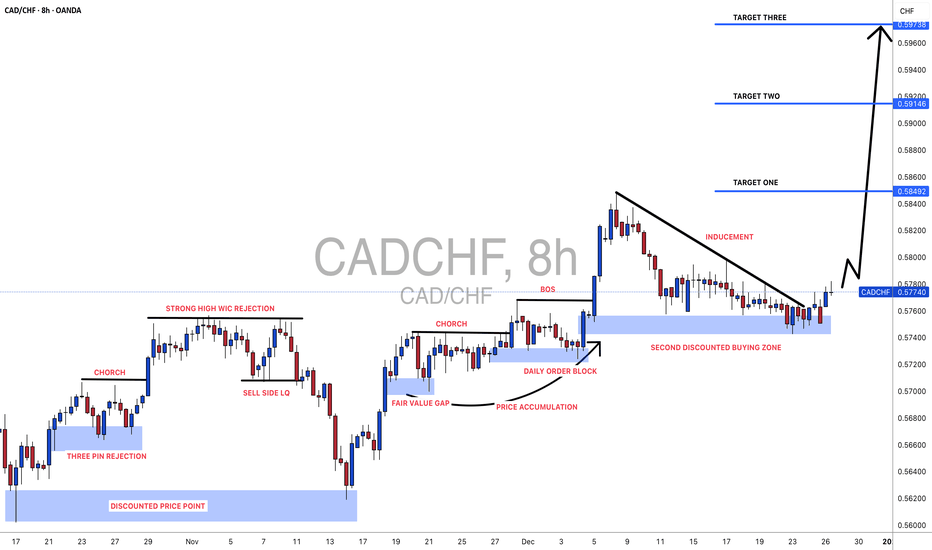

#CADCHF: Three Target Swing Buy For 2026! Dear Traders

Overview On #CADCHF👨💻📈

🔺CADCHF has recently accumulated and we believe the price is likely to enter a distribution phase. This phase will likely act as a swing target and is expected to hit all three of our targets.

🔺We’re still waiting for enough volume in the market to confirm our prediction.

Entry Zone, Exit Zone, Take Profit! 📊

🔺Enter the market when it’s fully formed with sufficient volume and momentum. Use a small stop-loss of 100 pips and set three standard take-profit targets.

🔺When trading the forex market, always use strict risk management.

Team SetupsFX_

⚠️ Disclaimer: Like, comment and follow for more trading setups. Get ready for 2026!

Cadchfanalysis

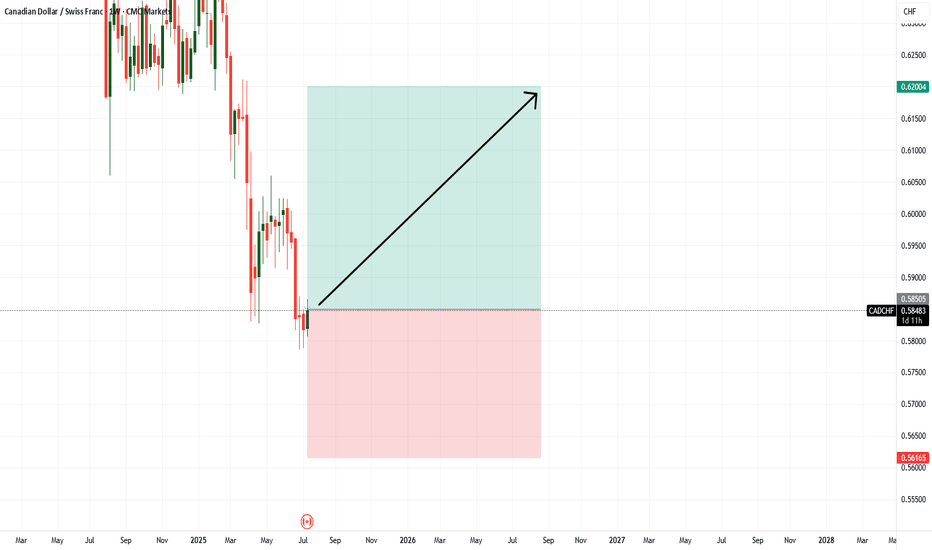

CAD/CHF Technical Roadmap for a Potential Upside Push📌 CAD/CHF Swing Trade — Thief Layer Strategy | Bullish Opportunity 🚀🇨🇦🇨🇭

Asset: CAD/CHF — “CANADIAN DOLLAR VS SWISS FRANC”

Market Type: Forex Swing Trade Setup

📈 Trade Plan (Bullish Bias)

This setup is based on Thief Strategy Layer Entries, a method that scales into the market using multiple limit orders to capture value zones and reduce average entry cost.

