Coca-Cola Company (KO) Set To Report Earnings Before Market OpenThe Coca-Cola Company (NYSE: NYSE:KO ) is set to report her earnings results before market open today. Shares of Coca-cola finished Mondays session down 1.34% amidst growing interest in the beverage and soda franchise.

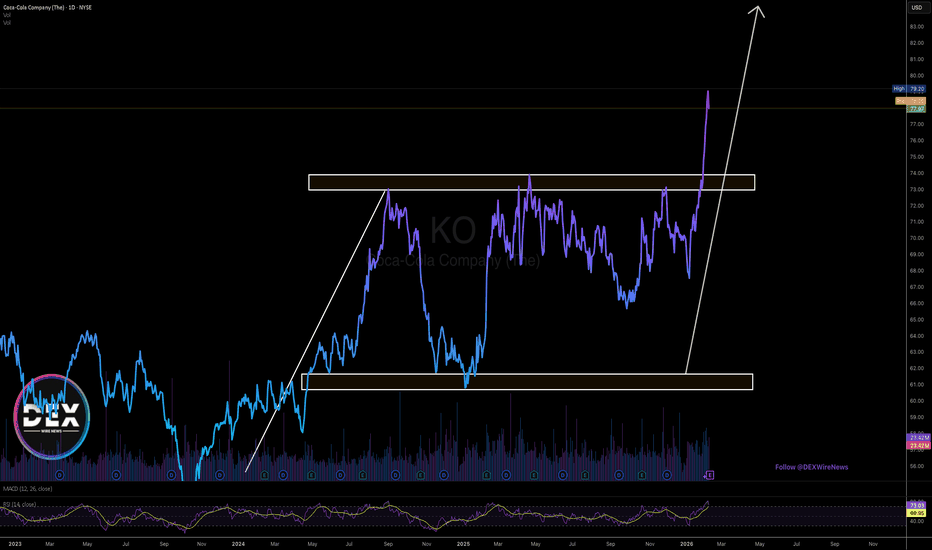

Technically, shares of NYSE:KO are gearing for a bullish reversal as the daily time frame chart depicts a bullish rectangle pattern. Another bullish precursor is the ceiling of the rectangle has been broken already so attaining to the $100 resistant isn’t far-fetch.

The shares have gained 13% since the start of the year, amid a broader rotation into consumer staples stocks. Rival PepsiCo (PEP), which on Tuesday reported better-than-expected earnings, has also seen its stock surge in recent weeks.

Analyst Summary

According to 12 analysts, the average rating for KO stock is "Strong Buy." The 12-month stock price target is $80.58, which is an increase of 3.35% from the latest price.

About KO

The Coca-Cola Company, a beverage company, manufactures and sells various nonalcoholic beverages in the United States and internationally. The company provides sparkling soft drinks and flavors; water, sports, coffee, and tea; juice, value-added dairy, and plant-based beverages; and other beverages. It also offers beverage concentrates and syrups, as well as fountain syrups to fountain retailers comprising restaurants and convenience stores.

Cocacolabuy

Coca-Cola (KO) Pullback Trade Aligns With Trend Strength!🔥 KO Playbook: Bullish Pullback Trap or Clean Rebound? 🥤📈

📌 Asset

NYSE:KO — The Coca-Cola Company

NYSE | Stock Market Profit Playbook

Style: Swing Trade / Day Trade

🧠 Market Structure & Technical Thesis

KO is currently showing a Bullish Pullback Setup after a healthy retracement into a Triangular Moving Average (TMA) zone, indicating potential mean-reversion and continuation strength.

Key technical factors supporting the bullish bias:

📐 Price pulling back into TMA dynamic support

📉 Controlled retracement (no breakdown structure)

🧲 Liquidity resting below current price (ideal for layered entries)

📊 Context supports a buy-the-dip strategy, not a chase

🎯 Trade Plan — Thief Style (Layered Entry Method) 🕵️♂️

🟢 Entry Strategy (Layering Method)

This plan uses a multiple buy-limit layering strategy, also known as scale-in entries, to reduce average cost and manage volatility.

