China A50 Market Analysis | Downtrend Confirmation🔥 China A50 (CHINA50) Short Bias Set-up | MA Breakout Confirmed 📉 + Correlation Watchlist + Macro Fuel

📌 DESCRIPTION — Pro Traders + OGs Only 🔓

Market: China A50 Index CFD (Trading Benchmark — top 50 A-shares listed Shanghai & Shenzhen).

Timeframe: Day / Swing Trade

🧠 TRADE STRUCTURE 📊

📉 Bias: Bearish — Confirmed MA Breakout (Price cracked dynamic zone)

🎯 Entry: Any logical price break / retest — flexibility preferred

🛑 Stop Loss:

“Thief SL” @ 15400 — Risk Protect Zone (manage risk, not hope)

📍 Target:

First Profits: ~14950 zone — confluence with dynamic support fade

(Remember: price can overshoot; scale profit taking)

🔥 RISK DISCLOSURE

Dear Ladies & Gentlemen (Thief OG’s) — this is trade guidance only. Set your own SL/TP based on your risk tolerance — not only mine. Trade smart, take profits, protect capital.

📌 PAIRS & CORRELATIONS TO WATCH 👀

Strong / relevant correlations with China equity sentiment:

• USD/CNH — rising USD against CNH usually pressures Chinese equities

• CSI 300 / HSI — if broader China large caps weaken, A50 often follows

• ASX200 / Hang Seng Tech — regional risk appetite bleed confirms gravity

• AUD/JPY / Nikkei 225 — Asia risk proxy; risk-off often means equities slide

Why watch these? Greater macro forces ripple across Asian/China markets and confirm momentum.

📊 FUNDAMENTAL & ECONOMIC CONTEXT (Latest + Upcoming)

🔎 China growth slowing but resilient: GDP forecast ~4.8% in 2026 (slightly below last year) with export strength supporting macro growth.

📈 Tech & ETF flows — institutions increasing exposure, tech earnings gaining momentum — positive undercurrent.

🏙️ Domestic weakness + property drag — ongoing property price declines and weak consumption could weigh on broader sentiment.

📰 Market oversight tightened — regulators vow stricter supervision to curb speculative excess; margin requirements rising.

⏰ Upcoming Macro Drivers:

✔ PMI/services releases

✔ China trade data (exports/imports)

✔ PBOC policy stance — interest rate / RRR actions

✔ US macro (PPI/CPI) impacting China export demand via currency flows

🛠 TECHNICAL EDGE

✔ MA breakout suggests bleeding momentum

✔ Dynamic MA acts as pseudo resistance

✔ Oversold zones + trap signals warrant profit realization

✔ Risk clusters / support confluence near target zone

📌 NEWS IMPACT SUMMARY (London Time)

• China met growth targets despite challenges, but domestic demand remains weak.

• Property sector softness risking broader economic drag.

• Regulatory tightening to curb speculation could pressure markets.

(All news interpreted in London time market context.)

🔔 LESSON IN A LINE

Price respects structure more than direction — trade levels with confirmation, not emotions.

China50

China50 Pullback Buy Setup — Tactical Layer Entries & Trade Map📌 Asset: "CHINA50 / A50" Index Market — Swing Trade Opportunity Guide

📈 Bias: Bullish outlook confirmed by a clean moving average pullback structure.

📊 Trade Plan

The market is retracing into dynamic support, respecting key moving averages — a classic bullish continuation setup.

To execute this with precision, the Thief Layering Strategy is used (multiple limit-order scaling during pullbacks).

🟢 Entry Plan — Layered Limit Orders

Using the thief-style multi-layer entry structure:

Buy Limit 1: 15000.0

Buy Limit 2: 14900.0

Buy Limit 3: 14800.0

👉 Traders can add extra layers depending on their capital, risk, and volatility tolerance.

Layering helps average into pullbacks instead of chasing breakouts.

🛑 Stop Loss

Thief SL: 14700.0

Dear Ladies & Gentlemen (Thief OG’s) — adjust your Stop Loss based on your own risk and your own system.

📌 This is not a fixed SL suggestion; trade responsibly.

🎯 Target

The price is approaching a strong resistance zone with signs of potential overbought pressure and possible bull traps.

Primary Take-Profit: 15800.0

Dear Ladies & Gentlemen (Thief OG’s) — secure profits based on your own rules.

📌 My TP is only a reference; manage exits according to your risk style.

📡 Related Markets to Watch (Correlation Guide)

1️⃣ HSI:HSI — Hang Seng Index

Strong correlation with China equities

When HSI shows risk-on flow, CHINA50 often follows

Watch for synchronized breakouts or divergence signals

2️⃣ CAPITALCOM:CN50 — China A50 Futures

Direct CME-tracked instrument

Useful for liquidity confirmation

CN50 volume spikes often lead CHINA50 movements

3️⃣ LSE:SSE — Shanghai Composite

Macro sentiment indicator

If SSE pushes higher while A50 pulls back, the pullback likely becomes a buy opportunity

