BTC-USD: Back to Basics | Structure, Levels & Market ControlIn this analysis, I break down COINBASE:BTCUSD using pure price action — no indicators, no hype.

This is a back-to-basics breakdown focused on:

Market structure

Key support and resistance levels

Breaks, fakeouts, and acceptance

Who is in control of price right now

The goal isn’t prediction - it’s clarity .

If you want to understand how price actually moves and how to read Bitcoin without overcomplicating your chart, this analysis is for you.

📌 This is analysis, not financial advice. Trade responsibly.

Btcupdate

BTC/USDT — Bearish Continuation After Pennant Breakdown✔️ The week closed with a bearish candle below previous closes.

Combined with last week’s structure, this confirms a bearish setup.

🟢 Hidden QE continues.

🟢 The longer conditions stay weak, the closer we get to relief — there are no stronger bullish arguments for now.

🟠 Fear has become the market’s baseline.

🟠 Gold at 5100 is historically overbought. A sharp correction looks likely — the only question is whether it becomes a trend reversal.

🔴 Significant ETF selling continues.

🔴 Negative cumulative delta: –$1.23B.

🔴 Geopolitical risk remains elevated. As the Greenland issue faded, escalation risks around Iran emerged. Markets are reacting lower.

🔴 Price broke down from a bearish pennant. The probability of sweeping lows below 80k has increased materially.

🧠 Markets can remain irrational longer than traders can remain solvent.

Equities currently look relatively rational.

Metals and commodities are reacting logically to geopolitics.

Crypto, however, absorbs all the irrationality — amplified.

A few more liquidation waves, and the reversal usually follows.

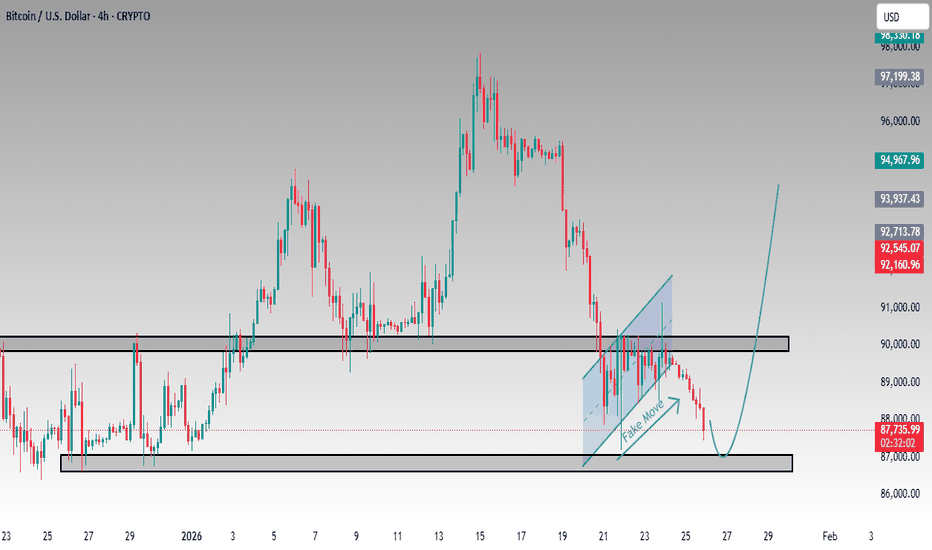

BTC/USD BUY SIGNAL – Support + Fake out Reversal Setup On the 4h Bitcoin chart, price has wicked down sharply into the major support zone around 87,000 – 87,866, forming what appears to be a classic fake move / liquidity grab below the channel bottom (blue shaded area + dashed trendline). This is often a bullish trap before reversal. Key Bullish Points: Strong horizontal support defended multiple times (gray box ~87k–91k)

Clear down-channel fake out / sweep of lows

Rejection candle + bounce already forming from the lows

Higher timeframe structure still bullish overall

Entry: Buy around current levels ~87,866 or on dips back to 87,000–87,500

Stop Loss: Below the wick low ~86,800–87,000 (tight risk)

Targets: TP1: 90,000 – 91,000 (channel top retest)

TP2: 92,500 – 93,000

TP3: 95,000+ (previous highs)

High-probability reversal setup if price closes back above the channel bottom. Watch volume and 4h candle close for confirmation. This is not financial advice. Crypto is highly volatile. Use proper risk management and trade at your own risk.

