GRAL: strong linearity and decent upside potential strong linear trend structure with price reaching key mid-term resistance, where a new base formation or extended consolidation may be expected.

If the current pullback remains contained within the 77–60 support zone (after one potential leg down), it could complete the corrective phase and set the stage for a higher low formation, opening room for the next upleg toward 155–200 mid-term resistance.

Alternatively, a breakdown below 60 would raise the odds for a transition into a diagonal structure, implying a deeper and longer pullback into the 55–45 area before any new attempt to resume the uptrend.

Chart:

Cancer

IBRX consolidating at $2.3 with volume confirmationThe share price has tested and been holding steady around/above ~2.3 for all of 2025. Volume is showing a very obvious increase over time as shares are being consolidated at this level. Price is due for a reversal. How high? My conservative guess is it will reach at least $6.7 before the end of its upward trend.

Don't know much about the company, just going off the chart.

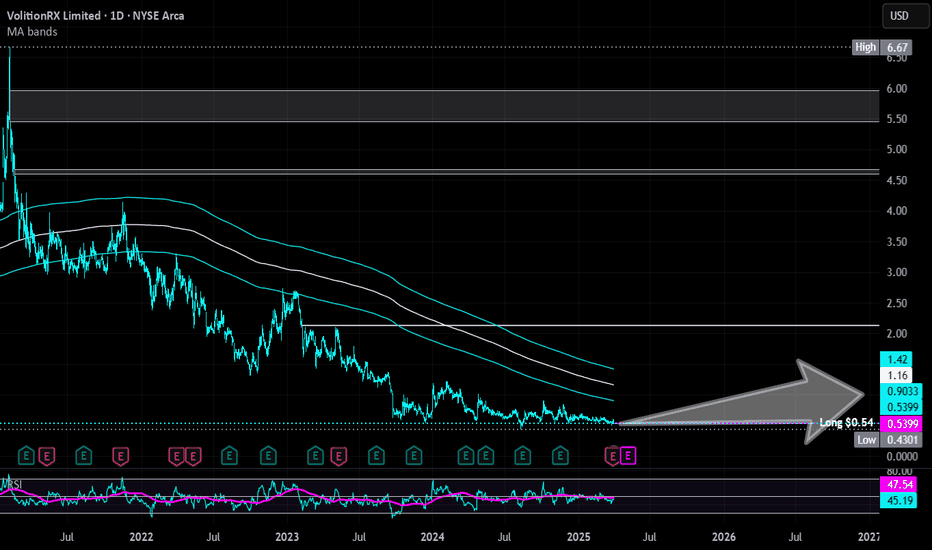

VolitionRX | VNRX | Long at $0.54***Stay away if you are risk averse (small cap with 300-400k daily volume and could go to $0).

VolitionRX AMEX:VNRX is a U.S.-based, multinational epigenetics company focused on developing blood tests for early disease detection, primarily targeting cancer and sepsis. Its Nu.Q blood tests are primarily for humans, focusing on early detection of diseases like cancer and sepsis. However, the company has also explored veterinary applications through its Nu.Q Vet product line, targeting cancer screening in animals, particularly dogs.

Recent insider purchases got my attention, with the CEO and Director each grabbing $100k worth at $0.55. Plus, many other insiders have recently been awarded options. The company is making progress in signing multiple licensing deals for their Nu.Q platform in the human market, with strong interest from large companies. Many development milestones have been made within their cancer testing program and more are likely to be announced. However, the company is unprofitable at this time, and this is a highly risky / speculative play. It may take years to unfold or be a total disaster and go to $0.00.

Rolling the dice at $0.54 with the goal to reach $0.75 and $1.00 in the coming 1-2 years. Analyst targets are in the $3.00-$3.50 range.

AI Biologics firm Absci tie up with AstraZeneca on Cancer Drug Anglo-Swedish drugmaker AstraZeneca (AZN.L) has signed a deal worth up to $247 million with U.S. artificial intelligence (AI) biologics firm Absci (ABSI.O) to design an antibody to fight cancer, Absci said in a statement on Sunday.

Absci's collaboration with AstraZeneca aims for a zero-shot generative AI model designed to create new and improved antibody therapeutics, the company said. It did not say what kind of cancer they plan to target.

