BTCUSDT Long: Holding Above Demand, Eyes on 91,800 RetestHello traders! Here’s a clear technical breakdown of BTCUSDT (3H) based on the current chart structure. BTCUSDT initially traded within a well-defined descending channel, where price consistently respected the lower highs and lower lows, confirming strong bearish pressure. This bearish structure eventually reached a key pivot point, from which price reversed and broke out of the descending channel to the upside. This breakout marked a structural shift and initiated a new ascending channel, signaling a transition from bearish to bullish control. Following this rejection, BTCUSDT moved into a range, highlighting temporary equilibrium between buyers and sellers. From this range, price attempted another push higher, once again testing the supply zone. The most recent price action shows rejection from the same area, reinforcing the importance of this resistance.

Currently, BTCUSDT is consolidating between clearly defined Demand (~89,600) and Supply (~91,800) zones after transitioning from a descending channel into an ascending structure. Despite the recent rejection from the supply zone, the overall market structure remains bullish as long as price holds above the key demand area.

My primary scenario: long bias remains valid as long as BTCUSDT holds above the 89,600 Demand Zone and no strong bearish acceptance occurs below this level. I expect buyers to continue defending the demand area, forming a higher low or showing a clear bullish reaction (long lower wicks, impulsive bounce, or an internal break of structure). Once buyer strength is confirmed, a move toward: TP1: a retest of the 91,800 Supply Zone. TP2: in case of a clean breakout and acceptance above 91,800, continuation toward new local highs. Manage your risk!

BTCUSDT

BTCUSDT: Bullish Structure Intact - Targeting 93K ResistanceHello everyone, here is my breakdown of the current BTCUSDT setup.

Market Analysis

BTCUSDT previously traded inside a well-defined consolidation range, where price moved sideways and volatility was compressed, showing balance between buyers and sellers. During this phase, multiple internal swings failed to establish a clear trend direction. Before the range, price experienced several fake breakouts near the upper highs, highlighting strong selling pressure inside the 93,000 Resistance Zone, where buyers repeatedly failed to gain acceptance.

Currently, price is trading above the support zone and consolidating below the key 93,000 Resistance, where selling pressure previously emerged. The structure remains constructive, with higher highs and higher lows still intact, suggesting the move is corrective rather than a full reversal.

My Scenario & Strategy

My primary scenario: as long as BTCUSDT holds above the 90,800 Support Zone and respects the rising trend line, the bullish bias remains valid. I expect price to consolidate and potentially push higher toward the 93,000 Resistance, which acts as the next major upside objective (TP1). A clean breakout and acceptance above the resistance zone would confirm bullish continuation and open the door for further upside expansion.

However, a decisive breakdown below support and the trend line would invalidate the long setup and signal a return to range behavior or deeper correction. For now, buyers remain in control while support holds.

That's the setup I'm tracking. Thank you for your attention, and always manage your risk.

Bitcoin Roadmap — Short-Term Bounce Before ContinuationAs I expected in the previous idea , Bitcoin ( BINANCE:BTCUSDT ) started to decline from the upper line of the ascending channel and reached its targets (full target).

Bitcoin is currently near the support zone($90,960-$89,220) around the lower line of the ascending channel and the Cumulative Long Liquidation Leverage($89,125-$88,670).

From an Elliott Wave perspective, it appears that Bitcoin has completed a zigzag corrective pattern at the top of the ascending channel, and we should now expect a corrective wave. However, this corrective wave might still include a temporary upward movement.

Considering the increasing tensions in global affairs, especially between Russia and the U.S. in recent hours, and the conditions of the S&P 500 index ( FX:SPX500 ), we can still expect a bearish trend for Bitcoin.

I expect that after a short-term bullish movement in the coming hours, Bitcoin will once again begin to decline. This decline could involve breaking the lower line of the ascending channel, the support zone, and filling the CME gap($88,720-$88,120).

We can first look for a long position, and if we find a trigger, we can take a short position.

What do you think about Bitcoin in the short term? I’d love to hear your thoughts!

Cumulative Long Liquidation Leverage: $87,125-$86,000

Cumulative Short Liquidation Leverage: $92,620-$92,040

Cumulative Short Liquidation Leverage: $94,630-$93,920

Cumulative Short Liquidation Leverage: $98,480-$96,970

💡 Please respect each other's opinions and express agreement or disagreement politely.

📌Bitcoin Analysis (BTCUSDT), 1-hour time frame.

