Bitcoin (BTC/USD): Inverse Head & Shoulders Breakout SetupHi!

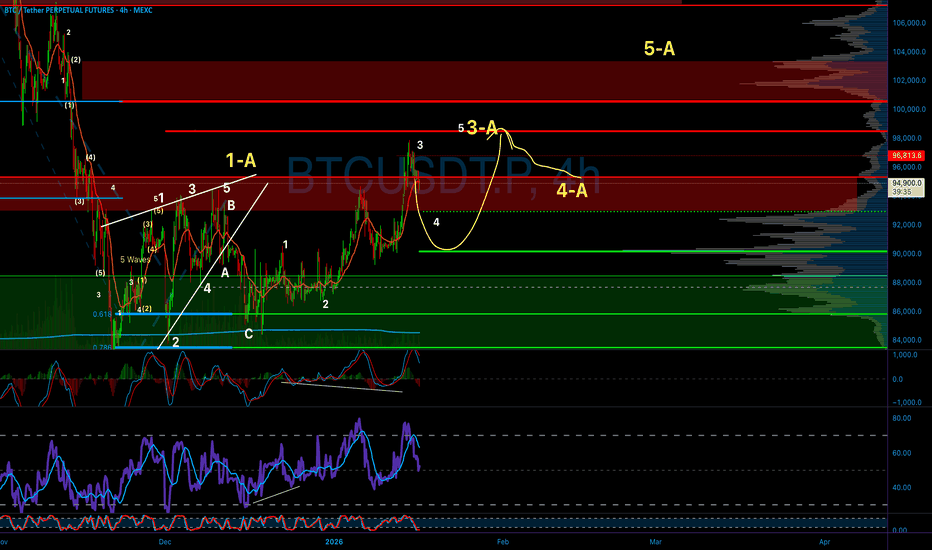

The chart shows a clear shift in structure after a prolonged downtrend. Price broke the descending trendline that had capped Bitcoin for months, signaling weakening bearish control. Following that break, an inverse head and shoulders pattern formed, with a left shoulder, head, and right shoulder resting on an ascending trendline.

The zone around 100k–102k stands out as the key resistance and measured target of the pattern. Current price action shows higher lows and improving momentum, suggesting buyers are in control as long as price holds above the rising support near the right shoulder.

If Bitcoin maintains this structure and confirms strength above the neckline, a move toward the 102k target is technically justified. However, failure to hold the ascending trendline would weaken the bullish thesis and could trigger another range or pullback.

Overall, the bias remains cautiously bullish, with confirmation dependent on a clean continuation toward the neckline resistance.

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

Btcupdate

BITCOIN MONDAY ANALYSIS (the next move is incoming) Yello Paradisers! Enjoy the video!

And Paradisers! Keep in mind to trade only with a proper professional trading strategy. Wait for confirmations. Play with tactics. This is the only way you can be long-term profitable.

Remember, don’t trade without confirmations. Wait for them before creating a trade. Be disciplined, patient, and emotionally controlled. Only trade the highest probability setups with the greatest risk to reward ratio. This will ensure that you become a long-term profitable professional trader.

Don't be a gambler. Don't try to get rich quick. Make sure that your trading is professionally based on proper strategies and trade tactics.

BTC/USDT — Bearish Pennant Risk Despite Supportive Macro✔️ The week closed up by ~$3k, but with a long upper wick.

A sustained hold below 91k would confirm a bearish setup.

🟢 Powell is confirmed to be stepping down.

🟢 Hidden QE continues.

🟢 Record inflows into crypto ETFs once again.

🟢 Positive cumulative delta (+$509M) — the first positive reading in 7 weeks.

🟠 Sentiment has shifted back to fear.

🟠 Gold is historically overbought. A correction looks inevitable, and liquidity may rotate into crypto.

🔴 Geopolitical risks are rising. Trump is pushing for Greenland and introducing tariffs against countries that resist. The EU is preparing retaliatory tariffs against the US.

🔴 Price briefly broke out of the triangle but quickly moved back inside .

There are increasing reasons to treat this structure as a bearish pennant.

🧠 From a macro perspective, conditions still look constructive — markets should be moving higher.

However, Trump continues to inject volatility.

