The Language of Price | Lesson 4 – Linking Candlesticks PracticeLesson Focus: Candlestick Combinations (Practice)

In the previous lesson, we explained combining candlesticks together using a theoretical illustration.

In this lesson, the same concept is now shown in practice on a real market chart , allowing the theoretical ideas to be observed in real price behavior.

📊 WHAT ARE WE LOOKING AT?

This chart demonstrates how individual candlestick behaviors can be combined together to read market structure more clearly.

Instead of focusing on a single candle, we observe how multiple candles communicate together over time within their surrounding context.

For readers who have not seen the previous lesson , reviewing the theoretical explanation of candlestick combinations may help provide clearer understanding, as this example directly builds on it.

🧠 COMBINATIONS IN PRACTICE

On this real chart example, you can see repeated combinations of:

• Shrinking candles → slowing momentum

• Long wicks / inverse long wicks → rejection and reaction

• Inside candles → consolidation within range

• Change color candles → pressure shift

• Momentum candles → temporary dominance

When several of these behaviors appear together, they provide a stronger directional bias compared to reading only one candle in isolation.

📌 IMPORTANT CLARIFICATION

• This is market reading , not prediction

• Bias does not mean certainty

• Candlesticks reflect past price behavior

• Nothing shown here is guaranteed

This example is presented strictly for educational and analytical purposes .

Those interested in continuing this educational series may choose to follow along, as upcoming lessons will further build on these concepts and explore market structure step by step.

ETHICAL & EDUCATIONAL NOTICE

This content is presented solely for educational and analytical purposes , based on historical price data.

It does not promote or encourage any specific trading method, financial instrument, gambling, leverage, margin usage, short selling, or interest-based activity .

Readers are encouraged to align any financial activity with their own ethical, legal, and religious principles .

⚠️ DISCLAIMER

This material is strictly educational and informational .

It does not constitute financial advice, investment recommendations, or trading instructions.

The author does not provide personalized guidance.

Any decisions made based on this content are the sole responsibility of the individual.

Chartreading

CHART SPEAKS- PSU BANKS#NiftyBank - PSU Banks have been rallying over a week. News came in Today. Was someone already aware of this?

The NEWS

UPDATE ON PSU BANKS: GOVT CONSIDERING TO RAISE FOREIGN INVESTMENT LIMITS IN PSU BANKS FROM THE CURRENT 20% -ET NOW

That's why I am Strong believer of Price Action. #Chartspeaks #chartsabkuchboltahai

Chart Speaks- GMDCI have been sharing for a long time now about News v/s Chart analysis. I am a strong believer that any development about the company is visible on chart, be it positive or negative. This time its GMDC.

Read the News -

CENTRE PREPARING INCENTIVES TO ENCOURAGE DOMESTIC PRODUCTION OF RARE EARTH MAGNETS: KUMARASWAMY: MONEYCONTROL

Company was in the news since early this month on rare earth materials. Price action already hinting it since March, April, July & Aug 2025.

Swing Trading Basic- How to Select a Stock for SwingHow to identify a Swing Trading Set up.

Let's take an Example of "Arihant Capital Fin". During that Reversal, price start floating above 20 MA. That's an early sign- Real Time EOD Price is now trending above 20 Day's Average price. It means now price is above monthly Average (22 Trading Days /Month).

Additionally, Volume confirmation also suggest same trend direction (During June 2025). Moreover 20 MA stops decline, pauses & starts it's reversal Journey. Exactly from hereon, if Price starts giving VCP or 20 MA Supporting scenario, get ready for a Swing Trade in such Stocks. You'll see in the chart, every dip to 20 MA was bought nicely.

This is not a buying/ trading advise. Market Factor, Stock & Sector specifics, needs to be considered for trading. Every stock has it's own soul of price movement. This is a psychological journey than Scanning, indicators & Technical skills. You'll master it if you repeatedly practice min 20 charts a Day for at least 6 months!

Wish you Happy Trading & Happy Learning!

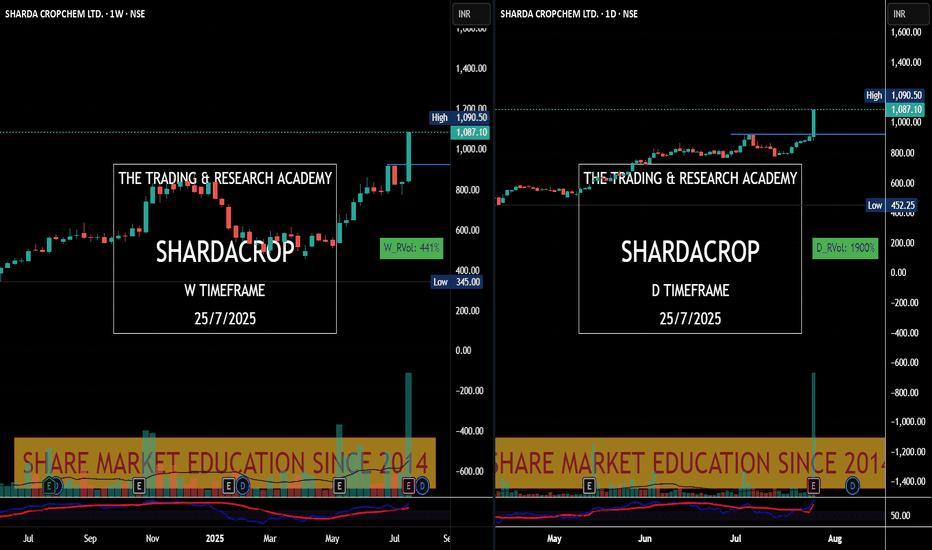

Charts Speak #Sharada Cropchem

Sharada Cropchem

Charts always lead the News! This is yet another example where price was leading & News came later.

Stock was under accumulation since June with higher qty. In fact since May 25, it was getting bought in average 2-3M qty weekly. What a planned buying..

28th May, 4 June, 18th July were nice buying alarms for us. Today it was just a final nail in the coffin.

Necklace Pattern = KECLMy favorite "Necklace Pattern" is getting unfolded in "KECL" on monthly Time Frame. In fact, this Kirloskar Group is seriously re-vamping all its group companies & it's evident in their charts as well!

Referring Monthly TF on BSE Chart since NSE has limited data to study for this scrip.

Cheers!

Necklace Pattern Trading - "S Chand & Company"This has been highly dependable stock since last 1 month. When benchmark Index "Nifty" fell by 500 points, this stock was rock solid holding its swing high level & stayed in the range of just 20 points. This is my Necklace Pattern stock it will be interesting to see how story unfolds when it reaches its previous swing highs.