Bitcoin - This chart is not bullish yet!🎲Bitcoin ( CRYPTO:BTCUSD ) still remains beairsh:

🔎Analysis summary:

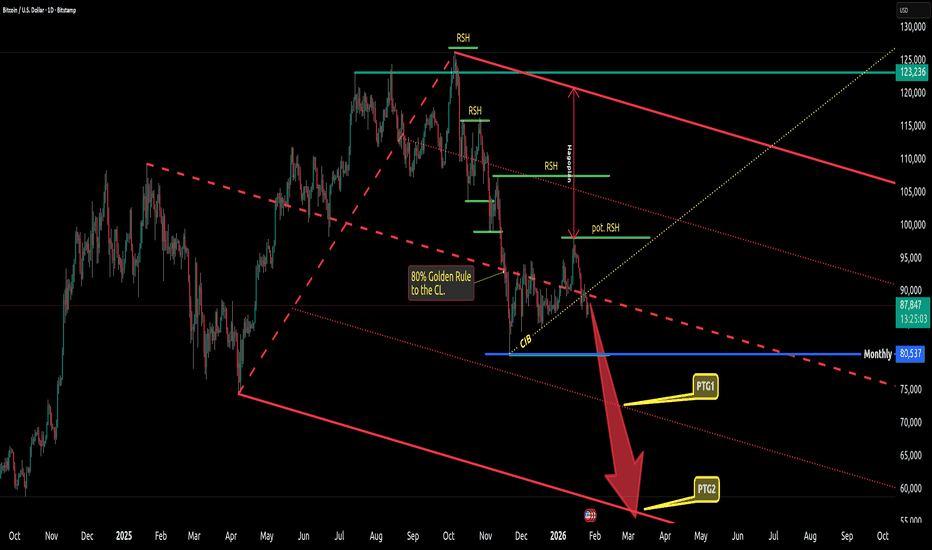

Bitcoin remains in an underlying bullish market. But looking at all the recent retests of resistance, it becomes quite likely that this is not the end of the bearmarket yet. Bitcoin will most likely create another move of -35% first in the next couple of weeks.

📝Levels to watch:

$65,000

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

Btcusdshort

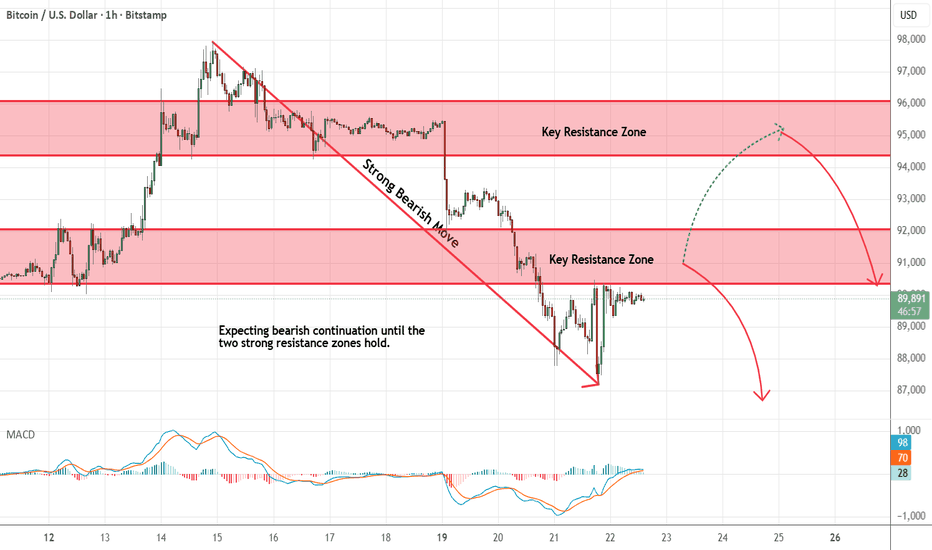

BTC/USD PROFESSIONAL CHART ANALYSISPrice Action Breakdown

The breakdown candle shows strong momentum and volume, suggesting institutional participation.

