Bitcoin – Stoic Equilibrium at the Threshold of Resistance.⊣

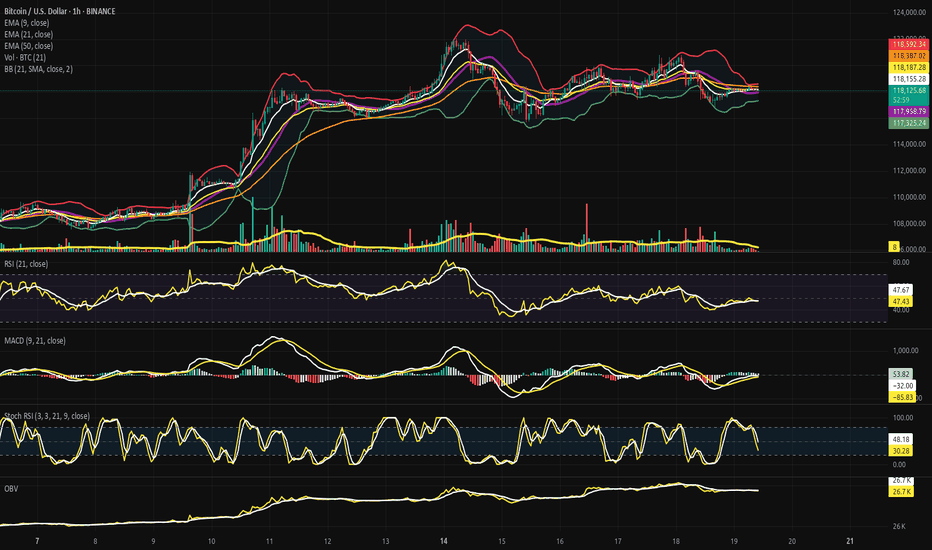

⟁ BTC/USD – BINANCE – (CHART: 1H) – (Sep 02, 2025).

◇ Analysis Price: $111,256.57.

⊣

⨀ I. Temporal Axis – Strategic Interval – (1H):

▦ EMA9 – (–2.78%):

∴ Price trading above EMA9 after recovery;

∴ Short-term bullish tilt, but EMA slope still negative;

∴ Needs sustained closes above to confirm momentum.

✴️ Conclusion: EMA9 = fragile bullish reclaim.

⊢

▦ EMA21 – (–3.06%):

∴ Mid-term intraday resistance;

∴ Price hovering above, but EMA slope negative;

∴ Confirms cautious recovery, not yet trend reversal.

✴️ Conclusion: EMA21 = tactical battleground.

⊢

▦ EMA50 – (–3.40%):

∴ Still trending lower;

∴ Acts as structural resistance in case of rejection;

∴ Price must conquer this line for sustainable recovery.

✴️ Conclusion: EMA50 = resistance wall.

⊢

▦ BB (21,2, basis = EMA9) – (Upper ~ –1.63% / Midline ~ –3.06% / Lower ~ –4.49%):

∴ Price touched upper band after expansion;

∴ Volatility rising, room for extension;

∴ Midline ($~109.7K zone) = key support.

✴️ Conclusion: Bands = bullish expansion but risky near top edge.

⊢

▦ RSI (21, 9) – (60.74 / 55.97):

∴ RSI above 60 = bullish momentum intraday;

∴ Far from overbought;

∴ Momentum supportive.

✴️ Conclusion: RSI confirms bullish bias.

⊢

▦ MACD (9,21,9) – (Line 330.85 / Signal 323.29 / Histogram –7.57):

∴ Slight bearish histogram despite positive lines;

∴ Indicates deceleration of bullish momentum;

∴ Potential for short-term pullback.

✴️ Conclusion: MACD = cautionary divergence.

⊢

▦ Stoch RSI (3,3,21,9) – (K 33.33 / D 21.85):

∴ Rebounding from oversold zone;

∴ Early bullish reset;

∴ Supports continuation if price holds EMA21.

✴️ Conclusion: Stoch RSI = tactical rebound in progress.

⊢

🜎 Strategic Insight – Technical Oracle:

∴ The intraday chart reveals BTC pressing into a critical transition zone, where price action is sustained above EMA9 and EMA21, yet still confronting the weight of EMA50. This structure embodies the conflict between short-term bullish recovery and the inertia of a broader corrective slope;

∴ Bollinger dynamics expose price testing the upper band (~$111.2K), signaling volatility expansion. A close above this band would shift the volatility regime into a breakout posture, yet rejection here would reaffirm the band as containment, pulling Bitcoin back toward the midline ($109.7K);

▦ Momentum oscillators diverge:

∴ RSI at 60.74 projects strength, comfortably above neutrality, implying the market has regained bullish control intraday;

∴ MACD, however, whispers caution: line > signal, yet histogram negative (–7.57). This subtle divergence hints that while price moves upward, the underlying strength of momentum is waning;

∴ Stoch RSI curled upward from oversold (K 33.33 / D 21.85), supporting the probability of a rebound continuation, but only if supported by volume;

∴ Bitcoin stands at the mouth of decision. Supportive global indices and a softer dollar open the door for bulls, but internal momentum signals warn that strength may be brittle unless confirmed with follow-through above EMA50 and sustained beyond ($111.2K).

✴️ Conclusion and Interpretation: The intraday oracle portrays Bitcoin caught between external tailwinds (equities, dollar weakness) and internal hesitation (MACD divergence at resistance). If the structure clears ($111.2K) with conviction, upside extends toward ($112 / $113K). Failure to break transforms ($109.7K) into the next gravitational pull.

⊣

⨀ II. Cross-Market Overlay (H1):

▦ S&P500 Futures (SPX) – (+1.69%):

∴ Strong upward performance, reflecting clear risk-on appetite in equities;

∴ Reinforces the idea that investors are rotating back into risk assets, easing pressure on Bitcoin;

∴ Correlation intraday favors Bitcoin following the equity impulse.

✴️ Conclusion: SPX surge = supportive external catalyst for crypto upside.

⊢

▦ Dow Jones Futures (DJI) – (+1.68%):

∴ Similar bullish posture to SPX, confirming broad equity strength;

∴ Dow’s advance adds structural confirmation: this is not sectorial, but systemic risk-on;

∴ Provides BTC with secondary reinforcement, as both indices align.

✴️ Conclusion: DJI rally = synchronized support, amplifying bullish context.

⊢

▦ US Dollar Index (DXY) – (–0.09%):

∴ Dollar weakening slightly = reduced headwinds for risk assets;

∴ Historically, Bitcoin rallies when DXY softens;

∴ Though the drop is modest, it’s directionally supportive.

✴️ Conclusion: DXY negative = marginal tailwind for Bitcoin’s rebound.

⊢

🜎 Interpretation – Cross-Market Oracle:

∴ With equities (SPX, DJI) rising in tandem and the dollar easing, the macro-intraday environment leans pro-risk;

∴ Bitcoin finds aligned external conditions: equities provide momentum correlation, while the dollar’s decline removes friction;

∴ The confluence strengthens the probability of Bitcoin challenging resistance zones ($111.2K+), provided internal momentum validates the move.

✴️ Conclusion: Cross-markets stand as aligned tailwinds for Bitcoin intraday, granting bulls external reinforcement.

⊣

𓂀 Stoic-Structural Interpretation – Intraday (BTC/USD + Cross-Market, H1):

∴ Structure of Price: Bitcoin advances above EMA9/21, reclaiming short-term control, yet EMA50 remains a slope of resistance; Bollinger bands widen, showing volatility release; Upper band ($111.2K) acts as the gateway: breach signals expansion, rejection returns price toward ($109.7K) equilibrium;

∴ Momentum of Will: RSI (>60) projects renewed strength, Stoch RSI lifts from oversold as tactical breath, yet MACD histogram whispers restraint - momentum falters even as price climbs. The will of the market is not pure force, but effort against inertia;

∴ Flow of Capital: Equities (SPX +1.69%, DJI +1.68%) roar in risk-on alignment, while DXY (–0.09%) softens, easing friction. External streams pour favorable winds upon Bitcoin’s sail, yet the vessel must hold its structure or drift back to harbor.

Fatum – Destiny of Intraday: The path is compressed between structure and external tide:

Break above $111.2K: opens the corridor to ($112 / $113K);

Failure and rejection: gravity returns to ($109.7K / $109.3K) support cluster.

✴️ Conclusion: Bitcoin intraday embodies the stoic lesson: external forces (equities up, dollar weak) favor advance, yet internal momentum is fragile. The outcome rests not in wish but in structure - resistance must yield for fate to shift.

⊢

· Cryptorvm Dominvs · MAGISTER ARCANVM · Vox Primordialis ·

· Dominivm Cardo Gyratio Omnivm · Silence precedes the next force. Structure is sacred ·

⊢

Btcusdbinance

Bitcoin – The Hinge of $108K: CME Gaps Define the Path.⊣

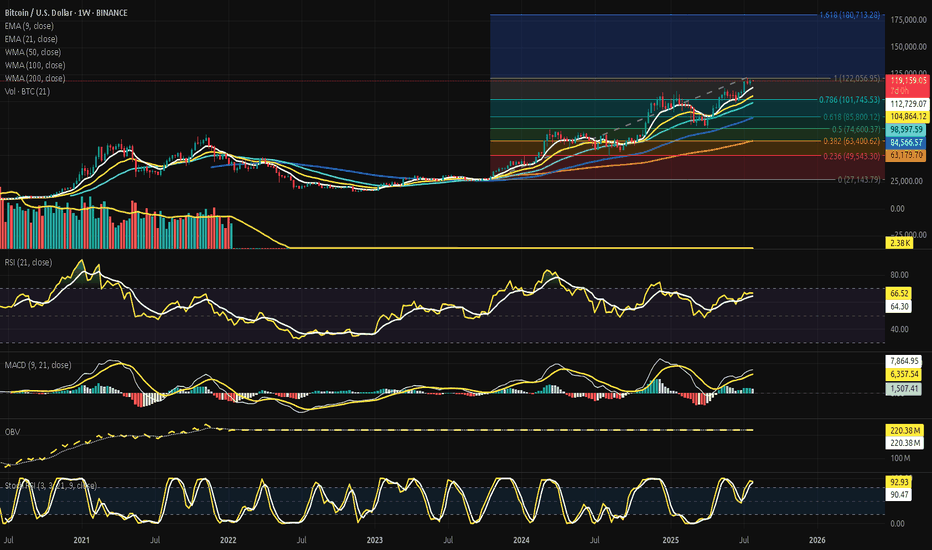

⟁ BTC/USD – BINANCE – (CHART: 1W) – (Sep 01, 2025).

◇ Analysis Price: $108,883.16.

⊣

⨀ I. Temporal Axis – Strategic Interval – (1W):

▦ EMA9 – $112,010.99:

∴ Price trades below EMA9, confirming weekly short-term weakness;

∴ Acts as dynamic resistance aligned with rejection candles;

∴ Bulls require a weekly close > EMA9 to regain strength.

✴️ Conclusion: EMA9 = first ceiling for recovery.

⊢

▦ EMA21 – $107,616.51:

∴ Price currently rests just above EMA21;

∴ EMA21 aligns with tactical support after EMA9 loss;

∴ Confluence with local structure reinforces as battle line.