Buy Limit Layers (Example):

🟢 70.00

🟢 69.50

🟢 69.00

👉 You may increase or adjust the number of limit layers based on your own risk management and execution style.

👉 Aggressive traders may also choose any price level entry, depending on confirmation.

🛑 Stop Loss (Risk Control)

Thief SL Reference: 68.00

⚠️ Note:

Dear Ladies & Gentleman (Thief OG’s),

I am not recommending you to use only my Stop Loss. Risk management is a personal choice — protect capital and trade responsibly.

🎯 Target / Exit Zone

Primary Target: 73.00

🚨 Why this level matters:

🚓 “Police force” zone = Strong resistance area

📈 Price likely to be overbought near this zone

Potential bull trap or profit-taking zone

👉 Kindly escape with profits if price reaches this level.

⚠️ Note:

Dear Ladies & Gentleman (Thief OG’s),

I am not recommending you to use only my Take Profit. Secure gains based on your own plan and comfort level.

🔍 Related Stocks to Watch (Correlation Insight)

NASDAQ:PEP (PepsiCo Inc.) 🥤

👉 Strong sector correlation with KO. Bullish continuation in PEP often supports upside momentum in KO.

AMEX:SPY (S&P 500 ETF) 📊

👉 Overall market strength matters. A bullish SPY environment increases follow-through probability for defensive stocks like KO.

AMEX:XLP (Consumer Staples ETF) 🛒

👉 If XLP holds support or trends higher, KO usually benefits as a sector leader.

💡 FINAL THOUGHTS FROM YOUR TRADER

This isn't a "set and forget" trade—it's an active, discipline-required play. The setup is clean, the technicals are aligned, but markets always have surprises.

The margin of safety exists at these levels. But margin of safety ≠ guaranteed profit. Ever.

Trade with conviction but manage risk like a pro. 🚀

📲 COMMUNITY APPRECIATION

✨ If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!

Happy Trading, Legends! 🚀💰 Chart your own path. The market rewards the prepared mind. 📊

Coca Cola - $78 Target for New Highs Imminent 🥤The Coca-Cola Company (KO) suggests the stock has definitively finished a long period of price correction and is now ready for a significant upward trend. This pullback, which had been complex, officially concluded when the price hit its low at $65.36. Critically, the strong bounce that followed has broken the stock out of its long-term downward trading range, confirming that the selling phase is fully over.

Following this successful breakout, the chart indicates that a major new five-wave rally is starting, with the stock currently engaging the powerful middle part of this upswing (Wave 3). The analysis projects that after completing this rally, the price will ultimately reach a target around $78.00. This suggests that the stock is now in a strong phase of growth, making it a key focus for traders looking for the next major increase in value.

Stay Tuned!

@Money_Dictators

Shares of Coca-cola Set For Breakout Amid Golden Cross Pattern The Coca-Cola Company (NYSE: NYSE:KO ) on Tuesday reported first-quarter sales below analysts' estimates but profit that topped expectations, as the beverage giant navigates tariff uncertainty.

Earnings Overview

The company said its "comparable," or adjusted, earnings per share came in at $0.73 on revenue that declined 2% YoY to $11.1 billion. Analysts expected $0.72 and $11.22 billion, respectively.

CEO James Quincey said:

"Despite some pressure in key developed markets, the power of our global footprint allowed us to successfully navigate a complex external environment."

Coca-Cola Says Operations 'Subject to Global Trade Dynamics'

In an update to its full-year outlook, Coca-Cola said that its "operations are primarily local, however, it is subject to global trade dynamics which may impact certain components of the company’s cost structure across its markets. At this time, the company expects the impact to be manageable."