🛑 Always set a Stop Loss(SL) for every position you open.

✅ This is just my idea; I’d love to see your thoughts too!

🔥 If you find it helpful, please BOOST this post and share it with your friends.

Bitcoin - Creating another -30% correction!🤬Bitcoin ( CRYPTO:BTCUSD ) is still in a bearish market:

🔎Analysis summary:

Just a couple of months ago, Bitcoin created its expected bullmarket all time high. Since then, we already witnessed a correction of about -30%. But looking at higher timeframe structure, this correction is not over and we might see a final push of -30% lower soon.

📝Levels to watch:

$60,000

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

BTC/USDT – Bearish Flag Breakdown | Bigger Correction Ahead?Bitcoin is currently forming a classic Bearish Flag pattern on the higher timeframe after a strong impulsive sell-off. This structure often signals trend continuation, and price action is now approaching a critical decision zone. BINANCE:BTCUSDT

📉 Strong impulse move down (flagpole) confirms bearish momentum

🏳️ Bearish flag consolidation forming inside rising channel

❌ Rejection near flag resistance increases breakdown probability

🔻 Breakdown could open the door toward:

🌍 Fundamental Perspective

1.Bitcoin sentiment is currently pressured by:

2.Profit-taking at higher levels after extended bullish runs

3.Macro uncertainty & risk-off sentiment across global markets

4.Interest rate expectations and USD strength impacting crypto flows

5.Reduced short-term liquidity entering the market

💰Take Profit (TP): At the Key Zone – major support area identified ahead.

🛑Stop Loss (SL): Above the pattern structure / recent swing high.

✅Psychological Discipline:

1️⃣Stick to plan – No Revenge Trades.

2️⃣Accept losing trades as part of the strategy.

3️⃣Risk only 1–2% of your account balance per trade.

✅ Support this analysis with a

LIKE 👍 | COMMENT 💬 | FOLLOW 🔔

It helps a lot & keeps the ideas coming!

⚠️ Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Forex trading involves high risk. Trade only with capital you can afford to lose and always do your own research.

BTC Intraday Long – Liquidity ContextContext

NY session delivered a clean liquidity manipulation.

Heavy long volumes were absorbed and are now acting as support.

Execution Zone

90,000 – 89,700

Looking for long opportunities only with confirmation and within system rules.

Targets

-90,850

-91,530

-92,200

Invalidation

Clear break and acceptance below 89,250 invalidates the idea.

Risk

Trade execution only within your own system. Risk management is mandatory.

Bitcoin Under Pressure - H1-Bearish Flag (10.01.2026)📝 Description 🔍 Setup (Market Structure) COINBASE:BTCUSD

BTC/USDT - Bitcoin is forming a classic Bearish Flag pattern on the H1 timeframe after a strong impulsive sell-off (flagpole). Price is consolidating upward in a tight channel while staying below EMA and Ichimoku cloud resistance, indicating weak bullish momentum and a high-probability continuation to the downside.

📌 Trade Plan - Bearish Bias 📉

Wait for a clear breakdown below the flag support

Aggressive entry: breakdown candle close

Conservative entry: breakdown + pullback (retest of flag support)

📍 Support & Resistance Levels

🔴 1st Support: 88,670

🔴 2nd Support (Measured Move Target): 87,620

🟢 Key Resistance: Bearish flag upper trendline / Cloud resistance

🎯 Target Projection: Height of flagpole applied from breakdown point

#Bitcoin #BTCUSDT #CryptoTrading #BearishFlag #PriceAction #TechnicalAnalysis #CryptoMarket #TradingView #Kabhi_TA_Trading

⚠️ Disclaimer

This analysis is for educational purposes only.

Crypto markets are highly volatile — always use proper risk management and trade with a stop-loss.

💬 Support the Idea 👍 Like if you see the bearish continuation

💬 Comment: Breakdown or Fakeout? 🔁 Share with traders watching Bitcoin

Bitcoin Top Is In — 35 Months Symmetry, Final Bottom TargetThey won't believe me even If I told them...

I’m going to state this plainly and accept that most people will dismiss it.

Bitcoin has already printed its cycle top.

Not because of vibes, not because of fear — but because the cycle math is complete.

The Core Thesis (Simple, Replicable, Unemotional)

The previous bear market bottom → bull market top duration this cycle is 35 months

That is identical to the last cycle

When cycles rhyme this precisely, it is not coincidence — it is structure

The market has already done what it historically does.

