BTC: The 15-Year Prophecy (Hosoda Time & The Diagonal)There is a ghost in the machine.

For the last few months, amidst the noise of breakouts and new highs, a specific signal has been flashing a warning that defies the rules of a standard Bull Market. It is a "glitch" in the data—a silence where there should be noise.

Most are ignoring it. Some are confused by it. Today, we are going to try solving it.

Below is the full evolution of the Bitcoin setup, from the Daily traps to the Macro truth, revealing why the "Silence" is actually the loudest signal we have ever seen.

Part 1: The Micro Trap (1D Chart)

Zooming into the daily timeframe, the structure of the decline is textbook. We are currently navigating Wave (4), but the context provided by the previous move is critical.

The "Extended" Wave 3: The drop we just witnessed wasn't a standard correction; it was an impulsive sell-off where Wave 3 was extended. when the third wave extends, it confirming strong momentum in the direction of the trend. The bears are in control.

Current Status (Wave 4): We seem to be in the middle of a Wave (4) relief rally, potentially unfolding as an ABC correction.

Sub-waves 'a' and 'b' appear complete, with 'b' potentially establishing a local higher low.

What's Next: We are likely waiting for Wave 'c' to expand upwards to potentially complete the structure.

The Potential Resistance ($99k): If this structure holds, Wave 'c' might push towards the resistance confluence around $99,323. This area could serve as a ceiling for this corrective phase.

The Downside Risk ($79k): Traders should remain cautious. If Wave (4) finds resistance near $99k, the Elliott Wave guidelines suggest a Wave (5) decline could follow. If that scenario plays out, the market might target the major support zone near $79,000.

Part 2: The Time Anomaly (1W Chart)

While the daily chart showed us the immediate price action, the Weekly chart reveals the true scale of the move. As discussed in previous updates, we are navigating a large-scale Irregular Flat Correction, and we are currently at the tail end of Wave (1) of the 5-wave impulse that makes up the larger C-Wave.

So, the entire impulsive structure we just analyzed on the Daily chart? That was just the first leg of this Weekly move.

☁️ The Ichimoku Signal: Testing "Senkou Span B" Price action has now entered the Ichimoku Cloud (Kumo), a critical zone of turbulence.

The Level: you can see candles trading inside the cloud. We have already tested the bottom support, specifically the Leading Span B (Senkou Span B).

The Forecast: Hitting this level signals that Wave (1) is either ending or has already ended. However, the market rarely makes it easy. I am expecting a potential "False Breakout" below the Cloud to trigger panic, followed by a sharp reclamation. That fake-out would likely mark the bottom of Wave (1) and start of Wave (2).

⏳ The Time Anomaly: Why so fast? There is a strange disconnect in the "Time" dimension of this cycle compared to history (see picture).

2021 Cycle: In the previous bull run, the correction for Wave 1 typically took 70 days to cool the RSI down to 37.

Current Cycle: We have smashed down to an RSI of 35.8 in just 42 days.

The Question: Why is the market correcting nearly twice as fast as before? This "Time Compression" indicates the cycle is moving faster and more violently than we are used to.

The "BBWP Mystery" Finally, look at the BBWP (Volatility) in the below picture. This presents a genuine anomaly. Throughout this cycle, we have seen contractions many times, yet the spectrum never reached the extreme 90% expansion levels. Now, at the very end of the cycle, we are seeing another massive BBWP Contractions.

Why is this happening? Is it just noise, or is this contraction actually telling us the truth?

Part 4: The Truth (6-Month Macro Chart)

Why is the market moving so fast? And what is the "BBWP Signal" we mentioned Before? Look at the 6-Month Logarithmic Chart below.

The Big Picture: Elliott Wave Supercycle on 6M Log Scale

On the logarithmic chart, Bitcoin appears to be wrapping up a massive impulse wave that started from its early days:

Wave (I): Peaked around 2013 (~$1,200 high).

Wave (II): Bottomed in 2015 (~$200 low).

Wave (III): Explosive rally to the 2021 all-time high (~$69,000).

Wave (IV): The 2022 bear market low (~$15,500).

Wave (V): Ongoing since late 2022, but here's the twist—it's unfolding as an ending diagonal (wedge pattern with overlapping subwaves: 1-2-3-4-5).