4️⃣ SP:SPX / CME_MINI:ES1! — S&P 500

Not strongly correlated, but global risk sentiment matters

When SPX is risk-on, Asian indices get spillover momentum

Especially important in weak macro weeks

5️⃣ HSI:HSCEI — China Enterprises Index

Tracks large China corporates

Good for spotting whether institutional flows are entering Chinese markets

China 50 Index Maintains Uptrend Above Dynamic Support🚀 CHINA A50 INDEX SWING/DAY TRADE OPPORTUNITY 🚀

═══════════════════════════════════════════════════════

📊 ASSET: FTSE China A50 Index (XIN9) | CNY

💹 CURRENT PRICE: 15,366.93 | Last Updated: Dec 23, 2025

📈 52-WEEK RANGE: 12,182.84 - 15,759.61

───────────────────────────────────────────────────

🎯 BULLISH TRADING THESIS

✅ SETUP CONFIRMATION:

GREEN Hull Moving Average: Pullback + Retest Pattern Identified

BLUE Triangular Moving Average: Strong Support Confirmation

Market Structure: Higher Lows + Higher Highs (Uptrend Intact)

Volume Profile: Buying Pressure on Dips

📍 TRADE STRUCTURE: Swing Trade (1-7 Days) / Day Trade (Intraday)

───────────────────────────────────────────────────

🔥 ENTRY STRATEGY - "THIEF LAYERING METHOD"

Multiple Limit Order Entries (Reduce Average Cost):

Layer 1: Buy @ 15,200 (First Position)

Layer 2: Buy @ 15,250 (Add Position)

Layer 3: Buy @ 15,300 (Increase Exposure)

Layer 4: Buy @ 15,350 (Final Layer)

💡 Strategy Notes: You can increase/decrease layers based on your risk tolerance and account size. Each layer reduces emotional decision-making and optimizes entry cost basis.

⚠️ IMPORTANT: These are suggested entry points using established support zones. Adjust entries based on YOUR chart analysis and risk management rules.

───────────────────────────────────────────────────

🛑 STOP LOSS MANAGEMENT

THIEF STRATEGY SL: 15,100

Protects against breakdown of critical support zone

Allows room for natural market noise & pullbacks

Defines your maximum loss per trade

⚠️ CRITICAL DISCLAIMER:

Dear Ladies & Gentlemen (Thief OG's), your stop loss is YOUR choice. I recommend managing SL based on:

Your account size

Your risk/reward ratio (1:2 minimum)

Your personal risk tolerance

Market volatility at time of trade

Risk = Your Decision. Trade Responsibly. 🎲

───────────────────────────────────────────────────

🎊 PROFIT TARGET

PRIMARY RESISTANCE/TP ZONE: 15,650

Why 15,650?

🔴 ELECTRIC SHOCK RESISTANCE - Multi-Month Strong Resistance

⚡ OVERBOUGHT CONDITION - RSI/Stochastic Extended Levels

⚠️ BULL TRAP RISK - Correction Likely at This Level

🚪 ESCAPE POINT - Prudent Exit to Secure Profits

Secondary Resistance: 15,750-15,800 (Extended Run if Breakout Confirmed)

⚠️ CRITICAL DISCLAIMER:

Dear Ladies & Gentlemen (Thief OG's), your take-profit level is YOUR choice. I recommend:

Take partial profits at 15,650 (secure 50-70%)

Trail stop on remaining position

Let winners run if breakout confirmed

Never get greedy at resistance

Profits = Your Decision. Manage Exits Professionally. 💰

───────────────────────────────────────────────────

📡 CORRELATED PAIRS TO MONITOR

1️⃣ HANG SENG INDEX (HSI) - HSI:HSI

Correlation: Strong (0.94+)

Hong Kong's main benchmark

Includes major Chinese enterprises

A50 & HSI often move in synchronized patterns

Watch For: If HSI breaks resistance while A50 confirms—CONFLUENCE ✅

2️⃣ CSI 300 INDEX - $CSI300

Correlation: Very Strong (0.94+)

Tracks 300 largest A-shares (Shanghai + Shenzhen)

Covers ~60% of market capitalization

Direct domestic sentiment indicator

Watch For: CSI300 momentum confirms A50 uptrend strength

Current Level: 4,611.62 | 12-Month: +14.67%

3️⃣ SHANGHAI COMPOSITE (SSE) - LSE:SSE

Correlation: Strong

Shanghai Stock Exchange aggregate

Macro sentiment barometer

Strategy: If SSE rallies while A50 corrects = BUY DIP signal

4️⃣ S&P 500 INDEX ( SP:SPX ) - Risk Sentiment Proxy

Correlation: Moderate (0.45-0.55)

Global risk appetite indicator

If SPX crashes → Flight to safety/A50 weakness likely

If SPX rallies → Risk-on flows boost A50

Watch: Use SPX as macro context, not direct trade signal

5️⃣ CHINESE YUAN (USDCNY) - FX_IDC:USDCNY

Correlation: Inverse (Negative)

Stronger Yuan = A50 typically gains

Weaker Yuan = Warning signal for weakness

Trade Implication: Monitor USDCNY breaks for A50 confirmation

🔗 CONFLUENCE STRATEGY:

When HSI + CSI300 + A50 all confirm support/resistance = Highest Probability Setup ⭐⭐⭐

