#BITCOIN: Still Expecting Price To Touch $60K To $65K! Bitcoin is likely to drop further down before we could see a strong bullish move taking price to all time high. This is our view only and it is not an guaranteed move; once price touch our reversal zone then we could see price going back to all time high. Good luck and trade safe!

Team Setupsfx_

Like And Comment Our Ideas For More Such Educational content! 📊🚀

Btcusdtsignal

BITCOIN: As Expected Price Is Dropping, Waiting To Come at 60K?Dear Traders,

As anticipated, the price is reversing from $98,000 and may experience a significant drop towards $60,000. The $60,000 area remains strong and attracts swing buyers. Our recommendation is to wait for the price to break through this trading range pattern. A strong breakthrough would indicate a clear price pattern.

If you like our idea, please like and comment for more.

Team SetupsFX_

BTCUSDT | Reaction at Weekly Support – 4H Rebound & Daily TargetBitcoin is currently reacting from a key weekly support zone after a strong bearish impulse.

On the 4H timeframe, price is showing signs of a technical rebound, supported by oversold conditions and a clear rejection from lower levels. This setup favors a short-term counter-trend move, with the first upside target located around the 74,000–76,000 USD zone, which aligns with a nearby resistance area.

From a daily perspective, BTC remains positioned on a macro support level. If the rebound develops with continuation, the daily target area is located around 85,000 USD, corresponding to a higher-timeframe resistance zone.

Key levels & scenarios:

Primary scenario: Rebound from weekly support

4H target: 74,000–76,000 USD

Daily target: ~85,000-90,000 USD

Invalidation: Clean break and acceptance below the weekly support

Alternative scenario: If support fails, the next major support is around 54,000 USD

At this stage, market structure favors a reaction and bounce before any deeper downside continuation.

This is a technical analysis idea, not financial advice.

BTC Monthly MACD Turns Bearish - Major Correction Ahead?Bitcoin has printed a bearish MACD crossover on the monthly timeframe, a signal that has historically aligned with the start of major market corrections. This pattern appeared during the 2018 top, again near the 2022 macro peak, and the chart now shows a similar bearish crossover forming once more.

Each previous monthly MACD bearish crossover occurred after a prolonged rally and was followed by a multi-month downtrend. The current crossover resembles those same market conditions, suggesting that BTC may be entering a deeper corrective phase if history repeats.

Key Highlights

- Monthly MACD bearish crossover, historically signals macro trend reversals.

-Similar crossovers occurred before the 2018 and 2022 bear markets.

-Strong rejection candle near major resistance aligns with previous cycle tops.

- Momentum weakening after an extended rally suggests potential for further downside.

- Monthly timeframe signals carry high weight and can drive long-term market direction.

Cheers

Hexa

Coinranger|BTCUSDT. Moving to H16 aim level🔥News

🔹JOLTS employment report at 18:00 UTC+3

🔥BTC

🔹Still moving within Monday's forecast. Let's see what's on the screens:

1️⃣ Dynamic levels above are 72600 and its potential extension to 75300.

2️⃣ 68470 remains actual below. Anything could happen when it gets there.

For now, I'm waiting for the H16 level to be reached.

---------------

Share your thoughts in the comments!

Coinranger|BTCUSDT. Reversal or continued decline?🔥News

🔹Today, the US votes on the government budget.

🔹US manufacturing PMI at 18:00 UTC+3.

🔥BTC

🔹A mega-drop to 74600. What's next:

1️⃣ Above there is the level at 79500, but it's dynamic. And until there's some kind of movement stop, there's nothing more to say. Keep an eye on your moving averages.

2️⃣ Below, a full set of waves with extensions on the h4 timeframe has already been completed. A reversal attempt could occur around the current level. There are 72900 and 71050 a bit lower on the hourly timeframe – a complete set of three consecutive downward sets.

I wouldn't do anything for now. It's best to wait for one of the above scenarios to play out.

---------------

Share your thoughts in the comments!

BTCUSD Technical Analysis: Demand Zone RejectionMarket Structure:

BTC is moving inside a descending channel / range, showing controlled consolidation after the previous bullish move. Price recently swept liquidity below support and quickly reclaimed it — a bullish sign.

Key Zone Reaction:

Price tapped the demand / support zone (≈ 77,650 – 77,800) and showed rejection. This area aligns with prior range support, increasing the probability of a bounce.

Entry Setup (Long):

Entry: ~77,797

Look for confirmation (bullish engulfing / strong close above support).

Stop Loss:

Below 76,750 – 76,800

A clean break below this zone invalidates the bullish idea.

