IMPRIOTAND #BITCOIN UPDATE MUST READE !!IMPORTANT BTC UPDATE 🚨

Alright, let’s talk about what’s going on with Bitcoin right now.

On the daily timeframe, BTC is extremely oversold. We don’t see this very often — maybe a couple of times over the last 1–2 years — and when it does happen, it’s usually somewhere around a local low.

Now, before anyone jumps to conclusions:

this does NOT mean the bottom is in.

We’ve actually gone lower after hitting oversold levels before. So no, this isn’t a “load the boat” signal.

What it does mean, though, is that in the short term, the bears are likely to need a breather.

Short-Term Expectations

When the daily RSI gets this stretched, price usually doesn’t just keep free-falling without pause. More often than not, we see:

A bit of relief

A bounce

Or some kind of sideways consolidation

Something that lets the market reset that oversold condition. That kind of pause could easily play out over the next few days to a couple of weeks.

But zooming out for a second the bigger picture still isn’t looking great. This kind of relief doesn’t automatically flip the trend bullish. It can just as easily set us up for another push lower later on.

Resistance If We Bounce

If we do see price lift, there are a few levels where I’d expect things to get heavy again:

Around 81,000 – 81,800

Then 84,000

And especially 86,000, which is a major resistance zone

If price makes it into these areas, I’d be cautious. These levels are far more likely to act as sell zones than confirmation of a full reversal.

The Bigger Problem: Liquidity Below

Here’s the part I really don’t want to ignore.

For the last few days, there’s been a large amount of liquidity building below current price, sitting roughly around 72,000 to 72,600 (around 72.5K).

This area is acting like a magnet.

Markets love liquidity, and until that zone gets tapped, it’s hard to argue that downside risk is gone. Even if we get a bounce first, that liquidity below is still there — and it matters.

So what’s the Play?

In short:

A short-term relief move is very possible

The larger trend is still bearish

72K liquidity remains a key downside area to keep in mind

This is one of those moments where patience really pays. Let the market breathe, see how it reacts at resistance, and don’t forget where the liquidity is sitting.

That’s where the real story is.