Time is the tell. Not price.

What Comes Next (The Downtrend Phase)

From here, Bitcoin enters its true bear market descent, not a “healthy pullback.”

My expectations:

Continued downside into Q4

Final capitulation window:

October (12 months) from the top

or December (14 months) from the top

I am specifically watching October 16th–26th as the most likely window for Bitcoin’s actual bottom.

That is where fear, disbelief, and exhaustion peak — not where hope lives.

Price Targets (No Sugarcoating)

$44k–$48k is a realistic and structurally sound bottom zone

Some argue Bitcoin will not break below $66k due to:

U.S. presidential election cycle effects

perceived structural support

That outcome is possible.

But my base case remains:

A deeper flush that convinces the majority that “Bitcoin is broken again.”

That is how every real bottom forms.

What Happens After the Bottom

Once the October/December bottom is in:

Bitcoin begins a parabolic recovery

Followed by exponential growth through 2027

New all-time highs projected:

Late 2027

or Early 2028

This is not bearish long-term.

This is cycle realism.

The Hard Truth (Why This Will Be Ignored)

Even if this thesis is 80–90% correct, most people will reject it.

Not because it’s wrong — but because:

Humans distrust information that comes too cleanly

They assume there must be a gimmick

They believe “nothing in life is free”

They fear being fooled more than they desire being early

I could give tomorrow’s winning lottery numbers to millions of people —

and I doubt most would even try to run them.

They’d ask:

“How could you possibly know that?”

And then do nothing.

That is human nature.

Final Note

This post is not asking for belief.

It’s documenting a cycle call — ahead of time.

If this plays out, it won’t feel impressive in hindsight.

It will feel obvious.

That’s how markets work.

Not financial advice. Just a timestamped thesis.

Elise | BTCUSD – 30M | HTF Demand Reaction SetupBITSTAMP:BTCUSD

After a sustained sell-off, price tapped into HTF demand and produced a strong impulsive reaction followed by consolidation. The market is currently compressing above demand, suggesting sellers are losing momentum. A higher low above the demand zone would signal a potential corrective bullish move.

Key Scenarios

✅ Bullish Case 🚀

If price holds above the HTF demand zone and breaks minor intraday structure:

🎯 Target 1: 91,200

🎯 Target 2: 92,000

🎯 Target 3: 92,800

❌ Bearish Case 📉

A clean breakdown and close below 88,900 would invalidate the bullish idea and expose lower liquidity levels.

Current Levels to Watch

Resistance 🔴: 91,200 – 92,000 – 92,800

Support 🟢: 89,600 – 88,900

⚠️ Disclaimer: This analysis is for educational and informational purposes only. It is not financial advice. Please conduct your own research before trading.

BTCUSDT: Pullback Toward Demand ZoneHi!

Bitcoin is showing short-term weakness after failing to hold above the recent high. Price is currently trading below the local resistance area, suggesting a corrective pullback rather than continuation.

The highlighted demand zone around 90.4K–90.9K is a key area to watch. This level previously acted as resistance and was later flipped into support.

Key Levels:

• Resistance: 93.1K–94.4K

• Demand / Support: 90.4K–90.9K

Downside Target:

• 90,500 (primary demand zone)

As long as price remains below resistance, a deeper retracement into demand is likely. Reaction at support will determine the next directional move.

Elise | BTCUSD – M30 | Bearish Structure ContinuationBITSTAMP:BTCUSD

After a strong impulsive rally from the accumulation zone, BTC failed to hold higher structure and printed a decisive bearish continuation move. The breakdown was followed by weak retracements, indicating a lack of strong buying interest. Current price action suggests distribution within the channel rather than reversal, with sell-side liquidity still exposed below recent lows.

Key Scenarios

❌ Bearish Case 📉 (Primary)

– Rejection from descending channel resistance

– Continuation below recent structure lows

🎯 Target 1: 90,500

🎯 Target 2: 89,200

🎯 Target 3: Sell-side liquidity below range lows

✅ Bullish Case 🚀 (Conditional Only)

– Strong impulsive move with acceptance above the last lower high

– 30M close above channel resistance required

🎯 Upside targets valid only after structure reclaim

Current Levels to Watch

Resistance 🔴: Descending channel upper boundary

Support 🟢: Range low / sell-side liquidity zone

⚠️ Disclaimer: This analysis is for educational purposes only. It is not financial advice. Please conduct your own research before trading.