2.Applying Hosoda Time Theory (Ichimoku Time Theory indicate potential future market turning point).

The vertical lines in the chart are not Fibonacci; they are Hosoda Numbers (9, 13, 17, 21...),

9: Marked the 2023 Bull Run start.

13: Exactly Marked the Jan 2025 Top as end of wave 3, which matches the irregular flat analysis on Weekly chart which states that Cycle top was on Jan 2025.

17 (±1): Matches our projection for the next major pivot—the end of wave IV and the start of the final Wave V run on Jul-2026 or Jan-2027.

The "Mystery": The BBWP Anomaly

BBWP is contracting sharply now on weekly chart—at what feels like the end of the cycle, not the start. This flips the script on historical behavior. Why? I tie it back to the higher-degree Elliott count: The ending diagonal's converging nature naturally squeezes volatility, compressing Bollinger Bands as momentum fades. Instead of signaling a fresh bull, this late-cycle contraction could be foreshadowing a reversal—think trend exhaustion rather than accumulation.

A Possible Explanation: If the macro structure is indeed an Ending Diagonal, then this volatility crunch (BBWP contractions) and the market correcting nearly twice as fast as before makes perfect sense. We would be squeezing into the apex of a 15-year wedge. The market might be running out of "oxygen".

The Verdict: With the 6-Month structure potentially squeezing into a corrective Wave IV, the weight of evidence suggests that the path of least resistance is down. Until the market touches the lower boundary of this diagonal (or invalidates the structure), the only logical macro view is bearish.

Btcprice

BTC is stuck in a range. What should we do?While Bitcoin is stuck in a range, we need to wait for it to break out in one direction before trading from the specified zones. The market is not volatile. It's the holidays; exchanges are closed and people are relaxing. Clearly, there's no point in expecting anything from the market right now.

BINANCE:BTCUSDT.P

Is This Where Bitcoin Makes Its Major Decision?

🔥 The Hidden April Gap Nobody Is Talking About — Is This Where Bitcoin Makes Its Major Decision?

Most traders completely missed this one.

Buried inside April’s fast displacement sits a hidden Fair Value Gap that aligns exactly with the real Monthly–Weekly Higher Low — and if price revisits it, this level could decide the next macro direction.

Let me walk you through it.

⸻

📍 The Level (Rounded for Clarity)

This forgotten 15m imbalance sits between:

• $86,200 (top)

• $85,350 (bottom)

Not just any gap — this one overlaps perfectly with the true HL in the Monthly–Weekly structure, the same HL that has been carrying the entire macro bullish leg.

This is where real decisions are made.

⸻

📉 Why This Zone Matters

If price revisits this area, there are only two outcomes — and both are significant:

1️⃣ Early Reversal Attempt (If Buyers Defend the HL)

A clean bullish reaction here could signal:

• Absorption of sell-side pressure

• Builder structure for a new daily leg

• First real attempt to end the higher-timeframe down sequence

2️⃣ Bearish Absorption (If Sellers Crush the HL)

If price cuts through the gap with displacement,

the Monthly–Weekly HL collapses.

That opens the door to deeper levels with minimal support.

This is not a small level — this is a macro hinge point.

⸻

👁️ My Plan

I’m watching $86.2K – $85.35K very closely.

When price returns to this zone, I want to see whether we get:

• Reversal intent,

or

• Full bearish continuation.

No predictions.

No hopium.

Price action will tell the truth.

⸻

🧭 Final Thought

This April gap isn’t random.

It’s the hidden liquidity pocket sitting directly on the real Monthly–Weekly Higher Low.

If Bitcoin revisits this level, the market will reveal whether buyers still have strength — or whether the bearish macro continues without mercy.

If this analysis brought you clarity or aligns with your view,

please Like ❤️ | Comment 💬 | Follow 🔔 | Share ↗️ —

your support motivates me to keep releasing clean, objective insights for the community.

NFA.

COINBASE:BTCUSD COINBASE:MCZ2025

Bitcoin Bullish Confirmation Above $119500 | Watch November MoveBitcoin is currently trading below a key resistance level of **$114,500**, and a **strong Monday closing on 13 October above this level** is crucial for confirming a short-term bullish recovery.

If BTC successfully closes above **$114,500**, the next important resistance will be around **$119,500**.