───────────────────────────────────────────────────

📊 FUNDAMENTAL & ECONOMIC FACTORS

MACRO BACKDROP (December 2025)

🇨🇳 GDP Growth: +5.2% YoY (Q1-Q3 2025)

On track to meet 5% full-year target

Q3 Growth: +4.8% YoY | +1.1% QoQ

Government support measures active

Risk: External headwinds intensifying

📈 Inflation Dynamics:

CPI (Nov 2025): +0.7% YoY (Up from 0.2% in Oct)

Highest level since February 2024

Food prices: Recovered (+0.2% vs -2.9% Oct)

Core CPI: +1.2% (20-month high)

Impact: Rising inflation may support equities against cash

🏭 Manufacturing PMI (Nov 2025): 49.2

Status: 8th consecutive month in contraction (<50 = contraction)

New Orders: Weak (-48.8)

Foreign Sales: Depressed (-47.6) — U.S. tariff pressure

Concern: Manufacturing weakness pressures corporate earnings

💼 Industrial Production (Jan-Sep 2025): +6.2% YoY

Equipment Manufacturing: +9.7%

High-Tech Manufacturing: +9.6%

Positive for tech-heavy A50 components

Private Enterprises outperforming SOEs

🛍️ Retail Sales (Jan-Sep 2025): +4.5% YoY

Steady recovery from H1

Consumer caution persists

Government trade-in stimulus helping

Risk: Domestic demand still sluggish

🌍 Trade Dynamics:

Q3 Exports: +8.4% YoY

Q3 Imports: +7.5% YoY

Risk: U.S. Tariff Threat (100% tariffs on Chinese goods threatened)

September U.S. exports: -27% YoY

Trade war uncertainty creating volatility

🏛️ Government Policy Support:

✅ Fiscal stimulus active (expanded budget deficit)

✅ Monetary accommodation (Low interest rates + ample liquidity)

✅ New quality productive forces (AI, robotics, green tech)

⚠️ Risk: Real estate sector downturn continues to drag confidence

───────────────────────────────────────────────────

⚡ UPCOMING ECONOMIC EVENTS (Watch These!)

📅 January 2026:

Full-Year 2025 GDP Data Release (Major Market Mover)

New government policy announcements for 15th Five-Year Plan

Spring Festival economic expectations

📅 Risk Factors to Monitor:

U.S. Trade Policy (Tariff announcements)

Fed Rate Decisions (Impact on USD/CNY)

China Property Market Data (Housing Confidence)

Tech Sector Earnings & Policy Changes

───────────────────────────────────────────────────

✅ PRE-TRADE CHECKLIST

Before entering this trade, confirm:

✔️ Hull MA in green (bullish)

✔️ Blue Triangle MA providing support

✔️ Price above key support (15,100)

✔️ Volume increasing on ups

✔️ No major news releases next 4 hours

✔️ HSI/CSI300 in agreement (Confluence)

✔️ Your position size = 1-2% account risk

✔️ Entries planned in advance (No emotion)

───────────────────────────────────────────────────

🎓 RISK MANAGEMENT REMINDERS

The Thief Golden Rules:

Capital Preservation First - Never risk more than 2% per trade

Emotion = Enemy - Use limit orders, avoid panic trading

This Plan is NOT Financial Advice - Make your own decisions

Trade YOUR Plan, Not Mine - Adapt to your strategy

Losses are Normal - Professional traders manage them, don't avoid them

Partial Profits - Don't be greedy at resistance

No FOMO - Wait for your setup, skip bad trades

Journal Everything - Learn from every trade

DISCLAIMER:

This trading idea is for educational & informational purposes only. Not financial/investment advice. Past performance ≠ future results. Trading involves high risk of loss. You may lose your entire investment. Only trade with capital you can afford to lose. Consult a licensed financial advisor before trading.

───────────────────────────────────────────────────

🔔 FINAL NOTES

Why This Setup Works:

Bullish confluence (Moving Averages + Support)

Attractive Risk:Reward Ratio

Multiple entry layers reduce emotional decision-making

Clear stop loss and targets pre-defined

Supported by improving macro backdrop (GDP growth, tech momentum)

Why This Setup Can Fail:

U.S. Tariff escalation (External shock risk)

Manufacturing weakness deepens (PMI sub-50)

Wider China property downturn spreads to equities

Trade war intensification

Corporate earnings misses

Your Edge: Manage risk, scale into winners, protect capital, and repeat.

Good luck, Thief OG's! May your profits exceed your losses! 🚀💰

China50 rallies continue to attract sellers.CHN50 - 24h expiry

The overnight rally has been sold into and there is scope for further bearish pressure going into this morning.

We are trading at oversold extremes.

Levels close to the 61.8% pullback level of 15226 found sellers.

15239 has been pivotal.

Bespoke resistance is located at 15250.

We look to Sell at 15215 (stop at 15335)

Our profit targets will be 14855 and 14755

Resistance: 15050 / 15212 / 15253

Support: 14978 / 14850 / 14767

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

CHINA A50 – Bullish Wave Setup After Compression Break Zone🎯 CHINA A50 INDEX: SWING TRADE BULLISH SETUP 📈

"Where Technical Analysis Meets Smart Entry Strategy"

🔍 MARKET OPPORTUNITY

The FTSE China A50 Index presents a premium swing trade opportunity. Current price action (≈15,305-15,511) confirms a bullish reversal pattern with validated double-pullback confirmation on the moving average, positioning traders for a meaningful upside move.

