Comex

Silver Pulls Back After Double Top TestSilver futures bounced off resistance at $82.67 on Tuesday. According to our primary scenario, the next key move will be for price to break through this level, which would open the way toward the red Target Zone between $92.25 and $111.28. In that area, we expect the prominent top of the green-labeled wave to form, followed by a larger corrective move. Based on this outlook, traders could consider entering short positions within the $92.25 to $111.28 range, using a stop set 1% above the upper boundary of the zone. Alternatively, it’s possible that the green wave alt. already peaked at $82.67 and price is now correcting directly below support at $69.26. If this scenario plays out—which we assign a 35% probability—a direct pullback into the alternative green long Target Zone between $53.26 and $47.16 would be expected.

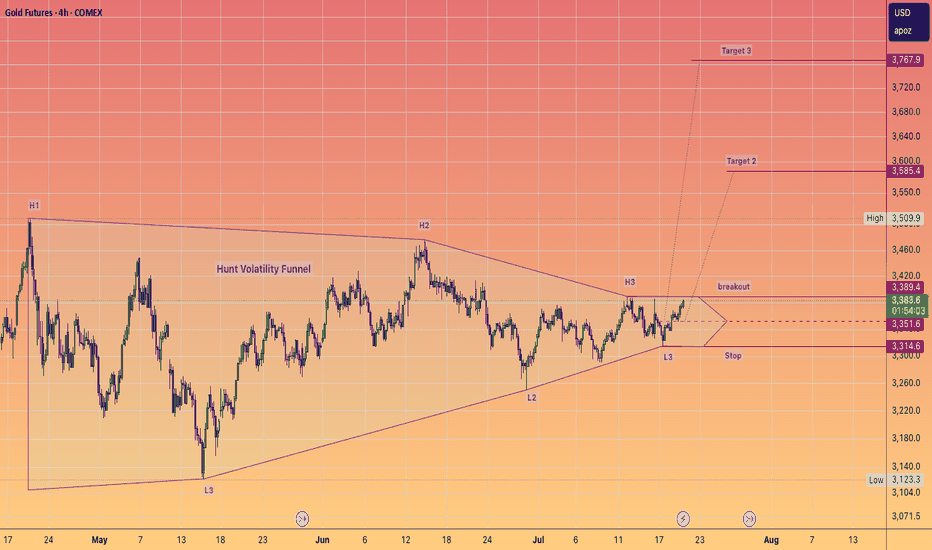

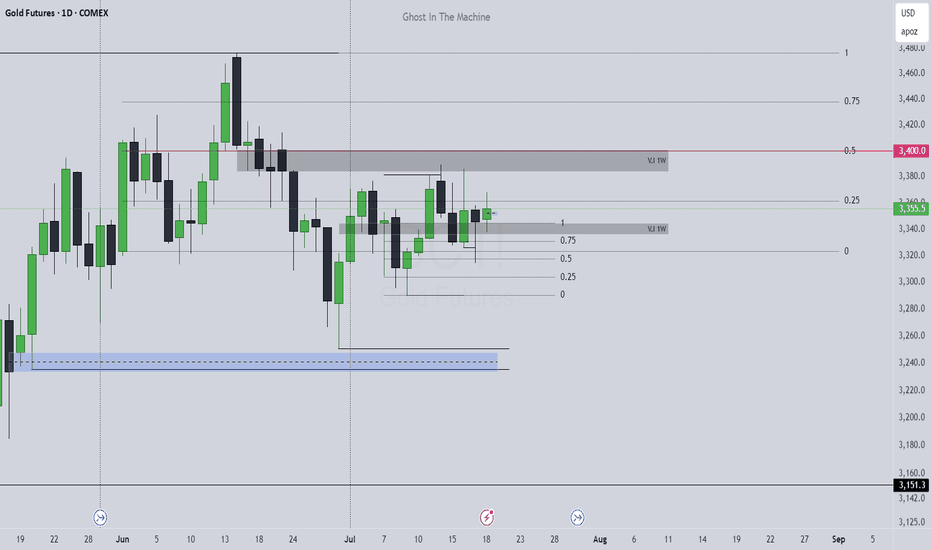

Gold’s Pullback: The Dip Everyone’s Afraid to Buy🏆 Gold’s Pullback: The Dip Everyone’s Afraid to Buy 🏆

Gold just gave us the pullback we’ve been waiting for. After an incredible vertical run to $4,400, price has tapped right back into long-term trend support — exactly where past rallies have launched from.

Zoom out on the weekly channel and it’s clear:

Momentum spikes look scary, but historically they’ve reset just before the next leg up.

Volume confirms conviction — this isn’t a fade; it’s a reload.

On the 4H chart, buyers are already defending the trendline like clockwork.

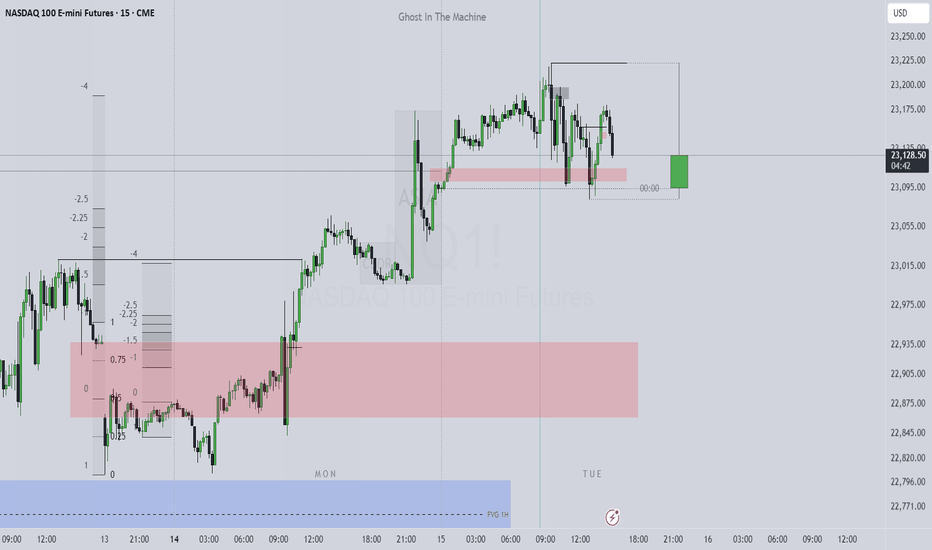

On the 15M, we’re seeing the first signs of stabilization.

💡 My take:

This isn’t the time to panic — it’s the time to position.

“Buy fear, sell greed” wasn’t written for stocks; it was written for gold.

🎯 Watch zone: $4,000–$4,050 — that’s my reload range.

Next resistance: $4,400 → $4,800 if the structure holds.

📈 I’m buying the dip. Are you brave enough to?

#Gold #GC1 #Comex #Futures #BuyTheDip #Macro #Commodities #TrendFollowing #TechnicalAnalysis