This has been a recurring strategy: maximize instability first, then attempt to flip the situation in his favor.

Historically, the next step tends to be harsher — followed by easing.

Market reactions need close monitoring.

The trend is deteriorating.

Selena | BTCUSD · 2H – Bullish Channel Near Premium ResistanceBINANCE:BTCUSD BITSTAMP:BTCUSD

The market delivered a strong impulsive rally from channel support, followed by minor consolidation. Current price is trading at premium levels, meaning upside continuation requires acceptance above resistance. Failure to hold above the breakout zone may result in a corrective pullback toward channel equilibrium.

Key Scenarios

✅ Bullish Case 🚀

Sustained acceptance above 97,400 – 97,900:

🎯 Target 1: 99,000

🎯 Target 2: 99,400 – 99,500 (upper supply & liquidity)

❌ Bearish Case 📉

Rejection from the resistance zone and breakdown below 95,800 may trigger a deeper correction toward:

🎯 93,800 – 92,500

🎯 Extended support near 90,300 (channel base)

Current Levels to Watch

Resistance 🔴: 97,900 – 99,400

Support 🟢: 95,800 – 93,800 – 90,300

⚠️ Disclaimer: This analysis is for educational purposes only. It is not financial advice.

BTCUSD 1H – Compression at Key Support with Liquidity Targets AbMarket Structure

Strong bullish BOS from ~94k → ~97.8k (impulse leg).

After the impulse, price failed to hold premium and formed a lower high.

Current structure is corrective / ranging, not trending.

👉 Bias is neutral–bearish short term, bullish only if support holds.

2. Key Levels

🔴 Resistance / Supply

97,500 – 97,900 (Target Point)

Prior high

Unfilled upper FVG

Liquidity resting above highs

This zone is valid only after bullish confirmation.

🟡 Support Level (Decision Zone)

94,800 – 95,100

Multiple reactions + consolidation

Acts as:

Range low

0.705–0.618 fib retracement area

Demand zone

Price is compressing into this support, signaling an upcoming expansion.

🔻 Downside Liquidity / FVG

93,700 – 94,000

Clear imbalance below support

Logical target if support breaks

3. Fair Value Gaps (FVG)

Bitcoin Breaks $95K Resistance - Bulls Target $100K+ RallyBITCOIN (BTC/USD) | Multi-Timeframe Analysis | Breakout Above $95K - Bulls Regain Control

Current Price: $95,214 | Date: January 17, 2026

🚀 BULLISH BREAKOUT: BTC SURGES PAST KEY RESISTANCE

💥 BTC breaks and holds above $95K - first sustained break of key resistance since early January

📈 Touched $97,838 high (Jan 14) - highest level since December 11, 2025

🔥 Strong rally from $91K lows - gaining +4.6% in recent sessions

✅ Key resistance at $93.5K-$95K zone now flipped to support - critical technical development

📈 MULTI-TIMEFRAME CONTEXT

📅 Weekly Chart: Breaking out of $88K-$94K consolidation box that lasted 4+ weeks

📅 Daily Chart: Clear bullish momentum emerging, higher lows forming

✅ Weekly $80K support remains strong foundation - never threatened during consolidation

🎯 Now testing $95K-$100K resistance zone - critical decision area for next major move

🎯 KEY TECHNICAL LEVELS - WEEKLY PERSPECTIVE

Major Weekly Resistance:

$118,000-$126,000 - All-time high zone, ultimate bull target

$106,000-$108,000 - Green scenario target, major resistance cluster

$100,000-$102,000 - Psychological milestone, high options interest at $100K strike

Major Weekly Support:

$92,000-$94,000 - Recent breakout zone, now first support

$88,000-$90,000 - Yellow scenario support, strong accumulation zone

$80,000 - CRITICAL WEEKLY SUPPORT - Tested 3x in Q4 2025, rock-solid base

$76,000-$78,000 - Secondary weekly support, extreme bear scenario only

🎯 KEY TECHNICAL LEVELS - DAILY PERSPECTIVE

Daily Resistance Zones:

$96,000-$98,000 - Immediate resistance, recent high at $97,838

$100,000-$102,000 - Major psychological level, Green scenario initial target

$106,000-$108,000 - Extended target if momentum sustains

Daily Support Zones:

