BTDR Macro analysis | The bigger picture | Long-term holdersNASDAQ:BTDR

🎯 After a 500%+ rally to all-time high, BTDR gave back most of its gain in a single week, alongside Bitcoin, undoing all that hard work. Price is currently finding support just above the weekly 200EMA and low-cap golden pocket, 0.786 Fibonacci retracement. The macro structure is still bullish with a series of higher highs and higher lows. Wave C of (C) appears to be underway with a target of the R3 pivot at $44 once momentum to Bitcoin and AI returns. The weekly pivot is the next resistance, $15.

📈 Weekly RSI is below the EQ with plenty of room to fall until oversold, though historically it never quite reaches this low.

👉 Analysis is invalidated if price falls below wave (B), $6, and the structure will start to look bearish.

Safe trading

BTDR

BTDR Short-term analysis | Trading and expectationsNASDAQ:BTDR

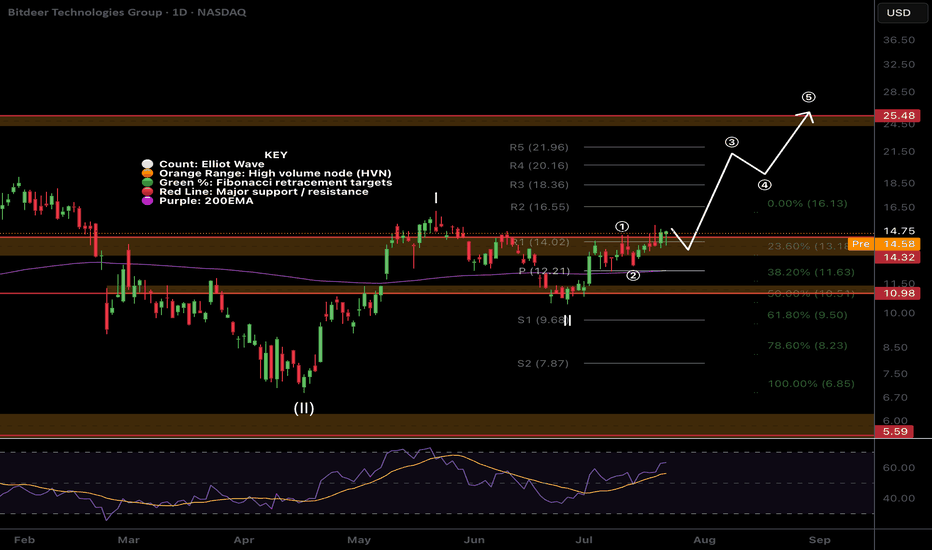

🎯 Price appears to have bottomed at the low-cap golden pocket, 78.6 Fibonacci retracement and major High Volume Node support. However, a triangle could be printing, suggesting one more push lower is on the table. Getting above $14.50 will negate this.

📈 Daily RSI has printed bullish divergence, but we need to see some follow though to be confident the bottom is in.

👉 Analysis is invalidated if price falls below wave (B), $6, and the structure will start to look bearish.

Safe trading

BTDR savage dump, renewed opportunity?NASDAQ:BTDR Locally, the price broke into an all-time high as expected, but the depth of the crash was unexpected, losing 70% of its value in a matter of days. My trading signal took partial profit for 3.57RR at the highs, and the rest of the position was knocked out at breakeven, leaving us with an overall win.

Bullish divergence on a higher low from oversold has emerged. This was also at the 78.6 Fibonacci, where we expected low-cap assets to retrace to- usually marking a bottom. Price behaviour is a series of ABCs changing the overall dynamics. Wave B appears to have ended with wave C minimum target being $38.22 based on 1:1 Fib extensions, also the R3 pivot.

📈 Daily RSI has printed a confirmed bullish divergence from oversold.

👉 Continued downside has a target of $5.59 High Volume Node

Safe trading

Mega bull trend starts now, CLSKIn short:

1) Goldencross soon to be triggered.

2) too see how the stock could perform (with accumulated, low 200dma), we can look in 2023. It peaked in mid July. After explosive rally in november.

3) 13$ levels is the 50% fibonacci..

4) 1st Elliot wave - people are skeptical. 2nd - woohoo. 3rd wave - fomo.

//Advancing in relative strength (CLSK/SPX).

//Small cap ( AMEX:IWM ) outperformance due to rate cut cycle (starts in September). Evidence is yesterday broadening rally.

//52WH is at november 18$. Expect a gamma squeeze?

position based on probabilities. I never make targets (future is unknown).

🥂

BTDR Consolidation below support often leads to a breakoutNASDAQ:BTDR Locally, price is struggling at the expected High Volume Node resistance but without a major rejection. Consolidation below resistance often leads to a breakout

Wave (3) characteristics are being followed with shallow pullbacks so far. The target for a stronger downwards move is the golden pocket and S1 pivot at $17 which would meet the rising daily 200EMA, adding confluence to a local bottom. This would be normal and should be expected.