Post-breakdown, price formed a lower low → bearish structure confirmed.

The current price action is a pullback into supply / resistance, not a reversal.

Trade Idea Marked on the Chart

Entry Zone (Short)

Entry area around 89,600 – 90,200

This zone aligns with:

Previous support turned resistance

Breakdown level retest

Psychological 90k level

Targets

1st Target: ~87,350

Local support

Likely intraday bounce area

Final Target: ~85,600

Strong demand zone

Prior range base / liquidity pool

Key Levels

Resistance:

90,200 – 91,000 → strong rejection zone

Support:

87,300 (minor)

85,500–85,600 (major)

Bitcoin lost it's support completelyOh my…

Here we are again: opening and closing below the centerline. The CIB line is broken as well.

This is now the second time Bitcoin has lost the centerline support. Before that happened, it gave us a Hagopian - a large one.

I stand by my target of 60K, unless a miracle comes down from crypto heaven.

Happy new trading week y'all.

BTCUSD: Narrow range at highsBTCUSD is trading in an extremely narrow range at highs today, with clearly tiered core support and resistance levels. The trading strategy centers on waiting for a breakout with volume and following the trend, with strict position control enforced.

Core Support Levels:

Short-term (Intraday Core)88,500 USD (Strong Support): The lower boundary of the consolidation range, a critical bull-bear demarcation level for the short term. A break below this level requires volume confirmation to validate a weakening trend.

Medium-term (Daily Chart, Swing Reference)87,000 USD (Strong Support): The level of the previous consolidation platform, a key defensive position for swing bullish positions. A break below this level will open up further downside correction space.

Core Resistance Levels:

Short-term (Intraday Core)90,500 USD (Intraday Resistance): Today’s high, where pullbacks are likely to occur on rebounds and tests of this level.

Medium-term (Daily Chart, Swing Reference)93,000 USD (Strong Resistance): The upper boundary of the previous consolidation range, a key target for short-term rebounds. A breakout above this level will leave no significant technical resistance to the upside.

Bitcoin (BTC/USD) Update: Multiple Scenarios Still in PlayI am providing an update on my Bitcoin analysis as the cryptocurrency navigates a critical phase in its price development. Bitcoin is currently trading at 89,412 USD, and the technical scenarios I previously outlined remain relevant as the market continues to choose its path forward.

Current Market Position:

Since my last analysis, Bitcoin has experienced notable volatility and is currently in a consolidation phase. The price has pulled back from higher levels and is now testing important support zones. This price action is healthy and typical of Bitcoin's cyclical nature, where periods of rapid appreciation are followed by consolidation or correction phases.

The market is at a decision point where the next major move will likely determine the trajectory for the coming months. The technical levels I identified in my previous analysis continue to serve as key reference points for understanding potential future price action.

Scenario One: Direct Path Higher

The first scenario involves Bitcoin finding support at current levels and resuming its upward trajectory. In this path, the cryptocurrency would work its way through the resistance zones around 98,124 and potentially extend toward 111,119. This scenario assumes that current support levels hold firm and that buying interest emerges at these prices.

This more conservative scenario would represent a measured advance where Bitcoin respects key resistance levels and builds a solid foundation at each stage. The consolidation at current levels would serve as an accumulation phase before the next leg higher. If this scenario unfolds, traders can expect a gradual climb with intermittent pullbacks to retest support before continuing upward.

Scenario Two: Deeper Correction Before Major Rally

The second scenario, illustrated with dashed lines on the chart, presents a more volatile path. This alternative suggests that Bitcoin could experience a deeper correction toward the 53,312 level, marked as point C on the chart. Such a move would represent a significant retracement that tests major support structures and likely shakes out leveraged positions and weak holders.