#Bitcoin #BTCUSD #BTC #BuyBitcoin #BitcoinDip #CryptoTrading #Fakeout #LiquidityGrab #BullishReversal #TradingSignal #Crypto #TechnicalAnalysis #Investor #TradeSmart #BitcoinBull

BTCUSD Market Structure Explained. Liquidity Above, Demand BelowHello traders,

I will keep this simple and structural because structure matters the most, right?

On the 6H timeframe, BTC is trading inside an ascending channel. As we see higher lows and consistent demand.

At the same time, price has been rejected multiple times from the channel upper trendline to sweep sell side liquidity.

This creates compression

As long as BTC holds this demand and maintains this bullish structure, this sets the stage for bullish continuation.

I previously stated multiple times that BTC could push toward the 100K+ region. This very chart could be the start of this move.

You should know that price reacts to structure, liquidity, and range expansion.

TL;DR: Overall bearish market 2026 | Short-term: Bullish relief rally

Good Luck!

If you find value in this content, a like supports more than anything🙏📊

Also, leave your comments and thoughts below.

#BTC Bitcoin - UP and then DUMP?Walked trough many analytics, and they have one in common plan, that we are going for correction to 74.000 for #BTC

Sentiment is very bearish across #Crypto and in my opinion we need to start an Uptrend towards $100.000 and only then probably could see correction.

What do You think about this kind of plan?

BTC Market AnalysisBitcoin has swept liquidity around the 87,436 support zone, indicating a potential stop-hunt and accumulation by smart money. Price reaction from this area suggests that buyers are still active and defending the zone.

As long as BTC holds above the 85,930 invalidation level, the bias remains bullish. A continuation move is expected from the same demand area, targeting higher liquidity pools.

Trade Plan

Buy Zone: Around 87,436 (post-support sweep)

Stop Loss: 85,930

Targets:

TP1: 89,930

TP2: 91,930

TP3: 93,930

If bullish momentum sustains and higher-timeframe structure remains intact, buyers’ extended target lies near 97,778, where major liquidity is resting.

⚠️ Follow proper risk management and wait for confirmation before entry

THE RALLY ISN’T OVER YET

My previous forecast is still valid, but it needs a small tactical adjustment. Locally, the structure still supports continuation to the upside.

Base case: more upside with price moving into the 96,000–100,000 area, where key technical magnets align:

a weekly imbalance retest,

a MA50-W + vWAP retest.

Key levels

The local bullish bias remains in place as long as price stays above:

VAH,

and the nearest support zone at 91,500–92,000.

Next support zone: 90,000–90,500.

Scenario logic

As long as 91,500–92,000 holds, the priority remains a push toward 96K–100K.

Losing 91,500–92,000 increases the odds of a deeper pullback into 90,000–90,500, where I’ll be watching for a reaction and demand confirmation.

Overall, my base expectation is that before the unemployment data release, BINANCE:BTCUSDT BITSTAMP:BTCUSD CME:BTC1! will likely move into consolidation, followed by trend continuation to the upside once the data is out and the market reacts.

BITCOIN BULLS ARE GETTING READY TO SMACK BEARS!!!!Yello Paradisers! Enjoy the video!

And Paradisers! Keep in mind to trade only with a proper professional trading strategy. Wait for confirmations. Play with tactics. This is the only way you can be long-term profitable.

Remember, don’t trade without confirmations. Wait for them before creating a trade. Be disciplined, patient, and emotionally controlled. Only trade the highest probability setups with the greatest risk to reward ratio. This will ensure that you become a long-term profitable professional trader.

Don't be a gambler. Don't try to get rich quick. Make sure that your trading is professionally based on proper strategies and trade tactics.

BTC Panic: Why This Flush Out Is a MONSTER Trade OpportunityWe are revisiting our BTC Bitcoin "Monster Trade" strategy following the recent volatility spikes triggered by Donald Trump’s tariff rhetoric at the World Economic Forum. While the market panicked, we saw a significant liquidity flush.

💰 The "Monster Trade" Strategy In this video, I break down exactly how we are capitalizing on any deep retrace and more importantly, this current pullback. We are executing a systematic position-building strategy.

The main thing with this is we MUST lock in 50% profit on existing positions before opening new ones. This allows us to ride the entire trend while banking realized gains along the journey.

Because we have already banked profits, this deep retracement isn't a threat or a risk.

🚀 The Macro View Looking at the Higher Time Frame (HTF), the technicals suggest the corrective trend is exhausting and potentially reversing. This structural shift indicates we are staring at a potentially once-in-a-lifetime opportunity to load the boat before the next parabolic Bitcoin rally.

