Chfjpyshort

CHF/JPY Downtrend Bias With Clear Risk Parameters🔻 CHF/JPY Bearish Breakdown | SMA Signal + Yen Strength Play 📉

Forex Market Trade Opportunity Guide (Day / Swing Trade)

📌 Asset

CHF/JPY – Swiss Franc vs Japanese Yen

🧠 Market Bias

🔴 Bearish Structure Confirmed

Price has broken and retested the Simple Moving Average (SMA) on the 4H timeframe, signaling momentum shift and trend continuation to the downside.

📊 Technical Breakdown

✅ SMA Breakout Confirmed @ 197.600 (4H TF)

📉 Market showing lower high pressure

⚠️ Short-term sellers active after rejection

🧲 Liquidity sweep + correction zone below

🎯 Entry Strategy

🟡 Flexible Entry Allowed

You may enter at ANY price level after confirmed SMA breakout

Best entries align with pullbacks toward dynamic resistance

Suitable for scaling or single-shot execution

🏁 Target Zone

🎯 195.500

Strong support zone

Oversold reaction area

Possible bear-trap / short covering

➡️ Book profits smartly — don’t wait for perfection

🛑 Stop Loss

🔐 199.000

Invalidation above structure

Protect capital if bullish reclaim occurs

⚠️ Risk Note

Dear Ladies & Gentlemen (Thief OG’s),

I do NOT recommend using only my TP or SL.

You control your risk. Take money when market pays.

Trade responsibly. 🧠💰

🌍 LIVE FUNDAMENTAL & MACRO WATCH (London Session Focus)

💴 Japanese Yen (JPY) Drivers

🏦 Bank of Japan (BoJ) policy expectations remain hawkish-leaning

📉 Yen strengthens during risk-off sentiment

📊 Watch:

Japan inflation trends

BoJ speeches & policy guidance

Global bond yield movements

🇨🇭 Swiss Franc (CHF) Drivers

🏦 SNB stance increasingly sensitive to deflation risks

CHF weakens when global risk appetite improves

📊 Watch:

Swiss CPI releases

SNB commentary

European economic spillover

⚡ Global Risk Factors

📉 Equity market weakness = JPY strength

🛢️ Commodity volatility affects CHF demand

🇺🇸 USD & Treasury yield moves influence both legs indirectly

🔗 RELATED PAIRS TO WATCH (Correlation Radar)

💹 USD/JPY → Strong inverse confirmation for JPY momentum

💹 EUR/JPY → Yen strength validation across majors

💹 CHF/USD → CHF weakness confirmation

💹 GBP/JPY → Risk sentiment thermometer

➡️ If JPY strengthens across the board, CHF/JPY downside gains confidence.

🧩 Final Thoughts

This setup blends:

✅ Clear technical confirmation

🌍 Strong macro alignment

🎯 Logical liquidity-based target

📌 Trade the plan, not emotions.

📈 Let structure guide you.

💬 Drop your bias & execution thoughts in comments!

If this helped — like 👍, follow 👣, and share with your trading circle.

TheGrove | CHFJPY Sell | Idea Trading AnalysisYou can expect a reaction in the direction of selling from the specified Resistance zone,

CHFJPY moving higher as it tests the strong resistance level..

We expect a bearish move from the confluence zone.

Hello Traders, here is the full analysis.

I think we can soon see more fall from this range! GOOD LUCK! Great SELL opportunity CHFJPY

I still did my best and this is the most likely count for me at the moment.

-------------------

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 🤝

You-Tube trade of Jan 3rd Week (CHFJPY)Market Context (Jan 3rd Week, 2026)

As of mid-January, CHFJPY has been trading in a volatile range. While the broader trend has shown bullish resilience, we are seeing clear signs of a "top wick" forming on the monthly timeframe, suggesting a potential reversal or deep correction is underway.

Current Price Data

Current Price: Approximately 197.24

Bearish Target: Your target of 196.5 aligns perfectly with the current S1/S2 support levels identified by several technical aggregators.

TheGrove | CHFJPY Sell | Idea Trading AnalysisYou can expect a reaction in the direction of selling from the specified resistance zone

CHFJPY moving higher as it tests the strong resistance level..