Market Structure ExplainedHello, traders! 😎

Understanding market structure is key to consistent profits. If you’re not paying attention to how price moves, you’re essentially flying blind. Let’s break it down to help you navigate the market like a pro.

Price Structure: The Backbone of Price Action

Market structure is how price behaves over time, forming the foundation for all trading decisions. It's based on a few core principles: higher highs and higher lows in an uptrend, and lower highs and lower lows in a downtrend. This structure is confirmed through price action and key indicators like moving averages, support and resistance levels, and trendlines.

In an uptrend, the price pushes higher with each rally, creating higher highs and higher lows. This signals bullish momentum, and traders look for breakouts above resistance levels or retest entries at support. Tools like the 50-period moving average (MA) or EMA can act as dynamic support, confirming trend strength. The RSI (Relative Strength Index) helps confirm that the trend is not overbought and has room to run.

In a downtrend, lower highs and lower lows show that sellers are in control. Price breaks through support levels, and corrective rallies face resistance at lower highs. Traders look for retracements, often at key Fibonacci levels, before continuing lower. The MACD (Moving Average Convergence Divergence) confirms the bearish momentum when both the MACD and signal lines trend downward.

Trend vs. Range: The Battle of Market Phases

Trends occur when price moves clearly in one direction, either up or down. Traders love trends because they offer opportunities to ride the price movement for profits. However, sometimes the market enters a range or consolidation phase, where price bounces between support and resistance with no clear direction. In this phase, price moves in an impulse (fast movement) and correction (pullback) pattern, before potentially resuming the trend.

Trend Structure: Knowing When the Market is Shifting

In an uptrend, price makes higher highs and higher lows. When this structure changes—higher highs turn to lower highs and higher lows disappear—that’s a sign of a possible reversal or consolidation.

In a range, price consolidates and waits for the next move. A breakout from the range signals a shift in structure and could lead to the start of a new trend.

Understanding market behavior, whether in a trend or range, is crucial. Recognizing when the market is trending or consolidating helps you navigate price action effectively. Stick to the structure, and you'll stay on track through market moves 🔄

That said, markets are unpredictable. Always rely on your judgment, conduct thorough research, and have a solid plan in place before making any decisions. Make sure to do your homework and be prepared 🙂↕️

Elise | BTCUSD – 30M | Bearish Structure ContinuationBITSTAMP:BTCUSD

After tapping into the HTF supply region, Bitcoin showed strong bearish displacement followed by a series of weak corrective pullbacks. Each pullback has failed below prior resistance, indicating continuation rather than reversal. The current price action suggests distribution and trend continuation toward lower liquidity levels.

Key Scenarios

❌ Bearish Continuation 📉

As long as price remains below the bearish structure trendline and HTF supply, continuation targets remain active:

🎯 88,800

🎯 87,600

🎯 86,000 (extended liquidity sweep)

✅ Bullish Invalidation 🚫

A strong break and close above the bearish trendline with acceptance would invalidate the short bias and shift structure.

Current Levels to Watch

Resistance 🔴: 90,800 – 92,000 (Structure Resistance)

Support 🟢: 88,800 – 87,600 (Liquidity Target Zone)

⚠️ Disclaimer: This analysis is for educational and informational purposes only. It is not financial advice. Please conduct your own research before trading.

BTC: Looking for one last leg down toward 78k?The General Outlook It looks like Bitcoin might be in the final stages of this corrective move. Before we see a real reversal, the market likely needs to complete the structure with one more push lower.

There are two main ways this could play out. We might see a direct, sharp drop where support levels break relatively quickly. Alternatively, it could turn into a "diagonal" style move—this would be choppier and slower, with lots of overlapping bounces, but the destination would likely be the same.

The Key Level The bears seem to be in control as long as the price stays below the recent high of $94,800. If we get a sustained break above that level, this immediate bearish setup is probably invalid.

First Target: Watch for a reaction around $85,500.

Second Target: A sweep of the lows near $80,300.

Final Target: The move could potentially finish somewhere in the $76,000 – $78,000 zone.

Just my thoughts on the chart

Bitcoin CME Gaps (1H)Bitcoin currently has two unfilled CME gaps located in the lower price regions. Historically, CME gaps tend to act as strong magnets for price, as Bitcoin often revisits these areas to fill the gaps before resuming its primary trend. While this behavior is not guaranteed, it has occurred frequently enough to be considered an important factor in technical analysis.