Absci applies generative artificial intelligence to design optimal drug candidates based on target affinity, safety, manufacturability and other traits.

Technical Analysist

Price Momentum

ABSI is trading in the middle of its 52-week range and above its 200-day simple moving average.

What does this mean?

Investors are still evaluating the share price, but the stock still appears to have some upward momentum. This is a positive sign for the stock's future value.

KVUE Split-off: A Response to JNJ's Cancer-Related Products?It is plausible to consider that Johnson & Johnson's decision to spin off Kenvue might be linked to an effort to mitigate potential legal liabilities stemming from its talc-based products, which have been implicated in cases of cancer in the US and Canada. This strategic maneuver could potentially offer a layer of legal protection. Shareholders are expected to transition from holding Johnson & Johnson shares to Kenvue shares in the upcoming week. A similar approach was attempted by MMM, although it did not yield successful results, causing a downward trajectory in its stock performance over the past two years.

From my perspective, the true rationale behind the division appears to be related to the numerous instances of individuals developing cancer due to Johnson & Johnson's talc-based products. A recent legal ruling mandated Johnson & Johnson to pay $18.8 million to a California resident who claimed to have contracted cancer from using its baby powder. This decision represents a setback for the company as it seeks resolution for thousands of comparable cases related to its talc-based products within a US bankruptcy court.

Johnson & Johnson recently disclosed detailed information regarding the much-anticipated division of its consumer healthcare venture, Kenvue. This move involves a separation of at least 80.1% of Kenvue shares, facilitated through an exchange offer presented to investors. Within this arrangement, shareholders have the flexibility to trade all, a portion, or none of their Johnson & Johnson shares for Kenvue stock.

The company is extending the choice to its investors, allowing them to opt for an exchange of shares for Kenvue stock. To incentivize this exchange, a 7% discount is being offered on the shares. However, there is an upper threshold of 8.0549 Kenvue shares for each Johnson & Johnson share. If this ceiling is not applicable, shareholders will receive approximately $107.53 worth of Kenvue shares for every $100 worth of Johnson & Johnson stock they intend to exchange. The execution of this exchange offer is anticipated to conclude by mid-August. Notably, this exchange program is voluntary and carries tax-free advantages.

Kenvue has outlined plans to distribute a portion of its available funds to shareholders through dividend payments. The company has recently initiated a quarterly dividend of $0.20 per share (equivalent to $0.80 annually), with the first payout scheduled for early September. This dividend framework translates to a dividend yield of 3.3% based on the prevailing stock price of approximately $24 per share. This yield marginally exceeds Johnson & Johnson's existing dividend yield of 2.8%.

It is likely that a significant portion of individuals holding Johnson & Johnson stock will opt to exchange their shares for Kenvue.

Based on this assessment, I anticipate that Kenvue's stock could potentially reach $30 in the near future.

Looking forward to read your opinion about it!

BriaCell Therapeutics Corp | Bria-MT™ | NASDAQ: BCTX TSX: BCTBriacell Therapeutics Corp has been trending higher on news - BriaCell Therapeutics Corp. (Nasdaq: BCTX, BCTXW) (TSX: BCT) #briacell #cancer #richtv #richtvlive #breastcancer (“BriaCell” or the “Company”), a clinical-stage biotechnology company specializing in targeted immunotherapies for cancer, is presenting positive clinical data from its lead product candidate, Bria-IMT™, summarized in four poster sessions during the 2023 American Association for Cancer Research (AACR) Annual Meeting held from April 14 – 19, 2023 at Orange County Convention Center, Orlando, Florida.

“Our data highlights the potential clinical value of the Bria-MT™ regimen in patients with advanced metastatic breast cancer after receiving multiple prior therapies,” said Carmen Calfa, M.D., of the Sylvester Comprehensive Cancer Center at the University of Miami, Associate Professor of Clinical Medicine, Principal Clinical Investigator, and co-author of the study of Bria-IMT™ in combination with PD-1 inhibitors pembrolizumab and retifanlimab. “These results are promising and the fact that patients have had a great quality of life thus far is remarkable. We are hopeful that this novel immunotherapy proves to be an effective therapy for our patients.”