A **Monday closing on 20 October above $119,500** would confirm a temporary bullish structure, giving Bitcoin the strength to test higher levels toward the **$127,600 liquidity zone** in November.

Currently, major liquidity is sitting near **$124,600 and $127,600**, which might attract price movement before any major reversal begins.

The market has already taken liquidity around **$101,000**, trapping retail sellers — and now, it may move up to grab the **short-side liquidity** before the next larger downtrend begins.

⚠️ **Be patient and stay disciplined. Avoid long positions for now.**

Focus on the market’s move toward the top, and prepare for **short positions near the highs** to capture the **2026 bear market** — which is expected to last from **September to November 2026**.

📊 The market often manipulates both sides before showing the real direction. Watch levels carefully and trade with confirmation.

💬 **Follow me on TradingView** for more Bitcoin and Ethereum updates — and comment below which coin you’d like me to analyze next!

Bitcoin Continues Uptrend as USD Weakens📊 Market Overview:

Bitcoin is currently trading around $117,117, maintaining its upward trend following the Federal Reserve's 0.25% rate cut to 4.0–4.25% and Chairman Jerome Powell's cautious signals on monetary policy. This has pressured the USD, providing support for Bitcoin.

📉 Technical Analysis:

• Key Resistance: $117,900–$118,000

• Nearest Support: $116,700–$116,800

• EMA: Price is above the EMA 09, indicating an uptrend.

• Candlestick / Volume / Momentum: RSI at 58.07 suggests the market may be in a neutral state.

📌 Outlook:

Bitcoin may continue to rise in the short term if it holds above $116,700, with resistance at $117,900–$118,000.

________________________________________

💡 Proposed Trading Strategy:

SELL BTC/USD at: $117,900–$118,400

🎯 TP: 40/80/200 pips

❌ SL: $119,000

BUY BTC/USD at: $116,500–$116,800

🎯 TP: 40/80/200 pips

❌ SL: $116,200

Bitcoin Continues Uptrend as USD Weakens📊 Market Overview:

Bitcoin is currently trading around $119,100, after reaching a peak of $122,242 in yesterday’s session. This price surge is supported by President Trump’s executive order establishing the National Bitcoin Reserve, along with strong buying demand from corporations and ETF funds.

📉 Technical Analysis:

• Key Resistance: $122,000 – $123,000

• Nearest Support: $118,000 – $118,500

• EMA09: Price is currently above the EMA09 on the H1 timeframe → short-term uptrend is maintained.

• Candlestick Pattern: Strong bullish momentum with long green candles; RSI above 70 indicates a possible short-term correction.

📌 Outlook:

Bitcoin may continue to rise if it holds above the $118,000 support level and no negative news emerges. However, caution is advised as RSI remains above 70, signaling potential short-term pullback.

💡 Suggested Trading Strategy:

