long time to rise.

*The price must not move sideways until the weekend,

and must not fall to the bottom.

It will hit 104.7K strongly and may see new highs starting next week.

Please use my analysis to this point for reference only.

I hope you operate safely, with principled trading and stop-loss orders essential.

Thank you.

JENUARY 15 Bitcoin Bybit chart analysisHello

It's a Bitcoin Guide.

If you "follow"

You can receive real-time movement paths and comment notifications on major sections.

If my analysis was helpful,

Please click the booster button at the bottom.

This is Bitcoin's 30-minute chart.

The Nasdaq indicators will be released shortly at 10:30 AM.

*Before and after the purple finger touches the top,

short->long switching or a long position waiting strategy is used.

(Long Position Strategy)

1. After touching $97,512.1 -> Light blue finger: Switch to a long position at $96,981.9.

/ Stop-loss price if the purple support line is broken.

If the price falls to the first section below, it is an upward sideways market.

2. $99,611 long position first target -> Target prices are Good and Great in that order.

If the purple finger is not touched at the top,

the final long waiting strategy is the second section below.

Stop-loss price is set if the green support line is broken.

If it falls below that level,

Bottom -> Please be careful, as it could drop as low as $93,157.6.

Up to this point,

please use my analysis for reference only.

Please operate safely, adhering to principled trading and stop-loss orders.

Thank you.

JENUARY 14 Bitcoin Bybit chart analysisHello

It's a Bitcoin Guide.

If you "follow"

You can receive real-time movement paths and comment notifications on major sections.

If my analysis was helpful,

Please click the booster button at the bottom.

This is Bitcoin's 30-minute chart.

The Nasdaq indicators will be released shortly at 10:30 AM and 12:00 PM.

*If the red finger moves, this is a conditional long position strategy.

1. After touching the first section of the purple finger at the top (autonomous shorting).

Switch to a long position at $94,634.9 (red finger at the bottom).

/If the green support line is broken, set a stop loss.

2. Long position: $97,733.7 (first target) -> Target prices are set at Top, then Good, in that order.

If the price falls immediately without touching the first section at the top, then set a final long position at Section 2 (possibility of a sideways movement).

If the green support line is broken, the stop loss remains the same.

Currently, the Nasdaq is trending.

Even if the price moves sideways, the strategy appears likely to succeed.

Below the second section,

Bottom -> A drop of up to $92,296.8 is possible.

If the price maintains the blue support line today,

it would be a good option for a long position.

Please note that my analysis is for reference only.

Please use it safely, with a principled trading strategy and stop-loss orders.

Thank you.

#BTCUSDT #12h (Bitget) Descending trendline breakout [LONG]Bitcoin looks ready for short-term recovery after regaining 100EMA support and pulling back to it.

⚡️⚡️ #BTC/USDT ⚡️⚡️

Exchanges: Bitget Futures

Signal Type: Regular (Long)

Leverage: Isolated (8.0X)

Amount: 4.7%

Current Price:

92299.9

Entry Zone:

92024.8 - 90186.8

Take-Profit Targets:

1) 96927.7

2) 101312.3

3) 105696.9

Stop Targets:

1) 86234.0

Published By: @Zblaba

CRYPTOCAP:BTC BITGET:BTCUSDT.P #12h #Bitcoin #PoW bitcoin.org

Risk/Reward= 1:1.2 | 1:2.1 | 1:3.0

Expected Profit= +51.1% | +89.6% | +128.1%

Possible Loss= -42.8%

Estimated Duration= 3-4 weeks

JENUARY 8 Bitcoin Bybit chart analysisHello

It's a Bitcoin Guide.

If you "follow"

You can receive real-time movement paths and comment notifications on major sections.

If my analysis was helpful,

Please click the booster button at the bottom.

This is Bitcoin's 30-minute chart.

The Nasdaq indicator will be released shortly at 10:30 AM.

*When the red finger moves,

this is a one-way long position strategy.

1. $89,346.8 is the entry point for a long position.

Stop-loss price is set when the green support line is broken.

(It must be touched before 9 PM,

to complete the 6+12 pattern and trigger an uptrend.)

2. I've marked the wave path with the finger in the middle.

The short-term target price is $90,546 -> $91,516.9.

After re-entering the long position at $90,880,

the target price is in order from Top -> Good -> Great.

If it touches the bottom today,

the mid-term pattern will be broken again,

creating the possibility of further declines. Please be careful.

The bottom section is connected to the uptrend line, so it's best to maintain a long position.

The bottom section is open up to section 1.