However, this scenario is not bearish in the long-term context. Following this deeper correction, the projection shows a powerful recovery rally that could ultimately reach much higher levels, potentially toward the 150,000+ area indicated by the upward arrow. This path would create a classic shakeout pattern where the market tests resolve before embarking on the next major bull phase.

Key Technical Levels:

Several critical zones have been identified on the chart that will determine which scenario unfolds. The resistance areas around 98,124 and 111,119 represent supply zones from previous price action where sellers have historically emerged. Breaking above these levels with conviction would confirm strength and support the first scenario.

On the support side, the current price area around 89,000 is important for maintaining the bullish structure of the first scenario. Below that, the order blocks marked on the chart represent institutional interest zones. The most significant support in the second scenario sits at 53,312, which aligns with major historical levels and would represent a substantial discount from current prices.

The "BUY LEVEL for ever!!" notation on the left side of the chart highlights a long-term accumulation zone that has historically provided excellent entry points for patient investors. This area represents a floor where strong hands have consistently stepped in to purchase Bitcoin.

What Could Trigger Each Scenario:

Multiple factors could influence which path Bitcoin takes. Macroeconomic conditions, particularly interest rate policies from major central banks, significantly impact risk asset valuations including Bitcoin. Regulatory developments, either positive or negative, can create volatility and influence medium-term direction.

Market sentiment and leverage levels also play crucial roles. High leverage in the system increases the probability of the second scenario, as cascading liquidations can drive sharp moves. Conversely, strong institutional buying interest and positive news flow could support the first scenario's more gradual appreciation.

Fundamental Considerations:

Bitcoin's long-term value proposition remains intact regardless of short-term price fluctuations. The fixed supply of 21 million coins, increasing institutional adoption, and growing recognition as a store of value and inflation hedge provide fundamental support. The halving cycles continue to reduce new supply entering the market, creating favorable supply-demand dynamics over time.

Additionally, Bitcoin's role in the global financial system continues to evolve. More institutions are incorporating Bitcoin into their treasury strategies, and infrastructure supporting Bitcoin adoption continues to expand. These fundamental developments support higher valuations over extended time horizons.

Risk Management Approach:

Given the uncertainty between these two scenarios, proper risk management becomes paramount. Traders and investors should consider their time horizons and risk tolerance when positioning. For long-term holders, both scenarios ultimately point toward higher prices, making the timing of entry less critical than maintaining exposure.

For more active traders, identifying key invalidation levels for each scenario can help manage risk. A decisive break below major support would favor the second scenario, while sustained strength above resistance zones would confirm the first path.

Market Psychology:

Understanding market psychology helps contextualize these scenarios. Bitcoin markets are known for maximum pain trades where price moves in the direction that causes the most discomfort to the largest number of participants. The deeper correction in scenario two would certainly qualify as such a move, flushing out recent buyers and creating fear before the eventual recovery.

Conversely, a steady grind higher in scenario one would frustrate bears waiting for lower entry points. Both paths are psychologically challenging in different ways, which is typical of cryptocurrency markets.

Conclusion:

This updated analysis reaffirms that Bitcoin remains at a critical juncture with multiple viable paths forward. The technical framework provides clear levels to monitor, while fundamental factors support long-term appreciation regardless of near-term volatility. Patience, discipline, and adherence to a well-defined trading plan will be essential as this phase develops.

Whether Bitcoin takes the more direct path higher or experiences a deeper correction before rallying, the long-term outlook remains constructive for those with appropriate time horizons and risk management. The key is to remain flexible, monitor the identified levels closely, and adjust positioning as the market reveals its chosen path.

This analysis represents my personal technical assessment and interpretation of potential scenarios based on chart patterns and market structure. It does not constitute financial advice. Cryptocurrency investments carry substantial risk, and you should never invest more than you can afford to lose. Always conduct your own research and consider consulting with a financial advisor.

Bitcoin - Looking To Sell Pullbacks In The Short TermH1 - Strong bearish move.

No opposite signs.

