CHFJPY Bullish Scenario Mapped With Precision and Discipline🔥 CHF/JPY Bullish Expansion Play | Smart Money Accumulation Setup 🔥

📌 Asset Overview

CHF/JPY – “SWISS vs YEN”

Market: Forex

Trade Type: Swing / Day Trade

Directional Bias: 🟢 BULLISH CONTINUATION

🧠 Trade Thesis (Professional Outlook)

CHF/JPY is positioned within a bullish market structure, supported by higher highs & higher lows, indicating trend continuation. Price behavior suggests institutional accumulation, favoring long exposure on pullbacks rather than chasing breakouts.

📈 Trade Plan

🔹 Plan: Bullish Plan Active

🔹 Entry Method:

✅ Any Price Level Entry via Layered Execution

Layered Buy Structure (Scaling-In Model):

🟢 Buy Limit 1: 197.000

🟢 Buy Limit 2: 197.500

🟢 Buy Limit 3: 198.000

(Additional layers can be added based on personal risk & exposure rules)

📌 Why Layering?

This method allows average price optimization, reduces emotional execution, and aligns with smart money positioning during retracements.

🛑 Risk Management

❌ Stop Loss: 196.500

⚠️ Dear Ladies & Gentlemen (Thief OG’s)

This SL is not mandatory. Adjust risk according to your capital, leverage, and strategy discipline. Capital protection > profits.

🎯 Profit Objective

🎯 Target: 200.000

🚨 Exit Logic:

Strong overbought conditions

Major resistance zone (“Police Barricade”)

Potential liquidity trap & correction risk

📌 Rule: Escape with profits when price reaches resistance. Do not marry trades.

⚠️ Dear Ladies & Gentlemen (Thief OG’s)

TP is guidance only. Partial profits and trailing logic are encouraged.

🔗 RELATED PAIRS TO WATCH (Correlation Insight)

💵 USD/JPY

Acts as a risk sentiment leader

JPY weakness across USD/JPY strengthens CHF/JPY upside bias

Sharp USD/JPY reversals may signal temporary CHF/JPY pullbacks

💵 CHF/USD

CHF strength vs USD supports bullish CHF flows

CHF demand from safe-haven inflows boosts CHF/JPY continuation

💵 EUR/JPY

Confirms overall JPY weakness

Strong EUR/JPY momentum = supportive environment for CHF/JPY longs

📊 Correlation Summary:

Weak JPY + Stable/Strong CHF = Bullish CHF/JPY Structure

🌍 Fundamental & Economic Drivers (Trade Context)

🏦 Swiss Franc (CHF) Factors

CHF remains supported by financial stability & capital inflows

SNB policy remains measured, avoiding aggressive easing

CHF benefits during risk-off to neutral market regimes

🏯 Japanese Yen (JPY) Factors

JPY pressured by ultra-loose monetary stance

Yield differentials continue to weaken JPY

BoJ maintains accommodative bias → structural JPY weakness

🗞️ Key Upcoming Catalysts to Monitor

⚠️ These can increase volatility:

Central bank speeches (SNB / BoJ)

Inflation & CPI releases (Switzerland / Japan)

Risk sentiment shifts (equity volatility, bond yields)

Unexpected safe-haven flows

📌 Rule: Reduce exposure or protect profits before high-impact events.

✅ Final Trading Notes

✔ Trade with structure, not emotion

✔ Layer entries, don’t chase price

✔ Protect capital first

✔ Take profits near resistance

✔ Discipline > Prediction

🚀 If this setup adds value, support with a 👍 LIKE & 📌 SAVE

Let smart money lead — retail follows structure.

Happy Trading 📊🔥

Chfjpyidea

#CHFJPY: 900+ PIPS Buying Setup, JPY Weakening! The OANDA:CHFJPY pair is in a sustained bullish trend. The current price is 195 and we anticipate further upward movement towards our take-profit levels. These are set at 198, 200 and 205.

Please use accurate risk management while trading. ❤️🚀

Team Setupsfx_

CHFJPY → Trade Analysis | SELL SetupThe price has fallen under the dynamic support, which now acts as resistance.

We expect the decline to continue after testing the lower boundary of the channel.

Hello Traders, here is the full analysis.

I think we can soon see more fall from this range! GOOD LUCK! Great SELL opportunity CHFJPY

I still did my best and this is the most likely count for me at the moment.

-------------------

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 🤝

CHF/JPY Trade Guide – Targeting the Next Resistance ZoneCHF/JPY "SWISS VS YEN"

Forex Swing Trade Opportunity Guide | Bullish Scenario

📊 TRADE SETUP AT A GLANCE

Asset: CHF/JPY | Timeframe: Swing Trade | Bias: BULLISH ↗️

Risk/Reward: Premium Setup | Strategy: Layered Entry Method

📍 ENTRY STRATEGY: "THIEF LAYERING METHOD"

Multiple Limit Order Entries (Smart Accumulation)

Deploy your capital across 5 strategic price layers for optimal risk management:

🎯 Layer 1: Entry @ 190.000 (20% allocation)

🎯 Layer 2: Entry @ 190.500 (20% allocation)

🎯 Layer 3: Entry @ 191.000 (20% allocation)

🎯 Layer 4: Entry @ 191.500 (20% allocation)

🎯 Layer 5: Entry @ 192.000 (20% allocation)

💡 Pro Tip: Adjust layers based on your account size & risk tolerance. This method averages your entry and reduces emotional trading.