Daily RSI has printed unconfirmed bullish divergence at the EQ.

Continued upside would flip $25 resistance into support.

BTDR Nothing changedHuge daily candles are perfectly normal behaviour and nothing to be afraid of, we stay zoomed out to observe the larger trend to keep our emotions check. It is feature of these type of assets and is why we can make so much money from them when using the right risk management strategy.

Our first profit target has been hit at $25 all time High Volume Node where price is finding a range as some exit. Price has done 10x since the 2023 bottom. Once this range has worked itself out price is expected to continue upwards into price discovery. A retracement to the weekly pivot should be expected, where I will add to my positions and look for a long.

The macro structure is bullish in an Elliot wave ABC as there are many series of 3 wave structures. Wave (3) of C of (C) is underway with a target of the 1.618 Fibonacci extension $41.17. Price can significantly overextend in volatile assets with momentum and it’s these extremities we look to take secondary profit.

🎯 Terminal target for the business cycle is still the channel upper boundary and R3 weekly pivot at $55. A break out above this would be very bullish and could see prices as high as $80+

📈 Weekly RSI has months left of upside potential.

👉 Analysis is invalidated below wave B and 200EMA, $11.

Bitdeer BTDR Macro Outlook. Nothing changed, Min 2x to come $54NASDAQ:BTDR is a low-cap volatile asset so traders and investors should expect wild pullbacks like we are seeing and is feature of these type of assets and is why we can make so much money from them when using the right strategy.

The macro structure is bullish in an Elliot wave ABC as there are many series of 3 wave structures.

Wave (3) of C of (C) is underway with a minimum target of the 1.618 Fibonacci extension $41.17 but price can significantly overextend in these assets.

Terminal target is the channel upper boundary and R3 weekly pivot at $55. A break out above this would be very bullish and could see prices as high as $80+

RSI has months left of upside. Analysis is only invalidated below the 200EMA.

Safe trading

BTDR Volatile, but uptrend intactNASDAQ:BTDR had a huge bearish engulfing candle Friday. I keep my positions smaller on these assets.

Price is still in a wave 3 breakout towards the $25 High Volume Node target. It appears wave (1) of 3 is complete with a wave (2) target of the daily pivot and 0.5 Fibonacci or golden pocket zone nearby. That would also test the untested wave 1 high as support a highly likely event.

RSI has reset to the EQ where it often finds support in a strong uptrend.

Safe trading

BITDEER – Bullish Outlook as Blockchain Meets AI PowerhouseBitdeer Technologies Group NASDAQ:BTDR is gaining serious traction as a dual-play on blockchain infrastructure and AI-driven compute power. The company operates at the intersection of crypto mining and artificial intelligence cloud services, offering exposure to two of the most dynamic sectors in tech.

🔍 Key Catalysts:

🚀 Revenue Momentum

Q2 2025 revenue surged +56.8% YoY, driven by expanding mining operations and renewed Bitcoin market strength.

📈 Massive Hashrate Growth

Bitdeer targets 40 EH/s of self-mining capacity by October, making it one of the largest global mining operators, well-positioned to ride institutional Bitcoin adoption.

🧠 AI Infrastructure Expansion

Transitioning beyond pure crypto, BTDR is doubling down on high-performance computing (HPC). Its AI Cloud platform, which won the 2025 AI Breakthrough Award, utilizes 1.6 GW of power capacity to run demanding AI workloads—marking a major evolution in the company’s model.

🌍 Global Footprint

A diversified presence across multiple geographies adds scalability and shields against regulatory shifts—a key edge in today’s policy-sensitive environment.

📌 Technical Setup:

We are bullish above the $14.00–$14.25 breakout zone. Sustained price action above this level could pave the way for an upside target of $27.00–$28.00 in the medium term.

BTDR Closed above the weekly pivot!NASDAQ:BTDR Wave (3) is underway and price has overcome the weekly pivot for now and bulls want to see this hold! The trend is up, the supports have been tested and the all time High Volume Node is the next target $25.

Fibonacci extension targets are minimum if $38 at the 1.618 with possibility to overextended bringing up the next target of the R5 weekly pivot at $76

RSI is not overbought and has plenty of room to grow, reaching the next leg often kicks in serious momentum!

Safe trading

BTDR Bounces from previous swing high support!NASDAQ:BTDR found support at the at the wave 1 high and R1 pivot and looks poised to continue to the first take profit target and all time High Volume Node tat $25! Wave (3) of 3 appears to be underway so should continue to be powerful!

Analysis is invalidated if we drop below $13 and lose the High Volume Node support which sits at the Fibonacci golden from the wave (2) bottom.

RSI did not reach overbought so has room to grow.

Safe trading

Bitdeer We got the Breakout! BTDRLocal Analysis / Targets / Elliot Wave

NASDAQ:BTDR Price is breaking out aggressively as predicted in previous analysis. We got the push above the descending resistance line. The next target is the $24 all time High Volume Node resistance but wave 3 minimum target is above $30 per the Fibonacci extension tool.