We expect a bearish move from the confluence zone.

Hello Traders, here is the full analysis.

I think we can soon see more fall from this range! GOOD LUCK! Great SELL opportunity CHFJPY

I still did my best and this is the most likely count for me at the moment.

-------------------

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 🤝

CHFJPY → Trade Analysis | SELL SetupThe price has fallen under the dynamic support, which now acts as resistance.

We expect the decline to continue after testing the lower boundary of the channel.

Hello Traders, here is the full analysis.

I think we can soon see more fall from this range! GOOD LUCK! Great SELL opportunity CHFJPY

I still did my best and this is the most likely count for me at the moment.

-------------------

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 🤝

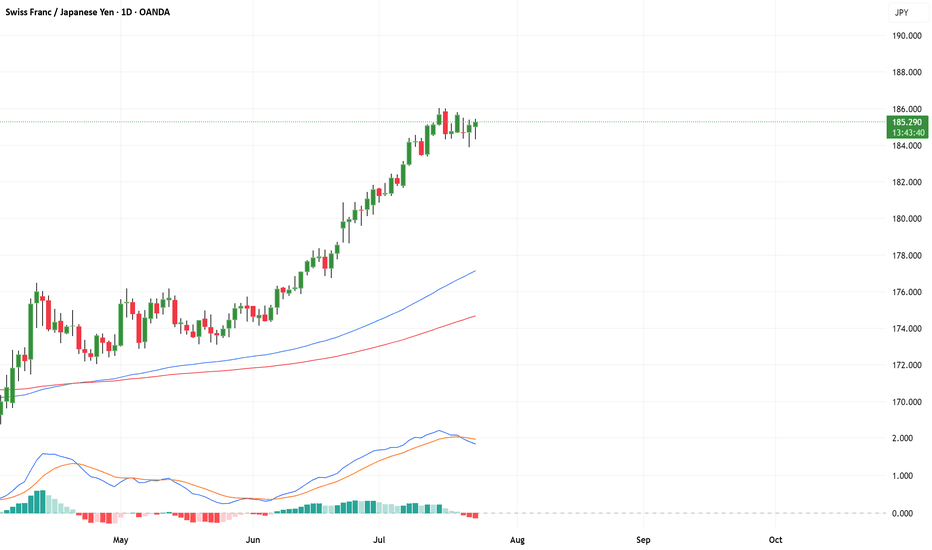

Is the CHFJPY Gap Fill to 185 About to Play Out?This pair has been on an absolute tear this year, clocking in nearly 14 straight bullish weeks — one of the strongest runs we’ve seen in a long time. Most of that surge came right after the Japanese election results last month, and now, things are looking seriously overextended.

Looking at the Monthly and Weekly charts, the structure remains bullish, but momentum is clearly stretched. The pair is deep in overbought territory, setting up a nice potential bearish correction — possibly down to fill the open gap around 185.00.

Daily Chart Breakdown:

Zooming into the daily chart, we can see a clear sideways range forming over the last six days. Thursday’s fake bullish breakout likely trapped a lot of retail traders, triggering stop losses right after the BOJ rate decision.

What caught my attention is that while price popped higher on Thursday, the MACD moving averages crossed down — a clear sign that underlying momentum is shifting bearish.

Game Plan:

If we get a daily close below 191.00 support, I’ll be watching closely for a quick retracement back above that level — that’s where I’ll be looking to get in on the short setup, either tomorrow or in the coming days.

Targets:

First Target: 189.00 (previous support)

Second Target: 185.00 (gap fill level from early last month)

If this plays out, we’re looking at a 300–500 pip opportunity on this move.

This pair has been flying for months, but even strong trends need to breathe — and this one’s showing all the signs of exhaustion.