🛑 STOP LOSS: "PROTECTION PROTOCOL"

SL Level: 189.000

⚠️ IMPORTANT: This is a suggested level ONLY.

👑 Thief OG's Rule: Adjust your SL based on YOUR strategy, account size, and personal risk management. This is YOUR decision.

🎯 TARGET: "POLICE BARRICADE BREAKOUT"

TP Level: 195.500

Why This Target? 🔍

Strong Resistance Zone identified at 195.500

Overbought Conditions present in upper range

Profit Trap Warning: Market shows reversal signals at this level

Smart Exit: Lock in gains before the police barricade stops the rally

🚨 CRITICAL NOTE: This TP is suggested guidance ONLY.

👑 Thief OG's Rule: Your profit target is YOUR choice. Take profits at levels comfortable with YOUR risk tolerance. Remember: Secured profits > Unrealized gains.

📈 RISK MANAGEMENT CHECKLIST

✅ Start with 1-2 layers to test the setup

✅ Scale into remaining layers as price confirms direction

✅ Move SL to breakeven after 2-3% profit

✅ Take partial profits at 50% of target

✅ Trail your remaining position for maximum gains

🔗 RELATED PAIRS TO WATCH (CORRELATION ANALYSIS)

FX:USDJPY (Strong Positive Correlation with CHF/JPY)

Why It Matters: Both are JPY pairs. If USD/JPY rallies, CHF/JPY typically follows

Key Point: USD strength = CHF strength against JPY

Watch For: When USD/JPY breaks resistance, CHF/JPY momentum accelerates

Current Setup: Bullish USD/JPY aligns with your CHF/JPY long bias

OANDA:EURJPY (Moderate Positive Correlation)

Why It Matters: EUR and CHF move together; both USD proxies

Key Point: EUR strength supports CHF strength

Watch For: If EUR/JPY stalls, CHF/JPY may face headwinds

Risk Alert: EUR weakness = potential CHF/JPY reversal signal

USD/CHF (Inverse Correlation)

Why It Matters: Inverse pair to your setup

Key Point: If USD/CHF drops, CHF/JPY rises (inverse logic)

Watch For: USD/CHF support breaks = CHF strength confirmation

Confirmation Tool: Use for entry validation

FX_IDC:CHFUSD (Direct Correlation)

Why It Matters: Shows pure CHF strength vs USD

Key Point: CHF/USD rally = CHF/JPY bullish confirmation

Watch For: Break above key resistance = continuation signal

Quick Check: Fast confirmation of CHF bullish bias

JPY Index (Inverse Correlation)

Why It Matters: Measures JPY weakness across all pairs

Key Point: When JPY weakens, CHF/JPY rallies

Watch For: JPY index breakdown = CHF/JPY tailwind

Macro Signal: Broader JPY weakness supports your trade

⚡ EXECUTION SUMMARY

Step 1: Place 5 buy limit orders at layered prices (190.000 → 192.000)

Step 2: Set SL at 189.000 (adjust to your preference)

Step 3: Target TP at 195.500 (adjust to your preference)

Step 4: Monitor correlated pairs (USD/JPY, EUR/JPY, CHF/USD)

Step 5: Manage risk aggressively — your account, your rules

👑 Thief OG's Philosophy: Make money on YOUR terms. Take profits at YOUR pace.

Last Updated: Real-Time Market Conditions

Follow for more strategic swing trade setups! 📈

Will the Swissy Outrun the Yen? CHF/JPY Eyes 195.000 Target💎 CHF/JPY “Swissy vs Yen” Profit Pathway Setup! 🚀 (Swing/Day Trade Plan)

Hey traders! 👋 Welcome to the Thief OG’s Market Mission — today’s spotlight is on the Swiss Franc vs Japanese Yen (CHF/JPY), a classic “steady hand vs safe haven” matchup ⚔️.

🧭 Trading Plan: Bullish Outlook

CHF/JPY is showing strong momentum — price continues to respect bullish structure and demand zones are stepping in with confidence.

Thief Layered Entry Strategy 💰

Our signature Thief Method uses layered buy limit orders, designed to smooth entries and catch retracements like a pro.

💎 Buy Limit Layers:

189.000

189.500

190.000

190.500

(You can add or adjust layers based on your risk tolerance and strategy preference.)

🎯 Target Zone (TP): 195.000

This area sits right below the major resistance barricade @ 195.500, where price may face supply pressure and potential correction signals. Don’t get trapped — take profits when the police lights flash 🚓💥

🛑 Stop-Loss Reference: 188.500

(Use this as a flexible zone — not a fixed rule. Manage your risk independently.)

💬 Thief’s Personal Note to the OG Community

Dear Ladies & Gentlemen (Thief OG’s) — this isn’t a recommendation or a signal, but a shared perspective for learning and entertainment. 💡

Trade at your own discretion, secure your profits your way, and always protect your capital. 🛡️

🔍 Correlation Corner & Watchlist Picks

Keep an eye on correlated and risk-sensitive pairs:

FX:USDJPY 💵 → closely tracks yen sentiment; when USD/JPY rises, CHF/JPY often follows.