✴️ Conclusion: EMA21 = current pivot, decisive for weekly trend.

⊢

▦ WMA50 – $102,456.32:

∴ Converges with Fib 0.786 ($103,061);

∴ Forms heavy support cluster;

∴ Break below exposes deeper retracement zones.

✴️ Conclusion: WMA50 + Fib 0.786 = structural shield.

⊢

▦ WMA100 – $88,496.32:

∴ Mid-term support level, far from spot;

∴ Safety net below Fib 0.618 ($86,834);

∴ Historical pivot in previous cycles.

✴️ Conclusion: WMA100 = mid-term structural base.

⊢

▦ WMA200 – $66,208.23:

∴ Ultimate macro support far below current action;

∴ Defines secular trend;

∴ Bears unlikely to reach without systemic capitulation.

✴️ Conclusion: WMA200 = macro foundation.

⊢

▦ RSI (21, close 9) – 56.57 / 60.59:

∴ RSI above 50 = positive bias, but descending from prior highs;

∴ Momentum weakening, approaching neutrality;

∴ No bullish divergence formed yet;

✴️ Conclusion: RSI fading, still positive but fragile.

⊢

▦ MACD (9,21,9) – Line: 4,394.48 / Signal: 5,963.54 / Histogram: –1,569.06:

∴ Bearish crossover confirmed;

∴ Histogram negative, momentum shifting bearish;

∴ Weekly timeframe signals mid-term risk.

✴️ Conclusion: MACD = bearish transition underway.

⊢

▦ OBV + EMA9 – OBV: 83.14K / EMA9: 80.26K:

∴ OBV above EMA9, reflecting prior accumulation;

∴ No expansion, flattening trajectory;

∴ Suggests distribution/neutral flows.

✴️ Conclusion: OBV steady but not supportive.

⊢

▦ Stoch RSI (3,3,21,9) – K: 1.09 / D: 21.48:

∴ In deep oversold (<20);

∴ Early cross attempt between K and D;

∴ Relief rally possible, not yet confirmed.

✴️ Conclusion: Oversold condition signals potential bounce.

⊢

▦ Fibonacci Retracement (0 = 27,143 -> 1 = 123,731):

0.786 -> $103,061 (≈ WMA50);

0.618 -> $86,834 (≈ WMA100);

0.500 -> $75,437;

0.382 -> $64,040;

0.236 -> $49,938.

✴️ Conclusion: $103k region = confluence fortress; loss exposes $86k.

⊢

🜎 Strategic Insight - Technical Oracle:

∴ The weekly structure is compressed between EMA9 ($112K) above and EMA21 ($107.6K) below, defining a narrow battlefield;

∴ Momentum tools diverge: RSI (56.6) still positive yet fading, while MACD confirms a bearish crossover, and Stoch RSI drifts in oversold territory;

∴ The confluence fortress at $103K (Fib 0.786 + WMA50) stands as the decisive defense; its loss would unlock the mid-cycle retracement path toward $86K (Fib 0.618 + WMA100);

∴ OBV above EMA9 indicates prior accumulation, but its flattening betrays absence of new inflows.

✴️ Conclusion: The weekly oracle confirms structural fragility: upside recovery demands a close >$112K, while downside destiny pulls toward ($103K if $107.6K) fails.

⊢

▦ CME Gap Analysis:

⌖

∴ CME daily chart highlights an open gap region in the ($112K -> $114K) zone - (from recent downside break);

∴ Historically, CME gaps tend to close with high probability, especially within 1–3 weeks;

∴ Current price ($109.4K) rests below this gap, leaving upside magnetism;

✴️ Conclusion: CME gap above acts as a gravitational pull; if price stabilizes >$108K, probability favors retrace into ($112 / $114K).

⊢

▦ Lower Gaps (Unresolved):

∴ Historical CME structure also leaves unfilled gap at ($103 / $104K) - (aligned with Fib 0.786 + WMA50 from weekly);

∴ This acts as downside magnet if $108K support fails;

∴ Market may oscillate between these dual magnets: ($103 / $104K) below, ($112 / $114K) above.

✴️ Conclusion: Dual CME gaps frame near-term battlefield; direction depends on structural defense of $108K.

⊢

𓂀 Stoic-Structural Interpretation – (BTC/USD + CME) - (Sep 01, 2025):

∴ Structure of Spot: Bitcoin clings to the Fib 0.382 ($108K), where the weekly EMA21 ($107.6K) marks the hinge of destiny. Above, the barrier of EMA9 ($112K) looms, resisting all relief. Below, the WMA50 + Fib 0.786 ($103K) stands as the fortress, the last shield before deeper descent;

∴ Structure of CME: The futures chart reveals the voids - an unclosed gap above ($112–114K) and another below ($103–104K). These voids are gravitational wells, pulling price toward their closure. Spot and CME converge: what the candle structure outlines, the gaps confirm.

∴ Momentum of Will: Indicators bear the stoic seal of decline. RSI fades from strength, MACD crosses bearish, and OBV flattens, whispering of distribution. Yet the Stoch RSI oversold breathes the faint promise of reprieve - not salvation, but respite.

∴ Fate of Flow: On-chain discipline shows no panic, whales remain silent; it is structure, not capitulation, that bends the market’s will. Thus, the battlefield is defined not by chaos but by the calm inevitability of compression between supports and voids.

✦ Structure Thus:

∴ Hold above $108K -> the path opens to the CME gap above ($112 / $114K), a short-term redemption;

∴ Fail below $107K -> the market is drawn into the CME gap below ($103 / $104K), aligning with the weekly fortress.

✴️ Conclusion: Bitcoin stands suspended between two voids - a promise above, a threat below. The stoic essence demands patience: fate will be decided by which gap the structure surrenders to first.

⊢

· Cryptorvm Dominvs · MAGISTER ARCANVM · Vox Primordialis ·

· Dominivm Cardo Gyratio Omnivm · Silence precedes the next force. Structure is sacred ·

⊢

Bitcoin - Inflows Whisper Calm, Structure Awaits Discipline.⊣

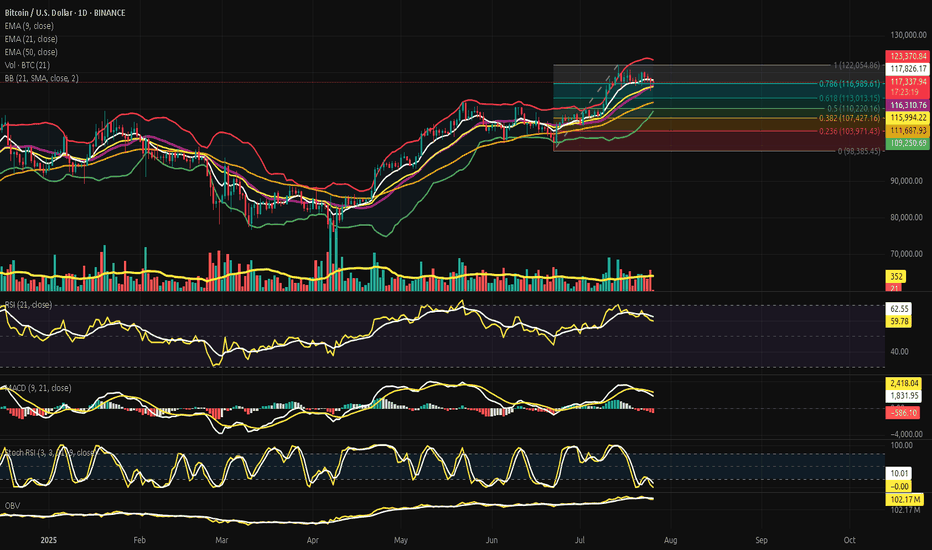

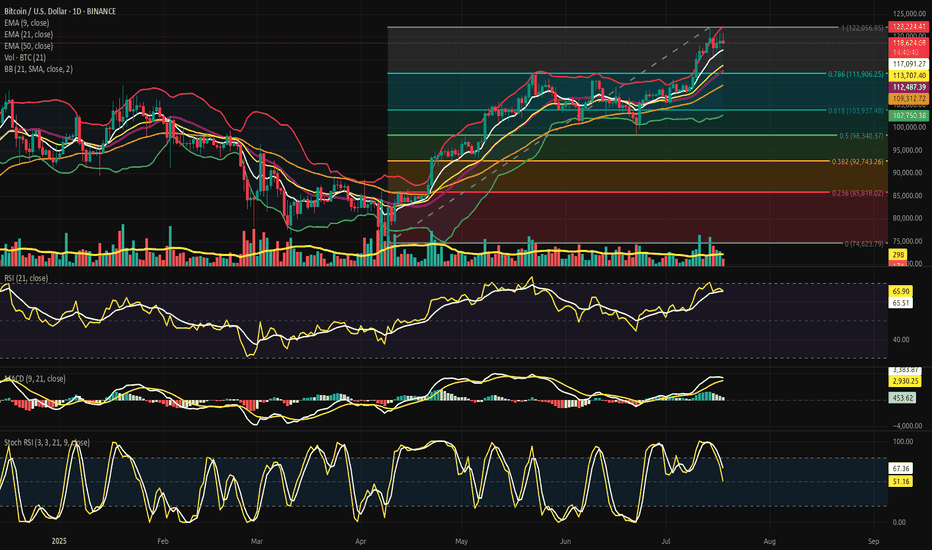

⟁ BTC/USD – BINANCE – (CHART: 1D) – (Aug 30, 2025).

◇ Analysis Price: $108,377.41.

⊣

⨀ I. Temporal Axis – Strategic Interval – (1D):

▦ EMA9 – $111,357.61:

∴ Price remains below EMA9, confirming immediate bearish control;

∴ EMA9 has flipped into dynamic resistance after multiple failed retests;

∴ Short-term recovery requires a clean daily close above EMA9.

✴️ Conclusion: EMA9 acts as near-term resistance, bearish short bias intact. Logic sealed.

⊢

▦ EMA21 – $113,437.56:

∴ EMA21 aligns with Fib 0.618 ($114,049), forming a resistance cluster;

∴ Persistent rejection since Aug 21 emphasizes mid-term weakness;

∴ Reclaiming EMA21 is the first real bullish trigger.

✴️ Conclusion: EMA21 = critical pivot to shift from bearish to neutral. Logic sealed.

⊢

▦ EMA50 – $113,852.43:

∴ Slightly above EMA21, adding weight to the $113.4 / 113.9k resistance zone;

∴ Until broken, this confluence acts as a bearish supply wall;

∴ A reclaim here reopens upside toward Fib 0.786 ($118.3k).

✴️ Conclusion: EMA50 reinforces resistance cluster. Logic sealed.

⊢

▦ EMA200 – $102,917.45:

∴ Long-term fortress, still untested in this cycle;

∴ Confluence with Fib 0.236 ($104,367) = macro defense zone;

∴ Bears’ ultimate target if current supports give way.

✴️ Conclusion: EMA200 stands as macro citadel. Logic sealed.

⊢

▦ Bollinger Bands (21, 2) – $121,042 / $113,437 / $105,833:

∴ Price riding lower band at $105.8k;

∴ Bands widening = volatility expansion with bearish tilt;

∴ Failure to revert to midline confirms continuation risk.

✴️ Conclusion: Bands highlight bearish volatility regime. Logic sealed.