📊 TECHNICAL ANALYSIS & SETUP

Pattern Recognition:

✅ Double Pullback Detected — Price successfully retested the moving average (MA) on two separate occasions without breaking support

✅ MA Retest Confirmation — Bullish structure intact; lower lows avoided

✅ Accumulation Phase — Institutional buyers confirmed via volume analysis

Current Technical Status: BULLISH BIAS ACTIVATED

🎪 THE "SMART LAYERING" ENTRY STRATEGY 💎

Rather than going all-in at a single entry point, we use a layered buy limit order approach — this is the professional's way to average down while maintaining risk management:

Multi-Level Entry Orders:

🎯 Layer 1: Buy Limit @ 15,100.0

🎯 Layer 2: Buy Limit @ 15,200.0

🎯 Layer 3: Buy Limit @ 15,300.0

Pro Tip: You can adjust the number of layers and price intervals based on your position size and risk tolerance. This strategy allows you to accumulate during pullbacks without committing all capital at once.

🛑 RISK MANAGEMENT - STOP LOSS

Stop Loss Level: 15,000.0

This level represents the invalidation point. A close below this breaks our bullish thesis and suggests we need to reassess the pattern.

⚠️ Risk Note: Your stop loss placement should align with YOUR trading plan and risk management rules. This is MY suggested level based on technical structure—always set stops YOU'RE COMFORTABLE WITH.

🚀 PROFIT TARGETS - ESCAPE THE TRADE PROFITABLY

Primary Target: 15,750.0

Reasoning for Exit Strategy:

📍 Strong technical resistance identified at this level

📍 Overbought conditions anticipated (RSI/momentum confluence)

📍 Resistance cluster + historical trapped sellers = optimal exit zone

📍 Risk/Reward Ratio: Favorable 1:2+ setup

⚠️ Profit Management Note: This is the price target I've identified based on technical confluence. However, YOUR exit strategy should be based on YOUR profit objectives and risk appetite. Never force a trade to a target if the market gives you signals to close earlier.

📍 CORRELATED PAIRS TO MONITOR 🌐

Keep an eye on these related assets for context & confirmation:

CNY (Chinese Yuan) — USDCNY

Why: A stronger yuan correlates with A50 rallies; look for CNY weakness as a warning signal

Hong Kong Index (HSI/Hang Seng) — HKEX

Why: HSI and A50 often move in sync; confirms mainland sentiment

Shanghai Index (SSE) — Shanghai Composite

Why: Direct underlying correlation; A50 components trade on Shanghai exchange

China's Tech Index (STAR Market - STAR50)

Why: Tech momentum drives A50; watch tech sentiment separately

Global Risk Sentiment — SPX (S&P 500)

Why: Risk-on/risk-off flows impact emerging market indices like A50

Key Correlation Strategy: If HSI breaks above local resistance while A50 confirms our setup, we have MULTI-TIMEFRAME CONFLUENCE ✅

💡 CRITICAL REMINDERS FOR THIS SETUP

✓ Layered entries reduce average cost and remove emotion from single-point entries

✓ Respect your SL — losses are part of trading; manage them professionally

✓ Trail profits as price moves in your favor to lock in gains

✓ Volume confirmation adds extra credibility to this move

✓ This is a SWING trade — expect 3-7 day holds, not scalps

📈 TRADE SUMMARY CARD

Asset: FTSE China A50 (CN50)

Setup Type: Bullish Swing Trade

Entry Method: Layered Buy Limits (15100/15200/15300)

Stop Loss: 15,000.0 (risk management)

Take Profit: 15,750.0 (primary)

Risk/Reward: ~1:2.5

Holding Period: 3-7 days typical

Current Price: ~15,305-15,511

🎬 MARKET CONTEXT SNAPSHOT

The A50 Index has demonstrated resilience despite macro headwinds, with technical recovery patterns suggesting institutional accumulation. The confluence of:

Double MA pullback confirmation

Volume support

Resistance zone placement

...creates a HIGH-PROBABILITY trade setup for disciplined traders.

✨ If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!

#ChinaA50 #SwingTrade #TechnicalAnalysis #IndexTrading #Trading #LayeredEntry #TradingSetup #FXTrading #SmartMoney #TradingStrategy #RiskManagement #FTSE #ChinaMarkets #BullishSetup #TradersOfTradingView

China50 to find enough buyers at current support?CHN50 - 24h expiry

The overnight dip has been bought into and there is scope for further bullish pressure going into this morning.

15160 has been pivotal.

Previous resistance at 15200 now becomes support.

Daily signals are mildly bullish.

Our outlook is bullish.

We look to Buy at 15185 (stop at 14995)

Our profit targets will be 15755 and 15855

Resistance: 15382 / 15570 / 15774

Support: 15235 / 15080 / 14827

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

China50 to continue in the upward move?CHN50 - 24h expiry

Daily signals are bullish.