Let me know what you think below 👇

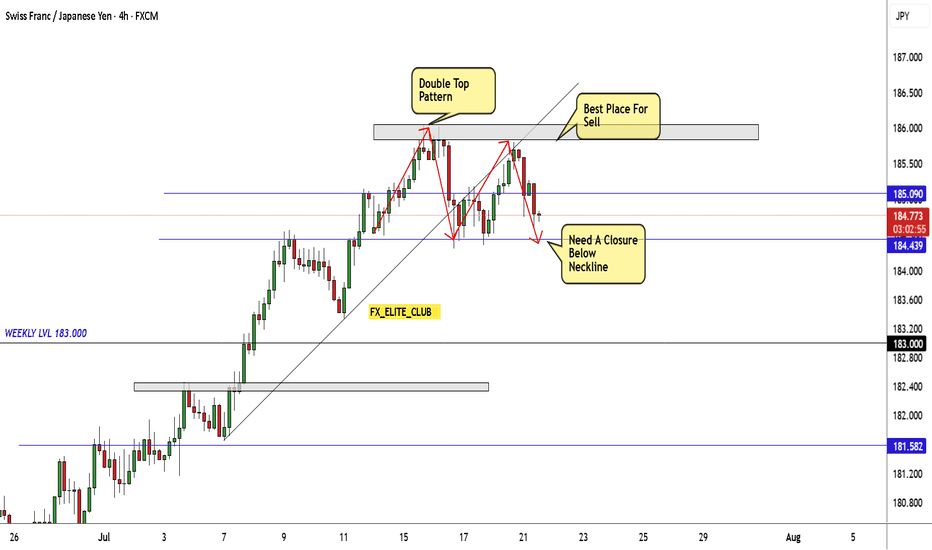

CHFJPY Sell Off (Retracement) Overall Bullish Bias

Price is currently in a bullish trend.

Price created a new high and formed a double top.

Expecting price to sell off (retrace) and test the 38.2-50.0 Fib Level before continuing with the bullish trend.

The retracement will serve as a Higher Low (support area) and bulls will look to go long.

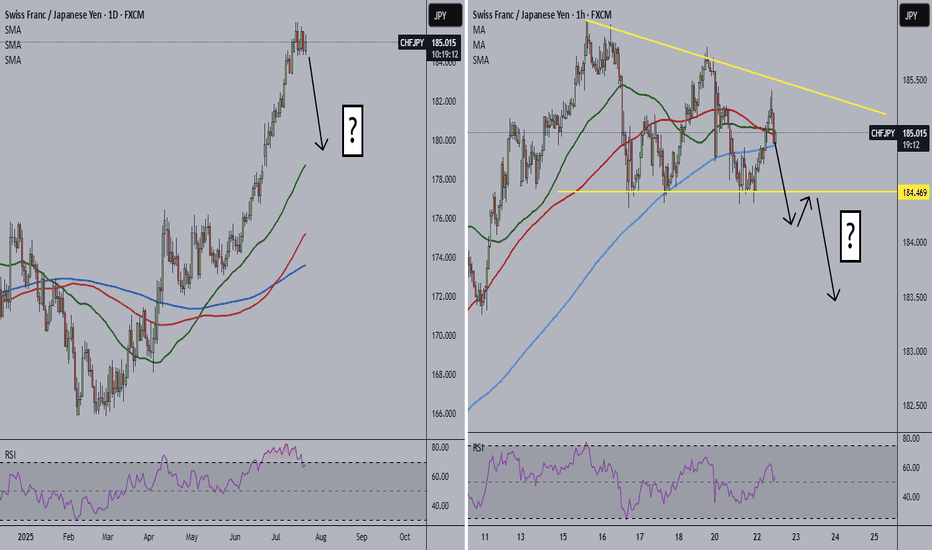

When We Can Sell CHF/JPY And Be Safe ? 2 Places Cleared !Here is My 1H CHF/JPY Chart and here is my opinion , this pair going up for a year and we have a small waves during this upside journey , and this week due to election the price go up very hard without any waves and the price opened in big gap and until now the prices didn`t cover it , until yesterday the price didn`t give us any bearish price action to can enter a sell trade even for 100 pips , but today the price trying to give us a good bearish price action to tell us that we can have a small movement to downside so i have 2 places i can sell this pair from it , the first place it`s show in the chart the res area it`s the highest price the price touch it so we can sell from it and my best place will be if the price closed below my support with 1h candle at least i will wait the price to back to retest my support and then i will enter a sell trade and this will be very safe for me . if the price closed above my res with 4H Candle than this idea will be not valid .