✅ Entry Plan — “Thief Layer Style”

Using multiple buy-limit layers, entering at:

0.56800

0.57000

0.57200

(You can increase or modify layers depending on your own market confidence and capital rotation.)

🛡️ Stop Loss (Manage With Discipline)

Thief SL: 0.56600

Dear Ladies & Gentlemen (Thief OG’s), adjust your SL according to your personal risk tolerance and strategy.

I am NOT recommending you to use my SL as your fixed level — protect your capital the way you see fit.

🎯 Take Profit (Escape With Profits)

Price faces moving-average resistance, overbought signals, and potential bull traps, so take profits without hesitation.

Primary TP: 0.58400

Again — this is NOT a fixed TP for you.

Make money and take money based on your own risk and your own timing.

📚 Market Logic & Why Bullish?

CAD is gaining momentum due to improved risk sentiment.

CHF weakness appears in correlated safe-haven flows.

Technical structure shows bullish demand zones aligning with MA support.

Layered buys allow high flexibility during any intraday volatility.

🔍 Related Pairs to Watch (Correlations & Key Notes)

💵 USD/CHF

When USD strengthens and CHF weakens, it often pushes CAD/CHF upward as well.

Watch for risk-on sentiment and U.S. macro prints — they indirectly drive CHF’s safe-haven behavior.

💵 CAD/JPY

A strong CAD here often confirms broad Canadian Dollar strength.

If CAD/JPY is bullish, it reinforces confidence in CAD/CHF longs.

💵 USD/CAD

If USD/CAD is falling, that means CAD is strengthening — supportive for CAD/CHF upside.

Oil prices also influence CAD heavily; rising oil generally lifts CAD.

💵 EUR/CHF

Good for tracking CHF strength/weakness cycles.

If EUR/CHF is climbing, that shows CHF weakening — positive for CAD/CHF bulls.

🔥 Final Words (Thief OG Style)

Stay patient. Let the layers fill.

Protect your capital. Book profits smart.

Trade your plan — not someone else’s emotions.

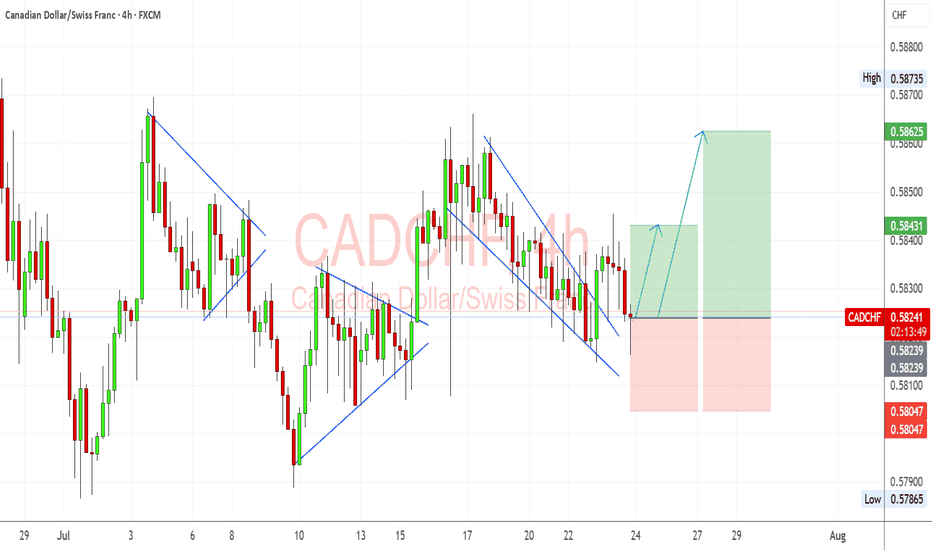

CADCHF Short Term Buy Trading Opportunity SpottedH4 - Strong bullish move

Higher highs

No opposite signs

Until the two support zones hold I expect bullish continuation

👉 If you enjoy this analysis, please Like, Follow, and Support the profile! Your engagement motivates us to share more quality setups.