$93,500-$95,000 - Now support after breakout, critical to hold

$91,000-$92,000 - Secondary support, recent consolidation base

$88,000-$90,000 - Strong support zone, Yellow scenario range bottom

📈 THREE SCENARIO ANALYSIS

🟢 SCENARIO 1: BULLISH CONTINUATION (Green Arrow)

Probability: 50-55% - FAVORED by current breakout momentum

Path: Hold $95K → Break $98K → Rally to $100-102K → Extended target $106-108K

Catalysts: Continued institutional inflows, favorable macro data, $100K options magnet effect

Confirmation: Daily closes above $96K with volume, sustained momentum above $98K

Timeframe: 2-3 weeks to $100K if momentum maintains

🟡 SCENARIO 2: CONSOLIDATION (Yellow Arrow)

Probability: 30-35% - If resistance at $98K proves too strong

Path: Chop between $92K-$100K for extended period, building base for next leg

Pattern: Higher low formation, healthy digestion of gains before next push

Confirmation: Multiple tests of $95K-$98K resistance without breakthrough

Timeframe: 3-4 weeks of consolidation before next decisive move

🔴 SCENARIO 3: FAILED BREAKOUT (Red Arrow)

Probability: 15-20% - Lower probability given current strength

Path: Reject at $98K → Break $93K → Retest $88-90K zone

Risks: Macro shock, large profit-taking, loss of $93.5K breakout support

Confirmation: Daily close below $93K with volume

Warning: Would invalidate bullish setup and signal deeper correction needed

🌐 MARKET CONTEXT & CATALYSTS

📊 Recent rally driven by favorable CPI data - inflation cooling supports risk assets

🏦 Institutional inflows returning - ETFs seeing renewed interest after Q4 2025 outflows

💼 Analysts targeting $100K - Tom Lee maintains year-end ATH forecast

📈 Technical breakout confirmed - (neutral/slight bullish), room to run higher

🎯 $100K options positioning - Significant open interest acts as price magnet

⚡ Volatility compressed for weeks - Squeeze releasing with upward bias

🔮 Forecast consensus: $96K-$102K range for late January, $105K possible by February

💰 Volume increasing - $13B+ daily trading volume shows strong participation

🌍 Haven asset demand - Geopolitical uncertainty driving Bitcoin adoption as digital gold

💡 TECHNICAL OUTLOOK

🎯 Short-term bias: BULLISH - Clean breakout above multi-week resistance

✅ Key achievement: Breaking $95K resistance after multiple rejections = strong bullish signal

🚧 Critical test: Must hold $93.5K-$95K as support to validate breakout

🟢 Bull case (50-55%): Momentum continues → $98K breaks → $100-108K targets realistic

⚖️ Base case (30-35%): Consolidate $92-100K range, build energy for $100K+ breakout

🔴 Bear case (15-20%): Fake breakout, rejection at $98K → Retest $88-90K support

⏰ Next 48-72 hours critical: Need to establish $95K as support with daily closes above it

📊 Volume analysis: Strong breakout volume present, need sustained 25B+ daily to confirm

🎯 Risk/Reward: Favorable - $5K downside to $90K support vs $10K+ upside to $106K+

💎 Multi-timeframe alignment: Weekly bullish, Daily bullish, momentum confirming uptrend

📈 Key level to watch: $98K resistance - breaking this opens path to $100K+ targets

🔮 Catalyst calendar: Continued favorable macro data, month-end positioning could add fuel

------------------------------------------------------------------------------------------------------------------

⚠️ DISCLAIMER

This is technical analysis for educational purposes only. Not financial advice. Always do your own research and manage risk appropriately.

#BTC/USD Weekly Update Rally to $106k but still Scary!!BTC Weekly:— sharing an honest view, and I’m open to being wrong unless proven otherwise.

There could be another move toward $100k–$106k, but the structure suggests it may turn into a trap.

Given the current conditions, focusing on scalping high-volume coins with clear invalidation levels, tight stop losses, and modest targets seems more prudent.

Holding positions for the long term doesn’t appear optimal in this kind of market.

Still, always do your own research, NFA!

Thank you

#PEACE

BITCOIN CAN FAKE THIS OUT NOW!!!!!!!(be careful)Yello Paradisers! Enjoy the video!