OANDA:EURJPY 💶 → similar structure; watch for synchronized breakouts.

CAPITALCOM:CHFSGD 🇨🇭🇸🇬 → potential secondary play for Swiss strength continuation.

Gold ( OANDA:XAUUSD ) 🟡 → when gold weakens, safe-havens like JPY may soften — boosting CHF/JPY upside momentum.

🧠 Key Market Notes

JPY weakness persists on BoJ’s dovish tone, while CHF strength remains steady due to stable SNB policy.

RSI hovering near mid-range — room for continuation before hitting overbought territory.

Volume indicates fresh participation in upside move — watch for sustained push above 191.000 zone.

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

📜 Disclaimer: This is a Thief-style trading strategy — created just for fun and educational purposes. Not financial advice. Trade wisely and stay legendary! 🕶️

#CHFJPY #Forex #SwingTrade #DayTrade #SwissFranc #JapaneseYen #FXAnalysis #PriceAction #ThiefTrader #TechnicalAnalysis #FXMarket #TradingView #BullishSetup #RiskManagement #TraderCommunity

CHFJPY Momentum Rebuilding — Pullback Zone Favors Buyers🔥 CHF/JPY “SWISSY vs YEN” | BULLISH SWING PLAN + LAYERED ENTRY STRATEGY 🔥

👋 Hello Traders & “Thief OGs”!

Welcome to a detailed swing trade setup on CHF/JPY – a unique Forex pair combining safe-haven & funding currencies. Below is a clear, actionable plan designed for visibility, engagement, and – most importantly – clarity.

📈 TRADE IDEA OVERVIEW

Asset: CHFJPY | Swissy vs Yen

Bias: Bullish | Confirmed via Hull Moving Average Pullback

Style: Swing Trade | Medium-term momentum play

Entry Strategy: Layered Limit Orders (Thief Strategy)

🎯 ENTRY PLAN – “THIEF LAYERING METHOD”

📊 Use multiple Buy Limit orders to scale into the trade smoothly:

1st Layer: 192.500

2nd Layer: 193.000

3rd Layer: 193.500

✅ Tip: You can add more layers based on your capital & risk tolerance.

⛔ STOP LOSS – RISK MANAGEMENT

🛑 Initial SL: 192.000

⚠️ Important Note: Dear Thief OGs & traders – adjust your SL based on your own strategy & risk. I don’t recommend using only my SL. Manage your trade, protect your capital.

🏁 TAKE PROFIT – EXIT STRATEGY

🎯 Primary Target: 197.500

Why here? This zone acts as:

Police barricade resistance

Overbought + trap zone – exit smoothly with profits

📢 Remember: Take profits based on your own analysis & comfort. I don’t recommend using only my TP.

🔍 RELATED PAIRS TO WATCH & KEY CORRELATIONS

Monitoring related pairs can confirm or contradict this CHF/JPY move:

USD/CHF ( OANDA:USDCHF )

Inverse correlation with CHF/JPY (if USD weakens, CHF often strengthens).

Key level breaks here can signal CHF momentum.

USD/JPY ( FX:USDJPY )

Positive correlation with CHF/JPY (both involve JPY as funding currency).

Watch for BoJ interventions or USD strength affecting JPY broadly.

EUR/CHF ( OANDA:EURCHF )

Indicates CHF strength vs Euro – if EUR/CHF falls, CHF may rally.

SNLB policy influences this cross.

GBP/JPY ( OANDA:GBPJPY )

Another JPY funding cross – often moves in sync with CHF/JPY during risk-on/off shifts.

Gold ( OANDA:XAUUSD )

Safe-haven flows can impact both CHF & JPY, but CHF often aligns closer with gold during uncertainty.

💡 WHY THIS IDEA IS ENGAGEMENT-FRIENDLY:

✅ Clear, layered entry – traders love actionable steps

✅ Risk disclaimer included – builds trust & encourages personal responsibility

✅ Related pairs added – encourages watchlist saves & broader discussion

✅ Emoji-optimized – improves readability & visual appeal in feed

✅ “Thief OG” community vibe – fosters belonging & comments

📢 CALL TO ACTION:

👉 Like if you find the plan useful!

👉 Follow for more layered-entry strategies!

👉 Comment your adjusted entry layers or SL/TP – let’s share insights!

👉 Share if you know someone trading CHF/JPY!

Disclaimer: This is not financial advice. All trades involve risk. The “Thief Strategy” requires strict risk management. Trade at your own discretion.