⊢

▦ RSI (21, 9) – 40.90 / 44.62:

∴ RSI below neutral 50, momentum bearish;

∴ Not oversold (<30), leaving room for more downside;

∴ No bullish divergence present.

✴️ Conclusion: RSI validates sellers’ momentum. Logic sealed.

⊢

▦ MACD (9, 21, 9) – Line: –2,079.96 / Signal: –1,342.25 / Histogram: –737.71:

∴ Bearish cross intact below zero-line;

∴ Histogram remains deeply negative, no sign of contraction;

∴ Momentum acceleration still favors bears;

✴️ Conclusion: MACD entrenched in bearish phase. Logic sealed.

⊢

▦ ADX (21, 9) – 26.25:

∴ Above 25 confirms trend strength;

∴ With DI– dominance, direction is bearish;

∴ Indicates continuation rather than reversal.

✴️ Conclusion: ADX confirms strengthening bearish trend. Logic sealed.

⊢

▦ MFI (21) – 34.75:

∴ Below 50 = capital outflows dominate;

∴ No oversold signal (<20) yet;

∴ Market still has selling pressure capacity.

✴️ Conclusion: MFI aligns with distribution bias. Logic sealed.

⊢

▦ OBV (21, BB2) – (–86.84K):

∴ OBV trending lower, confirming distribution;

∴ Volume does not show accumulation footprint;

∴ Confirms sellers dominate liquidity.

✴️ Conclusion: OBV validates distribution regime. Logic sealed.

⊢

▦ Stoch RSI (3, 3, 21, 9) – K: 16.30 / D: 24.97:

∴ In oversold territory (<20);

∴ No confirmed bullish crossover yet;

∴ Relief bounce possible if crossover occurs.

✴️ Conclusion: Oversold condition may allow relief, but not structural reversal. Logic sealed.

⊢

▦ Fibonacci Retracements (0 = $98,385 -> 1 = $123,731):

0.786 -> $118,307 – (upper resistance);

0.618 -> $114,049 – (current battlefield, confluence EMA21/50);

0.500 -> $111,058 – (reclaim point for neutralization);

0.382 -> $108,067 – (current support pivot);

0.236 -> $104,367 – (deeper target, near EMA200).

✴️ Conclusion: Market clings to 0.382; Loss exposes 0.236 + EMA200 fortress; Logic sealed.

⊢

🜎 Strategic Insight - Technical Oracle:

∴ Short-term structure: price pinned under EMA9 and EMA21/50 cluster, bearish dominance confirmed;

∴ Momentum: RSI below 50, MACD negative, ADX >25 = sellers in control;

∴ Capital flows: MFI <50, OBV falling = distribution not yet exhausted;

∴ Only counterpoint: Stoch RSI oversold; potential for technical bounce, not structural reversal.

✴️ Conclusion: The battlefield is 0.382 Fib ($108k). Bulls must reclaim $111k -> $113.4k to neutralize; failure drags price toward ($104 / 103k). Logic sealed.

⊢

∫ II. On-Chain Intelligence - (Source: CryptoQuant):

▦ Exchange Inflow Total + EMA9 - (All Exchanges):

∴ Current inflow readings remain low-to-moderate, no spikes comparable to 2022 capitulation phases (>200K BTC);

∴ EMA9 of inflows trending stable/declining since Q2 2025;

∴ Lack of exchange deposits suggests no broad panic selling.

✴️ Conclusion: Inflows do not confirm capitulation; sellers are present but not aggressive. Logic sealed.

⊢

▦ Historical Context:

∴ Spikes above ~150K BTC inflow (e.g. 2022–2023) correlated with sharp price drawdowns;

∴ 2024–2025 shows inflows mostly <50K BTC/day, even during corrections;

∴ Current cycle corrections appear orderly rather than panic-driven.

✴️ Conclusion: Current inflow regime supports controlled distribution, not mass liquidation. Logic sealed.

⊢

▦ Liquidity Implications:

∴ Absence of exchange inflow surges implies supply pressure limited to tactical sellers;

∴ On-chain wallets continue holding, whales not rushing coins into exchanges;

∴ Technical breakdowns (EMA clusters, Fib 0.382) would require derivative/liquidation cascades rather than spot-led panic.

✴️ Conclusion: Structural downside must be driven by futures leverage, not spot panic flows. Logic sealed.

⊢

𓂀 Stoic-Structural Interpretation and On-Chain Oracle:

∴ Structure: EMA stack inverted; Fib 0.382 ($108k) = present bastion; EMA200 ($103k) = macro citadel;

∴ Momentum: RSI, MACD, ADX in alignment with descent, affirming stoic acceptance of downward will;

∴ Capital Flow: OBV and MFI declare liquidity leaving, distribution sealing bearish fate;

∴ Oracle: Oversold Stoch RSI whispers of fleeting respite, not salvation;

∴ Structure of Flow: Unlike past cycles, inflow discipline holds; coins remain largely in cold storage;

∴ Momentum of Will: Market decline is technical, not yet forced by whales. Bears act by structure, not by panic;

∴ Fate of Distribution: Without inflow surges, spot-driven capitulation remains unlikely; path to $103K relies on derivative liquidation.

⊢

✦ Structure Thus:

∴ The market embodies stoic compression;

∴ Only a reclaim >$113.4k reopens neutrality;

∴ Loss of $108k pulls destiny to ($104 / 103k);

∴ Fate sealed in bearish compression, awaiting expansion - logic sealed;

∴ On-chain inflows confirm the absence of mass panic;

∴ Technical charts dominate destiny;

∴ Bears have structure, but not yet blood;

∴ Bulls retain a chance if they defend $108K with low inflows sustained.

⊢

⚚ Unified Insight (Technical + On-Chain):

∴ Technical: Bitcoin clings to Fib 0.382 ($108K); failure = ($104 / 103K). Momentum + OBV favor bears.

∴ On-Chain: No whale capitulation; inflows remain muted, meaning downside is not spot-led.

✴️ Consequence: If inflows stay low, bulls may engineer a bounce at $108K -> $111K. If derivatives trigger cascade, EMA200 ($103K) becomes the stoic fortress.

⊢

· Cryptorvm Dominvs · MAGISTER ARCANVM · Vox Primordialis ·

· Dominivm Cardo Gyratio Omnivm · Silence precedes the next force. Structure is sacred ·

⊢

Bitcoin – Silence at the 0.618, Fate Awaits Beyond the Citadel.⊣

⟁ BTC/USD - BINANCE - (CHART: 1D) - (Aug 21, 2025).

◇ Analysis Price: $113,851.76.

⊣

⨀ I. Temporal Axis - Strategic Interval - (1D):

▦ EMA9 - $115,774.47:

∴ Price currently trades below EMA9, confirming short-term bearish control;

∴ Recent candles show rejection at EMA9 with no sustained recovery;

∴ EMA9 is now acting as immediate dynamic resistance.

✴️ Conclusion: Short-term bias remains bearish.

⊢

▦ EMA21 - $116,406.15:

∴ EMA21 overlaps with Bollinger midline, reinforcing resistance;

∴ Market has repeatedly failed to reclaim this level;

∴ Confirms mid-range structural weakness.

✴️ Conclusion: EMA21 = critical rejection zone.

⊢

▦ EMA50 - $114,864.59:

∴ Price hovering around this level in confluence with Fib 0.618;

∴ Sustained breakdown may unlock deeper retracements;

∴ Acts as battlefield between bulls and bears.

✴️ Conclusion: EMA50 = structural pivot under pressure.

⊢

▦ EMA200 - $103,250.81:

∴ Long-term trend support, still untouched;

∴ Represents final defense line for macro-bullish structure;

∴ Bears will target it if Fib 0.5 and 0.382 fail.

✴️ Conclusion: EMA200 = macro fortress below.

⊢

▦ Bollinger Bands (21, 2, base EMA9) - $121,471.73 / $116,406.15 / $111,340.57:

∴ Price moving towards lower band after rejection at midline;

∴ Bands widening, signaling volatility expansion;

∴ Downward trajectory consistent with bearish volatility regime.

✴️ Conclusion: Bands confirm ongoing bearish expansion.

⊢

▦ RSI (21, 9) - 46.86 / 50.67:

∴ RSI trending below neutral 50;

∴ No bullish divergence spotted;

∴ Momentum favors sellers.

✴️ Conclusion: RSI validates bearish control.

⊢

▦ MACD (9, 21, 9) - Line: –766.13 / Signal: –631.35 / Histogram: –134.78:

∴ Bearish crossover intact, histogram negative;

∴ Acceleration of bearish momentum confirmed;

∴ No signal of reversal yet.

✴️ Conclusion: MACD reinforces bearish regime.

⊢

▦ ADX (21, 9) - 25.31:

∴ Above 25 = trend gaining strength;

∴ Directional bias negative;

∴ Confirms transition from range into downtrend.

✴️ Conclusion: Bearish trend strengthening.

⊢

▦ MFI (21) - 40.14:

∴ Below 50 = capital outflows dominate;

∴ No oversold conditions yet;

∴ Space for further selling pressure.

✴️ Conclusion: Flow aligned with bearish market.

⊢

▦ OBV (21, BB2) - (–86.16K):

∴ Downward OBV shows distribution phase;

∴ Confirms sellers in control of volume dynamics;

∴ Bears dominate liquidity.

✴️ Conclusion: OBV confirms distribution bias.

⊢

▦ StochRSI (3, 3, 21, 9) - K: 8.01 / D: 7.62:

∴ Oversold condition;

∴ May allow short-term relief bounces;

∴ But no confirmed bullish reversal yet.

✴️ Conclusion: Short-term oversold, but within bearish context.

⊢

▦ Fibonacci Retracement (0.000 / 1.000):

0.618 -> $114,049.13 - (current battlefield, price at edge);

0.500 -> $111,058.33 - (next target if broken);

0.382 -> $108,067.53 - (deeper continuation);

0.236 -> $104,367.05 - (bear extension);

EMA200 confluence near 0.236 zone = macro defense.

✴️ Conclusion: 0.618 = last defense before accelerated bearish continuation.

⊢

⨀ II. Derivatives Sentiment – Skew, 180D Deribit - (Source: Amberdata & Coindesk):

▦ Call-Put Skew (180D / –0.42) - (Aug 21, 2025):

∴ Most negative since Jun/2023;

∴ Reflects strong demand for puts vs calls = hedging / defensive positioning;

∴ Institutional sentiment aligned with technical bearish regime.

✴️ Conclusion: Skew confirms institutional bearish caution.

⊢

🜎 Strategic Insight - Technical Oracle:

∴ The 1D chart reveals a bearish regime shift. Price rejected EMA21 + Bollinger midline, failing to regain momentum;

∴ EMA50 + Fib 0.618 ($114K) is under siege, and breakdown would expose $111K and $108K zones;

∴ Momentum indicators (MACD, RSI, ADX) align with bears, while OBV + MFI confirm capital outflows and distribution;

∴ The only counterpoint is StochRSI oversold, which may fuel minor relief rallies, but not structural reversal.

⊢

⚚ Coupled with the (Deribit 180D) Skew plunging to (–0.42 = most negative in 2 years), the institutional derivative market validates the caution: Risk aversion dominates ahead of Jackson Hole, with Powell’s speech poised as catalyst for either breakdown or miraculous reclaim above EMA21 - ($116.4K).