“Our clinical findings continue to confirm our approach for our upcoming pivotal trial of Bria-IMT™ combination regimen,” commented Dr. William V. Williams, BriaCell’s President and CEO. “With over 40,000 annual deaths in the U.S. alone, advanced metastatic breast cancer remains an unmet medical need. Patients who have only months to live tend to avoid current therapies that are proven ineffective and are associated with excessive toxicities. BriaCell’s regimen has shown robust clinical efficacy, better than expected survival outcomes, and an excellent safety profile in this very difficult to treat patient cohort. We are seeing benefits in patients who failed other treatments and/or cannot tolerate the harsh side effects of other therapies.”

Roche Holding AG bullish scenario:The technical figure Triangle can be found in the daily chart in the German company F. Hoffmann-La Roche AG (ROG.vx). Roche is a Swiss multinational healthcare company that operates worldwide under two divisions: Pharmaceuticals and Diagnostics. Its holding company, Roche Holding AG, has shares listed on the SIX Swiss Exchange. Roche is the fifth largest pharmaceutical company in the world by revenue and the leading provider of cancer treatments globally. The Triangle broke through the resistance line on 07/09/2022, if the price holds above this level, you can have a possible bullish price movement with a forecast for the next 10 days towards 333.65 CHF. Your stop-loss order, according to experts, should be placed at 311.75 CHF if you decide to enter this position.

Roche announced the launch of the Digital LightCycler System, Roche’s first digital polymerase chain reaction (PCR) system. This next-generation system detects disease and is designed to accurately quantify trace amounts of specific DNA and RNA targets not typically detectable by conventional PCR methods.

The Digital LightCycler System will allow clinical researchers to divide DNA and RNA from an already extracted clinical sample into as many as 100,000 microscopic individual reactions. The system can then perform PCR and produce highly sophisticated data analysis on the results.

Risk Disclosure: Trading Foreign Exchange (Forex) and Contracts of Difference (CFD's) carries a high level of risk. By registering and signing up, any client affirms their understanding of their own personal accountability for all transactions performed within their account and recognizes the risks associated with trading on such markets and on such sites. Furthermore, one understands that the company carries zero influence over transactions, markets, and trading signals, therefore, cannot be held liable nor guarantee any profits or losses.

BioNTech showing a solid entryBNTX is finally concluding a year long descending triangle pattern. I see a low risk entry at $150 and will be buying. Stop loss set at $138.49, risking about 8.5%. If we see a large move upward, I could see the stock retesting both its 200 day moving average (likely at $183) and its next major resistance after that at $295. A potential of nearly 100% profit (not to say its a sure bet or smart to dump huge amounts into the trade without the stop loss...). Fundamentally, the company has a P/E of 3, no debt, and a huge free cash flow to fund its mrna platforms for a lot of other diseases partnering with some of the largest pharma companies in the world. Yet another variant of covid, upward pressure from the 50and100 day MAs, large portions of the world unvaccinated, and president biden contracting the virus could be potential catalysts for a move. If you're looking for a bio tech exposure this is a stock that seems to be set up well. Good luck to all.

$BCTX poised to bounce $BCTX - BriaCell is a cancer treatment biotech that recently dropped 40% AFTER receiving fast track designation for FDA approval. The drop was somewhat coincidental as it's month long bull run finished with a FinTwit pump and dump. BUT the retrace is in and it's approaching historical trend lines and levels of support and looks poised to bounce in the coming week. TD9 is flashing a buy signal, but I wouldn't be shocked if it begins to curl throughout the week. Looking to enter a long swing trade to ride it back to previous highs.

GOVX Corporate Update soon | 10X Upside Potential Analyst RatingGOVX GeoVax Labs is a biotechnology company developing immunotherapies and vaccines against infectious diseases and cancer.

GeoVax Labs will report Q1 2022 financial results on April 27.

Jason McCarthy from Maxim Group has a $10.00 price target for GOVX.

The stock is now $1.01.

Market Cap of only 7.23Mil.

This is a 4X upside potential short term stock in my opinion.

CWBR Upside PotentialCWBR closed 2 months ago a $15.0 Million Public Offering of Common Stock and Warrants at $0.72, so this is a safe upside in my opinion if you want to enter now.