BUY Bitcoin/USD at: $118,500 – $118,000

🎯 TP: $120,000 – $122,000

❌ SL: $117,500

SELL Bitcoin/USD at: $122,000 – $123,000

🎯 TP: $120,000

❌ SL: $123,500

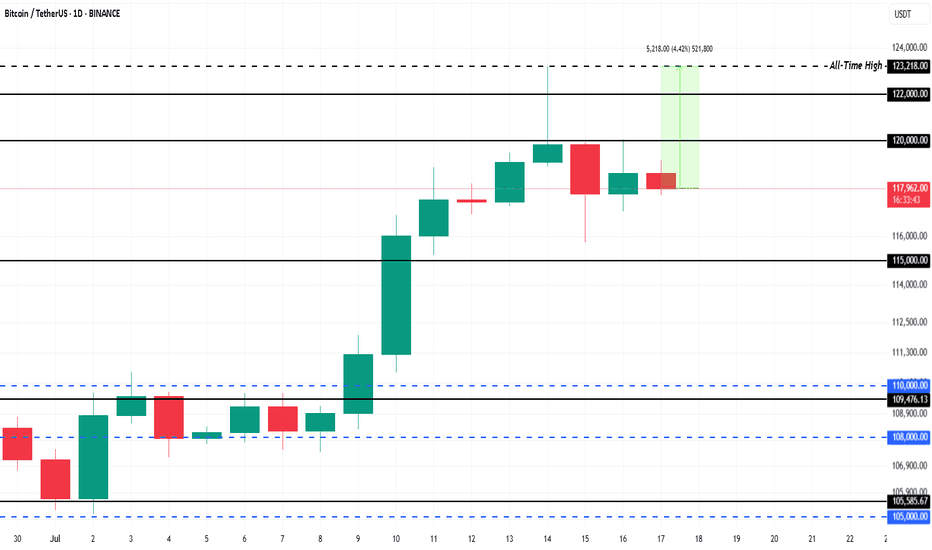

$1.5 Billion ETF Inflows Could Push Bitcoin Price 4% to New ATHBINANCE:BTCUSDT is currently trading at $118,325, facing resistance at the $120,000 level. This resistance is crucial for Bitcoin if it wants to break back to its ATH of $123,218 . The 4.4% gap to reach the ATH indicates potential for growth, but Bitcoin needs to secure support above $120,000 for this to happen.

This week, spot BINANCE:BTCUSDT exchange-traded funds (ETFs) saw over $1.5 billion in inflows , a significant portion of which occurred in the last 48 hours during Bitcoin’s dip.

The influx of institutional money highlights that investors are confident in Bitcoin’s potential despite the market cooling. If this trend persists, it could propel BINANCE:BTCUSDT price upward, as institutional support provides stability.

If BINANCE:BTCUSDT can hold above $120,000 and push past $122,000, it could continue its ascent toward new all-time highs. The current market conditions and ETF inflows support a bullish outlook, with a significant chance of breaking the resistance.

However, the risk of profit-taking remains , which could lead to a price drop. If BINANCE:BTCUSDT faces selling pressure, it could fall back to $115,000 , erasing a portion of recent gains. This would invalidate the bullish thesis, causing Bitcoin to retest lower support levels.

Bitcoin Awaits Breakout Above $114K🪙 Current Price: ~$109,500

📈 Trend: Bullish but facing strong resistance at $114,000

📉 Support: $106,000–$107,000

📌 Outlook: Breakout above $114K could lead to $130K+. Otherwise, possible pullback to $106K.

📊 Key Drivers: ETF inflows, Fed rate cut expectations, weak USD.

💡 Strategy:

🔺 Buy: $107,000 – $107,500 → TP $114,000 | SL $106,000

🔻 Sell (take profit): $114,000 – $115,000 → SL if closes below $112,000

₿itcoin: Continuing B WaveBitcoin has recently reclaimed the key $106,000 level. Under our primary scenario, we anticipate continued increases into the blue Target Zone between $117,553 and $130,891 – where green wave B is expected to conclude. From that corrective peak, we project a significant move lower in wave C, which should ultimately pull prices into the lower blue Target Zone between $62,395 and $51,323. This range is expected to mark the completion of orange wave a. We then foresee a brief corrective rally before wave (ii) completes its broader correction with a final sell-off.

📈 Over 190 precise analyses, clear entry points, and defined Target Zones - that's what we do.

BTC in 17 April 2025Potential Major Move on Thursday, April 17, 2025 📍

📊 Based on an analysis of historical Bitcoin chart averages and similar patterns, there is a likelihood of a significant price movement on this date.

This analysis is conducted using technical analysis and a detailed examination of Bitcoin’s movement averages. It suggests that approximately every 150 days after the start of a neutral trend, we can expect a sharp upward or downward move that sets the stage for the main trend in the future.

📅 As of the current date, March 29, 2025, there are about 18 days left until this significant event.

You can follow the results of this analysis and the conducted review on TradingView on the specified date.

HolderStat | BTC daily digestBitcoin price today ~ FWB:83K (-5% 24h). BTC futures open interest down ~7%, funding +0.006% 📉

Wider market 🌐: Altcoins fell too (ETH -6%, SOL -12%). Sentiment is split – some shout #BuyTheDip, others urge caution.

📰 CoinDesk: Tariff news spooked crypto markets, fueling BTC’s drop. Meanwhile, whales (big holders) bought this dip 🐳 – a bullish sign.

🔍 Analysis: Traders remain cautious, but whale dip-buying shows big players bullish. Expect crypto bulls 🐂 and bears 🐻 to battle it out for now.