∴ The battlefield is set:

Above ($116.4K) = reclaim & neutralization;

Below ($114K) = bear continuation -> ($111K / $108K);

If EMA200 breaks ($103K) -> full structural collapse.

⊢

𓂀 Stoic-Structural Interpretation:

✴️The BTC/USD daily structure now embodies the essence of stoic fate: inevitable compression leading to directional release.

∴ Structure of Trend: EMA's (9, 21, 50) breached, with price now clinging to the (Fib 0.618 - $114K) - the last bastion before surrender to deeper retracement ($111K / $108K). EMA200 ($103K) stands as the final citadel of macro structure;

∴ Momentum of Will: RSI below neutrality, MACD in decisive bearish cross, ADX strengthening - the market’s will bends toward decline. Only the StochRSI whispers of oversold respite, a fleeting breath amid descent, not yet salvation;

∴ Flow of Capital: MFI and OBV confirm distribution, liquidity escaping upward promise into the void. Volume contracts, yet each rejection seals the bearish dominion further;

∴ Derivative Oracle: The 180D Deribit Skew (–0.42), most negative since 2023, signals that institutions cloak themselves in protection. Demand for puts over calls mirrors stoic prudence: fortify the self, expect the storm.

✦ Structure Thus:

The market is bound by fatum;

Only a reclaim above $116.4K reopens the gates of neutrality;

Failure below $114K drags the structure into its stoic descent, step by step, until the macro fortress at $103K is tested.

✴️ Conclusion: Bitcoin stands in compression before expansion. The silence of charts echoes the discipline of Stoicism: prepare for loss, endure the storm, and only act when the structure allows.

⊢

· Cryptorvm Dominvs · MAGISTER ARCANVM · Vox Primordialis ·

· Dominivm Cardo Gyratio Omnivm · Silence precedes the next force. Structure is sacred ·

⊢

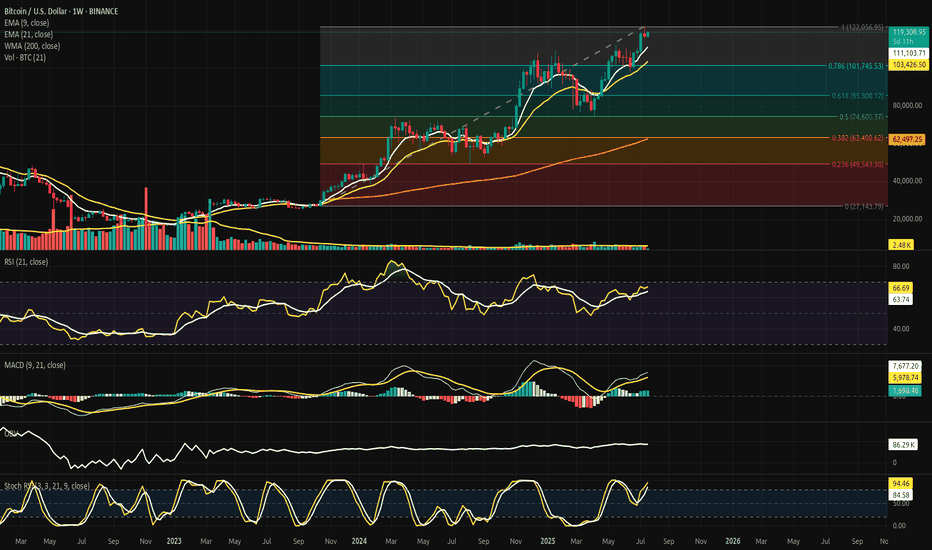

Bitcoin - Structural Compression, CME Pull Below.⊣

⟁ BTC/USD - BINANCE - (CHART: 1D) - (Aug 17, 2025).

◇ Analysis Price: $117,902.79.

⊣

⨀ I. Temporal Axis - Strategic Interval - (1D):

▦ EMA9 - $118,141.19:

∴ Current price sits $238.40 (−0.20%) below the EMA9, signaling short-term momentum cooling;

∴ The EMA9 is still aligned above EMA21 and EMA50, reflecting bullish micro-trend structure;

∴ However, the rejection from EMA9 suggests it is acting as immediate resistance rather than support.

✴️ Conclusion: The EMA9 transforms into a barrier for continuation; price must reclaim it promptly or risk sliding deeper into mid-range.

⊢

▦ EMA21 - $117,435.56:

∴ Spot trades $467.23 (+0.40%) above EMA21;

∴ EMA21 coincides with the Bollinger Basis, reinforcing its importance as the primary daily mean;

∴ The EMA21 serves as a pivot magnet - losing it would turn the short/mid bias neutral.

✴️ Conclusion: EMA21 remains structural support anchoring the trend, but pressure is visible from overhead EMA9.

⊢

▦ EMA50 - $114,977.49:

∴ Spot trades $2,925.30 (+2.55%) above EMA50;

∴ The bullish stack (EMA9 -> EMA21 -> EMA50) holds intact, confirming trend integrity on the mid horizon;

∴ A drop to EMA50 would mark a full corrective retracement, aligning with (Fibo 0.618 - $114,049.13).

✴️ Conclusion: EMA50 is the deeper structural defense; maintaining distance here preserves the bullish medium trend.

⊢

▦ BB (21, 2) - Basis: $117,435.56 / Upper: $122,084.15 / Lower: $112,786.98:

∴ Bandwidth (≈ 7.9%) of the basis -> market in a moderate volatility state;

∴ %B (≈ 0.54), situating price in the upper-mid envelope, not yet expansionary;

∴ Distance to upper band = (+3.54%), to lower band = (−4.34%), giving slightly more downside breathing room.

✴️ Conclusion: Market is balanced in volatility containment, with room both ways, yet downside slightly more open than upside.

⊢

▦ Volume (21) - 330 (current bar: 124):

∴ Current volume = (62.4%) below the rolling average -> weak participation;

∴ Weak volume on corrective candles indicates seller conviction lacking;

∴ Lack of strong volume also impairs breakout potential, keeping consolidation dominant.

✴️ Conclusion: Thin liquidity magnifies potential for wicks and mean reversions, reducing clarity of current move.

⊢

▦ RSI (21, 9) - RSI: 54.00 | Signal: 55.60:

∴ RSI resides in the neutral-positive range, above the 50-line;

∴ Momentum lags the EMA9 signal -> short-term bearish divergence;

∴ No oversold/overbought conditions (20–80 boundaries untouched).

✴️ Conclusion: RSI reflects fragile bullishness, vulnerable to further drift unless it recaptures momentum above signal.

⊢

▦ MACD (9, 21, 9) - Line: 705.63 / Signal: 750.84 / Histogram: –45.21:

∴ MACD line under signal confirms bearish crossover;

∴ Histogram remains negative yet shallow, consistent with corrective phase, not collapse;

∴ Momentum is softening, aligning with RSI’s neutral drift.

✴️ Conclusion: MACD indicates waning momentum but not trend failure - a corrective digestion phase is unfolding.

⊢

▦ ADX (21, 9) - 27.92:

∴ ADX -> 25 shows a moderate active trend;

∴ No extreme strength (>40), leaving market prone to external catalysts (macro/news);

∴ Combined with EMA stack, direction leans bullish, but ADX’s plateau signals loss of directional energy.

✴️ Conclusion: ADX affirms trend strength but hints that fuel is draining, requiring new impulse for extension.

⊢

▦ MFI (21) - 37.98:

∴ Sub-50 reflects capital outflows dominating inflows;

∴ Value remains far from oversold (<20), no exhaustion yet;

∴ Divergence emerges if price holds above EMA21 while liquidity bleeds.

✴️ Conclusion: Liquidity suggests buyers hesitating, weakening upside conviction.

⊢

▦ Fibonacci Retracement (0.000 / 1.000) - Low: $98,385.45 -> High: $123,731.21:

∴ 0.786 ($118,307.22) - Current price sits $404.43 (−0.34%) below, forming short-term ceiling;

∴ 0.618 ($114,049.13) - Key support, confluent with EMA50 ($114,977.49);

∴ 0.500 ($111,058.33) - Deeper retracement support, aligning with volatility lower structure.

✴️ Conclusion: Market trapped between 0.786 resistance and 0.618/EMA50 support -> pivotal compression zone.

⊢

🜎 Strategic Insight - Technical Oracle:

∴ The BTC/USD daily structure reveals a market in compression: EMA9 as immediate resistance, EMA21 as fragile pivot, and EMA50 + Fib 0.618 as deep anchor support;

∴ RSI and MACD both highlight momentum decay, while ADX confirms moderate but fading trend strength;

∴ MFI points to hesitant inflows, warning of liquidity weakness;

∴ Thus, the battlefield crystallizes: $118,307.22 (Fib 0.786 / EMA9 proximity) as resistance, and $114,049–114,977 (Fib 0.618 + EMA50) as structural defense. A break either way will dictate expansion.

✴️ Conclusion: Until resolved, the market remains in stoic compression - silence before expansion.

⊢

∫ III. On-Chain Intelligence - (Source: CryptoQuant):

▦ Exchange Inflow Total + EMA9 - (All Exchanges):

∴ Historically, surges in inflows correlate with distribution events - localized tops or sell pressure phases;

∴ The current inflow reading remains muted, far below major spikes (100K / 300K BTC) observed during prior capitulation or distribution clusters;

∴ Sustained low inflows indicate reduced immediate sell pressure, aligning with exchange reserves declining trend.

✴️ Conclusion: Current inflow profile is neutral-to-bullish, as supply entering exchanges is contained.

⊢

▦ Structural Pattern (2022 -> 2025):

∴ In 2022–2023, inflows frequently exceeded 200K BTC, triggering strong bearish legs;

∴ Since 2024, inflow peaks are smaller and less frequent, even as price advanced past $100K - showing increased holding conviction;

∴ Localized inflow upticks in early 2025 preceded short-term corrections, yet were absorbed without trend breakdown.

✴️ Conclusion: Market maturity visible - holders distribute less aggressively, supporting resilience of higher valuations.

⊢

▦ EMA9 Overlay (On-Chain Inflow Smoothing) - (not numerically explicit, observed visually):

∴ EMA9 of inflows remains flat-to-declining into mid-2025;

∴ Lack of sustained inflow uptrend -> exchanges not receiving systematic sell-side waves;

∴ This reduction aligns with macro hodling behavior dominating.

✴️ Conclusion: The inflow EMA reinforces quiet supply pressure, consistent with accumulation psychology.

⊢

🜎 Strategic Insight - On-Chain Oracle:

∴ Exchange inflow dynamics confirm a structurally quieter supply environment compared to previous cycles;

∴ While localized inflow bursts still produce short-term pullbacks, the overarching pattern is one of diminished distribution;

∴ In tandem with technical compression (Fib 0.786 vs 0.618 battle on daily chart), this on-chain restraint tilts risk asymmetry toward buyers - provided inflows remain subdued.

✴️ Conclusion: The silence of supply is itself a force: fewer coins offered into the market mean any liquidity shock could amplify upward expansion.

⊢

⟁ BTC/USD - CME Futures BTC1! - (CHART: 1D) - (Aug 17, 2025):

◇ Current Price: $118.150.