CADCHF - Looking To Buy Pullbacks In The Short TermH4 - Strong bullish move.

Currently it looks like a pullback is happening.

Until the two Fibonacci support zones hold I expect the price to move higher further.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------

CAD/CHF ∫ Swing Trade Plan and Price RoadmapCAD/CHF Bullish Swing Setup 🚀 | Kijun Breakout & Retest in Play! 🇨🇦🇨🇭

TradingView Idea Description:

🎯 Hey Traders! Welcome to a detailed swing trade opportunity on the CAD/CHF. Let's break it down for maximum clarity and potential profits! 👍 & 💬 if you're following!

📈 Trade Thesis: Bullish Swing

The setup is simple: We are waiting for a decisive breakout and a successful retest of the Kijun-sen (Baseline from the Ichimoku Cloud) to confirm bullish momentum.

Asset: CAD/CHF (Canadian Dollar vs. Swiss Franc)

Strategy: Breakout & Retest | Swing Trade

Bias: BULLISH ✅

⚙️ Trade Plan & Execution

Trigger Zone: Watch price action around 0.57400.

Entry Signal: A clean breakout above the Kijun-sen, followed by a retest of it as new support. A bullish rejection candle (like a hammer or bullish engulfing) on the retest is your ideal confirmation.

Entry: You can enter on the retest confirmation or any point after a confirmed breakout closes above the level.

🛑 Dear Ladies & Gentleman (Thief OG's) - Risk Management is KEY! 🛑

Stop Loss (SL): My strategic stop loss is placed at 0.56800, below the recent structure.

⚠️ IMPORTANT NOTE: I am NOT recommending you use only my SL. Adjust your position size and stop loss based on your own risk tolerance and strategy. You are the captain of your own ship! 🧭

🎯 Profit Targets (PT):

TP 1: Our primary target is 0.58000.

Why Here? This level is where multiple technical factors converge:

🟥 Triangular Moving Average (TMA) acting as strong dynamic resistance.

📊 Potential overbought conditions on lower timeframes.

⚠️ A classic "trap zone" where corrections can begin.

Smart Move: This is a zone to escape with profits! Consider taking partial profits here.

⚠️ REMINDER: Just like the SL, this is MY target. You are free to take profits earlier or manage your trade based on your own analysis. Make your money, your way! 💰

🔍 Market Context & Related Pairs to Watch

Diversifying your view is crucial. Here are key pairs to keep on your radar and why:

USD/CAD ( OANDA:USDCAD ): 🔥 INVERSE Correlation. A weaker USD often means a stronger CAD (bullish for CAD/CHF). If USD/CAD is falling, it can support our bullish CAD/CHF thesis.

USD/CHF ( OANDA:USDCHF ): 🔥 POSITIVE Correlation. The CHF is a safe-haven. Often, USD/CHF and CAD/CHF can move in similar directions against the USD. A strong USD/CHF can sometimes lend strength to CAD/CHF.

EUR/CHF ( OANDA:EURCHF ): 🔥 POSITIVE Correlation. The Swiss Franc is often traded as a bloc against European currencies. Watch this for general CHF strength/weakness.

WTI Crude Oil ( BLACKBULL:WTI ): 💎 Key for CAD. The Canadian Dollar is a commodity currency, heavily linked to Oil prices. Rising Oil prices are generally BULLISH for the CAD. A strong rally in Oil could be the fundamental driver for this technical breakout.

Let's have a green and profitable trade! 🍀

#TradingView #Forex #CADCHF #SwingTrading #Ichimoku #Breakout #TechnicalAnalysis #ForexSetup #TradingIdeas #CommodityCurrencies #SafeHaven #ThiefOGs

CAD/CHF – Price Action Analysis (SELL Bias) Take Profit: 0.57171Institutional Technical Breakdown | All Sessions

CAD/CHF has activated a SELL signal driven entirely by Price Action, supported by pattern recognition from the last 200 bars and aligned with bearish structural flow. The pair is trading near a well-protected supply zone, where repeated rejections are signaling weakening buyer strength and increasing downside probability.