Targets:

TP1: ~78,300 (range mid / intraday resistance)

TP2: ~78,380 – 78,400 (range top & projected move)

Bias:

✅ Short-term bullish bounce while above support

⚠️ Expect choppy price action inside the range

Invalidation:

❌ Strong close below the support zone

Summary:

This is a support-based long setup after a liquidity sweep. If buyers hold this area, BTC can push back toward the upper range. Patience and confirmation are key on 15M.

BTCUSDT - "GAME " ON 2m CHART, A QUICK SELL SET UP - 02-02-2026BTCUSDT - G-Money's short version analysis based purely on technical analysis only, no nonsense or "BS". I do totally ignore any fundamental analysis, technical analysis only

BTCUSDT - still kinda on the "move" and continue DOWN... (2m TRADE, RISKY...)

Who did enter this trade earlier congratulations! Who missed it... See you next time! ;)

Chart is itself explaining. Kept a "KISS" approach all the way ( "Keep It Simple, Stupid") & beginners friendly... ;)

I do hope that nobody ignoring SL ( Stop Loss) ! Without it, It is a fastest way to loose hard earned money...

;)

Trade safe & don't do "gambling". In the end it never pays, not worth it to risk loose all your $...

PS: above technical analysis is done for the community & educational purpose only! It is not a financial advice. Just share my very own insight to it.

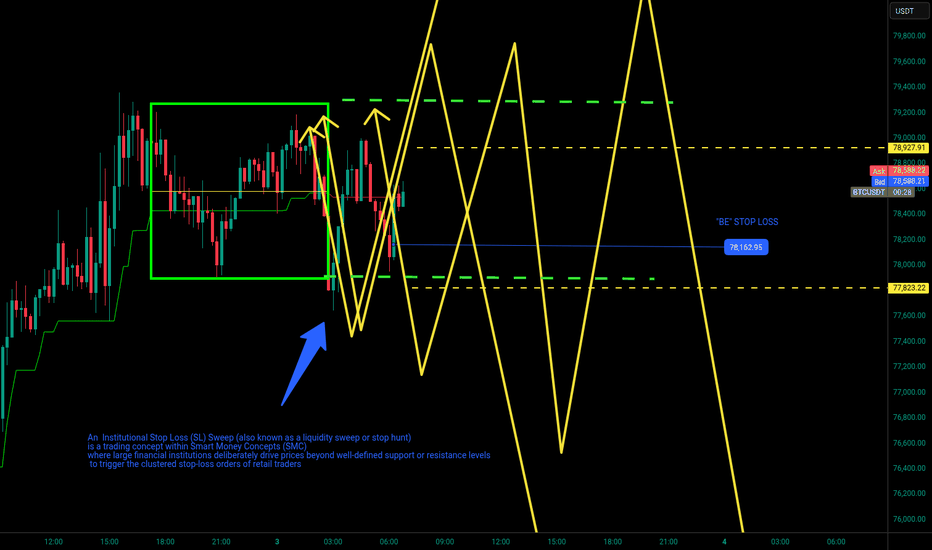

BTCUSDT - 2m UPDATE, EXIT WITH PARTIAL PROFIT 03-02-2026BTCUSDT - still kinda on the "move" and after some "INSTITUTIONAL" manipulations will continue DOWN...

Who did enter this trade earlier congratulations! Who missed "BE" Stop Loss... See you next time! ;)

Sadly 2m "quick" trade "mutated " and multiply to 5m failed set ups, developed institutional "accumulation" and SL sweep range .

"BE" Stop Loss exits from 2 trades ( Leverage * 50 = +60%P/L and LEV.*20=+6% P/L )

Stay "SAFE" today, don't rush with entering trades, seems going to be Loss Stop "hunting" day...

Educational "piece":

An Institutional Stop Loss (SL) Sweep (also known as a liquidity sweep or stop hunt)

is a trading concept within Smart Money Concepts (SMC)

where large financial institutions deliberately drive prices beyond well-defined support or resistance levels to trigger the clustered stop-loss orders of retail traders

Chart is itself explaining. Kept a "KISS" approach all the way ( "Keep It Simple, Stupid") & beginners friendly... ;)

I do hope that nobody ignoring SL ( Stop Loss) ! Without it, It is a fastest way to loose hard earned money...

;)

Trade safe & don't do "gambling". In the end it never pays, not worth it to risk loose all your $...

PS: above technical analysis is done for the community & educational purpose only! It is not a financial advice. Just share my very own insight to it.