Watch now to see the exact price levels I'm watching! 👇

BITCOIN (BTC/USD) LONG SIGNAL – Breakout Watch! On the 4H chart: BTC is testing a major resistance zone around 89,928 (key horizontal level with multiple touches + recent bounce rejection). Entry Trigger: Decisive breakout & close above 89,928 (preferably with strong volume/green candle)

→ Enter LONG position

Targets: T1: 92,160 – 92,545 (previous swing highs)

T2: 93,937 – 94,967 (next resistance cluster)

Stretch: 97,000+ if momentum continues

Stop Loss: Below 89,000 – 88,800 (to invalidate the breakout) Bullish structure forming with higher lows and potential for new leg up if we clear this level cleanly. #Bitcoin #BTCUSD #BitcoinBreakout #CryptoTrading #LongBTC #Crypto Not financial advice – This is for educational purposes only. Crypto markets are extremely volatile. Always do your own research, use proper risk management, and never risk more than you can afford to lose. #Investing #CryptoInvesting #BitcoinInvestor #WealthBuilding #HODL #AltcoinSeason

BTC Order Block Bounce SetupAfter strong bullish momentum toward 98K , BTC tested a strong buy-side order block and bounced firmly from this region with a strong bullish candle. A buy can be considered at the current price, with a stop loss below the demand zone and take profit targets toward the sell-side order blocks.

BTC 4H CHART ROUTE MAPDear Traders,

BTC has shown strong gains this week and has confirmed a short-term bullish trend across multiple confluences.

Wait for the price to pull back to the entry zone around IFVG & BPR area close to $89K–$91K before looking for TP1, TP2, and TP3, with your stop-loss set at $83,500.

Always trade with proper risk and money management.

The Quantum Trading Mastery

BITCOIN BULLS GETTING READY!!!! SHORT SQUEEZE INCOMING? Yello Paradisers! Enjoy the video!

And Paradisers! Keep in mind to trade only with a proper professional trading strategy. Wait for confirmations. Play with tactics. This is the only way you can be long-term profitable.

Remember, don’t trade without confirmations. Wait for them before creating a trade. Be disciplined, patient, and emotionally controlled. Only trade the highest probability setups with the greatest risk to reward ratio. This will ensure that you become a long-term profitable professional trader.

Don't be a gambler. Don't try to get rich quick. Make sure that your trading is professionally based on proper strategies and trade tactics.

“Bitcoin 4H – Market Structure Shift and High-Probability Reacti1. Market Structure Overview

Higher-timeframe context:

BTC previously made a bullish BOS (break of structure) from the left, driving price aggressively into the 97k supply area.

At the top:

Price formed a distribution range (yellow box) with:

Multiple rejections at highs

Bearish CHoCH / PCHSE → early signal of trend weakness

This confirms a local trend reversal from bullish → bearish.

2. Breakdown & Momentum Shift

The sharp red move is a decisive bearish displacement, not a pullback.

Key signs:

Clean break below range low

No immediate bullish reaction

Bearish candles with follow-through

This validates the bearish BOS and shifts short-term control to sellers.

3. Liquidity & Support Zone (Yellow Area)

The support zone ~90,000–88,800 is critical:

Prior demand

Equal lows / resting liquidity

Previous bullish CHoCH area

Price is currently sweeping liquidity into this zone, which is healthy for a bounce if buyers defend it.

4. Target & Retracement Logic

Current idea illustrated on chart:

Down → Sweep liquidity → Retrace

Expected reaction:

Bounce from 88.8k–90k

Retracement toward 93.3k–94k (target point marked)

That target aligns with:

Prior support → resistance flip

4H imbalance / inefficiency

Logical bearish mitigation zone

5. Bullish vs Bearish Scenarios

🔵 Bullish Reaction (Counter-trend)

Valid only if:

Strong reaction from 88.8k–90k

Bullish displacement + CHoCH on lower TF (15m–1H)

Target: 93k–94.6k

This would be a relief rally, not trend reversal.