Please note that my analysis up to this point is for reference only.

I hope you operate safely, with a clear focus on principled trading and stop-loss orders.

Thank you.

JENUARY 7 Bitcoin Bybit chart analysisHello

It's a Bitcoin Guide.

If you "follow"

You can receive real-time movement paths and comment notifications on major sections.

If my analysis was helpful,

Please click the booster button at the bottom.

This is Bitcoin's 30-minute chart.

There will be two Nasdaq indicator releases at 12:00 PM.

*If the light blue finger moves in a two-way direction, it indicates a short-to-long switching or long-wait strategy.

1. $92,770.5 is the entry point for a short position at the top. Stop loss is set when the pink resistance line is broken.

2. $91,617.2 is the switch point for a long position. Stop loss is set when the green support line is broken.

3. $93,669.3 is the first target for a long position. Target prices are Good and Great in that order.

If the price immediately declines without touching the short entry point at the top, wait for a long position at the first zone.

The stop loss is the same when the green support line is broken.

If the first section breaks,

from Gap 7 at the bottom, the price remains open up to Section 2,

and this section marks the recovery of the medium-term pattern.

Since the daily and weekly candlestick lows have been broken,

there is a risk of further decline,

but if the price maintains the second section, there should be no major issues within the long-term uptrend.

Please note that my analysis is for reference only.

I hope you operate safely, with a clear focus on principled trading and stop-loss orders.

Thank you.

JENUARY 6 Bitcoin Bybit chart analysisHello

It's a Bitcoin Guide.

If you "follow"

You can receive real-time movement paths and comment notifications on major sections.

If my analysis was helpful,

Please click the booster button at the bottom.

This is the Bitcoin 30-minute chart.

There are no Nasdaq indicators released today.

With the MACD dead cross in progress on the 4-hour chart,

the current position is divided into upside and downside.

Note the pink resistance line and purple support line at the top.

In this situation,

I boldly developed a strategy.

In the lower left corner, the purple finger connects the strategy to the long position entry point, $92,527.5, which was entered yesterday, January 5th.

*If the red finger moves,

I'm following the chase buying strategy.

1. Chase buying at $93,744.7 / Stop loss if the green support line is broken.

2. Long position 1st target price at $96,366.3 -> Good, 2nd target price.

From the current position, if 1 -> If the orange resistance line is broken first,

or the purple parallel line is maintained without breaking away,

there is a possibility of a vertical uptrend.

(Since the second section at the bottom is a sideways market, I intentionally set a generous stop-loss level.)

Conversely, if the price fails to touch the purple finger at the first section above the current level, there's a possibility of a decline to the bottom.

The bottom is the final long position re-entry and waiting area.

Below that, the third section is open, so please be careful.

Please use my analysis to this point for reference only.

I hope you operate safely, adhering to principled trading and stop-loss levels.

Thank you.

JENUARY 5 Bitcoin Bybit chart analysisHello

It's a Bitcoin Guide.

If you "follow"

You can receive real-time movement paths and comment notifications on major sections.

If my analysis was helpful,

Please click the booster button at the bottom.

This is a Bitcoin 30-minute chart.

There will be a Nasdaq indicator release at 12:00 PM shortly.

*If the red finger moves,

this is a conditional long position strategy.

1. After touching the first purple finger at the top,

switch to a long position at $92,627.5 / stop-loss if the green support line is broken.

2. At the top, $94,642.8 is the first target price at the top -> Good. Second target price.

(If the Good level is reached, there is a high possibility of a short-term rise to 104.7K.)

Also, if the first target price at the top is touched,

a vertical rise may occur immediately.

If it fails to touch the first target and immediately falls,

wait for a final long position at the second target price at $92,210.9. (If the green support line is broken, the stop-loss price remains the same.)

I've also marked a bottom level of $91,462.8.

If the price falls below this level, the weekly and daily candlestick lows will be broken, so it may take time for the uptrend to resume.

It would be advantageous for a long position to hold until the light blue support line is reached, right?

Please use my analysis as a reference only.

I hope you operate safely, following the rules and maintaining a stop-loss price.

Thank you.

JENUARY 2 Bitcoin Bybit chart analysisHello

It's a Bitcoin Guide.

If you "follow"

You can receive real-time movement paths and comment notifications on major sections.

If my analysis was helpful,

Please click the booster button at the bottom.

This is a 30-minute Bitcoin chart.

There's no separate Nasdaq indicator release.

I was pressed for time today, so I did this in a hurry.