At the moment, the first CME gap is positioned in the 91K–90K zone, which represents a relatively shallow pullback area and could be tested during a normal corrective move. If selling pressure increases or the market enters a deeper retracement phase, the second CME gap located around 88K may come into play as a stronger downside target.

These levels should be monitored closely, as price reactions around CME gaps can provide valuable insight into market strength, liquidity absorption, and potential trend continuation. A clean fill followed by strong bullish confirmation could indicate that the market is preparing for the next leg higher. Conversely, failure to reclaim these levels may suggest extended consolidation or deeper correction.

As always, CME gaps should be analyzed in confluence with other technical tools such as market structure, support and resistance zones, volume behavior, and momentum indicators. They are not standalone signals, but when combined with broader market context, they can significantly improve trade planning and risk management.

If you have a coin or altcoin you want analyzed, first hit the like button and then comment its name so I can review it for you.

This is not a trade setup, as it has no precise stop-loss, stop, or target. I do not publish my trade setups here.

BTC/USDT 4H Chart📈 Trend

Main trend: up

Local trend: downward correction

The uptrend line (black) has still not been broken → this is crucial.

🟩 Support Zones

The most important levels you have well-marked:

91,120 – 91,400

Current price reaction

Local support + mid-range

Decisive in the short term

90,120

Very important zone

Overlaps with:

previous consolidation

potential retest of the trendline

Loss = deepening correction

88,843

Strong structural support

If price reaches here → high probability of bounce

87,235

Bulls' last line of defense

Break = structure changes to bearish

🔴 Resistance

91,400 – 91,500

Nearest resistance

Here we'll see if the uptrend has fuel

92,718

Very important level

Return above = bulls regain control

94 834

High / supply zone

Unlikely to be broken on the first try without an impulse.

📊 Stochastic RSI

Was heavily oversold.

Now bouncing from the lows → a short-term bounce signal.

Note: in an uptrend, the Stochastic RSI often gives false short signals.

➡️ Supports a corrective bounce scenario, not a dump.

🧠 Scenarios

🟢 Baseline scenario (more likely)

Defense 90-91k

Bounce → test 91.5k → 92.7k

Consolidation and decision

🔴 Negative scenario

Break 90 120

Down to 88.8k

Reaction there (or fake breakdown)

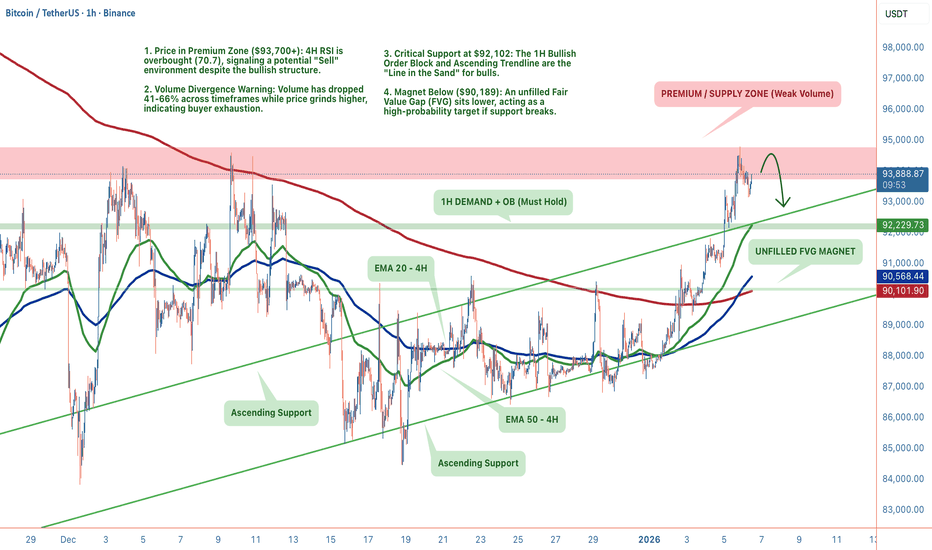

BTC: The Premium Zone Trap (4H vs 1H)Bitcoin is at a decisive junction. We are trading in the Premium Zone ($93,700+) with a clear conflict between timeframes. The 4H screams exhaustion (RSI 70.7 + Low Volume), while the 1H structure remains stubbornly bullish, holding above the $92,102 demand zone. The structure is intact, but the conviction is missing.