Btcupdate

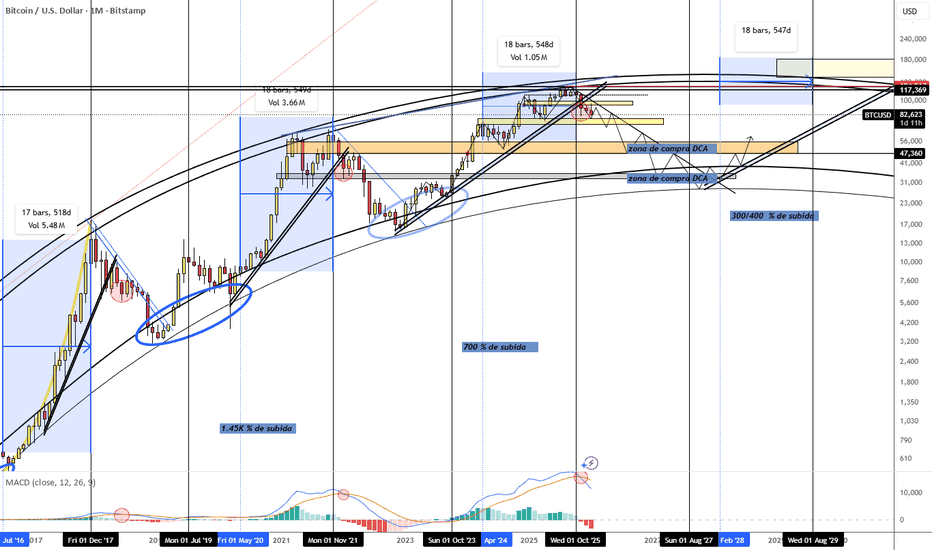

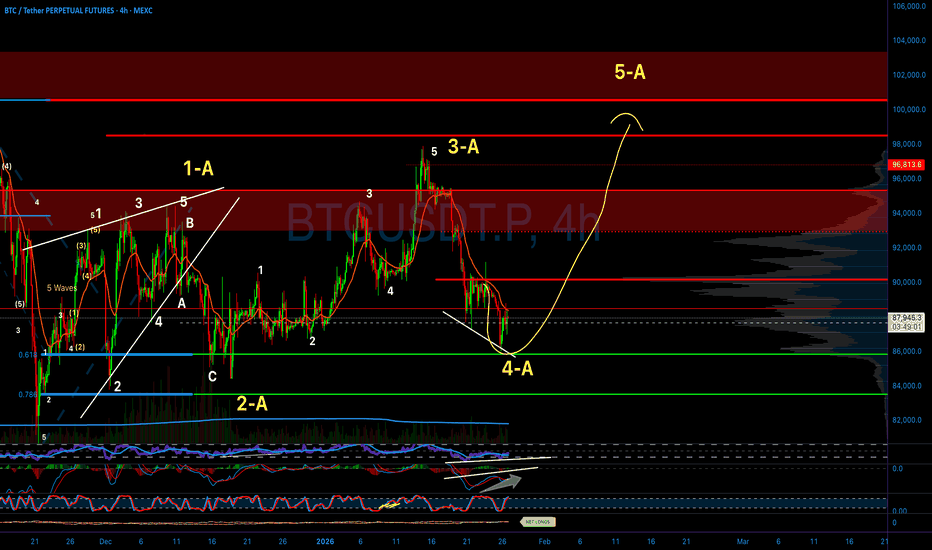

BTC is bottoming out and ready to fly. ATH before 2026 ends!🚨 BTC IS BOTTOMING — NEXT LEG = ALL-TIME HIGHS 🚀

The weekly structure is screaming accumulation. Smart money doesn’t buy tops… it loads right here.

Why this looks ultra-bullish 👇

🔵 Major HTF Support Holding

– Price is reacting exactly where prior demand + breakout zone sits

– This is classic bull-market retrace, not trend reversal

📉 Deep Pullback = Fuel

– Sharp drops flush leverage

– Weak hands out → strong hands in

– These zones historically precede explosive expansions

📊 Higher-Timeframe Trend Still Intact

– Macro structure remains bullish

– No lower-low on the cycle yet

– Consolidation under resistance = pressure cooker

🏦 Institutional Era Isn’t Done

– ETFs + sovereign accumulation

– Supply shock still in play

– Long-term holders not distributing meaningfully

🔥 Sentiment Reset = Opportunity

– Fear after euphoria is exactly what bottoms look like

– Bull markets climb walls of worry

💡 Translation:

This isn’t the end of the cycle.

This is the reload before the next impulse wave.

🎯 2026 ATHs are still on the table.

This dip may be the last gift before price discovery resumes.

📈 Bottoming → Base → Breakout → New Highs.

#Bitcoin #BTC #Crypto #BullMarket #ATH #BuyTheDip

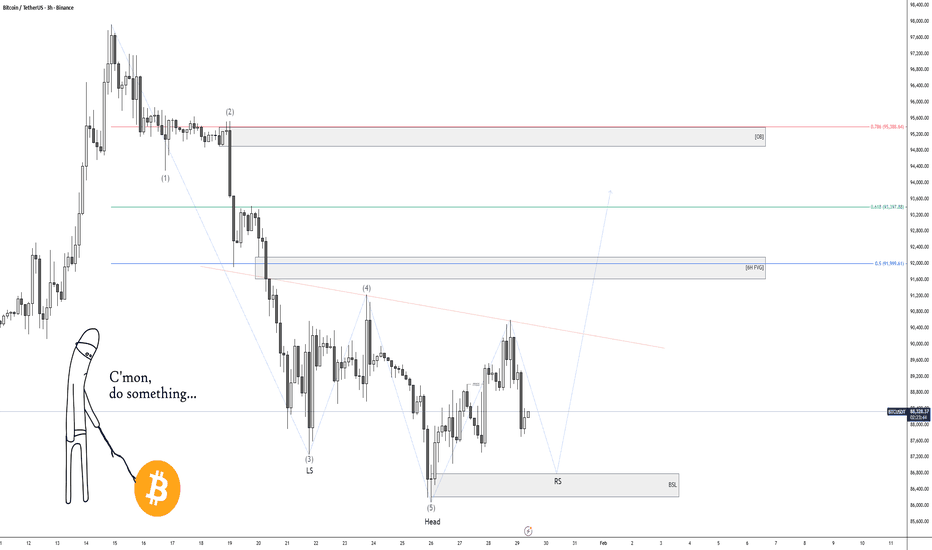

BTCUSD 45-Min Chart — Support Reclaim Setup After Sharp Breakdow

Market Structure:

Clear bearish break from the prior range near 87k resistance, followed by a strong impulsive sell-off → confirms a bearish market shift.