Currently it looks like a pullback is happening.

Expecting bearish continuation until the two strong resistance zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------

Bitcoin - Creating another -30% correction!🤬Bitcoin ( CRYPTO:BTCUSD ) is still in a bearish market:

🔎Analysis summary:

Just a couple of months ago, Bitcoin created its expected bullmarket all time high. Since then, we already witnessed a correction of about -30%. But looking at higher timeframe structure, this correction is not over and we might see a final push of -30% lower soon.

📝Levels to watch:

$60,000

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

BTCUSD: Retracement from elevated levelsBTCUSD trended in a pattern of pulling back from highs and extending weak consolidation during the intraday session. Hit by the escalation of U.S.-EU tariff frictions, rising geopolitical risks and a sell-off in risk assets, the price plummeted sharply from the high of $95,500 and now hovers within the range of $87,000–$91,000. Market panic sentiment is mounting, bears hold the upper hand technically, and rebound momentum remains constrained.

Support Levels:

Short-term Strong Support: 87,000 (lower boundary of the intraday consolidation range, key support zone for rebounds)

Secondary Support: 86,000 (weekly moving average support, previous congestion zone)

Medium-term Support: 85,000 (defensive line for the medium-term trend)

Resistance Levels:

Short-term Strong Resistance: 91,000 (intraday rebound resistance level, bears’ defensive line)

Secondary Resistance: 92,000 (4-hour moving average resistance, key resistance for rebounds)

Medium-term Resistance: 95,000–96,000 (previous all-time high, a strong resistance zone dominated by bears)

Trading Strategy:

Buy 88000 - 88500

SL 87500

TP 90500 - 91000 - 92000

Sell 91000 - 91500

SL 92000

TP 89500 - 88000 - 87200

BTC medium to long term doesn't look goodHello traders,

BTC is following the classic market maker's sell off pattern a classic distribution.

Each bounce is corrective, not impulsive. 2025 top will not be reached again for now. Not before 2027 imo. If you bought high, welp...sell at any price jump to mitigate as much damage. This is how sell-off models work:

➡️ breakdown

➡️ relief rally to rebalance inefficiency

➡️ continuation lower

As long as price fails to reclaim previous value areas, rallies remain sell opportunities, not trend reversals. The path forward favors range-to-range repricing, with volatility expanding during markdown before a new base is formed.

Bias: Bearish until proven otherwise.

Good Luck!

All our analysis is shared with honesty, care, and real effort. If you find value in it, a like or comment means a lot to show your support🙏📊

BTCUSD: Pressure-driven pullback then low consolidationBTCUSD traded in a pattern of correcting under pressure followed by low-range consolidation and recovery today. During the Asian session, it came under selling pressure alongside other risk assets amid escalating U.S.-EU trade frictions, with bears dictating the near-term price action. The core trading range has shifted lower to 90,000–93,000.

Support Levels:

90,000–90,500 (Strong Support): Confluence of the intraday low and the EMA30 trend support level, which has attracted buying interest on multiple retests and serves as the core short-term defense zone for bulls. A breakdown below this level could trigger a further decline toward the 89,000–89,800 range.89,000–89,800 (Medium Support): Boasts robust support strength; a test of this range is likely to trigger a technical rebound.

Resistance Levels:

92,800–93,000 (Strong Resistance): Confluence of the upper boundary of the intraday consolidation range and short-term moving average resistance. Bulls have made multiple unsuccessful attempts to breach this level, which stands as the key defensive line for short-term bears. A decisive breakout could open up upside momentum toward the 93,500–94,000 range.93,500–94,000 (Medium Resistance): Confluence of the 0.618 Fibonacci retracement level and previous swing highs, exerting marked downward pressure and acting as a key target for the bulls’ medium-term rebound.