*Long position strategy based on the red finger movement path

1. $88,721.5 long position entry point / Stop loss if the green support line is broken

2. $90,815 long position primary target -> Good, Great, Miracle

Target prices in that order until the weekend

If the price doesn't fall to the red finger entry point,

but touches the first section in the middle,

and then rebounds within the purple support line,

it's a vertical rise (a strong upward movement).

If the price breaks below the light blue support line,

be careful, as further downtrends or mischief may occur.

The price could fall to approximately $87,840.9 on the screen.

The current price has reached the daily Bollinger Band resistance line,

so if the strategy fails, a strong correction is possible.

If the long position strategy succeeds, a strong upward trend is possible even after tomorrow.

Please pay attention to Nasdaq movements from now on.

Please use my analysis to this point for reference only.

I hope you operate safely, with principled trading and stop-loss orders essential.

Thank you.

December 23 Bitcoin Bybit chart analysisHello

It's a Bitcoin Guide.

If you "follow"

You can receive real-time movement paths and comment notifications on major sections.

If my analysis was helpful,

Please click the booster button at the bottom.

This is the Nasdaq 30-minute chart.

Indicators will be released shortly at 10:30 AM and 12:00 PM.

I've made rough predictions about the likely movements.

Whether the red finger or Gap 6 retraces before and after the purple finger touches seems important.

I've applied this directly to Bitcoin.

Here's a 30-minute Bitcoin chart.

Tomorrow is Christmas Eve, and the day after is Christmas Day, so I've covered two days of analysis up to the 25th.

I'll briefly summarize the key points and then move on.

*When the red finger moves,

One-way long position strategy

1. Confirm the purple finger touches once at the top (autonomous short)

Long position entry point at $87,328.6 at the bottom / Stop loss if the green support line is broken

2. If the strategy is successful, utilize the intermediate wave with the pink finger

First target for a long position: $89,398 -> Target prices in order from the top to the top.

If the pink resistance line is not broken from the current position,

it will trigger a vertical decline.

The key question today is whether the Nasdaq will retraceive Gap 6.

Also, if the price touches the first section and rebounds without breaking above the purple support line, it's most advantageous for a long position.

I've set my stop-loss level slightly loosely to the green support line.

If it holds until this point, it will become a safe sideways market.

(Check the MACD dead cross on the 6-hour chart.)

After breaking the green support line, the candlestick pattern can fall to the second section at the bottom.

The price is open to a maximum of 84.5K until the 25th.

If this section breaks, it will represent a double bottom.

Holding the light blue support line at the bottom of the second section will create the conditions for continued upward movement this month.

Please use my analysis to this point as a reference only.

I hope you operate safely, adhering to principled trading and a stop-loss level.

Will there be a Christmas Santa beam?

Have a good year-end and see you on Friday.

thank you

December 19 Bitcoin Bybit chart analysisHello

It's a Bitcoin Guide.

If you "follow"

You can receive real-time movement paths and comment notifications on major sections.

If my analysis was helpful,

Please click the booster button at the bottom.

This is a Bitcoin 30-minute chart.

Shortly, at 10:30 AM and 12:00 PM, the Nasdaq indicators will be released.

At the bottom left, the purple finger indicates the strategy, which follows yesterday's final long position entry point of $84,682.

*If the red finger follows the path, it is a one-way long position strategy.

1. Touch the first point of the purple finger at the top, or even if it doesn't, the red finger indicates the long position entry point at $86,935.2. Stop-loss price if the green support line is broken.

2. $90,815 is the first target for the long position -> Target price is up to Miracle over the weekend.

If the strategy is successful, the top point can be used as a long position re-entry point.

The first point at the top is today's maximum resistance level.

If it touches this point after 9:00 AM tomorrow,

it can ignore the resistance line and continue to rise.

Conversely, if it touches the bottom immediately, a sharp correction could occur, so focus on the 86.9K long position entry point.

Today, it's best to avoid breaking below the light blue support line (bottom) to safely move upward.

Below that, the weekend's lowest support line (2nd) -> double bottom (84082.2 dollars) remains.

If it reaches the double bottom,

unless a very strong rebound occurs,

an additional downtrend could occur next week, so be careful.

(The gray uptrend line is marked in section 2.)

**It's been a while since I've made this fully public.

My daily analysis, which I diligently write, is divided into key support and resistance levels,

and can be utilized in real-time from entry to liquidation.

So, I think it's no different.

Thank you for your support, and I'll make more full public releases in the future.**

Please use my analysis to this extent for reference only.

I hope you'll operate safely, with a strict trading strategy and stop-loss orders.

Thank you for your hard work this week.