BTCUSD 15M | Descending Channel Reaction – Buy the PullbackMarket Structure

Price was moving inside a descending channel (overall corrective / bearish pressure).

Strong rejection from the lower channel boundary → sharp impulsive bounce.

Now BTC is testing the upper channel / resistance zone, showing strength but also short-term hesitation.

🟨 Key Levels

Support zone: 77,750 – 76,450

→ Previous demand + breakout base.

Current price: ~78,890

Resistance / trigger area: 79,200 – 79,400

Upside target: 79,700 – 80,200

📈 Expected Scenario (Bullish Continuation)

A healthy pullback toward 78,000–77,800 would be normal.

As long as price holds above 77,750, bullish structure remains valid.

Break & 15M close above channel resistance → continuation toward 79.7k – 80.2k.

⚠️ Invalidation / Risk

15M close below 76,450

→ bullish idea fails

→ price may revisit lower channel support.

🧠 Trading Insight

This is a pullback → continuation setup, not a blind breakout.

Best entries come:

From support retest, or

After confirmed breakout + retest of resistance.

📌 Bias: Bullish while above 77,750

🎯 Target: 79,700 → 80,200

🛑 Invalidation: Below 76,450

BTCUSDT - FEB/MARCH "VIBES" A QUICK SELL SET UP - 01-02-2026BTCUSDT - G-Money's short version analysis based purely on technical analysis only, no nonsense or "BS". I do totally ignore any fundamental analysis, technical analysis only

BTCUSDT - still kinda on the "move" and continue DOWN...

Who did enter this trade earlier congratulations! Who missed it... See you next time! ;)

(TRY TO "EXPLORE" LTF ENTRY SET UPS, DON'T RUSH TO "JUMP IN", TAKE YOUR TIME...)

Chart is itself explaining. Kept a "KISS" approach all the way ( "Keep It Simple, Stupid") & beginners friendly... ;)

I do hope that nobody ignoring SL ( Stop Loss) ! Without it, It is a fastest way to loose hard earned money...

;)

Trade safe & don't do "gambling". In the end it never pays, not worth it to risk loose all your $...

PS: above technical analysis is done for the community & educational purpose only! It is not a financial advice. Just share my very own insight to it.

BTC/USDT - Bitcoin H1 | Continuation Pattern Signals Downside📝 Description🔍 Setup (Technical Structure) BINANCE:BTCUSDT

BTC/USDT is forming a classic Bearish Pennant pattern on the H1 timeframe.

After a strong impulsive sell-off (flag pole), price consolidated inside a tight pennant structure, showing lower highs and weak buying pressure.

Price remains below EMA & Ichimoku cloud, confirming bearish control and continuation bias.

This structure typically favors trend continuation, not reversal.

📍 Support & Resistance

🔴 1st Support: 85,800 – 86,000

🔴 2nd Support (Flag Target): 84,000 – 84,200

🟡 Pennant Resistance Zone: 90,500 – 91,000

Flag-pole height projection aligns with lower support targets

#BTCUSDT #Bitcoin #CryptoTrading #BearishPennant #PriceAction #TechnicalAnalysis #TradingView #Kabhi_TA_Trading

⚠️ Disclaimer

This analysis is for educational purposes only.

Crypto markets are highly volatile — always manage risk and use proper position sizing.

💬 Support the Idea 👍 Like if you’re bearish on BTC

💬 Comment: Continuation or fake breakdown? 🔁 Share with traders watching Bitcoin

Coinranger|BTCUSDT. Potential reversal to 90930🔹Fed rates at 22:00 UTC+ 3, FOMC press conference at 22:30 UTC+ 3. We can fly on this news.

🔹US earnings season is in full swing.

🔥BTC

🔹Still holding towards 89840:

1️⃣ The main upper level has been clarified at 89840. Above that are 90930 and 92930, but these are just worth keeping in mind for now. This is a complete set of upside waves.

2️⃣ Below, the important 88,500 level is actual and 85,000 and 84,700 lower are still relevant.

Until the rate issue, bitcoin may be trading in a micro-flat of 89,840 - 88,500. There's a chance afterward of a move higher to 90,930.

---------------

Share your thoughts in the comments!

Coinranger| BTCUSDT. Continuing decline to 85,000🔥News

🔹No important news today. Only an old data on american market will be released, which is usually considered preliminary.

🔥BTC

🔹Fell down last night and broke through previous peak. Current levels:

1️⃣ The levels above can only be calculated tentatively. 88,500 is the first level for the end of the pullback.