Support Zone (Key Area):

Price is reacting around 80,600–81,000, a marked demand/support zone. This is the first meaningful base after the dump.

Current Price Action:

BTC is testing support after a lower high, suggesting sellers are losing momentum. Wicks into support show buying interest, but confirmation is still needed.

Entry Logic:

The marked entry near 80.6k assumes:

Support holds

A bounce + reclaim of minor structure (above ~82k)

Targets:

TP1: ~83.2k (range midpoint / liquidity)

TP2: ~83.7k (previous consolidation)

Final Target: ~87.1k resistance (major supply zone + breakdown origin)

Bias Summary:

Short-term: Tactical long from support

Invalidation: Clean break and close below 80.6k

Overall trend: Still bearish until 87k is reclaimed

Takeaway:

This is a counter-trend long setup — high reward, but only valid if support holds and momentum flips. Conservative traders should wait for a confirmed reclaim above 82–83k before committing.

BTCUSD/BITCOIN DAY SELL PROJECTION 31.01.26BTCUSD / Bitcoin – Sell Projection (31-01-2026)

Bitcoin is currently trading in a bearish continuation phase, showing strong selling pressure.

Technical Analysis:

Price is moving under a descending trendline, confirming bearish momentum.

The previous uptrend line has been broken, signaling a trend shift.

An Evening Star candlestick pattern formed near resistance, indicating a bearish reversal.

Price has broken below the demand zone, confirming seller dominance.

Market structure shows a lower high and lower low, aligning with a bearish bias.

Trade Setup:

Sell Entry: At the neckline / retest zone

Stop Loss: Above the recent swing high

Take Profit: At the major support zone

You will ask "how did he know Btc would get rejected at $98K"?On Nov 30th 2025 I suggested that Btc had bottomed at 80K & would bounce up to $98-99K and get rejected.

Target hit as anticipated and now Btc is now heading down to swipe the 80K lows as it always does after a long term WT has be hit.

Congrats to all that followed and caught the 22% pump (and was able to get out at 98K).

May the trends be with you.

BITCOIN IS BULLISH!!!!! (but watch out for this) Yello Paradisers! Enjoy the video!

And Paradisers! Keep in mind to trade only with a proper professional trading strategy. Wait for confirmations. Play with tactics. This is the only way you can be long-term profitable.

Remember, don’t trade without confirmations. Wait for them before creating a trade. Be disciplined, patient, and emotionally controlled. Only trade the highest probability setups with the greatest risk to reward ratio. This will ensure that you become a long-term profitable professional trader.

Don't be a gambler. Don't try to get rich quick. Make sure that your trading is professionally based on proper strategies and trade tactics.

XAUUSD – Buy Zone ReactionContext: Strong bullish move → distribution → sharp selloff.

Current structure: Price dumped into a prior demand / liquidity area (your buy zone).

Reaction: Clear bullish response from the zone (long lower wick + impulse candle).

Plan:

Buy zone: Prior demand / sweep of lows

Target: Previous support-turned-resistance (that blue box above)

Why the idea makes sense

✅ Liquidity sweep below recent lows before the bounce

✅ HTF bullish bias still intact despite the pullback

✅ Discount entry relative to the prior range

✅ Target aligns with a retest of broken structure

This is a classic pullback → mitigation → continuation setup. Clean and logical.

