BNX/USDT at Critical Demand Zone — Reversal or Breakdown?BNX/USDT on the Weekly (1W) timeframe remains in a long-term bearish structure after a significant decline since its 2022 peak. Currently, price is pulling back toward a strong historical demand zone, highlighted by the yellow box between 0.383 – 0.330. This zone has previously acted as a key reaction area, triggering multiple strong bounces.

---

Pattern & Structure Explanation

Primary Trend: Bearish (Lower Highs – Lower Lows).

Market Structure:

Price is moving within a large macro range, repeatedly reacting between lower support and mid-range resistance.

Key Patterns Identified:

Range-bound structure with potential accumulation at the bottom.

Possible base formation / double bottom if price holds above the demand zone.

Repeated rejections from the 0.73 – 0.95 resistance area, indicating strong selling pressure.

The yellow zone represents a weekly demand zone that has been tested multiple times, increasing the probability of a buyer reaction.

---

Key Levels to Watch

Major Demand Zone:

0.383 – 0.330

Minor Support:

0.450

Key Resistance Levels:

0.540

0.730

0.830

0.957

---

Bullish Scenario

Price holds and shows strong rejection from the 0.383 – 0.330 demand zone.

Formation of a bullish weekly close, such as a long lower wick or bullish engulfing candle.

A confirmed breakout above 0.540 may open upside targets:

First target: 0.730

Next targets: 0.830 – 0.957

This scenario suggests accumulation and a potential medium-term trend reversal.

---

Bearish Scenario

A weekly close below 0.330 with strong bearish momentum.

Failure of the major demand zone to hold price.

Increased risk of bearish continuation toward:

Lower liquidity zones and potential new lows.

A valid breakdown would confirm that sellers remain in full control of the market.

---

Conclusion

BNX/USDT is currently trading within a high-impact decision zone. The 0.383 – 0.330 demand area is a critical level that will determine whether price forms a base for reversal or continues its long-term downtrend. Price reaction at this zone will be crucial for the next major move.

#BNX #BNXUSDT #CryptoAnalysis #WeeklyChart #DemandZone #SupportResistance #PriceAction #AltcoinAnalysis #MarketStructure #Downtrend #Accumulation

Bntusdtperp

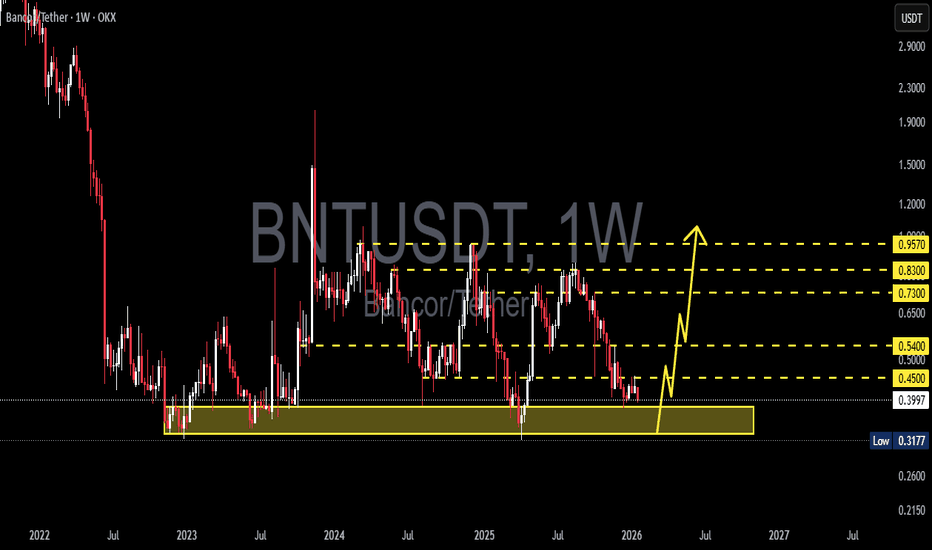

BNTUSDT 200% Potential!BNTUSDT Technical Analysis Update.

BNT/USDT has been ranging for the last 500 days, we can expect a good up move once breakout confirms.

Buy zone : Below $0.64

Stop loss : $0.54

Take Profit 1 : $0.635

Take Profit 2 : $0.89

Take Profit 3 : $1.25

Take Profit 4: $1.95

Always Keep Stop Loss

Thanks

Hexa