IMPORTANT BITCOIN ALERT! TRAP BEFORE THE CRASH? Jan 30 2026!!BTC IMPORTANT ALERT! Jan 29 2026.

I know you've been waiting for this update, but there's been a new development in the chart.

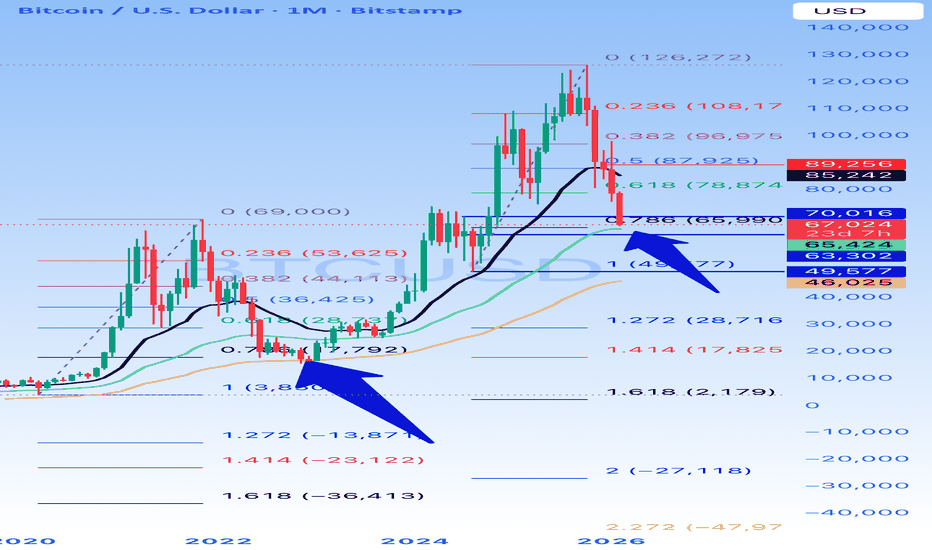

Data from 2014 to 2026, presented across multiple charts, suggests that we are approaching a major market crash. That said, there may still be short-term rallies in altcoins, while Bitcoin is likely to remain relatively muted. This final move could turn out to be the ultimate bull trap.

This is purely based on fractal analysis; it’s not a personal bias.

I expect Bitcoin to form a bottom somewhere between $44k and $54k over the coming months. I’ll be sharing a more detailed chart soon, including the projected timelines for potential bottoms in both BTC and altcoins.

I plan to position on the bearish side once the final bull trap is in. Until then, we will continue scalping on lower timeframes, primarily from the short side.

We will make money even if the market crashes.

This cycle hasn’t been the bull run we hoped for; it’s been brutal. But what defines us is that we never give up. We adapt, we fight back, and we keep going.

Hope this gets the point across.

In short, BTC could still push as high as $100k in the coming weeks as part of a final bull trap, even though the overall structure looks extremely ugly.

Please hit the like button if you like it.

Let me know what you think in the comments.

Thank you

#PEACE

Btcusdtanalysis

BTCCRASH - Bottom FishingBTCUSD – Will history repeat? (Short report)

Context from the chart (Monthly):

• BTC previously topped, corrected to the 0.786 Fibonacci retracement, then based and resumed a strong uptrend.

• Current price (~67k) is again pulling back from a major high (~126k) and is now approaching the same 0.786 Fib zone (~65–66k), which you highlighted.

• Long-term moving averages (black/green) are still rising, suggesting the broader bull structure is not yet broken.

Historical rhyme:

• In the prior cycle, BTC:

1. Topped → sharp correction

2. Found support near 0.786 Fib + rising MA

3. Consolidated for several months

4. Expanded into a new impulsive leg higher

• The current structure closely resembles that pattern, especially in candle behavior and MA positioning.

Key levels to watch:

• Critical support: 65k–63k (0.786 Fib + horizontal support)

• Bullish confirmation: Monthly close back above 70k

• Invalidation: Sustained monthly close below ~60k, which opens risk toward ~50k–46k

Conclusion:

• Yes, history can repeat — but only if the 65k zone holds on a monthly close.

• This area is a decision point, not a guaranteed bounce.

• If defended, odds favor a multi-month consolidation followed by continuation higher.