_____________________

📊 Want more useful analytics? Like and subscribe to stay up to date with the most relevant trading ideas!

Always DYOR! 🔬

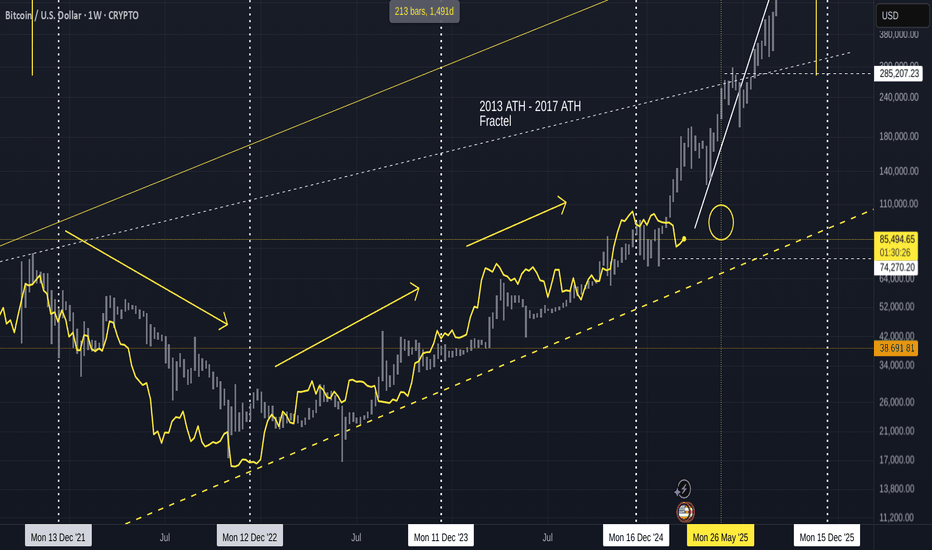

Bitcoin Following 2013-2017 Fractal UPDATE 2We can see from the chart above that PA has now fallen below the Fractal for the first time since July 2023

This is itself was expected as we can see from previous posts on this Idea

PA was overbought and so HAS to cool off

However, we have targets as to when PA may try and recover.

initially, the circle in End of May was my expected "turn around" point

Things have progressed faster and so now, we have possibilities opening up for a move higher, sooner, maybe around end of April 2925

However until the weekly MACD is on Neutral, these would be short lived - hopefully.

For a sustainable move higher, PA needs to have the ability to maintain the push

the Weekly MACD shown above needs till end of April before any significant move can be maintained. PA has bounced of Neutral previously. But MACD can , obviously, Drop below this point, wait till May, or later, and move then.

For me, the line of the arrow higher is becoming the more realistic ideal path

But the longer we wait, the Steeper the rise has to be to maintain the idea of Cycle ATH in Q4, as per cycle trends.

And to conitnue to follow this Fractal.

The Time WILL come were we break away from this Fractal but as I have been saying for years, we are still on it......many things point towards that continuing.

But as I have mentioned in a post earlier today, These Trends may be changing.

Bitcoin is Maturing

All we can do is watch, react and learn

HAVE A PLAN FOR ALL OUTCOMES but also understand, the idea of Bitcoin collapsing is becoming more and more unrealistic...

The outlook is BULLISH noi matter what

I expect to remain on the fractal path till Next cycle ATH

Time will tell

BTC → Bitcoin Retrace to $69,500? Or Bounce to $150,000?The short version, the probability that Bitcoin tests the breakout price around $69,500 is very high. That's simply the nature of breakouts; bulls take profits (sell orders) until the previous high is reached, at which point the bulls start buying again, and the bears take their profits (buy orders), driving the market up for another leg.

The question is, what is our next move as traders? Or even Bitcoin investors?

How do we trade this? 🤔

Let's zoom out to the Monthly chart. Bitcoin is resting on the 9EMA, a support area we've closed above it since September of 2023. Our current context is we've broken out of the 2021 cycle high of $69,500 and reached a new high just shy of $110,000. It's clear we're in pullback mode right now, so far-reaching down to $78,000.