#Forex #CHFJPY #Swissy #Yen #SwingTrading #TradingSetup #ForexStrategy #ThiefStrategy #LayerEntry #RiskManagement #TradingViewIdea

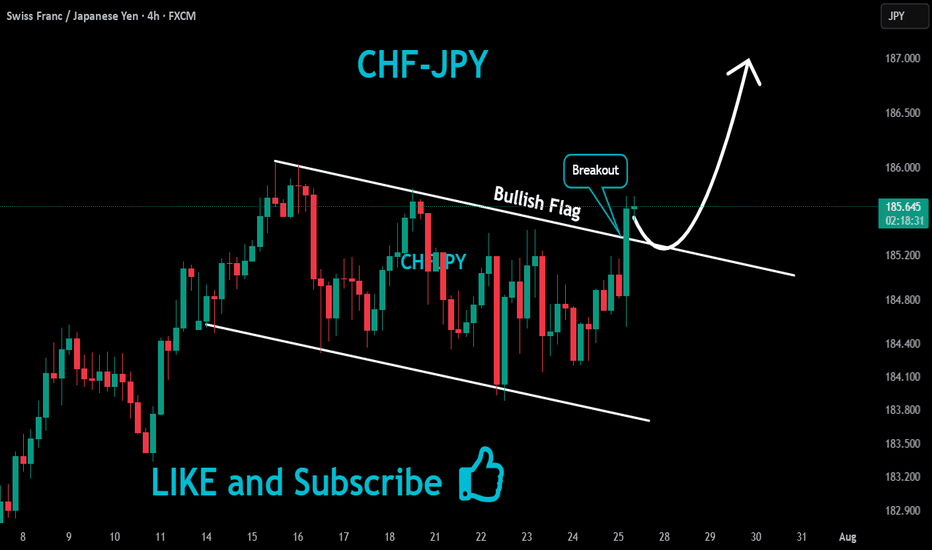

CHF/JPY Ready To Go Up And Give Us 150 Pips , Are You Ready ?Here is my 4H Chart on CHF /JPY , We Have A Clear Breakout and the price closed above my old res and new support and we have a very good bullish Price Action on 1 And 2 Hours T.F Also the price will try to retest the area and if it give us a good bullish price action on smaller time frames we can enter a buy trade and we can targeting from 70 to 150 pips . and if we have a daily closure again below my new res then this idea will not be valid anymore .

Entry Reasons :

1- Clear Breakout

2- Many T.F Confirmations .

3- Perfect Price Action

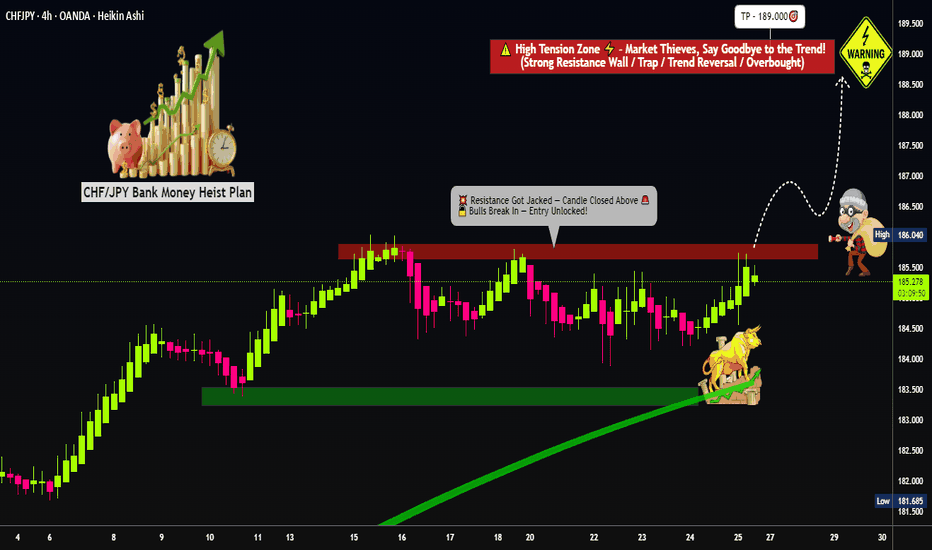

Will the Swiss Franc Outperform the Yen in This Bullish Move?💼 CHF/JPY — Swiss vs Yen Wealth Strategy Map (Swing/Day Trade) 💼

🗺️ Plan (Thief Trader Layering Strategy)

I’m mapping a bullish play on CHF/JPY using the Thief layering method (multiple buy-limit orders to scale into positions). Instead of rushing in, we stack layers like pros:

📌 Limit Buy Entries (Layered style):

186.000

186.500

187.000

(Feel free to add more layers depending on your style!)

🛑 Stop Loss (Thief SL): @185.500

(Note: Dear Ladies & Gentlemen — I’m not recommending only my SL. Always set risk according to your own rules. Make money ➝ take money at your own risk.)

🎯 Target Zones:

First Target: @189.000 (smart escape point)

Extended Target: @189.500 🚨 (beware of Police Barricade = strong resistance + overbought trap zone)

⚡ Key Notes for Thief OG’s

The layering system = multiple buy/sell limit orders → adds flexibility + reduces FOMO.

Strong resistance sits around 189.000 – 189.500, so treat that level like a trap zone where liquidity hunts begin.

Scaling out profits before the barricade = smart Thief escape plan.