20 1day EMA is at 15033.

Intraday dips continue to attract buyers and there is no clear indication that this sequence for trading is coming to an end.

Dips continue to attract buyers.

We look for a temporary move lower.

Risk/Reward would be poor to call a buy from current levels.

We look to Buy at 15055 (stop at 14898)

Our profit targets will be 15505 and 15585

Resistance: 15339 / 15400 / 15500

Support: 15150 / 15000 / 14827

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

CHINA50 Bull Run: Time to Steal Some Pips?🔐 OPERATION BULL DRAGON: CHINA50 HEIST 🔐

🔥 YOUR INVITATION TO THE ULTIMATE MONEY HEIST 🔥

🌏 ASSET: CHINA50 INDEX (A50)

📅 TRADE TYPE: SWING + DAY TRADE

✅ BIAS: BULLISH — TIME TO STEAL SMART! 💰✨

📋 MISSION BRIAMER (PLAN):

We’re entering LONG 🚀 using a LAYERED LIMIT ORDER strategy — because real thieves don’t FOMO in!

🎯 ENTRY ZONES (MULTI-LEVEL LAYERS):

➖ LAYER 1: 14900.0 🟢

➖ LAYER 2: 14800.0 📍

➖ LAYER 3: 14600.0 🔁

🧠 Feel free to ADD MORE LAYERS based on your risk appetite!

⛔ STOP LOSS (DIP EXIT):

🔻 THIEF SL: 14200.0

⚠️ Adjust based on your strategy & risk tolerance! Protect your capital!

🎯 TAKE PROFIT (ESCAPE WITH THE BAG):

🚀 TP: 15600.0

⚡ Resistance & Overbought zone around 15700.0 — Don’t get caught! Exit like a ghost! 👻💰

👁️ SCALPER NOTES:

Only take LONG scalps! Use TRAILING SL to lock in profits! 🧨

📊 WHY THIS HEIST?

Strong bullish structure + fundamental tailwinds! 🌊🐂

Always confirm with your own analysis! 📈

🔔 ALERT — NEWS RISK:

Avoid entering during high-impact news! Volatility = Police traps! 🚨🚓

💎 GENERAL DISCLAIMER:

This is NOT financial advice. Do your own research. Trade at your own risk.

We are not your financial advisor. We’re just fellow thieves sharing a plan. 😉

✨ SUPPORT THE SQUAD:

👉 If you like this plan, SMASH that 👍 BOOST button!

👉 It helps us bring more high-quality heists to you!

👉 Follow for daily trading ideas & market insights!

💬 Let’s conquer the markets together — one heist at a time! 🎯🤑

#CHINA50 #A50 #Trading #SwingTrade #DayTrade #Investing #Crypto #Stocks #Forex #MoneyHeist #TradingStrategy #Profit #RiskManagement #TradingCommunity #FinancialFreedom #TraderLife #Bullish #MarketAlert #TechnicalAnalysis #LimitOrders #LayeredEntry #ThiefTrading

China50 to form a higher low?CHN50 - 24h expiry

Daily signals are bullish.

Intraday dips continue to attract buyers and there is no clear indication that this sequence for trading is coming to an end.

Trading has been mixed and volatile.

Dip buying offers good risk/reward.

Trend line support is located at 15030.

We look to Buy at 15075 (stop at 14945)

Our profit targets will be 15465 and 15525

Resistance: 15339 / 15400 / 15500

Support: 15109 / 14948 / 14855

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

CN50 price action forming a top?CHN50 - 24h expiry

Intraday rallies continue to attract sellers and there is no clear indication that this sequence for trading is coming to an end.

Price action looks to be forming a top.

Rallies should be capped by yesterday's high.

We look for a temporary move higher.

Risk/Reward would be poor to call a sell from current levels.

We look to Sell at 15235 (stop at 15369)

Our profit targets will be 14835 and 14765

Resistance: 15288 / 15400 / 15500

Support: 15063 / 15000 / 14900

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

China50 intraday rallies continue to attract sellers.CHN50 - 24h expiry

Bespoke resistance is located at 15000.

15068 has been pivotal.

15045 has been pivotal.

Preferred trade is to sell into rallies.

Expect trading to remain mixed and volatile.

We look to Sell at 14975 (stop at 15095)

Our profit targets will be 14615 and 14545

Resistance: 14921 / 15068 / 15200

Support: 14756 / 14600 / 14447

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

Can CHINA50 Deliver Big Gains | Before the Vault Closes?💰🕶 CHINA50 Bullish Heist Blueprint 🚀🏴☠️

📌 Asset: "CHINA50" Index CFD

📌 Plan: Bullish — Thief using multiple limit layers (13860 | 13830 | 13800) OR enter at any price level to join the heist.

📌 Stop Loss: Thief SL @ 13800 (adjust to your risk)

📌 Target: 14400 — Cash Out & Vanish!

🔥 Mission Briefing (Thief OG Style) 🔥

Ladies & Gentlemen of the Thief Crew — the vault is open, the guards are sleeping, and the CHINA50 is ripe for a high-class heist. We’re stacking layered buy limits like lockpicks, slipping in unnoticed at each price level. Your loot? A fat bullish run to our target.