What to watch out for (important)

⚠️ If price closes strongly below the buy zone, idea is invalid

⚠️ That target zone is likely to be reaction-heavy (partial profits make sense)

⚠️ Best confirmation would be:

Lower-timeframe BOS

Bullish engulfing / strong displacement candle

Volume expansion on the bounce

How I’d manage it

Entry: Inside buy zone only after confirmation

Stop: Below the liquidity sweep low

TP1: Mid-range / first resistance

TP2: Your marked target zone

BTCUSD – Bearish Pullback from Channel Resistance (1HKey Levels on Your Chart

Resistance Zone: 82,900 – 83,500

Price already reacted here

This zone aligns with channel resistance + previous structure

Stop Loss: ~83,600

Above resistance → invalidates the bearish setup

Target Zone: 79,400 – 79,300

Strong demand / liquidity area

Near previous lows

📊 Trade Bias

Primary Bias: BEARISH (Sell on rejection)

Sell Idea:

Entry: From resistance zone (82.9k–83.5k) after bearish confirmation

SL: Above 83.6k

TP: 79.4k / 79.3k

Risk–Reward: Very clean & favorable ✅

🧠 What to Watch Before Entry

Bearish candle confirmation (engulfing / rejection wick)

Weak volume on bullish candles

No strong bullish breakout above 83.6k

⚠️ Invalidation

A strong close above the channel + 83.6k

This would shift bias to short-term bullish / range behavior

📌 Summary

Trend: Bearish

Setup: Pullback sell

Structure: Descending channel

Execution: Wait for confirmation, don’t rush

If you want, I can:

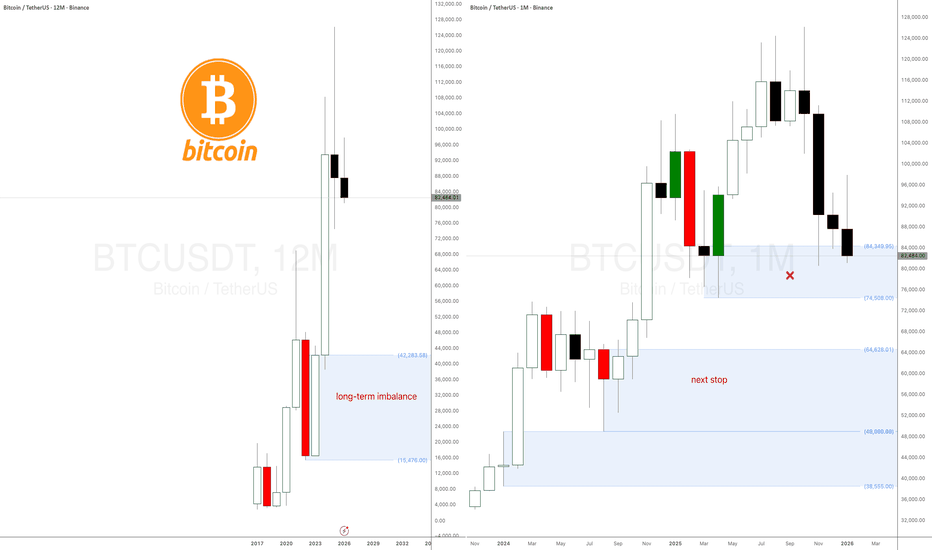

BitCoin long-term forecast 2026 dropping to $45k?Bitcoin monthly demand level is under attack. New low printed.

The yearly timeframe is trending up and the dump has started, hopefully. CRYPTOCAP:BTC can continue the dump as explained a few weeks ago.

Next stop is the monthly demand imbalance at $64k. No longs are adviced in the middle or a long-term dump.

EURUSD 1H – Demand Zone Rejection Setup EURUSD previously moved in a strong bullish channel, indicating healthy upward momentum. After reaching the channel high, price faced selling pressure and transitioned into a consolidation phase.

The marked demand zone is acting as a key resistance-turned-supply area. Price is currently reacting below this zone, forming a lower high structure, which suggests potential bearish continuation.

A rejection from the demand zone combined with the current structure opens the door for a pullback toward the lower support / target zone, highlighted on the chart.