Technical Outlook

Shares of Coca-Cola ( NYSE:KO ) were down about 1% shortly after the market opened Tuesday. They entered the day up about 15% since the start of the year. As of the time of writing, the stock is up 0.49%.

Albeit earnings missed estimate, the 4 hour price of Coca-Cola shares (NYSE: NYSE:KO ) depicts a golden cross pattern- this is a metric that is generally seen as a bullish reversal with its counterpart known as "Death cross". With the RSI at 51 and the Golden cross pattern, NYSE:KO might be on the cusp of a bullish campaign.

Coca-Cola To Report Q4 Earnings Today Ahead of Market OpenCan the Beverage Giant Sustain Its Momentum?

Coca-Cola (NYSE: KO) is set to report its fourth-quarter earnings results on Tuesday, February 11,2025 ahead of the market open. Investors and traders are closely watching the stock, which has already shown premarket strength, rising 0.20% early Tuesday morning. With the Relative Strength Index (RSI) at 60.84, market participants are anticipating a potential bullish continuation, provided earnings results meet or exceed expectations.

Strong Performance in 2023

Coca-Cola, a global leader in the beverage industry, has continued to demonstrate resilience despite economic uncertainties. In 2023, the company reported $45.75 billion in revenue, marking a 6.39% increase from the previous year’s $43 billion. Earnings also saw an impressive 12.28% growth, reaching $10.71 billion. This performance underscores Coca-Cola’s ability to maintain steady growth through product diversification and strategic market positioning.

Analysts remain optimistic about the stock, with 17 analysts giving KO a consensus rating of "Strong Buy." The 12-month price target of $72.18 suggests a potential 11.82% upside from its latest price, reinforcing bullish sentiment ahead of the earnings report.

Technical Analysis

As of Tuesday’s premarket session, NYSE:KO is trending upwards, with its price hovering near $65, a key pivot and resistance level. Breaking this barrier could trigger a bullish rally, potentially pushing KO toward higher price targets in the coming weeks.

However, if earnings disappoint, a retracement may be in play, with immediate support aligning with the 38.2% Fibonacci retracement level at $63. This level could serve as a critical point for a potential rebound, should selling pressure emerge following the earnings announcement.

What to Expect Post-Earnings

A strong earnings beat could propel KO further into bullish territory, confirming its upward trajectory and attracting more institutional interest. On the flip side, weaker-than-expected results may lead to a temporary pullback, offering a potential buying opportunity at key support levels.

Coca-Cola's Bull Run Intensifies: Pole & Flag Breakout Expected!The chart shows that the stock price encountered resistance near the $65 level, subsequently dropping to $52, where it found support.

After rebounding from this support, the price began to rise, successfully breaking through the Inverted Head & Shoulders pattern that had formed during the consolidation phase.

Following this breakout, the price entered another consolidation period, created an Ascending Triangle Pattern.

With another breakout, the stock price surged to an all-time high of $73.5 before experiencing a pullback.

A bullish Pole & Flag pattern has emerged on the chart, signaling a potential continuation of the upward trend.

It is expected that the price will break through this pattern and reach new highs in the near future.

Coca-Cola I Potential move to upside Welcome back! Let me know your thoughts in the comments!

** Coca-Cola Analysis - Listen to video!

We recommend that you keep this pair on your watchlist and enter when the entry criteria of your strategy is met.

Please support this idea with a LIKE and COMMENT if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email in the future.

Thanks for your continued support!

COCA COLA BUYHi, according to my analysis of Coca-Cola stock. There is a good buying opportunity. We notice that the stock came back from a very strong area, which is the strong support at 59, which it could not break several times. All of these things indicate that the stock remains in a very positive state. good luck for everbody

Coca-GOlaCoca-Cola

Short Term

We look to Buy a break of 64.83 (stop at 63.28)

A break of bespoke resistance at 65.50, and the move higher is already underway. We are trading within a Bullish Ascending Triangle formation. The trend of higher lows is located at 63.00. The medium term bias remains bullish.