◇ Chart Link:

⊣

▦ CME Futures GAP - Observation & Ritual Closure:

CME Previous Close - $117,235.00;

CME Current Open - $117,995.00;

CME Last Print - $118,150.00.

∴ GAP CME (Open vs. Previous Close) = +760 pts (+0.65%);

∴ This leaves an upward GAP from ($117,235) -> ($117,995);

∴ GAP already in partial closure zone (low today $117,645).

✴️ Conclusion: CME opened with bullish GAP, partially tested intraday. Historical tendencies favor full gap closure within subsequent sessions (≈ 85% probability), yet persistence above $118K could normalize it as a continuation gap.

⊢

▦ Volume (CME - Session) - 38 contracts (low relative participation):

∴ Initial session prints show light activity;

∴ Weak volume reduces conviction of gap as an institutional “breakaway”;

∴ Implies gap more likely to be filled than sustained immediately.

✴️ Conclusion: Low conviction inflow reduces sustainability of gap.

⊢

🜎 Strategic Insight - CME Oracle:

∴ The CME chart reveals an upward opening GAP (+760 pts), currently under test. Historically, such gaps on BTC futures act as magnets until closure, unless validated by institutional surge volume;

∴ With today’s session showing thin activity, the odds tilt toward eventual closure at ($117,235);

∴ Thus, the institutional map places immediate magnetic risk below spot, even as the daily technicals (BTC/USD - 1D) compress between (Fib 0.786 and EMA50).

⧉ Together with subdued on-chain inflows, the structure suggests:

Spot chart = technical compression (awaiting breakout);

On-chain = low supply inflows, bullish undertone;

CME = gap pull magnet down toward ($117,235), unless denied by volume expansion.

⊢

𓂀 Stoic-Structural Interpretation:

∴ The daily BTC/USD frame manifests in compression - EMA9 overhead resistance vs. EMA21/EMA50 layered supports, with Fib 0.786 as ceiling and 0.618 as anchor;

∴ On-chain inflows remain muted, signaling reduced distribution and a silent, stoic restraint of supply;

∴ The CME Futures GAP (+760 pts) exerts a gravitational magnet toward ($117,235), yet its low-volume print weakens institutional conviction.

✴️ Stoic Arcane Conclusion: Structure stands at the threshold of stoic tension - supply muted, momentum fading, futures pulling. The silence of inflows aligns with a potential expansion, yet institutional gravity demands respect.

⊢

✦ Structure:

∴ BTC/USD (1D Spot) -> Compression defined between Fib 0.786 ($118,307) resistance and Fib 0.618 + EMA50 ($114,049–114,977) support; EMA9 acts as immediate friction, EMA21 as fragile pivot;

∴ On-Chain Inflows -> Exchange inflows remain muted (10.2K BTC recent), far from historic distribution surges, confirming supply silence and stronger holder conviction;

∴ CME Futures -> Market opened with an upward GAP (+760 pts) from $117,235–$117,995, partially tested but unresolved; low volume weakens breakout sustainability, implying magnetic pull back toward closure.

✴️ Structural Reading: Bitcoin stands at a convergent triad - technical compression, on-chain restraint, and institutional gap gravity. Expansion is imminent, but direction hinges on whether the spot chart breaks above ($118,307) or the CME magnet drags price to ($117,235).

⊢

· Cryptorvm Dominvs · MAGISTER ARCANVM · Vox Primordialis ·

· Dominivm Cardo Gyratio Omnivm · Silence precedes the next force. Structure is sacred ·

⊢

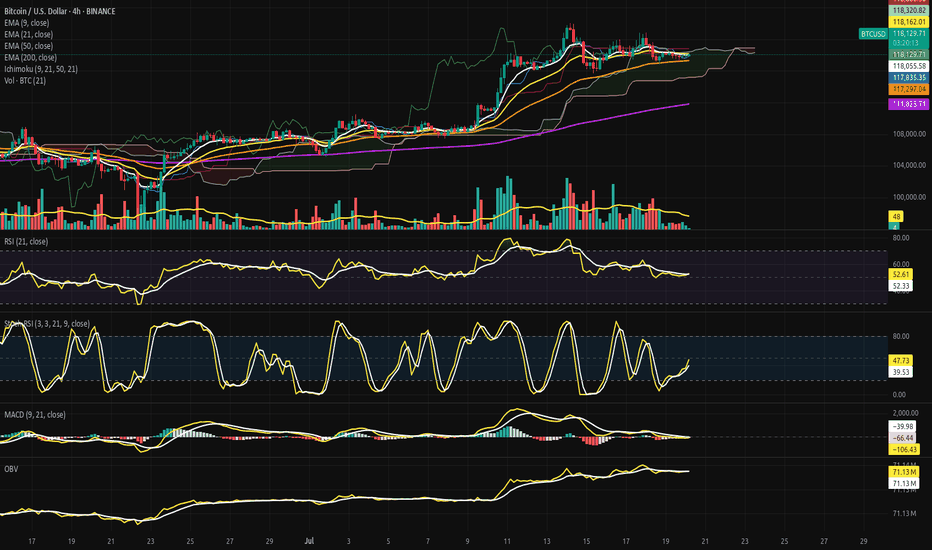

Bitcoin - Structure in Compression, Silence Before Expansion?⊣

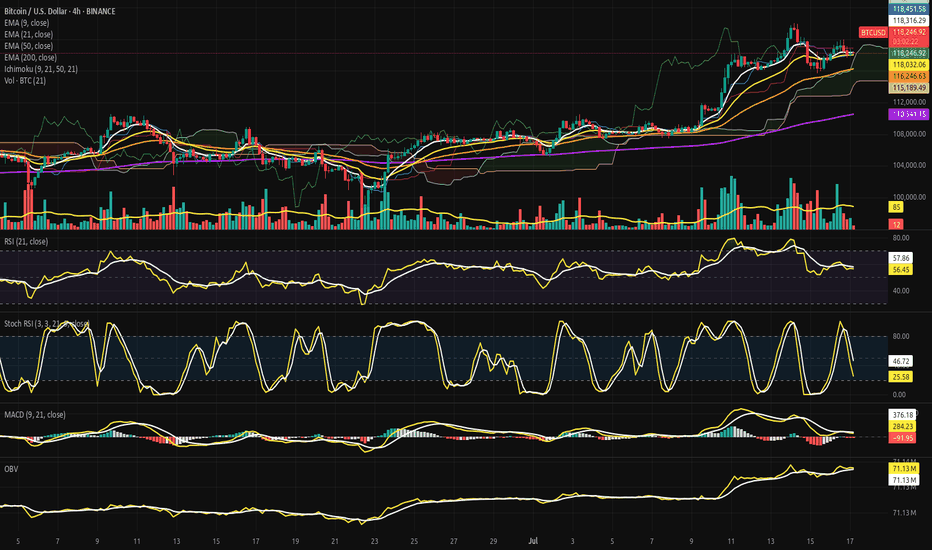

⟁ BTC/USD - BINANCE - (CHART: H4) - (Aug 16, 2025).

◇ Analysis Price: $118,020.60.

⊣

⨀ I. Temporal Axis - Strategic Interval - (H4):

▦ EMA50 - $118,425.87:

∴ The EMA50 is currently positioned slightly above the active trading price - ($118,020.60), establishing a localized resistance zone, showing that the market is struggling to sustain momentum above this median dynamic level;

∴ In recent sessions, price action fluctuated around EMA50, but failed to reclaim it as stable support, indicating weakness in short-term recovery attempts;

∴ The slope of EMA50 remains almost flat, not strongly ascending, suggesting market indecision and lack of directional strength.

✴️ Conclusion: EMA50 is a resistance barrier, neutral-to-bearish unless reclaimed decisively.

⊢

▦ EMA200 - $116,394.72:

∴ The EMA200, being a long-term stability reference, is below the current market price, acting as structural support for the mid-term;

∴ The wide gap between EMA200 and EMA50 indicates a neutral compression phase — price oscillating between medium and long horizons;

∴ If the market falls back toward EMA200, buyers may attempt defense; a breach would confirm broader weakness in market structure.

✴️ Conclusion: EMA200 is a strong support anchor, still intact, but tested boundaries are plausible.

⊢

▦ TEMA9 - $117,520.39:

∴ TEMA9 is below the current price, serving as immediate dynamic support, often used by short-term traders;

∴ Market bounces in the last sessions respected this fast-moving indicator, giving temporary confidence to bulls;

∴ However, repeated retests weaken its authority, showing fragility in momentum if volume does not sustain.

✴️ Conclusion: TEMA9 is immediate support, fragile, requiring reinforcement by volume.

⊢

▦ HMA21 - $116,919.69:

∴ The HMA21 lies under market value, acting as secondary support, confirming alignment with EMA200 as part of the supportive axis;

∴ Its curve is slightly ascending, signaling a faint bullish rebound in the short horizon;

∴ Alignment below price confirms resilience but also dependency - if price collapses, this level could break swiftly.

✴️ Conclusion: HMA21 is secondary support, dynamic yet vulnerable to volatility.

⊢

▦ SMA21 - $119,371.78:

∴ SMA21 sits above current price, working as resistance, in opposition to the supports listed (HMA21/TEMA9);

∴ This creates a compression corridor: TEMA9 + HMA21 (support) vs SMA21 (resistance);

∴ Market structure indicates stagnation inside a tight channel, waiting for breakout or breakdown.

✴️ Conclusion: SMA21 is resistance, framing the price in a boxed range.

⊢

▦ SuperTrend (10, 1.5) - $119,325.29:

∴ The SuperTrend remains above the actual price, signaling a bearish bias;

∴ Market action is still below its trigger, rejecting short-term bullish confirmation;

∴ Only a sustained breakout above this level could alter the bearish sentiment.

✴️ Conclusion: SuperTrend = Bearish stance remains active.

⊢

▦ BB (21, 2) - Upper: $123,154.36 / Basis: $119,371.78 / Lower: $115,589.21:

∴ Price is compressed between the midline (basis) and lower band, showing weakness;

∴ Recent volatility spikes touched the upper band but were rejected, confirming lack of strength;

∴ The narrowing of bands signals imminent expansion - market preparing for stronger volatility move.

✴️ Conclusion: Bollinger = Compression near lower range, potential breakout ahead.

⊢

▦ StochRSI (3, 3, 21, 9) - K: 44.11 / D: 37.23:

∴ Both K and D lines are mid-range, neither oversold nor overbought, reflecting indecision;

∴ The slight upward crossing indicates a possible rebound attempt, but weak until confirmed by momentum;

∴ Position in neutral zone diminishes conviction - signal could reverse quickly.

✴️ Conclusion: StochRSI suggests fragile recovery, neutral-to-bullish bias.

⊢

▦ Volume (21) - 9 / 85:

∴ Current volume is extremely weak compared to the SMA21, showing low conviction;

∴ This volume drought reduces the probability of sustainable breakouts;

∴ Whales or institutions are not actively engaged at this moment.

✴️ Conclusion: Volume shows lack of strength; market drifting without strong participation.

⊢

▦ MACD (9, 21, 9) - MACD: -170.26 / Signal: -425.48 / Histogram: -595.74:

∴ MACD remains negative, showing bearish underlying pressure;

∴ Histogram is contracting, indicating that bearish momentum is slowing down, but not reversed;

∴ A bullish crossover is still distant, weakening bullish recovery chances in near term.