1. THE TECHNICAL REALITY (4H + 1H)

📉 We are seeing a divergence between price action and momentum:

• The Trap (4H): Price is in the Premium sell zone. RSI is overbought (70.7) and volume is down 41% at these highs. This is classic "divergence" behavior, price grinding up while participation drops.

• The Floor (1H): Despite the macro exhaustion, the 1H timeframe has cooled off (RSI 42.9) and is respecting the Ascending Support Trendline ($92,306).

• The Magnet: We have a bearish OB supply overhead at $94,760, but a juicy unfilled FVG sitting below at $90,189. Price hates leaving these gaps open.

2. THE CONFLICT: MOMENTUM VS. STRUCTURE ⚖️

Bearish Case (The Exhaustion):

• Volume has collapsed 66% on the 1H timeframe.

• MACD is printing bearish divergence on the 4H.

• 14.1% wick rejection at the $94,760 local top suggests sellers are active.

Bullish Case (The Trend):

• CHoCH and BOS are both confirmed bullish.

• Price is holding above all major EMAs (20/50/200).

• Buyers are defending the $92,102 Order Block.

3. THE TRADE SETUP 🎯

We play the reaction, not the prediction. Here are the two probability paths:

🔴 Scenario A: The Premium Rejection (Higher Probability) If volume fails to return, gravity takes over.

• Trigger: Loss of the 1H support trendline ($92,300)

• Target 1: $90,189 (Filling the 4H FVG)

• Target 2: $86,760 (Major Swing Low)

• Invalidation: 4H Close above $94,760

🟢 Scenario B: The Demand Reclaim If the 1H structure holds, we squeeze the shorts.

• Trigger: Bounce from $92,102 (Bullish OB) with increasing volume

• Target: $94,760 (Range High) → $96,000 Extension

• Stop: Tight below $91,900

MY VERDICT Short-term structure is bullish, but the "fuel" (volume) is empty. I am leaning 68% bearish (expecting a sweep of the $90k FVG) unless we see a massive volume injection above $94k. Patience is the play, let the $92,100 level dictate the next move.

MARKET ROTATION WATCHLIST

📋 While Bitcoin consolidates in this premium zone, liquidity often rotates into specific altcoin setups that are lagging behind.

I am updating my watchlist today for coins that are showing cleaner structure than BTC.

Will ZCash go Down?What Zcash (ZEC) Actually Is:

Zcash is a privacy-focused cryptocurrency that was created in 2016 as an alternative to Bitcoin.

Kriptomat

Key features: Like Bitcoin, it’s a digital currency with a limited supply and proof-of-work consensus.

The major difference is optional privacy:

ZEC uses zero-knowledge proofs (zk-SNARKs) to allow private, encrypted transactions where the sender, receiver, and amounts are hidden. Users can choose shielded (private) or transparent transactions depending on their needs. So its value proposition is privacy, which appeals to people who want more confidentiality than Bitcoin’s public ledger offers.

Why Zcash Has Surged Recently

In 2025, Zcash has had strong rallies, even outperforming many other cryptos:

Possible reasons for the recent run:

1) Privacy coin demand:

Privacy coins like Zcash and Monero have outpaced most sectors in 2025. Rising interest in digital privacy and financial confidentiality boosts demand for privacy-focused tokens.

2) Technical breakout and adoption:

Innovations (e.g., protocols like Zashi CrossPay expanding use cases) can push utility and liquidity.

3) Market rotation:

Some analysts believe traders rotate capital from Bitcoin into altcoins like ZEC when BTC is tiring or consolidating, which can lift ZEC even when BTC isn’t rising strongly.

Why Zcash Can Go Down

1) Correlation with Bitcoin:

Even if ZEC can decouple, crypto markets still broadly move together. In periods when Bitcoin rallies strongly, many altcoins also rise because market sentiment improves. Conversely, if BTC drops to $70–60k or weaker conditions return, liquidity often shifts back to BTC, and many altcoins, including ZEC, may fall too.

2) Negative or weak correlation is fragile:

Some observations show Zcash can have inverse or low correlation with Bitcoin, meaning sometimes it rises when BTC falls. But that relationship is not stable, and if the overall market environment turns bearish again, that correlation can weaken or reverse.

3) Profit-taking and volatility:

After strong rallies, traders often take profits, which can cause sharp corrections. Liquidity is relatively thinner than major assets, so price swings can be abrupt.