• If lost, BTC likely enters a deeper corrective phase, not an immediate new bull leg.

#BITCOIN: Still Expecting Price To Touch $60K To $65K! Bitcoin is likely to drop further down before we could see a strong bullish move taking price to all time high. This is our view only and it is not an guaranteed move; once price touch our reversal zone then we could see price going back to all time high. Good luck and trade safe!

Team Setupsfx_

Like And Comment Our Ideas For More Such Educational content! 📊🚀

BITCOIN: As Expected Price Is Dropping, Waiting To Come at 60K?Dear Traders,

As anticipated, the price is reversing from $98,000 and may experience a significant drop towards $60,000. The $60,000 area remains strong and attracts swing buyers. Our recommendation is to wait for the price to break through this trading range pattern. A strong breakthrough would indicate a clear price pattern.

If you like our idea, please like and comment for more.

Team SetupsFX_

Coinranger|BTCUSDT. Moving to H16 aim level🔥News

🔹JOLTS employment report at 18:00 UTC+3

🔥BTC

🔹Still moving within Monday's forecast. Let's see what's on the screens:

1️⃣ Dynamic levels above are 72600 and its potential extension to 75300.

2️⃣ 68470 remains actual below. Anything could happen when it gets there.

For now, I'm waiting for the H16 level to be reached.

---------------

Share your thoughts in the comments!

BTCUSD 15M – Bearish Continuation From ResistanceMarket Structure

Strong sell-off followed by weak consolidation

Price rejected from resistance / supply zone

No bullish displacement → sellers still in control

📐 Key Levels

Sell Zone / Entry: 75,400 – 75,500 (previous support → resistance)

Stop Loss: Above 76,550 – 76,580 (structure invalidation)

Target: 73,150 – 73,100 (liquidity + demand zone)

🧠 Trade Expectation

Possible pullback toward resistance for sell confirmation

Rejection from entry zone favors bearish continuation

Increased volatility expected after rejection

⚠️ Invalidation

Strong 15M close above 76,580 would invalidate the bearish setup and shift bias to neutral/bullish.

Coinranger|BTCUSDT. Reversal or continued decline?🔥News

🔹Today, the US votes on the government budget.

🔹US manufacturing PMI at 18:00 UTC+3.

🔥BTC

🔹A mega-drop to 74600. What's next:

1️⃣ Above there is the level at 79500, but it's dynamic. And until there's some kind of movement stop, there's nothing more to say. Keep an eye on your moving averages.

2️⃣ Below, a full set of waves with extensions on the h4 timeframe has already been completed. A reversal attempt could occur around the current level. There are 72900 and 71050 a bit lower on the hourly timeframe – a complete set of three consecutive downward sets.

I wouldn't do anything for now. It's best to wait for one of the above scenarios to play out.

---------------

Share your thoughts in the comments!

BTCUSD Technical Analysis: Demand Zone RejectionMarket Structure:

BTC is moving inside a descending channel / range, showing controlled consolidation after the previous bullish move. Price recently swept liquidity below support and quickly reclaimed it — a bullish sign.

Key Zone Reaction:

Price tapped the demand / support zone (≈ 77,650 – 77,800) and showed rejection. This area aligns with prior range support, increasing the probability of a bounce.

Entry Setup (Long):

Entry: ~77,797

Look for confirmation (bullish engulfing / strong close above support).

Stop Loss:

Below 76,750 – 76,800

A clean break below this zone invalidates the bullish idea.

Targets:

TP1: ~78,300 (range mid / intraday resistance)

TP2: ~78,380 – 78,400 (range top & projected move)

Bias:

✅ Short-term bullish bounce while above support

⚠️ Expect choppy price action inside the range

Invalidation:

❌ Strong close below the support zone

Summary:

This is a support-based long setup after a liquidity sweep. If buyers hold this area, BTC can push back toward the upper range. Patience and confirmation are key on 15M.

Bitcoin Holds Heavy Support — Bullish Flag Signals Next ImpulseAs I expected in my previous idea , Bitcoin( BINANCE:BTCUSDT ) reached its targets and rose as anticipated.

Currently, Bitcoin is moving within the heavy support zone($78,260-$70,080).