✴️ Conclusion: MACD = Bearish pressure moderating, no reversal confirmed yet.

⊢

▦ RSI (21, 9) - 43.19:

∴ RSI is below 50, confirming bearish bias;

∴ Position not yet oversold, showing market retains room for further downside;

∴ The flat slope reflects indecision - neither strong selling panic nor buying force.

✴️ Conclusion: RSI = Bearish-neutral, momentum still under equilibrium.

⊢

▦ MFI (21) - 43.19:

∴ MFI mirrors RSI levels, confirming lack of strong inflow or outflow;

∴ Volume-weighted money flow confirms market neutrality, slightly leaning bearish;

∴ No divergence spotted to suggest imminent reversal.

✴️ Conclusion: MFI = Neutral, aligned with RSI weakness.

⊢

▦ OBV (21) - 74.89M:

∴ OBV is flat, not rising in accordance with recent small price upticks, showing lack of buyer confirmation;

∴ Absence of strong accumulation suggests price is rising on weak grounds;

∴ If OBV fails to climb, rallies will likely fail at resistance points.

✴️ Conclusion: OBV confirms weak demand, neutral-bearish stance.

⊢

🜎 Strategic Insight - Technical Oracle:

∴ The H4 structure reveals a compressed battlefield: dynamic supports (TEMA9, HMA21, EMA200) try to sustain price above $116K–117K, while layered resistances (EMA50, SMA21, SuperTrend, BB basis) weigh down overhead near $118K–119K;

∴ Volume collapse and flat OBV expose the fragility of bullish attempts, showing lack of participation. RSI and MFI align at ~43, signaling neutrality with bearish tilt. MACD remains negative, albeit moderating, hinting bearish exhaustion rather than reversal;

∴ Thus, BTC/USD stands in tense equilibrium: support corridor anchored near $116K, resistance dome at $119K;

∴ Market awaits volatility ignition, and the Bollinger Band squeeze warns a breakout is imminent;

∴ Without volume, upward attempts risk collapse; with momentum reactivation, resistance layers may fracture.

⊢

𓂀 Stoic-Structural Interpretation:

∴ The chart reveals not strength, but suspension - Bitcoin hovers between its moving average guardians, caught within corridors of compression where price neither collapses nor ascends with conviction;

∴ EMA50 denies passage above, while EMA200 anchors from below - structure is preserved not by will, but by inertia;

∴ Indicators whisper the same tale: RSI and MFI linger at 43, momentum without fire, money without decisive flow;

∴ MACD stays in the shadows, still negative, showing the bear’s hand loosening but not releasing;

∴ OBV remains flat, silence of accumulation, a desert where no buyer’s army marches;

∴ Bollinger Bands coil tighter, warning of the coming storm - when silence stretches, force prepares.

✴️ Stoic Arcane Conclusion: The market does not yield to hope nor despair, it waits - stillness before expansion. To the disciplined observer, this is not chaos, but structure: a narrowing gate where patience is the true weapon.

⊢

✦ Structure:

∴ The H4 battlefield is confined within a narrow dominion - ($116,000 to $119,500) - where supports (TEMA9, HMA21, EMA200) forge the lower bulwark, and resistances (EMA50, SMA21, SuperTrend, BB Basis) construct the ceiling;

∴ Momentum oscillators (RSI, MFI, StochRSI) hover in neutrality, neither signaling exhaustion nor ignition, mirroring the market’s stoic posture;

∴ MACD remains submerged in negative territory, its histogram contracting, a sign of fading bearish strength but absent bullish conquest;

∴ Volume and OBV betray the truth: demand is hollow, accumulation is absent, and rallies lack the blood of conviction;

∴ Bollinger compression seals the chamber, a tightening coil foretelling release - structure bends, not breaks, awaiting its destined expansion.

✴️ Structural Seal: The architecture is one of suspended energy, a locked formation where silence is not weakness, but the breath before eruption.

⊢

· Cryptorvm Dominvs · MAGISTER ARCANVM · Vox Primordialis ·

· Dominivm Cardo Gyratio Omnivm · Silence precedes the next force. Structure is sacred ·

⊢

Bitcoin - Post-Breakout Compression at the Gate of Fibo - 0.786.⊣

⟁ BTC/USD - BINANCE - (CHART: 1D) - (Aug 14, 2025).

◇ Analysis Price: $118,876.69.

⊣

⨀ I. Temporal Axis - Strategic Interval - (1D):

▦ EMA9 - $118,643.08:

∴ Price has pulled back toward the EMA9 after peaking at the recent (ATH of $123,731.21);

∴ Current positioning above EMA21 and EMA50 keeps the short-term trend intact despite the intraday retracement;

∴ EMA9 slope remains positive, signaling residual bullish momentum.

✴️ Conclusion: Short-term dynamic support intact; breach would increase pressure toward EMA21.

⊢

▦ EMA21 - $117,392.05:

∴ Serves as the first significant swing-support layer in the daily structure;

∴ Distance between EMA9 and EMA21 is narrowing due to today’s sell-off;

∴ Sustained closes below EMA21 would threaten the current daily uptrend.

✴️ Conclusion: Structural pivot for sustaining the bullish daily cycle.

⊢

▦ EMA50 - $114,650.23:

∴ Represents medium-term equilibrium and major market memory zone;

∴ Considerable gap between price and EMA50 indicates an extended run from equilibrium;

∴ A deeper retracement could naturally gravitate toward this zone for rebalancing.

✴️ Conclusion: Last defensive bastion before mid-term trend deterioration.

⊢

▦ BB (21, 2) - Upper: 121,847.18 / Basis: 117,060.71 / Lower: 112,274.25:

∴ Price reached the upper band during the ATH spike, triggering volatility expansion;

∴ Retraction from the upper band indicates profit-taking pressure;

∴ Basis line aligns closely with EMA21, reinforcing its importance as structural midline support.

✴️ Conclusion: Current movement reflects band rejection; volatility contraction likely if basis holds.

⊢

▦ Volume (21) - Current: 397 / MA: 317:

∴ Above-average daily volume during ATH session confirms real participation;

∴ Today’s sell-side volume surge shows immediate counterforce;

∴ Sustained high volume in both directions could precede a range formation.

✴️ Conclusion: Market is in active price discovery with heightened participation.

⊢

▦ RSI (21, 9) - RSI: 55.87 / Signal: 57.61:

∴ RSI cooled off from near overbought levels (above 70) toward midline;

∴ Positive divergence versus recent price pullback not yet visible;

∴ Momentum has weakened but remains in bullish territory above 50.

✴️ Conclusion: Momentum is consolidating; failure to hold 50 will shift control to sellers.

⊢

▦ MACD (9, 21, 9) - MACD: 548.09 / Signal: 702.94 / Histogram: 1,251.03:

∴ MACD histogram contracting, indicating fading bullish impulse;

∴ Cross-over risk emerging if current trajectory persists;

∴ Still in positive zone, showing bulls have residual control.

✴️ Conclusion: Bullish momentum waning; MACD line needs resurgence to avoid daily cross-down.

⊢

▦ ADX (21, 9) - 27.43:

∴ ADX below 30 suggests trend strength is moderate;

∴ Rising slope in recent days indicates a possible re-acceleration attempt;

∴ Low-to-mid readings show this ATH push lacked extreme trend force.

✴️ Conclusion: Trend strength improving but not yet at dominant breakout levels.

⊢

▦ MFI (21) - 41.60:

∴ MFI pulled back sharply from high 70s toward neutral zone;

∴ Indicates capital outflow matching the retracement in price;

∴ Still above oversold threshold, leaving room for either renewed inflow or deeper drawdown.

✴️ Conclusion: Liquidity pressure present; directional bias still undecided.

⊢

▦ Fibonacci Retracement - (from $98,385.45 to $123,731.21):

∴ 0.0: 98,385.45 – cycle origin;

∴ 0.236: 104,367.05 – minor support;

∴ 0.382: 108,067.33 – intermediate support;

∴ 0.500: 111,068.53 – psychological & technical balance;

∴ 0.618: 114,049.13 – golden retracement zone;

∴ 0.786: 118,307.22 – rejection point in current candle;

∴ 1.000: 123,731.21 – ATH resistance;

∴ 1.618: 139,394.89 – next major extension target.

✴️ Conclusion: Price reaction at 0.786 signals a possible retracement cascade unless recovered.

⊢

🜎 Strategic Insight - Technical Oracle:

∴ The daily chart reveals a market in the aftermath of a sharp thrust to ATH, now facing immediate rejection at the Bollinger upper band and (Fibo - 0.786);

∴ EMA structure remains bullish but compression between EMA9 and EMA21 signals a vulnerability window;

∴ Momentum (RSI, MACD) is losing altitude, while trend force (ADX) is only moderately engaged; ∴ Liquidity flow (MFI) shows sellers matching buyer aggression post-ATH;

∴ The golden retracement at 0.618 aligns with EMA50 as a potential deeper support target if selling accelerates. Bulls must reclaim (Fibo - 0.786) quickly to preserve the breakout narrative.

⊢

𓂀 Stoic-Structural Interpretation:

∴ The chart speaks in tempered cadence - the market reached upward into new territory, only to feel the weight of its own ascent pressing back;

∴ Structure remains poised, with EMA lines still aligned to the north, yet their narrowing gap whispers of momentum’s fatigue;

∴ Momentum and liquidity indicators agree in their caution: the thrust was bold, but the grip on this altitude is not yet certain;

∴ (Fibo - 0.786) stands as the immediate gatekeeper - a threshold where either conviction renews or gravity takes its due;

∴ Trend force is not absent, but it is not yet the roar of inevitability; the ADX reads not triumph, but preparation;

∴ Inflows and volume affirm the battle is active, not concluded - the field is contested, not surrendered.

⚖️ The Stoic mind sees in this neither triumph nor defeat, but the natural stillness between impulse and outcome - a moment to fortify structure, for in patience the stronger hand prevails.

⊢

✦ Structure holds, yet breathes caution.

▦ This is a post-breakout compression - the market testing its new heights while equilibrium forces gather for the next decisive move.

⊢

· Cryptorvm Dominvs · MAGISTER ARCANVM · Vox Primordialis ·

· Dominivm Cardo Gyratio Omnivm · Silence precedes the next force. Structure is sacred ·

⊢

Bitcoin - Structure Holds, Momentum Fades, CME Pull Grows.⊣

⟁ BTC/USD - BINANCE - (CHART: 1W) - (Aug 05, 2025).

◇ Analysis Price: $114,907.55.

⊣

⨀ I. Temporal Axis - Strategic Interval - (1W):

▦ EMA9 - ($112,389.19):

∴ Price action is currently positioned above the EMA9 on the 1W timeframe, reflecting ongoing bullish strength;

∴ The candle body maintains a healthy gap from the EMA9 line, indicating that short-term trend control remains with the buyers;

∴ This level also coincides closely with the upper bound of the active CME Gap, suggesting strategic confluence support in the $112.3k zone.

✴️ Conclusion: Short-term bullish structure remains intact. EMA9 acts as frontline dynamic support.

⊢

▦ EMA21 - ($105,376.55):

∴ The EMA21 remains far below the current price structure, confirming that mid-term momentum is still securely bullish;

∴ Distance between price and EMA21 reflects a sustained uptrend, but also implies vulnerability to sudden reversion if volume drops;

∴ No signs of flattening or curling - the EMA21 slope is upward, validating continuation bias.