Fundamentally, there aren't many catalysts for bullish activity. Bulls are simply taking profit at the first 6-figure Bitcoin price, which is both a psychological and technical price for selling. Monetary policy is still in a state of qualitative tightening, inflation has been slowly rising since September 2024, from 2.4% to 3%. Not a dramatic move, which certainly isn't helping Bitcoin move to the upside. Bitcoin seems to respond more to monetary policy than inflation rates and while the rates have steadily climbed, it's not enough to shock the market, while monetary policy has largely stayed the same.

Technical analysis shows TOTAL, TOTAL2, and TOTAL3 crypto market cap charts all were rejected at key resistance areas in early December. Bitcoin broke the 2021 right shoulder around $46,000 to $73,000, then had a measured move up to $109,000, about a 55% move each, give or take. We're simply in a state where we've reached a key resistance level after a breakout while the market as a whole is in a state of uncertainty. I believe that uncertainty will lead to a capitulation down to the high $ 60,000s, even if it's a quick wick. This would likely lead to a $1,500 ETH, $1.50 XRP, it may look ugly. But take a look at past cycles; a 30-40% pullback for Bitcoin is just another Thursday in the crypto market. The alts can pull back as much as 50%-60%.

I think we wait for the buy signal. Look for a pullback to the breakout area at $69,500, and wait for the market to tell us that we found the buy zone with a strong candle close on or near its high on the Daily chart, likely somewhere around $75,000. Then I believe $150,000 is the area for this cycle high based on the Lifetime Resistance and measured move target. The measured move shows a 57% move up after the breakout; if we take that 57% move up and stack it on the mid-price of the current trading range at $91,000, that takes us to right around $150,000. Anything beyond that is a bonus. I think from there, it makes a second attempt to breach the high, followed by our 12-18 month bear market as shown in the chart.

💡 Trade Idea 💡

Long Entry: $75,000

🟥 Stop Loss: $55,000

✅ Take Profit #1: $105,000

✅ Take Profit #2: $135,000

⚖️ Risk/Reward Ratio: 1:3

🔑 Key Takeaways 🔑

1. Breakout above 2021 Cycle High $69,500

2. Psychological and technical high of $100,000 reached

3. Pullback phase has been in motion since December, breakout zone is the buy target

4. Wait for a two-legged pullback toward the Monthly 30EMA (breakout zone), look for strong buy signal, large bull candle closing on or near its high.

5. RSI is near 64.00 and below the Moving Average. Wait for contact and a drop toward 60.00 in concurrence with the price action to enter.

💰 Trading Tip 💰

It's reasonable to take half profits at the first resistance target in a long trade, or the first support target in a short trade. Using a 1:1 Risk/Reward Ratio for your first target, you can move your stop loss up to your entry price, locking in profits. This allows you to watch the rest of the trade execute without worry of losing money. This helps improve trading psychology and the equity in your account.

⚠️ Risk Warning! ⚠️

Past performance is not necessarily indicative of future results. You are solely responsible for your trades. Trade at your own risk!

Like 👍 and Follow to learn more about:

1. Reading Price Action

2. Chart Analysis

3. Trade Management

4. Trading Psychology

Bitcoin: 74k-72k Line in the Sand!Hello everyone!

First of all happy international women's day to all the ladies out there! (Don't forget to get flowers guys)

Bitcoin is approaching a key area

with extremely strong support, but several indicators also mark the line in the sand for the current bullmarket for Bitcoin.

Weekly

- Fib: 38.2% of the complete trend retracement (15.5k - 109.4k)

- MA: 50 SMA (75.4k)

- S/R: 70k-74k Strong supply/resistance area

A consistent pattern emerges on Bitcoin's chart: breaks below the 50-week SMA (black line) after an all-time high (red arrows) have reliably indicated bear markets. Similarly, reclaiming the 50-week SMA (green arrows) has historically confirmed bull runs toward fresh all-time highs.

3D

- Fib: 61.8% of the retracement from previous range low to current high (49.5k - 109.4k)

- MA: 100 SMA (77k)

On the 3-day chart, the 100 SMA has acted as strong support during this bull market. Bitcoin revisited the moving average on 5 individual occasions and bounced off it. Despite briefly closing below it twice, BTC quickly reclaimed it with the following candle.

A potential correction to $70,000 is possible for Bitcoin. To maintain the bull market, it's crucial for bulls to find support there and drive the price back above the 3-day 100 SMA and the weekly 50 SMA.

Happy trading!