Trading Strategy:

Buy 90500 - 90800

SL 91000

TP 92000 - 92500 - 93000

Sell 92800 - 93000

SL 93500

TP 92000 - 92500 - 93000

Elise | BTCUSD – 30M | Bearish Continuation After DistributionBITSTAMP:BTCUSD

Bitcoin failed to hold above the mid-range supply and experienced aggressive selling, signaling strong seller control. The impulsive downside move was not retraced with strength, showing lack of bullish demand. Price is currently consolidating below the breakdown zone, which favors continuation lower rather than reversal. This is a textbook bearish continuation environment.

Key Scenarios

❌ Bearish Case 📉 (Primary Bias)

Rejection below 93,200 – 93,500

🎯 Target 1: 91,800 – 91,600

🎯 Target 2: 90,300 – 90,200

✅ Bullish Case 🚀 (Invalidation Only)

Strong acceptance above 95,600

Would negate bearish structure and signal range recovery

Current Levels to Watch

Resistance 🔴: 95,300 – 95,600

Support 🟢: 91,800, then 90,200

⚠️ Disclaimer: This analysis is for educational purposes only. It is not financial advice.

BTC/USD BEARISH SETUP TECHNICAL CHART ANALYSIS (2H)Key Resistance Zone

95,900 – 97,200

This zone aligns with:

Previous swing high

Supply zone

Upper boundary of the bearish structure

Rejection from this area confirms sellers are active.

Entry Zone

~95,300 – 95,400

Entry is valid after:

Weak bullish candles

Bearish rejection or breakdown from consolidation

This area acts as a retest of broken support.

Stop Loss

Above 97,200

Invalidates the bearish idea if price breaks and holds above resistance.

Targets

Target 1: 93,277

Previous support

Likely reaction zone (partial profit recommended)

Final Target: 91,100 – 91,000

Strong demand zone

Completion of bearish move

BTCUSD - The Shift to DistributionThe Narrative:

From Accumulation to Distribution Bitcoin has perfectly executed a Turtle Soup setup at the highs. After sweeping the CRTH (Candle Range Theory High), price wicked aggressively into the Weekly FVG and the Keylevel (~98k), clearing buy-side liquidity.

The Confluences:

SMT Divergence: The chart confirms SMT at the highs (likely against ETH), signaling exhaustion in the bullish momentum.

Fake Structure Shift (FMSS): The sharp rejection has created a FMSS (Fake Market Structure Shift), confirming the transition from the Manipulation phase to the Distribution phase.

Bearish Breaker (BB): Price has punched through support, establishing a Bearish Breaker. This zone now acts as the "line in the sand" for any retracements.

The Execution Plan:

We are now in the Expansion leg.

Entry: Watch for a retrace into the Bearish Breaker (BB) or the internal FVG for a high-probability short entry.

Target: The draw on liquidity is clear—the CRTL (Candle Range Theory Low) around 80k–82k.

"Structure is your map; liquidity is your fuel."

Greetings,

MrYounity

BTCUSD (45-Min) — Bearish Structure With Weak Momentum, WatchingMarket Structure

Price is forming lower highs, respecting a descending trendline (red dashed line).

This indicates a short-term bearish trend.

Current price is around 95,090, struggling to break above recent minor highs.

2. Price Action

Recent candles show small-bodied candles → lack of strong buying pressure.

Rejections near 95,200–95,300 suggest this area is acting as near-term resistance.

Downside pressure remains dominant unless the trendline is clearly broken.

3. RSI (14)

RSI is around 46, below the neutral 50 level.

This confirms bearish momentum, but not oversold.

No strong bullish divergence visible yet → sellers still have control.

4. AO (Awesome Oscillator)

AO is negative (-65) and flattening.

Indicates weak bearish momentum, not aggressive selling.

Often precedes either consolidation or a continuation move.

5. MACD

MACD lines are below zero and moving sideways.

Histogram is weak → momentum is bearish but slowing.

No bullish crossover yet, so trend reversal is not confirmed.