Entry Reasons :

1- Highest Level The Price Touch It

2- Upside Movement Without Any Waves .

3- New Support Created .

4- Clear Price Action .

5- Clear Support & Res .

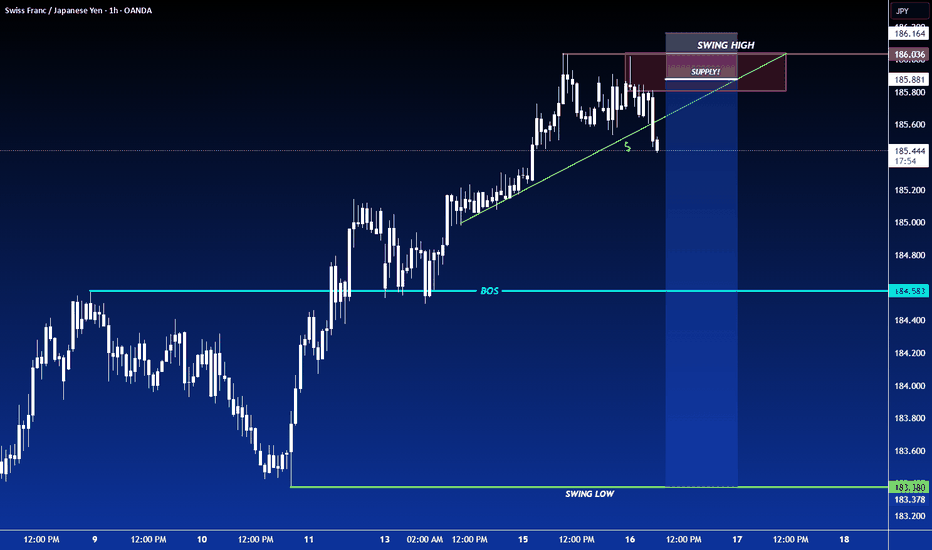

CHFJPY – Bulls Eye Fresh Highs as Momentum BuildsCHFJPY has been grinding higher after bouncing from its recent lows, and price is now testing resistance with strong bullish intent. The market is respecting its upward channel structure, and with both the franc and yen playing safe-haven roles, the battle comes down to relative central bank stances. At the moment, the Swiss franc looks stronger, keeping the upside path intact.

Current Bias

Bullish – CHFJPY continues to trend higher, with buyers in control toward key resistance.

Key Fundamental Drivers

CHF: The Swiss National Bank (SNB) remains cautious but is less dovish than the BoJ, allowing CHF to retain strength.

JPY: The yen is supported by safe-haven flows but capped by BoJ’s slow exit from ultra-loose policy.

Rate spreads: The differential continues to lean in favor of CHF versus JPY.

Macro Context

Interest rates: SNB has signaled less urgency to cut compared to other central banks, while BoJ is still defending easy policy despite yield adjustments.

Growth: Japan shows modest economic expansion, while Switzerland’s economy remains steady, backed by low inflation.

Geopolitical: Risk sentiment plays a key role—when risk aversion spikes, both CHF and JPY strengthen, but CHF has recently outperformed.

Primary Risk to the Trend

A sudden shift in BoJ policy or a sharp risk-off wave could swing momentum toward JPY, cutting CHFJPY’s upside potential.

Most Critical Upcoming News/Event

SNB policy outlook and any intervention chatter.

BoJ commentary around yield curve control and inflation targets.

Leader/Lagger Dynamics

CHFJPY often acts as a lagger, following broader safe-haven demand trends shaped by USDJPY and EURCHF. It tends to react after JPY crosses move, rather than leading.

Key Levels

Support Levels: 184.79, 183.84

Resistance Levels: 185.74, 186.70

Stop Loss (SL): 183.84

Take Profit (TP): 186.70

Summary: Bias and Watchpoints

CHFJPY bias is bullish, with SL at 183.84 and TP at 186.70. CHF’s relative resilience against JPY keeps the upside favored, especially as SNB remains firmer compared to BoJ. The key watchpoints are SNB policy tone and Japanese yield commentary, which could shift the balance. Unless JPY strengthens sharply on safe-haven demand, CHFJPY looks set to test higher resistance levels.