2️⃣ The levels below - 85,000 and 84,700 - almost coincident potential ends of the downward sets of waves on h1 and h4.

Without news, we could either continue the decline, or make a pullback, and then, for example, fall further.

---------------

Share your opinion in the comments!

Coinranger| BTCUSDT. Flat at 90500 - 87550?🔥News

🔹The WEF continues. Preliminary US manufacturing and services PMI data will issue at 17:45 (UTC+3) - no sharp movements expected.

🔥BTC

🔹Staying within yesterday's levels:

1️⃣ The levels above are the same: 91800 and 92855.

2️⃣ Below, 87550 remains actual.

The situation remains unclear. A pullback is still possible - we're currently seeing a triangle forming in the second wave. Potential flat ranges are 90500 - 87550.

---------------

Share your thoughts in the comments!

Coinranger| BTCUSDT. Is growing still actual?🔥News

🔹No important news today. Potentially, Trump could start doing something in Iran. And, as we remember, in such cases, crypto can go down very fast.

🔥BTC

🔹However, yesterday it broke through 96,700 and even went a little higher:

1️⃣ Today's levels above: 98,900, and that's a bit too much. There are a couple of lower timeframe levels: 97,860 and 98,300. But today, both Trump and the pending US crypto laws are against crypto growing.

2️⃣ Levels below, a bit updated: 94,770, 93,460, 92,450

The downside move remains the priority. Glassnode data isn't talking about an influx of new capital, but about a short squeeze. This is a dangerous and fragile situation for such powerful growth.

Coinranger| BTCUSDT. Is further growth possible?🔥News

🔹Today at 16:30 (UTC+3) will issue the US PPI data for December, and most likely for October at the same time. Plus retail sales at the same time.

🔥BTC

🔹We soared to 95,000 on Trump's words about aid to Iran and made a good level. Now:

1️⃣ There's still 96,700 above, but we're unlikely to go there.

2️⃣ New levels below: 92,850, 91,450, 90,200 (preliminary estimates)

Theoretically, BTC should decline after such a rise; the number of completed upward waves is enough for a pullback. But PPI and Trump could change reality. For now, the priority is a pullback to 92,850.

Coinranger| BTCUSDT. Potential reversal to 90100🔹At 16:15 UTC+3 - ADP nonfarm payrolls data.

🔹At 18:00 UTC+3 - PMI in services and the JOLTS employment report. More important.

High volatility is possible on both news.

🔥BTC

🔹Currently, Bitcoin has made just enough progress on the h4 to begin a reversal, but interestingly, this timeframe is currently experiencing the same level of uncertainty as it did on the h1 on Monday before the small rally. Summary:

1️⃣ The important h4 level is 93450 above.

2️⃣ There's a whole set of levels for decline with potential extensions: 91160, 90100 (especially important), 88200, and 86700.

I think we'll drop to 90100 today or tomorrow, and then there'll be a turning point.

BTCUSD: Bitcoin's Wave Structure Is on the Verge of a New ImpulsBTCUSD: Bitcoin's Wave Structure Is on the Verge of a New Impulse

BTCUSD Wave Overview (D1 and H4)

As a trader who has been practicing wave analysis for over ten years, I note that the current Bitcoin picture shows the completion of an extended corrective formation and the potential for a new move.

Chart D1: The global structure indicates that the market is gradually breaking out of its sideways range. The wave formation looks like the end of a correction, which is laying the foundation for the next impulse.

Chart H4: Local dynamics confirm the first signs of an impulse. Key entry points are forming here, which could mark the beginning of a larger wave.

Main Scenario

After the completion of the corrective phase, a downward impulse sequence is expected to develop. This movement may be accompanied by increased seller activity and a shift in focus to the downside.

Alternative Scenario

If the price holds above local peaks and forms a stable upward impulse structure, the focus will shift to continued growth. In this case, the correction will be considered incomplete, and Bitcoin may experience a further rebound.

Trading Idea

Conservative approach: wait for confirmation of a breakout of key levels and enter with the trend.

Aggressive approach: use local impulses on H4 for earlier entries, but with tight stops.

In both cases, it is important to maintain strict risk management and adjust the plan as new impulses emerge.

Results

BTCUSD is at a crossroads between the end of the correction and the beginning of a new impulse. The wave structure on D1 and H4 provides clear guidelines for action: watch for confirmation of the scenario and act with discipline.