✴️ Conclusion: Mid-range trend remains intact and structurally sound. Acts as deep dynamic support for broader bullish context.

⊢

▦ WMA50 - ($99,364.99):

∴ The WMA50 weighted average is trending upward, reflecting ongoing macro-bullish alignment;

∴ Price remains safely above it, affirming structural support and healthy trend continuation;

∴ No flattening or curve-down detected - the momentum is sustained.

✴️ Conclusion: Primary trend remains unbroken. WMA50 serves as dynamic base.

⊢

▦ WMA100 - ($85,341.14):

∴ Price remains well above the WMA100 weighted average, confirming long-term structural strength;

∴ The slope remains positive, showing no signs of decay or macro exhaustion;

∴ Acts as a foundational support level, unlikely to be challenged unless momentum is broken across multiple time frames.

✴️ Conclusion: Long-term support confirmed. Structure remains in favor of bullish control.

⊢

▦ WMA200 - ($63,767.52):

∴ The WMA200 weighted moving average holds firm as the ultimate line of structural defense in long-term cycles;

∴ Price is elevated nearly 80% above this level, affirming that Bitcoin remains far from macro breakdown territory;

∴ The slope has resumed a slight upward curve, indicating that deep-cycle accumulation zones are now behind.

✴️ Conclusion: Foundational macro support fully intact. Long-term bullish cycle structurally confirmed.

⊢

▦ VOLUME + EMA21 - (347.41 BTC):

∴ Weekly volume shows a steady decline over the past four candles, indicating weakening participation despite elevated price;

∴ The EMA21 sits just below current candle activity, suggesting that momentum is fading but not yet broken;

∴ No volume spike confirms breakout - current structure lacks conviction.

✴️ Conclusion: Volume compression persists. Trend remains, but force is thinning.

⊢

▦ FIBONACCI - (0 = $27,143.79 / 1 = $122,056.95):

⌖ 0.236 - ($49,543.30):

∴ First shallow retracement level, often reached in early corrections;

∴ Remains untouched during this cycle - represents an extreme fallback zone.

✴️ Status: Unreached - deep structural support.

⌖ 0.382 - ($63,400.62):

∴ First zone of major institutional interest;

∴ Closely aligned with the WMA200 - double confirmation as a defense line;

∴ Still far below the current structure.

✴️ Status: Untouched - possible gravity point if collapse.

⌖ 0.500 - ($74,600.37):

∴ Midpoint of the entire bull impulse;

∴ May act as magnet if the current momentum breaks down;

∴ Strongest neutral reversion zone.

✴️ Status: Unreached - mid-cycle equilibrium.

⌖ 0.618 - ($85,800.12):

∴ The golden zone - ideal level for healthy retracements in bullish trends;

∴ Not yet tested, but visible as psychological and strategic area for institutions.

✴️ Status: Unreached - primary retracement target if pullback strengthens.

⌖ 0.786 - ($101,745.53):

∴ Upper-level retracement before full price reentry into macro top territory;

∴ Very close to current price - may act as last resistance zone before all-time high break.

✴️ Status: Approaching - active resistance zone.

⌖ 1.000 - ($122,056.95):

∴ The swing high of the current macro wave;

∴ Current candles are pressing against this level;

∴ A breakout would signal macro continuation - failure could initiate retracement to 0.786 or lower.

✴️ Status: Active - pressure point of decision.

⌖ 1.618 - ($180,713.28):

∴ Full Fibonacci expansion;

∴ Represents speculative future cycle extension;

∴ Only attainable through breakout + sustained volume and ETF inflow.

✴️ Status: Untouched - long-term speculative beacon.

✴️ Conclusion:

∴ Price is now fighting just beneath (1.000 - $122K) - while leaning on (EMA9 - $112K);

∴ The macro structure remains intact, but pressure is rising between the (0.786 / 1.000) band, a known resistance battlefield;

∴ Failure to break (1.000) may activate gravitational pull toward (0.786 or 0.618) - where strength shall be tested.

⊢

▦ RSI (21, 9) - ($62.75):

∴ The Relative Strength Index remains above the 60 threshold, confirming that momentum is still bullish without entering euphoric territory;

∴ The signal line (EMA9 - $63.34), slightly above the RSI value - suggesting mild divergence and loss of acceleration;

∴ No overbought condition present, but a slow downward curve has begun from the local peak.

✴️ Conclusion: Momentum is positive but softening. Watch for confirmation of divergence or RSI breakdown below 60.

⊢

▦ MACD (9, 21, 9) - ($6,403.95):

∴ The MACD line currently sits below the signal line ($7,012.64), confirming a bearish crossover on the weekly scale;

∴ Histogram bars have turned negative, reflecting declining momentum and weakening trend strength;

∴ Despite this, the MACD remains in positive territory, indicating that the macro trend has not yet reversed - only softened.

✴️ Conclusion: Bearish momentum signal confirmed. Short-term weakness within a still intact bullish macro context.

⊢

▦ OBV (9, BB2) - ($220.38M):

∴ The On-Balance Volume indicator maintains a steady upward slope, showing continued net accumulation over time;

∴ No divergence is present between OBV and price - both remain structurally aligned;

∴ The OBV line resides within the upper half of its Bollinger Band (BB2), signaling orderly inflow rather than euphoric volume spikes.

✴️ Conclusion: Accumulation remains healthy and controlled. No warning signs from volume flow.

⊢

▦ StochRSI (3, 3, 21, 9) - (%K: 65.16 / %D: 78.96):

∴ The %K line has begun curving downward after exiting the overbought zone, suggesting momentum exhaustion;

∴ The %D line remains higher, forming a potential crossover to the downside - a classic reversion signal;

∴ Both lines still hover in the upper band, but the slope indicates a softening trend.

✴️ Conclusion: Overbought momentum is decaying. A short-term pullback or consolidation phase is likely.

⊢

🜎 Strategic Insight - Technical Oracle:

∴ EMA9 and EMA21 maintain a healthy bullish spread, preserving the dynamic trend structure without showing signs of decay;

∴ WMA50, WMA100, and WMA200 confirm full macro alignment - the base of the cycle remains strong and upward-facing;

∴ Weekly volume is compressing below its EMA21, indicating that momentum is softening despite price holding high ground;

∴ RSI (21, 9) holds above 60, preserving bullish momentum but showing early signs of curvature loss and possible divergence;

∴ MACD (9, 21, 9) has completed a bearish crossover with a negative histogram, signaling internal weakness under the surface;

∴ OBV (9, BB2) continues its upward trajectory with no volume divergence, confirming that no distribution is currently present;

∴ StochRSI (3, 3, 21, 9) is exiting the overbought zone, with %K descending and %D beginning to curve down - classic signal of momentum exhaustion.

✴️ Conclusion: The weekly structure remains bullish, but all momentum indicators are converging toward a transitional phase; Trend is intact - yet losing energy; A new directional impulse will be required to preserve the current bullish architecture.

⊢

▦ CME GAP - ($111,300 / $112,300):

⌖

∴ This gap was formed between the closing candle of Friday, July 26th and the opening candle of Monday, July 29th, on the BTC Futures contract (CME:BTC1!);

∴ The Friday close occurred near ($111,300), while the Monday open jumped to ($112,300), leaving a 1,000-point dislocation - a vacuum zone where no trades were registered;

∴ As of the current 1W candle, this gap remains completely unfilled - price has not returned to touch or shadow into this void;

∴ The gap is strategically aligned with the (EMA9 - $112,389.19) on the (1W) timeframe, forming a dual-confluence support that amplifies its gravitational potential;

∴ CME gaps of this magnitude, when left open, tend to act as attractors - especially when momentum slows and volume compresses, as currently observed in the MACD and Volume indicators.

✴️ Conclusion: The ($111,300 / $112,300) zone remains an active gravitational target;

If the current weakening of momentum persists, price may be pulled downward to close this imbalance before attempting any further upside expansion; It now acts as a pivot point between bullish continuation and corrective rebalancing.

⊢

𓂀 Stoic-Structural Interpretation:

∴ The structure does not collapse, but it no longer expands - it holds, sustained not by force, but by form;

∴ Indicators speak not of panic, nor of euphoria - they speak of pause, of a market that has climbed far and now waits for intention;

∴ The moving averages form a solid stairway, but the feet have slowed; the MACD has turned, the RSI bends gently, the volume has quieted;

∴ There is no sell-off. No rush to escape. But there is no thrust forward either;

∴ This is not weakness. It is controlled fatigue. The kind that precedes choice - will you break through, or rest and descend?

𓂀 The Stoic mind sees neither threat nor promise - only the present structure, and its silent demand for action.

∴ Hold position : Observe the slope. Momentum must return - or gravity will.

⊢

· Cryptorvm Dominvs · MAGISTER ARCANVM · Vox Primordialis ·

· Dominivm Cardo Gyratio Omnivm ·

⚚ · Silence precedes the next force. Structure is sacred · ⚚

⊢

Bitcoin Structure in Stillness, Power in Silence, Just Control?⊣

⟁ BTC/USD - BINANCE - (CHART: H1) - (Aug 02, 2025).

◇ Analysis Price: $113,869.77.

⊣

⨀ I. Temporal Axis - Strategic Interval - (1H):

▦ EMA9 - ($113,889.32):

∴ The price is trading just below the EMA9, which acts as immediate reactive resistance;

∴ The short-term slope remains negative, with no breakout signal;

∴ Buyers are unable to push the price above this threshold, indicating technical weakness.

✴️ Conclusion: Momentum remains capped; the EMA9 has not been reclaimed.

⊢

▦ EMA21 - ($113,896.52):

∴ The EMA21 stands as a tactical compression line in this range;

∴ The close proximity of EMA9 and EMA21 forms a technical knot - indecision zone;

∴ Past rejections in this region reinforce it as a powerful barrier.

✴️ Conclusion: Mid-range resistance holds; continuation is blocked unless breached with volume.

⊢

▦ EMA50 - ($114,128.22):

∴ EMA50 defines the current macro resistance on the 1H chart;

∴ The price has yet to test this level directly after the last drop;

∴ For structural recovery, this line must be broken cleanly with follow-through.

✴️ Conclusion: Primary obstacle on the path to reversal - decisive zone.

⊢

▦ BB (21 + EMA9) - Status: Compression:

∴ Bands are tightening around the price, signaling low volatility;

∴ Price action is contained within the central channel;

∴ Indicates upcoming volatility spike - direction still unknown.

✴️ Conclusion: Volatility compression is active; no directional bias confirmed.

⊢

▦ Volume + EMA21 - (3.84 BTC):

∴ Trading volume remains below the EMA21 period average;

∴ No surge of bullish commitment visible;

∴ Momentum lacks conviction without participation.

✴️ Conclusion: Absence of volume undermines the strength of any move.

⊢

▦ RSI (21, 9) - (42.37):

∴ RSI hovers in the lower neutral band - weak momentum;

∴ Slight upward curve suggests a modest rebound;

∴ No divergence or strength signal confirmed.

✴️ Conclusion: Minor relief rally underway - structurally weak.