From a classical technical analysis standpoint, on the 15-minute timeframe, Bitcoin seems to be forming a bullish flag pattern, which is a good sign for continued short-term upside.

From an Elliott Wave perspective, it appears Bitcoin is completing a Double Three Correction(WXY) on the 15-minute timeframe. We should expect the start of a 5-wave impulsive move next.

I expect Bitcoin to continue upward in the next few hours, at least toward the Cumulative Short Liquidation Leverage($80,100-$79,450) and possibly fill parts of the upper CME Gap($84,560-$79,660).

What’s your view on Bitcoin’s direction, at least for the next couple of days? I’d love to hear your thoughts!

First Target: Cumulative Short Liquidation Leverage($80,100-$79,450)

Second Target: $80,971

Stop Loss(SL): $76,281

Points may shift as the market evolves

Cumulative Short Liquidation Leverage: $86,170-$84,760

Cumulative Long Liquidation Leverage: $77,460-$76,600

Cumulative Long Liquidation Leverage: $75,000-$74,000

💡 Please respect each other's opinions and express agreement or disagreement politely.

📌Bitcoin Analysis (BTCUSDT), 15-minute time frame.

🛑 Always set a Stop Loss(SL) for every position you open.

✅ This is just my idea; I’d love to see your thoughts too!

🔥 If you find it helpful, please BOOST this post and share it with your friends.

Bitcoin 30M Bearish Bias Inside Rising ChannelMarket Structure

Overall macro bias remains bearish (strong sell-off on the left).

Price is currently moving inside a rising channel, which is acting as a bearish corrective structure.

Recent price action shows weak momentum near channel resistance → signs of exhaustion.

📐 Key Levels

Resistance Zone: 78,700 – 80,200

Current Price Area: ~77,900

Support / Target Zone: 76,800 – 75,100

🧠 Trade Idea (Short Bias)

Best entries near upper channel resistance.

Expect choppy consolidation, then a breakdown toward channel support.

Measured move target aligns with the previous demand / liquidity zone.

🎯 Bearish Scenario (Primary)

✔ Price rejects from channel top

✔ Break below 77,800 confirms weakness

✔ Continuation toward 76,800 → 75,100

⚠️ Bullish Invalidation

A clean 30M close above 80,200 invalidates the bearish setup.

That would open upside toward 82K+.

✅ Summary

Bias: Bearish continuation

Pattern: Rising channel (corrective)

Strategy: Sell rallies, not breakouts

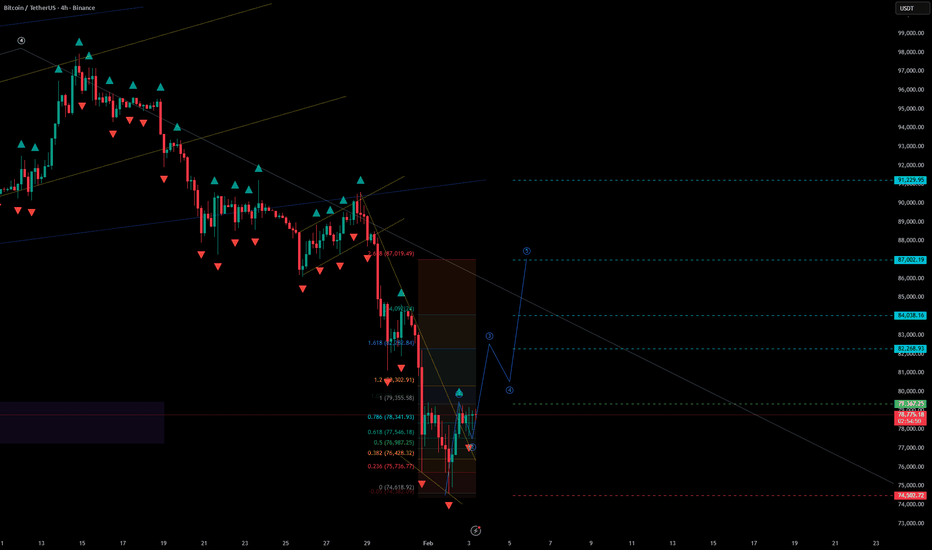

Bitcoin (BTCUSDT) — H4 Formation of the 3rd Wave + Trendline RetBitcoin (BTCUSDT) — H4 Formation of the 3rd Wave + Trendline Retest

🔎 Market Structure (H4)

On the H4 timeframe, Bitcoin has completed a strong impulsive decline followed by a corrective phase and is now forming a potential 3rd bullish wave.