Today - Bitcoin Genesis Day Today, January 3, 2026, marks Bitcoin’s birthday (Bitcoin Genesis Day), as it was on January 3, 2009 that the unknown creator Satoshi Nakamoto mined the Genesis Block (Block 0) of the blockchain network. This is the symbolic launch date of the first decentralized cryptocurrency, which became the foundation of the entire system.

Key points:

Date: January 3, 2009

Event: Mining of the first block (Genesis Block)

Significance: The official start of the Bitcoin network and the foundation of the cryptocurrency revolution

Reward: In this first block, Satoshi Nakamoto received 50 BTC, and the block’s hash contains a headline from The Times newspaper, confirming the time of its creation.

BTCUSD:Bearish Bias with ConsolidationToday, BTCUSD is in a downtrend - dominated consolidation pattern, trading sideways after failing to hold gains above 89000 and dropping to test the 85000 key support zone. The price dipped to a low of 85055 in the early session then rebounded, with upside momentum curbed by persistent selling pressure and weak risk appetite. Key drivers include EMA50 dynamic resistance, RSI still in a weak range, and institutional caution (ETF outflows), pushing the market into a technical defensive phase where 85000 acts as the bull’s critical short - term lifeline.

Core Price Zones:

Resistance:88500 - 89000 (intraday first resistance), 90000 (psychological + trend - line resistance), 92000-94000 (mid - term target)

Support:85000 - 85500 (Fibonacci 0.786 retracement + dense trading zone), 84000 (intraday low), 80000-82000 (major support cluster)

Trading Strategy:

Buy 85000 - 85500

SL 84300

TP 86500 - 87500 - 88500

Sell 88500 - 89000

SL 89700

TP 87000 - 86000 - 85000

BTCUSD: weak oscillating patternToday, BTCUSD has extended its correction trend that started in October, exhibiting a weak oscillating pattern. Prices have been range-bound around the core zone of $85,000–$86,000. Following the flash crash after the price challenged the $90,000 level, the pair is now lingering near the critical support at $85,000, with bears firmly in control of the market.

Support Levels:

$85,000 serves as the current core lifeline. This level corresponds to the 0.786 Fibonacci retracement of the uptrend that began in April. A daily close below this threshold will most likely trigger a new round of panic selling, opening the door to the next support zone of $78,000–$80,000. In the short term, a weak support has formed around $86,000, though its effectiveness has already been undermined. From the perspective of the daily EMA indicator, $85,000 also coincides with the EMA 400 level, further underscoring its significance as a support level.

Resistance Levels:

For any short-term rebound, the primary resistance zone lies at $87,000–$88,000, with $87,200 and $87,500 as key intraday resistance points. Stronger resistance is concentrated at $91,000 (the midpoint of the previous consolidation phase) and $94,700. Additionally, the descending trend line from the October high has formed a robust resistance barrier. Without the support of large-scale spot buying, it will be difficult for any rebound to break through these levels.

Trading Strategy:

Sell 86500–87000

SL 87500

TP 85000 - 84000 - 83000

Buy 85000 - 85200

SL 84500

TP 86000 - 86500 - 87000

BTCUSDT: Bearish Wave 5, Setting a Path to Under 70,000?Hey Realistic Traders!

“Bitcoin Is Riding Bearish Reversal Momentum, Is a New Lower Low on the Horizon?”

Let’s dive into the technical analysis to answer this question and see what the chart is really telling us.

Technical Analysis

On the daily chart, BINANCE:BTCUSDT has moved below the EMA200 line. Each rebound has failed to break above, and price has rarely even touched the EMA200, reinforcing the strength of the broader bearish trend.

During the Wave 4 formation, BTCUSDT consolidated within a rising wedge pattern, a corrective structure that typically appears as upside momentum weakens within a larger downtrend. A decisive breakdown from this pattern signals renewed bearish pressure and often marks the beginning of Wave 5 in Elliott Wave theory.

Following the breakdown, a bearish MACD crossover occurred, adding confirmation to the bearish bias. Together, these signals strengthen the view that momentum is shifting back in favor of the bears.

Based on Fibonacci projections, Wave 5 may extend toward the 0.786 Fibonacci ratio, aligning with the second downside target near 66,450. Before reaching that level, price may encounter a historical support zone around the first target at 72,464, where a temporary pullback could occur.

This bearish wave count remains valid as long as price stays below the stop-loss level at 95,596 . A move above this level would invalidate the potential Wave 5 formation and shift the outlook back to neutral.

Support the channel by engaging with the content, using the rocket button, and sharing your opinions in the comments below 🚀

Disclaimer:

Please note that this analysis is solely for educational purposes and should not be considered a recommendation to take a long or short position on Bitcoin.