🔗 Correlation & Pairs to Watch

Keep an eye on correlated FX majors and safe-haven flows:

💴 FX:USDJPY – Yen sentiment check

💶 OANDA:EURCHF – Swiss strength mirror

💵 OANDA:USDCHF – Safe-haven correlation

Gold ( OANDA:XAUUSD ) – Yen + CHF often follow risk sentiment with Gold

(Watching these pairs helps validate CHF/JPY swings as risk-on/risk-off flows shift.)

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

📜 Disclaimer: This is a Thief Style Trading Strategy created for fun and educational purposes only. Not financial advice.

#CHFJPY #Forex #SwingTrading #DayTrading #ForexStrategy #LayeringStrategy #TechnicalAnalysis #ThiefTrader

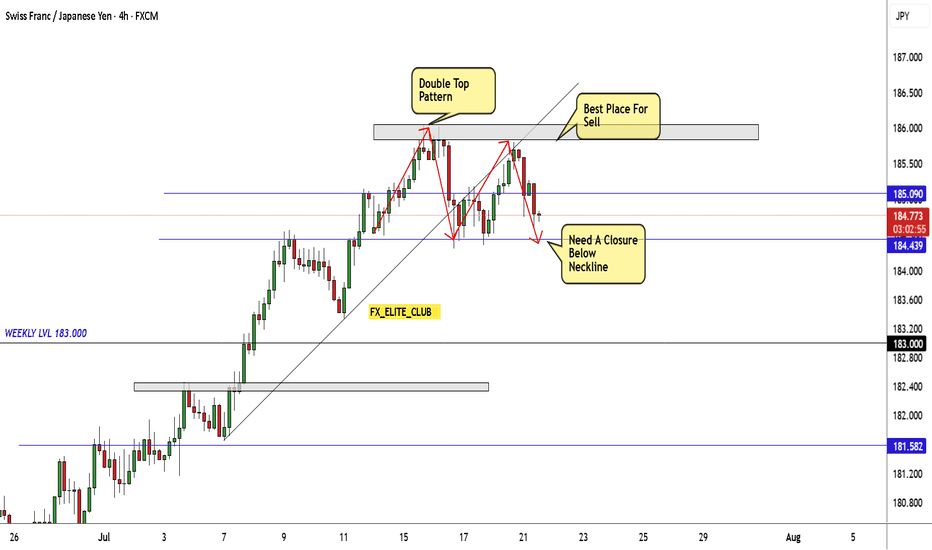

When We Can Sell CHF/JPY And Be Safe ? 2 Places Cleared !Here is My 1H CHF/JPY Chart and here is my opinion , this pair going up for a year and we have a small waves during this upside journey , and this week due to election the price go up very hard without any waves and the price opened in big gap and until now the prices didn`t cover it , until yesterday the price didn`t give us any bearish price action to can enter a sell trade even for 100 pips , but today the price trying to give us a good bearish price action to tell us that we can have a small movement to downside so i have 2 places i can sell this pair from it , the first place it`s show in the chart the res area it`s the highest price the price touch it so we can sell from it and my best place will be if the price closed below my support with 1h candle at least i will wait the price to back to retest my support and then i will enter a sell trade and this will be very safe for me . if the price closed above my res with 4H Candle than this idea will be not valid .

Entry Reasons :

1- Highest Level The Price Touch It

2- Upside Movement Without Any Waves .

3- New Support Created .

4- Clear Price Action .

5- Clear Support & Res .

CHF/JPY Momentum Building — Who Wins, Swissy or Yen?📌 Description for TradingView Idea – CHF/JPY "Swissy vs Yen" Forex Market Heist Plan

⚡ Asset: CHF/JPY — “Swissy vs Yen”

🎯 Strategy: Swing/Day Trade | Thief Plan (Layered Entries)

🔥 Why This Plan? (The Thief Strategy Explained)

The Thief Strategy is about using layered limit buy entries — scaling into the position like a “heist crew” building multiple doors into the vault. Risk is managed with flexible stop-loss and take-profit levels depending on your own plan.

Pattern Setup: Bullish Triangular Moving Average Breakout spotted near 183.800.

Market Context: Technicals, fundamentals, sentiment, and macro factors are aligned with a bullish outlook.

Trader Sentiment: Retail is heavily short, while institutions lean bullish = contrarian edge.

📊 Thief Entry Plan (Layering Strategy)

Layered Buy Entries (Limit Orders):

184.500

184.700

185.000

185.300

(You can increase layers depending on your risk appetite)

Stop-Loss (Flexible):

This is Thief SL: @184.000 🔒

⚠️ Dear Ladies & Gentlemen (Thief OG’s) — adjust your SL based on your own risk appetite. I am not recommending you copy my SL. Trade safe.

Target (Take Profit Zone):

Short-circuit resistance + overbought + supply/“tarap” zone near 187.500 🎯

⚠️ Again, Dear Thief OG’s — this TP is my personal exit, not a recommendation. Manage your own escape route.

