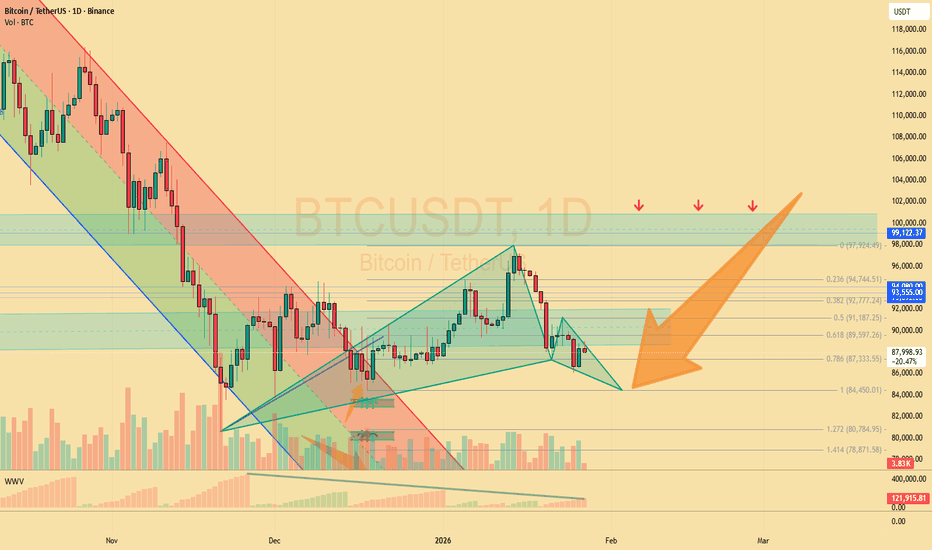

BTCUSD/BITCOIN DAY SELL PROJECTION 31.01.26BTCUSD / Bitcoin – Sell Projection (31-01-2026)

Bitcoin is currently trading in a bearish continuation phase, showing strong selling pressure.

Technical Analysis:

Price is moving under a descending trendline, confirming bearish momentum.

The previous uptrend line has been broken, signaling a trend shift.

An Evening Star candlestick pattern formed near resistance, indicating a bearish reversal.

Price has broken below the demand zone, confirming seller dominance.

Market structure shows a lower high and lower low, aligning with a bearish bias.

Trade Setup:

Sell Entry: At the neckline / retest zone

Stop Loss: Above the recent swing high

Take Profit: At the major support zone

BTCUSDC

Bitcoin Targeting 84.450 - watching for point D CompletionOn the Bitcoin daily chart, i am observing a very intersting harmonic pattern that is gaining more technical significance every day. Everything points to a developing GARTLEY FORMATION, where point B is already clearly visible, and following the BC bounce, the market is currently heading towards completing the entire structure. My key decision-makin area is the around 84.450 level, which is where point D of the formation sits. I have identified this zone based on significant reference points, such as the lower shadows from early December and the lows from December 18th. I'm now waiting for this setup to fully complete and I intend to trade it once the price precisely reaches that designated level.

BTC/USDT — Bearish Continuation After Pennant Breakdown✔️ The week closed with a bearish candle below previous closes.

Combined with last week’s structure, this confirms a bearish setup.

🟢 Hidden QE continues.

🟢 The longer conditions stay weak, the closer we get to relief — there are no stronger bullish arguments for now.

🟠 Fear has become the market’s baseline.

🟠 Gold at 5100 is historically overbought. A sharp correction looks likely — the only question is whether it becomes a trend reversal.

🔴 Significant ETF selling continues.

🔴 Negative cumulative delta: –$1.23B.

🔴 Geopolitical risk remains elevated. As the Greenland issue faded, escalation risks around Iran emerged. Markets are reacting lower.

🔴 Price broke down from a bearish pennant. The probability of sweeping lows below 80k has increased materially.

🧠 Markets can remain irrational longer than traders can remain solvent.

Equities currently look relatively rational.

Metals and commodities are reacting logically to geopolitics.

Crypto, however, absorbs all the irrationality — amplified.

A few more liquidation waves, and the reversal usually follows.

Selena | BTCUSD · 2H – Bullish Channel Near Premium ResistanceBINANCE:BTCUSD BITSTAMP:BTCUSD

The market delivered a strong impulsive rally from channel support, followed by minor consolidation. Current price is trading at premium levels, meaning upside continuation requires acceptance above resistance. Failure to hold above the breakout zone may result in a corrective pullback toward channel equilibrium.