⊢

▦ MACD (9, 21, 9) - (MACD: -238.89 / Signal: -340.58):

∴ Bullish crossover confirmed, histogram positive;

∴ Both lines remain in bearish territory - (below zero);

∴ Trend momentum is building but not strong enough to reverse.

✴️ Conclusion: Technical rebound in play - not a structural shift.

⊢

▦ Stoch RSI (3, 3, 21, 9) - (%K: 58.90 / %D: 52.70):

∴ Positive crossover established and advancing in neutral-upper zone;

∴ No overbought signal;

∴ Possibility of further upside if confirmed with price action.

✴️ Conclusion: Oscillator supports continuation - contingent on volume.

⊢

▦ OBV (21, BB2) - (26.35K):

∴ OBV remains flat, indicating market indecision;

∴ No divergence with price movement;

∴ No fresh buying pressure detected.

✴️ Conclusion: Neutral volume behavior - flow not favoring bulls.

⊢

🜎 Strategic Insight - Technical Oracle:

∴ The 1H chart of (BTC/USD) reveals a battlefield sealed in compression and anticipation.

The price is locked beneath converging exponential resistances (EMA9, EMA21, EMA50), forming a triple entrenchment zone. None have been broken - each rejection reinforces the stronghold;

∴ The Bollinger Bands constrict like a ritual binding. Volatility is silent - too silent - awaiting the spark. Yet no participant steps forward with force; volume remains suppressed, showing that neither side has declared war;

∴ Momentum oscillators (RSI, Stoch RSI) hint at an upward drift, but these are echoes, not proclamations;

∴ The MACD crossover is not a trumpet - it is a murmur in the underworld, below the zero line, concealed from the living trend;

∴ The OBV confirms it: no one is entering the field with conviction. This is not a battlefield - it is a waiting room;

✴️ And yet, amidst this silence, the Code speaks:

∴ If the zone between ($114.1K and $114.6K) is breached with volume and confirmation, this will mark the first true structural challenge to the prevailing descent. If it fails - the repique folds into another trap, devoured by gravity.

⊢

∫ II. On-Chain Intelligence - (Source: CryptoQuant):

▦ Exchange Inflow Total + EMA9 - (All Exchanges) - (6.2K BTC):

∴ The total Bitcoin flowing into centralized exchanges remains subdued, with no signs of aggressive sell-side pressure;

∴ The EMA9 confirms a flat, low-intensity behavior, distinct from capitulation spikes;

∴ The absence of major inflows during price compression implies a strategic wait state.

✴️ Conclusion: No incoming threat detected - institutions are not preparing to sell.

⊢

▦ Exchange Netflow Total + EMA9 - (All Exchanges) - (-644.5 BTC):

∴ Netflow remains negative, indicating Bitcoin is being withdrawn from exchanges rather than deposited;

∴ A negative netflow during a price downtrend reflects silent accumulation behavior or rotation into cold storage;

∴ The EMA9 shows a consistent drainage pattern, not episodic outflow.

✴️ Conclusion: This confirms defensive posture by large holders - supporting the technical compression.

⊢

▦ Spent Output Profit Ratio - (SOPR) + EMA9 - (1.003):

∴ The SOPR hovers just above 1.0, suggesting coins moved on-chain are being sold at or near cost basis;

∴ No signs of aggressive profit-taking or panic selling - rather, equilibrium behavior;

∴ The 9-period EMA confirms stability in this zone.

✴️ Conclusion: Market psychology is suspended - no one is winning or losing.

⊢

🜎 Strategic Insight - On-Chain Oracle:

∴ All on-chain signals reflect preparation without declaration;

∴ No pressure enters, and no blood leaves;

∴ The field is not empty - it is coiled;

∴ Withdrawals - (Netflow) - suggest protective accumulation;

∴ Low Inflow signals no new panic supply;

∴ SOPR near 1.0 says: (We're all waiting - and none are ahead);

∴ The technical compression in price is not betrayed by the chain;

∴ The silence is consistent;

∴ But silence is not peace - it is a veil.

✴️ Conclusion: If volume does not breach $114.6K - all remains a ghost echo beneath resistance.

If broken - the coil unwinds.

⊢

⧉ III. Contextvs Macro-Geopoliticvs - Interflux Economicvs - (Aug 02, 2025):

⟁ All movements of the market's breath are influenced not only by price, nor volume, but by the tides beyond the chart. Here begins the reading of the outer realm:

▦ EVENTVM I - (Wall Street Silent Accumulation) - (U.Today + Coindesk):

∴ Institutional actors are actively acquiring BTC and ETH through stealth operations - not OTC spikes, but ETF inflows and treasury balance shifts;

∴ Tom Lee (Bitmine/Fundstrat) confirms: Wall Street is not waiting for clarity, it is accumulating in silence;

∴ SEC’s Project Crypto and “in-kind” ETF mechanisms further reduce friction for institutional entry.

✴️ Conclusion: Price stagnation conceals power transfer - retail hesitates while funds consolidate control.

⊢

▦ EVENTVM II - (SEC’s “Project Crypto” Activation):

∴ Regulatory framing under “Project Crypto” unfolds in phases: transparency, compliance infrastructure, and institutional bridges;

∴ Despite its regulatory mask, the program facilitates liquidity channels into crypto markets;

∴ Legalized ETF's now serve as strategic vacuum points for Bitcoin supply.

✴️ Conclusion: What appears as regulation is in fact an alignment mechanism - structure over rebellion.

⊢

▦ EVENTVM III - (July ETF Flows (US) - $12.8B Inflow):

∴ U.S.-based crypto ETF's report record-breaking $12.8 billion inflows in July alone;

∴ Largest flows tracked in BlackRock, Fidelity, and VanEck vehicles - no signs of reversal;

∴ These flows occurred during price weakness, not during breakout - a signature of accumulation.

✴️ Conclusion: The public hesitates while custodians act - the veil of weakness conceals a new floor.

⊢

🜎 Strategic Interpretation - Macro Context:

∴ The charts compress. The flows retract;

∴ But the outer forces converge - Wall Street is no longer watching. It is acquiring;

∴ Through structure, silence, regulation, and engineering of access;

∴ This is no longer the market of peer-to-peer rebellion;

∴ This is the codification of power into institutional hands;

✴️ Conclusion: Price may appear static - but ownership is shifting.

⊢

𓂀 Stoic-Structural Interpretation:

∴ The chart does not lie. The data does not beg. The market does not care. Bitcoin remains trapped beneath resistance - not by force, but by inaction, by lack of intention, by silent contest;

∴ On-chain signals whisper: no one is selling in panic, no one is buying in euphoria;

∴ The macro realm reveals: the hands of power are moving beneath regulation, using silence as shield;

∴ Thus we see a paradox - the technical shell compresses, the on-chain bloodstream circulates without fever, the macro structure redefines.

⚖️ The Stoic mind recognizes this not as chaos, but as necessary stillness.

∴ The Arcane practitioner does not chase a move - he maps the pressure points and waits;

∴ He acts only when the veil thins;

∴ To act prematurely is to violate the structure;

∴ To wait blindly is to betray the will;

∴ The Stoic Arcane path demands this: know the boundary, seal the insight, then act - once - with clarity;

∴ At ($114.6K) the veil may part. If it does not - the silence continues.

⊢

✦ Structure Bearish.

▦ This is a bearish containment, not a breakdown.

∴ The market is not collapsing - it is being held below by absence of volume, of intention, of structural reversal;

∴ The EMA's are stacked above like iron gates;

∴ The price has failed to break $114.6K - the veil remains intact;

∴ On-chain data confirms neutrality, not optimism;

∴ Macro signals suggest accumulation by institutions - but not defense for the public.

⊢

🜎 Therefore:

∴ Technically Bearish - (structure not yet reversed);

∴ Tactically Neutral to Bearish - (fragile repique);

∴ Strategically in Transition Phase - (institutions buying beneath silence).

✴️ Conclusion: Until ($114.6K) is broken with conviction, the structure remains bearishly biased - wrapped in stillness.

⊢

⧉

· Cryptorvm Dominvs · MAGISTER ARCANVM · Vox Primordialis ·

⚜️ ⌬ - Silence precedes the next force. Structure is sacred - ⌬ ⚜️

⧉

⊢

Bitcoin Monthly - Structure Intact, Tension Rising?⊣

⟁ BTC/USD - BINANCE - (CHART: 1M) - (Aug 01, 2025).

◇ Analysis Price: $114,994.73.

⊣

⨀ I. Temporal Axis - Strategic Interval - (1M):

▦ EMA9 - ($100,069.29):

∴ Price holds 14.93% above this dynamic threshold, indicating momentum continuation but also positioning within an overheated range;

∴ The EMA9 structure is firmly ascending, representing the spine of the short-term bullish wave;

∴ July’s candle remains fully above the EMA without testing it - no wick beneath the line-marking dominance of buyers without internal correction.

✴️ Conclusion: The EMA9 governs the tempo of the current trend and stands untouched. Elevated, but structurally intact.

⊢

▦ EMA21 - ($81,990.60):

∴ A core support vector in the macrostructure, now 28.73% below price, suggesting strong bullish detachment from equilibrium;

∴ The line maintains a smooth, upward slope, echoing the recovery arc since late 2022’s structural low;

∴ Its alignment with the Bollinger Basis and Realized Cap forms a triad of reinforced technical stability.

✴️ Conclusion: EMA21 anchors the mid-term uptrend and guards the sanctum of continuation. No breach, no threat.

⊢

▦ EMA50 - ($47,983.10):

∴ Deep beneath price, resting at 58.27% below the current level - a relic of past cycles, yet still relevant as ancestral support;

∴ The EMA50 has curved upward subtly, signaling the final stage of long-term bear cycle recovery;

∴ Price has not interacted with this zone since late 2023, preserving its status as last-resort structural bedrock.

✴️ Conclusion: EMA50 serves as the sacred foundation of the macro trend - distant, but silently upholding the higher order.

⊢

▦ BB (21, 2) - ($81,990.60, $124,871.91, $39,109.29):

∴ The Basis of the bands aligns precisely with the EMA21, confirming equilibrium at ($81,990.60) - the mid-guardian of the macro cycle;

∴ The Upper Band is currently intersecting the candle body at ($124,871.91), marking an imminent volatility ceiling that may trigger either breakout or rejection;

∴ The Lower Band rests at ($39,109.29), far beneath the trend structure, now serving as a shadow chamber rather than an active field of probability.

✴️ Conclusion: The BB channels have opened widely, signaling expansion. With price nearing the upper rim, the phase is volatile but directional. The core remains intact through the EMA21 basis.

⊢

▦ Volume + EMA21 - (37.62B, 29.71B):

∴ Monthly volume for July reached $37.62 Billion, standing above the EMA21 of volume at $29.71 Billion, indicating an active expansion phase in market participation;

∴ This is the third consecutive monthly close above the EMA21, forming a sequence of rising activity that mirrors the price climb - suggesting healthy conviction behind the movement;

∴ The volume body also aligns with bullish momentum confirmation, as it occurs within an ascending slope of the EMA21, avoiding false divergence or exhaustion patterns.

✴️ Conclusion: Volume expansion supports the current trend. The flow is consistent, not speculative.

⊢

▦ RSI (21, 9) - (69.79, 64.71):

∴ The RSI main line stands at (69.79), nearing the classical overbought threshold but not breaching it, reflecting a strong yet controlled uptrend;