📉 CHF/JPY Market Snapshot (08 Sept 2025)

🔢 Real-Time Exchange Rate Moves

Daily Change: +0.74% 📈

Weekly Change: +1.04% 📈

Yearly Change: +8.68% 🚀

🤔 Trader Sentiment

Retail Traders:

Long (Bullish): 29% 🐂

Short (Bearish): 71% 🐻

Avg Long: 182.86 | Avg Short: 173.67

Institutional Traders:

Sentiment Index: +15% (Moderately Bullish) 📈

Longs: 57% 🐂 | Shorts: 43% 🐻

😱 Fear & Greed Index

Current Level: 50 (Neutral) 🟡

Daily Change: +7 points 📈

7-Day Avg: 49 🟡

30-Day Avg: 54 🟢

Mood: Neutral, slightly recovering from fear — cautious optimism.

🌍 Fundamental & Macro View

📊 Fundamental Score: 65/100 (Moderately Positive) ✅

🇨🇭 Swiss Economy: Stable, safe-haven currency, low rates.

🇯🇵 Japanese Economy: BoJ steady, low inflation, yen safe-haven.

Key Data: Japan Q2 GDP +2.2% annualized (above forecast) 📈

⚖️ Macro Score: 60/100 (Neutral)

Global risk appetite stable 🌎

Yen impacted by trade balance & inflation 📉

SNB maintaining accommodative stance 💰

📈 Technical & Market Outlook

Technical Rating: Strong Buy 🟢

Trend: Bullish channel on Daily + 4H 🚀

Outlook: Bullish (Long Bias) 🐂

Pullbacks to support = entry opportunities

Retail shorts = potential squeeze catalyst

🔑 Key Takeaways

CHF/JPY showing bullish breakout structure 📈

Retail heavily short vs Institutional bullish ⚖️

Neutral Fear & Greed suggests market waiting for confirmation 🟡

Stable macro + fundamentals = supportive for upside 🐂

🔍 Related Pairs to Watch

$EUR/JPY - Euro/Yen correlation

$USD/CHF - Dollar/Swiss inverse relationship

$GBP/JPY - Pound/Yen risk sentiment indicator

$AUD/JPY - Australian Dollar/Yen carry trade proxy

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

#CHFJPY #Forex #SwingTrade #DayTrade #TechnicalAnalysis #ThiefPlan #ForexStrategy #JPY #CHF #CurrencyPairs

Thief Trader vs Police: CHF/JPY Market Heist Plan Uncovered🚨💰 CHF/JPY "Swiss vs Yen" Forex Market Robbery Plan 🎭🚨

🌍 Dear Money Bandits, Robbers & Thief OG’s 🕵️♂️💸

This is the master heist plan to crack the vault of the Swiss vs Yen market! 🏦💴

📈 Entry – The Looting Begins

"The vault is unlocked, robbers – time to load the bags!" 👜💰

We don’t wait for a perfect door – Thief goes in with layers (limit orders):

💎 Buy Layer 1: 183.800

💎 Buy Layer 2: 183.500

💎 Buy Layer 3: 183.000

💎 Buy Layer 4: 182.700

👉 Add more layers if you’ve got the courage, robbers.

🛑 Stop Loss – Escape Route

This is the Thief SL 🔒 placed at 182.000.

⚠️ Dear Ladies & Gentlemen of the crew, adjust your SL depending on your weapon (lot size), risk appetite & strategy. 🕶️

🎯 Target – The Great Escape

Police barricade spotted 👮🚨 … Escape route is clear until 187.500.

👉 Don’t be greedy, robbers – secure the loot before the cops close in.

🔥 Why this heist works?

Market shows bullish footprints 👣

Layering = stealth entry 🕵️

Smart robbers always plan exits 🎯

⚠️ News guards may ambush – stay alert 📡 and trail your loot with stop-locks.

💖 Support the Thief Crew 🚀

Hit that 💥BOOST💥 button & join the robbery squad – every click makes our gang stronger. Together, we steal from the market, not from each other 🏆🤝💵

Stay sharp, stay hidden – next heist loading soon… 🤑🎭

CHFJPY – Bulls Eye Fresh Highs as Momentum BuildsCHFJPY has been grinding higher after bouncing from its recent lows, and price is now testing resistance with strong bullish intent. The market is respecting its upward channel structure, and with both the franc and yen playing safe-haven roles, the battle comes down to relative central bank stances. At the moment, the Swiss franc looks stronger, keeping the upside path intact.

Current Bias

Bullish – CHFJPY continues to trend higher, with buyers in control toward key resistance.

Key Fundamental Drivers

CHF: The Swiss National Bank (SNB) remains cautious but is less dovish than the BoJ, allowing CHF to retain strength.

JPY: The yen is supported by safe-haven flows but capped by BoJ’s slow exit from ultra-loose policy.

Rate spreads: The differential continues to lean in favor of CHF versus JPY.

Macro Context

Interest rates: SNB has signaled less urgency to cut compared to other central banks, while BoJ is still defending easy policy despite yield adjustments.

Growth: Japan shows modest economic expansion, while Switzerland’s economy remains steady, backed by low inflation.

Geopolitical: Risk sentiment plays a key role—when risk aversion spikes, both CHF and JPY strengthen, but CHF has recently outperformed.

Primary Risk to the Trend

A sudden shift in BoJ policy or a sharp risk-off wave could swing momentum toward JPY, cutting CHFJPY’s upside potential.

Most Critical Upcoming News/Event

SNB policy outlook and any intervention chatter.