December 8 Bitcoin Bybit chart analysisHello

It's a Bitcoin Guide.

If you "follow"

You can receive real-time movement paths and comment notifications on major sections.

If my analysis was helpful,

Please click the booster button at the bottom.

Here's a 30-minute Bitcoin chart.

There are no separate indicators released today.

I've developed a long position strategy based on Nasdaq movements.

*Conditional long position strategy based on the red finger movement path.

- If the price touches the top once or twice and rebounds within the purple support line, it's a vertical rise.

1. If the price falls immediately without touching the top once, the lower level is $91,308.2, the entry point for a long position. / If the green support line is broken, the stop-loss price is $91,308.2.

2. $93,432.7, the first target price for a long position -> the top is the second target price.

If the strategy is successful, $92,961.4 is the point at which to re-enter a long position.

If the price reaches the top before the 9:00 AM candlestick tomorrow, you can enter a short position and then wait for a long position. (Bollinger Band daily chart resistance zone)

The green support line held tight,

but after breaking out, it opened to the bottom, reaching 3 levels.

Please note that my analysis is for reference only.

I hope you will operate safely, with a focus on principled trading and stop-loss orders.

Thank you.

December 4 Bitcoin Bybit chart analysisHello

It's a Bitcoin Guide.

If you "follow"

You can receive real-time movement paths and comment notifications on major sections.

If my analysis was helpful,

Please click the booster button at the bottom.

This is a 30-minute Bitcoin chart.

It's not visible on the screen due to limited space,

but at the bottom, it touched the long position entry point of $83,495.4 on December 1st,

and continues to rise.

The Nasdaq indicators will be released shortly at 10:30 AM,

and I developed today's strategy based on the Nasdaq and Tether dominance patterns.

*Conditional long position strategy based on the red finger's path

1. After touching the purple section once at the top (autonomous short)

Switch to a long position at the red finger at the bottom at $93,101.8

/Stop-loss price if the green support line is broken

2. First target for a long position at the top section at $96,923.6 -> Target prices in the order of Good and Great

Before tomorrow's daily candlestick is created,

if the top section is touched alone,

since it is a resistance line on the Bollinger Band daily chart,

a strong correction is likely.

If the Good section is touched at once,

it is highly likely to be ignored and continue to rise.

If the price drops immediately without touching the first section at the top,

it's a final long strategy in the second section,

and the stop-loss price remains the same.

The third section below is a sideways movement.

If the green support line holds today, a vertical rise is possible after tomorrow.

If the price holds today's light blue support line,

it could lead to a strong upward movement after tomorrow.

Below the bottom, the price is open to 88.6K, the lowest point today.

Please note this.

Please use my analysis to this point for reference only.

I hope you operate safely, adhering to principled trading and a stop-loss price.

Thank you.

November 28 Bitcoin Bybit chart analysis Hello It's a BitcoinHello

It's a Bitcoin Guide.

If you "follow"

You can receive real-time movement paths and comment notifications on major sections.

If my analysis was helpful,

Please click the booster button at the bottom.

This is the Nasdaq 30-minute chart.

Today is an early closing day due to Thanksgiving.

*Roughly speaking, among the red finger long position strategies,

the rebound after touching the first section is a vertical rise.

25.2K -> Bottom is a safe zone for long positions,

and the lowest point, 25,098.7K, is the 1+4 section.

While today's sideways movement is most likely,

I've also calculated major fluctuations just in case.

I've applied this directly to Bitcoin.

This is Bitcoin's 30-minute chart.

I assumed the Nasdaq would move sideways,

and conducted a 1:1 analysis with Tether Dominance.

It first touched the lower Bollinger Band (the area where the 30-minute and 1-hour support levels touch and shake simultaneously).

The danger signal was the MACD dead cross on the 4-hour chart.

Since the Ichimoku Kinko Hyo has a thick bullish cloud,

I set a short stop-loss, ignored the 4-hour MACD dead cross, and operated aggressively.

*When the red finger moves,

One-way long position strategy.

1. $91,110.2 long position entry point / Stop-loss price if the purple support line is broken.

2. $94,187.6 long position primary target -> Great secondary target.

If the strategy is successful, the top area can be used as a long position re-entry point.

Instead, the Top -> Good section is the center line of the daily Bollinger Band chart, so a strong correction is likely.

Also, the purple flag marked on the far right indicates the area where a new monthly candlestick is formed next month.

A strong rebound this weekend is unavoidable, as the monthly MACD dead cross could be resolved. Even if the Great section is formed at the top, closing down to the gap section formed over the weekend is the best option for long positions.