6. Key Levels

Resistance:

95,200 – 95,300

Trendline resistance above current price

Support:

94,650

94,400 (next major downside target if support breaks)

7. Bias & Scenarios

Bearish Bias: While below the descending trendline.

Bearish Continuation:

Break below 94,650 → possible move toward 94,400 or lower.

Bullish Invalidation:

Strong close above 95,300 + trendline break → shift toward 95,600–95,800.

: BTCUSD Daily Chart – Rising Trendline Holds, Momentum ImprovinPrice Structure

Bitcoin is trading around $95,000, respecting a rising trendline from the December lows.

The market has shifted from a strong downtrend (Nov) into a higher-low / higher-high structure, suggesting a short-term bullish recovery.

Price recently pulled back slightly after testing the $98k–$99k resistance zone, which is acting as near-term supply.

Trend & Support/Resistance

Key Support:

Trendline support: $92k–$93k

Horizontal support: $88k–$90k

Key Resistance:

Immediate: $98k–$99k

Major psychological level: $100k–$107k (next upside zone if breakout occurs)

RSI (14)

RSI is around 61–62, above the neutral 50 level.

This indicates bullish momentum without being overbought yet.

No clear bearish divergence at the moment; momentum remains constructive.

MACD

MACD lines are crossed bullish and flattening slightly.

Histogram remains positive, suggesting upside momentum is still present but losing some acceleration.

AO (Awesome Oscillator)

AO has turned positive (green bars), supporting the bullish continuation bias.

Momentum is improving compared to December.

Overall Bias

Short-term bias: Bullish to neutral

As long as price holds above the rising trendline, buyers remain in control.

A clean daily close above $99k could open the door to a $100k+ breakout.

A breakdown below $92k would weaken the bullish structure and signal a deeper pullback.

BTCUSD Intraday AnalysisBTCUSD traded in a pattern of retesting support followed by consolidation intraday, maintaining a high-range oscillation overall with the bullish structure remaining intact. The core intraday tussle focused on the 94,000–96,000 range, where profit-taking flows and support buying coexisted in balance.

Intraday Short-term Levels:

Support Levels:

94,200–94,300 (Strong Support): Confluence of intraday lows, short-term neckline and the 0.618 Fibonacci retracement level, with effective buying interest confirmed by multiple retests.

94,800–95,000 (Medium Support): Lower boundary of the consolidation range, acting as a secondary key defense zone for short-term bulls.

Resistance Levels:

95,700–95,800 (Strong Resistance): Confluence of intraday highs and previous swing highs; a decisive breakout requires significant volume confirmation.

96,000–96,500 (Medium Resistance): Psychological level plus previous congestion zone, exerting marked downward pressure on price action.

Trading Strategy:

Buy 94800 - 95000

SL 94000

TP 95500 - 96000

Sell 95800 - 95600

SL 96000

TP 95000 - 94500

BTCUSD – Hedge Fund Attention Zone |BTCUSD – Hedge Fund Attention Zone | Supply Test Could Trigger New Bearish Session

📊 Technical Structure (1D):

• Price has reached a well-defined supply zone

• Momentum is losing strength

• No strong acceptance above supply yet

• Market still trading below key breakout confirmation

⸻

🔴 Primary Scenario – Bearish Continuation (High Probability)

❌ If BTC fails to break and hold below the supply zone:

• This confirms institutional selling / hedge fund profit booking

• Market structure turns weak

• A new bearish session may begin

• Downside expansion opens towards lower demand zones (80K area)

This would align with distribution behavior, not accumulation.

⸻

🟢 Alternative Scenario – Bullish Only on Confirmation

✅ Bullish bias is valid only if:

• Strong daily close above the supply zone

• Clear acceptance + follow-through

• Volume supports breakout

📈 In that case, upside liquidity opens towards 107K+

⸻

⚠️ Trader’s Note (Premium Insight):

This is not a chase zone.

This is where smart money decides, and retail reacts late.

👉 Wait for confirmation, not prediction.