Pat

MARA ($MARA) Q4—$214.4M HAUL STUNS MARKETMARA ( NASDAQ:MARA ) Q4—$214.4M HAUL STUNS MARKET

(1/9)

Good Morning, TradingView! MARA Holdings ( NASDAQ:MARA ) smashed Q4 ‘24 with $ 214.4M revenue, up 37% YoY 🌍 Bitcoin hoard hits $ 3.94B—let’s unpack this mining beast! 💰

(2/9) – REVENUE SURGE

• Q4 Take: $ 214.4M, 37% up from $ 156.8M 📈

• Net Income: $ 528.3M, 248% leap 🌟

• BTC Price: 132% boost adds $ 119.9M 💸

NASDAQ:MARA ’s cashing in—halving? What halving?

(3/9) – BLOCKS BUZZ

• Blocks Won: 703, up 25% from 562 🚗

• Hashrate: 53.2 EH/s, 115% jump 🔧

• EPS: $ 1.24, beats $ 0.32 loss call 🌞

NASDAQ:MARA ’s grinding—blocks stack, stock pops!

(4/9) – BTC HOARD

• Stash: 45,659 BTC, $ 3.94B haul 🌍

• Growth: 197% since Jan ‘24—22,065 bought 💼

• Bitdeer: $ 532M loss—ouch 😕

NASDAQ:MARA ’s stacking—rival’s stumbling!

(5/9) – RISKS IN SIGHT

• Costs: $ 127.4M energy, up 70% ⚠️

• Volatility: BTC swings sting 🐻

• Halving: $ 64.2M output hit 🔒

NASDAQ:MARA ’s hot—can it dodge the chill?

(6/9) – SWOT: STRENGTHS

• Haul: $ 214.4M, profit beast 💪

• Blocks: 25% more—mining grit 🏋️

• Hoard: $ 3.94B BTC—stack king 🌱

NASDAQ:MARA ’s tough—built to last!

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES

• Weaknesses: Energy costs bite 🙈

• Opportunities: BTC price, AI pivot—zing 🌏

Can NASDAQ:MARA vault past the snags?

(8/9) – NASDAQ:MARA ’s $ 214.4M Q4, what’s your vibe?

1️⃣ Bullish, $ 20+ stacks up 😎

2️⃣ Neutral, Solid, risks linger 🤷

3️⃣ Bearish, Costs clip it 😞

Vote below! 🗳️👇

(9/9) – FINAL TAKEAWAY

NASDAQ:MARA ’s $ 214.4M Q4 and $ 3.94B BTC pile stun—mining hauler Costs creep, but grit shines—gem or bust?

BITCOIN ($BTC) DIPS TO $82K—FEAR OR FORTUNE?BITCOIN ( CRYPTOCAP:BTC ) DIPS TO GETTEX:82K —FEAR OR FORTUNE?

(1/9)

Good Morning, TradingView! Bitcoin ( CRYPTOCAP:BTC ) slumped to $ 82,000, lowest since Nov ‘24 💰 Market’s glum, let’s unpack this crypto dip! 🌐

(2/9) – PRICE SLIDE

• Drop: $ 82K, 20% off $ 109K high 📊

• Month: Altcoins down 30%+ 💧

• Fear Index: 10/100, rock bottom 😟

CRYPTOCAP:BTC ’s shivering, gloom’s thick!

(3/9) – TECH TELL

• 200-Day MA: $ 81,500, support holds 🌟

• RSI: 28, oversold, bounce hint 🚀

• Past: Aug ‘24 $ 49K to $ 100K 📈

CRYPTOCAP:BTC ’s teetering, rebound or rubble?

(4/9) – MARKET MOOD

• Fear: Lowest since FTX ‘22, $ 16K 🌍

• History: Extreme fear sparks rallies 🌞

• Outflows: $ 1B from ETFs, trade woes 💼

CRYPTOCAP:BTC ’s testing, panic or patience?

(5/9) – RISKS IN PLAY

• Trump: Tariff talk, no crypto juice ⚠️

• Volatility: Bear turn stings 🐻

• Stablecoins: Inflows, sideline cash 🔒

CRYPTOCAP:BTC ’s wobbly, can it dodge the funk?