🔴 Bearish Continuation (Higher Probability)

If:

Support fails cleanly

No impulsive bullish response

Then next downside liquidity sits around:

87.5k

Possibly 85k if panic expands

6. Key Levels to Watch

Level

Significance

97k

Major HTF supply

94.6k–93.3k

Retracement / short entry zone

90k–88.8k

Critical demand & liquidity

87.5k

Next downside magnet

7. Bias Summary

HTF bias: Bearish

Current phase: Liquidity sweep into demand

Best trade ideas:

Short on retracement into 93–94k

Cautious long scalp only if structure flips at suppor1. Market Structure Overview

Higher-timeframe context:

BTC previously made a bullish BOS (break of structure) from the left, driving price aggressively into the 97k supply area.

At the top:

Price formed a distribution range (yellow box) with:

Multiple rejections at highs

Bearish CHoCH / PCHSE → early signal of trend weakness

This confirms a local trend reversal from bullish → bearish.

2. Breakdown & Momentum Shift

The sharp red move is a decisive bearish displacement, not a pullback.

Key signs:

Clean break below range low

No immediate bullish reaction

Bearish candles with follow-through

This validates the bearish BOS and shifts short-term control to sellers.

3. Liquidity & Support Zone (Yellow Area)

The support zone ~90,000–88,800 is critical:

Prior demand

Equal lows / resting liquidity

Previous bullish CHoCH area

Price is currently sweeping liquidity into this zone, which is healthy for a bounce if buyers defend it.

4. Target & Retracement Logic

Current idea illustrated on chart:

Down → Sweep liquidity → Retrace

Expected reaction:

Bounce from 88.8k–90k

Retracement toward 93.3k–94k (target point marked)

That target aligns with:

Prior support → resistance flip

4H imbalance / inefficiency

Logical bearish mitigation zone

5. Bullish vs Bearish Scenarios

🔵 Bullish Reaction (Counter-trend)

Valid only if:

Strong reaction from 88.8k–90k

Bullish displacement + CHoCH on lower TF (15m–1H)

Target: 93k–94.6k

This would be a relief rally, not trend reversal.

🔴 Bearish Continuation (Higher Probability)

If:

Support fails cleanly

No impulsive bullish response

Then next downside liquidity sits around:

87.5k

Possibly 85k if panic expands

6. Key Levels to Watch

Level

Significance

97k

Major HTF supply

94.6k–93.3k

Retracement / short entry zone

90k–88.8k

Critical demand & liquidity

87.5k

Next downside magnet

7. Bias Summary

HTF bias: Bearish

Current phase: Liquidity sweep into demand

Best trade ideas:

Short on retracement into 93–94k

Cautious long scalp only if structure flips at suppor1. Market Structure Overview

Higher-timeframe context:

BTC previously made a bullish BOS (break of structure) from the left, driving price aggressively into the 97k supply area.

At the top:

Price formed a distribution range (yellow box) with:

Multiple rejections at highs

Bearish CHoCH / PCHSE → early signal of trend weakness

This confirms a local trend reversal from bullish → bearish.

2. Breakdown & Momentum Shift

The sharp red move is a decisive bearish displacement, not a pullback.

Key signs:

Clean break below range low

No immediate bullish reaction

Bearish candles with follow-through

This validates the bearish BOS and shifts short-term control to sellers.

3. Liquidity & Support Zone (Yellow Area)

The support zone ~90,000–88,800 is critical:

Prior demand

Equal lows / resting liquidity

Previous bullish CHoCH area

Price is currently sweeping liquidity into this zone, which is healthy for a bounce if buyers defend it.

4. Target & Retracement Logic

Current idea illustrated on chart:

Down → Sweep liquidity → Retrace

Expected reaction:

Bounce from 88.8k–90k

Retracement toward 93.3k–94k (target point marked)

That target aligns with:

Prior support → resistance flip

4H imbalance / inefficiency

Logical bearish mitigation zone

5. Bullish vs Bearish Scenarios

🔵 Bullish Reaction (Counter-trend)

Valid only if:

Strong reaction from 88.8k–90k

Bullish displacement + CHoCH on lower TF (15m–1H)

Target: 93k–94.6k

This would be a relief rally, not trend reversal.

🔴 Bearish Continuation (Higher Probability)

If:

Support fails cleanly

No impulsive bullish response

Then next downside liquidity sits around:

87.5k

Possibly 85k if panic expands

6. Key Levels to Watch

Level

Significance

97k

Major HTF supply

94.6k–93.3k

Retracement / short entry zone

90k–88.8k

Critical demand & liquidity

87.5k

Next downside magnet

7. Bias Summary

HTF bias: Bearish

Current phase: Liquidity sweep into demand

Best trade ideas:

Short on retracement into 93–94k

Cautious long scalp only if structure flips at suppor