Key Scenarios

✅ Bullish Case 🚀

Sustained acceptance above 97,400 – 97,900:

🎯 Target 1: 99,000

🎯 Target 2: 99,400 – 99,500 (upper supply & liquidity)

❌ Bearish Case 📉

Rejection from the resistance zone and breakdown below 95,800 may trigger a deeper correction toward:

🎯 93,800 – 92,500

🎯 Extended support near 90,300 (channel base)

Current Levels to Watch

Resistance 🔴: 97,900 – 99,400

Support 🟢: 95,800 – 93,800 – 90,300

⚠️ Disclaimer: This analysis is for educational purposes only. It is not financial advice.

BITCOIN CAN FAKE THIS OUT NOW!!!!!!!(be careful)Yello Paradisers! Enjoy the video!

And Paradisers! Keep in mind to trade only with a proper professional trading strategy. Wait for confirmations. Play with tactics. This is the only way you can be long-term profitable.

Remember, don’t trade without confirmations. Wait for them before creating a trade. Be disciplined, patient, and emotionally controlled. Only trade the highest probability setups with the greatest risk to reward ratio. This will ensure that you become a long-term profitable professional trader.

Don't be a gambler. Don't try to get rich quick. Make sure that your trading is professionally based on proper strategies and trade tactics.

Elite | BTCUSD · 4H – Distribution → Bearish Expansion RiskBITSTAMP:BTCUSD

Bitcoin has retraced into a critical resistance band following a prolonged consolidation phase. The current price action shows hesitation and rejection wicks near the supply zone, indicating weakening bullish strength. Unless price accepts and sustains above this area, the structure favors a rejection and expansion toward lower liquidity zones.

Key Scenarios

✅ Bullish Case → A strong 4H close and acceptance above 96,500 would invalidate the bearish setup and open the path toward higher continuation levels.

🎯 Upside Targets: 100,000 → 104,000

❌ Bearish Case → Failure to hold above the 94,800 – 96,400 resistance zone with rejection confirms distribution and continuation to the downside.

🎯 Downside Targets: 92,000 → 88,500 → 82,100

Current Levels to Watch

Resistance 🔴: 94,800 – 96,400

Support 🟢: 92,000 → 88,500 → 82,100

⚠️ Disclaimer: This analysis is for educational and informational purposes only. It is not financial advice. Please conduct your own research before trading.

Selena | BTCUSD – 30M | Demand Holding Inside Ascending StructurBITSTAMP:BTCUSD BINANCE:BTCUSD

Market Overview

After rejecting from the upper channel resistance, BTC corrected toward the mid-range demand area. The current reaction suggests buyers are defending this zone, keeping the higher-timeframe bullish structure intact unless the demand fails decisively.

Key Scenarios

✅ Bullish Case 🚀

If price continues to hold above the demand zone and respects the ascending trendline:

🎯 Target 1: 92,000

🎯 Target 2: 94,000

🎯 Target 3: 95,200

❌ Bearish Case 📉

A clean breakdown and close below 88,500 would invalidate the bullish structure and expose deeper downside toward the lower range lows.

Current Levels to Watch

Resistance 🔴: 92,000 – 94,000 – 95,200

Support 🟢: 89,000 – 88,500

⚠️ Disclaimer: This analysis is for educational and informational purposes only. It is not financial advice. Please conduct your own research before trading.

Bitcoin - bad day and week.CRYPTOCAP:BTC #Bitcoin

Looking at the chart, the S&P 500 has finally started correcting, and given everything going on in the world right now, it was long overdue.

The pattern looks extremely similar to the first quarter of 2025 when the S&P 500 tanked hard, and Bitcoin followed with a -18% to -22% correction.

Trade idea with a tight stop loss at $92,555.

Take profit at $70,555 (based on the Coinbase order book).

If you don't want to sit around waiting for Bitcoin to correct, keep an eye on gold, silver, platinum, and aluminum = they all have solid upside potential in the same 20-40% range.

Gold:

Silver:

Platinum:

Aluminum:

BTC or Gold? UpdateI first published this chart back on March 4, 2025. I got precisely 14 likes (including mine) haha! Since the top, the BTC/Gold ratio has collapsed by -47% now trading for only 21oz. of gold.

Even if you did not take the pairs trade and switched from BTC to Gold, you would have made a 124% profit today. A very handsome ROI.