Key technical points:

Clear impulse → correction → continuation structure

Price has retested the broken descending trendline

Current consolidation suggests preparation for wave 3 expansion

As long as price holds above the recent low, the structure favors upside continuation.

📐 Elliott Wave Context

• Wave 1 — impulsive move from local lows

• Wave 2 — corrective pullback into Fibonacci zone

• Wave 3 — expected to develop after trendline retest

This is a classic continuation setup, where the 3rd wave typically shows strong momentum and range expansion.

📍 Entry Zone

Entry: 79,367.25

Entry is aligned with:

Trendline retest

Fibonacci support cluster

Completion of wave 2 structure

Aggressive entries should be avoided until momentum confirms.

🎯 Target Levels (from the chart)

Upside targets are defined using Fibonacci extensions and structure highs:

TP1: 82,268.93

TP2: 84,038.16

TP3: 87,002.19

TP4: 91,229.95

Partial profit-taking is recommended at each target.

🛑 Invalidation / Stop

Stop: 74,502.72

Placed below the low of wave 1, fully invalidating the bullish wave-3 scenario if broken.

🧠 Risk & Trade Management

• This is a trend continuation setup, not a reversal

• Wave 3 confirmation is critical — avoid over-leverage

• Risk should remain controlled until impulsive acceleration appears

• Failure to hold above support may lead to deeper consolidation

📌 Summary

Bitcoin on H4 is forming a potential 3rd bullish wave after a clean trendline retest.

As long as price remains above 74,502, the structure favors upside continuation toward higher Fibonacci targets.

Bitcoin – Market Context & Liquidity PerspectiveEven though Bitcoin remains bullish in the long term, price has been in a corrective bearish phase since October, which is a normal reaction after a strong impulsive move.

Since October 2022, price has been retracing and is currently revisiting a key area that many traders are watching closely.

In the past, this level acted as resistance before being broken. Once broken, it became support, and price has recently reacted from this area.

At this level, many participants are positioning long, while others are already positioned short. It is important to remember that for price to move higher, sell-side liquidity is required.

In order to generate that sell-side liquidity, price often needs to trade below support levels where liquidity is resting. For this reason, I expect Bitcoin to sweep liquidity below the 72,000 level at minimum.

As long as the 98,000 high remains intact, there is no clear structural reason for price to move higher from current levels. Before a break above 98,000, a break below the 72,000 support is, in my view, more likely.

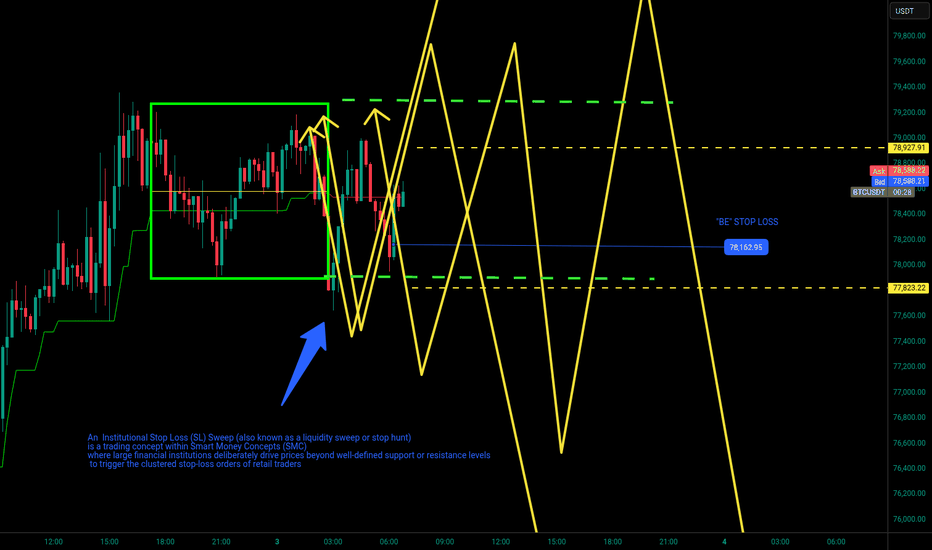

BTCUSDT - "GAME " ON 2m CHART, A QUICK SELL SET UP - 02-02-2026BTCUSDT - G-Money's short version analysis based purely on technical analysis only, no nonsense or "BS". I do totally ignore any fundamental analysis, technical analysis only

BTCUSDT - still kinda on the "move" and continue DOWN... (2m TRADE, RISKY...)