CHFJPY Bearish Pattern LoadingThe pair has recently rallied into the 186.60 resistance zone, which has acted as a strong ceiling in the past. Price is now struggling to break higher, showing rejection candles near this level. Sellers have stepped in around the same area multiple times before, confirming it as a key supply zone.

On the downside, the nearest support lies around 185.15, followed by deeper levels near 184.40 and 183.60. These zones represent potential targets if bearish momentum continues. The broader market structure shows CHFJPY losing steam after a strong push up, suggesting a likely corrective leg lower.

Momentum indicators (from the chart’s rejection) are also hinting that buyers are fading, giving more weight to your bearish view.

Here’s a clean trade setup based on the chart 📉:

• Entry: 186.10 – 186.20 (near resistance rejection zone)

• Stop-Loss: 186.62 (above resistance)

• Take Profit 1: 185.15 (nearest support)

• Take Profit 2: 184.40 (extended target)

• Risk/Reward: ~1:2.2

🔑 Risk Handling Strategy

• Book partial profits at 185.15 to secure gains, then let the rest ride toward 184.40.

• Use a trailing stop once TP1 is hit—move SL to breakeven or slightly in profit to lock in risk-free trade.

• If bullish pressure unexpectedly resumes and price breaks above 186.60, exit the trade early, as it would invalidate the bearish bias.

________________________________________

📌 Summary: CHFJPY is showing rejection from a major resistance zone at 186.60. The technicals support a bearish correction toward 185.15 first, and potentially 184.40 if selling pressure accelerates. Risk is well-defined, and profit-taking with trailing stops ensures protection while allowing room for extended downside.

________________________________________

CHF/JPY Near Strong Res Area , Short Valid To Get 150 Pips !Here is my opinion on 8H CHF/JPY Chart , the price touch a very strong res area that forced the price to respect it and go down for more than 500 pips for 5 times , and now the price touch it and moved 30 pips to downside so now i`m waiting the price to go back to retest the same area again and give me a good bearish price action to can enter a sell trade and we can targeting from 100 : 200 pips . if we have a daily closure above my res area this idea will not be valid anymore .

Entry Reasons :

1- Very Strong Daily Res Area .

2- Perfect Bearish Price Action .

3- Bigger Time Frames Confirmed .

CHFJPY Day/Swing Trade Setup – Bearish Move Loading...💸"Operation Swiss Shadow: The CHF/JPY Forex Heist Blueprint" 💸

(Thief Trading Style: Master Plan Edition)

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers, Robbers & Market Ninjas 🤑💰✈️,

This ain't your average trade idea — this is a Thief Trading certified forex heist targeting the CHF/JPY aka "Swiss vs Japanese". Based on my unique blend of 🔥technical traps + fundamental pressure points🔥, we've built the perfect blueprint to rob this pair at its weakest moment.

💣 Our target? The overhyped bullish zone — oversold, consolidating, and ripe for reversal. This is where institutional bulls camp, and we’re about to hit ‘em where it hurts.

🎯 Trade Setup Breakdown (Bearish Bias)

🎯 Entry Point:

The heist begins at 183.800 — wait for a neutral level breakout and prepare your sell orders.

💥 Recommended play:

Place Sell Stop just below the breakout confirmation.

For pros: use Sell Limit orders above MA or at pullback zones (15m/30m chart) near recent swing highs/lows — layer in using DCA style to catch premium entries.

🔔 Pro Tip:

Set alerts at the breakout zone. Don’t sleep on the move — timing is key in every robbery.

🛑 Stop Loss Strategy

"Yo listen! This ain't no demo drill!"

SL = 185.500 (4H swing high wick)

Place SL ONLY after breakout confirms — no pre-breakout SLs, no pre-heist drama.

Adjust SL based on risk %, lot size, and number of entries you're stacking.

If you’re reckless, go wild. But don’t say I didn’t warn you. You’re dancing with the FX devil here.

📉 Target Exit Zone

TP = 181.500

But real thieves know: If the heat gets heavy, vanish early. Escape before the target if price action warns you.

Survive > Greed. Always.