At the most basic fundamental level, it would have shown you that BTC was just too damn expensive to think about getting involved in. Gold or something else was a much better VALUE option to take.

I won't go into where the price can go from here and what else to look for. That's for another time and place.

I’ve been posting a lot about understanding the value of X and using simple charts to see what the market is actually willing to pay for it. I want the TradingView community to approach trading and investing in a more meaningful way, more authentic, more raw, less complicated. Simple can be powerful. Beautiful, even.

But I need your help to grow.

If you enjoy the work:

👉 Drop a solid comment

Let’s push it to 6,000 and keep building a community grounded in raw truth, not hype.

BITCOIN WILL SURPRISE YOU WITH THIS MOVE!!! (warning)Yello Paradisers! Enjoy the video!

And Paradisers! Keep in mind to trade only with a proper professional trading strategy. Wait for confirmations. Play with tactics. This is the only way you can be long-term profitable.

Remember, don’t trade without confirmations. Wait for them before creating a trade. Be disciplined, patient, and emotionally controlled. Only trade the highest probability setups with the greatest risk to reward ratio. This will ensure that you become a long-term profitable professional trader.

Don't be a gambler. Don't try to get rich quick. Make sure that your trading is professionally based on proper strategies and trade tactics.

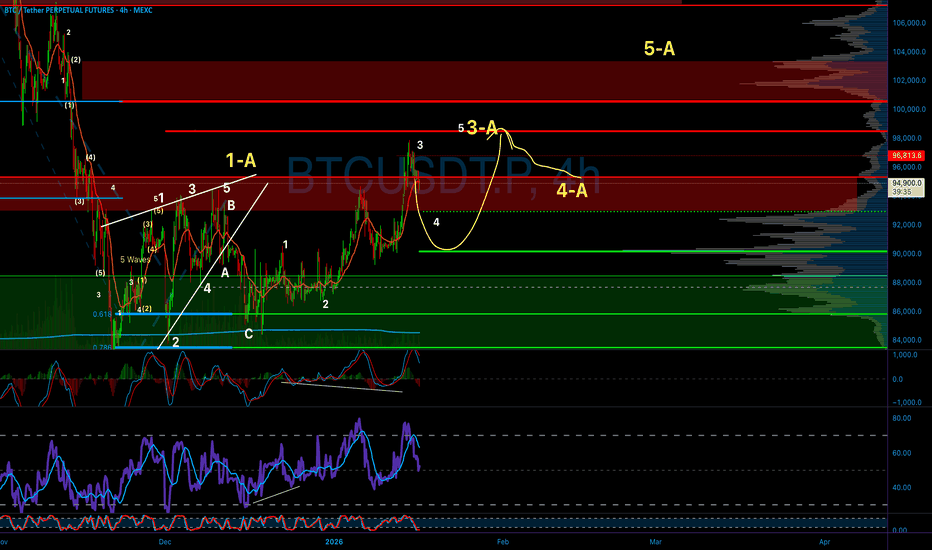

BTC – Higher Timeframe Structure in PlayBINANCE:BTCUSDT is compressing within a descending wedge / falling channel, and price is currently holding above the rising support trendline.

Key observations:

- Multiple rejections from the descending resistance, now nearing the apex

- Strong demand zone highlighted near trendline support

- Market structure suggests selling pressure is weakening

- This zone historically favors accumulation rather than panic

As long as BTC holds this support, any dip into the highlighted area can be considered a potential buying opportunity, with upside expansion likely once the descending trendline is decisively broken.

Patience is key here. Let the structure play out.

Not financial advice. Trade with proper risk management.

BTCUSDT – Inverse Head & Shoulders Target in SightHi!

BTC is forming a clean inverse head & shoulders inside a rising channel. The right shoulder is holding well, and the price is pushing toward the neckline.

Structure:

Inverse H&S: bullish continuation

Supported by an ascending channel

🎯 Target:

➡️ 91,100 – 91,200 (measured move of the pattern)

As long as the price stays above the channel support, the bullish setup remains valid. A clean push through the neckline should send the price to the target area.

BTC/USD 4H – Range Breakout Holding Above Key Support*Overall Market Structure

Trend: Short-term bullish continuation

BTC has broken out of a prior consolidation range and is making higher highs and higher lows.

Price is currently above a key support zone, suggesting strength.