4) Regulatory risk:

Privacy coins face increased regulatory scrutiny, which can dampen demand if governments restrict or delist privacy-focused tokens.

How Bitcoin (BTC) Affects Zcash

Bitcoin is still the dominant market driver in crypto:

Many altcoins historically move with BTC’s direction, up in bull markets and down in bear markets.

Even if ZEC occasionally outperforms or diverges, prolonged declines in BTC often reduce overall crypto risk appetite, negatively impacting altcoins. So if BTC falls significantly (e.g., to $70–60k), ZEC may face selling pressure too, even if it has its own narrative, because: investors tend to exit riskier assets first; funds rotate back into BTC as the “safe crypto”; liquidity for smaller assets dries up faster

Disclaimer:

This analysis is for informational and educational purposes only and does not constitute financial advice, investment recommendation, or an offer to buy or sell any securities. Asset prices, valuations, and performance metrics are subject to change and may be outdated. Always conduct your own due diligence and consult with a licensed financial advisor before making investment decisions. The information presented may contain inaccuracies and should not be solely relied upon for financial decisions. I am not a licensed financial advisor or professional trader. I am not personally liable for your own losses; this is not financial advice.

BTCUSDT Holding Higher Lows, $94,700 Resistance in FocusHello traders! Here’s my technical outlook on BTCUSDT (3H) based on the current chart structure. BTCUSDT initially experienced a strong sell-off, marked by aggressive bearish momentum as price dropped from higher levels. After this decline, the market found a base and started to grow, transitioning into an ascending channel. This phase showed a clear shift in control from sellers to buyers, supported by a rising support line and multiple bullish reactions along the channel. However, as price approached the upper boundary of the channel and the Seller Zone, upside momentum began to slow. During this phase, BTC formed several fake breakouts and failed attempts to hold above resistance, signaling strong selling pressure near the highs. Price then broke back below short-term structure and entered a consolidation phase, forming a clear range. This range reflected temporary balance, with buyers defending the lower boundary while sellers capped the upside. Recently, BTC broke out from the range to the upside and reclaimed the Buyer Zone, confirming renewed bullish intent. Price is now trading above key support around 91,500–92,000 and is respecting the rising support line, indicating that buyers are actively defending pullbacks. The current move is pushing price back toward the Resistance Level and Seller Zone around 94,700, where a test is expected. My scenario: as long as BTCUSDT holds above the Buyer Zone and the rising support line, the bullish bias remains intact. I expect price to retest the 94,700 Resistance, with TP1 aligned near this level. A clean breakout and acceptance above resistance would confirm bullish continuation and open the door for higher targets. However, a strong rejection from the Seller Zone followed by a breakdown below support would invalidate the bullish scenario and suggest a deeper corrective move. Please share this idea with your friends and click Boost 🚀

Bitcoin (BTCUSD) – Bullish Breakout with Pullback to Demand (4H)Market Structure

Overall bias: Bullish continuation

Price formed a strong accumulation base inside the red demand zone (≈ 86,500–89,000).

A clean breakout from the range led to a rising price channel, confirming trend strength.

Current move is a healthy pullback, not a breakdown.

🔑 Key Zones & Levels

🟥 Demand / Support Zone

Major demand: 86,500 – 89,000

This zone acted as:

Accumulation

Breakout base

Strong institutional demand area

As long as price holds above ~89K, bullish structure remains intact.

🔄 Pullback Area

Current price retraced from the channel high (~94–95K).

Pullback is corrective, forming potential higher low.

Ideal reaction zone: 90,000 – 92,000

⬆️ Resistance / Target

Primary target: 95,000 – 95,200

Previous high

Marked “TARGET POINT” on your chart

Break and hold above this level → opens room for 97K+

🎯 Trade Scenario (Based on Your Setup)

Bullish Scenario (Primary Bias)

Price respects 90K–89K

Bullish confirmation (strong 4H close, rejection wick, higher low)

Continuation toward 95K

Bearish Scenario (Invalidation)

Clean break and 4H close below 86,500

Would indicate:

Failed breakout

Deeper correction toward 83K–84K

📊 Price Action Insights

Higher highs & higher lows remain intact.

No strong bearish engulfing or distribution signals.

Volume expansion on breakout supports continuation bias.

🧠 Summary

Trend: Bullish

Phase: Pullback after breakout

Key decision zone: 89K–90K

Upside target: 95K+

Bias: Buy pullbacks while above demand