Our profit targets will be 69.02 and 70.90

Resistance: 65.65 / 66.50 / 75.00

Support: 63.00 / 61.30 / 59.50

Disclaimer – Saxo Bank Group. Please be reminded – you alone are responsible for your trading – both gains and losses. There is a very high degree of risk involved in trading. The technical analysis, like any and all indicators, strategies, columns, articles and other features accessible on/though this site (including those from Signal Centre) are for informational purposes only and should not be construed as investment advice by you. Such technical analysis are believed to be obtained from sources believed to be reliable, but not warrant their respective completeness or accuracy, or warrant any results from the use of the information. Your use of the technical analysis, as would also your use of any and all mentioned indicators, strategies, columns, articles and all other features, is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness (including suitability) of the information. You should assess the risk of any trade with your financial adviser and make your own independent decision(s) regarding any tradable products which may be the subject matter of the technical analysis or any of the said indicators, strategies, columns, articles and all other features.

Please also be reminded that if despite the above, any of the said technical analysis (or any of the said indicators, strategies, columns, articles and other features accessible on/through this site) is found to be advisory or a recommendation; and not merely informational in nature, the same is in any event provided with the intention of being for general circulation and availability only. As such it is not intended to and does not form part of any offer or recommendation directed at you specifically, or have any regard to the investment objectives, financial situation or needs of yourself or any other specific person. Before committing to a trade or investment therefore, please seek advice from a financial or other professional adviser regarding the suitability of the product for you and (where available) read the relevant product offer/description documents, including the risk disclosures. If you do not wish to seek such financial advice, please still exercise your mind and consider carefully whether the product is suitable for you because you alone remain responsible for your trading – both gains and losses.

PFE, KO - Very Strong Monthly ChoicesFor anyone looking for a long position in their portfolio (Monthly) Pfizer and Coca-Cola Hodl great potential in their current state

Pfizer has formed a bullflag above the Gaussian Channel

Coca-Cola is very similar above the Channel, however lacking the bullflag

For Coca-Cola check out my previous post below

KO - Extremely Bullish State 3M Coca-Cola has currently provided us a great long opportunity on this 3 Month chart

Price has moved up just above the Gaussian Channel

Last time this was seen (the previous strong bullrun) price soared about 4000% over a period of 20 years

Whos in it for the long game?

Coca Cola Analysis / RSI divergence Hello everyone, as we all know the market action discounts everything :)

_________________________________Make sure to Like and Follow if you like the idea_________________________________

The KO stock has been doing great lately, where in the last 2 weeks the price jumped from $54.28 and reached $56.92 today almost a 5% increase.

Both the short-term and long-term trends are positive. This is a very positive sign.

KO is currently trading near its 52 week high, which is a good sign. The S&P500 Index however is also trading near new highs, which makes the performance in line with the market.

KO has an average volume of 14981700. This is a good sign as it is always nice to have a liquid stock.

Possible Scenario for the market :

Looking at how the stock has been doing lately we notice a strong Bullish movement that will lead the stock to the first resistance line at $56.95, if the Bulls were able to push further and breakout that resistance then we could be seeing the stock reaching the $57.92 range by the end of the week.

In case they weren't able to breakout the first resistance then a correction wave will happen that will cause the price to drop back the support line at $56.13.

Technical indicators show :

1) The market is above the 5 10 20 50 100 and 200 MA and EMA (Strong Bullish Sign)

2) The MACD is above the 0 line indicating a Bullish market with a positive crossover between the MACD line and the Signal line

3) The RSI is 64.84 showing great strength. with a small Bullish divergences

Weekly Support & Resistance points :

support Resistance

1) 56.14 1) 57.03

2) 55.67 2) 57.45

3) 55.25 3) 57.92

Fundamental point of view :

Kepler Capital analyst Richard Withagen maintained a Buy rating on Coca-Cola (NYSE:KO) Europacific Partners on Tuesday, setting a price target of EUR59, which is approximately 17.15% above the present share price of $57.8.