On the other hand, Cantor Fitzgerald brokerage has a $2.5 price target for it.

52 Week Range 0.34 - 2.27 Just bounced from its lowest support.

SESN Price TargetOn 8/17/2021 Canaccord Genuity brokerage Lower Price Target for SESN giving a Buy rating from $7.00 to $3.00.

Sesen Bio (SESN) flagship drug candidate Vicineum, failed to obtain FDA approval, but they will try a second time to get the regulatory go-ahead for the bladder cancer treatment.

buying long term calls could be a strategy for this one. volatility is likely after they announce the second FDA submission.

GRTX important Price Target Upgrades Today !An "error" in previously released results sent Galera Therapeutics, Inc. (GRTX) stock price down by more than 70% in October.

Today GRTX was upgraded today by HC Wainwright to buy, 10usd price target and by BTIG Research to 15usd price target.

Have you bought it yesterday?

isr bREAKING OUTMy kid came by and when i was looking at the chart, she said: hey look! a bird! and at the time, there was no bird there was only a small cone I drew for the pennant at the tip of the retracement.

I zoom out a little, and noticed, wow you are right the bouncing kind of looks like ahead when you add an eye when I zoomed out more, the chart had a real recollection so I drew it. I think this chart is bullish and this tells tales about the physical element and visual elements of stocks

they need to look good, and they project a feeling of motion to people's psyche.

the shape, is soothing, smooth, looks organic, (even tho it isn't it is highly manufactured by the shorts)

just thought it was interesting to share...

I think this stock will go to 8-10$ despite what lots of people are saying in the Weibull chats.

This is good lung cancer treatment stock and I think people would be wise to have some. it had a nice-sized green hammer this morning.

CVM and Multikine; Rating and Confidence ReaffirmedDisclaimer

I am long $CVM to the tune of X0,000 shares (and growing). I genuinely believe, as a scientist, biochemist, and analyst, in Cel-Sci Corporation's Multikine. This article serves as the thesis that $CVM deserves that I have given to other stocks. As always buy shares, options are dangerous and are often used to manipulate the stock.

Now that we have gotten through that:

This is in no way, shape or form, fluid and function, an analytical, qualitative or intelligent compte rendu. There is absolutely no financial advice here because the only financial advice I can give is to research, research, and research. The purpose of this analysis is to serve as an example of an investigation into a company's background, fundamentals, and assets through various lenses to determine if it is a good potential investment for you. The function of this write up is to serve as an educational resource for investors looking to understand how to find good investments. So read and learn some things about a company that cured cancer, yeah, the big C.

Thesis

It is upon rare occasion that one must look towards the past for moving into the future. Then certainly we are led here, a company starting it's preclinical scientific journey in the 1980s. A relic of a flare in a field few thought held value, immunology. Now, it is one of the fastest growing fields in medicine and science, where immunotherapies are quickly becoming the next generation of cancer treatments. Where others have come, and shown promise, Multikine has been here, for decades, toiling in the dark, fighting off bankruptcy, manipulative media and share attacks, and snobby scientists and doctors. Cel Sci Corp stand on victory, their quest coming to an end, and the market coming to the beginning of their own: How much is a drug that safely cures cancer worth?

Keytruda, itself an inhibitor of the immunoblockade, brings in nearly $15 billion in revenue per year over the last 3, with some estimates that this is early rather than late. Keytruda's therapeutic effects limited to an average of 6 to 8 months of survival time depending on cancer, Immunotherapies quickly became the sensation despite "limited" clinical benefits. Molecularly speaking- that is under the hood- Keytruda's true glory served as a limited toxic drug. Standard chemotherapeutics rely on a simple principle: do as much damage to quickly dividing cells, as much so to cancerous cells. This damage is not specific to the cancer cells: normal, happy, healthy cells get damaged too, often leading to them dying. But sometimes they don't die, they carry that damage on and then become a cancer cell later on. Sometimes that which doesn't kill you, makes you stronger, and sometimes it makes something inside you stronger that then kills you. Cisplatin, itself a platinum based drug that binds to the DNA, RNA and proteins in a cell causing them to clump up, get degraded, fixed if possible, leading to massive chromosomal damage (the genetic code). Normal cells take up the Cisplatin to a similar degree to the cancer cells (in fact cancer cells can make more of a special drug pump, then pump all of the drug out of the cancer cell to be consumed by the healthy cells, thus helping it grow), except normal cells have special checkpoints in place to look out for damaged DNA to fix it, or if unfixable, destroy it. 99.9% of the time, the damage gets fixed, or the cell dies, and 99.9% of those times where the cell continues on and becomes cancerous, the immune system finds it and kills it as it identifies it shouldn't be there. Cisplatin has an extremely high rate of cancer reoccurrence, keeping patients alive through cancer round 1, but often failing in round 2 or 3, but also being the cause of round 2 and 3.