Key Levels

Demand Zone: Upper red zone (sell pressure area)

Entry Area: Rejection below demand

Target: Lower red support zone

Trade Bias

Bias: Bearish below demand zone

Invalidation: Strong breakout and close above demand

The BTC "Fakeout" Play: My Exact Plan for $94,000The plan remains exactly as discussed. We need to see price reclaim support to confirm a 'fakeout' of the recent lows, which would open the door for an upward continuation toward $94,000 – $95,000.

⚠️ The Bear Case: However, if we see strong red candles on the daily close over the next few days, it’s a warning sign. This potential weakness could drive price further down toward the lower support zones at $84,800 – $83,500.

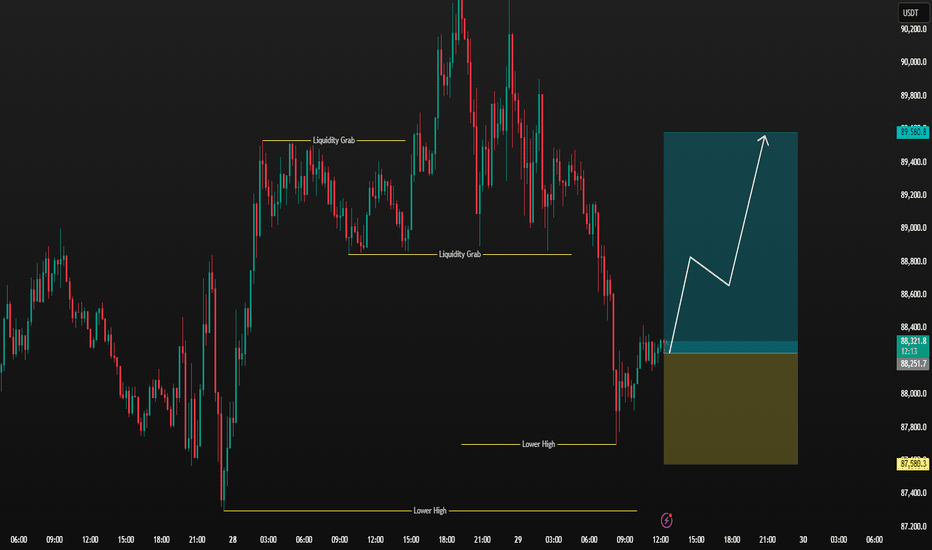

BTC/USDT 4H — Liquidity Sweep at Support Followed by Bullish RetMarket Structure

Overall structure:

Price was in a descending / consolidation phase, then formed an ascending channel (bullish corrective structure).

You marked a BOS (Break of Structure) earlier → confirms prior bearish pressure.

The move down into the support zone was followed by a fake breakout (liquidity sweep), which is typically bullish.

👉 This suggests smart money accumulation below support before moving price up.

2. Support Zone & Fake Breakout

Support zone: ~87,400 – 87,000

Price dipped below prior lows, triggering stop-losses (fake breakout), then reclaimed the zone.

This is a classic liquidity grab, often followed by a strong impulse move.

✅ This strengthens the bullish bias as long as price holds above the support zone.

3. Current Pullback

After reaching the target point (~90,500 – 90,600), price rejected and pulled back.

The pullback is healthy and aligns with:

Previous structure

Channel support

Demand zone

🔍 This looks like a retest, not a trend reversal (yet).

4. Trade Idea Shown on Chart

📈 Long Setup Logic

Entry zone: ~87,400

Stop loss: ~86,050

Target: ~90,500 – 90,600

📊 Risk–Reward:

Roughly 1:2.5 to 1:3, which is very solid.

5. Bullish Scenario (Preferred)

Price holds above 87,000

Forms a bullish 4H confirmation (engulfing / strong close)

Continuation toward:

89,500 (minor resistance)

90,500+ (major liquidity & resistance)

6. Bearish Invalidation

🚨 The setup fails if:

4H candle closes below 86,000

Support zone is lost decisively

If that happens, next downside targets could be:

84,800

83,500 (higher timeframe demand)

7. Summary

✅ Fake breakout + reclaimed support = bullish signal

✅ Structure favors continuation upward

⚠️ Still a retest phase, confirmation matters

🎯 Target zone aligns with liquidity & resistance

BTCUSD Bullish Channel Continuation (30MBTCUSD – 30M Technical Analysis 📊

Here’s a clear read of the Bitcoin chart you shared:

🔹 Market Structure

Price is moving inside a rising channel, signaling a controlled bullish trend.