This is a clean, technically driven setup with no major news distortions.

📌 Signal Summary

Bias: SELL

Model: Price Action

Risk/Reward: ~1:2.5

Conditions: All Sessions

Volatility: Moderate & stable

The algorithm identifies consistent bearish reaction patterns when price approaches the current resistance zone.

📊 Technical Outlook

1. Price Action & Structure

Price is currently reacting below the 0.57535 – 0.57565 resistance band, which has acted as a strong intraday supply zone.

Upper-wick rejections indicate aggressive sell pressure at higher levels.

Candle structure is compressing — often a precursor to a decisive breakout toward the nearest liquidity pocket.

Market flow shows a lower-high formation, supporting continuation to the downside.

2. Momentum Alignment

Even though this is primarily a price-action signal, supporting indicators show:

Bearish divergence formation

Weakening bullish momentum

Increased probability of a downside break

This adds strong confluence to the bearish idea.

3. Market Context

CAD remains neutral-to-weak across cross-pairs.

CHF remains supported by safe-haven flows.

No major news for CAD or CHF, keeping this setup purely technical.

All sessions provide stable liquidity for execution.

📌 Key Technical Levels

Type Level

Immediate Resistance 0.57535

Immediate Support 0.57475

Major Resistance 0.57565

Major Support 0.57445

Price is currently sitting just below these resistance levels — ideal for a bearish continuation setup.

🎯 Trade Parameters

Entry Price: 0.57505

Stop Loss: 0.57671

Take Profit: 0.57171

The stop-loss placement is safely above major resistance, protecting the trade from short-term volatility spikes.

The take-profit level targets the next liquidity zone, aligning with the broader bearish rhythm.

🧠 Trade Rationale

Rejection from multi-layered resistance (0.57535 / 0.57565).

Bearish divergence confirms momentum failure.

Strong supply overhead restricting bullish expansion.

Clean liquidity void down to 0.57171.

Structural lower highs support continuation.

Overall, this setup represents a textbook bearish price-action continuation opportunity.

📉 Risk Management Recommendations

Use 1–2% risk per trade maximum.

Optionally take partial TP at 0.57445, the first liquidity shelf.

Enable trailing stop once price breaks below 0.57445.

If a candle closes above 0.57671, bearish bias becomes invalid.

📌 Analyst Conclusion

CAD/CHF shows a high-quality bearish setup backed by clean price action, structural confluence, and momentum alignment. As long as price stays below 0.57535–0.57565, downside continuation toward 0.57171 remains the most probable path.

CADCHF Massive Bullish Breakout!

HI,Traders !

#CADCHF is trading in a strong

Uptrend and the price just

Made a massive bullish

Breakout of the falling

Resistance line and the

Breakout is confirmed

So after a potential pullback

We will be expecting a

Further bullish continuation !

Comment and subscribe to help us grow !

Is This the Start of a Momentum Shift for CAD/CHF Bulls?🎯 CADCHF: The Great Swiss Bank Heist! 🏦💰

📊 Market Overview: Loonie vs Swiss Showdown

Pair: CAD/CHF (The Maple Leaf meets the Alpine Fortress)

Strategy Type: Swing/Day Trade | Metals Market Cash Flow Management

Bias: 🐂 BULLISH (Confirmed with Accumulation + LSMA Breakout)

Trade Style: The "Thief Strategy" - Ocean's Eleven meets Wall Street 🎭

🎬 The Setup: Planning the Perfect Heist

We've spotted a golden opportunity in CADCHF! The accumulation phase is complete, and the Least Squares Moving Average (LSMA) has broken out like a master thief slipping through laser security systems. The Swiss vault is looking vulnerable, and the Loonie is ready to make its move! 🍁💨

Why This Setup? Metals market correlations are aligning beautifully with this pair, creating a cash flow momentum we can't ignore. The technical confluence is stronger than a bank vault door... but we've got the code! 😎

💼 The Heist Plan: Entry Strategy

🎯 "The Layering Method" - Multiple Entry Points

Instead of going all-in at one price (rookie mistake!), we're using multiple limit orders like a professional crew positioning themselves at different access points:

Recommended Layer Entries:

🥉 Layer 1: 0.57200 (The Ground Floor)

🥈 Layer 2: 0.57300 (The Mezzanine)

🥇 Layer 3: 0.57400 (VIP Access)

Flexibility Note: You can add MORE layers based on your account size and risk appetite. Scale in gradually - this isn't a smash-and-grab; it's a calculated operation! 🧠

Entry Philosophy: Any price level within the zone works, but layering gives you dollar-cost averaging benefits and reduces emotional decision-making.