RSI is overbought but with no divergences yet and can remain this way for weeks.

Standard Deviation Band Analysis

Standard deviation bands fair value line was tested as support and price is about to breakout above the SD+3 threshold starting a new trend into price discovery with a $50 target. Traders should still be cautious of a rejection in this area.

Safe trading

BTDR US ( Bitdeer Technologies Group) Long#Invest #US #BTDR #BTC #USDT

Bitdeer Technologies Group

Demonstrates Growth Through a Combination of Operational Improvements, Industry Trends, and Strategic Initiatives

Now, in order:

Bitdeer reported a significant 56.8% year-over-year revenue increase in Q2 2025 to $155.6 million. This growth was driven by a 42% increase in mining revenue and mining hardware sales

The company increased its monthly bitcoin mining volume by 45.6% in April 2025 compared to March

The rise in the price of bitcoin has directly impacted the profitability of Bitdeer's mining operations

Tether, the issuer of USDT , increased its stake in Bitdeer to 21.4% in March 2025, and then to over 24% in April

The company is actively expanding its energy and data center capacity. 361 MW of capacity has been commissioned since the beginning of 2025, with the total available electrical capacity reaching 1.3 GW. This is expected to increase to 1.6 GW by the end of the year

Bitdeer has confirmed that it is on track to reach its own hashrate of 40 EH/s by the end of October 2025, and plans to exceed this figure by the end of the year

The company is focusing on the SEALMINER A4 project, which aims to achieve unprecedented chip efficiency of around 5 J/Th

Bitdeer plans to set up a production line in the US

Bitdeer held 1,502 bitcoins (worth around $170 million at the time) at the end of Q2 2025, up significantly from 113 BTC the year before

BTDR Still in a triangle, Wave c of (C) downNASDAQ:BTDR Bitdeer was rejected harshly on the 4th test of the High Volume Node (HVN) resistance, each test weakening the Node and adding probability to a breakout.

Wave c of an ABC within a triangle wave (C) appears to be underway with price closing below both the daily pivot and 200EMA. RSI has slight bullish divergence.

Until we get a break below wave (A) or a above wave (B) the analysis is good. Will readjust and update if anything changes. A breakdown below the triangle has a wave 2 target of the golden pocket Fibonacci retracement and HVN support at $9.63 and may offer a great buying opportunity.

Breakout target is the R5 daily pivot at $21.84

Safe trading

$BTDR Pressure Building?NASDAQ:BTDR still appears to be in a wave 2 triangle building pressure for a significant wave 3 up into price discovery.

Wave (II) found support a the golden pocket, shallower than the other miners! Price has tested the upper boundary of the triangle and High Volume Node multiple times at $15 and only once at the bottom threshold hinting at a breakout upwards. Each test makes the boundary weaker.

The weekly pivot point at $17 is the first area of resistance to watch followed by the all time high at $25

Analysis is invalidated below $6.44. RSI is only at the EQ so has room to grow.

Safe trading

$BTDR Closed above resistance!NASDAQ:BTDR Bitdeer closed above major resistance yesterday, despite BTC and alt coins having a bearish day, triggering our long signal in the Weekly Trade signals substack.

I am looking for price to start to accelerate in wave 3 and resistance now support to hold. If BTC reverses it will add additional tailwinds with a target of the major resistance above the R5 daily pivot $24

Safe trading

Technical Analysis of Bitdeer Technologies Group.Long Position:

Entry Point: Consider entering a long position if the stock breaks and holds above $12.00.

Target Price: $15.00

Stop Loss: $10.50 (to protect against significant downside risk)

Short Position:

Entry Point: A short position could be considered if the stock falls below $10.00.

Target Price: $8.50

Stop Loss: $11.00 (to limit potential losses)

Based on the technical indicators and current price action, Bitdeer Technologies Group exhibits strong potential for further growth. Analysts have set a 1-year price target of $15.06, representing a potential upside of approximately 31.16% from the current price.

Bullish Scenario: If the stock maintains its upward momentum, breaking through the resistance level at $12.50, we could see a quick rally towards $15.00. The strong buy rating from analysts further supports this view.

Bearish Scenario: Should the stock face downward pressure, critical support levels are at $10.50 and $9.50. A breach below these levels could indicate a trend reversal.

Bitdeer Technologies Group is positioned well for growth with its current bullish trend and positive technical indicators. However, traders should remain vigilant and use appropriate stop-loss orders to manage risk effectively. The stock's balanced RSI and strong moving averages make it an attractive candidate for long positions, with a speculative price target of $15.00 within the next year.

BITDEER deserves to be re-rated HIGHERBased on fundamentals and technicals of course!

This company I expect to comfortably trade as a double digit company by years end

And during the #Bitcoin bull top even has the potential to tag this log projection

we can see an Inverse head and shoulders clearly being formed.

Yet to trigger, but it has some impressive projections.

Will Bitdeer outperform it's more well known rival #Mining competitors?