Recent pullback is corrective, not impulsive → structure still valid.

🔹 Key Levels

Primary Support Buy Zone: 87,500 – 87,150

Strong horizontal support + channel support confluence.

Major Lower Support: 86,200

Breakdown below this level would weaken bullish momentum.

Stop Loss: Below 87,150

🔹 Upside Targets

Main Target Zone: 90,500 – 90,700

This aligns wth the upper boundary of the ascending channel and projected bullish leg.

🔹 Trade Perspective

✅ Buy confirmations near the support zone

📈 Expect continuation toward channel resistance if price holds above support

❌ Bearish only if price closes decisively below support and channel

🔹 Bias

Bullish while price holds above 87,150

Current move looks like a pullback before continuation, not trend reversal.

BTCUSD | Trying to predict the unpredictableHello traders,

USD index is weakening. Metals, stocks and basically anything USD related is skyrocketing. And there we have BTC dumping over and over.

BTC is currently in a very unpredictable price action as it forms an internal uptrend and a dump all of a sudden like what happened yesterday

The reason is? Buy side liquidity sweep

Now, I'm expecting BTC to continue lower to target around 86,200 to 86,800

From this range, we could potentially form an inverse H&S that could reverse the trend to short-term bullish

If that fails, price will drop to target 84,000 zone

Action plan? For now, nothing. I'll monitor how the indicated level ($86,000) reacts to price first

Good Luck!

Bitcoin Loves Bulls Right Now… Until This HappensYello Paradisers! Enjoy the video!

And Paradisers! Keep in mind to trade only with a proper professional trading strategy. Wait for confirmations. Play with tactics. This is the only way you can be long-term profitable.

Remember, don’t trade without confirmations. Wait for them before creating a trade. Be disciplined, patient, and emotionally controlled. Only trade the highest probability setups with the greatest risk to reward ratio. This will ensure that you become a long-term profitable professional trader.

Don't be a gambler. Don't try to get rich quick. Make sure that your trading is professionally based on proper strategies and trade tactics.

BITCOIN IS ABOUT TO PENETRATE BEARS!!!!!? (hard)Yello Paradisers! Enjoy the video!

And Paradisers! Keep in mind to trade only with a proper professional trading strategy. Wait for confirmations. Play with tactics. This is the only way you can be long-term profitable.

Remember, don’t trade without confirmations. Wait for them before creating a trade. Be disciplined, patient, and emotionally controlled. Only trade the highest probability setups with the greatest risk to reward ratio. This will ensure that you become a long-term profitable professional trader.

Don't be a gambler. Don't try to get rich quick. Make sure that your trading is professionally based on proper strategies and trade tactics.

BITCOIN - time to buy BTCUSD nowBITCOIN (BTC/USD) has recently been stuck inside a triangle channel pattern and has struggled to break out for a few weeks. However, the price has recently broken a strong resistance level (the white trend line shown on the chart) - The price is currently above the trend line which acted as a strong resistance level and is now very likely to hit the next resistance zone which is labeled as the take profit level. Buy BTCUSD now!

BTC Bitcoin MONSTER Trade in Play | Planning Our Next MoveIn this video, we continue managing our BTC Bitcoin MONSTER trade 🥇💪. We break down our strategy and how this can be a lifge changing opportunity.. now planning our next move. Price is printing clear higher highs and higher lows on the 30-minute chart ⏱️📊, and we’re looking to capitalize on the next swing high and retracement.

BTC-USD: Back to Basics | Structure, Levels & Market ControlIn this analysis, I break down COINBASE:BTCUSD using pure price action — no indicators, no hype.

This is a back-to-basics breakdown focused on:

Market structure

Key support and resistance levels

Breaks, fakeouts, and acceptance

Who is in control of price right now

The goal isn’t prediction - it’s clarity .

If you want to understand how price actually moves and how to read Bitcoin without overcomplicating your chart, this analysis is for you.

📌 This is analysis, not financial advice. Trade responsibly.