🛡️ Risk Management: Don't Get Caught!

🚨 Stop Loss (Emergency Exit Plan)

Thief's SL: 0.57000

⚠️ IMPORTANT DISCLAIMER: This is MY stop loss based on technical invalidation levels. YOU should set YOUR OWN stop loss based on:

Your risk tolerance (1-2% of account recommended)

Your position size

Your account equity

Your sleep-at-night comfort level

Risk Management = Freedom. Don't let one trade blow up your account! 🎰❌

🎯 Target Zone: The Getaway Plan

🏦 Take Profit Target: 0.58000

Why This Level?

This is where the "Police Barricade" sits - a strong resistance zone with multiple technical factors:

Historical resistance area

Potential overbought conditions forming

Classic bull trap territory

The Pro Move: As we approach 0.58000, consider:

Taking 50% profits at 0.57800

Moving stop loss to breakeven

Letting remaining position run with trailing stop

GET OUT BEFORE THE TRAP CLOSES! 🚓

📢 CRITICAL NOTE: This is MY target based on risk/reward analysis. YOU should take profits when YOU feel comfortable. No one ever went broke taking profits! Lock in those gains and live to trade another day, Thief OGs! 💎🙌

🌍 Correlated Pairs to Watch (Global Context)

Related Opportunities:

OANDA:USDCHF - The big brother move (inverse correlation)

OANDA:EURCHF - European cousin in the Swiss franc family

OANDA:XAUUSD (Gold) - Metals correlation play! 🥇

OANDA:XAGUSD (Silver) - Industrial metals momentum 🥈

Crude Oil ( BLACKBULL:WTI ) - Canadian dollar's best friend (CAD is oil-sensitive) 🛢️

Why These Matter?

CAD strength = Rising commodity prices (especially oil & metals)

CHF weakness = Risk-on sentiment in markets

When Gold & Oil rally together, CAD typically follows. Watch these correlations for confirmation! 🔗

🔑 Key Technical Points

✅ LSMA Breakout Confirmed - Momentum is building

✅ Accumulation Phase Complete - Smart money is positioned

✅ Higher Lows Forming - Bullish market structure

✅ Volume Supporting Move - Not a fake breakout

✅ Metals Market Tailwinds - Macro environment favorable

🎓 Trading Psychology Corner

For the Thief OGs out there:

⏳ Patience is your superpower - don't force trades

📏 Position sizing > being right - manage risk first

🎯 Plan your trade, trade your plan - no improvising mid-heist!

💰 Take profits like a pro - greed is the enemy

🧘 Stay emotionless - this is business, not personal

🎬 Final Word from Your Friendly Neighborhood Thief

Remember, the best traders are the ones who live to trade another day. We're not here to hit home runs every time - we're here to stack consistent singles and doubles. This CADCHF setup looks promising, but the market always has the final say.

Stay sharp, stay disciplined, and may the pips be ever in your favor! 🎯

Good luck out there, Thief OGs! Let's make this heist count! 🏦💰🚀

✨ If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!

#CADCHF #ForexTrading #SwingTrading #DayTrading #TechnicalAnalysis #PriceAction #ForexSignals #TradingStrategy #RiskManagement #LSMA #BullishSetup #ForexEducation #TradingCommunity #MetalsMarket #CommodityCorrelation #CAD #CHF #ForexIdeas #TradingView #ChartAnalysis #ForexLife #ThiefStrategy

CADCHF Rally Meets Resistance, Bears Eye Fresh DownsideCADCHF has recovered into resistance near the 0.5770 zone after an aggressive drop earlier in September. The bounce looks corrective rather than structural, and the broader downtrend remains intact. With Canada facing stagflation risks and Switzerland maintaining low but stable inflation, the franc’s safe-haven demand keeps pressure on CAD.