💎 Entry Plan

🎯 Any price level within the buy limit layers. The more layers you stack, the bigger your bag — just don’t get greedy, thieves.

🛡 Stop Loss Strategy

Set your SL where it keeps you safe but still in the game. Default: @13800. If you’re a risk-hungry OG, adjust to taste.

🏆 Target & Exit

TP at or pull the escape lever earlier if the market shows too many alarms going off. Always leave with profit, not regrets.

⚠️ Thief Crew Reminder ⚠️

📰 Watch for China market news drops — they can flip the scene fast.

🔔 Set alerts, trail your SL once you’re in the green, and protect the loot.

💥 Boost this plan if you’re running with us — more visibility, more crew members, more wins. Let’s rob this market clean, one candle at a time.

— Thief Trader™ 🐱👤💸

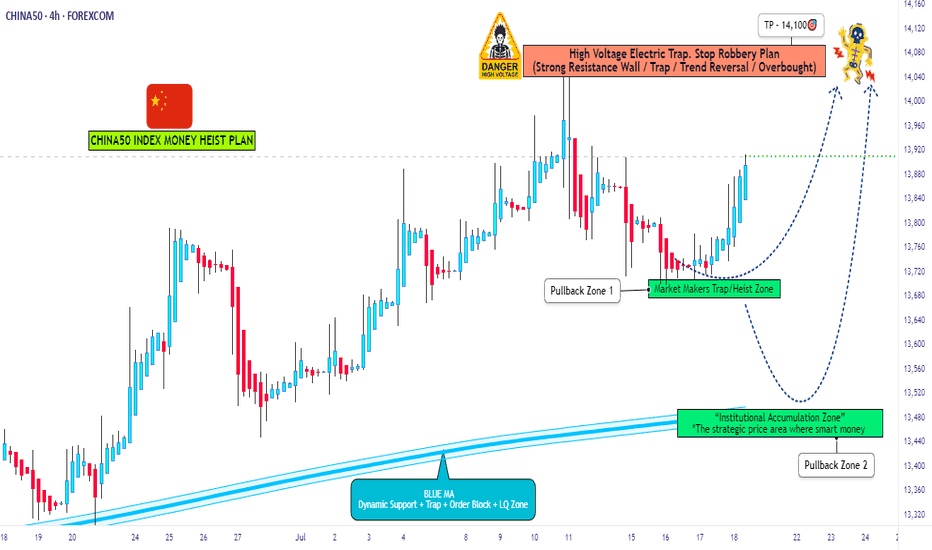

China50 Target Locked | Long Setup via Thief Strategy🏴☠️ CHINA50 Market Robbery Blueprint 🔥 | Thief Trading Style (Swing/Day Plan)

🌍 Hey Money Makers, Chart Hackers, and Global Robbers! 💰🤑💸

Welcome to the new Heist Plan by your favorite thief in the game — this time targeting the CHINA50 Index CFD like a smooth criminal on the charts. 🎯📊

This is not your average technical analysis — it's a strategic robbery based on Thief Trading Style™, blending deep technical + fundamental analysis, market psychology, and raw trader instincts.

💼 THE SETUP — PREPARE FOR THE ROBBERY 🎯

We're looking at a bullish operation, setting up to break into the high-value vaults near a high-risk, high-reward resistance zone — beware, it's a high-voltage trap area where pro sellers and bearish robbers set their ambush. ⚡🔌

This plan includes a layered DCA-style entry, aiming for max profit with controlled risk. Chart alarms on, mindset ready. 🧠📈🔔

🟢 ENTRY: "The Robbery Begins"

📍 Zone-1 Buy: Near 0.63700 after MA pullback

📍 Zone-2 Buy: Near 0.62800 deeper pullback

🛠️ Entry Style: Limit Orders + DCA Layering

🎯 Wait for MA crossover confirmations and price reaction zones — don’t chase, trap the market.

🔻 STOP LOSS: "Plan the Escape Route"

⛔ SL for Pullback-1: 13540 (4H swing low)

⛔ SL for Pullback-2: 13350

📌 SL placement depends on your position sizing & risk management. Control the loss; live to rob another day. 🎭💼

🎯 TARGET ZONE: “Cash Out Point”

💸 First TP: 14100

🏁 Let the profit ride if momentum allows. Use a trailing SL once it moves in your favor to lock in gains.

👀 Scalpers Note:

Only play the long side. If your capital is heavy, take early moves. If you’re light, swing it with the gang. Stay on the bullish train and avoid shorting traps. Use tight trailing SL.

🔎 THE STORY BEHIND THE HEIST – WHY BULLISH?

CHINA50 shows bullish momentum driven by:

💹 Technical bounce off major support

🌏 Macroeconomic & geopolitical sentiment

📰 Volume + sentiment shift (risk-on)

📈 Cross-market index confirmation

🧠 Smart traders are preparing, not reacting. Stay ahead of the herd.