And Paradisers! Keep in mind to trade only with a proper professional trading strategy. Wait for confirmations. Play with tactics. This is the only way you can be long-term profitable.

Remember, don’t trade without confirmations. Wait for them before creating a trade. Be disciplined, patient, and emotionally controlled. Only trade the highest probability setups with the greatest risk to reward ratio. This will ensure that you become a long-term profitable professional trader.

Don't be a gambler. Don't try to get rich quick. Make sure that your trading is professionally based on proper strategies and trade tactics.

Building a Bitcoin MONSTER Trade | Here's My Trade Plan We’re continuing our BTC Bitcoin Monster Trade 🚀📈, building on existing positions and getting ready for Bitcoin’s next potential move 🔍💰.

In this video, we break down the Monster Trade strategy, exploring its benefits and how it could be a life-changing opportunity when you catch a higher time frame trend reversal with an extended target 🧠⚡.

We cover price action, market structure, and the multiple trade strategy, plus risk management techniques and the rules of engagement for opening your next position 🛡️📊.

Not financial advice.

Elite | BTCUSD · 4H – Distribution → Bearish Expansion RiskBITSTAMP:BTCUSD

Bitcoin has retraced into a critical resistance band following a prolonged consolidation phase. The current price action shows hesitation and rejection wicks near the supply zone, indicating weakening bullish strength. Unless price accepts and sustains above this area, the structure favors a rejection and expansion toward lower liquidity zones.

Key Scenarios

✅ Bullish Case → A strong 4H close and acceptance above 96,500 would invalidate the bearish setup and open the path toward higher continuation levels.

🎯 Upside Targets: 100,000 → 104,000

❌ Bearish Case → Failure to hold above the 94,800 – 96,400 resistance zone with rejection confirms distribution and continuation to the downside.

🎯 Downside Targets: 92,000 → 88,500 → 82,100

Current Levels to Watch

Resistance 🔴: 94,800 – 96,400

Support 🟢: 92,000 → 88,500 → 82,100

⚠️ Disclaimer: This analysis is for educational and informational purposes only. It is not financial advice. Please conduct your own research before trading.

Selena | BTCUSD – 30M | Demand Holding Inside Ascending StructurBITSTAMP:BTCUSD BINANCE:BTCUSD

Market Overview

After rejecting from the upper channel resistance, BTC corrected toward the mid-range demand area. The current reaction suggests buyers are defending this zone, keeping the higher-timeframe bullish structure intact unless the demand fails decisively.

Key Scenarios

✅ Bullish Case 🚀

If price continues to hold above the demand zone and respects the ascending trendline:

🎯 Target 1: 92,000

🎯 Target 2: 94,000

🎯 Target 3: 95,200

❌ Bearish Case 📉

A clean breakdown and close below 88,500 would invalidate the bullish structure and expose deeper downside toward the lower range lows.

Current Levels to Watch

Resistance 🔴: 92,000 – 94,000 – 95,200

Support 🟢: 89,000 – 88,500

⚠️ Disclaimer: This analysis is for educational and informational purposes only. It is not financial advice. Please conduct your own research before trading.

BTC/USDT is at a decisive level.The price is trading around the 95.7k–98.4k resistance zone, which will likely determine the next major move.

Next scenarios:

If CRYPTOCAP:BTC breaks and holds above 98.5k on the daily close, continuation is likely toward 104.9k, followed by 115.2k. Momentum structure favours continuation if this level flips to support.

If BTC gets rejected from 98k–99k, expect a pullback toward 92k, with deeper support around 89k before any further upside attempt.

The market is transitioning from recovery to expansion. The next daily close will set the direction.

Invalidation: Break below $90.3k.

DYOR, NFA

Is Our Bitcoin Monster Trade Really Shaping Up? So Far So Good.In the last two videos, we’ve been tracking this potential monster trade 👀📈.

In this video, we take it to the next stage 🔍.

So far, everything is looking solid ✅ — we’re securing profits 💰, however the next level is a bit more delicate ⚠️ as price is now trading into a key resistance zone. A deeper pullback is definitely possible from here.

Either way, here’s a full breakdown of the charts and my current analysis 📊🧠.