Current Bias

Bearish – recent strength appears corrective; sellers are likely to re-engage below resistance.

Key Fundamental Drivers

Bank of Canada: Rate cut expectations are rising after soft GDP and weak labor data, weighing on CAD.

Swiss National Bank (SNB): Steady policy with inflation under control keeps CHF stable.

Oil Prices: Weak oil performance undermines CAD, given Canada’s reliance on energy exports.

Macro Context

Interest Rates: BoC is tilting dovish, while the SNB holds steady. Divergence favors CHF strength.

Growth Trends: Canadian economy shows stagnation risks; Switzerland remains resilient with moderate growth.

Commodity Flows: Oil remains a drag on CAD, with geopolitical headlines adding volatility.

Geopolitics: CHF demand often spikes during global risk-off events, while CAD suffers in those conditions.

Primary Risk to the Trend

A sharp rebound in oil prices or stronger-than-expected Canadian economic data could give CAD relief and weaken the bearish case.

Most Critical Upcoming News/Event

Canada GDP and inflation data

SNB commentary on currency strength

Global energy headlines affecting oil prices

Leader/Lagger Dynamics

CADCHF is generally a lagger, reflecting moves in oil and broader CHF sentiment. Watch oil for CAD momentum and EURCHF for CHF direction.

Key Levels

Support Levels: 0.5736, 0.5701

Resistance Levels: 0.5776, 0.5816

Stop Loss (SL): 0.5816 (above key resistance)

Take Profit (TP): 0.5736 (first target), 0.5701 (secondary target)

Summary: Bias and Watchpoints

CADCHF holds a bearish bias with the recovery stalling at 0.5770. The broader fundamental backdrop favors CHF as BoC shifts dovish and oil remains under pressure. A stop loss above 0.5816 helps protect against false breakouts, while profit-taking targets are set at 0.5736 and 0.5701. This pair is more of a lagger, following oil and CHF flows, so traders should stay alert to energy headlines and safe-haven demand.

CAD/CHF: Bearish Trend Resumes After Retest of Downtrend LineCAD/CHF continues to respect its prevailing downtrend, with price reacting from the descending trendline and showing signs of renewed bearish pressure. Fundamentals support further downside as CAD remains weighed by weak domestic data, while CHF holds steady as a safe-haven currency amid global tariff concerns.

Technical Analysis (4H Chart)

Trend: Strong downtrend structure, with repeated rejections from the descending trendline.

Current Level: 0.5829, consolidating after failing to break above 0.5863 resistance.

Key Support Levels:

0.5786 (near-term support and first bearish target).

0.5736 (secondary support and next major target).

Resistance Levels:

0.5863 (immediate resistance at descending trendline).

0.5910 (upper resistance if a breakout occurs).

Projection: Likely pullback toward 0.5863 (retest zone) before continuation to 0.5786 and possibly 0.5736.

Fundamental Analysis

Bias: Bearish.

Key Fundamentals:

CAD: Weak Canadian manufacturing PMI and trade risks from US tariffs limit CAD upside.

CHF: Swiss Franc remains supported by safe-haven demand amid tariff uncertainty.

Oil Prices: Stable oil offers partial CAD support but insufficient to change the broader trend.

Risks:

A sharp rise in oil prices could strengthen CAD.

Global risk-on sentiment could weaken CHF and lift CAD/CHF.

Key Events:

BoC policy updates.

SNB stance and global risk sentiment shifts.

Oil market data.

Leader/Lagger Dynamics

CAD/CHF is a lagger, following CAD’s performance relative to oil and CHF’s safe-haven flows.

Summary: Bias and Watchpoints

CAD/CHF remains bearish, with price respecting the downtrend and targeting 0.5786 initially. A break below this level opens the door to 0.5736. The key watchpoints are oil price fluctuations, global risk sentiment, and potential safe-haven demand for CHF.

Bears Trapped — CADCHF Heist Begins (Buy Setup Inside)💎💣CAD/CHF Swiss Vault Breakout 💰 Heist in Progress (Scalp/Day Plan)💣💎

“When the market sleeps, we rob it clean!”

🌍 Hola! Bonjour! Hallo! Marhaba! Hello, Thieves & Market Movers! 🌍

💰🤑💸Welcome to another high-stakes heist from the vaults of Thief Trader HQ!💸🤑💰

This time, our radar’s locked on CAD/CHF — aka the Loonie vs the Swissy.