Who did enter this trade earlier congratulations! Who missed it... See you next time! ;)

Chart is itself explaining. Kept a "KISS" approach all the way ( "Keep It Simple, Stupid") & beginners friendly... ;)

I do hope that nobody ignoring SL ( Stop Loss) ! Without it, It is a fastest way to loose hard earned money...

;)

Trade safe & don't do "gambling". In the end it never pays, not worth it to risk loose all your $...

PS: above technical analysis is done for the community & educational purpose only! It is not a financial advice. Just share my very own insight to it.

BTCUSDT - 2m UPDATE, EXIT WITH PARTIAL PROFIT 03-02-2026BTCUSDT - still kinda on the "move" and after some "INSTITUTIONAL" manipulations will continue DOWN...

Who did enter this trade earlier congratulations! Who missed "BE" Stop Loss... See you next time! ;)

Sadly 2m "quick" trade "mutated " and multiply to 5m failed set ups, developed institutional "accumulation" and SL sweep range .

"BE" Stop Loss exits from 2 trades ( Leverage * 50 = +60%P/L and LEV.*20=+6% P/L )

Stay "SAFE" today, don't rush with entering trades, seems going to be Loss Stop "hunting" day...

Educational "piece":

An Institutional Stop Loss (SL) Sweep (also known as a liquidity sweep or stop hunt)

is a trading concept within Smart Money Concepts (SMC)

where large financial institutions deliberately drive prices beyond well-defined support or resistance levels to trigger the clustered stop-loss orders of retail traders

Chart is itself explaining. Kept a "KISS" approach all the way ( "Keep It Simple, Stupid") & beginners friendly... ;)

I do hope that nobody ignoring SL ( Stop Loss) ! Without it, It is a fastest way to loose hard earned money...

;)

Trade safe & don't do "gambling". In the end it never pays, not worth it to risk loose all your $...

PS: above technical analysis is done for the community & educational purpose only! It is not a financial advice. Just share my very own insight to it.

BTCUSD 15M | Descending Channel Reaction – Buy the PullbackMarket Structure

Price was moving inside a descending channel (overall corrective / bearish pressure).

Strong rejection from the lower channel boundary → sharp impulsive bounce.

Now BTC is testing the upper channel / resistance zone, showing strength but also short-term hesitation.

🟨 Key Levels

Support zone: 77,750 – 76,450

→ Previous demand + breakout base.

Current price: ~78,890

Resistance / trigger area: 79,200 – 79,400

Upside target: 79,700 – 80,200

📈 Expected Scenario (Bullish Continuation)

A healthy pullback toward 78,000–77,800 would be normal.

As long as price holds above 77,750, bullish structure remains valid.

Break & 15M close above channel resistance → continuation toward 79.7k – 80.2k.

⚠️ Invalidation / Risk

15M close below 76,450

→ bullish idea fails

→ price may revisit lower channel support.

🧠 Trading Insight

This is a pullback → continuation setup, not a blind breakout.

Best entries come:

From support retest, or

After confirmed breakout + retest of resistance.

📌 Bias: Bullish while above 77,750

🎯 Target: 79,700 → 80,200

🛑 Invalidation: Below 76,450

BTC Bullish Setup: RSI < 30 Has Marked Strong ReversalsBTC Daily Chart – RSI < 30 Has Historically Marked Strong Bounce Zones

On the BTC daily chart, we can see a recurring pattern: whenever the RSI dips below the 30 level (oversold conditions), price has historically reacted with a notable bounce.

The highlighted blue circles show multiple instances across different market phases where:

- RSI dropped into oversold territory

-Price was trading near key support or demand zones

\-BTC followed with a relief rally or trend continuation move

This does not guarantee a bottom every time, but it does suggest that risk-to-reward improves significantly when BTC becomes oversold on higher timeframes like the daily chart.