Cel-Sci Corporation's Multikine, a mix of interleukins and cytokines used to communicate between the working immune system that an issue is there and needs to be addressed, showed excellent promise in Phase 1 and 2 clinical trials. However, clinical trials have been difficult and slow for a multitude of reasons; the immune system is extremely complex, and until recently there was no technology available to easily study the system in the true depth necessary. Pre-clinical research could not be done on standard laboratory animals as their immune systems are nearly completely defective. From there, a biochemical understanding of the nature of treatment itself impossible until recently, clinicians had little to no idea on what therapeutic response should look like, or what it could look like. Perhaps in some medieval notion, doctors might have considered activating the immune system to fight cancer would be similar to fighting a virus; shakes, shivers, fevers, sickness. When none of these effects, or even no side effects occurred, perhaps there was a considerable amount of white coats in large rooms shaking their heads assuming the project dead.

Through nearly 10 years of a Phase 3 in Head and Neck cancer, starting with a criminal and negligent CRO leading to a successful trial and large monetary recuperation, and ending with a stock-collapsing headline of " 14% increased 5 year survival over Surgery and Radiation alone, less than 10% increased 5 year survival over Surgery, Radiation and Cisplatin ". Perhaps in some small way, Cel-Sci Corporation never had a chance of an easy time, starting from the uphill battle through Ivy Tower elite scientists, ego-heavy medical doctors without a degree in immunology, manipulative short sellers and evil hedge funds reminiscent of the vile Michael Milken; through 3+ decades of pushing the entire medical field forward, paving the way through doctrine and dogma, leading to a breakthrough therapy with no significant side effects through hundreds of people, and an impressive long term survival rate in a cancer that has had no medical breakthroughs in just as long.

Previous articles by this author and others have suggested that the Cisplatin arm of head and neck cancer patients is likely at or below 62%, which is Multikine's 5 year survival topline result. However, the numbers drop from there, and the specifics of that population look even worse. Cisplatin has an extremely low disease free survival/cured rate (where cure is defined as 5 years without cancer), and high secondary tumour incidence. That isn't to say that if given a choice between death and Cisplatin by the oncologist, the patient should absolutely chose Cisplatin, but very soon, they won't have to. Oncologist's will be able to choose a treatment profile in waves, where the first wave is safe therapies, specifically those with low death/suffering rate, such as surgery, radiation, and perhaps a side effect free drug that activates the immune system leading to a long term immune response capable of suppressing the immuno-evasion of the tumour cells right through to 5+ years of healthy life. Patient's from the Phase 2 trial of Multikine had a significant shrinkage of tumour, composite loss of pain, regained freedom of movement in tongue, etc; the drug was an absolute success. In fact the muted response from the clinical results from the trial paper is astounding. While the world must wait for the Phase 3 results to be published in a peer-reviewed journal, a critical step in validating and diffusing the data, the door to the FDA is coming closer and closer. Within the next several weeks or months, a pre-BLA meeting is expected between the FDA and CVM, where they will discuss the next steps and review keynotes of the data organizing it for the final submission and drug review process through the hands of dozens of scientists and medical professionals. Here, the FDA will see as any scientific or medical eye will find, Multikine is a breakthrough drug that will revolutionize cancer treatments.