The current consensus among 10 TipRanks analysts is for a Moderate Buy rating of shares in Coca-Cola Europacific Partners, with an average price target of $66.65.

The analysts price targets range from a high of $76 to a low of $48.78.

Coca-Cola European Partners (NASDAQ:CCEP) Plc engages in the distribution and sale of ready-to-drink beverages. It operates through the following brands: Coca-Cola, Diet Coke or Coca-Cola Light, Coke Zero, Coca-Cola Life, Fanta, and Sprite. It also offers energy drinks, waters, juices, sports drinks, and ready-to-drink teas. The company was founded on August 4, 2015 and is headquartered in Uxbridge, the United Kingdom.

This is my personal opinion done with technical analysis of the market price and research online from Fundamental Analysts and News for The Fundamental point of view, not financial advice.

If you have any questions please ask and have a great day !!

Thank you for reading.

Cola-Cola: Ready for Take-Off 🔜🔜🔜The Coca-Cola stock has proven to be one of the more stable stocks in the world. It shows a long history of growth and another push should come very soon as the price is testing the $54.61 resistance. Once over this threshold, the way is paved for higher prices!

Another day, another opportunity!

COCA COLA LONG WE HAVE REJECTION OF PITCHFORK TREND , AT THE SAME TIME IT'S REJECTING SUPPORT WITH 190 MA , WITH A LONG PIN BAR CANDLE , & IF WE TAKE A LOOK ON FIBO'S IMPORTANT LEVEL WE HAVE STRONG REJECTION , THE RSI IS SHOWING US A KIND OF DIVERGANCE , WICH CONFIRM OUR PROBABILITY , SO BETTER TO TAKE A LONG POSITION ON THIS MARKET , TILL 83,30 & TRAIL STOP THE PROFITS !

KO - COCA-COLA S/R zonesHello traders,

Description of the analysis:

Coke is currently on the first support (upper gray) suitable for analysis into investment input. Another suitable opportunity to enter during the decline is the second support (bottom gray). In general, invest in instruments that you understand. With balance and your own plan. This is not an investment recommendation.

Be careful to trade and invest sparingly!

About me:

Hi, my name is Jacob Kovarik and I´m trading on stock exchange since 2008. I started with a capital of 3000 USD. My first strategy was based on OTM options. (American stock index and their ETF ). I´ve learnt on my path that professional trading is based on two main fundaments which have to complement each other, to make a bussiness attitude profitable. I´ve tried a lot of techniques and many manners how to analyze the market. From basic technical analysis to fundamental analysis of single title. My analytics gradually changed into professional attitude. I work with logical advantages of stock exchange (return of value back to average, volume , expected volatility , advantage of high stop-loss, the breakdown of time in options, statistics and cosistent thorough control of risk). At the moment, my main target is ITM on SPM index. Biggest part of my current bussiness activity comes from e mini futures (NQ, ES). I´m trader of positions. I´m from Czech republic and I take care of a private fund (4 000 000 USD). During my career I´ve earned a lot of valuable experience, such as functionality of strategies and what is more important, control of emotions. Professional trading is, in my opinion, certain kind of mental training and if we are able to control our emotions, accomplishment will show up. I will share with you my analysis and trades on my profile. I wish to all of you successul trades.

Jacob

$KO. Strong uptrend channel. Conservative investing.Do you think how to save money or how to make a decent profit, then you should buy $KO. BTW I like their drinks more than Pepsi, and you?

The biggest drink company, good drinks, and they are considering marijuana-infused drinks. Everything is good for Coca-Cola

Resistance: the upper bound

Support: the lower bound

Enter ~ around EMA 50 line or near the lower bound of the channel.

NO TP, NO SL.

Keep Calm and Hold.

I have the subreddit with the same name, if you wanna ask me or community, feel free to do that. Good Luck.