Key takeaways:

- RSI < 30 on the daily has often aligned with local or macro bottoms

- These zones are worth watching for reversal signals, bullish divergence, or confirmation from price action

- Best used in combination with support levels, volume, and market structure

Cheers

Hexa

BTCUSD It is Inevitable...I hate to say it… but this chart is giving me flashbacks.

When you zoom out on BTC’s weekly structure, you see similarities between 2021 and what’s happening right now in 2025. This doesn't look good to me.

After the double-top formation in 2021, we got a relief rally that tricked everyone into thinking new highs were coming. But it was just a Bull Trap.

Fast forward to today:

Price is crawling back into the identical type of bull trap zone we saw last cycle at 0.38 Fibonacci (same as 2021).

If the market keeps repainting the same structure, BTC could deliver one more “hope” bounce into the red circle (which will be another bull trap)…only to roll over again and start a deeper correction.

No hopium here… just the chart speaking for itself.

I would recommend avoiding swing trades that leaves you exposed you to an uncertain market. Day trading remains effective but only on smaller timeframes.

Good Luck!

$BTC Weekly Fractal Breakdown. Liquidity around 70k!CRYPTOCAP:BTC — Weekly Market Structure Overview

Bitcoin is currently following a price sequence that closely resembles the previous market cycle.

During the last major distribution phase, price topped, broke market structure, retraced, and then declined approximately 32% into a weekly Fair Value Gap (FVG).

In the current cycle, the same structural behaviour has occurred, with a larger drawdown of roughly 40%, bringing price directly into a comparable weekly FVG.

---

Current area of interest

Weekly Fair Value Gap: 70,000 – 80,000

Price has now reached this zone.

The next significant technical reference is the 185-week exponential moving average (EMA), currently located near 70,000.

---

Historical behaviour at these levels

When Bitcoin reaches a weekly FVG during a distribution phase, the market typically follows a three-step process:

1. An initial reaction bounce

2. A period of range development

3. A directional resolution, which is usually one of the following:

– Reclaim of market structure, leading to continuation

– Failure to hold the FVG, resulting in a deeper correction

---

Key technical levels

Resistance: 91,000 – 95,000

Short-term risk below: 76,000

Next major liquidity zone: 70,000

---

This behaviour reflects systematic market rebalancing after distribution, rather than random price movement.

Participants who understand a higher-timeframe structure are better positioned—those who do not often provide liquidity for stronger hands.

---

As outlined in my previous BTC analysis, a sustained loss of the 185-week EMA would likely pave the way for the 50,000 region, a move that historically unfolds over several months rather than occurring rapidly.

For now, Bitcoin is expected to consolidate around the 70,000 area. Until price can reclaim a higher-timeframe structure, the short-term bias remains to the downside.

DYOR | NFA

Please hit the like button if you like it. Do not forget to follow me!

If this chart crosses 200 likes, I'll cover altcoins in the coming week.

Thank. you.

BTCUSDT - FEB/MARCH "VIBES" A QUICK SELL SET UP - 01-02-2026BTCUSDT - G-Money's short version analysis based purely on technical analysis only, no nonsense or "BS". I do totally ignore any fundamental analysis, technical analysis only

BTCUSDT - still kinda on the "move" and continue DOWN...

Who did enter this trade earlier congratulations! Who missed it... See you next time! ;)

(TRY TO "EXPLORE" LTF ENTRY SET UPS, DON'T RUSH TO "JUMP IN", TAKE YOUR TIME...)

Chart is itself explaining. Kept a "KISS" approach all the way ( "Keep It Simple, Stupid") & beginners friendly... ;)

I do hope that nobody ignoring SL ( Stop Loss) ! Without it, It is a fastest way to loose hard earned money...

;)

Trade safe & don't do "gambling". In the end it never pays, not worth it to risk loose all your $...

PS: above technical analysis is done for the community & educational purpose only! It is not a financial advice. Just share my very own insight to it.

BTCUSD – Bearish Channel Resistance Rejection Setup (30M)Alright, let’s break this BTCUSD (30-min) chart down clearly 👇

You’ve marked it well already — structure is doing most of the talking here.