Emulating Keytruda's path from rich to uber-rich, Multikine will seek for, and gain, approval for Head and Neck cancer with an open label allowance for other indicated cancers. Keytruda went from seeking approval, to nearly complete market approval in a matter of 6 months. While Cel-Sci Corporation does not have the wealth and power to force such a keystone move on the FDA, following historical precedent and medical need, Multikine will be in cancer patients across the spectrum as long as they have a working immune system by the end of 2022, just as Keytruda was in the same position at the same time scale. There is nothing exclamatory or insane about this statement, it has been this way for every disease and every drug that has gone through the FDA; a standard of care exists, experimental drugs better than SOC come along, the new SOC is formed through years of main-stream drug use showing wide market agreement with the clinical trials. Even in Keytruda's own question, failure of all primary or secondary endpoints has not stopped it from getting added to the therapeutic regiment for nearly every cancer, and ultimate approval for said cancer by the FDA.

Multikine's lack of additional clinical response with Cisplatin was a scientific inevitability. Cisplatin damages fast growing cells, the immune system being one of the fastest. Cisplatin often leaves patient's immune system naïve, leading to a need for a geriatric round of childhood vaccines! However, the scientific team at Cel-Sci realized this pre-Phase 3, leading to the establishment of the clinical trial arm without Cisplatin. While bear's might call this part out as evidence of CVM's failure, it is specifically opposite. Cel-Sci Corporation's leadership strong-armed the FDA to allow this branch of the trial, and because of it, have illustrated multiple paramount issues;

Immunotherapies take a long time to work in cancer, but they do work.

Immunotherapies do not work with mainstream chemotherapeutics that have the potential to inhibit and mute their effects.

Cisplatin is a bad drug that kills people and is only used because sometimes it kills the cancer before killing the person.

In this thread, CVM's true long term worth comes in the clinical lessons learned, not just the lives saved. And Multikine does save lives. If only indicated for the current population, head and neck cancer without cisplatin treatment, an estimated 12,000 people a year will be saved by getting Multikine too. Financially speaking, that is a lot of dough. If given to all available patients in the 144,000 group and sitting at Keytruda costs per year of $150k, Multikine could see revenues of $21.6 billion within 3 years. Any deviation in patient population upwards, as is expected, could lead to the most economically impressive drug of all time, and a metric %&#@ of lives saved.

While the current price action is little more than the chaotic meandering of algorithms, market makers, and maleficent hedge funds trying to prevent a massive squeeze from decades of phantom shares being sold, the inevitable trajectory is upwards. This author will leave the curious investor's mind to wander through previous articles and historical acquisition deals of similar scope, but there has never been a drug with more active therapeutic potential than Multikine. When collective cancer research was losing it's mind over Keytruda/PD-L1/PD-1/CAR-T cells, etc, there was only pre-clinical evidence and all early clinical evidence was looking rough. Multikine is out of Phase 3s with a perfect safety record, a massive amount of therapeutic evidence showing a massive clinical benefit, 14% 5 year survival rate in Head and Neck cancer patients leading to a similar short term, and much better longer (>5yrs) term survival rates than Cisplatin. While the catalysts are in full scope for $CVM from today's $11, to a potential $X00, the most important element is this:

Fuck cancer.

Trading Beta

TradingView will enjoy my use of the term Beta with their new rock climbing theme.

The chart shows current price valuations across bear, bull and base case estimates.

From a basic standpoint, this author continues to buy shares, especially as the price continues to be pummeled by the banks and large hedge funds offloading their puts and getting in more calls. Ultimately, a short squeeze/retail interest/increased volume should yield a $50-75 bear price, where appropriate dissemination and understanding of the clinical data and therapeutic implications could lead to an initial bull run to $150-200 giving the company a market capitalization around $5-7 billion (a measly sum considering $OCGN's worth given vaccine uncertainty and $SAVA with pre-clinical data issues and a drug early on in a lengthy and competitive clinical process).

Reasonably speaking, the goal is to amass a large sum of shares, never sell, use leverage and margin to build up secondary positions as $CVM's long term success is guaranteed. Current and future short sellers will force smart moves, but appropriate risk management practices leave this as the primary goal.

Secondarily, amassing large quantities of shares and selling monthly covered calls at critical price points as a way to create sustaining, secondary income and a forward momentum/pressure on the stock promises some level of efficacy.

Tertiarily, options around impulse waves while keeping my own position stable and growing yields more favourable derivative outcomes. Cel-Sci Corporation no longer needs to be acquired to achieve maximum market capitalization, and in some ways, may best achieve shareholder value by utilizing their new manufacturing space to continue on their smaller scale, guaranteeing current investor access to a double digit billions in yearly revenue within 3-5 years.