BoJ commentary around yield curve control and inflation targets.

Leader/Lagger Dynamics

CHFJPY often acts as a lagger, following broader safe-haven demand trends shaped by USDJPY and EURCHF. It tends to react after JPY crosses move, rather than leading.

Key Levels

Support Levels: 184.79, 183.84

Resistance Levels: 185.74, 186.70

Stop Loss (SL): 183.84

Take Profit (TP): 186.70

Summary: Bias and Watchpoints

CHFJPY bias is bullish, with SL at 183.84 and TP at 186.70. CHF’s relative resilience against JPY keeps the upside favored, especially as SNB remains firmer compared to BoJ. The key watchpoints are SNB policy tone and Japanese yield commentary, which could shift the balance. Unless JPY strengthens sharply on safe-haven demand, CHFJPY looks set to test higher resistance levels.

CHF/JPY Near Strong Res Area , Short Valid To Get 150 Pips !Here is my opinion on 8H CHF/JPY Chart , the price touch a very strong res area that forced the price to respect it and go down for more than 500 pips for 5 times , and now the price touch it and moved 30 pips to downside so now i`m waiting the price to go back to retest the same area again and give me a good bearish price action to can enter a sell trade and we can targeting from 100 : 200 pips . if we have a daily closure above my res area this idea will not be valid anymore .

Entry Reasons :

1- Very Strong Daily Res Area .

2- Perfect Bearish Price Action .

3- Bigger Time Frames Confirmed .

CHFJPY Day/Swing Trade Setup – Bearish Move Loading...💸"Operation Swiss Shadow: The CHF/JPY Forex Heist Blueprint" 💸

(Thief Trading Style: Master Plan Edition)

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers, Robbers & Market Ninjas 🤑💰✈️,

This ain't your average trade idea — this is a Thief Trading certified forex heist targeting the CHF/JPY aka "Swiss vs Japanese". Based on my unique blend of 🔥technical traps + fundamental pressure points🔥, we've built the perfect blueprint to rob this pair at its weakest moment.

💣 Our target? The overhyped bullish zone — oversold, consolidating, and ripe for reversal. This is where institutional bulls camp, and we’re about to hit ‘em where it hurts.

🎯 Trade Setup Breakdown (Bearish Bias)

🎯 Entry Point:

The heist begins at 183.800 — wait for a neutral level breakout and prepare your sell orders.

💥 Recommended play:

Place Sell Stop just below the breakout confirmation.

For pros: use Sell Limit orders above MA or at pullback zones (15m/30m chart) near recent swing highs/lows — layer in using DCA style to catch premium entries.

🔔 Pro Tip:

Set alerts at the breakout zone. Don’t sleep on the move — timing is key in every robbery.

🛑 Stop Loss Strategy

"Yo listen! This ain't no demo drill!"

SL = 185.500 (4H swing high wick)

Place SL ONLY after breakout confirms — no pre-breakout SLs, no pre-heist drama.

Adjust SL based on risk %, lot size, and number of entries you're stacking.

If you’re reckless, go wild. But don’t say I didn’t warn you. You’re dancing with the FX devil here.

📉 Target Exit Zone

TP = 181.500

But real thieves know: If the heat gets heavy, vanish early. Escape before the target if price action warns you.

Survive > Greed. Always.

🔍 Macro Market Intel for Our Heist Plan

CHF/JPY is in a Bearish narrative, aligned with:

🧠 Fundamental Shifts

🏦 Macro Trends (Swiss deflation concerns + Japanese carry trade dynamics)

📉 Commitment of Traders (COT) Data

🌦️ Seasonal & Intermarket Correlation

🧭 Sentiment, Risk Flows & Future Pricing Models

🗞️ Before you break in, read the news, study the reports, watch the market smoke signals.

🚨 Trading Alert (News Protocol):

📢 Important: News releases = wild volatility. Stay smart:

No new trades during high-impact releases

Use trailing SLs to protect bagged profits

Adjust sizing to dodge unnecessary exposure

💖💥 Support the Robbery Plan 💥💖

Smash that 🚀BOOST button if you're vibing with the Thief Trading Style.

Every click helps build the strongest robbery crew in the FX game. This ain't luck — it's strategy, timing, and execution. 💪📈🎯

I'll be back soon with another market heist plan — stay sharp, stay paid. 🐱👤💼📊

"Master Plan to Rob CHF/JPY – Breakout Trading Idea"💣CHF/JPY Forex Heist: Swiss vs Yen 🔥Master Robbery Plan Unfolded!

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers, Bandits & Chart Pirates 🤑💰💸✈️

It's time to reload your gear and lock in the blueprint. Based on our 🔥Thief Trader Technical + Fundamental Intelligence🔥, we’re all set to ambush the CHF/JPY "Swiss vs Yen" battlefield. This ain’t no casual walk—it’s a full-scale market operation targeting the High Voltage Reversal Trap Zone⚡. The pressure is real: Overbought, Tricky Consolidation, and Bears camping at resistance. Your job? Steal profits before they smell the breakout! 🏆💪💵

🎯 Entry Point — "Let the Heist Begin"

🗝 Entry Level: Wait for the Breakout @ 186.000. When price shatters the Moving Average ceiling—that's your greenlight!