👉 For deeper insight, refer to:

✅ Macro Reports

✅ COT Data

✅ Intermarket Correlations

✅ CHINA-specific index outlooks

⚠️ RISK WARNING – TRADING EVENTS & VOLATILITY

🗓️ News releases can flip sentiment fast — we advise:

❌ Avoid new positions during high-impact events

🔁 Use trailing SLs to protect profit

🔔 Always manage position sizing and alerts wisely

❤️ SUPPORT THE CREW | BOOST THE PLAN

Love this analysis? Smash that Boost Button to power the team.

Join the Thief Squad and trade like legends — Steal Smart, Trade Sharp. 💥💪💰

Every day in the market is a new heist opportunity — if you have a plan. Stay tuned for more wild robbery blueprints.

📌 This is not financial advice. Trade at your own risk. Adjust based on your personal strategy and capital. Market conditions evolve fast — stay updated, stay alert.

Shanghai Composite: Double bottom signals potential upsideChinese stocks are not for the faint-hearted. It's a market with a lot of volatility, swings, and roundabouts. Despite this, we've been keeping a close eye on the Shanghai Composite Index over the past few weeks and like the pattern we are seeing emerge.

As of the time of writing, the Shanghai Composite Index trades in the 3,500 range. A clear double bottom emerged in September and January last year, as indicated in the chart. We think this is a bullish pattern. When markets test the lows twice and rebound, conviction grows. The worst, it seems, is maybe behind us.

New trades should take important note and understand that Shanghai-listed stocks differ greatly from the H-shares trading in Hong Kong. The Shanghai Composite primarily includes A-shares, domestic Chinese companies driven by local sentiment and liquidity. H-shares, though still Chinese firms, list offshore in Hong Kong and often reflect global investor attitudes rather than local momentum.

Understanding your instrument is crucial. While Shanghai A-shares capture China's domestic economic pulse, H-shares in Hong Kong frequently mirror global risk appetite and geopolitical narratives. Our bullish case lies specifically with the Shanghai market. It is a bet on China's internal economic recovery, supportive policy measures, and improving investor sentiment.

China’s economic stabilisation is underway. Stimulus measures from Beijing are gaining traction. Property market stabilisation efforts (which are medium term in nature) and easing monetary policy signal confidence. Domestic investors, increasingly optimistic, are positioned to drive a sustained rally.

The Shanghai Composite Index could see upside towards the 4,000 and then 4,500-level in the coming years, if the rally continues. Our conviction rests on improving domestic fundamentals, policy tailwinds, and powerful market sentiment unique to mainland China's equity landscape.

Caution is important, given the volatility nature of the index.

The forecasts provided herein are intended for informational purposes only and should not be construed as guarantees of future performance. This is an example only to enhance a consumer's understanding of the strategy being described above and is not to be taken as Blueberry Markets providing personal advice.

China50 to find sellers at current market price?CHN50 - 24h expiry

Selling posted close to the previous high of 13800.

13868 has been pivotal.

Bespoke resistance is located at 13800.

Early optimism is likely to lead to gains although extended attempts higher are expected to fail.

We look for a temporary move higher.

We look to Sell at 13795 (stop at 13890)

Our profit targets will be 13515 and 13435

Resistance: 13821 / 13905 / 14000

Support: 13764 / 13676 / 13638

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

China50 to find sellers at current swing high?CHN50 - 24h expiry

Selling posted close to the previous high of 13800.

13868 has been pivotal.

Bespoke resistance is located at 13800.

Early optimism is likely to lead to gains although extended attempts higher are expected to fail.

We look for a temporary move higher.

We look to Sell at 13795 (stop at 13875)

Our profit targets will be 13555 and 13505

Resistance: 13699 / 13760 / 13800

Support: 13600 / 13510 / 13431

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

"CHINA50 Money Heist: Will You Join the Gang or Get Robbed?"🚨 CHINA50 HEIST ALERT: Bullish Loot & Trap Escape Plan! 🚨

🌟 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌟

Dear Money Makers & Market Robbers, 🤑💰💸✈️

Based on 🔥Thief Trading Style🔥 (technical + fundamental analysis), we’re plotting the ultimate heist on the CHINA50 Index Cash market! Our master plan focuses on a long entry—targeting the high-risk Red Zone (overbought, consolidation, potential reversal). Beware: Bears are lurking, and traps are set! 🏆💸 Book profits fast, stay wealthy, and trade safe! 💪🎉

🔓 ENTRY: The Vault Is Open – Swipe the Bullish Loot!

Buy Limit Orders: Place within 15-30min (recent swing low/high).

Alert Recommended! Don’t miss the heist.

🛑 STOP LOSS: Escape Route

Set near the latest swing low or below 4H MA (~13150.00).

Adjust based on risk, lot size, and multiple orders.

🎯 TARGET: 13840.00 (or Run Before It Hits!)

Scalpers: Only long-side plays! Use trailing SL to lock profits.

Swing Traders: Execute the robbery plan patiently.

📡 MARKET INTEL: Why CHINA50 is a Bullish Target

Fundamental Drivers: Macro trends, COT data, geopolitics, sentiment.

Intermarket & Index-Specific Factors in play.

👉 For full analysis, check the linkss below! 🔗🔗

⚠️ TRADING ALERTS: News & Position Safety

Avoid new trades during high-impact news.

Trailing SL is a MUST to protect profits.

💥 BOOST THE HEIST! Hit Like & Follow!