We’re executing a precise scalping/day trading robbery based on the mix of technical traps, macro fundamentals, and sentiment distortion.

The vault is unattended, the guards are napping — time to MOVE.

🎯 ENTRY PLAN 📈

The vault’s unlocked — bulls, suit up.

☑️ Execute BUY LIMITS closest to swing lows on the 15M or 30M chart for precision pullbacks.

☑️ Use DCA layering — multiple limit orders = more loot bags.

📌 Entry Zone: Flexible — "Any dip is a gift. Rob it!"

🛑 STOP LOSS STRATEGY 🚫

🔒 SL secured at 0.58200, based on 4H swing low.

🛡️ Adjust based on your risk appetite, trade size, and how heavy you stack your orders.

💸 TARGET TAKE 🏁

🎯 Primary TP: 0.59000

🤑 Trail if price rips through — let the robbery run.

📊 WHY THIS HEIST? 🔥

We’re seeing:

✔️ Bullish market shift

✔️ Overbought bait trap for late bears

✔️ Reversal zones tested

✔️ Consolidation breakout pattern forming

✔️ Risk-reward setup aligned for thieves

All backed by:

📌 COT Reports

📌 Macro Trend Forecasts

📌 Quant Models & Sentiment Flow

📌 Intermarket Confirmation (Oil correlations, CHF flows, risk sentiment)

📰⚠️ TRADING ALERT – News Watch 🚨

News is a market alarm system — don’t trip it.

✔️ Avoid entries during red-folder releases

✔️ Use trailing SLs to protect profit loot

✔️ Update your chart often — the game moves fast

❤️ SHOW SOME LOVE TO THE CREW

💥 SMASH the Boost Button if you love the plan 💥

🎯 Help grow the strongest robbery crew on TradingView

📈 Daily profits using Thief Trading Style — no cap, just charts.

🕶️ Stay stealthy. Stay smart. Stay Thief.

See you on the next plan.

Until then... 💼💸🧠

CADCHF - turnaround?A prolonged downtrend that started with a triple top led to an all time low at 0.57831.

A double or triple bottom followed, and then a couple of higher lows.

This could still go either way, I think its premature to conclude that this PA is an early sign of a bullish trend.

However, if we get a daily close above 0.5900 then this could get really interesting.

This is not a trade recommendation; it’s merely my own analysis. Trading carries a high level of risk so carefully managing your capital and risk is important. If you like my idea, please give a “boost” and follow me to get even more.

CADCHF - Looking To Sell Pullbacks In The Short TermM15 - Strong bearish move.

No opposite signs.

Currently it looks like a pullback is happening.

Expecting bearish continuation until the two Fibonacci resistance zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

CADCHF Bullish Reversal in Motion Channel Break & Momentum ShiftCADCHF setup is developing into a potential bullish recovery after a breakout from a falling wedge. I’m looking for signs of buyer control as price attempts to build higher structure off the recent breakout.

📊 Technical View (My Setup Insight):

Falling Wedge Breakout: Price has cleanly broken out of the descending channel/wedge formation. That’s often a reversal signal, especially near support zones.

Support Holding: The pair found buyers around 0.5810–0.5820, an area tested multiple times in July. This zone has acted as a soft base.

Bullish Flag Recovery: Prior corrective patterns (flags/pennants) were followed by strong impulsive moves, and we may be repeating this pattern now.

Next Targets:

TP1: 0.5843 – aligns with previous structure and minor resistance.

TP2: 0.5862 – near the most recent high and top of consolidation.

Stop-Loss: Below 0.5800 to invalidate the reversal structure.

🧮 Fundamental Drivers (My Outlook):

CAD Support from Oil Stability: Oil prices have firmed around $78–$80, which helps the CAD via improved trade and energy revenue prospects.

SNB Stance Neutral-Dovish: Swiss inflation remains soft, and SNB has signaled comfort with its current policy rate, reducing CHF bullish pressure.

BoC Hawkish Bias: Despite softening Canadian CPI, the BoC remains cautious and hasn’t ruled out future hikes. CAD remains supported relative to CHF.