Links to Previous articles

Links to other highly qualified articles

There are many more articles than this, I just tried to choose a few from the various mixed media sources. I absolutely encourage any investor to see what others have written on the matter, but do not, under any circumstance, believe any single person, including me, without doing your own research and confirming or denying any and every thing. It is absolutely imperative to double check, triple check any and everything.

www.cvmresearch.com

seekingalpha.com

www.sciencetimes.com

seekingalpha.com

finance.yahoo.com

biotechhealthx.com

Disclaimer

Thank you for reading, please review all links, articles, press briefings and scientific data. If ever any questions, please comment, message me, or find me on twitter.

SESN Sesen Bio Selloff | Buy the dip???SESN received a preapproval for the dug, Vicineum, but not in its present form. and the market overreacted to it. sold at market prices. and the price went down to 0.86usd, its strongest support.

The FDA has determined that it cannot approve the BLA for Vicineum in its present form and has provided recommendations specific to additional clinical/statistical data and analyses in addition to Chemistry, Manufacturing and Controls (CMC) issues pertaining to a recent pre-approval inspection and product quality. (businesswire.com)

And they don`t have only one product in their pipeline.

Sesen Bio focuses on designing, engineering, developing, and commercializing targeted fusion protein therapeutics (TFPTs) for the treatment patients with cancer. The company's lead product candidates include Vicinium, a locally-administered targeted fusion protein that is in Phase III clinical trials for the treatment of BCG-unresponsive non-muscle invasive bladder cancer (NMIBC); and VB6-845d, a product candidate for use in the treatment of various types of an anti-epithelial cell adhesion molecule (EpCAM)-positive solid tumors. It also develops Vicinium in combination with Durvalumab, which is in Phase I clinical trials for use in the treatment of BCG-unresponsive NMIBC; and Vicinium in combination with AstraZeneca's checkpoint inhibitor for the treatment of squamous cell carcinoma of the head and neck. Sesen Bio, Inc. has an agreement with Leiden University Medical Center to co-develop an imaging agent. (marketbeat.com)

On 8/11/2021 BlackRock Inc. reported 10,657,812 for a total of $49.24M +264.7% increase and an ownership in SESN of 6.150%

On 8/13/2021 Vanguard Group Inc. reported 8,503,982 for a total of $39.29M +18.2% increase and an ownership in SESN 4.339%

My price target is between 2.7 to 3.2usd.

I look forward to read your opinion

BYSI BeyondSpring Price TargetBYSI BeyondSpring drug, plinabulin, increased overall survival and improved other measures of disease while staving off a dangerous side effect associated with Chemotherapy.

BeyondSpring is preparing to ask for plinabulin approval in the U.S. and China.

On 8/4/2021 J. Pantginis from HC Wainwright brokerage Upgraded BYSI BeyondSpring from Neutral to Buy giving a Price Target of $100.00

My price target is the all time high resistance of 48usd until we hear some news from the FDA.

CVM; Breakout from bear pennant, prime for liftoffDisclaimer

General disclaimer here.

Short but sweet, we have sustained breakout from the bear pennant, we have a dwindling short pool (460k as of today borrowable from Fidelity, down from ~600k on Monday).

Less kick in the shorts, and they have until the 20th of this month to sustain the price channel and try to get it under 7.5.

Meanwhile, more and more groups are buying up shares in small amounts, likely on the back of bigger entities buying up, as State Street increased their position on the drop from $25.

We are only a few weeks away from a catalyst with the pre-BLA meeting, pushed by more and more FDA breakthrough news.

This is a great time to look for an entry on shares.

If you buy options, a good rule I use is 90-10. Only use 10% of funds on the options, that way if they go south, you are still likely to end up green on the overall trade.

With that said, we have no ceiling as the drop from 26 was abberative manipulation, we have a gamma squeeze lining up from $9 and into the $20s. Theoretical M&A prices are obscenely high, even conservative values at $5 billion would give this a x15 multiple.

Have fun y'all, always be safe, and please do your own research to verify. And always ask questions!

whalewisdom.com