🔍 Macro Market Intel for Our Heist Plan

CHF/JPY is in a Bearish narrative, aligned with:

🧠 Fundamental Shifts

🏦 Macro Trends (Swiss deflation concerns + Japanese carry trade dynamics)

📉 Commitment of Traders (COT) Data

🌦️ Seasonal & Intermarket Correlation

🧭 Sentiment, Risk Flows & Future Pricing Models

🗞️ Before you break in, read the news, study the reports, watch the market smoke signals.

🚨 Trading Alert (News Protocol):

📢 Important: News releases = wild volatility. Stay smart:

No new trades during high-impact releases

Use trailing SLs to protect bagged profits

Adjust sizing to dodge unnecessary exposure

💖💥 Support the Robbery Plan 💥💖

Smash that 🚀BOOST button if you're vibing with the Thief Trading Style.

Every click helps build the strongest robbery crew in the FX game. This ain't luck — it's strategy, timing, and execution. 💪📈🎯

I'll be back soon with another market heist plan — stay sharp, stay paid. 🐱👤💼📊

CHF/JPY Finally Broke Sideway Area , Breakout Confirmed ?Here is my 4H Chart on CHF/JPY , As we see we have a clear breakout after this long time in sideway after this huge movement to upside without any correction , so the price will go down for sometime in the next few days maybe weeks , we are looking for short setups only now , and we have a very good place o sell from it , it`s show in the chart , it`s my fav place right now to sell from it and we can targeting 100: 200 pips . if we have a daily closure above my res we can wait the price to go up a little and waiting for bearish price action and we can sell .

CHFJPY Looks Toppy… Is a 500 Pip Crash Coming?CHFJPY Has Exploded Past 180 — But Is the Top Already In?

After blowing clean through the key 180 resistance level, CHFJPY has continued surging into July — a month historically known for thin liquidity as traders hit holiday mode. These low-volume environments often lead to exaggerated price moves, much like we see in late December.

From a structural standpoint, this pair looks seriously overextended and ripe for a sharp pullback — with potential downside targets around 180 and 178 over the coming weeks.

If I were a bull, I’d want to see a clear break and weekly/monthly close above 186 before considering further upside.

As it stands, I’m gradually building into a short position, eyeing that 180 handle as my first key level.

Let me know your thoughts in the comments — agree, disagree, or seeing something I’m not?

*This is my personal analysis shared for educational purposes only. Always do your own research — never blindly follow anyone’s trades.*

CHFJPY Alert!

🚨 CHFJPY Alert 🚨

Don't catch a falling knife... 🔪 However, price always returns to moving averages, and CHFJPY could be starting its descent.

Personally, I think price may form one last bullish move up and then come crashing down. However, the 1-hour is forming a descending triangle. A break below the triangle could be the start of the daily retracement.

Thoughts?

CMCMARKETS:CHFJPY

CHF/JPY Creating Double Top Reversal Pattern , Ready To Sell ?Here is my opinion on CHF/JPY 4H Chart , if we take a look we will see that the price moved tp upside very hard without any correction and now finally we have a reversal pattern but still not confirmed , so we have 2 places to sell this pair , first one is highest one around 185.800 To 186.000 and the second one if the price confirmed the pattern and closed below the neckline then we can enter a sell trade and targeting the nearest support . if we have not a closure below the neckline to confirm the pattern then this setup not valid .

CHFJPY July Setup: Bearish Reversal Brewing from RSI ExtremesCHFJPY is setting up for a clean bearish reversal heading into July.

📌 Here's the breakdown using Vinnie’s Trading Cheat Code System:

✅ RSI OB Zone triggered – momentum stretched

✅ Trendline exhaustion forming near key resistance (~178.00)

✅ Waiting on Confirm Sell or MACD cross to validate entry

✅ First targets at 174.00 and 170.60 (prior demand zones)

The pair is showing signs of topping after a strong JPY selloff and CHF strength surge. If risk-off flows hit, CHFJPY could unwind fast.

Watching for lower timeframe triggers to scale in. Will update once confirmation hits.

🧠 Powered by:

Cheat Code Confirm Alerts

CC Trend Indicator

RSI OB/OS

MACD Momentum Roll

Drop a comment if you’re watching this too — let’s track it together.