Global Risk Mood: CHF is sensitive to risk-off flows. With equities and commodities rebounding modestly, safe haven flows into CHF may slow.

⚠️ Risks to the Setup:

A sudden drop in oil prices could hurt CAD.

Risk-off sentiment due to geopolitical tensions or US equity selloffs could fuel CHF strength.

Any surprise SNB jawboning about FX could cause CHF to spike.

📆 Upcoming Events to Monitor:

Canadian GDP / Retail Sales – if strong, reinforces CAD recovery.

Swiss KOF Economic Barometer – gives insight into CHF macro tone.

Oil Inventories – strong builds or drawdowns influence CAD indirectly.

🔁 Leader/Lagger Context:

CADCHF is often a lagger, especially when risk sentiment or oil makes bigger moves. It can follow USDCHF or USDCAD behavior due to shared components.

If oil or global risk sentiment shifts, CADCHF tends to react with a small lag, making it great for secondary confirmation trades.

🧩 Summary – Bias & Watchpoints:

I currently hold a bullish bias on CADCHF following the falling wedge breakout and support defense. Fundamentals are moderately in favor of CAD due to oil stability and BoC’s cautious stance versus the more passive SNB. Key risks include any renewed CHF demand from risk-off shifts or soft Canadian economic surprises. The most critical levels now lie at 0.5843 and 0.5862 for upside targets, while 0.5800 remains key invalidation support.

CAD/CHF Loonie Heist: Sniping Swiss Profits with Thief Trading!🌍 Hello Global Traders! 🌟

Money Makers, Risk Takers, and Market Shakers! 🤑💸✈️

Dive into our CAD/CHF "Loonie vs Swiss" Forex heist, crafted with the signature 🔥Thief Trading Style🔥, blending sharp technicals and deep fundamentals. Follow the strategy outlined in the TradingView chart, focusing on a long entry targeting the high-risk MA Zone. Expect a wild ride with overbought conditions, consolidation, and potential trend reversals where bearish players lurk. 🏆💰 Celebrate your wins, traders—you’ve earned it! 💪🎉

Entry 📈: The vault’s open! Grab bullish opportunities at any price, but for precision, set buy limit orders on a 15 or 30-minute timeframe near swing lows or highs for pullback entries.

Stop Loss 🛑:

📍 Place your Thief SL at the recent swing low on the 4H timeframe (0.59400) for scalping or day trades.

📍 Adjust SL based on your risk tolerance, lot size, and number of open orders.

Target 🎯: Aim for 0.61500.

💵 CAD/CHF is riding a bullish wave, fueled by key market drivers. ☝

Unlock the full picture—dive into Fundamentals, Macro Insights, COT Reports, Quantitative Analysis, Sentiment Outlook, Intermarket Trends, and Future Targets. Check 👉🌎🔗.

⚠️ Trading Alert: News & Position Management 📰🚨

News can shake the market hard. Protect your trades by:

Avoiding new entries during news releases.

Using trailing stops to lock in profits and shield running positions.

📌 Markets move fast—stay sharp, keep learning, and adapt your strategy as conditions evolve.

💖 Power up our heist! 🚀 Tap the Boost Button to amplify our Thief Trading Style and make stealing profits a breeze. Join our crew, grow stronger, and conquer the markets daily with ease. 🏆🤝❤️

Catch you at the next heist, traders—stay ready! 🤑🐱👤🤩

Potential Reversal Setup on CAD/CHF as CHF Strength PeaksThe CAD/CHF pair has been under sustained bearish pressure, reaching historic lows amid continued CHF strength. The ongoing U.S. trade and tariff tensions have heightened global uncertainty, driving investors toward safe-haven currencies like the Swiss franc. In contrast, the Canadian dollar remains sensitive to risk sentiment and commodity demand, amplifying the pair's downside.

Technically, CAD/CHF has been trading within a well-defined **descending channel**, respecting both the upper resistance and lower support boundaries. After reaching the lower boundary of this channel — which coincides with a major historical support level — the pair is now showing early signs of a potential bullish reversal:

If the pair can hold this level and break above the midline or upper resistance of the channel, it could open the door for a corrective move to the upside. Key resistance levels to watch include

As always, any bullish move will depend on how global risk sentiment evolves in response to trade developments.