🚀 Execution Choices:

Place Buy Stop above the breakout point

Or, use Buy Limit Orders near recent swing highs/lows on the 15/30-min chart using Layering/DCA tactics (that’s how the real thieves sneak in 🕶️).

🔔 Set an alert to stay sharp—don’t miss the vault crackin’ open!

🛑 Stop Loss — “Cover Your Escape”

🎯 SL Level: Just under the recent swing low on the 4H timeframe (around 184.000)

🚫 Never place the SL before the breakout confirms! Let the move prove itself first.

🧠 SL sizing depends on your capital, lot size, and number of entries stacked. You control the risk, not the other way around!

🎯 Target — "Cash Out or Vanish"

💎 First Take-Profit: 189.000

🚪Optional Escape: Secure the bag early if momentum fades. Better leave rich than be late!

👀 For Scalpers & Swing Robbers Alike

🔍 Scalpers: Only ride the Long wave.

💼 Big pockets? Hit straight entry.

👟 Small capital? Tag in with swing trades and trail that SL like a pro.

🎣 Use a Trailing SL to lock profits as price sprints toward resistance.

📰 The Bigger Picture: Why CHF/JPY?

The pair is pumped by:

📈 Macro Economics

📊 Quant Analysis

📰 COT Reports

📉 Intermarket Correlations

🧠 Sentiment Heatmaps

🔥 Future Price Dynamics

Don’t pull the trigger blind. Read the battlefield before charging in.

⚠️ Thief’s Caution Zone: News Traps Ahead

🛎 News = chaos.

📌 Avoid entering fresh trades during major data drops.

🔐 Use Trailing SLs to protect ongoing plays.

📉 Let the market dance, but you control the music.

💥Hit the Boost Button!💥

If this heist plan pumps your portfolio, smash that boost. That’s how we fund more blueprints, fuel the Thief Gang’s vault, and keep the robbery cycle alive.

🤑💵 Together, let’s rob this market clean—Thief Style.

New plan drops soon. Stay locked. Stay sharp. Stay profitable.

🧠💰🏴☠️

— Thief Trader Out 🐱👤🔓🚀

CHF/JPY Finally Broke Sideway Area , Breakout Confirmed ?Here is my 4H Chart on CHF/JPY , As we see we have a clear breakout after this long time in sideway after this huge movement to upside without any correction , so the price will go down for sometime in the next few days maybe weeks , we are looking for short setups only now , and we have a very good place o sell from it , it`s show in the chart , it`s my fav place right now to sell from it and we can targeting 100: 200 pips . if we have a daily closure above my res we can wait the price to go up a little and waiting for bearish price action and we can sell .

CHF/JPY Creating Double Top Reversal Pattern , Ready To Sell ?Here is my opinion on CHF/JPY 4H Chart , if we take a look we will see that the price moved tp upside very hard without any correction and now finally we have a reversal pattern but still not confirmed , so we have 2 places to sell this pair , first one is highest one around 185.800 To 186.000 and the second one if the price confirmed the pattern and closed below the neckline then we can enter a sell trade and targeting the nearest support . if we have not a closure below the neckline to confirm the pattern then this setup not valid .

CHF/JPY in Strong Uptrend – Clear Buy Opportunity!Hi traders!, Analyzing CHF/JPY on the 30-minute timeframe, price is currently continuing a strong bullish trend, breaking above recent consolidation and showing momentum to the upside.

🔹 Entry: 183.429

🔹 Take Profit (TP): 184.429

🔹 Stop Loss (SL): 183.341

Price is respecting the 21 EMA and riding it upwards, indicating strong bullish momentum. The RSI is also in the overbought zone, but still climbing, which confirms buyer strength. This setup aligns with the trend continuation and offers a favorable risk-to-reward ratio.

A breakout above the minor resistance and the clear structure of higher highs and higher lows support the bullish idea. Watch for possible reactions near 184.429, where price may face short-term resistance.

⚠️ DISCLAIMER: This is not financial advice. Every trader is responsible for their own decisions and risk management.

#CHFJPY: Next Target 180 or Beyond! Get ReadyCHFJPY is extremely bullish this week. The price has risen above 175 as of today, primarily due to the strong USD economic data and the BOJ’s decision not to change interest rates. We anticipate a steady bullish move.

Good luck and trade safely!

Thank you for your unwavering support! 😊

If you’d like to contribute, here are a few ways you can help us:

- Like our ideas

- Comment on our ideas

- Share our ideas

Team Setupsfx_

❤️🚀

#CHFJPY: Last Idea +200 pips, Another 500+ Remanning Hey there!

Our CHFJPY trade is going swimmingly, with a +200 pips move already under our belt. We’re expecting the price to keep climbing and potentially reach 185 or more. Feel free to set your own take profit and stop loss based on your own trading strategy. We’re just sharing this exciting opportunity with you.

Good luck and happy trading! 😊

We really appreciate your unwavering support! ❤️🚀

If you’d like to lend a hand, here are a few ways you can contribute:

- Like our ideas

- Comment on our ideas

- Share our ideas

Cheers,

Team Setupsfx_