(Possibility of a December bull market without the risk of a monthly MACD)

The first section + the bottom section at the bottom is the safest area for long positions, with the possibility of a sideways movement.

Up to the second section is open after the bottom section is broken.

This is because the second touch, between the 4-hour Bollinger Band center line and the 6-hour Bollinger Band center line, could lead to a strong push without support.

Up to this point, I ask that you use my analysis for reference only.

I hope you operate safely, with a focus on principled trading and stop-loss orders.

Thank you for your hard work this week.

Thank you.

#ERAUSDT #1D (Bitget Futures) Descending channel on support LONGCaldera just printed a morning star on daily with good bounce back volume, bottom seems likely.

⚡️⚡️ #ERA/USDT ⚡️⚡️

Exchanges: Bitget Futures

Signal Type: Regular (Long)

Leverage: Isolated (1.3X)

Amount: 4.8%

Current Price:

0.2508

Entry Zone:

0.2503 - 0.2187

Take-Profit Targets:

1) 0.3245

2) 0.3921

3) 0.4598

Stop Targets:

1) 0.1593

Published By: @Zblaba

EURONEXT:ERA BITGET:ERAUSDT.P #1D #Caldera #RaaS #Rollups #DeFi caldera.xyz

Risk/Reward= 1:1.2 | 1:2.1 | 1:3.0

Expected Profit= +49.9% | +87.4% | +124.9%

Possible Loss= -41.7%

Estimated Gaintime= 1-2 months

November 20 Bitcoin Bybit chart analysisHello

It's a Bitcoin Guide.

If you "follow"

You can receive real-time movement paths and comment notifications on major sections.

If my analysis was helpful,

Please click the booster button at the bottom.

Here's a Bitcoin 30-minute chart.

Shortly, at 10:30 AM and 12 PM, the Nasdaq indicators will be released.

At the bottom left, the purple finger indicates the final long position entry point on the 19th, at $90,355.8. I've linked the strategy to that level.

The bottom area at the bottom is what I consider to be the major support line for this week.

(The center line of the Bollinger Bands monthly chart has moved from the previous $87,665.3.)

Everyone knows this and is waiting for it.

In my experience, if you wait at the bottom,

it generally doesn't come down easily. + Nasdaq volatility

Of course, we'll have to watch today's movement,

but please watch until the very end.

Because today could be a day with a significant move,

I kept my strategy as safe and simple as possible.

*Red Finger Movement Path:

One-Way Long Position Strategy

1. $90,341.7 long position entry point / Stop loss price if the purple support line is completely broken

2. $93,343.2 long position primary target -> Top, Good target price in that order

If the strategy is successful, you can utilize the 92.3K long position re-entry point indicated.

Since the 4-hour Bollinger Bands are repeatedly hitting the center line,

barring a sharp decline in the Nasdaq,

it is poised for a strong upward trend.

Note that the first point at the bottom is a double bottom.

If it falls to this level,

it is more likely to reach the bottom than to rebound.

Today, the Nasdaq and Bitcoin must move as far upward as possible to avoid falling to 86.7K this week. In the event of a weak sideways movement or correction,

I recommend keeping the bottom open until 9:00 AM next Monday.

Please use my analysis to this point for reference only.

I hope you operate safely, with a clear focus on principled trading and stop-loss orders.

Thank you.

November 11 Bitcoin Bybit chart analysisHello

It's a Bitcoin Guide.

If you "follow"

You can receive real-time movement paths and comment notifications on major sections.

If my analysis was helpful,

Please click the booster button at the bottom.

This is a Bitcoin 30-minute chart.

There are no separate Nasdaq indicators.

I developed a strategy based on the lower gap retracement of both Bitcoin and Nasdaq.

*Conditional long position strategy when the red finger moves

1. Confirm the first touch of the purple finger at the top (autonomous short)

Switch to a long position at the bottom at $103,790.4 /

Stop-loss price if the green support line is completely broken or the bottom is touched

2. First target for a long position at $106,701.5 / Target prices are Top and Good in that order.

If the strategy is successful, the first section is used to re-enter the long position.

If a correction occurs immediately without touching the first section at the top,

I'll wait for a long position at the bottom. Looking at the overall picture today, if the price drops to the bottom,

the medium-term pattern will be broken.

The purple support line must be maintained or the upper limit must be reached at 106.7K.

A rebound in the 1+4 range is required without breaking the green support line.

The Nasdaq variable is important, so please keep a close eye on the movement.

I hope you operate safely, with principled trading and stop-loss orders essential.

Thank you.