📦 Key Zones & Levels

🟦 Major Support Zones

$89,750 – $91,350 (Primary Support)

Former resistance → now acting as support

Price is currently retesting this zone

Strong area for bullish defense

$85,800 – $87,600 (Secondary Support)

Previous accumulation range

If price loses the upper support, this is the next high-probability bounce zone

🎯 Resistance / Target

$98,200 (Target Point)

Clear horizontal resistance

Matches prior rejection / liquidity area

Logical upside target if support holds

📈 Bullish Scenario (High Probability)

Price holds above $89.7k

Consolidation or shallow pullback

Continuation move toward:

$94k → $98.2k

Break and close above $98.2k could open the door to $100k psychological resistance

📉 Bearish / Pullback Scenario

Loss of $89.7k support

Price likely revisits:

$87.6k

Then $85.8k

As long as price stays above $85.8k, the macro bullish structure remains intact

🧠 Market Behavior Insight

The clean breakout + retest pattern suggests smart money accumulation

Sharp rejection from support would confirm buyers in control

Choppy price inside the support zone = healthy consolidation, not weakness

✅ Summary

Bias: Bullish

Key Level to Watch: $89,750

Upside Target: $98 200

Invalidation: Clean 4H close below $85,800

Bitcoin Map: Make It Or Break ItThe main coin has been under pressure after a strong Bearish Divergence

appeared on the chart

www.tradingview.com(

Two bearish patterns formed consecutively after the all time high

The second one, a Bear Flag, was recently invalidated

Price has now reached the lower boundary of the yellow uptrend and bounced so far

This puts Bitcoin in a clear Make It Or Break It zone

Below is the updated big picture showing three possible paths for Bitcoin, from bearish to bullish

1) The orange circle marks the current consolidation, very similar to what we saw in 2022

This scenario suggests another leg down toward the next major support around $48k

2) The red zigzag outlines a potential reversal via a Head & Shoulders structure, where the Right Shoulder may still be forming

Price could first move toward the mid line before reversing lower

3) The final scenario represents an ultra bullish outcome, where price breaks above the mid line and pushes to the opposite side of the channel around $140–150k

btc await breakout before selling#BTCUSD price needs to retest back 91700 for new formation, now we await for retrace back 93200 or today high to sell. One time breakout there will reverse.

Sell from 93200, target 91700, SL 93600.

If price make a breakout above 93200 on m5 tf it's needs to reverse below 93150 or more but closure above 93200 on M5 tf means bullish is strong then await valid breakout on m15 to buy.

BTC/USD 4H – Range Consolidation with Demand Zone Targeting ResiMarket Structure

Overall structure:

BTC is moving sideways / range-bound after a prior decline.

Price is clearly respecting a range:

Resistance (range high): ~90,500 – 90,600 (marked as Target Point)

Support (range low / demand): ~85,000 – 86,000 (Demand Zone)

This indicates consolidation, not a confirmed trend yet.

2. Key Levels on the Chart

3.

🔴 Demand Zone (Support)

Zone: ~85,000 – 86,000

Multiple reactions here → strong institutional demand

Long lower wicks inside this zone suggest buyers defending aggressively

If price revisits this zone:

Bullish reaction = continuation of range / possible breakout attempt

Clean break below = bearish continuation toward lower liquidity

🟢 Resistance / Target Point

Level: ~90,500 – 90,600

Price has been rejected multiple times

This is a major liquidity & supply zone

A clean 4H close above this level would be a bullish breakout confirmation

3. Current Price Behavior

Price is currently mid-range (~87,900) → no-man’s land

This area has:

Low R:R for new trades

Choppy price action

The small zig-zag drawn suggests expected pullback first, likely into demand before expansion.

4. Trade Scenarios (Based on Chart Logic)

🟢 Bullish Scenario (Higher Probability if Demand Holds)

Price pulls back into 85k–86k demand

Shows reaction (long wicks / bullish candles)

Continuation toward:

TP1: 88,500

TP2: 90,500 (range high)

Risk-reward shown on chart (~1:3+) looks healthy.

🔴 Bearish Scenario (If Demand Fails)

Clean breakdown below ~85,000

Likely acceleration toward:

83,500

82,000 (next visible liquidity below)

This would invalidate the current long setup.

5. Bias Summary

Short-term: Neutral → slightly bullish

Mid-term: Range trading

Key confirmation:

Above 90.6k → bullish breakout

Below 85k → bearish continuation