👉 Trade reaction, not expectation.

Risk management > Bias.

⸻

📌 Educational purpose only. Not financial advice.

#BTC #Bitcoin #BTCUSD #CryptoTrading #HedgeFunds #SmartMoneyConcepts #SupplyAndDemand #InstitutionalTrading #MarketStructure #PriceAction #TradingViewPremium

Bitcoin (BTC/USD) – Rising Wedge Breakdown Setup 3H TimeframeRising Wedge

Upper trendline: Acting as resistance

Lower trendline: Rising support

Price is now near the upper boundary, where rejection is common.

This structure typically resolves to the downside, especially after a strong uptrend.

Key Levels

Resistance

92,800 – 93,200 → wedge resistance + recent highs (entry zone marked)

94,500 – 95,000 → major rejection zone if price spikes higher

Support / Targets

1st Target: ~89,000

Previous structure support

Psychological level

Final Target: ~86,500 – 87,000

Strong horizontal demand

Prior consolidation base

The chart suggests a bearish bias: BTC is sitting near the suppoThe chart suggests a bearish bias: BTC is sitting near the support at 93,182 and the analyst expects a breakdown into the red target zone around 90,233.

A small‑scale idea would be to watch the 91,955 level (current price). If it breaks below the support, you could expect the price to chase the target at ~90,200. Conversely, if it bounces off 93,182, the move might stay in the range or test the seller zone again.

Elite | BTCUSD – 1H | Market Structure & Key Reaction ZoneBITSTAMP:BTCUSD COINBASE:BTCUSD

After a strong impulsive rally toward the 95,000 resistance region, BTCUSD entered a corrective phase. The current decline shows controlled selling pressure rather than panic distribution. Price is consolidating around a key demand zone, suggesting potential absorption of sell-side liquidity before the next directional move.

Key Scenarios

✅ Bullish Case 🚀

If price holds above the demand zone and shows acceptance, continuation targets remain:

🎯 92,500

🎯 94,800

🎯 96,000+

❌ Bearish Case 📉

A clean breakdown and sustained close below the demand zone would invalidate the bullish continuation and expose downside toward the lower range support.

Current Levels to Watch

Resistance 🔴: 92,500 – 95,000

Support 🟢: 89,000 – 90,000 (Key Demand Zone)

⚠️ Disclaimer: This analysis is for educational and informational purposes only. It is not financial advice. Please conduct your own research before trading.

BTCUSD (4H) – Bearish Structure After Distribution, ConsolidatioMarket Structure:

The chart shows a clear bearish shift after the January impulsive rally.

A BOS (Break of Structure) to the upside occurred first, followed by distribution and then a CHoCH (Change of Character) to the downside, confirming loss of bullish control.

Price is now making lower highs and lower lows, respecting a descending trendline, which reinforces bearish bias.

Key Levels & Zones:

Supply / Resistance:

~93,500–94,500 (previous highs & rejection zone)

~92,000–92,500 (mitigated area / prior structure)

Current Price: ~90,574, trading below key structure and trendline.

Demand / Support:

~87,800–88,500 (FVG / demand zone)

Below that, next liquidity rests near ~85,500.

Fair Value Gaps (FVG):

The lower FVG remains unfilled, acting as a bearish magnet if downside continuation occurs.

Upper FVGs have mostly been mitigated, reducing bullish fuel.

Bias & Scenarios:

Primary Bias: Bearish continuation while price remains below ~92,000.

Bearish Scenario:

Consolidation → breakdown → move toward 88,500 FVG, possibly extending to 85,500.

Invalidation / Bullish Shift:

Strong reclaim and close above 92,500–93,000, breaking the descending trendline, could open continuation toward 94,500+.

Trading Insight (ICT / SMC perspective):

Favor sell-on-rallies into premium zones and trendline resistance.

Wait for lower-timeframe CHoCH confirmation for entries.

Avoid longs unless structure flips decisively.