(6/9) – SWOT: STRENGTHS

• Base: $ 82K holds, tough nut 💪

• Past: Fear flips to gold, $ 100K+ 🏋️

• Liquidity: Central banks ease 🌿

CRYPTOCAP:BTC ’s gritty, battle-tested!

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES

• Weaknesses: Sentiment sinks 😕

• Opportunities: Fear buys, rate cuts 🌏

Can CRYPTOCAP:BTC vault past the blues?

(8/9) – CRYPTOCAP:BTC ’s $ 82K dip, what’s your take?

1️⃣ Bullish, $ 100K rebound soon 😎

2️⃣ Neutral, Holds, risks linger 🤷

3️⃣ Bearish, $ 70K slide looms 😞

Vote below! 🗳️👇

(9/9) – FINAL TAKEAWAY

CRYPTOCAP:BTC ’s $ 82K slump spooks, fear at 10 🪙 $ 1B ETF outflows sting, but history hints bounce, gem or gloom?

BTC - Key Zones & Liquidity InsightsBINANCE:BTCUSDT is currently oscillating within a new trading range, establishing a trustable support zone while facing a weaker resistance trendline and resistance zone. Given this setup, a breakout isn’t the primary expectation just yet.

🔹 Key Observations:

Support Zone Strength: The support zone is stronger than the resistance, making it less likely for BTC to break downward easily.

Resistance Weakness: The resistance trendline and zone appear weaker, meaning any rejection could be temporary.

Liquidity Perspective: As seen on the liquidity chart, there’s favorable liquidity above the resistance zone, increasing the probability of a short-term push higher to hunt liquidity.

💡 Potential Scenarios:

1️⃣ BTC could move toward the resistance zone, tapping into liquidity before reacting.

2️⃣ If buyers step in aggressively, a short-term liquidity grab above resistance might trigger further upside.

3️⃣ Failure to reclaim key levels could lead to continued range-bound movement.

🚀 Stay ready for the next Bitcoin move! Follow for real-time updates and professional insights! 🔔

BTC - 15m Scalp OpportunityCOINBASE:BTCUSD is consolidating within a narrow range, and a breakout could trigger a strong move. Given the sharp drop yesterday, this ascending channel may act as a bearish flag, signaling a potential continuation of the downtrend.

If BTC loses support, expect another significant fall. Watching for a breakdown confirmation!

📉 Stay alert for price action signals!

Is Bitcoin Heading to $78K? Key Patterns Explained!

''BTC/USD: Key Supply Zone in Focus''

This chart highlights a significant supply zone between $94,858.98 and $95,979.83, marked by previous price rejections (indicated by the arrows). This zone represents a key area of resistance where selling pressure has historically dominated.

If the price revisits this zone, there’s a high probability of another rejection, potentially leading to a downward movement. Traders should monitor this area closely for potential short opportunities or signs of a breakout.

👉 What’s your take on this supply zone? Will it hold, or are we breaking through? Let me know your thoughts in the comments!

"BTC/USD: Bearish Head and Shoulders Pattern"

This chart showcases a classic Head and Shoulders pattern, often regarded as a bearish signal. The price has already broken the neckline, indicating a potential continuation to the downside.

The target for this pattern lies near $78,490.59, calculated based on the height of the structure. Combined with the current price action, this setup suggests further bearish momentum could be on the horizon.

👉 Do you agree with this bearish outlook? Or do you see a reversal coming? Share your analysis in the comments below!

BTC - 1H PulllbackBitcoin has formed a bearish descending channel following a sharp bearish spike, indicating continued downward momentum. Currently, the price is showing signs of recovery and may rise towards the channel base around the $97,000 resistance zone.

This resistance zone, marked by previous rejections and high selling pressure, is a critical area to monitor. It offers a potential opportunity to enter short positions if rejection signs are observed, with expectations of further declines from that zone.

Traders should remain cautious and wait for confirmation of price action at the resistance before entering positions. Both bullish retracements and potential rejections at resistance offer opportunities for strategic trades. 🚀

BTC Target Price & Supports after 12/30/2024 structure break.BTC has broken its current market structure and is now seeking new support. I’ve identified three key support zones and a potential target price to monitor for the future. I plan to execute three trades, each with a 2% risk allocation. The exit strategy will be determined later, but for now, the target price serves as the anticipated level for evaluation.