Support the plan → More profits → Easier robberies! 💰🚀

Stay tuned for the next heist! 🤑🐱👤🤩

CHINA50 to break to the upside?CHN50 - 24h expiry

A break of the recent high at 13506 should result in a further move higher.

A Morning Doji Star formation has been posted at the low.

The overnight dip has been bought into and there is scope for further bullish pressure going into this morning.

We look for gains to be extended today.

Buying continued from the 78.6% pullback level of 13375.

We look to Buy a break of 13511 (stop at 13412)

Our profit targets will be 13808 and 13858

Resistance: 13506 / 13647 / 13815

Support: 13375 / 13274 / 13137

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

CHINA50 to find buyers at market price?CHN50 - 24h expiry

Buying continued from the 78.6% pullback level of 13375.

Offers ample risk/reward to buy at the market.

Although the bears are in control, the stalling negative momentum indicates a turnaround is possible.

Early pessimism is likely to lead to losses although extended attempts lower are expected to fail.

Daily signals are mildly bullish.

We look to Buy at 13385 (stop at 13280)

Our profit targets will be 13695 and 13765

Resistance: 13543 / 13647 / 13700

Support: 13386 / 13300 / 13170

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

"CHINA50" Index CFD Market Bullish Heist Plan (Day or Swing)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "CHINA50" Index CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk ATR Line. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (13300) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a buy stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📍 Thief SL placed at the nearest/swing low level Using the 4H timeframe (13000) Day / Swing trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 13800 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💸"CHINA50" Index Market Heist Plan (Swing/Day Trade) is currently experiencing a Bullish trend.., driven by several key factors.☝☝☝

📰🗞️Get & Read the Fundamental, Macro, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Future trend targets with Overall outlook score... go ahead to check 👉👉👉🔗🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Phantom Heist: Sniping CHINA50 Longs for Epic Loot!🌍 Salutations, worldly wealth seekers! Ola! ✨

Dear Coin Conquerors & Chart Corsairs, 💸⚔️

Crafted in the 🔥 Phantom Trader’s cauldron of technical wizardry and fundamental finesse 🔥, behold our cunning plot to pillage the “CHINA50” Index Market. Follow the chart’s secret map, zeroing in on long entries. Our prize? Slip away near the treacherous ATR Red Zone, where overbought whispers, consolidation, reversals, and ambushes lurk, with bearish bandits poised to strike. 🦹♂️💰 “Secure your loot and treat yourself, traders—you’re a force to be reckoned with!” 🎊💥

**Entry 📊**: The vault’s cracked open! Seize the bullish bounty at current prices—the heist is on!

For precision strikes, set buy limit orders on a 15 or 30-minute chart at the latest swing low or high. Pro move: activate chart alerts to stay ahead of the game!

**Stop Loss 🛑**:

📍 Phantom SL planted at the recent swing low on the 8H timeframe (13500.00) for day or swing trades.

📍 Tweak SL to match your risk appetite, lot size, and open orders.

**Target 🎯**: Eye 14350.00—or vanish early if the market gets slippery!

🧨 **Scalpers, keep your wits!** 👁️: Stick to long-side scalps. Deep pockets? Dive in now! Lighter funds? Join swing traders for the caper. Use trailing SL to protect your treasure 💎.

💴 **CHINA50 Market Raid (Swing Trade Snapshot)**: Hovering in neutral territory with a bullish flicker, fueled by pivotal market tides. ☝

📰 **Uncover the full story**: Dive into Fundamental Signals, Macro Trends, COT Insights, Geopolitical Waves, Sentiment Cues, Intermarket Links, Index Drivers, Positioning, and Future Targets for the complete intel! 👉🔗🌎

⚠️ **Trade Warning: News & Position Strategy** 🗳️🚨

Market-moving news can stir chaos like a storm. Safeguard your gains:

- Avoid new trades during news drops.

- Use trailing stop-losses to lock profits and defend open positions.

💪 **Fuel our plunder!** 💥 Hit the Boost Button 💥 to supercharge our profit-grabbing game. Join the Phantom Trading Style crew and stack riches daily with flair. 🏅🤝🚀

Rendezvous at the next market ambush—stay sharp! 🤑🐆🎯

"CHINA 50" Index CFD Market Heist Plan (Scalping/Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "CHINA 50" Index CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise to Place sell limit orders within a 15 or 30 minute timeframe most nearest or swing, low or high level.

Stop Loss 🛑: (13400) Thief SL placed at the nearest / swing high level Using the 8H timeframe swing / day trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 12950 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

"CHINA 50" Index CFD Market Heist Plan (Swing/Day) is currently experiencing a bearishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro Economics, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Positioning and future trend targets... go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

CN50 to find sellers at previous support?CHN50 - 24h expiry

Price action looks to be forming a top.

There is no clear indication that the downward move is coming to an end.

Risk/Reward would be poor to call a sell from current levels.

A move through 13500 will confirm the bearish momentum.

The measured move target is 13350.

We look to Sell at 13600 (stop at 13700)

Our profit targets will be 13400 and 13250

Resistance: 13600 / 13650 / 13700

Support: 13500 / 13400 / 13350

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.