🔍 Market Structure

Clear descending channel (lower highs + lower lows)

Price is respecting the channel boundaries → strong bearish control

Overall bias on this timeframe: Bearish continuation

🟦 Channel Behavior

Price is currently near the upper half / resistance zone of the channel

Multiple rejections from this zone in the past

Dashed midline acting as dynamic resistance

This tells us:

Rallies are corrective, not impulsive.

📍 Key Levels (from your chart)

🔴 Resistance / Sell Zone

82,800 – 83,500

Labeled correctly as RESISTANCE POINT

Ideal area for short entries after rejection

🟢 Entry

Around 82,450 – 82,800

Wait for:

bearish candle close

or rejection wick

or minor lower-high confirmation

🎯 Target

80,250 – 80,300

Aligns with:

channel support

previous liquidity sweep

Strong probability target if structure holds

🛑 Stop Loss

84,700 – 84,800

Above:

channel resistance

invalidation of bearish structure

📉 Trade Idea Summary

Bias: Short

Setup Type: Trend continuation (bearish channel)

Plan:

Let price react at resistance

Look for rejection / weak bullish candles

Enter short

Target channel support

SL above channel = protected trade

Risk–Reward:

✅ Clean and favorable (worth taking if confirmation appears)

⚠️ Important Notes

If price breaks and holds above the channel, this setup is invalid

No FOMO — wait for reaction, not blind entry

Best confirmation = rejection + volume slowdown

Bitcoin Long-Term Monthly Chart: Parabolic Advance Meets DistribMacro Trend

Bitcoin is still in a long-term bullish structure. Each cycle shows higher highs and higher lows since inception.

The move from ~20k to ~90k happened in very few monthly candles, which signals a parabolic phase rather than healthy trend growth.

2. Current Candle Structure

The most recent candles show:

Large bullish impulse followed by

Strong rejection wicks and consecutive red monthly candles

This usually indicates profit-taking and distribution, not immediate trend continuation.

3. Volatility & Momentum

The current red candle (~-10%) after a blow-off green candle suggests:

Momentum is cooling

Buyers are no longer in full control

Historically, after similar structures (2013, 2017, 2021), BTC entered extended consolidation or deep pullbacks.

4. Volume Insight

Volume peaked during the explosive green candles and is now declining, which often means:

Smart money already positioned

Late buyers are absorbing supply

5. Key Levels to Watch

78k–80k: Current support (short-term)

60k–65k: Strong macro support (prior cycle top zone)

45k–50k: Extreme but historically reasonable retracement in bull cycles

6. Probable Scenarios

Base Case (Most Likely):

Sideways to downward consolidation over several months (range expansion).

Bull Continuation:

Needs a strong monthly close above prior highs with increasing volume.

Bearish Extension:

Loss of 60k opens the door for a deeper macro correction.

BTC/USDT – Bearish Flag Breakdown | Bigger Correction Ahead?Bitcoin is currently forming a classic Bearish Flag pattern on the higher timeframe after a strong impulsive sell-off. This structure often signals trend continuation, and price action is now approaching a critical decision zone. BINANCE:BTCUSDT

📉 Strong impulse move down (flagpole) confirms bearish momentum

🏳️ Bearish flag consolidation forming inside rising channel

❌ Rejection near flag resistance increases breakdown probability

🔻 Breakdown could open the door toward:

🌍 Fundamental Perspective

1.Bitcoin sentiment is currently pressured by:

2.Profit-taking at higher levels after extended bullish runs

3.Macro uncertainty & risk-off sentiment across global markets

4.Interest rate expectations and USD strength impacting crypto flows

5.Reduced short-term liquidity entering the market

💰Take Profit (TP): At the Key Zone – major support area identified ahead.

🛑Stop Loss (SL): Above the pattern structure / recent swing high.

✅Psychological Discipline:

1️⃣Stick to plan – No Revenge Trades.

2️⃣Accept losing trades as part of the strategy.

3️⃣Risk only 1–2% of your account balance per trade.

✅ Support this analysis with a

LIKE 👍 | COMMENT 💬 | FOLLOW 🔔

It helps a lot & keeps the ideas coming!

⚠️ Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Forex trading involves high risk. Trade only with capital you can afford to lose and always do your own research.